| Followers | 686 |

| Posts | 142310 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, November 17, 2015 7:45:30 AM

* November 17, 2015

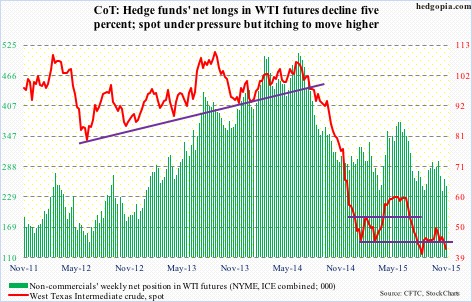

The following are futures positions of non-commercials as of November 10, 2015. Change is week-over-week. (Due to Veterans Day, a Federal holiday, last week, the CFTC released numbers on Monday.)

Crude oil: For the week ended November 6th, U.S. gasoline stocks fell 2.1 million barrels, to 213.2 million barrels – a 12-week low. As well, refinery utilization continued to inch up, rising 0.8 percentage point, to 89.5 percent. It has now risen 3.5 percentage points since October 9th. Utilization peaked at 96.1 percent in the August 7th week. All positives! The rest of the data was anything but…

Distillate stocks rose 352,000 barrels, to 141.1 million barrels. The prior period was at a 17-week low…Crude production rose by 25,000 barrels per day, to 9.19 million barrels per day – a 10-week high. Production peaked at 9.61 mbpd in the June 5th week. Rig counts have plunged in recent weeks/months, but has not impacted production much…Crude imports rose 434,000 barrels per day, to 7.38 mbpd…The final nail in the coffin came from crude stocks, which jumped 4.2 million barrels, to 487 million barrels. This was the seventh straight weekly increase, and stocks were at the highest since the April 24th week.

Spot West Texas Intermediate crude collapsed nearly nine percent last week.

To rub salt in the wound, the International Energy Agency said Tuesday its core expectation is for oil prices to return to $80/barrel by 2020, but the odds of it remaining stuck between $50 and $60 well into the 2020s cannot be ruled out.

The next OPEC meeting is on December 4th. Last November, the cartel decided against production cuts. Despite calls from countries like Venezuela and Algeria to cut production, odds are the Saudi Arabia-dominated group will maintain the status quo.

Put all this together, and the fact that spot WTI was once again rejected at the $48 level last week, it is not hard to fathom why oil bulls are leaving. With this, it has now lost two-plus-month support at $43. On a weekly basis there is room for downward pressure still, but daily conditions are oversold – a good opportunity for bulls to put their foot down.

Currently net long 248.9k, down 14.2k.

http://www.hedgopia.com/cot-peek-into-future-through-futures-17/

• George.

Click on "In reply to", for Authors past commentaries.

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• gtsourdinis

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM

Bantec's Howco Short Term Department of Defense Contract Wins Will Exceed $1,100,000 for the current Quarter • BANT • Jun 25, 2024 10:00 AM