Thursday, October 08, 2015 9:31:50 AM

This morning CPST issued a PR that appears to have provided share-price support, Capstone Secures New Shale Gas Customers Despite Slowdown in Energy Markets.

The day opened with a ~55.8K block at $0.2597 and after a few minutes of wide-spread low-volume volatility the trading settled into a low-volume narrow $0.2626/$0.2647 range through 9:49, ending at $0.2631. 9:50-10:29 started a rocket-shot upward, initially on low volume, that went to $0.28 at 10:29 with good volume only at 10:00-10:05 and 10:25-10:29, ending the period at $0.279/$0.28. 10:30-11:04 began a low-volume sag to $0.275, went sideways with a wide spread $0.275-$0.2789 with mostly lower highs around $0.2771 and then $0.2757 and ended the period at $0.273/$0.2733 on low volume. 11:04-11:19 began with a huge 179.2K minute that ranged from $0.28 down to $0.2731 and then went almost perfectly flat at $$0.2732/$0/2735 and ended the period at $0.2732/3. 11:20-11:28 started innocuously enough with a 51.5K first minute and a sideways range of $0.272/$0.2735 but it was the precursor of what was coming and ended at $0.272/$0.2722 on generally rising, medium, volume. 11:29-11:34 began with another huge minute of ~222.7K that ranged from $0.2715 down to $0.27 and was followed by steps down all the way to $0.26, a -4.24% drop. 11:35-11:45 began a low-volume $0.26/$0.261 sideways move setting up for a normal rebound and consolidation, ending at $0.2607. 11:46-12:05 started a low and medium volume step up that took price to $0.2701 at 11:48, dropped to $0.2627 in the next few minutes on low volume, made the next swing up to $0.2635/$0.2685 by 11:51, and then began consolidating on narrowing swings, ending the period at $0.2649/$0.2655. 12:06-12:35 continued the low-volume consolidation in the $0.2623/$0.2635 range, with a two-minute excursion to $0.266 beginning at 12:14, and ended the period at $0.2638. 12:36-12:46 began a low-volume $0.2642/$0.2644 sideways trade with one excursion to $0.266 at 12:39, and ended the period at $0.2644/6. 12:47-14:15 began a short rising trading pattern at $0.2644 and moved up $0.2654 and flattened out on low volume at $0.265/$0.2653, and later $0.265/$0.2659 with dropping highs. This gave us a drop back to $0.265/$0.2653 around 13:33. 14:00 gave us a one-minute 31K spike to $0.2666. The period ended at $0.2652. 14:16-14:35 began with a 51.5K spike to $0.27 and immediately fell back to $0.2652 and began going sideways with highs at $0.2672 and lows rising, ending the period at $0.2674/$0.2676. 14:36-15:12 began with a 25K spike to $0.27, went sideways with lows of $0.2671 and highs starting at $0.27 and falling to $0.2685. It went sideways in that range until the highs bumped to $0.27 again at 15:02 and traded there with rising lows through the period end, finishing at $0.2694/$0.27. 15:13-15:48 began with 42.8K at $0.2694/$0.2704 followed by 58.8K at $0.2699/$0.2716 and then 200 shares at $0.26 (trying to trigger stops?). Price immediately went $0.2699/$0.27 on medium volume and then went $0.2694/$0.27 through the period end. 15:49-15:58 began with 104.2K $0.2684/$0.2711 followed by low-volume trading $0.269/$0.2691 through period end. 15:59-16:00 started with 33.2K $0.2667/$0.2691 and was followed by the close on a "small" block of ~19.2K at $0.2651.

Including the opening block, there were fifteen larger trades (>=20K) totaling 526,151shares, 15.08% of day's volume, with a VWAP of $0.2684. Excluding the opening block, there were fourteen larger trades totaling 470,371 shares, 13.49% of day's volume, with a VWAP of $0.2695.

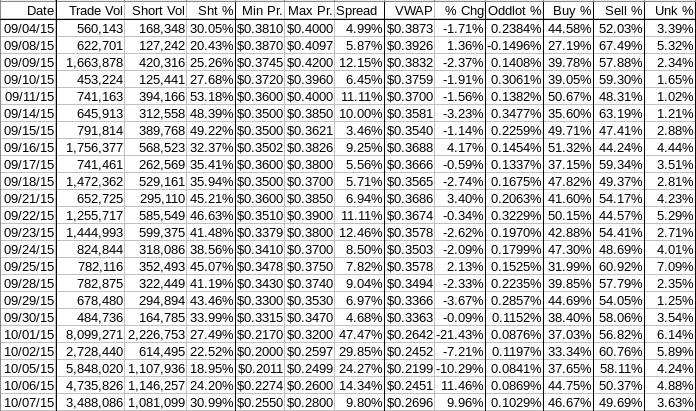

On the traditional TA front, movements of the open, low, high, close and volume were 10.51%, 11.92%, 9.80%, 4.17%, and -26.35% respectively, vs. yesterday's -2.49%, 13.08%, 2.04%, 15.73%, and -19.02% respectively. These are good movements, but for the volume which continued to weaken, suggesting that the movement up from the all-time low continues to weaken. This seems supported by the intra-day action, which could not sustain the early move up and finish strong like we saw yesterday. Instead we pushed up early, weakened 10:30-1:30 and then did a long slow climb up through the rest of the day to recover about 1/2 what was lost in the 10:30-11:30 period.Ending Period Period Period Per. Trade_ Period_ % Day_ Per. End

Period Volume Low High Dollar Val. VWAP___ Volume Buy ~%

09:49 228946 $0.2550 $0.2688 $59,641.56 $0.2605 6.56% 66.22% Incl 09:30 $0.2597 55,780 $0.2597 39,822

10:29 727849 $0.2634 $0.2800 $198,034.96 $0.2721 20.87% 56.25% Incl 10:00 $0.2676 20,200 10:01 $0.2669 28,100

10:18 $0.2765 20,000 10:26 $0.2785 25,000

11:04 328443 $0.2730 $0.2792 $90,748.17 $0.2763 9.42% 57.39%

11:19 232028 $0.2731 $0.2800 $64,240.75 $0.2769 6.65% 55.37% Incl 11:05 $0.2800 49,000

11:28 141559 $0.2715 $0.2735 $38,586.46 $0.2726 4.06% 46.13%

11:34 349628 $0.2600 $0.2715 $93,844.02 $0.2684 10.02% 47.22% Incl 11:29 $0.2700 20,000 $0.2700 75,149

11:30 $0.2670 26,800

11:45 111008 $0.2600 $0.2610 $28,896.57 $0.2603 3.18% 45.76%

12:05 135755 $0.2609 $0.2701 $36,234.77 $0.2669 3.89% 44.99%

12:35 108562 $0.2622 $0.2660 $28,625.74 $0.2637 3.11% 45.07% Incl 12:35 $0.2638 20,000

12:46 22100 $0.2641 $0.2660 $5,844.72 $0.2645 0.63% 44.70%

14:15 242047 $0.2644 $0.2666 $64,215.44 $0.2653 6.94% 43.05% Incl 13:03 $0.2650 46,600 13:36 $0.2651 20,000

14:35 166500 $0.2652 $0.2700 $44,523.78 $0.2674 4.77% 44.01%

15:12 144210 $0.2671 $0.2700 $38,781.81 $0.2689 4.13% 45.80%

15:48 347900 $0.2600 $0.2716 $93,829.20 $0.2697 9.97% 46.71% Incl 15:33 $0.2700 33,600

15:58 144300 $0.2684 $0.2711 $38,873.02 $0.2694 4.14% 46.70% Incl 15:49 $0.2700 46,100

16:00 53767 $0.2651 $0.2691 $14,377.84 $0.2674 1.54% 46.40%

I'm still waiting to see if a new channel develops on my minimal chart.

On my one-year chart, I note that the high of yesterday is right about the mid-point of my long-term descending channel, which suggests we've recovered about 50%, one of the Fibonacci points. All the oscillators I watch continued to improve and RSI and full stochastic got out of oversold, joining the others which exited that condition yesterday. All are still below neutral, not having had enough time with strength yet to drive the readings above that level. With volume tapering off as we rise they may not get there on this particular leg up.

This recovery has been a pretty good one and had enough rise that I expect another push up attempt today will both weaken and have lower volume. Whether it finishes lower so quickly I can't say, but it is about time that the profit taking for those that bought at the lows is irresistible and potential buyers on the rise should be getting a bit cautious wondering if the rise can continue.

Percentages for daily short sales and buys moved in the same direction again, which is good. The short percentage is still a bit low, likely still affected by more inter/intra-broker trades, as suggested by the number of larger trades, and MMs that saw attractive covering opportunities 10/5, although those short-term long shares should be about gone now. That suggest short percentage should move into my normal range (needs re-check) tomorrow if buy percentage improves again, which may not happen based on what's seen in the summary of trading table above.

The price spread has reduced again and is now close to being "normal" and was not produced by "open high and plunge" and stay down. So even though it's a bit high still, I don't think it suggests a lot of weakening. Also we are not in a short-term down-trend ATM.

All considered, I think we'll see the first signs of flattening begin to appear today. This should be accompanied by reducing volume again.

As always, much is experimental and should be treated as such.

Bill

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.