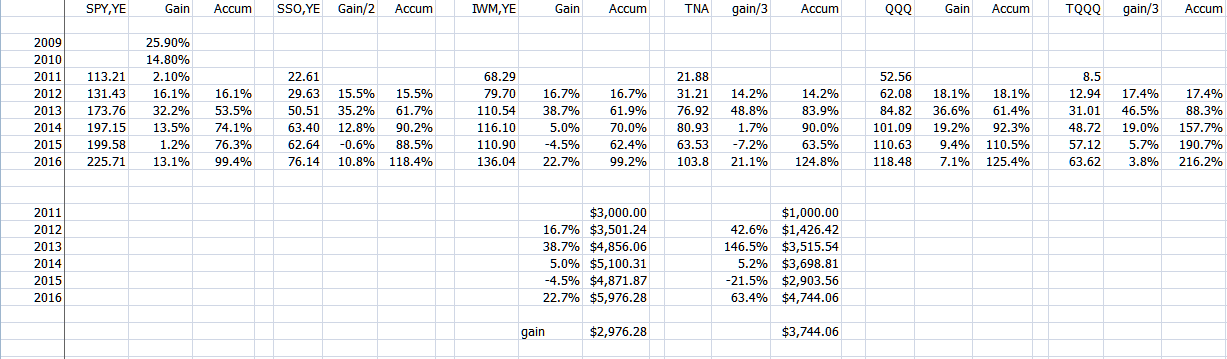

When I calculate gains with 2x or 3x fund I always divide by 2 or 3, so that I can compare with 1x funds. From the table below, here are the 5 year gains.

SPY 99.4% SSO 118.4%

IWM 99.2% TNA 124.8%

QQQ 125.4% TQQQ 216.2%

The math is a little tricky, so I also showed how $3000 invested in IWM would have gained $2976; while only $1000 invested in TNA would gain $3744.

In my case I hold TNA a large part of the time, so I can leverage my money, not because I want to be 300% invested. I like to be invested near 150% for IWM. If I use TNA, I only need to use half of my cash to do that. This leaves me with the other half to invest in other things.

The way I trade however even enhances the use of 3x funds even more. I actively trade a daily chart, so I am only in the market when it is generally going up. This makes the 3x gain vs 1x even greater. For 2016, IWM yielded 38.8% while TNA gained 48.9%. Just buying and holding IWM gained only 21.6%, so a big improvement.

It takes a bit to wrap your head around these numbers, but they are real. But for sure holding 2x or 3x funds in a down turn is going to amplify the losses.

Trade the Charts and not the Heart - Expect the trend to

continue until it doesn't - Realtime is the real deal

Recent BRK.B News

- Intel Loses Pentagon Funding, Shell Plans 20% Business Team Reduction, and Latest News • IH Market News • 03/13/2024 11:02:03 AM

- Expedia Announces 1,500 Job Cuts; Hims & Hers Surges 19.8% Post Financial Results, and More News • IH Market News • 02/27/2024 11:15:07 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/26/2024 06:53:12 PM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 02/26/2024 11:08:31 AM

- Broadcom in Talks to Sell Computing Unit, Alcoa Acquires Alumina for $2.2 Billion, and Latest News • IH Market News • 02/26/2024 10:55:58 AM

- Uniswap Skyrockets 55% with Incentive Proposal, Avalanche Confronts 4-Hour Shutdown, and More • IH Market News • 02/23/2024 06:26:18 PM

- Nvidia’s Earnings Skyrocket by 769%, BuzzFeed’s Pre-Market Shares Surge by 85%, and Other Highlights • IH Market News • 02/22/2024 11:08:52 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 09:46:01 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 09:40:04 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/14/2024 09:39:50 PM

- Form 13F-HR - Quarterly report filed by institutional managers, Holdings • Edgar (US Regulatory) • 02/14/2024 09:02:18 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/05/2024 10:27:17 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 10:08:12 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/10/2024 09:16:32 PM

- Wall Street Highlights: Google Rejects Union Negotiations, Exxon Mobil Announces $2.5 Billion Accounting Write-Down in California • IH Market News • 01/05/2024 11:14:00 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:41:33 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/14/2023 11:45:55 PM

- Apple Stocks Reach Record, Adobe Faces Stock Drops, Berkshire Hathaway Increases Stake in OXY, and More • IH Market News • 12/14/2023 10:59:57 AM

- Hasbro Job Cuts, Oracle’s Stock Decline, Google’s Epic Antitrust Loss, and More • IH Market News • 12/12/2023 10:50:47 AM

- Batteries Plus & Duracell Ignite Children's Holiday Spirit With Annual Toys For Tots Partnership • PR Newswire (US) • 12/05/2023 03:07:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/01/2023 02:11:02 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/29/2023 09:50:02 PM

- Amazon Unveils Innovative Services, Okta Discloses Data Breach, Textron Plans 2% Global Workforce Reduction, and More • IH Market News • 11/29/2023 11:18:11 AM

- Monday’s Wall Street Highlights: Walmart, Disney, Lloyds Banking, Mitsui Financial, HSBC, and more • IH Market News • 11/27/2023 11:29:25 AM

- Wednesday’s Wall Street Highlights: Nvidia, Broadcom, Berkshire Hathaway, Guess, Virgin Galactic, and more • IH Market News • 11/22/2023 11:49:26 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM

Avant Technologies to Implement AI-Empowered, Zero Trust Architecture in Its Data Centers • AVAI • Apr 29, 2024 8:00 AM