| Followers | 373 |

| Posts | 16792 |

| Boards Moderated | 3 |

| Alias Born | 03/07/2014 |

Saturday, February 21, 2015 12:51:04 PM

A great many companies that trade on the OTC and ever reach true "penny" status, as in 50 cents or 25 cents by statistical facts do end in BK.

Passing well over 600 MILLION shares O/S on a sub ONE CENT share price- is a sign IMO that a company is in serious, serious trouble. A great deal of the most profitable and largest companies trading on the NYSE and the NASDAQ to not have that number of diluted common shares O/S. I can list 100's of them- cash generating, profit monsters with far, far less O/S shares, and they pay dividends too boot.

When a company gets to true "penny" as in SUB PENNY, like .009, .008, .007 and even .0066, with market caps like a pittance of say barely $5 million dollars, w/ essentially almost no staff (2 people plus a few others), w/ essentially no assets as in $250K total to their name against immediate debts exceeding $10 MILLION, w/ essentially no or little cash at any given time, for example as in $46K cash end of last qter (despite so called "revenues") per their last SEC filing, etc- per all market research, numerous academia studies, the SEC warnings itself, etc- a great, great numbers of companies that ever reach sub ONE CENT do in fact end in BK, a vast percentage of them. Just easily researched and easily verifiable market data FACT.

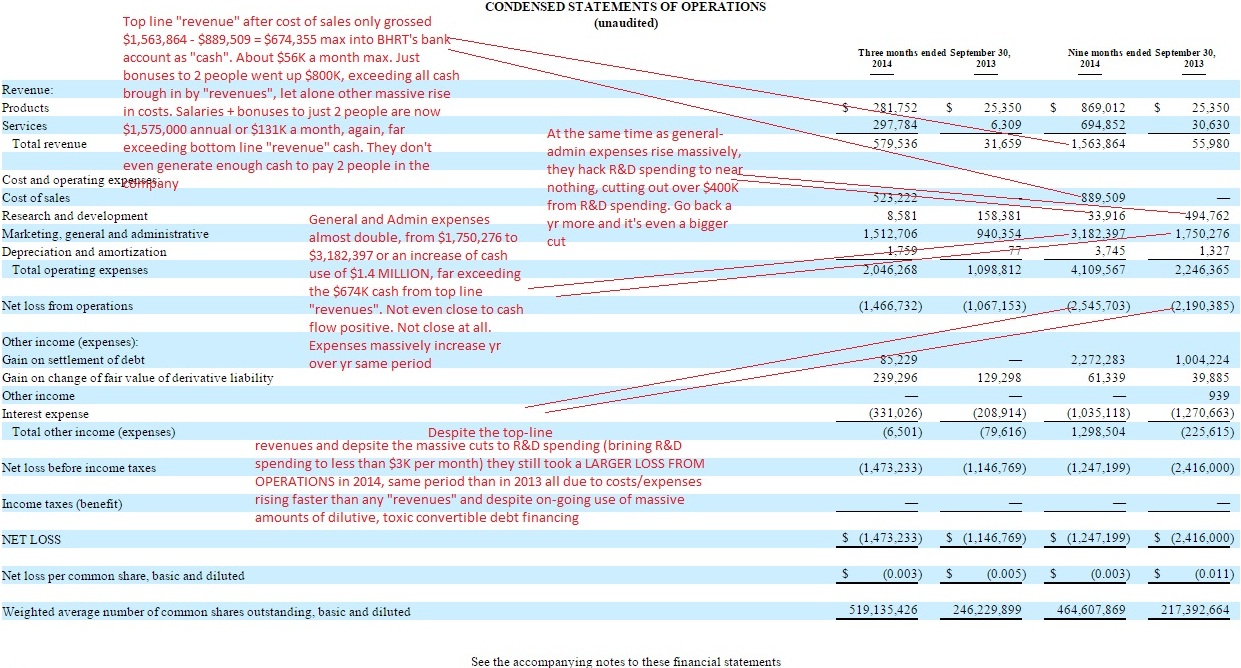

And NO, top line "revenue" per their own SEC filings has not made a difference to their cash desperation situation or lack of need to continue to use toxic, "convertible debt" financing- they did toxic notes as recent as Oct 2014, despite "revenues" as their expenses have risen faster than any bottom line revenues after cost of sales- see 10-Q filing, statement of operations. They are not generating even close to enough cash to be cash flow positive or not rely on dilution or toxic debt financing- nothing in the last 10-Q showed that to be true. Their LOSS FROM OPERATIONS is LARGER in 2014, yr over yr, for the same period in 2013 due to massive expense increases, and despite R&D spending being cut to nearly zero (less than $3K a month). $3K a month funds nothing in terms of a phase 3 trials. The INSTANT they put back in any R&D expense line costs for an actual "trial" (like MIRROR that never actually got "funded" as claimed) their cash situation will only get that much more worse. Simple as that. READ THE "financials" in the SEC FILINGS- it's all there.

From the company's own 10-Q, most recently filed, PAGE 12:

"NOTE 2 — GOING CONCERN MATTERS

The accompanying unaudited condensed financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying unaudited condensed financial statements, during nine months ended September 30, 2014, the Company incurred an operating loss of $1,247,199 and used $747,184 in cash for operating activities. As of September 30, 2014, the Company had a working capital deficit (current liabilities in excess of current assets) of approximately $10.0 million. These factors among others may indicate that the Company will be unable to continue as a going concern for a reasonable period of time.

The Company’s existence is dependent upon management’s ability to develop profitable operations and to obtain additional funding sources. There can be no assurance that the Company’s financing efforts will result in profitable operations or the resolution of the Company’s liquidity problems. The accompanying statements do not include any adjustments that might result should the Company be unable to continue as a going concern."

See their own financial entries- the OPERATIONAL LOSS in 2014 is going to EXCEED THAT OF 2013, despite top line "revenues" and despite over $400K being hacked out of the R&D expense line. It's right there, plain as day. They're not cash flow positive- not even close. Let alone they're not funding any phase 3 supposed "trial" right now- which would blow those expenses off the chart and put um deep, deep cash deficits, worse than even those numbers in that table below. Simple accounting realities. And their continual GOING CONCERN WARNING reflect that reality. "revenues" when exceeded by INCREASING EXPENSES change nothing when it comes to cash being generated. If one spends $1.10 or $1.25 for ever $1 generated of "revenue" they either borrow endlessly or eventually go broke- it's just that simple. It's biz 101 basics. Companies with over a $BILLION in revenues go broke all the time- Radio Shack being the most recent example. They just filed full-on BK w/ annual "revenues" of about $3.5 BA BILLION annually. Made no difference- as their "expenses" exceeded their revenues.

Look at the last 10-Q and ask why a financially healthy, cash positive company pays ordinary bills in SHARES OF COMMON STOCK??

Last 10-Q, PAGE 27:

"Subsequent issuances

On October 3, 2014, the Company issued 514,886 shares of its common stock as payment of $70,521 interest on its Northstar (related party) debt.

In October 2014, the Company issued 1,818,182 shares of its common stock in settlement of $20,000 of convertible debt.

In October 2014, the Company issued 1,293,103 shares of its common stock in settlement of $15,000 of convertible debt.

In October 2014, the Company issued 2,260,764 shares of its common stock in settlement of $18,000 of convertible debt and accrued interest of $2,120.

In October 2014, the Company issued 552,846 shares of its common stock in settlement of $5,500 of convertible debt and accrued interest of $1,300.

In October 2014, the Company issued an aggregate 2,773,549 shares of common stock for consulting services.

In October 2014, the Company issued 538,875 shares of common stock in settlement of accounts payable."

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM