| Followers | 375 |

| Posts | 17014 |

| Boards Moderated | 4 |

| Alias Born | 03/07/2014 |

Wednesday, March 11, 2015 11:02:07 AM

WHY despite the ole "revenues" blah, blah, blah claims is the stock sitting at and hitting near its ALL TIME RECORD LOWS? How does that "work"? Why did they tap toxic, convertible debt financing deals as recent as Oct 2014 for pittance amounts of cash like $25K and $38K (see last filed 10-Q the Daniel James Management toxic note and the KBM Worldwide toxic note- horrible terms and mega steep share discounts on floorless, 100% toxic dilutive note financing deals. Then Magna was also added on a "note" to keep cash coming in) Why? When this imaginary scenario supposedly exists where "revenue" is now supposedly "funding" their operations and blah, blah which is NOT happening?

Stock just went RED today also. Bid sinking to .0091 (now .0092) The Bid hasn't moved up at all, despite the volume falling off to near nothing- there's little or no buying interest in the stock at this point. Crossing the 50 DMA is not the technical indicator that matters- it's the 200 DMA that matters, as the 50 DMA and 200 DMA are inverted right now. It would need to break above approx. .02 on very high vol to even begin to be in a technical reversal. It's traded a big $120 bucks worth or so, so far today (now just bumped up a bit to maybe $7,500 bucks but Bid didn't move- trading the spread again) . It traded maybe $1,200 bucks worth total, something like that for an entire trading day yesterday. There's no "big buying" or "accumulation" going on or whatever?

What "changed" supposedly? They didn't generate any cash via "revenues" that could be used to pay down debt, fund a trial, or LOL be used to "buy back shares"?? They finished the last quarter, despite the ole "top line" ole "revenues" with a grand total of $46K CASH left to their name (bording on insolvency for all intents and purposes and their own 10-Q filed GOING CONCERN WARNING in that same filing said so). That's despite cutting R&D spending to essentially nothing- barely $3K a month and that is NOT "funding any trials" of any phase (I, II, or III) that's for sure IMO. It would be impossible to fund trials on that pittance. So despite not funding any trials they still took a LARGER LOSS FROM OPERATIONS in the first 9 months so far of 2014, larger than in 2013 and again, finished the last qtr with a whopping $46K bucks left on-hand.

The only "Debt reduction" was NOT done via using any internally generated cash? It was done by 1) Convincing one old, old creditor to allow them to discharge, aka "write off" a debt they never paid back (Willian Beaumont Hospital, whatever the exact name was) and then b) Via allowing some ole Northstar LLC insiders to do "debt to equity swaps". That is IT when it comes to "debt reductions". They, BHRT, never generated any cash internally and then used it to "pay down debt" or whatever else was claimed in some post? DID NOT HAPPEN. Even in the last 10-Q, the most recent- they, BHRT were just living off of dilution financing and also paying common bills via issuing millions of shares of dilutive common stock for common items like "accounts payable" and similar- as they HAD NO CASH to pay those bills, despite the ole "revenues" blah, blah, blah.

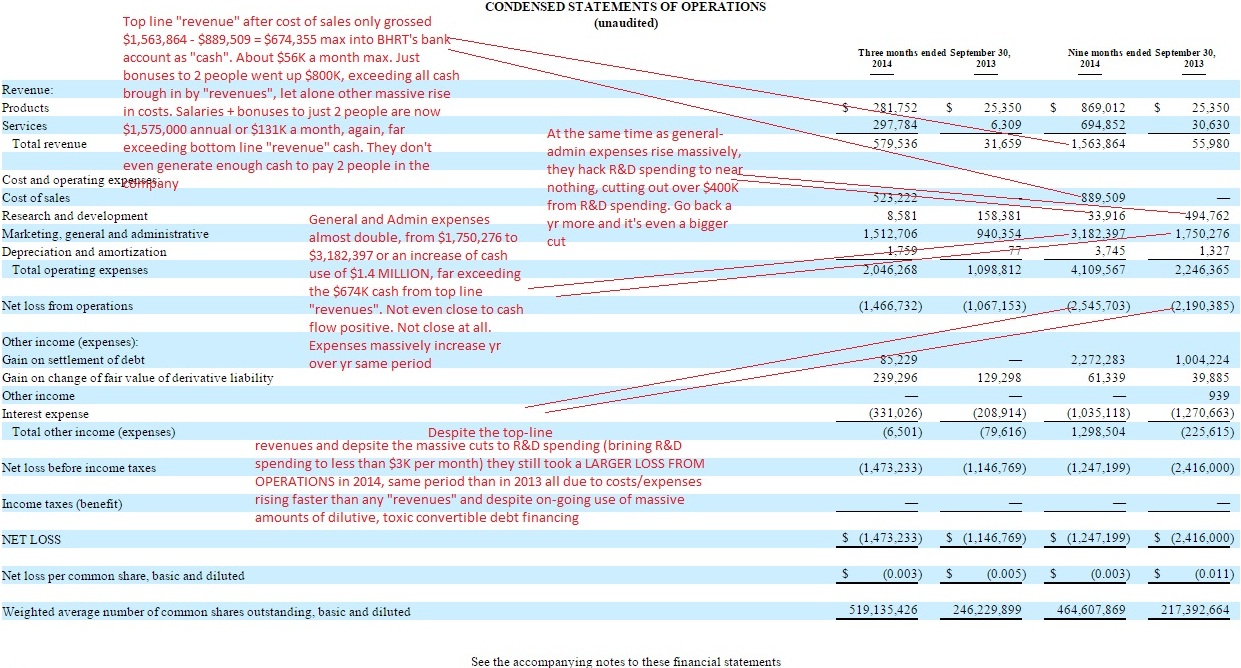

From the last filed 10-Q, showing the massive rise in EXPENSES off-setting any top line "revenues" and thus making their LOSS FROM OPERATIONS larger this yr so far than last yr:

There was a greater LOSS from operations because EXPENSES EXPLODED UPWARD and also the gross margin on top-line revenue that past qtr was a dismal approx. 10%. They made almost nothing to bank on the "revenues" - it was eaten up in cost of sales.

From the same 10-Q, most recently filed, PAGE 12:

"NOTE 2 — GOING CONCERN MATTERS

The accompanying unaudited condensed financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying unaudited condensed financial statements, during nine months ended September 30, 2014, the Company incurred an operating loss of $1,247,199 and used $747,184 in cash for operating activities. As of September 30, 2014, the Company had a working capital deficit (current liabilities in excess of current assets) of approximately $10.0 million. These factors among others may indicate that the Company will be unable to continue as a going concern for a reasonable period of time. The Company’s existence is dependent upon management’s ability to develop profitable operations and to obtain additional funding sources. There can be no assurance that the Company’s financing efforts will result in profitable operations or the resolution of the Company’s liquidity problems. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern.

"

"liquidity problems" is the nice way IMO to say teetering on insolvency (lacking enough timely cash being on-hand to pay your bills as they come due, aka often leading to BK). Nothing "changed" in their dire financial condition IMO because of top-line "revenues" as their expenses grew faster and ate of the ole "revenues".

Same 10-Q filing, most recent PAGE 26 (TOXIC financing continues to be used for survival- NOT "revenues" generating internal cash to fund any trials or "buy back shares" LOL !"

"KBM Worldwide

On October 6, 2014, the Company entered into a Securities Purchase Agreement with KBM Worldwide, Inc., for the sale of an 8% convertible note in the principal amount of $38,000 (the “Note”).

The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on July 8, 2015,. The Note is convertible into common stock, at holder’s option, at a 45% discount to the lowest daily trading price of the common stock during the 10 trading day period prior to conversion. In the event the Company prepays the Note in full, the Company is required to pay off all principal and accrued interest at 150%, and any other amounts.

Daniel James Management

On October 3, 2014, the Company entered into a Securities Purchase Agreement with Daniel James Management, Inc., for the sale of a 9.5% convertible note in the principal amount of $25,000 (the “Note”).

The Note bears interest at the rate of 9.5% per annum. All interest and principal must be repaid on October 2, 2015. The Note is convertible into common stock, at holder’s option, at a 47% discount to the lowest daily trading price of the common stock during the 10 trading day period prior to conversion. In the event the Company prepays the Note in full, the Company is required to pay off all principal and accrued interest at 150%, and any other amounts."

So a company is going to use TOXIC, floorless, convertible debt financing or a Magna dilutive "credit line" to borrow money to then "buy back" their own shares - aka using more dilution to buy-back the very dilution shares they just issued? What? That's the equivalent of using credit card "A" to max it out to pay down credit card "B" for a while? That never accomplishes anything?

Same 10-Q filing, the latest filed, showing common stock being issued out in the millions and millions of shares to pay what would be "common" business bills and obligations as the company HAD NO CASH of their own to pay those bills when due- and that's despite cutting over $400K out of the R&D budget and then finishing that last qtr with $46K total dollars cash left in their bank account:

PAGE 27:

"Subsequent issuances

On October 3, 2014, the Company issued 514,886 shares of its common stock as payment of $70,521 interest on its Northstar (related party) debt.

In October 2014, the Company issued 1,818,182 shares of its common stock in settlement of $20,000 of convertible debt.

In October 2014, the Company issued 1,293,103 shares of its common stock in settlement of $15,000 of convertible debt.

In October 2014, the Company issued 2,260,764 shares of its common stock in settlement of $18,000 of convertible debt and accrued interest of $2,120.

In October 2014, the Company issued 552,846 shares of its common stock in settlement of $5,500 of convertible debt and accrued interest of $1,300.

In October 2014, the Company issued an aggregate 2,773,549 shares of common stock for consulting services.

In October 2014, the Company issued 538,875 shares of common stock in settlement of accounts payable."

What? All that "revenue" blah, blah and they're paying their bills by issuing out common stock NOT USING CASH as any business would normally do? Why? Why would that be?

Top line "revenues" haven't "changed" a thing in their dire financial condition IMO or the fact they're basically running/existing as a share dilution machine. None. Oh, and they issued out $800K in "cash" bonuses to just 2 of the "4 full time employees" at the company (see latest 10-Q PAGE 23, $500K cash bonus to Tomas and $300K cash bonus owed to Comells, now being carried as debt "notes" owed w/ interest) thus they issued an IOU for those bonuses, earning interest- as they didn't have the CASH ON HAND despite the ole "revenues". Those bonuses will get paid first IMO before any cash goes to any ole "trials" or whatever. Same old, same old the way I see it.

My 2 cents.

Panther Minerals Inc. Launches Investor Connect AI Chatbot for Enhanced Investor Engagement and Lead Generation • PURR • Jul 9, 2024 9:00 AM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM