Sunday, April 05, 2015 2:00:46 PM

GRC.V – More DD Notes and Background.

2014 MD&A (mandated TSX filing) highlights below from phase 2 of my DD.

Per my bolded highlight below it appears current annualized run-rate of royalty income is $6.0M with $1.5-$2.0M in cash opex and $1.4M of cash interest on convertible debentures. That won’t cover cash divvy of about $4M per my prior post, but management declared the monthly dividend in February 2015 after the MD&A was locked down so I don’t think they would of declared unless it was sustainable and there was even a larger revenue pick-up in February 2015.

Note: Their definition of “Free Cash Flow” is not CFOps less capex as you’d typically see when this metric is used, but is a measure of cash generated from operations (this is pre-convertible debenture interest). If interested just read through MD&A section. Takeaway is that “Free Cash Flow” which is really cash generated from operations adjusted for change in working capital was $1.2M in Q4-2014 which equates to $4.8M on an annualized basis which will cover the divvy.

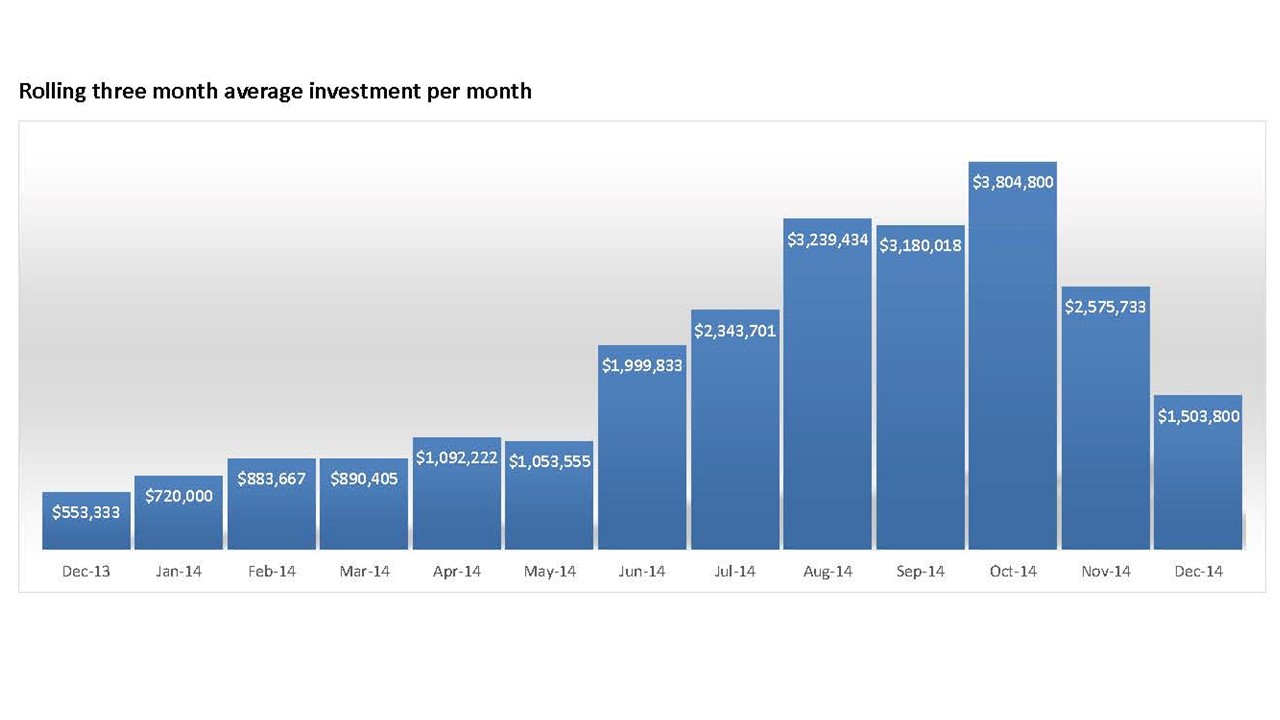

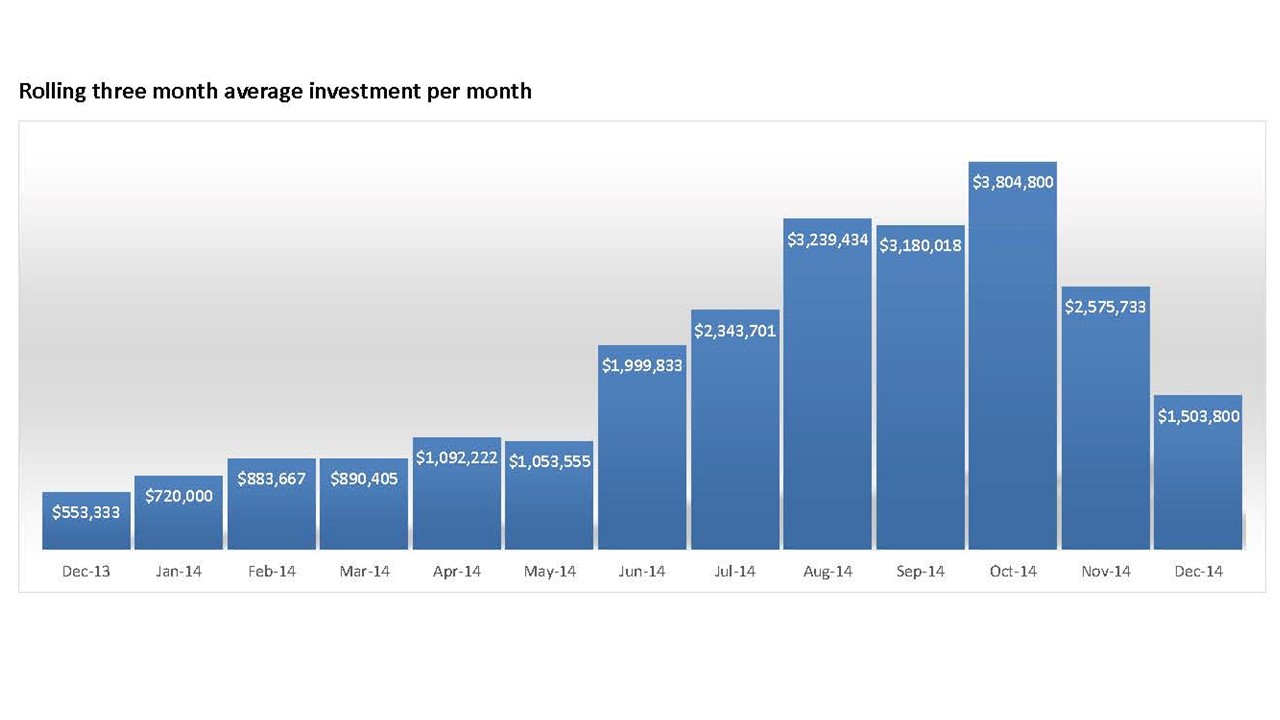

Finally – I think the real takeaway here is that it looks like they have culled back their investment rate in Q4-2014 and will keep it at a more steady state in order to generate the cash from operatinos suffeicient to cover the divvy and the convertible debenture interest. This if from MD&A:

MD&A for general background:

2014 MD&A

GENERAL DESCRIPTION OF BUSINESS

Grenville seeks to purchase non-dilutive, revenue-based royalties in primarily private and public, small to medium (SME) companies in North America. The Company’s royalty investments are structured to align with the interests of founders, management and shareholders of SMEs by protecting the ability of the existing management of investee companies to manage their business

Grenville buys royalty interests in the revenue stream generated by many companies diversified across many industrial sectors and North American geographies. Grenville believesthat it has identified a large and underserviced finance market for companies typically generating up to $50,000,000 in revenue, many of which are well managed and generating improving cash flow, however face difficult financing hurdles from traditional debt and equity markets. The royalty financing structure offered by Grenville can bridge the financing needs of these companies until traditional debt and equity is available to them on more attractive commercial terms. In some cases, Grenville’s royalty may act as a lead order in combination with other forms of financing. Grenville’s royalty financing structure is non-dilutive, on an equity basis, and better aligned with management, in terms of growth: a model that has proven to be very successful in the mining and oil & gas, film and pharmaceutical industries.

Grenville seeksto purchase royalties in companies where historical financial and product performance can be used as the primary gauge of risk. Investment due diligence is focused on tangible, measurable results rather than forward looking estimates more common in venture capital investments. Grenville seeks to generate returns by creating royalty rates and structures capable of generating returns similar to venture capital-like investments, using a portfolio model which de-risks investment returns through diversification

PORTFOLIO UPDATE

As at December 31, 2014, the Company has deployed capital of approximately $24,632,168 of which $4,511,400 related to four royalty agreements completed during the three months ended December 31, 2014. In January 2015, an additional royalty investment was made totaling $100,000. Together, this brings the Grenville portfolio to twenty four investments into nineteen individual investees, with five investees having received a 2nd installment.

The Weighted Average Royalty Rate (a non-IFRS measure, refer to Definition of Non-IFRS Measures for definition) for all the royalty financings made as of December 31, 2014 was 3.86%, compared to 2.41% for all the investments made (including any write-downs) as of December 31, 2013.

My Note: 60% of royaty investments in $USD American companies, therefore benefiting company with topside revenue translated in to $CAD with current weak $CAD.

OUTLOOK

Grenville’s royalty agreements with its portfolio companies provided revenue to the Company of approximately $3.0 million in 2014. For January 2015, the current agreements with our portfolio companies have earned royalty payment income of approximately $0.5m which will increase as new investments are added throughout 2015. Operating expenses for 2014, excluding the exceptional items around the RTO, share based payment and unrealized foreign exchange gains, came in at approximately $1,320,000, or $110,000 per month, and are estimated to run in the range of $1,650,000 and $1,950,000 on an annualized basis in the early part of 2015.

Grenville’s unique capital offering continues to fill an expansive niche in the North American small to medium enterprise, growthcapital markets. With continued access to funding accretive to shareholder value, we are confident we will be able to add new portfolio companies to the Company’s holdings. Each new portfolio company added will further diversify and strengthen Grenville’s existing portfolio. Management also believes that the revenue contribution per portfolio-company added will be priced at roughly the same rate as existing companies within the portfolio.

2014 MD&A (mandated TSX filing) highlights below from phase 2 of my DD.

Per my bolded highlight below it appears current annualized run-rate of royalty income is $6.0M with $1.5-$2.0M in cash opex and $1.4M of cash interest on convertible debentures. That won’t cover cash divvy of about $4M per my prior post, but management declared the monthly dividend in February 2015 after the MD&A was locked down so I don’t think they would of declared unless it was sustainable and there was even a larger revenue pick-up in February 2015.

Note: Their definition of “Free Cash Flow” is not CFOps less capex as you’d typically see when this metric is used, but is a measure of cash generated from operations (this is pre-convertible debenture interest). If interested just read through MD&A section. Takeaway is that “Free Cash Flow” which is really cash generated from operations adjusted for change in working capital was $1.2M in Q4-2014 which equates to $4.8M on an annualized basis which will cover the divvy.

Finally – I think the real takeaway here is that it looks like they have culled back their investment rate in Q4-2014 and will keep it at a more steady state in order to generate the cash from operatinos suffeicient to cover the divvy and the convertible debenture interest. This if from MD&A:

MD&A for general background:

2014 MD&A

GENERAL DESCRIPTION OF BUSINESS

Grenville seeks to purchase non-dilutive, revenue-based royalties in primarily private and public, small to medium (SME) companies in North America. The Company’s royalty investments are structured to align with the interests of founders, management and shareholders of SMEs by protecting the ability of the existing management of investee companies to manage their business

Grenville buys royalty interests in the revenue stream generated by many companies diversified across many industrial sectors and North American geographies. Grenville believesthat it has identified a large and underserviced finance market for companies typically generating up to $50,000,000 in revenue, many of which are well managed and generating improving cash flow, however face difficult financing hurdles from traditional debt and equity markets. The royalty financing structure offered by Grenville can bridge the financing needs of these companies until traditional debt and equity is available to them on more attractive commercial terms. In some cases, Grenville’s royalty may act as a lead order in combination with other forms of financing. Grenville’s royalty financing structure is non-dilutive, on an equity basis, and better aligned with management, in terms of growth: a model that has proven to be very successful in the mining and oil & gas, film and pharmaceutical industries.

Grenville seeksto purchase royalties in companies where historical financial and product performance can be used as the primary gauge of risk. Investment due diligence is focused on tangible, measurable results rather than forward looking estimates more common in venture capital investments. Grenville seeks to generate returns by creating royalty rates and structures capable of generating returns similar to venture capital-like investments, using a portfolio model which de-risks investment returns through diversification

PORTFOLIO UPDATE

As at December 31, 2014, the Company has deployed capital of approximately $24,632,168 of which $4,511,400 related to four royalty agreements completed during the three months ended December 31, 2014. In January 2015, an additional royalty investment was made totaling $100,000. Together, this brings the Grenville portfolio to twenty four investments into nineteen individual investees, with five investees having received a 2nd installment.

The Weighted Average Royalty Rate (a non-IFRS measure, refer to Definition of Non-IFRS Measures for definition) for all the royalty financings made as of December 31, 2014 was 3.86%, compared to 2.41% for all the investments made (including any write-downs) as of December 31, 2013.

My Note: 60% of royaty investments in $USD American companies, therefore benefiting company with topside revenue translated in to $CAD with current weak $CAD.

OUTLOOK

Grenville’s royalty agreements with its portfolio companies provided revenue to the Company of approximately $3.0 million in 2014. For January 2015, the current agreements with our portfolio companies have earned royalty payment income of approximately $0.5m which will increase as new investments are added throughout 2015. Operating expenses for 2014, excluding the exceptional items around the RTO, share based payment and unrealized foreign exchange gains, came in at approximately $1,320,000, or $110,000 per month, and are estimated to run in the range of $1,650,000 and $1,950,000 on an annualized basis in the early part of 2015.

Grenville’s unique capital offering continues to fill an expansive niche in the North American small to medium enterprise, growthcapital markets. With continued access to funding accretive to shareholder value, we are confident we will be able to add new portfolio companies to the Company’s holdings. Each new portfolio company added will further diversify and strengthen Grenville’s existing portfolio. Management also believes that the revenue contribution per portfolio-company added will be priced at roughly the same rate as existing companies within the portfolio.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.