| Followers | 375 |

| Posts | 17014 |

| Boards Moderated | 4 |

| Alias Born | 03/07/2014 |

Wednesday, March 11, 2015 6:49:00 PM

I would never IMO refer to a single "power point" slide to try and gauge anything really relevant about the true health or lack of health about a pubic traded stock company. The 10-K filing will probably be 60 plus pages in length- and IMO needs to be read cover to cover to fully understand the true condition of the company. The first 10 pages or so - will present the company "financials" which are the fastest way to get a snap-shot of the true financial condition of the company (balance sheet, statement of operations, statement of cash flows, etc).

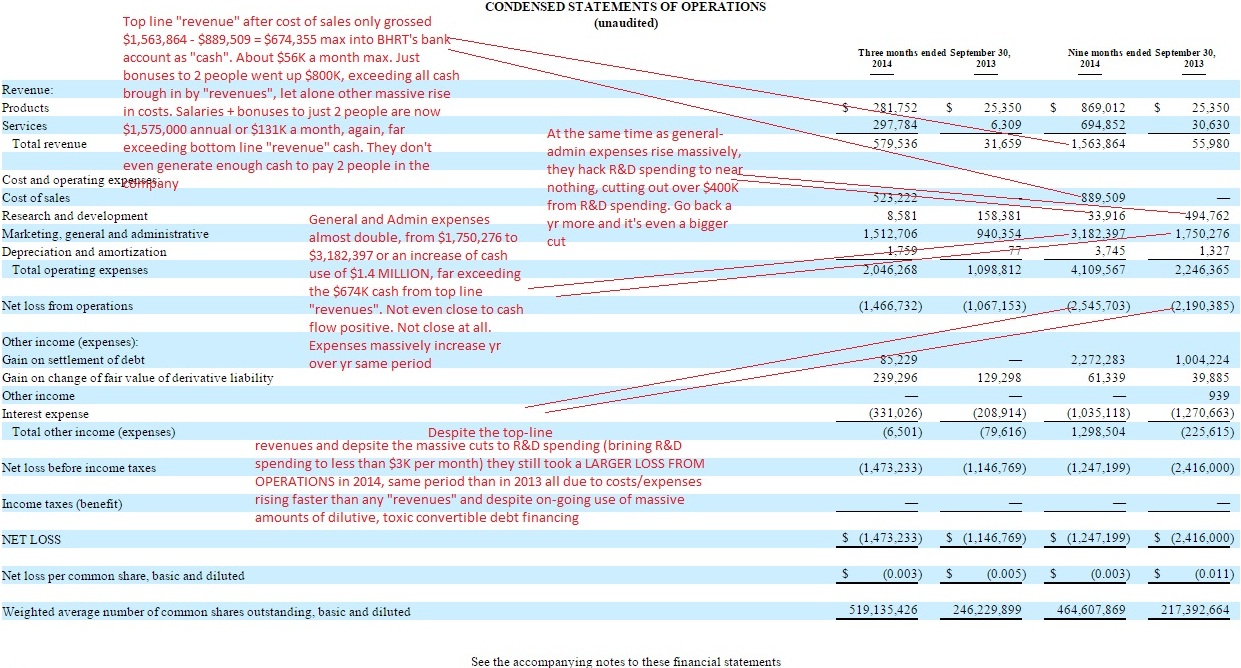

Here are some key points/pages from the last filed 10-Q, prior qtr showing many issues with the company's lack of financial health- despite top line "revenues".

Those IMO are some of the things one will find in a 10-K and should look for.

Also, look for statements like this from the Sr. Mgt and auditors: Last 10-Q, PAGE 12:

"NOTE 2 — GOING CONCERN MATTERS

The accompanying unaudited condensed financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying unaudited condensed financial statements, during nine months ended September 30, 2014, the Company incurred an operating loss of $1,247,199 and used $747,184 in cash for operating activities. As of September 30, 2014, the Company had a working capital deficit (current liabilities in excess of current assets) of approximately $10.0 million. These factors among others may indicate that the Company will be unable to continue as a going concern for a reasonable period of time.

The Company’s existence is dependent upon management’s ability to develop profitable operations and to obtain additional funding sources. There can be no assurance that the Company’s financing efforts will result in profitable operations or the resolution of the Company’s liquidity problems. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern."

Things like that- that's what's in a 10-K. Again, probably 50 to 60 plus pages of reading- and IMO should be read cover to cover.

Good luck to all

Panther Minerals Inc. Launches Investor Connect AI Chatbot for Enhanced Investor Engagement and Lead Generation • PURR • Jul 9, 2024 9:00 AM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM