| Followers | 679 |

| Posts | 141019 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Saturday, December 17, 2016 10:27:07 AM

* December 17, 2016

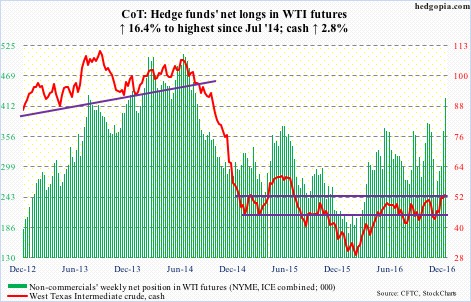

Following futures positions of non-commercials are as of December 13, 2016.

Crude oil: In the wake of the November 30th OPEC deal to cut output by 1.2 million barrels/day comes a non-OPEC agreement on December 11 to reduce by 558,000 b/d on their end. Now, markets will be nervously awaiting if the producers fully comply.

Plus, this probably gives a lifeline to struggling U.S. shale oil producers. U.S. oil rig counts, in fact, have gone up from 316 in May this year to 510. Strategically, it is not in OPEC’s interest to see a significant rise in oil price. On Monday, Nigeria’s petroleum minister said on Bloomberg TV that oil prices at $60/barrel would be “ideal” for OPEC. The Brent closed the week up 1.6 percent to $55.29.

From this respect, the potentially bullish inverse head-and-shoulders pattern on spot West Texas Intermediate crude likely does not complete. This week’s long-legged doji followed a doji last week. Although non-commercials’ net longs have risen to the highest since July 2014.

By Wednesday, bulls were unable to cash in on the EIA report.

In the week ended last Friday, U.S. crude stocks fell by 2.6 million barrels to 483.2 million barrels – a six-week low. Crude imports dropped by 943,000 b/d to 7.4 mb/d – a seven-week low. Distillate stocks declined by 762,000 barrels to 155.9 million barrels. And, refinery utilization inched up one-tenth of a point to 90.5 percent.

Gasoline stocks, however, rose by 497,000 barrels to 230 million barrels. This was a 15-week high. Crude production grew a tad, by 99,000 b/d to 8.8 mb/d. This was the highest since early May this year.

Currently net long 426.4k, up 60.2k.

http://www.hedgopia.com/cot-peek-into-future-through-futures-74/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

FEATURED NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM