| Followers | 2530 |

| Posts | 69910 |

| Boards Moderated | 0 |

| Alias Born | 07/30/2012 |

Saturday, November 19, 2016 10:38:24 PM

$DLCR DD COMPILATION - READ ALL

SPECIAL THANKS TO ***TWOSECURE***, DREW88 and PENNYPINCHER in gathering all this DD.

‘DLCR’50% INCREASE OUTPUT,LOGGING and PROCESSING CAPACITY

‘DLCR’ plan to upgrade our capital equipment in order to increase logging and processing capacity for a 50% increase in output.

www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

‘DLCR’ REVENUES IN EXCESS OF $375,000 PER MONTH

‘DLCR’ will move two more mills from Brown River TA to Rigo to boost capacity. Once these additional mills are in place ‘DLCR’ plans to run two shifts to maximize output. The yield from the log processing may vary, but ‘DLCR’ forecasts an output of 400 cubic meters per month when fully operational. Based upon ‘DLCR’ estimated sales mix and customer requirements, ‘DLCR’ estimates that 400 cubic meters of timber would result in revenues in excess of $250,000 per month.

Once ‘DLCR’has consistent revenue, ‘DLCR’ plans to upgrade their capital equipment in order to increase logging and processing capacity for a 50% increase in output

(50% increase in output logging and processing capacity would result in revenues in excess of $375,000 per month)

http://www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

$DLCR purchased / acquired 100% of the outstanding shares of the Paradise Gardens for $19,687.50 US Dollars (The Purchase Price was funded through existing cash on hand including sums from prior loan proceeds.)

The sworn value of the Paradise Garden assets on the balance sheet of Paradise Gardens as audited and prepared by International Accounting firm BDO was PGK 1,481,891 (USD $489,072), and after depreciation a holding value of PGK 876,088 (USD$ 289,137). In addition to the acquired assets, Paradise Gardens has significant carry forward income tax loss in Papua New Guinea as per the financial statements prepared by BDO (PGK 3,479,985 at 30% tax rate = PGK1,043,995 (USD $344,552)

‘DLCR’ will continue in the short-term using the processing area that is leased by Paradise Gardens at Kairuku Hiri District approximately 60 kilometers from Port Moresby, until we establish a new processing facility closer to Port Moresby. We are currently looking at areas around the Laloki region 30 minutes north east from Port Moresby. We anticipate the transition of our processing facility to the Laloki area will be completed during the quarter ended June 30, 2017.

http://finance.yahoo.com/news/kibush-capital-finalizes-purchase-paradise-120000855.html

http://ih.advfn.com/p.php?pid=nmona&article=72647872

CEO Warren is already pursuing 3 other timber commercialization opportunities in addition to the Kubuna and Rigo sites.

CEO_SAID ‘DLCR' SHARE_PRICE_SHOULD_BE_TRADING @ $.30-50 CENTS

‘DLCR’ stock should be trading 30-50 cents given the assets we are taking on

Warren Sheppard

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124419148

‘DLCR’ CEO MR WARREN SHEPPARD said . …..

“price of the share sitting where it is today will be a bargain compared to what the market then determines the value of those shares.”

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=126050155

DLCR~EMAIL FROM WARREN--RE: set-up

Tuesday, October 25, 2016 1:50 PM

Mark as Unread

From: "Kibush" <admin@kibushcapital.com>To: "'Stan

Full Headers Printable View

HI Stan

I have not converted any of my convertible notes into shares nor have I ever sold any shares in Kibush.

I have no control over the conversion of convertible notes held by financiers to shares in the company. A number of investors don’t understand the timeframes in conversion from a convertible note to a dtc accepted share. My comments to my knowledge are correct all through these past 4 weeks, at the time I checked with my TA and noteholders to clarify what was currently being converted, that answer is correct. The difference is the time frame for the TA to accept and issue and then the broker to accept with supporting documentation and then the back office clearing account of the brokerage to accept all of the documentation and then clear the shares as tradeable to DTC. From that point the new shares are at the discretion of the holder to be held or sold, some may wish to hold for an immediate, short, medium or long term strategy.

There is one thing the rumours are forgetting, that is what has been disclosed is absolutely 100% accurate, unfortunately the timing may have had a delay through normal business interruptions, but the revenues projected and the resource available will support the price when we can quantify this to the market. That is imminent and then the price of the share sitting where it is today will be a bargain compared to what the market then determines the value of those shares.

Have patience I have

Regards

Warren Sheppard

-----Original Message-----

From:Stan

Sent: Saturday, 22 October 2016 2:26 PM

To: admin@kibushcapital.com

Subject: set-up

Hello Warren, I need confirmation that you told a Roepicks by Email that there would be no more CVs' this year.

I consider you to be a upright man.

"They" (those who are shorting the stock) want to dis-credit you for failure to keep his word._THEREFORE_ I need a confirmation Email as to what was said _or_ not said concerning Convertibles(CVs') .If you said anything at all by Email to a RoePicks about CVs'

Best Regards,Stan

$DLCR Completes First Week of Timber Operations at Rigo, PNG

Nov 08, 2016

OTC Disclosure & News Service

MELBOURNE, Australia, Nov. 08, 2016 (GLOBE NEWSWIRE) -- Kibush Capital Corporation (OTC:DLCR) (the “Company”) announced today that its subsidiary Aqua Mining had completed its first week of operations at Rigo. During that week we have cut 42 trees which will yield approximately 200 cubic meters of timber and we will now commence processing the rough sawn timber. Two Lucas mills are currently on site in Rego, and the Company will move two more mills from Brown River TA to Rigo to boost our capacity. Once these additional mills are in place we plan to run two shifts to maximize output. The yield from the log processing may vary, but we forecast an output of 400 cubic meters per month when fully operational. Based upon our estimated sales mix and customer requirements, we estimate that 400 cubic meters of timber would result in revenues in excess of $250,000 per month. Once we have consistent revenue, we plan to upgrade our capital equipment in order to increase logging and processing capacity for a 50% increase in output. Warren Sheppard, the Company’s CEO stated, “this is a great achievement by our management team and employees located in Papua New Guinea. It is great to see that the Timber Authority resource at Rigo can now be quantified by actual logging and processing results. We look forward to the growth of our timber operations in Papua New Guinea.”

http://www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

http://www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

With mining in Australia and their logging revenue they could easily partner up with a TSXV a company looking for Lithium in Australia which is right now one of the hottest sectors out there and obvious dissolving of the NAFTA agreement dissolves timber sales will skyrocket.

Also with the logging caps in Canada. The US will start sourcing globally for better deals in Australia only towards the Ports of San Francisco and Los Angeles.

https://www.facebook.com/plugins/video.php?href=https%3A%2F%2Fwww.facebook.com%2Fkibushcapitaldlcr%2Fvideos%2F1769283119994145%2F&;

TIMBER AND LOGGING - PAPUA NEW GUINEA

A timber logging and sawmill business in the Kairuku Hiri District of Central Province in Papua New Guinea. The sawmill site is approximately 1 hour's drive from the center of the nation's capital Port Moresby.

With the formal contracted consent of the customary land owners, the company operates a Timber Authority ("TA") registered with the PNG Forest Authority which permits a harvest of 5,000m3. The saw milling operation also has relatively easy access to extensive other timber resources in adjacent areas, including a signed exclusive Supply Agreement with neighbors to purchase their hardwood logs, and verbal Agreements with other landowners nearby.

HARVESTING, PROCESSING AND PRODUCTS

The facility has been refurbished and extended it is producing 350m3 of saleable timber per month and it is anticipated that log production can be grown to become consistently maintained at a minimum of 500m3 per month (subject to wet season constraints). This estimate is for production from logs sourced from the company's registered Timber Authority and plentiful availability of additional log supply for which the company holds contracts to purchase from neighbors. Furthermore, the company also has verbal agreements to purchase logs with other parties nearby.

ENVIORMENTAL SUSTAINABILITY

Logging operations conform to Logging Code of Practive and particularly the 24 key Standards. Buffer zones are established for the different classes of creeks, streams and rivers and marked with colored ribbons. Operators are instructed to ensure that trees within the restricted areas are not felled.

The company undertakes "selective logging" in keeping with a philosophy ensuring that operations are undertaken on a sustainable basis. Basically, only selected species of commercial value (and as approved by the T.A.) are marked, felled and sawn. This method minimizes disturbances or destruction of to the forest area.

GOLD - PAPUA NEW GUINEA

Aqua Mining is a wholly owned subsidiary of Kibush Capital. Aqua Mining is currently in the exploration stage. Aqua Mining was created to undertake certain opportunities that exist within the mining sector of the economy of Papua New Guinea. The Director Mr. Vincent Appo, has extensive experience and knowledge in this sector and has over the years assembled a vast network of contacts and contractors that will assist the company in their managerial and operational endeavors. From the outset the company is negotiating over 2 mine sites for further exploration.

Aqua Mining in the past six months has negotiated and finalized with landowners in the WAU area of PNG, Joint Ventures to conduct mineral exploration activities. These Joint Venture Agreements will form the basis of applications to the Mining Resource Authority in PNG for Mining Licenses. In addition, Aqua Mining has been accepted as a developer of AML 694-695.

JADE - AUSTRALIA

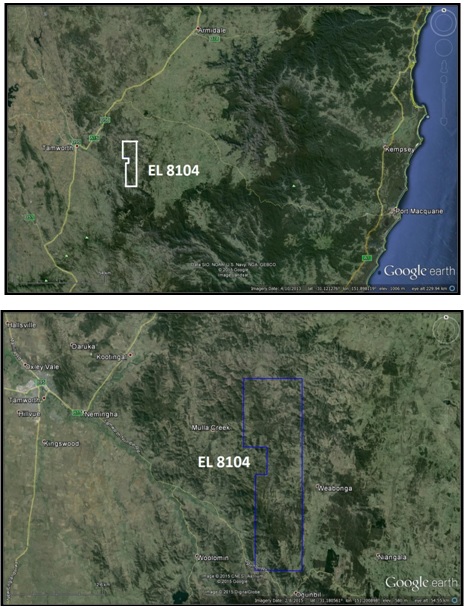

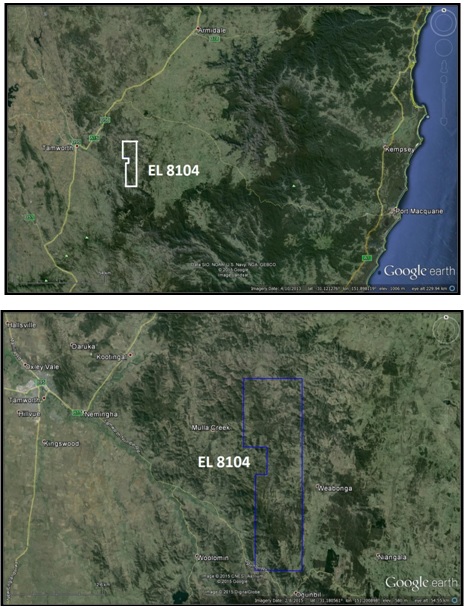

The Company owns 70% of the ordinary shares of Angel Jade Pty Ltd, an Australian company. The assets of Angel Jade are comprised of Exploration License 8104, the area covered is 35 km SE of Tamworth, 300 sq. km in size, 250 km from the port of Newcastle, NSW and accessible by sealed road. Nephrite jade occurs in the New England Fold Belt, which extends from northeast New South Wales into southeast Queensland. The target mineral in this tenement is jade, but we will also explore for Rhodonite.

Angel Jade has identified a 3 tiered exploitation of jade. The First Tier, finely ground lower quality jade to nano particle sized powder, enabling the jade to release infra-red radiation. These particles can be added to paint, ceramic tiles and to cotton for use in fabrics. The Second Tier, exclusive works of art created by the renowned artist Xie Shen. These carved pieces are typically between 0.5 and 2 tons each, and would be showcased at major Asian Art Galleries. The Third Tier is to establish a premium high end Jade Brand for jewelry and art, to be sold and marketed through respected gallery and jewelry outlets. The current price of jade per kilogram has a spread of $5 to $50 depending on the grade.

SPECIAL THANKS TO ***TWOSECURE***, DREW88 and PENNYPINCHER in gathering all this DD.

‘DLCR’50% INCREASE OUTPUT,LOGGING and PROCESSING CAPACITY

‘DLCR’ plan to upgrade our capital equipment in order to increase logging and processing capacity for a 50% increase in output.

www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

‘DLCR’ REVENUES IN EXCESS OF $375,000 PER MONTH

‘DLCR’ will move two more mills from Brown River TA to Rigo to boost capacity. Once these additional mills are in place ‘DLCR’ plans to run two shifts to maximize output. The yield from the log processing may vary, but ‘DLCR’ forecasts an output of 400 cubic meters per month when fully operational. Based upon ‘DLCR’ estimated sales mix and customer requirements, ‘DLCR’ estimates that 400 cubic meters of timber would result in revenues in excess of $250,000 per month.

Once ‘DLCR’has consistent revenue, ‘DLCR’ plans to upgrade their capital equipment in order to increase logging and processing capacity for a 50% increase in output

(50% increase in output logging and processing capacity would result in revenues in excess of $375,000 per month)

http://www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

$DLCR purchased / acquired 100% of the outstanding shares of the Paradise Gardens for $19,687.50 US Dollars (The Purchase Price was funded through existing cash on hand including sums from prior loan proceeds.)

The sworn value of the Paradise Garden assets on the balance sheet of Paradise Gardens as audited and prepared by International Accounting firm BDO was PGK 1,481,891 (USD $489,072), and after depreciation a holding value of PGK 876,088 (USD$ 289,137). In addition to the acquired assets, Paradise Gardens has significant carry forward income tax loss in Papua New Guinea as per the financial statements prepared by BDO (PGK 3,479,985 at 30% tax rate = PGK1,043,995 (USD $344,552)

‘DLCR’ will continue in the short-term using the processing area that is leased by Paradise Gardens at Kairuku Hiri District approximately 60 kilometers from Port Moresby, until we establish a new processing facility closer to Port Moresby. We are currently looking at areas around the Laloki region 30 minutes north east from Port Moresby. We anticipate the transition of our processing facility to the Laloki area will be completed during the quarter ended June 30, 2017.

http://finance.yahoo.com/news/kibush-capital-finalizes-purchase-paradise-120000855.html

http://ih.advfn.com/p.php?pid=nmona&article=72647872

CEO Warren is already pursuing 3 other timber commercialization opportunities in addition to the Kubuna and Rigo sites.

CEO_SAID ‘DLCR' SHARE_PRICE_SHOULD_BE_TRADING @ $.30-50 CENTS

‘DLCR’ stock should be trading 30-50 cents given the assets we are taking on

Warren Sheppard

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124419148

‘DLCR’ CEO MR WARREN SHEPPARD said . …..

“price of the share sitting where it is today will be a bargain compared to what the market then determines the value of those shares.”

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=126050155

DLCR~EMAIL FROM WARREN--RE: set-up

Tuesday, October 25, 2016 1:50 PM

Mark as Unread

From: "Kibush" <admin@kibushcapital.com>To: "'Stan

Full Headers Printable View

HI Stan

I have not converted any of my convertible notes into shares nor have I ever sold any shares in Kibush.

I have no control over the conversion of convertible notes held by financiers to shares in the company. A number of investors don’t understand the timeframes in conversion from a convertible note to a dtc accepted share. My comments to my knowledge are correct all through these past 4 weeks, at the time I checked with my TA and noteholders to clarify what was currently being converted, that answer is correct. The difference is the time frame for the TA to accept and issue and then the broker to accept with supporting documentation and then the back office clearing account of the brokerage to accept all of the documentation and then clear the shares as tradeable to DTC. From that point the new shares are at the discretion of the holder to be held or sold, some may wish to hold for an immediate, short, medium or long term strategy.

There is one thing the rumours are forgetting, that is what has been disclosed is absolutely 100% accurate, unfortunately the timing may have had a delay through normal business interruptions, but the revenues projected and the resource available will support the price when we can quantify this to the market. That is imminent and then the price of the share sitting where it is today will be a bargain compared to what the market then determines the value of those shares.

Have patience I have

Regards

Warren Sheppard

-----Original Message-----

From:Stan

Sent: Saturday, 22 October 2016 2:26 PM

To: admin@kibushcapital.com

Subject: set-up

Hello Warren, I need confirmation that you told a Roepicks by Email that there would be no more CVs' this year.

I consider you to be a upright man.

"They" (those who are shorting the stock) want to dis-credit you for failure to keep his word._THEREFORE_ I need a confirmation Email as to what was said _or_ not said concerning Convertibles(CVs') .If you said anything at all by Email to a RoePicks about CVs'

Best Regards,Stan

$DLCR Completes First Week of Timber Operations at Rigo, PNG

Nov 08, 2016

OTC Disclosure & News Service

MELBOURNE, Australia, Nov. 08, 2016 (GLOBE NEWSWIRE) -- Kibush Capital Corporation (OTC:DLCR) (the “Company”) announced today that its subsidiary Aqua Mining had completed its first week of operations at Rigo. During that week we have cut 42 trees which will yield approximately 200 cubic meters of timber and we will now commence processing the rough sawn timber. Two Lucas mills are currently on site in Rego, and the Company will move two more mills from Brown River TA to Rigo to boost our capacity. Once these additional mills are in place we plan to run two shifts to maximize output. The yield from the log processing may vary, but we forecast an output of 400 cubic meters per month when fully operational. Based upon our estimated sales mix and customer requirements, we estimate that 400 cubic meters of timber would result in revenues in excess of $250,000 per month. Once we have consistent revenue, we plan to upgrade our capital equipment in order to increase logging and processing capacity for a 50% increase in output. Warren Sheppard, the Company’s CEO stated, “this is a great achievement by our management team and employees located in Papua New Guinea. It is great to see that the Timber Authority resource at Rigo can now be quantified by actual logging and processing results. We look forward to the growth of our timber operations in Papua New Guinea.”

http://www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

http://www.otcmarkets.com/stock/DLCR/news/Kibush-Capital-Completes-First-Week-of-Timber-Operations-at-Rigo--PNG?id=144250&b=y

With mining in Australia and their logging revenue they could easily partner up with a TSXV a company looking for Lithium in Australia which is right now one of the hottest sectors out there and obvious dissolving of the NAFTA agreement dissolves timber sales will skyrocket.

Also with the logging caps in Canada. The US will start sourcing globally for better deals in Australia only towards the Ports of San Francisco and Los Angeles.

https://www.facebook.com/plugins/video.php?href=https%3A%2F%2Fwww.facebook.com%2Fkibushcapitaldlcr%2Fvideos%2F1769283119994145%2F&;

TIMBER AND LOGGING - PAPUA NEW GUINEA

A timber logging and sawmill business in the Kairuku Hiri District of Central Province in Papua New Guinea. The sawmill site is approximately 1 hour's drive from the center of the nation's capital Port Moresby.

With the formal contracted consent of the customary land owners, the company operates a Timber Authority ("TA") registered with the PNG Forest Authority which permits a harvest of 5,000m3. The saw milling operation also has relatively easy access to extensive other timber resources in adjacent areas, including a signed exclusive Supply Agreement with neighbors to purchase their hardwood logs, and verbal Agreements with other landowners nearby.

HARVESTING, PROCESSING AND PRODUCTS

The facility has been refurbished and extended it is producing 350m3 of saleable timber per month and it is anticipated that log production can be grown to become consistently maintained at a minimum of 500m3 per month (subject to wet season constraints). This estimate is for production from logs sourced from the company's registered Timber Authority and plentiful availability of additional log supply for which the company holds contracts to purchase from neighbors. Furthermore, the company also has verbal agreements to purchase logs with other parties nearby.

ENVIORMENTAL SUSTAINABILITY

Logging operations conform to Logging Code of Practive and particularly the 24 key Standards. Buffer zones are established for the different classes of creeks, streams and rivers and marked with colored ribbons. Operators are instructed to ensure that trees within the restricted areas are not felled.

The company undertakes "selective logging" in keeping with a philosophy ensuring that operations are undertaken on a sustainable basis. Basically, only selected species of commercial value (and as approved by the T.A.) are marked, felled and sawn. This method minimizes disturbances or destruction of to the forest area.

GOLD - PAPUA NEW GUINEA

Aqua Mining is a wholly owned subsidiary of Kibush Capital. Aqua Mining is currently in the exploration stage. Aqua Mining was created to undertake certain opportunities that exist within the mining sector of the economy of Papua New Guinea. The Director Mr. Vincent Appo, has extensive experience and knowledge in this sector and has over the years assembled a vast network of contacts and contractors that will assist the company in their managerial and operational endeavors. From the outset the company is negotiating over 2 mine sites for further exploration.

Aqua Mining in the past six months has negotiated and finalized with landowners in the WAU area of PNG, Joint Ventures to conduct mineral exploration activities. These Joint Venture Agreements will form the basis of applications to the Mining Resource Authority in PNG for Mining Licenses. In addition, Aqua Mining has been accepted as a developer of AML 694-695.

JADE - AUSTRALIA

The Company owns 70% of the ordinary shares of Angel Jade Pty Ltd, an Australian company. The assets of Angel Jade are comprised of Exploration License 8104, the area covered is 35 km SE of Tamworth, 300 sq. km in size, 250 km from the port of Newcastle, NSW and accessible by sealed road. Nephrite jade occurs in the New England Fold Belt, which extends from northeast New South Wales into southeast Queensland. The target mineral in this tenement is jade, but we will also explore for Rhodonite.

Angel Jade has identified a 3 tiered exploitation of jade. The First Tier, finely ground lower quality jade to nano particle sized powder, enabling the jade to release infra-red radiation. These particles can be added to paint, ceramic tiles and to cotton for use in fabrics. The Second Tier, exclusive works of art created by the renowned artist Xie Shen. These carved pieces are typically between 0.5 and 2 tons each, and would be showcased at major Asian Art Galleries. The Third Tier is to establish a premium high end Jade Brand for jewelry and art, to be sold and marketed through respected gallery and jewelry outlets. The current price of jade per kilogram has a spread of $5 to $50 depending on the grade.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.