| Followers | 375 |

| Posts | 16984 |

| Boards Moderated | 4 |

| Alias Born | 03/07/2014 |

Sunday, March 15, 2015 11:01:01 PM

"

Nothing in that statement IMO is even close to true. Bioheart finished the last qtr with a grand total of $46K cash on-hand against over $2 million in just "accounts payable" and total current debts exceeding $10 million. Aka CASH POOR, a 10-Q w/ "going concern" warning plastered in it, the prime target that Manga seek out IMO according to the criteria described in the Bloomberg article.

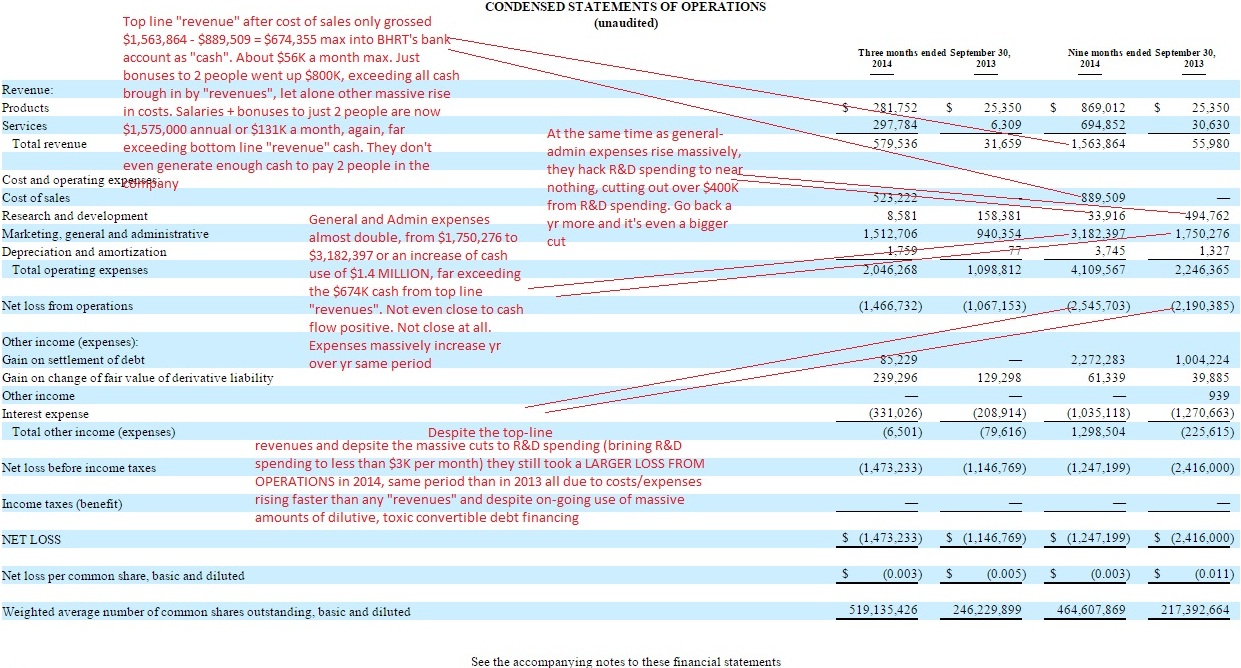

"revenues" DO NOT = positive cash flow, DO NOT = profitability etc when expenses rise or rose faster and more than any so called top line "revenues". A very simple read of the last BHRT 10-Q "statement of operations" reveals they are taking a LARGER LOSS FROM OPERATIONS in 2104 than they did in 2013, despite hacking their R&D spending to near zero and despite any "top line" revenues. They're not even remotely close to "self sufficiency" - it's simply not true via looking at their own financial statements.

As fast as "revenue" came in- they paid out that much more in just base salary increases and cash "bonuses" to just 2 people in the company- after top line sales - coat sales or whats known as gross margin, or actual cash banked to their accounts. They SPENT MORE than they generated via any "revenues" so far- it's real simple reading their accounting entries.

Why would they even be tapping Magna for a $205K toxic note in which they owe $307K face value back to Magna the lender and then also be using toxic convertible notes also with Daniel James and KBM Worldwide for pittances of cash of $25K and $38K again at horrible, horrible terms of 45% and 47% share discounts- which will create share price crushing dilution when those lenders convert- etc. Why would BHRT be doing that if this myth that they are nearly "self sufficient" and are paying their way now, etc is even remotely true? They just did those toxic financing deals as recent as Oct and then Dec of 2014.

I don't care if a company "turns over" (whatever that means) a $BILLION in annual "top line" so called "revenues" - if that company spends $1 billion and $100 dollars on expenses- they're on the road to BK, or dilution or debt or some other means to make up their lack of cash generation. It's just that simple.

Why is the price at .008 recently and hitting near the all time lows of .007 (just a micro tad off of .0063, the lowest they've ever traded) - why if this fantasy that their "revenues" is "fixing" everything is even remotely true?

Just from the filing of the last 10-Q to the O/S share count given on that recent proxy vote SEC filing- showed that over 50 MILLION shares of dilution had occurred in less than that 3 month period. Dilution is still occurring at a furious pace with this company- and I don't see a single sign or indicator that anything is going to cause it to abate soon.

There is a whole rash of "convertible debt" all coming due this summer- multiple convertible debt deals that at these current share prices, will result in 10's and 10's of millions of shares needing to be converted to pay back those debt obligations. (just read the SEC filings and all due dates of all convertible "notes" done coming due from today to about Oct of 2015, it's a boat load of shares that are going to be issued out IMO, I'd guess over 100 million more dilution shares coming in less than the next 6 months)

I'm guess by the 10-K that the O/S share count (at least the fully diluted share count) will now exceed 700 MILLION shares- it'll be the first item I look for when that 10-K goes public. Then the loss from operations, then cash on-hand, etc. "revenues", top line- don't mean much to me personally- I'll be looking at the bottom line of their accounting entries before the top lines- as the bottom line is what really matters in the end, that and CASH. And in the case of this dilution penny stock- shares being poured out (will also be checking to see if they did the usual, issuing millions, if not 10's of millions of share to more to pay common bills, also a regular occurrence for them going back years, with no break in that track record either)

My .009 cents worth

Here is the REALITY of their last qtr despite the ole "revenues- their LOSS FROM OPERATIONS INCREASED over 2013, not decreasing and that's despite the R&D spending being hacked out and also now $800K in "bonuses" still being owed as "notes" now to 2 people - due on demand and earning interest, as the company DID NOT HAVE THE CASH to pay those bonuses when granted and issued (SEE 10-Q SEC filing, all there for the reading).

Oh, and add rising legal/attorney bills to that exploding, ever growing "general/admin" expense line now too IMO. See their financials below- from last 10-Q, it's plain, they are NOT even close to cash flow positive or not taking losses from operations, despite "revenues".

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM

Branded Legacy, Inc. and Hemp Emu Announce Strategic Partnership to Enhance CBD Product Manufacturing • BLEG • Jun 27, 2024 8:30 AM

POET Wins "Best Optical AI Solution" in 2024 AI Breakthrough Awards Program • POET • Jun 26, 2024 10:09 AM

HealthLynked Promotes Bill Crupi to Chief Operating Officer • HLYK • Jun 26, 2024 8:00 AM