Saturday, December 10, 2016 3:49:38 PM

Ponder the last 6 months revs & gross-profit history...

AVID PROFITABILITY (GROSS) BY QTR:

QTR Avid-Rev$ CostofMfg$ Gross-Profit$ GP%

FY15Q4 4-30-15 9,308,000 4,758,000 4,550,000 49%

FY16Q1 7-31-15 9,379,000 4,608,000 4,771,000 51%

FY16Q2 10-31-15 9,523,000 4,741,000 4,782,000 50%

FY16Q3 1-31-16 6,672,000 3,896,000 2,776,000 42%

FY16Q4 4-30-16 18,783,000 9,721,000 9,062,000 48%

FY17Q1 7-31-16 5,609,000 3,062,000 2,547,000 45%

FY17Q2 10-31-16 “we remain on track to gen. revs in excess of $20mm in Q2.”

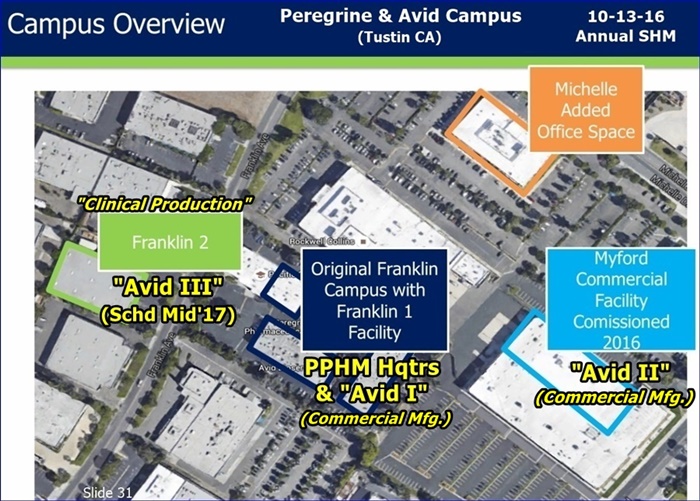

Now Fy16Q3+4 was $25mm, and per P.Lytle 9-8-16/CC (see below), that was ALL from AVID I (“Franklin”) ONLY.

...That tells me that Avid I/Franklin Alone is running roughly $13mm per qtr.

Now, FY17Q1 is where we had the “3rd Party Testing Delay”, so revs only $5.6mm. The key is that P.Lytle said on 9-8-16 that Q1 contained THE FIRST AVID II (“Myford”) revs (“process validation runs” for customerS PLURAL, prior to FDA approval for Commercial runs).

I’m going to venture that without that delay, Q1 would have come it AT LEAST $15mm – $13mm from Franklin, and let’s say $2mm from Myford’s 1st qtr of producing revenues.

That means roughly $9mm were “delayed” and will fall into Q2 (q/e 10-31-16) to be reported Monday.

Now, what does that mean for Q2 on Monday?

I think you take the $9mm delayed from Q1 and add another MIN. $16mm ($13 + $3/Myford, again very conservative as Avid II Myford has got to be on an upswing, from Q1=>Q2).

That gives you $25mm.

I honestly don’t see why that can’t happen.

IF IF IF Q2 comes in at $25mm, think about what that does to Q1’s CASH BURN of $9.6mm.

You’re taking an addl. $19mm in revs of Q2 over Q1, times a GP% that’s been running roughly 47%.

TO ME, that about forces that Q1 CASH BURN down close to zero for Q2.

- - - - - - - - -

9-8-16 CC/Q&A, CFO Paul Lytle:

“We recognized $44mm in revenues during FY16 (fye 4-30-16) and that all came from our original Franklin facility. In March this year, we commissioned our new Myford facility, which is built for late stage Phase III clinical & commercial production. We are currently going through the motions of multiple process validation runs and those runs right now are built into our financial projections of the $50-55mm, with our goal of turning those process validation runs, which is the final step before submitting something to the FDA under preapproval inspection in terms of producing commercial quantities for those clients. So this year is really a building year in terms of building those process validation runs for our clients, and then we’re hopeful that those will turn into commercial supply needs in future FY’s.” http://tinyurl.com/jydtkoy

...Avid II (Myford) revenues were coming in as of 9-8-16, albeit via “mult. process validation runs” for clientS (<=note plural per PL). We don’t know when the FDA allows those to turn into Commercial Runs, but the trendline on Avid II revenue contributions to total Avid revenues is clearly UP – they’ve told us “up to $40mm per year” when Avid II is really humming.

Recent CDMO News

- Avid Bioservices Reports Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 04/24/2024 09:25:33 PM

- Avid Bioservices Announces Receipt of Deficiency Notice from Nasdaq Regarding Late Form 10-Q • GlobeNewswire Inc. • 03/20/2024 11:00:10 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/07/2024 11:30:11 AM

- Avid Bioservices Announces Pricing of Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/07/2024 04:58:48 AM

- Avid Bioservices Announces Proposed Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/06/2024 09:32:07 PM

- Avid Bioservices Announces Certain Preliminary Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 03/06/2024 09:31:28 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/06/2024 09:30:18 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/26/2024 09:57:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 12:34:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:39:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:38:30 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:37:38 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:36:27 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:35:47 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/11/2024 12:56:02 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/08/2024 09:32:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:56:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:55:07 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:53:58 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:51:57 AM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 12/19/2023 09:05:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:34:08 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:33:03 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:32:11 AM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM