Friday, February 03, 2017 11:27:46 PM

Friday Nights MMGYS Heavy Metals Moments

MMgys

Good Morning

~Welcome To

~*~Mining & Metals Du Jour~*~ Graveyard Shift~

Can You take us Higher///// Oh Yeah \\\\\

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Gold And The Middle Class Revolt

Cliff Droke

February 2, 2017

If the past two years could be described with a single word, it would have to be “uncertainty.” Investors and non-investors alike have been dominated by this emotion, and its ubiquitous presence can be seen in the absence of a clearly-defined trend in the US broad market up until November. This uncertainty has been most pronounced among those in the middle class.

This lack of confidence in the economic outlook among middle class wage earners has had an enormously outsized influence in the political realm. The outcome of the 2016 presidential election is a case in point; the lack of money velocity is another. Perhaps the biggest result of middle class uncertainty has been the directionless trend in the NYSE Composite Index (NYA), which reflects the overall market for U.S. equities. Sustained, runaway-type rallies typically require widespread participation among retail investors, most of whom are middle class.

Middle class uncertainty can be seen in the organized protests all across the country this week. Over the weekend the crowds in Washington, D.C. again made the news, only this time it wasn’t Trump’s inaugural crowd but a gathering of protestors. A crowd of almost 500,000 gathered for the Women’s March on Washington to protest the Trump presidency. Times of uncertainty breed hostility and revolt.

The flip side of the spirit of uncertainty is that, unlike its much stronger cousin fear, it tends to be unfocused and aimless. Witness for instance the Women’s March on Washington and the many smaller marches in cities throughout the country this weekend. What exactly were these people protesting? I’m not sure most of them even knew what they were doing on the streets, yet they felt compelled to go out and protest something -- anything. Indeed, when the spirit of uncertainty is prevalent it breeds indecision in almost every aspect of life. This is another facet of the directionless and range-bound market environment worth considering.

My mentor, the late Bud Kress, emphasized that whenever his Grand Super Cycle of 120 years bottoms, it’s always accompanied or followed by revolution. Prior to his death, Bud predicted that the 2014 Super Cycle bottom would witness an accelerated trend toward socialism in the U.S. government. While there is some merit to his prediction, it’s probably closer to the truth to say that the revolution(s) that have happened in the last couple of years have been mass reactions against socialism in government. One thing is for certainty, though: the spirit of revolt has been quite strong.

The insecurity and uncertainty prevalent among the middle class is also reflected in the following graph. The Middle Class Index (MCI) show below is comprised of the companies which cater mainly to the middle class, including WalMart, Dollar General, McDonalds, Ford, and JC Penny.

As you can see here, the MCI has traced out a sideways pattern since 2014 and in recent weeks has shown a modicum of weakness. This sagging pattern over the past few weeks even as the major stock market indices approaching all-time highs is a little disconcerting. Perhaps this explains the feelings of anger and revolt that have become commonplace of late.

Should the middle class index fail to break out from its 2+ year trading range soon, the middle class may show further signs of discontent this year – especially if President Trump fails to deliver on his promises to the middle class.

Moreover, a failure of the upper-middle class index to reverse its downward trend fairly soon could potentially cause problems with the broader economy given their outsized impact on consumer spending. Needless to say, the next few months will be very informative on a number of levels.

With discontent clearly reaching the boiling point in the middle class, why hasn’t this been adequately reflected in the price of gold? Although gold rose more than 9% in 2016, its first annual gain in four years, it finished the year well below summer high. Gold’s weak finish to 2016 was largely due to the market tide expecting strength from the U.S. economy under the incoming Trump administration. Investors expectations of higher interest rates and higher stock prices in 2017 triggered an unwinding of safe haven trades in both gold and government bonds in Q4, undermining the metal’s desirability for uncertain times.

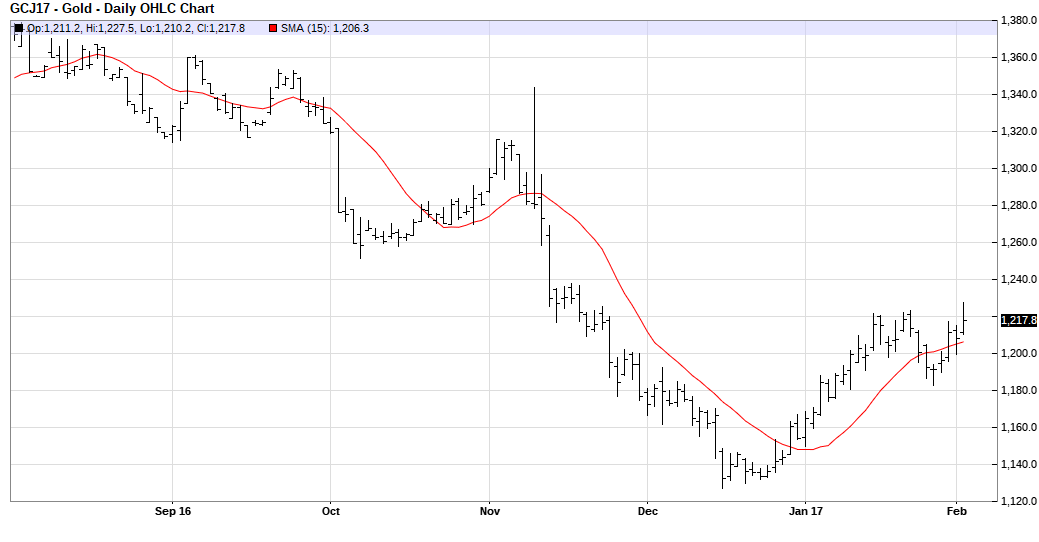

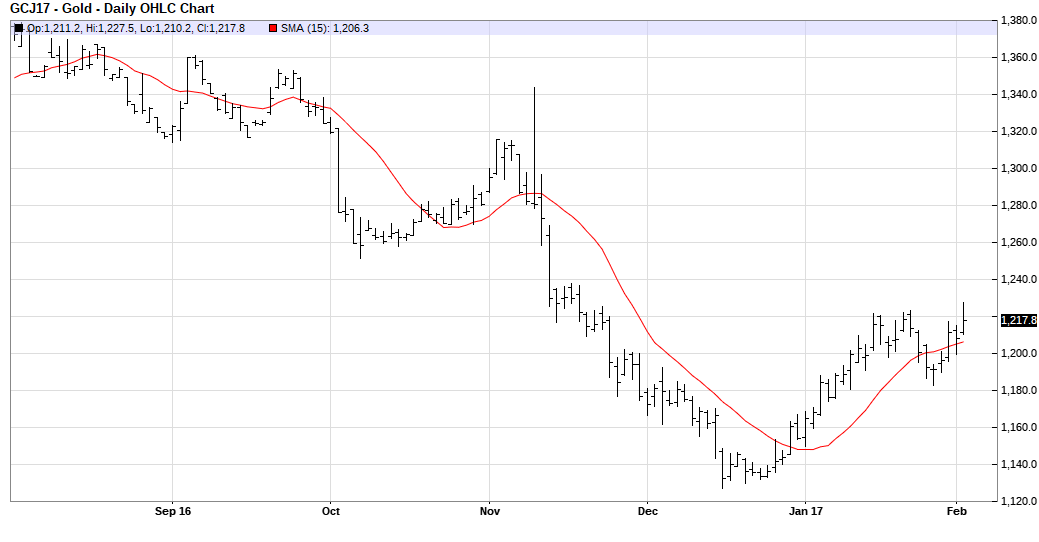

More recently, however, gold has benefited from a technically oversold condition as well as signs of short-term weakness in the global equity market. In late December, gold confirmed a bottom in relation to its 15-day moving average per the rules of our technical trading discipline.

Not everything was supportive for gold’s latest rally effort, though. Also needed to confirm anything beyond a short-term rally is a reversal of gold’s relative strength indicator (versus equities), which remains near its low for the year.

Uncertain times usually bode well for the gold price since the yellow metal is a prime haven for safety-minded investors. Gold’s best performances, however, occur when outright fear is the dominant emotion among investors. Uncertainty can serve as a supporting factor for gold prices, but by itself it’s unlikely to carry the gold price to substantial heights. Something more meaningful is needed for that. Gold is driven primarily by two major factors: sustained inflationary pressure or sustained deflationary pressure. Anything that threatens to undermine U.S. dollar strength (e.g. the threat of military conflict or political uncertainty) would bode well for gold’s intermediate-term outlook. Inflation, per se, isn’t needed to boost gold but a reversal of the dollar’s uptrend, even if only temporarily, would suffice.

The rally to date in gold and silver has been characterized by many analysts as simply a technical rally. Short covering and seasonal/holiday-related buying were certainly key factors in the rally getting started. However, additional gains from here, provided they are accompanied by steady erosion in the dollar index and improvement in relative strength, could turn a technical rally into something more substantial. In particular, a break below the 120-day moving average for the dollar index (see above chart) would markedly improve gold’s intermediate-term prospects.

********

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.

........continues http://www.gold-eagle.com/article/gold-and-middle-class-revolt

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Another “Dovish Jobs Report”-And The Future Of Precious Metal Storage

Andrew Hoffman

| February 3, 2017 - 2:56pm

It’s Friday morning, and I want to start by demonstrating just how desperate the powers that be have become – to preserve a dying status quo, in which the causes of decades of profligate fiscal and monetary policy are being exposed by the effects of political destabilization; economic stagnation; debt explosion; social unrest; and serial currency collapse.

Yesterday’s epic combination of “PM-bullish, everything-else-bearish” headlines; including Trump’s contentious exchanges with Presidents of Mexico, Iran, and Australia – following China, Japan, and Germany two days earlier; ugly, way below expected Deutsche Bank earnings; dovish Bank of England and Japan policy statements -following the previous day’s epic Federal Reserve punt; and a surging January Challenger job cuts report.

After which, the Cartel did its thing, using the same “Cartel Herald” algorithm as always, to push gold and silver down after the 10:00 AM EST close of the global physical markets. Still, both metals touched highs for the year; having decidedly held their 50 day moving averages of $1,177/oz and $16,71/oz, respectively, as they prepare to inevitably challenge their 200 day moving averages of $1,266/oz and $17.93/oz, respectively. At one point, the (meaningless but widely watched) “dollar index” fell as low a as 99.3, before moving back up towards the key psychological level of 100; i.e., the post-election breakout level, representing the market’s current view on just how realistic the (ridiculous, soon-to-be-permanently-disproven) “Trump-flation” meme actually is.

Fast forward to today – as I edit, three hours after “another dovish jobs report”; and with the dollar back down to 99.7; gold and silver again challenging $1,220/oz and $17.50/oz); and the benchmark 10-year Treasury yield at 2.43%, I can’t help reiterating last month’s “2.5%, ‘Nuff Said” thesis; i.e., that the 10-year yield – as a proxy to U.S. interest rates in general – simply CANNOT rise above this increasingly obvious “line in the sand” without annihilating the U.S. – and global – economy; and subsequetly, the vast majority of already collapsing fiat toilet papers. This, compared to the 3.0% “economic line in the sand” I first predicted – and was proven wildly correct about – three years ago; as today, the economy is in much worse shape; whilst global debt levels are much higher.

Aside for the, rigged headline number of 227,000 new January “jobs” being “better than expected,” everything else about the report, as usual, was horrible. Starting with the fact that the household survey showed a decline of 30,000 jobs; whilst December’s NFP headline number was revised downward by 40,000, entirely offsetting this month’s “beat.” Moreover, the all-important average weekly earnings number, at up 0.1%, was well below the expected 0.3%, despite countless minimum wage increases having been enacted to start the year; whilst last month’s supposedly “great” 0.4% average weekly earnings gain was revised down to just 0.2%. And again, I cannot empasize enough how vital wage growth is to the Fed’s thesis regarding inflation – which for the vast majority of Americans, is non-existent.

Sure, the labor force increased for the first time in ages; likely, due to people making New Year’s resolutions to look for a job; but unfortunately, most of them didn’t get one, resulting in a rise in the (already laughably understated) “unemployment rate.” And if you believe what the BLS tells us – that (mostly minimum wage paying) retailers were the biggest source of January jobs, following the worst holiday spending season since the 2008 crisis, I have a bridge in Brooklyn to sell you.

Trust me, if the Cartel is failing to smash Precious Metals on a day when the jobs report was supposedly “great,” what’s left of actual market participants decidedly know otherwise. Let alone, in the currency and bond markets – which loudly and clearly, are increasingly questioning the Fed’s (ridiculous, impossible, propagandist) expectation of three rate hikes this year.

Which brings me to today’s slightly less “economic” topic – although clearly, the reasons behind Precious Metal storage decisions are as much economic, as they are political and logistic. Which is, further commentary about what I believe to be the future of Precious Metals – and even cash storage (in this case, U.S. dollars, Canadian dollars, and Swiss Francs); i.e., Miles Franklin’s new, to the best of our knowledge unparalleled in the bullion industry, Private Safe Deposit Box program with Brink’s Toronto and Vancouver – as detailed in this article from November, when the service was launched; and this interview with President and Co-Founder Andy Schectman, in which all aspects of the program are discussed.

I’m not going to go over specific attributes of the program here, as they are discussed in detail in the aforementioned article and interview. And of course, you can call one of Miles Franklin’s brokers – on average, with roughly 25 years of bullion industry experience – at 800-822-8080; and they’d be happy to answer any questions you might have. Instead, I’m simply going to share my experience with the program, now that I have just become a client.

Long-time readers know that Miles Franklin commenced its segregated Precious Metal storage program with Brink’s Montreal back in 2012, which was expanded to Brink’s Vancouver location last year. I have been a satisfied client since 2013, and personally attended two regularly scheduled audits – where I witnessed my personal metal be counted. And now, as of this month, I’m a client of the Private Safe Deposit Box program, too.

The reason I bring it up, as that Andy Schectman and Joel Kravitz spent more than a year working on the logistics of this one-of-a-kind program; and when I personally saw the finished product, I couldn’t have been more impressed. To wit, I received in the mail – by signature delivery, of course – a vacuum-sealed packet holding a laminated, authenticated certificate describing my Brink’s Toronto holdings; as well as two keys to my personal safe deposit box. And by personal, I mean that no one, aside from me, has a key. Not even Brink’s themselves, or Miles Franklin.

Yes, Brink’s and Miles Franklin are aware of what’s in the box for accounting and logistics purposes – but they do NOT have a key; and thus, cannot open the box unless I send a key with explicit instructions. After which, if the contents change – due to a deposit or withdrawal – I’ll receive a new vacuum-sealed bag, with a new authenticated holdings certificate and my key back. Or, alternatively, I could simply go to the vault myself, or send the key with a third party – provided I send Brink’s explicit instructions of what that person is allowed to do.

With the global political, economic, and monetary situation more uncertain that at any time in generations, the urgency to protect one’s financial net worth has never been stronger; and given Precious Metals’ unchallenged historical track record, there’s no better way to “insure” yourself than physical gold and silver. And if offshore storage in Canada – one of the most politically stable jurisdictions on the planet – is for you, please give Miles Franklin a call; as in our view, our new Private Safe Deposit Box program represents the “future of Precious Metal storage.”

http://www.silverseek.com/commentary/another-%E2%80%9Cdovish-jobs-report%E2%80%9D-and-future-precious-metal-storage-16303

MMgys

Kicking out some Heavy Metal tonight

Good Morning

~Welcome To

~*~Mining & Metals Du Jour~*~ Graveyard Shift~

Can You take us Higher///// Oh Yeah \\\\\

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Gold And The Middle Class Revolt

Cliff Droke

February 2, 2017

If the past two years could be described with a single word, it would have to be “uncertainty.” Investors and non-investors alike have been dominated by this emotion, and its ubiquitous presence can be seen in the absence of a clearly-defined trend in the US broad market up until November. This uncertainty has been most pronounced among those in the middle class.

This lack of confidence in the economic outlook among middle class wage earners has had an enormously outsized influence in the political realm. The outcome of the 2016 presidential election is a case in point; the lack of money velocity is another. Perhaps the biggest result of middle class uncertainty has been the directionless trend in the NYSE Composite Index (NYA), which reflects the overall market for U.S. equities. Sustained, runaway-type rallies typically require widespread participation among retail investors, most of whom are middle class.

Middle class uncertainty can be seen in the organized protests all across the country this week. Over the weekend the crowds in Washington, D.C. again made the news, only this time it wasn’t Trump’s inaugural crowd but a gathering of protestors. A crowd of almost 500,000 gathered for the Women’s March on Washington to protest the Trump presidency. Times of uncertainty breed hostility and revolt.

The flip side of the spirit of uncertainty is that, unlike its much stronger cousin fear, it tends to be unfocused and aimless. Witness for instance the Women’s March on Washington and the many smaller marches in cities throughout the country this weekend. What exactly were these people protesting? I’m not sure most of them even knew what they were doing on the streets, yet they felt compelled to go out and protest something -- anything. Indeed, when the spirit of uncertainty is prevalent it breeds indecision in almost every aspect of life. This is another facet of the directionless and range-bound market environment worth considering.

My mentor, the late Bud Kress, emphasized that whenever his Grand Super Cycle of 120 years bottoms, it’s always accompanied or followed by revolution. Prior to his death, Bud predicted that the 2014 Super Cycle bottom would witness an accelerated trend toward socialism in the U.S. government. While there is some merit to his prediction, it’s probably closer to the truth to say that the revolution(s) that have happened in the last couple of years have been mass reactions against socialism in government. One thing is for certainty, though: the spirit of revolt has been quite strong.

The insecurity and uncertainty prevalent among the middle class is also reflected in the following graph. The Middle Class Index (MCI) show below is comprised of the companies which cater mainly to the middle class, including WalMart, Dollar General, McDonalds, Ford, and JC Penny.

As you can see here, the MCI has traced out a sideways pattern since 2014 and in recent weeks has shown a modicum of weakness. This sagging pattern over the past few weeks even as the major stock market indices approaching all-time highs is a little disconcerting. Perhaps this explains the feelings of anger and revolt that have become commonplace of late.

Should the middle class index fail to break out from its 2+ year trading range soon, the middle class may show further signs of discontent this year – especially if President Trump fails to deliver on his promises to the middle class.

Moreover, a failure of the upper-middle class index to reverse its downward trend fairly soon could potentially cause problems with the broader economy given their outsized impact on consumer spending. Needless to say, the next few months will be very informative on a number of levels.

With discontent clearly reaching the boiling point in the middle class, why hasn’t this been adequately reflected in the price of gold? Although gold rose more than 9% in 2016, its first annual gain in four years, it finished the year well below summer high. Gold’s weak finish to 2016 was largely due to the market tide expecting strength from the U.S. economy under the incoming Trump administration. Investors expectations of higher interest rates and higher stock prices in 2017 triggered an unwinding of safe haven trades in both gold and government bonds in Q4, undermining the metal’s desirability for uncertain times.

More recently, however, gold has benefited from a technically oversold condition as well as signs of short-term weakness in the global equity market. In late December, gold confirmed a bottom in relation to its 15-day moving average per the rules of our technical trading discipline.

Not everything was supportive for gold’s latest rally effort, though. Also needed to confirm anything beyond a short-term rally is a reversal of gold’s relative strength indicator (versus equities), which remains near its low for the year.

Uncertain times usually bode well for the gold price since the yellow metal is a prime haven for safety-minded investors. Gold’s best performances, however, occur when outright fear is the dominant emotion among investors. Uncertainty can serve as a supporting factor for gold prices, but by itself it’s unlikely to carry the gold price to substantial heights. Something more meaningful is needed for that. Gold is driven primarily by two major factors: sustained inflationary pressure or sustained deflationary pressure. Anything that threatens to undermine U.S. dollar strength (e.g. the threat of military conflict or political uncertainty) would bode well for gold’s intermediate-term outlook. Inflation, per se, isn’t needed to boost gold but a reversal of the dollar’s uptrend, even if only temporarily, would suffice.

The rally to date in gold and silver has been characterized by many analysts as simply a technical rally. Short covering and seasonal/holiday-related buying were certainly key factors in the rally getting started. However, additional gains from here, provided they are accompanied by steady erosion in the dollar index and improvement in relative strength, could turn a technical rally into something more substantial. In particular, a break below the 120-day moving average for the dollar index (see above chart) would markedly improve gold’s intermediate-term prospects.

********

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.

........continues http://www.gold-eagle.com/article/gold-and-middle-class-revolt

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Another “Dovish Jobs Report”-And The Future Of Precious Metal Storage

Andrew Hoffman

| February 3, 2017 - 2:56pm

It’s Friday morning, and I want to start by demonstrating just how desperate the powers that be have become – to preserve a dying status quo, in which the causes of decades of profligate fiscal and monetary policy are being exposed by the effects of political destabilization; economic stagnation; debt explosion; social unrest; and serial currency collapse.

Yesterday’s epic combination of “PM-bullish, everything-else-bearish” headlines; including Trump’s contentious exchanges with Presidents of Mexico, Iran, and Australia – following China, Japan, and Germany two days earlier; ugly, way below expected Deutsche Bank earnings; dovish Bank of England and Japan policy statements -following the previous day’s epic Federal Reserve punt; and a surging January Challenger job cuts report.

After which, the Cartel did its thing, using the same “Cartel Herald” algorithm as always, to push gold and silver down after the 10:00 AM EST close of the global physical markets. Still, both metals touched highs for the year; having decidedly held their 50 day moving averages of $1,177/oz and $16,71/oz, respectively, as they prepare to inevitably challenge their 200 day moving averages of $1,266/oz and $17.93/oz, respectively. At one point, the (meaningless but widely watched) “dollar index” fell as low a as 99.3, before moving back up towards the key psychological level of 100; i.e., the post-election breakout level, representing the market’s current view on just how realistic the (ridiculous, soon-to-be-permanently-disproven) “Trump-flation” meme actually is.

Fast forward to today – as I edit, three hours after “another dovish jobs report”; and with the dollar back down to 99.7; gold and silver again challenging $1,220/oz and $17.50/oz); and the benchmark 10-year Treasury yield at 2.43%, I can’t help reiterating last month’s “2.5%, ‘Nuff Said” thesis; i.e., that the 10-year yield – as a proxy to U.S. interest rates in general – simply CANNOT rise above this increasingly obvious “line in the sand” without annihilating the U.S. – and global – economy; and subsequetly, the vast majority of already collapsing fiat toilet papers. This, compared to the 3.0% “economic line in the sand” I first predicted – and was proven wildly correct about – three years ago; as today, the economy is in much worse shape; whilst global debt levels are much higher.

Aside for the, rigged headline number of 227,000 new January “jobs” being “better than expected,” everything else about the report, as usual, was horrible. Starting with the fact that the household survey showed a decline of 30,000 jobs; whilst December’s NFP headline number was revised downward by 40,000, entirely offsetting this month’s “beat.” Moreover, the all-important average weekly earnings number, at up 0.1%, was well below the expected 0.3%, despite countless minimum wage increases having been enacted to start the year; whilst last month’s supposedly “great” 0.4% average weekly earnings gain was revised down to just 0.2%. And again, I cannot empasize enough how vital wage growth is to the Fed’s thesis regarding inflation – which for the vast majority of Americans, is non-existent.

Sure, the labor force increased for the first time in ages; likely, due to people making New Year’s resolutions to look for a job; but unfortunately, most of them didn’t get one, resulting in a rise in the (already laughably understated) “unemployment rate.” And if you believe what the BLS tells us – that (mostly minimum wage paying) retailers were the biggest source of January jobs, following the worst holiday spending season since the 2008 crisis, I have a bridge in Brooklyn to sell you.

Trust me, if the Cartel is failing to smash Precious Metals on a day when the jobs report was supposedly “great,” what’s left of actual market participants decidedly know otherwise. Let alone, in the currency and bond markets – which loudly and clearly, are increasingly questioning the Fed’s (ridiculous, impossible, propagandist) expectation of three rate hikes this year.

Which brings me to today’s slightly less “economic” topic – although clearly, the reasons behind Precious Metal storage decisions are as much economic, as they are political and logistic. Which is, further commentary about what I believe to be the future of Precious Metals – and even cash storage (in this case, U.S. dollars, Canadian dollars, and Swiss Francs); i.e., Miles Franklin’s new, to the best of our knowledge unparalleled in the bullion industry, Private Safe Deposit Box program with Brink’s Toronto and Vancouver – as detailed in this article from November, when the service was launched; and this interview with President and Co-Founder Andy Schectman, in which all aspects of the program are discussed.

I’m not going to go over specific attributes of the program here, as they are discussed in detail in the aforementioned article and interview. And of course, you can call one of Miles Franklin’s brokers – on average, with roughly 25 years of bullion industry experience – at 800-822-8080; and they’d be happy to answer any questions you might have. Instead, I’m simply going to share my experience with the program, now that I have just become a client.

Long-time readers know that Miles Franklin commenced its segregated Precious Metal storage program with Brink’s Montreal back in 2012, which was expanded to Brink’s Vancouver location last year. I have been a satisfied client since 2013, and personally attended two regularly scheduled audits – where I witnessed my personal metal be counted. And now, as of this month, I’m a client of the Private Safe Deposit Box program, too.

The reason I bring it up, as that Andy Schectman and Joel Kravitz spent more than a year working on the logistics of this one-of-a-kind program; and when I personally saw the finished product, I couldn’t have been more impressed. To wit, I received in the mail – by signature delivery, of course – a vacuum-sealed packet holding a laminated, authenticated certificate describing my Brink’s Toronto holdings; as well as two keys to my personal safe deposit box. And by personal, I mean that no one, aside from me, has a key. Not even Brink’s themselves, or Miles Franklin.

Yes, Brink’s and Miles Franklin are aware of what’s in the box for accounting and logistics purposes – but they do NOT have a key; and thus, cannot open the box unless I send a key with explicit instructions. After which, if the contents change – due to a deposit or withdrawal – I’ll receive a new vacuum-sealed bag, with a new authenticated holdings certificate and my key back. Or, alternatively, I could simply go to the vault myself, or send the key with a third party – provided I send Brink’s explicit instructions of what that person is allowed to do.

With the global political, economic, and monetary situation more uncertain that at any time in generations, the urgency to protect one’s financial net worth has never been stronger; and given Precious Metals’ unchallenged historical track record, there’s no better way to “insure” yourself than physical gold and silver. And if offshore storage in Canada – one of the most politically stable jurisdictions on the planet – is for you, please give Miles Franklin a call; as in our view, our new Private Safe Deposit Box program represents the “future of Precious Metal storage.”

http://www.silverseek.com/commentary/another-%E2%80%9Cdovish-jobs-report%E2%80%9D-and-future-precious-metal-storage-16303

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.