| Followers | 923 |

| Posts | 48277 |

| Boards Moderated | 0 |

| Alias Born | 07/22/2008 |

Saturday, December 03, 2016 2:37:38 PM

2.70 way undervalued here

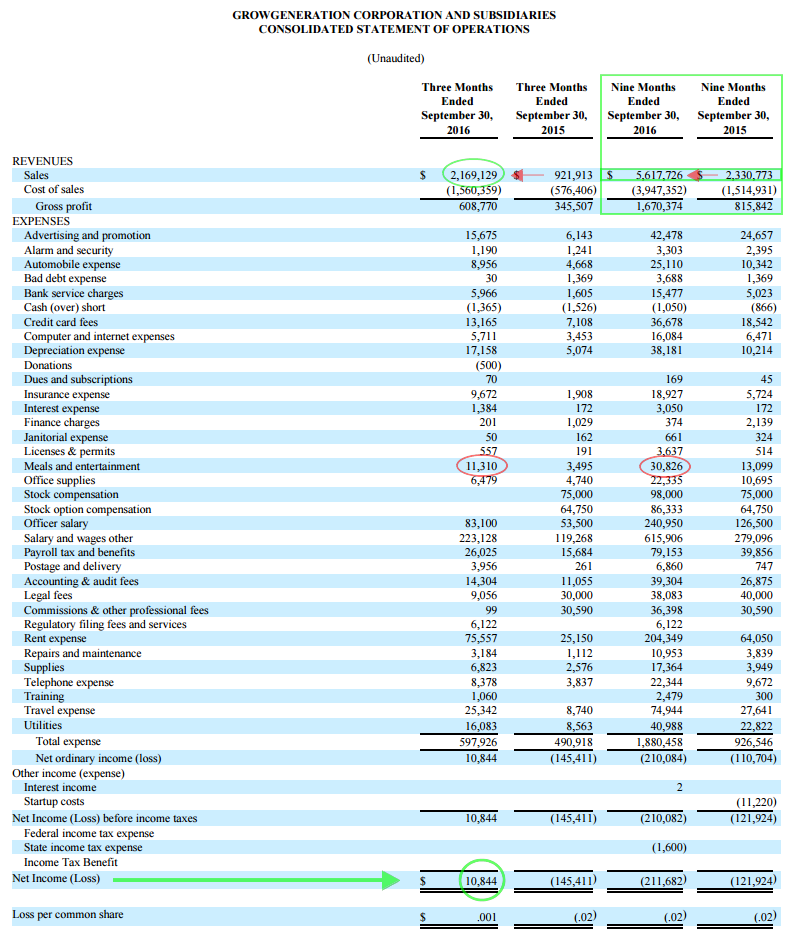

Bottom line > High revenue growth and now turning a profit...small...but profit. $10,844 profit for the Q.

On pace for approximately $8 million in revenues for the year.

Market cap with 11,053,548 OS is $29,844,580 (3.5 x sales/revenues).

High growth, if sustained, equates to 'way undervalued' at current price. JMO (stockholders' equity looks like $3.30ish per share based on that metric only. I'll post the balance sheet later when I get time.)

Good day.

Link > GRWG 10Q FILED 11/14/2016

Recent GRWG News

- GrowGeneration to Participate in the Lake Street Capital Markets 8th Annual Best Ideas Growth Conference on September 12, 2024 • Business Wire • 08/28/2024 08:05:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/16/2024 09:00:15 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/15/2024 09:01:08 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/15/2024 09:00:37 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/08/2024 08:27:24 PM

- GrowGeneration Reports Second Quarter 2024 Financial Results • Business Wire • 08/08/2024 08:05:00 PM

- GrowGeneration Schedules Second Quarter 2024 Earnings Release Conference Call for August 8, 2024 • Business Wire • 07/24/2024 08:05:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/23/2024 03:12:45 PM

- GrowGeneration Announces Second Quarter 2024 Preliminary Results, Strategic Restructuring Plan and Outlines Path to Profitability • Business Wire • 07/22/2024 08:05:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/18/2024 07:29:15 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/18/2024 07:28:46 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/18/2024 07:28:15 PM

- GrowGeneration to Participate in The Benzinga Cannabis Market Spotlight on June 17, 2024 • Business Wire • 06/13/2024 12:00:00 PM

- GrowGeneration’s Horticultural Rep Group Unveils B2B Portal for Hydroponic Retailers and Garden Centers Nationwide • Business Wire • 06/11/2024 12:00:00 PM

- KCSA Cannabis Virtual Investor Conference Presentations Now Available for Online Viewing • GlobeNewswire Inc. • 06/06/2024 12:35:00 PM

- GrowGeneration to Participate in Oppenheimer's 24th Annual Consumer Growth and E-Commerce Virtual Conference • Business Wire • 06/06/2024 12:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/03/2024 09:06:37 PM

- KSCA Cannabis Virtual Investor Conference Agenda Announced for June 5th • GlobeNewswire Inc. • 05/31/2024 12:43:44 PM

- GrowGeneration to Present at the KCSA Cannabis Virtual Investor Conference June 5th • GlobeNewswire Inc. • 05/30/2024 12:35:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/08/2024 09:13:47 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 05/08/2024 09:12:49 PM

- GrowGeneration Reports First Quarter 2024 Financial Results • Business Wire • 05/08/2024 08:05:00 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 05/08/2024 06:04:44 PM

- GrowGeneration Announces Change to Board of Directors • Business Wire • 04/25/2024 12:00:00 PM

- GrowGeneration Schedules First Quarter 2024 Earnings Release Conference Call for May 8, 2024 • Business Wire • 04/23/2024 12:00:00 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM