Tuesday, August 04, 2015 1:24:03 PM

Secondary outcome measure are hinting positive with the company securing Orphan Drug status and planning a Phase 2/3 for Ovarian Cancer. Without Secondary indications of efficacy, this move wouldn't make sense.

So discussion of Kevetrin having a failed trial is just not a likely event at this point. Every indication is of a successful trial, with at least two to mid stage trials to follow. Once possibly an adaptive design that can morph into a Phase 3 trial.

At that later point risk returns with new trials underway, as positive results are not guaranteed. That is the possible risk of bio-tech investing. The possible reward is a successful trial leads to many-multiples of the share price.

Should any trial ever fail there is always a hit to the share price. Right now CTIX is low risk as we are a ways from that possibility, and with all the trials starting, we should have the opportunity to re-evaluate risk at higher share prices than the currently undervalued share price. Some people take their cost basis off on a double, or quadruple, then ride free shares to compensate for risk. Others hold all for a big win or a lose. To each his own. My personal opinion is it is too early to worry about trial risk and CTIX has not yet risen to a reasonable valuation, so this discussion is premature.

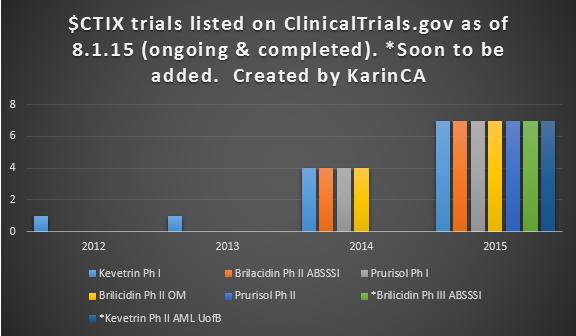

CTIX also has 3 drugs testing 4 indications, with more clinical trials planned and more drugs in the pipeline. Any one having a success brings the share price to a significantly higher valuation. So CTIX has excellent safety nets as well as excellent upside opportunity.

But of course there is always risk. There are no guaranteed emerging biotech investments that promise many multiples of profit without risk. No such thing.

But it's also important to understand biotech catalysts and risks. At the current time, CTIX has numerous catalysts and reduced risk. The only trial near wrapping up is Kevetrin, and that is a near certain success. The other trials have just started, or soon to start. So their results risk is a ways off. The real conversation currently IMO is when and if the market will wake up to CTIX's dramatic increase in clinical trials and begin a new valuation.

(Click to enlarge)

"Games are won by players who focus on the playing field -- not by those whose eyes are glued to the scoreboard." - Warren Buffett

Recent IPIX News

- Form 8-K - Current report • Edgar (US Regulatory) • 02/01/2024 01:30:25 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/05/2023 09:25:58 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/20/2023 09:05:44 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 11/15/2023 01:00:19 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 10/30/2023 08:15:25 PM

- Form 10-K - Annual report [Section 13 and 15(d), not S-K Item 405] • Edgar (US Regulatory) • 09/28/2023 01:00:08 PM

Hydromer Announces Attainment of ISO 13485 Certification • HYDI • Jun 17, 2024 9:22 AM

ECGI Holdings Announces LOI to Acquire Pacific Saddlery to Capitalize on $12.72 Billion Market Potential • ECGI • Jun 13, 2024 9:50 AM

Fifty 1 Labs, Inc. Announces Major Strategic Advancements and Shareholder Updates • CAFI • Jun 13, 2024 8:45 AM

Snakes & Lattes Opens Pop-Up Location at The Wellington Market in Toronto: A New Destination for Fun and Games - Thanks 'The Well', PepsiCo, Indie Pale House & All Sponsors & Partners for Their Commitment & Assistance Throughout The Process • FUNN • Jun 13, 2024 8:18 AM

HealthLynked Introduces Innovative Online Medical Record Request Form Using DocuSign • HLYK • Jun 12, 2024 8:00 AM

Ubiquitech Software Corp (OTC:UBQU) Posts $624,585 Quarterly Revenue - Largest Quarter Since 2018 • UBQU • Jun 11, 2024 10:13 AM