| Followers | 681 |

| Posts | 141881 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Saturday, December 03, 2016 9:45:41 AM

* December 3, 2016

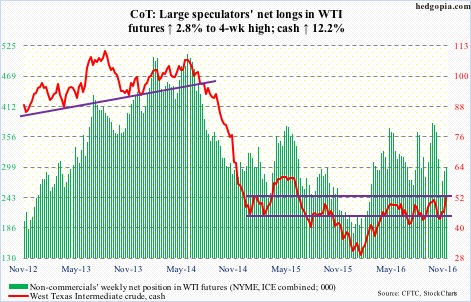

Following futures positions of non-commercials are as of November 29, 2016.

Crude oil: So OPEC does hash out a deal to cut production after all – first cut in eight years! It plans to reduce crude output by 1.2 million barrels per day by January. Even Russia, a non-OPEC member, will pitch in with a cut of as much as 300,000 b/d.

Markets were surprised. Spot West Texas Intermediate crude surged 9.3 percent on Wednesday, adding another 4.6 percent in the next two sessions. U.S. shale plays soared – with Continental Resources (CLR) up 23 percent and Whiting Petroleum up 30 percent on Wednesday, among others.

Therein lies the rub. Would the OPEC deal end up giving lifeline to the U.S. shale producers that were severely hurting by the low price?

Markets will also be on pins and needles whether or not all parties stick to the agreement. It is a six-month deal. OPEC will next meet on May 25 next year.

Spot WTI ($51.68) is literally sitting at resistance at $52-ish, which goes back two years, and makes up the neckline of a reverse-head-and-shoulders formation.

Wednesday’s EIA report for the week ended last Friday was mixed.

U.S. crude stocks were down 884,000 barrels to a three-week low 488.1 million barrels.

Crude imports fell, too, by 30,000 b/d, to 7.5 mb/d.

Other data points were not so positive.

Gasoline stocks rose by 2.1 million barrels to 226.1 million barrels, and distillate stocks by five million barrels to 154.2 million barrels.

Crude production rose by 9,000 b/d to 8.7 mb/d, and refinery utilization shrank one percentage point to 89.8.

Currently net long 300.4k, up 8.1k.

http://www.hedgopia.com/cot-peek-into-future-through-futures-72/

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

FEATURED DaBaby and Stunna 4 Vegas's "NO DRIBBLE" Joins Music Licensing, Inc.'s Portfolio • Jun 7, 2024 10:15 AM

Mushrooms Inc. (OTC: MSRM) Announces Significant Share Buy Back by the Board Director and New Strategic Initiatives. • MSRM • Jun 5, 2024 1:32 PM

Hydromer Announces Launch of HydroThrombX Medical Device Coating Technology • HYDI • Jun 5, 2024 10:24 AM

Dr. Michael Dent Finances $1 Million to Drive HealthLynked's Healthcare Transformation • HLYK • Jun 5, 2024 8:00 AM

Avant Technologies Enters Binding LOI to Purchase Dozens of High-Performance, Immersible, AI-Powered Servers • AVAI • Jun 5, 2024 8:00 AM

IQST - iQSTEL Announces $290 Million 2024 Annual Revenue Forecast • IQST • Jun 4, 2024 1:43 PM