Everyone needs to read that. Several times.

"Houghton [college] got out of hedge funds and all alternative

investments a year and a half ago, and moved the entire

portfolio to a mix of low-cost index funds and mutual

funds at the fund giant Vanguard."

For college endowments the problem is managers are mostly interested in keeping their cushy jobs. Hitting home runs is unimportant. Heck, batting .300 is unimportant.

They're also hoping to sign on at a hedge fund or the like if they become unemployed. That's why even TIAA didn't totally bash hedge funds when California dropped them in 2014.

I've never understood investing in anything that charges the 2/20 formula, especially in funds that have rarely equalled the S&P 500. I understand the non-correlation argument for exotic funds, but keeping some money in ultra low cost bond funds -- corp, muni and perhaps foreign -- seems more sensible.

It's worked for me.

______________________________________________________________

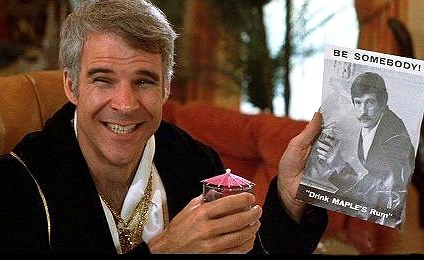

Because the Good Life is Just a Pump or Two Away