Wednesday, November 11, 2015 11:01:49 PM

Oil is going to $20/bbl, Here's Why

Summary

-Oil is going to $20/bbl and will stay there.

-There's a way to keep from being on the wrong side of this massive shift.

-We'll discuss what this means for markets, and how to play it.

Crude oil has been, and continues to be, one of these fantastic opportunities. The price of oil has been cut by roughly 60% since June of last year, and is now trading at around $44/bbl. There has been endless calls for a bottom in crude throughout the entire collapse in price. Many investors have been caught wrong-footed as they've continued to think the price would revert back to $100/bbl.

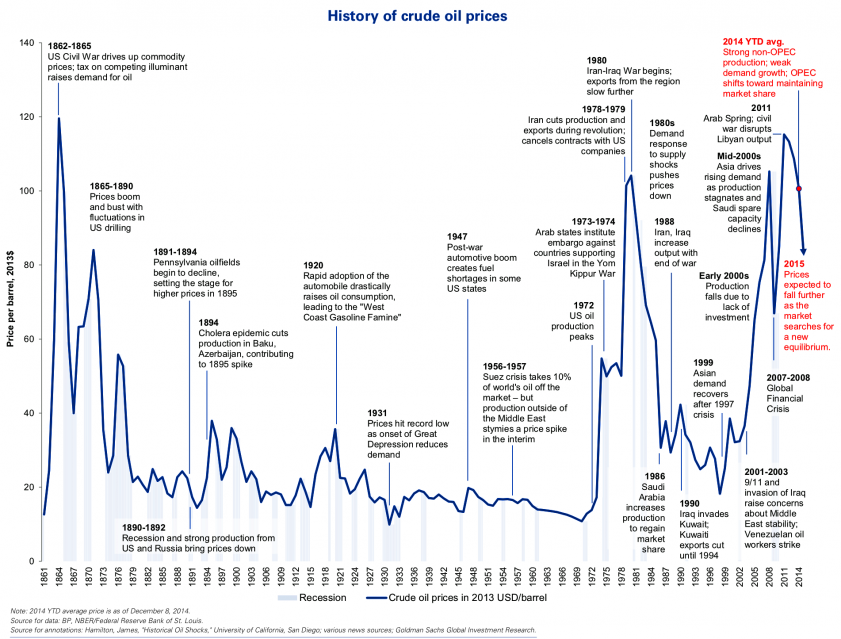

What they have failed to understand, is that a reversion to the long-term mean in oil, would put price in the range of $20, not $100/bbl -- indicating a further decline of 50%. The annotated chart below (courtesy of Business Insider) shows the price of oil going all the way back to 1861.

The price of oil has spent the majority of time in the $15-30/bbl range for the greater part of the last 150 years. The secular bull market in oil began in 2001. The "Peak Oil" narrative became a commonly accepted fact and talk on the street was dominated with how much higher oil could go. In hindsight, it seems rather silly doesn't it.

People forgot these fundamental economic truths:

-Rising prices spur increased investment and accelerates innovation which increases supply (i.e., fracking technology).

-Explosive credit fueled demand growth is not sustainable. Economies eventually revert to their average long-term 2% productivity growth and causes demand to fall (i.e., China's debt driven infrastructure expansion).

The following are the four primary reasons why oil is going to $20/bbl.

Saudi war on U.S. marginal producers:

We're not going to waste too much ink discussing the Saudi's war on U.S. frackers and the disintegration of OPEC cooperation here. This has been discussed to the point of near exhaustion.

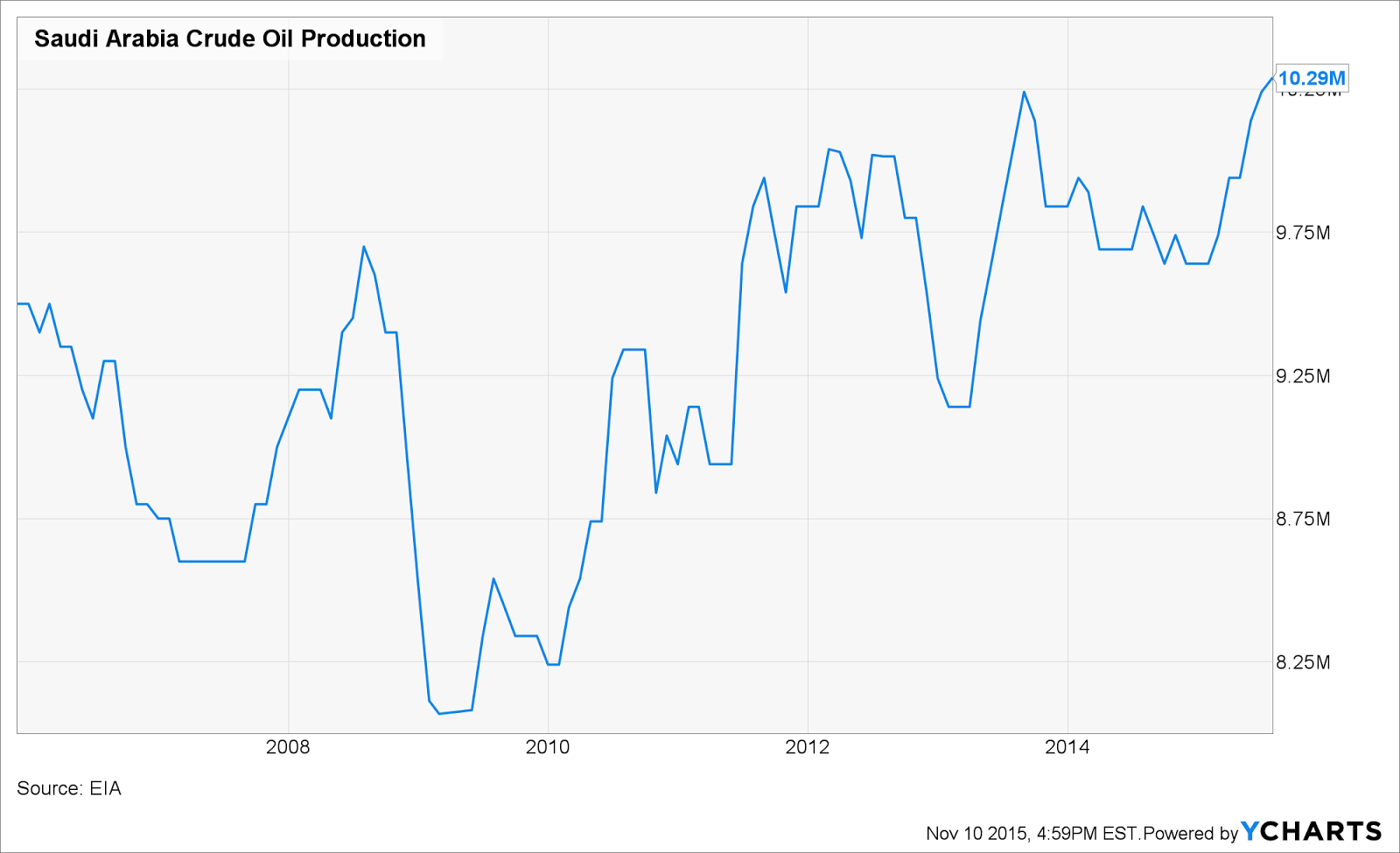

Suffice to say, as you can see in the chart below, Saudi Arabia's crude oil production is near an all-time high at 10.29M bbl/day. The house of Saud is committed to retaining its status as swing-state producer. And we shouldn't expect a significant reversal of this policy until they believe this mission has been accomplished.

The Fed's ZIRP policy is keeping many frackers alive:

U.S. frackers have surprised the Saudis with their resilience in the face of cratering oil prices. This resilience has been born by two factors. One, frackers have proven to be extremely innovative in continually lowering recovery costs.

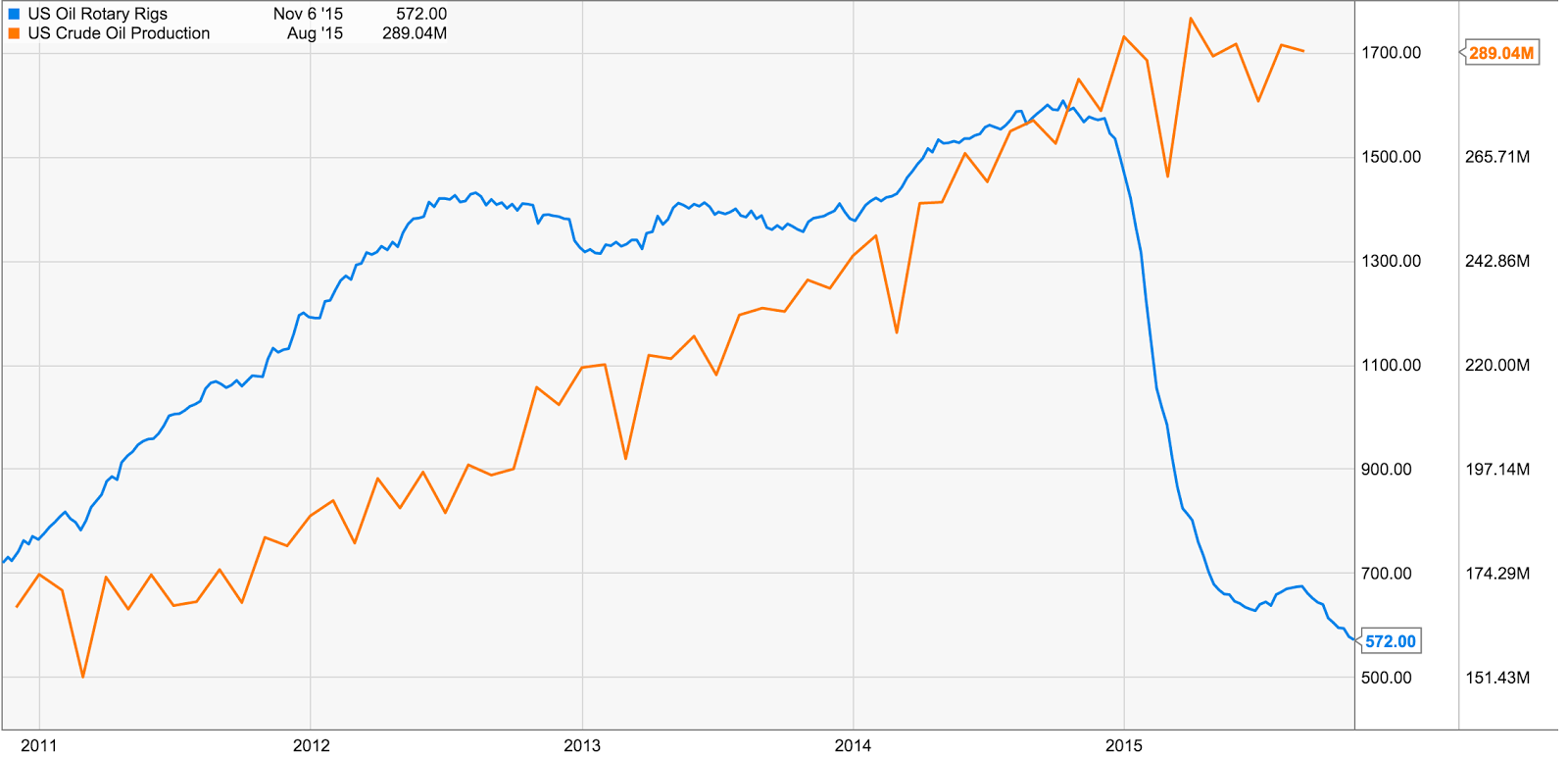

Though the U.S. rig count has plummeted to 572 from an all-time high 0f 1,608 last October, total production has remained near all-time highs. The agility of fracking producers has resulted in higher output from a fewer number of rigs.

Two, and more importantly, is the swath of marginal high-cost producers that have been kept alive by suppressed interest rates. These are essentially "dead companies pumping" whom still exist because money has been free and easy.

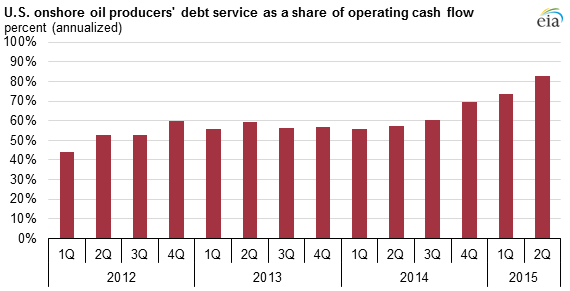

According to the EIA's September energy report, U.S. frackers are now spending 83% of their operating cash flows on debt service costs alone. This is double what it was just three years ago. The irony is, these high debt costs have kept frackers pumping oil regardless of price. They literally can't afford to stop. If they stop producing they die. If rates rise and credit spreads blow out, they die.

Eventually many of these debts will be proven bad and the system will clear. This is already occurring, though at a very slow pace. Investor appetite has remained surprisingly robust for leveraged loans, at least until very recently. The additional supply from U.S. frackers will continue to act as a deflationary force on oil prices until the market drops significantly enough to wipe out excess production. We believe this pain point will occur some 12-18 months in the future.

Diverging central bank policy and a strengthening dollar:

Fed Chairwoman Janet Yellen signaled in the Fed's latest policy meeting that they are looking for a reason to raise rates in December. The recent strong jobs report has given them reason enough, so barring any surprises, it looks likely the Fed will begin its effort toward normalizing rates at its next meeting. At the same time, the ECB, BOJ, PBOC and other second-tier central banks have committed to maintaining or further loosening their monetary policies.

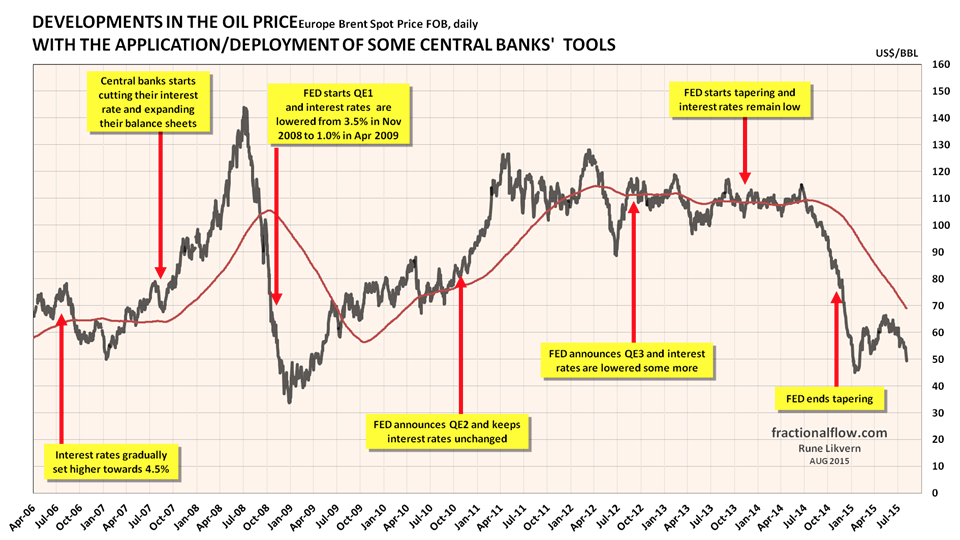

This policy divergence will act as a Saturn-V rocket booster for the U.S. dollar in relation to other currencies. Since commodities, oil included, are priced in dollars, this will continue to have a large impact on price. The above chart (via fractionalflow.com) displays the relationship between monetary policy and crude price nicely.

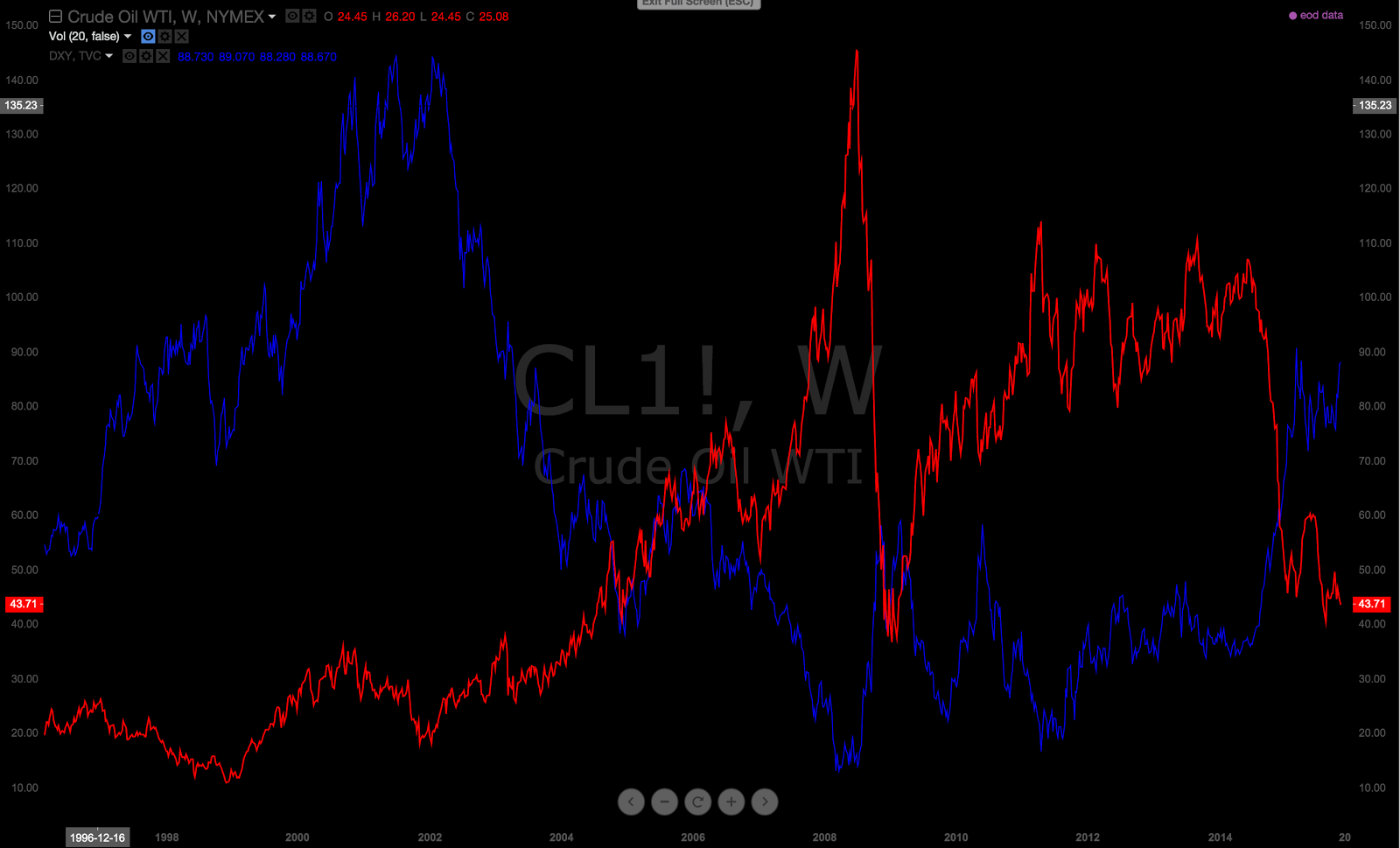

The chart above shows the strong negative correlation between oil price and U.S. dollar strength. Currency trends like that of the dollar tend to last on average two to three years. DXY is only 15 months into its current move.

Global deleveraging, primarily in China is crushing demand:

The largest and most under-appreciated driver of the commodity super-cycle over the last decade and a half has been China's massive credit fueled infrastructure build. To give you a sense of the scope of China's debt fueled resource binge, read the following stat (via the NYT):

China used more cement in the last three years than the United States used in the entire 20th century.

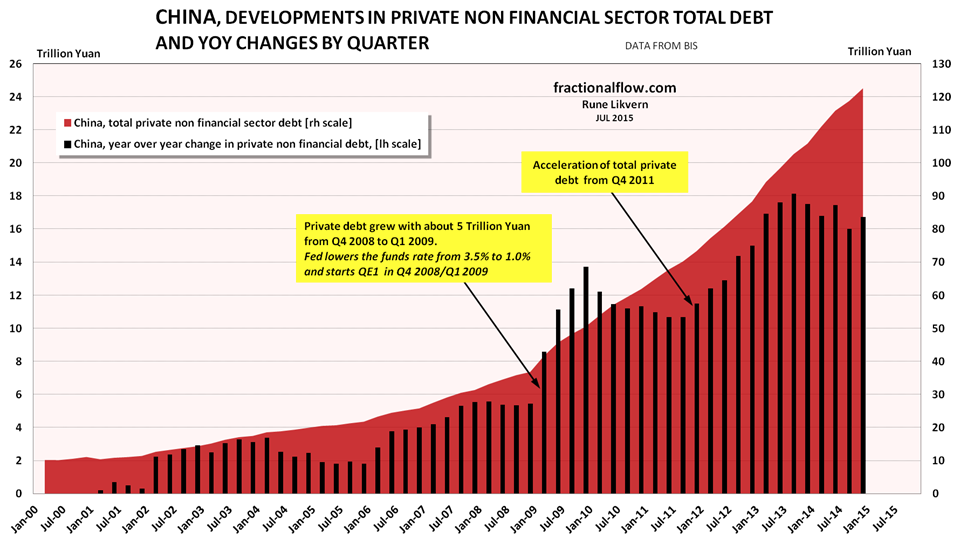

That fact is nearly beyond comprehension. What is almost as impressive is the gigantic pile of debt China accumulated to fund this breathtaking expansion. The chart below shows how the Chinese really started leveraging around 2001, about the same time oil prices started rising from around $20 (side note: this chart only covers private sector credit growth, public debt growth followed similar path).

This demand growth is what drove the commodity super-cycle. According to the EIA, China's oil consumption growth accounted for "43% of the world's oil consumption growth in 2014."

Like most things that seem too good to be true, China's rapid growth phase is coming to an end. The credit consumption over the last 15 years has succeeded in pulling future spending forward. As a result, demand growth over the next decade is likely to peter out as the world's "growth engine" rebalances. This is the most important factor in falling oil prices in our opinion. Where China goes, oil follows.

Getting squeezed from both ends:

Oil is getting popped from both ends of the supply/demand curve. Plus the price has to fight its tendency to revert to its long-term mean of $15-30/bbl. Basic economics will continue to push the price lower until the system clears and regains equilibrium. Oil producing countries (i.e., Russia, Saudi Arabia, Iraq, etc.) will continue to ramp up production where possible to plug widening budget gaps -- establishing a sort of positive feedback loop, pulling oil lower.

Of course, there are additional factors such as the probability of Iran oil coming to market if/when sanctions are finally lifted. And longer-term secular technology shifts that are changing how we produce and consume energy, which will continue to act as strong deflationary forces into the foreseeable future. While crude will likely experience violent swings in both directions, barring any significant international flare-ups (think ISIS pushing into Saudi Arabia or Russia doing something unexpected), the trend will continue lower.

We are looking to short crude futures once price has a strong weekly close below the $42.40 level, as noted by the red line on the chart below. This is a key support level, which when broken, will likely cause demand to evaporate and bring additional selling into the market.

Summary

-Oil is going to $20/bbl and will stay there.

-There's a way to keep from being on the wrong side of this massive shift.

-We'll discuss what this means for markets, and how to play it.

Crude oil has been, and continues to be, one of these fantastic opportunities. The price of oil has been cut by roughly 60% since June of last year, and is now trading at around $44/bbl. There has been endless calls for a bottom in crude throughout the entire collapse in price. Many investors have been caught wrong-footed as they've continued to think the price would revert back to $100/bbl.

What they have failed to understand, is that a reversion to the long-term mean in oil, would put price in the range of $20, not $100/bbl -- indicating a further decline of 50%. The annotated chart below (courtesy of Business Insider) shows the price of oil going all the way back to 1861.

The price of oil has spent the majority of time in the $15-30/bbl range for the greater part of the last 150 years. The secular bull market in oil began in 2001. The "Peak Oil" narrative became a commonly accepted fact and talk on the street was dominated with how much higher oil could go. In hindsight, it seems rather silly doesn't it.

People forgot these fundamental economic truths:

-Rising prices spur increased investment and accelerates innovation which increases supply (i.e., fracking technology).

-Explosive credit fueled demand growth is not sustainable. Economies eventually revert to their average long-term 2% productivity growth and causes demand to fall (i.e., China's debt driven infrastructure expansion).

The following are the four primary reasons why oil is going to $20/bbl.

Saudi war on U.S. marginal producers:

We're not going to waste too much ink discussing the Saudi's war on U.S. frackers and the disintegration of OPEC cooperation here. This has been discussed to the point of near exhaustion.

Suffice to say, as you can see in the chart below, Saudi Arabia's crude oil production is near an all-time high at 10.29M bbl/day. The house of Saud is committed to retaining its status as swing-state producer. And we shouldn't expect a significant reversal of this policy until they believe this mission has been accomplished.

The Fed's ZIRP policy is keeping many frackers alive:

U.S. frackers have surprised the Saudis with their resilience in the face of cratering oil prices. This resilience has been born by two factors. One, frackers have proven to be extremely innovative in continually lowering recovery costs.

Though the U.S. rig count has plummeted to 572 from an all-time high 0f 1,608 last October, total production has remained near all-time highs. The agility of fracking producers has resulted in higher output from a fewer number of rigs.

Two, and more importantly, is the swath of marginal high-cost producers that have been kept alive by suppressed interest rates. These are essentially "dead companies pumping" whom still exist because money has been free and easy.

According to the EIA's September energy report, U.S. frackers are now spending 83% of their operating cash flows on debt service costs alone. This is double what it was just three years ago. The irony is, these high debt costs have kept frackers pumping oil regardless of price. They literally can't afford to stop. If they stop producing they die. If rates rise and credit spreads blow out, they die.

Eventually many of these debts will be proven bad and the system will clear. This is already occurring, though at a very slow pace. Investor appetite has remained surprisingly robust for leveraged loans, at least until very recently. The additional supply from U.S. frackers will continue to act as a deflationary force on oil prices until the market drops significantly enough to wipe out excess production. We believe this pain point will occur some 12-18 months in the future.

Diverging central bank policy and a strengthening dollar:

Fed Chairwoman Janet Yellen signaled in the Fed's latest policy meeting that they are looking for a reason to raise rates in December. The recent strong jobs report has given them reason enough, so barring any surprises, it looks likely the Fed will begin its effort toward normalizing rates at its next meeting. At the same time, the ECB, BOJ, PBOC and other second-tier central banks have committed to maintaining or further loosening their monetary policies.

This policy divergence will act as a Saturn-V rocket booster for the U.S. dollar in relation to other currencies. Since commodities, oil included, are priced in dollars, this will continue to have a large impact on price. The above chart (via fractionalflow.com) displays the relationship between monetary policy and crude price nicely.

The chart above shows the strong negative correlation between oil price and U.S. dollar strength. Currency trends like that of the dollar tend to last on average two to three years. DXY is only 15 months into its current move.

Global deleveraging, primarily in China is crushing demand:

The largest and most under-appreciated driver of the commodity super-cycle over the last decade and a half has been China's massive credit fueled infrastructure build. To give you a sense of the scope of China's debt fueled resource binge, read the following stat (via the NYT):

China used more cement in the last three years than the United States used in the entire 20th century.

That fact is nearly beyond comprehension. What is almost as impressive is the gigantic pile of debt China accumulated to fund this breathtaking expansion. The chart below shows how the Chinese really started leveraging around 2001, about the same time oil prices started rising from around $20 (side note: this chart only covers private sector credit growth, public debt growth followed similar path).

This demand growth is what drove the commodity super-cycle. According to the EIA, China's oil consumption growth accounted for "43% of the world's oil consumption growth in 2014."

Like most things that seem too good to be true, China's rapid growth phase is coming to an end. The credit consumption over the last 15 years has succeeded in pulling future spending forward. As a result, demand growth over the next decade is likely to peter out as the world's "growth engine" rebalances. This is the most important factor in falling oil prices in our opinion. Where China goes, oil follows.

Getting squeezed from both ends:

Oil is getting popped from both ends of the supply/demand curve. Plus the price has to fight its tendency to revert to its long-term mean of $15-30/bbl. Basic economics will continue to push the price lower until the system clears and regains equilibrium. Oil producing countries (i.e., Russia, Saudi Arabia, Iraq, etc.) will continue to ramp up production where possible to plug widening budget gaps -- establishing a sort of positive feedback loop, pulling oil lower.

Of course, there are additional factors such as the probability of Iran oil coming to market if/when sanctions are finally lifted. And longer-term secular technology shifts that are changing how we produce and consume energy, which will continue to act as strong deflationary forces into the foreseeable future. While crude will likely experience violent swings in both directions, barring any significant international flare-ups (think ISIS pushing into Saudi Arabia or Russia doing something unexpected), the trend will continue lower.

We are looking to short crude futures once price has a strong weekly close below the $42.40 level, as noted by the red line on the chart below. This is a key support level, which when broken, will likely cause demand to evaporate and bring additional selling into the market.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.