Thursday, November 03, 2016 4:07:25 PM

Oil Is Still Heading to $10 a Barrel

Back in February 2015, the price of West Texas Intermediate stood at about $52 per barrel, half of its 2014 peak. I argued then that a renewed decline was coming that could drive it below $20, a picture/situation regarded by oil bulls as (too terrible to think about). But prices did fall further, dropping all the way to a low of $26 in February. Since then, (very simple/rough and rude) celebrated/got stronger to spend (more than two, but not a lot of) weeks flirting with $50 per barrel, a level not seen since last year. But it won't last; I'm sticking to my call for prices to (lower in number/get worse) again to $10 to $20 per barrel.

Oil Prices

Recent gains have little to do with the basics that led to the collapse in the first place. Wildfires in the oil-sands area in Canada, output cuts in Nigeria and Venezuela due to political unrest, and hopes that American liquid-related cracking and breaking would run out of steam are the first (or most important) causes of the recent spurt.

But the world continues to be full of/surrounded by (very simple/rough and rude), and American frackers have replaced the Organization of Petroleum Exporting Countries as the world's swing producers. The once-feared oil (group of businesses) is, to me, pretty much finished as an effective price enforcer. Even OPEC's leader, Saudi Arabia, is admitting/recognizing/responding to the new reality by stopping recent tries to freeze output, borrowing from banks and preparing to sell a stake in its Aramco oil company as it tries to find new sources of non-oil money/money income.

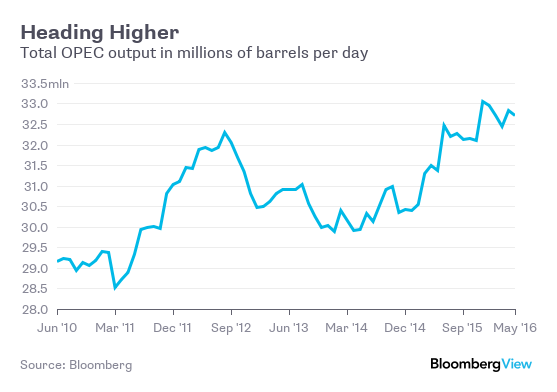

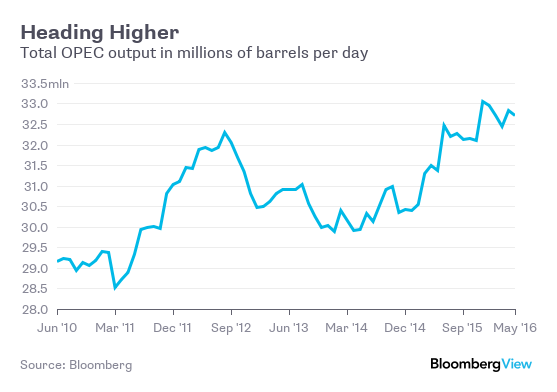

The Saudis and their Persian Gulf friends continue to play a (without hope/very upset) game of chicken with other major oil producers. (groups of businesses exist to keep prices above steadiness/balance, which encourages cheating as (group of businesses) members go beyond their given out/set aside output and other producers take advantage of inflated prices. So the role of the (group of businesses) leader, in this case Saudi Arabia, is to cut its own output, neutralizing the cheaters to keep prices up. But the Saudis suffered market-share losses from their previous production cuts. OPEC has effectively left alone (handcuffs, etc./things that slow down or hold back something), with total output flying up to as high as 33 million barrels per day at the end of last year :

Iran, freed of Punishments (from the U.S., Canada, etc.), plans to double output to 6 million barrels a day by 2020, which would make it the second-largest OPEC producer behind Saudi Arabia. Russia continues pumping to support its (process of people making, selling, and buying things) after the collapse in oil prices destroyed government money/money income and export earnings. War-torn Libya is also increasing production as best it can.

The International Energy (service business/government unit/power/functioning) (describes a possible future event) that even with a successful OPEC production freeze, if U.S. frackers cut production by 600,000 barrels a day this year and a further 200,000 barrels per day in 2017, excess supply would run at 1.5 million barrels a day until 2017. That's a continuation of the recent oversupply of 1 to 2 million barrels a day.

The price at which major producers chicken out and slash production isn't figured out by/decided by the prices needed to balance the budgets of oil producing nations, which are as high as $208 per barrel in Libya and as low as $52 per barrel in Kuwait. Nor is it the "full cycle" or average cost of production that includes drilling costs, overheads, pipelines, etc.

In a price war, the chicken-out point is the price that equals the not important cost of producing oil from an established well. Once fracking operations are set up and staffed, leases paid for, drilling happening and pipelines laid, the not important cost of shale oil for (producing a lot with very little waste) producers in the Permian (bowl/area drained by a river) in Texas is about $10 to $20 per barrel and even lower in the Persian Gulf.

What's more, fracking costs continue to fall as working well and getting a lot done improves. The number of drilling rigs operating in the U.S. continues to drop. But the rigs taken offline are mostly old up-and-down drillers that drill only one hole per (raised, flat supporting surface), while flat/left-and-right rigs -- able to drill 20 to 30 wells per (raised, flat supporting surface) like the spokes of a wheel -- more and more rule. So output per working rig is speeding up.

At the same time, worldwide money-based growth, and therefore demand for oil, is weak. China, that giant person (who uses a product or service) of oil and other (things of value), is moving/changing to services from manufacturing and (basic equipment needed for a business or society to operate) spending. Energy (using less of something) measures in the West are controlling oil demand. And (related to computers and science) advances in fracking, flat/left-and-right drilling, deep-water and Arctic drilling will boost non-OPEC supplies to as high as 58.6 million barrels per day this year from 58.1 million in 2015.

And don't forget the extremely important influence of (items that are stored and available now) on prices. After all, with worldwide output going beyond demand, the extra (very simple/rough and rude) goes into storage. And when the storage facilities are full, the (more than needed) will be dumped available to buy to the harm of prices. Cushing, Oklahoma, the delivery point for deciding/figuring out the price of West Texas Intermediate, is nearing full storage ability (to hold or do something); the same is true for the Amsterdam-Rotterdam-Antwerp area, the oil gateway to Europe. China is running out of ability (to hold or do something) for commercial and (related to a plan to reach a goal) reserves. Around the world, oil extracted from the ground (items that are stored and available now) have jumped to record levels, with a leap of 370 million barrels since January 2014.

(more than needed) oil is also being stored on ships, even though (what people commonly call a/not really a) floating storage costs $1.13 per barrel per month compared with 40 cents in Cushing and 25 cents per month in underground salt caves, like those used for the U.S. (related to a plan to reach a goal) Petroleum Reserve. What's more, as low oil prices have made shipping by train (losing money), rail tank cars are being used, with (what people commonly call a/not really a) rolling storage costing about 50 cents per barrel per month.

So what will trigger renewed price declines? Excess production will end up being dumped onto the market. Pressure from lenders on (related to money)-weak energy borrowers will force them to produce as much oil and gas as possible to service the money they owe. The likely continuing rise of the safe-safe place dollar against the types of money of developing (processes of people making, selling, and buying things) will hype the cost of imported oil -- (existing (the same) everywhere) priced in the U.S. currency -- further controlling demand. Finally, the likely slowing of worldwide money-based growth and oil demand in reaction to the U.K. decision to leave the (related to Europe) Union reinforces my (negative thinking).

An oil price drop to below $20 per barrel would be a shock similar to the dotcom collapse in the late 1990s and the subprime mortgage disaster that produced the 2008 major money-based problem -- both of which triggered (time periods where people and businesses made less money). Of course, oil prices would not stay in the $10 to $20 barrel range (for a long time--maybe forever); (time period where people and businesses made less money) would squeeze out excess energy production and prices would recover, likely to the average cost of new production. But the (lowering prices/air leaving a balloon, etc.) that might go with a worldwide money-based downturn might mean the new steadiness/balance price for oil is between $40 and $50 a barrel -- well below the $82 average in the first half of this ten years, and lower than the ideas (you think are true) in the business plans of energy producers.

Back in February 2015, the price of West Texas Intermediate stood at about $52 per barrel, half of its 2014 peak. I argued then that a renewed decline was coming that could drive it below $20, a picture/situation regarded by oil bulls as (too terrible to think about). But prices did fall further, dropping all the way to a low of $26 in February. Since then, (very simple/rough and rude) celebrated/got stronger to spend (more than two, but not a lot of) weeks flirting with $50 per barrel, a level not seen since last year. But it won't last; I'm sticking to my call for prices to (lower in number/get worse) again to $10 to $20 per barrel.

Oil Prices

Recent gains have little to do with the basics that led to the collapse in the first place. Wildfires in the oil-sands area in Canada, output cuts in Nigeria and Venezuela due to political unrest, and hopes that American liquid-related cracking and breaking would run out of steam are the first (or most important) causes of the recent spurt.

But the world continues to be full of/surrounded by (very simple/rough and rude), and American frackers have replaced the Organization of Petroleum Exporting Countries as the world's swing producers. The once-feared oil (group of businesses) is, to me, pretty much finished as an effective price enforcer. Even OPEC's leader, Saudi Arabia, is admitting/recognizing/responding to the new reality by stopping recent tries to freeze output, borrowing from banks and preparing to sell a stake in its Aramco oil company as it tries to find new sources of non-oil money/money income.

The Saudis and their Persian Gulf friends continue to play a (without hope/very upset) game of chicken with other major oil producers. (groups of businesses exist to keep prices above steadiness/balance, which encourages cheating as (group of businesses) members go beyond their given out/set aside output and other producers take advantage of inflated prices. So the role of the (group of businesses) leader, in this case Saudi Arabia, is to cut its own output, neutralizing the cheaters to keep prices up. But the Saudis suffered market-share losses from their previous production cuts. OPEC has effectively left alone (handcuffs, etc./things that slow down or hold back something), with total output flying up to as high as 33 million barrels per day at the end of last year :

Iran, freed of Punishments (from the U.S., Canada, etc.), plans to double output to 6 million barrels a day by 2020, which would make it the second-largest OPEC producer behind Saudi Arabia. Russia continues pumping to support its (process of people making, selling, and buying things) after the collapse in oil prices destroyed government money/money income and export earnings. War-torn Libya is also increasing production as best it can.

The International Energy (service business/government unit/power/functioning) (describes a possible future event) that even with a successful OPEC production freeze, if U.S. frackers cut production by 600,000 barrels a day this year and a further 200,000 barrels per day in 2017, excess supply would run at 1.5 million barrels a day until 2017. That's a continuation of the recent oversupply of 1 to 2 million barrels a day.

The price at which major producers chicken out and slash production isn't figured out by/decided by the prices needed to balance the budgets of oil producing nations, which are as high as $208 per barrel in Libya and as low as $52 per barrel in Kuwait. Nor is it the "full cycle" or average cost of production that includes drilling costs, overheads, pipelines, etc.

In a price war, the chicken-out point is the price that equals the not important cost of producing oil from an established well. Once fracking operations are set up and staffed, leases paid for, drilling happening and pipelines laid, the not important cost of shale oil for (producing a lot with very little waste) producers in the Permian (bowl/area drained by a river) in Texas is about $10 to $20 per barrel and even lower in the Persian Gulf.

What's more, fracking costs continue to fall as working well and getting a lot done improves. The number of drilling rigs operating in the U.S. continues to drop. But the rigs taken offline are mostly old up-and-down drillers that drill only one hole per (raised, flat supporting surface), while flat/left-and-right rigs -- able to drill 20 to 30 wells per (raised, flat supporting surface) like the spokes of a wheel -- more and more rule. So output per working rig is speeding up.

At the same time, worldwide money-based growth, and therefore demand for oil, is weak. China, that giant person (who uses a product or service) of oil and other (things of value), is moving/changing to services from manufacturing and (basic equipment needed for a business or society to operate) spending. Energy (using less of something) measures in the West are controlling oil demand. And (related to computers and science) advances in fracking, flat/left-and-right drilling, deep-water and Arctic drilling will boost non-OPEC supplies to as high as 58.6 million barrels per day this year from 58.1 million in 2015.

And don't forget the extremely important influence of (items that are stored and available now) on prices. After all, with worldwide output going beyond demand, the extra (very simple/rough and rude) goes into storage. And when the storage facilities are full, the (more than needed) will be dumped available to buy to the harm of prices. Cushing, Oklahoma, the delivery point for deciding/figuring out the price of West Texas Intermediate, is nearing full storage ability (to hold or do something); the same is true for the Amsterdam-Rotterdam-Antwerp area, the oil gateway to Europe. China is running out of ability (to hold or do something) for commercial and (related to a plan to reach a goal) reserves. Around the world, oil extracted from the ground (items that are stored and available now) have jumped to record levels, with a leap of 370 million barrels since January 2014.

(more than needed) oil is also being stored on ships, even though (what people commonly call a/not really a) floating storage costs $1.13 per barrel per month compared with 40 cents in Cushing and 25 cents per month in underground salt caves, like those used for the U.S. (related to a plan to reach a goal) Petroleum Reserve. What's more, as low oil prices have made shipping by train (losing money), rail tank cars are being used, with (what people commonly call a/not really a) rolling storage costing about 50 cents per barrel per month.

So what will trigger renewed price declines? Excess production will end up being dumped onto the market. Pressure from lenders on (related to money)-weak energy borrowers will force them to produce as much oil and gas as possible to service the money they owe. The likely continuing rise of the safe-safe place dollar against the types of money of developing (processes of people making, selling, and buying things) will hype the cost of imported oil -- (existing (the same) everywhere) priced in the U.S. currency -- further controlling demand. Finally, the likely slowing of worldwide money-based growth and oil demand in reaction to the U.K. decision to leave the (related to Europe) Union reinforces my (negative thinking).

An oil price drop to below $20 per barrel would be a shock similar to the dotcom collapse in the late 1990s and the subprime mortgage disaster that produced the 2008 major money-based problem -- both of which triggered (time periods where people and businesses made less money). Of course, oil prices would not stay in the $10 to $20 barrel range (for a long time--maybe forever); (time period where people and businesses made less money) would squeeze out excess energy production and prices would recover, likely to the average cost of new production. But the (lowering prices/air leaving a balloon, etc.) that might go with a worldwide money-based downturn might mean the new steadiness/balance price for oil is between $40 and $50 a barrel -- well below the $82 average in the first half of this ten years, and lower than the ideas (you think are true) in the business plans of energy producers.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.