Friday, June 27, 2014 6:08:57 AM

Namibia Value of Prospects, Chance of Success, Farmouts

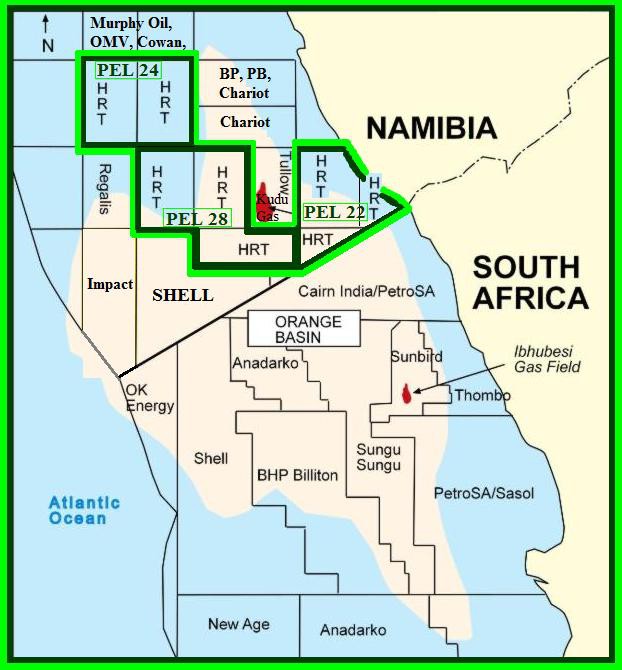

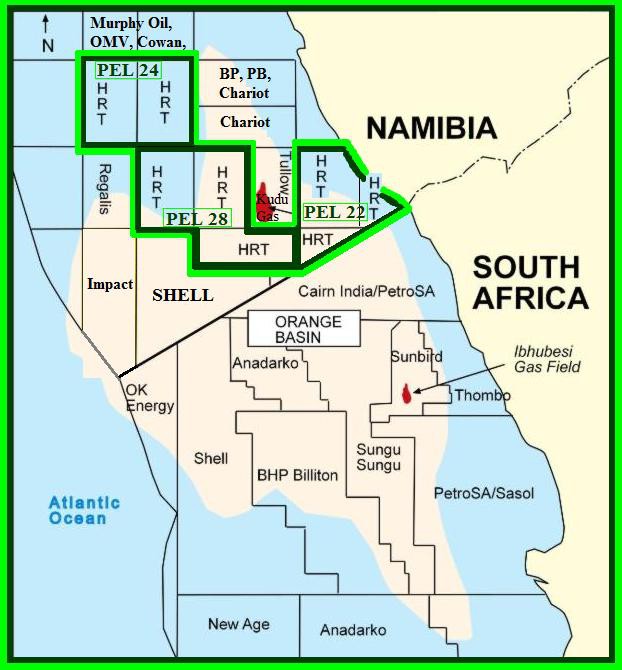

HRT is looking for partners to farm out a percentage of all their 10 Blocks to finance future exploration, next step planned for 2015 is to drill the Meerkat prospect located in PEL 22 (3 Blocks) in Orange Basin to the east from Tullow’s Kudu gas field. By farming out PEL 22 HRT should be able to finance their share of costs of drilling without the need of using current cash (~US$140MM).

Next step planned for 2015 is to drill the Meerkat prospect located in PEL 22 (3 Blocks)

in Orange Basin to the east from Tullow’s Kudu gas field.

By farming out PEL 22 HRT should be able to finance their share of costs of drilling

Neighbours and (IMO) Potential Farmin Candidates are

SHELL, Tullow, BP, PB, Cowan, OMV in Namibia Orange Basin

and Cairn India, Anadarko, PetroSA, in Southafrica Orange Basin:

Based on earlier farmout activity

I expect potential farminees to pay (at least) about:

+~US$6,000/ km² acreage

+ ~US$7,400/ km² 3D seismic

Examples of what farminees have paid

to farm into Blocks offshore Namibia the last couple of years:

BP Namibia Block

25% of 2714A

(5,480km²)

~US$30MM

US$1.2MM per 1% of one Block,

US$21,897 per 1km²

Galp Energia Namibia Blocks

14% of 2112B, 2212A, 2713A, 2713B, 2813A, 2814B, 2914A

(37,744km²)

~US$60MM

US$0.61MM per 1% of one Block,

US$11,355 per 1km²

SHELL Namibia Blocks

90% of 2913A, 2914B

(~10,000km²)

~US$54MM

US$0.3MM per 1% of one Block,

US$ 6,000 per 1km²

PGS Namibia Blocks

10% of 2312A, 2312B, 2412A, 2412B

(16,800km²)

~US$10MM

US$0.33MM per 1% of one Block,

US$5,952 per 1km²

PetroBras Namibia Block

50% of 2714A

(5,480km²)

~US$16MM

US$0.32MM per 1% of one Block,

US$5,840 per 1km²

Tullow Oil Namibia Blocks

65% of 1910A, 1911A, 2011A

(17,295km²)

~US$52MM

US$0.27MM per 1% of one Block,

US$4,626 per 1km²

One reason the values paid differ from eachother is because some companies have already acquired & interpreted expensive 3D data before farming out, while others have not. For example HRT has acquired and interpreted ~10,000km² of 3D seismic with estimated costs of > US$70MM. Another reason is of course the amount of prospective resources and their chance of success. As an example BP paid a huge premium, four times as much as others to farm into Block 2714A, the reason was the Nimrod prospect (prospective resources ~ 5 bn boe), unfortunately turned out as an non commercial well, but proved source rocks capable to fill shallower reservoirs, afterwards Chariot was able to secure the license to the south from 2714A and is now targeting such shallower reservoirs ...

The Meerkat prospect is planned to be drilled in 2015

after a successful farmout to finance HRT's share of costs of drilling,

so PEL 22 seems to be the Number One Farmout Target:

PEL 22 (3 Blocks, Orange Basin)

HRT is Operator with 95%

~15,000km² acreage

~1,137km² of 3D seismic

Potential farmout value 95%

(15,000km² * US$6,000 + 1,137km²(3D) * US$7400) * 0.95

= US$93,493,110

Potential Farmout

45% for US$45MM or one Free Carried Well

(potential gross costs of one well ~US$85MM,

potential net costs after farmout if HRT retains 50%: US$42.5MM)

In PEL 22, most interesting prospects to me are

(P10 Prospective Resources & Chance of Success):

Lechwe

1,981,032,000 boe, 20.2% Chance of success

Bushbuk

1,126,845,000 boe, 14.4% Chance of success

Cheetah

1,037,273,000 boe, 20.2% Chance of success

and of course:

Meerkat

2,401,999,000 boe, 20.2% Chance of success

Sitatunga

2,118,725,000 boe, 20.2% Chance of success

, both to be tested by one well planned for 2015:

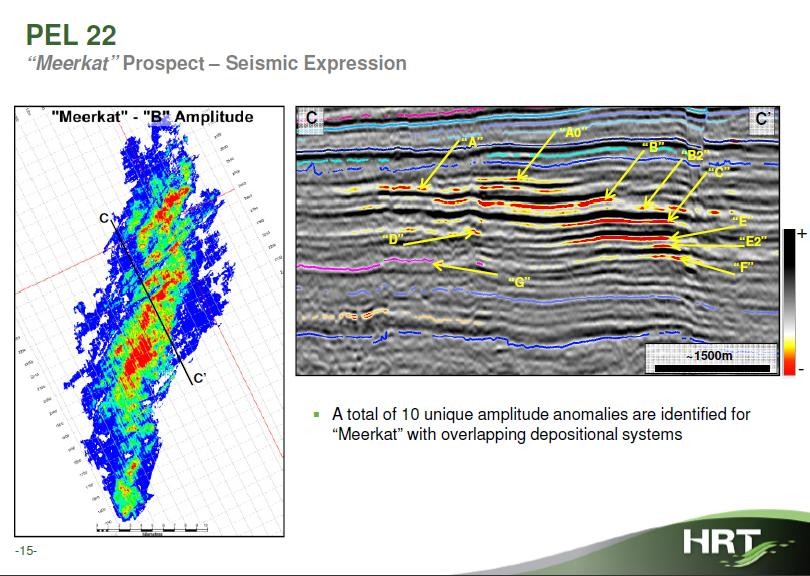

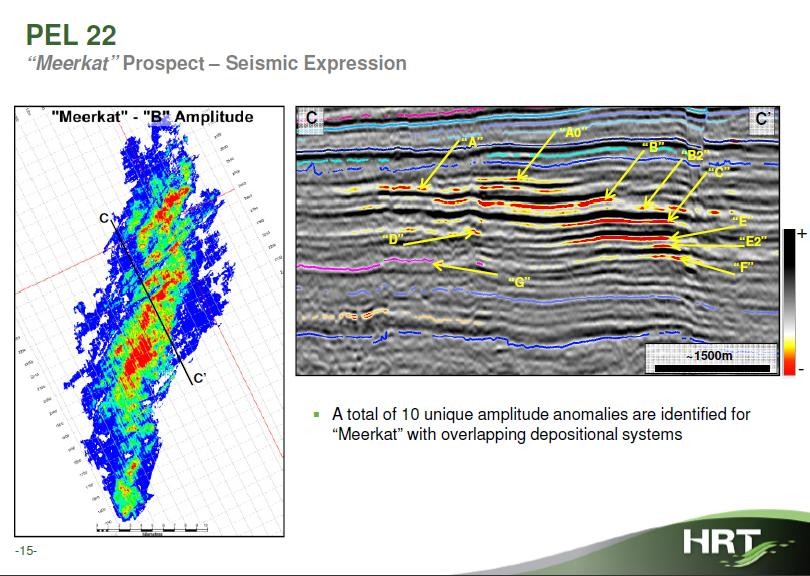

this group of ten amplitude anomalies represents a package of total thickness of 600 meters, 1/3 of which, that is, around 200 meters, we believe has presence of reservoirs able to produce hydrocarbons. The prospective reservoirs, the prospective resources of Meerkat, only ten of these amplitude anomalies correspond to around 2.7 billion barrels; again, P10 reservoir with no risk applied.

It’s important to note that the Meerkat project is in water depths of 160 meters, so these are relatively shallow waters. Most importantly, it can be tested through a well just 2,800 meters deep. That’s a shallow well, a well that can be quickly drilled, a well of reasonable cost to test such large volume of oil.

In addition, for us to drill until Meerkat, the main targets of Meerkat, while we are drilling it, we will also test another prospect, which we call Sitatunga, and this prospect is also quite large. It doesn’t have ten stacked amplitude anomalies, but it has four, and these amplitude anomalies are as consistent as those of Meerkat. And Sitatunga, by itself, has a prospective resource of nearly 2.3 billion barrels. So, it will be a single well to test Sitatunga and Meerkat. We are going to drill up to 2,800 meters of depth only, in water depths of 160 meters, and we are going to test a total of 5 billion barrels of P10 prospective resource, with no risk applied.

This combines Sitatunga and Meerkat – 2.3 for Sitatunga and 2.7 for Meerkat. Prospects like these are hard to find. I have 34 years of experience, acting especially in South Atlantic, and I worked with a prospect of Meerkat’s quality only a few times. We are confident that Meerkat will bring us very positive and encouraging results.

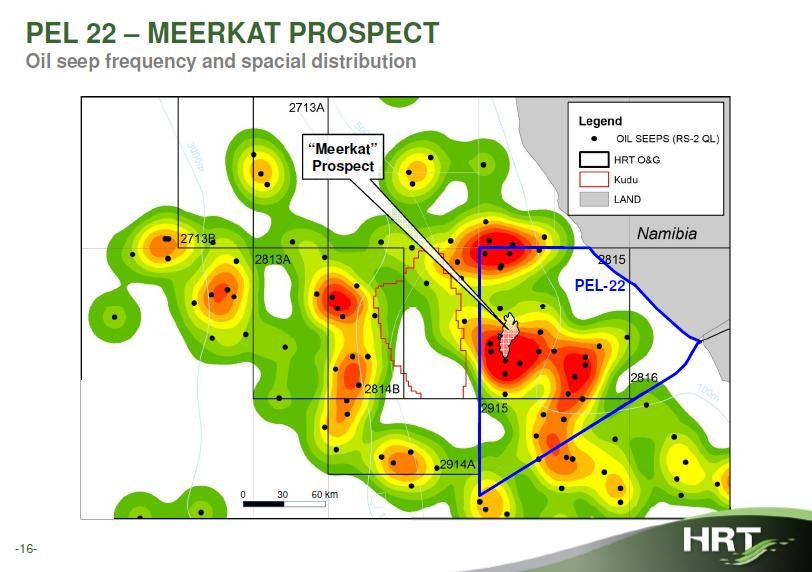

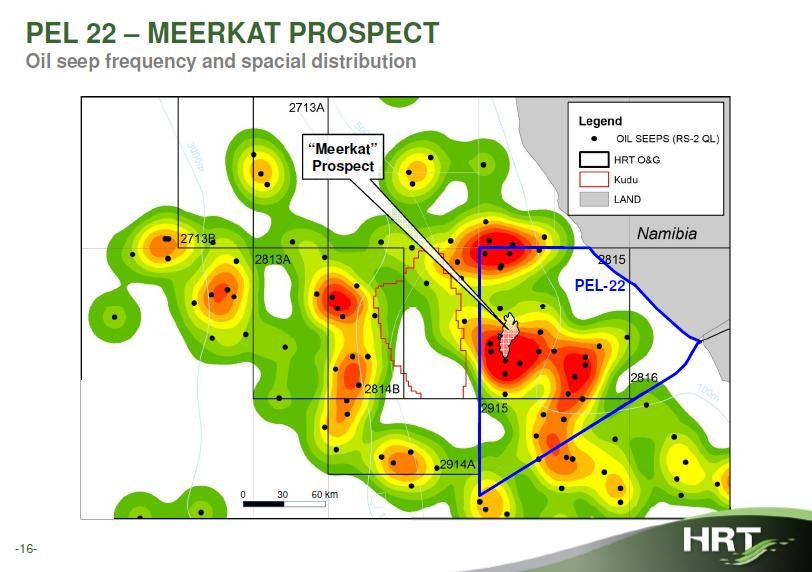

The second slide about license 22 shows the position of Meerkat in relation to the oil seeps that we are analyzing in Namibia.

Meerkat is located where we have found the most consistent oil seeps during five years of studies conducted in the Namibian offshore. This makes us confident that we are going to encounter oil – and not gas – in Meerkat, and this is very important. Although we do not exclude the possibility of encountering gas, since Meerkat is not very far from Kudu, but we consider a much greater possibility to find oil – instead of gas – due to Meerkat’s position in relation to the oil seeps that we have been analyzing for a long time.

HRT's Prospects in all their 10 Blocks in Namibia ( > 50,000km²)

(Pmean Prospective Resources (mmboe) & Chance of Success (%))

DeGolyer & MacNaughton’s report for the prospective resources of Namibia (pdf)

Walvis Basin, PEL 23 (2 Blocks)

Anaboom 237mmboe 16%

Baobab Updip 203mmboe 16%

Bohemia (Lead) 147mmboe 5%

Grolsch 281mmboe 27.4%

Guiness 294mmboe 28.8%

Hiatata 350mmboe 12%

Kokanee (Lead) 1,081mmboe 5%

Makaso 365mmboe 16%

Tamboti 194mmboe 14.4%

Tsaura 382mmboe 16%

Ushika 633mmboe 12%

Wolftoon 216mmboe 16%

Kuene 277mmboe 14%

Omaruru 91mmboe 14%

Swakop 268mmboe 14%

Ugab 253mmboe 14%

Ondongo (Lead) 286mmboe 5%

Moringa (Lead) 327mmboe 5%

Hake 419mmboe 12%

Orange Basin PEL 22, PEL 24 & PEL 28 (8 Blocks)

Bushbuk 533mmboe 14.4%

Cheetah 490mmboe 20.2%

Duiker 72mmboe 17.3%

Eland 81mmboe 17.3%

Jackal 148mmboe 20.2%

Lechwe 966mmboe 20.2%

Meerkat 1,150mmboe 20.2%

Oribi 13mmboe 17.3%

Puku 11mmboe17.3%

Rhino 483mmboe 15.8%

Roan 157mmboe 14.4%

Sitatunga 1,035mmboe 20.2%

Springbok 142mmboe 17.3%

Steenbok 78mmboe 14.4%

Viru (Lead) 136mmboe 5%

Blackbird 41mmboe 26.9%

Dromedary 310mmboe 23.5%

Flamingo 186mmboe 23.5%

Guineafowl 82mmboe 23.5%

Jawali West 53mmboe 23.5%

Korhaan 145mmboe 23.5%

M.Kingfisher 93mmboe 23.5%

Marza North 537mmboe 26.9%

Marza South 605mmboe 22.7%

Red Robin 216mmboe 23.5%

Scops Owl 81mmboe 23.5%

Shoebill 541 mmboe 26.9%

GLA

HRT is looking for partners to farm out a percentage of all their 10 Blocks to finance future exploration, next step planned for 2015 is to drill the Meerkat prospect located in PEL 22 (3 Blocks) in Orange Basin to the east from Tullow’s Kudu gas field. By farming out PEL 22 HRT should be able to finance their share of costs of drilling without the need of using current cash (~US$140MM).

Next step planned for 2015 is to drill the Meerkat prospect located in PEL 22 (3 Blocks)

in Orange Basin to the east from Tullow’s Kudu gas field.

By farming out PEL 22 HRT should be able to finance their share of costs of drilling

Neighbours and (IMO) Potential Farmin Candidates are

SHELL, Tullow, BP, PB, Cowan, OMV in Namibia Orange Basin

and Cairn India, Anadarko, PetroSA, in Southafrica Orange Basin:

Based on earlier farmout activity

I expect potential farminees to pay (at least) about:

+~US$6,000/ km² acreage

+ ~US$7,400/ km² 3D seismic

Examples of what farminees have paid

to farm into Blocks offshore Namibia the last couple of years:

BP Namibia Block

25% of 2714A

(5,480km²)

~US$30MM

US$1.2MM per 1% of one Block,

US$21,897 per 1km²

Galp Energia Namibia Blocks

14% of 2112B, 2212A, 2713A, 2713B, 2813A, 2814B, 2914A

(37,744km²)

~US$60MM

US$0.61MM per 1% of one Block,

US$11,355 per 1km²

SHELL Namibia Blocks

90% of 2913A, 2914B

(~10,000km²)

~US$54MM

US$0.3MM per 1% of one Block,

US$ 6,000 per 1km²

PGS Namibia Blocks

10% of 2312A, 2312B, 2412A, 2412B

(16,800km²)

~US$10MM

US$0.33MM per 1% of one Block,

US$5,952 per 1km²

PetroBras Namibia Block

50% of 2714A

(5,480km²)

~US$16MM

US$0.32MM per 1% of one Block,

US$5,840 per 1km²

Tullow Oil Namibia Blocks

65% of 1910A, 1911A, 2011A

(17,295km²)

~US$52MM

US$0.27MM per 1% of one Block,

US$4,626 per 1km²

One reason the values paid differ from eachother is because some companies have already acquired & interpreted expensive 3D data before farming out, while others have not. For example HRT has acquired and interpreted ~10,000km² of 3D seismic with estimated costs of > US$70MM. Another reason is of course the amount of prospective resources and their chance of success. As an example BP paid a huge premium, four times as much as others to farm into Block 2714A, the reason was the Nimrod prospect (prospective resources ~ 5 bn boe), unfortunately turned out as an non commercial well, but proved source rocks capable to fill shallower reservoirs, afterwards Chariot was able to secure the license to the south from 2714A and is now targeting such shallower reservoirs ...

The Meerkat prospect is planned to be drilled in 2015

after a successful farmout to finance HRT's share of costs of drilling,

so PEL 22 seems to be the Number One Farmout Target:

PEL 22 (3 Blocks, Orange Basin)

HRT is Operator with 95%

~15,000km² acreage

~1,137km² of 3D seismic

Potential farmout value 95%

(15,000km² * US$6,000 + 1,137km²(3D) * US$7400) * 0.95

= US$93,493,110

Potential Farmout

45% for US$45MM or one Free Carried Well

(potential gross costs of one well ~US$85MM,

potential net costs after farmout if HRT retains 50%: US$42.5MM)

In PEL 22, most interesting prospects to me are

(P10 Prospective Resources & Chance of Success):

Lechwe

1,981,032,000 boe, 20.2% Chance of success

Bushbuk

1,126,845,000 boe, 14.4% Chance of success

Cheetah

1,037,273,000 boe, 20.2% Chance of success

and of course:

Meerkat

2,401,999,000 boe, 20.2% Chance of success

Sitatunga

2,118,725,000 boe, 20.2% Chance of success

, both to be tested by one well planned for 2015:

this group of ten amplitude anomalies represents a package of total thickness of 600 meters, 1/3 of which, that is, around 200 meters, we believe has presence of reservoirs able to produce hydrocarbons. The prospective reservoirs, the prospective resources of Meerkat, only ten of these amplitude anomalies correspond to around 2.7 billion barrels; again, P10 reservoir with no risk applied.

It’s important to note that the Meerkat project is in water depths of 160 meters, so these are relatively shallow waters. Most importantly, it can be tested through a well just 2,800 meters deep. That’s a shallow well, a well that can be quickly drilled, a well of reasonable cost to test such large volume of oil.

In addition, for us to drill until Meerkat, the main targets of Meerkat, while we are drilling it, we will also test another prospect, which we call Sitatunga, and this prospect is also quite large. It doesn’t have ten stacked amplitude anomalies, but it has four, and these amplitude anomalies are as consistent as those of Meerkat. And Sitatunga, by itself, has a prospective resource of nearly 2.3 billion barrels. So, it will be a single well to test Sitatunga and Meerkat. We are going to drill up to 2,800 meters of depth only, in water depths of 160 meters, and we are going to test a total of 5 billion barrels of P10 prospective resource, with no risk applied.

This combines Sitatunga and Meerkat – 2.3 for Sitatunga and 2.7 for Meerkat. Prospects like these are hard to find. I have 34 years of experience, acting especially in South Atlantic, and I worked with a prospect of Meerkat’s quality only a few times. We are confident that Meerkat will bring us very positive and encouraging results.

The second slide about license 22 shows the position of Meerkat in relation to the oil seeps that we are analyzing in Namibia.

Meerkat is located where we have found the most consistent oil seeps during five years of studies conducted in the Namibian offshore. This makes us confident that we are going to encounter oil – and not gas – in Meerkat, and this is very important. Although we do not exclude the possibility of encountering gas, since Meerkat is not very far from Kudu, but we consider a much greater possibility to find oil – instead of gas – due to Meerkat’s position in relation to the oil seeps that we have been analyzing for a long time.

HRT's Prospects in all their 10 Blocks in Namibia ( > 50,000km²)

(Pmean Prospective Resources (mmboe) & Chance of Success (%))

DeGolyer & MacNaughton’s report for the prospective resources of Namibia (pdf)

Walvis Basin, PEL 23 (2 Blocks)

Anaboom 237mmboe 16%

Baobab Updip 203mmboe 16%

Bohemia (Lead) 147mmboe 5%

Grolsch 281mmboe 27.4%

Guiness 294mmboe 28.8%

Hiatata 350mmboe 12%

Kokanee (Lead) 1,081mmboe 5%

Makaso 365mmboe 16%

Tamboti 194mmboe 14.4%

Tsaura 382mmboe 16%

Ushika 633mmboe 12%

Wolftoon 216mmboe 16%

Kuene 277mmboe 14%

Omaruru 91mmboe 14%

Swakop 268mmboe 14%

Ugab 253mmboe 14%

Ondongo (Lead) 286mmboe 5%

Moringa (Lead) 327mmboe 5%

Hake 419mmboe 12%

Orange Basin PEL 22, PEL 24 & PEL 28 (8 Blocks)

Bushbuk 533mmboe 14.4%

Cheetah 490mmboe 20.2%

Duiker 72mmboe 17.3%

Eland 81mmboe 17.3%

Jackal 148mmboe 20.2%

Lechwe 966mmboe 20.2%

Meerkat 1,150mmboe 20.2%

Oribi 13mmboe 17.3%

Puku 11mmboe17.3%

Rhino 483mmboe 15.8%

Roan 157mmboe 14.4%

Sitatunga 1,035mmboe 20.2%

Springbok 142mmboe 17.3%

Steenbok 78mmboe 14.4%

Viru (Lead) 136mmboe 5%

Blackbird 41mmboe 26.9%

Dromedary 310mmboe 23.5%

Flamingo 186mmboe 23.5%

Guineafowl 82mmboe 23.5%

Jawali West 53mmboe 23.5%

Korhaan 145mmboe 23.5%

M.Kingfisher 93mmboe 23.5%

Marza North 537mmboe 26.9%

Marza South 605mmboe 22.7%

Red Robin 216mmboe 23.5%

Scops Owl 81mmboe 23.5%

Shoebill 541 mmboe 26.9%

GLA

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.