| Followers | 184 |

| Posts | 19312 |

| Boards Moderated | 0 |

| Alias Born | 03/07/2009 |

Tuesday, October 28, 2014 2:56:27 PM

A comparable transaction approach to the valuation of Tre Kronor Media (not UCPA)

- Many times in the past few years, we have determined the company value by fundamental metrics. And we agreed that the value should be a multiple of current market cap. One problem with this approach is that it doesn't really say much about the value to a strategic buyer.

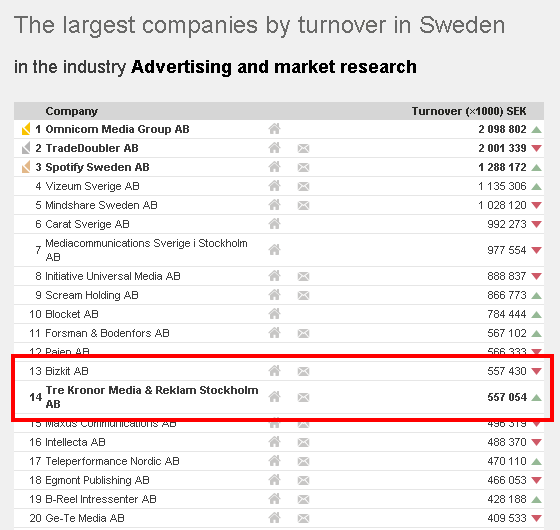

- So, I was looking for an alternative valuation approach based on comparable transactions, i.e. actual acquisition deals in the industry, rather than fundamental company metrics. After all, the valuation paid for competitive firms of similar size and operations should give a good indication of the company's value to an acquiring party. The problem to this approach, apparently, is the lack of market data. As it happens, one of TKM closest competitors just got acquired by an advertising network. In September 2014, Havas (formerly known as euro RSCG) announced the acquisition of controlling interest in Bizkit AB.

Press Release

2014-09-23

Havas S.A. acquires Bizkit Wisely AB

vas S.A., the parent company of the communications group Havas, has acquired 60 per cent of the shares in Bizkit Wisely AB. The acquisition is in line with the ambition to strengthen Havas’ position in the Nordic region. Bizkit Wisely will be included in Havas Media Group.

Bizkit Wisely is a media and digital agency working across digital, print, TV, creative and analytics. Bizkit Wisely carries out business through Bizkit AB and Wisely AB. Bizkit was named media agency of the year 2013 in Sweden. The group has 45 employees and an annual turnover of approximately SEK 600 million.

http://www.danowsky.se/en/nyheter/havas-s-a-forvarvar-bizkit-wisely-ab/

Industry Stats

- Bizkit, as of Dec 2013, generated almost identical SEK 557m in media billings. It is very similar in size, number of employees, and operations. Is the 2014 winner of the "Swedish Media Agency of the Year" award (as was TKM in the years 2013 and 2012). And the agency experienced further growth in 2014 to SEK 600m in media billings as of September 2014. Just as TKM was able to grow its business in 2014. In fact, we know that TKM doubled its revenues in the first quarters of this year, but a large part of that growth comes from added services, and does not necessarily mean a doubling of the media billings. Again, the 600m should give a close comparable to TKM's media billings as of now. Knowing that TKM also grew revenues from other services that are not listed as media billings just makes the valuation more conservative in nature.

- In short, Bizkit AB is as close as a comparable analysis can get. And the company was just acquired.

The juicy part

- So what does this tell us about the value of Tre Kronor media? Well, according to Dagensmedia, the "deal value has not yet fixed, [but]it is expected to land between 85 and 130 million"

http://www.dagensmedia.se/nyheter/byraer/article3848611.ece

- An average of SEK 100m equals approx. USD 13.7m

- If 60% of the company change hands for USD13.7m, the company's value to the buyer is $22.8m

- A valuation of 22.8m would equal $0.014 per share of UCPA for Tre Kronor Media alone.

- This valuation does not consider the other business units of UCPA (In Sight, Howcom, Nativeclicks).

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM