Wednesday, June 04, 2014 1:56:52 PM

Jun. 3, 2014

The Investment Doctor

SeekingAlpha.com

Disclosure: I am long DNGDF. (More...)

Summary

* Dynacor Gold should be seen as a services provider and not as a mining company.

* Dynacor expects to expand its operation base by 160% before the end of this year, and by 300% within the next 36 months.

* Using a conservative starting point, the NPV8% of Dynacor's toll milling business is $3.78/share.

* Additionally, Dynacor has a net cash position of almost $20M which increases daily.

Introduction

In this article I'll have a closer look at Dynacor Gold (OTC:DNGDF) which is quite a special company. Instead of mining gold, the company is actually a services provider as it does not operate its own mine, but allows smaller miners to use Dynacor's mill to process their ore. I will explain why this company should be valued as a services provider and not as an exploration company.

The volume on the US exchange isn't too bad with 11,000 shares per day, but I'd still recommend to trade in shares of Dynacor Gold through the facilities of the Toronto Stock exchange where the company is listed with DNG as its ticker symbol. The average daily dollar volume there is approximately $60,000.

As always, all images in this article were directly taken from the company's website, press releases, technical reports and presentations. As Dynacor is a Canadian company I have - where applicable - recalculated all amounts from CAD into USD using an USD/CAD exchange rate of 1.08.

What is toll milling and what are the advantages and risks?

Alright, let's start by explaining what toll milling actually is. A toll milling company is a company which owns a mill and processes mineralized ore from third parties which don't have their own processing facility and thus need to rely on third-party operated mills like Dynacor's mill. Dynacor purchases the mineralized ore and processes it to end up with gold and silver as end-product, which the company then sells.

So who are Dynacor's suppliers of ore? Those are usually artisanal miners which produce a limited amount of tonnes per day and don't have their own processing facilities as it wouldn't be efficient to have a mill with a throughput of just a few tonnes per day. And when I say 'artisanal miners,' I really mean those are 'mom and pop' type of operations where a father and his sons are recovering ore.

Why are these people selling to toll mill operators? There's a straightforward answer (actually there are several reasons) to this question as well. First of all, artisanal miners don't have their own processing facilities and it wouldn't make sense for them to build one, because their output is so low. Would it be a good idea to 'pool together' with a few fellow miners? Probably, yes. But don't forget most of these people aren't too keen on taking the responsibility of operating a mill (and I don't mean this in a negative way. Miners are miners and can't always be familiar with (legal and administrative) procedures inherent to owning and operating a mill). Additionally, if the paperwork of the mill hasn't been filed correctly, the facility will be destroyed and the owners/operators could be sentenced to 20 years in jail. That's not really a risk those artisanal miners are willing to take.

Secondly, a professionally managed processing facility should obtain higher recovery rates than small-scale plants. This is confirmed by seeing Dynacor Gold's recovery rate which is consistently around 95%. This means that Dynacor's plant is very efficient, and it definitely makes sense for the artisanal miners to use an efficient plant with a recovery rate of 95% instead of trying it themselves, reaching a recovery rate of 60% and facing 20 years in jail.

I have now highlighted the advantages for the artisanal miners, but what's Dynacor's main advantage? Well first of all, it isn't really subject to the price of gold. Should the gold price go down to $1000/oz, its margins will obviously be lower, but the company won't go out of business. Additionally, by operating just a mill, it doesn't get involved in the (very) capital-intensive mining business and as such doesn't have huge operational risks. These three reasons make it very attractive to have a closer look at a toll milling company to capture benefits from the mining sector.

Are there risks? Of course there are. As said, should the gold price go down, Dynacor's margins will be lower. Should the gold price go up, Dynacor shareholders won't benefit as much from a price rise compared to gold miners. Additionally, there's always a legislative risk even though the company has been toll milling in Peru for several years now. As you can see, Dynacor's business isn't very exciting, the company mainly is just a boring 'services provider.'

Another key factor Dynacor will have to take into consideration is that it will have to make sure it continues to purchase the ore from legal miners, as acquiring ore from illegal mines would result in an immediate shutdown of the mill. And a shutdown is actually an understatement, because as you can see later in this article, the Peruvian army is using illegal mills to practice with explosive devices, so Dynacor would be pretty stupid to risk everything it has by buying illegal ore.

The fact that the company is doing everything legally can be found in the statement the company is allowed to export the gold from Peru again after a thorough check from the government where the ore was sourced from, which would not have been the case if the gold was derived from 'suspicious' ore. As Dynacor has now also promised to buy the ore from a list of miners/mining companies approved by the government, I dare to say the risk of Dynacor 'accidentally' buying illegal ore is reduced to practically zero as it will be able to prove it bought the ore from operations which were undeniably approved by the government.

How does Dynacor Gold make its money?

Okay, let's now see how Dynacor generates its cash flow. First of all, it purchases mineralized ore from the artisanal miners. Milling doesn't happen for free, and Dynacor charges a fee per processed tonne of ore, and probably also charges extra for the use of chemicals et cetera. Through grade control, Dynacor is able to effectively estimate the gold and silver content in the ore, and pays a percentage of the face value after deducting an allowance based on the expected recovery rate.

By paying a discounted value of the ore (which is a common business practice), Dynacor is actively taking steps to mitigate the gold price risk, in order to be covered against short-term price volatility.

The recent crackdown on illegal mining in Peru - good news for Dynacor Gold, but what's Peru's end game?

The reason why the toll milling business in Peru is receiving more attention than before is caused by the fact the Peruvian government is coming down hard on illegal mining activities in the country. And as actions speak louder than words do, the Peruvian army regularly raids illegal mining and milling activities, and destroys the illegal operating plants.

This means that the legal Peruvian miners have less possibilities to process the ore at illegal plants, so the government is actually helping the legal milling companies to strengthen its position in the country. Unfortunately this also had a negative impact on Dynacor, as it had to cease production for about a month until some details were clarified. This was an unfortunate event, but I think it will be a non-recurring event, given the situation was resolved quite fast.

So what's Peru's long-term plan? As the government seems to be very serious about formalizing the mining activities in the country and end the illegal mining and milling activities, that there are plans for a bigger end game. As a lot of these artisanal miners don't pay (enough) taxes, I think we are evolving to a scenario whereby the toll mill will already levy an 'anticipative' tax on the artisanal miners. This would create a quadruple win-situation; official milling companies get the support from the government, illegal mining will be stopped, the artisanal miners can now 'come clean,' and the government receives the taxes it's owed.

So if this is a fantastic business model, why aren't there more companies entering the scene?

I don't want to be a party-pooper, but recently at least two other small Canadian companies have entered Peru and are aiming to start up their own toll milling businesses, meaning Dynacor will face some competition in the near future.

But I'm not really scared, because the Peruvian pie is large enough to share with several others. On top of that, Dynacor has been working in Peru for quite a while and probably has the necessary relationships to attract more ore for its new facilities. So whilst at first sight it might look like the competition will destroy Dynacor's first mover advantage, I'm not worried at all, because after all, most of these milling facilities will remain limited to just a few hundred tonnes a day, which is peanuts. Additionally, as I explained in the previous paragraph, a lot of currently operating mills were destroyed by the government during raids against illegal milling. This means that there will most definitely be a demand for new (legal!) milling capacity, so I personally expect new entrants in this space just to replace old (illegal) processing facilities so that there won't be a change in the supply/demand equilibrium. The Peruvian small-scale mining sector is huge, and there's room for a lot of additional capacity without disturbing the pricing mechanism.

This all sounds nice, but what's the value of Dynacor's toll milling business?

As the company should be seen as a services provider and not as a mining company, you can't really determine its fair value by calculating an NPV on a pre-determined mine life, which is the case with 'real' mining companies.

A first question you'd have to ask yourselves is 'is its revenue model perpetual?' The answer to this question actually isn't that simple. Whilst one would be quick to say 'yes, it's perpetual as it's a service providing company,' one has to look at the underlying type of business, and mines (even the artisanal ones) have per definition a finite mine life. Does this mean Dynacor's revenue model also has an end date? Yes, but as I expect the smaller mines to be up and running for the next few decades, I will assume Dynacor's business model has an infinite (well, 'quasi-infinite' would be a better description) life expectancy, so I can use the formula (net cash flow / discount rate) to determine the fair value.

Let's dig in the company's financial statements. In 2013, Dynacor generated an operating cash flow of $10.3M and will have spent approximately $1M in sustaining capital expenditures (note: I don't add expansion capex to the equation as that wouldn't be fair, considering expansion capex usually are non-recurring and one-time events). Allow me to be conservative and apply an additional 20% discount to this number (to take a gold price fluctuation and possible higher taxes into consideration). This results in an after tax net cashflow of roughly $7M per year in a very conservative scenario.

As you all know, the formula to calculate the NPV of a perpetual revenue model is (net cash flow / discount rate). If I'd use a discount rate of 8% (because it's a proven business model which has been operating in the past few years without any issues), the fair value for the current toll mill operation would be $88M.

However, that's just the current situation. The company was producing at a rate of 230 tonnes per day, and expects to increase this throughput to 300 tonnes per day (+25%) and to achieve a run rate of 600 tonnes per day at its new facility in Chala (which should be up and running at 300 tonnes per day within a year).

So the production rate should increase by an astonishing 160% later this year which will obviously have a huge impact on the operating cash flow as well. Even if I'd be very conservative and let the cash flow increase by just 100% (to err on the safe side), Dynacor should have a net operating cash flow of roughly $15M by the end of this year. If I'd once again try to determine the fair value by using a discount rate of 8%, both the Chala and Huanca mill will have an NPV8% of $188M, based on a production rate of 600 tonnes per day. Keep in mind this production rate will very likely be increased further down the road but I'm not taking that into consideration right now.

If I'd now use a ratio of 50/50 for both scenario's (again, to be on the conservative side, as there's no doubt the company should be at a run rate of 600 tonnes per day by the end of this year), the toll milling business should be valued at $138M.

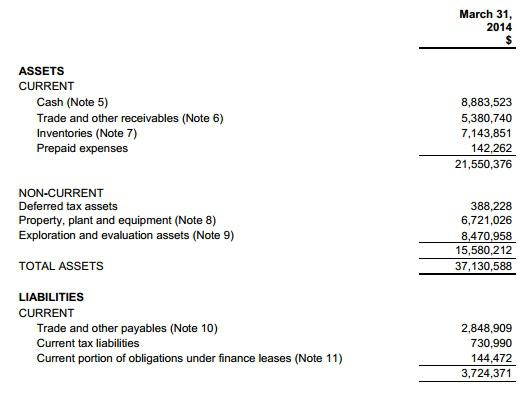

Source: financial statements

If this already sounds exciting (again, my assumptions are quite conservative!), don't forget to add the net cash value to the equation, as the company had a net cash position (here: current assets + deferred tax assets - total liabilities) of $17.6M (and a net working capital position of $17.8M, see previous image), resulting in a total fair value of $155M for Dynacor Gold.

And oh, I didn't even take the Tumipampa exploration asset into account, where a maiden NI43-compliant resource estimate is expected later this year.

Investment thesis

Dynacor Gold should see its processing capacity increase by 160% by the end of this year, and this will have huge consequences for the free cash flow of the company and should result in a re-valuation of the share price by the market.

I have established a fair value of $155M for Dynacor Gold, which results in a fair value of $4.24/share, which is 173% higher compared to the last closing price of $1.55. Even though the share price has tripled in 18 months time, it's not too late to get in, as you're investing in a company with a proven business model and management team, backed by $0.49/share in positive working capital. Throw in an expected 160% production increase by the end of this year and a 300% increase within the next 2-3 years, and this company might very well be one of the best growth-stories in the mining sector. Additionally, you get the exploration upside from Tumipampa thrown in for free.

Even though the company isn't paying a dividend right now, income investors should also put Dynacor on their radar, as the company wants to become a dividend payer down the road. If Dynacor would pay out just 1/3rd of its net annual cash flow at 600 tonnes per day, the annual dividend would be $0.12/year for a yield of 8.4%.

Editor's Note: This article covers a stock trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

http://seekingalpha.com/article/2250173-dynacor-gold-the-numbers-dont-lie-and-a-re-rating-will-follow-soon

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM