Friday, April 04, 2014 9:55:03 AM

Detroit's Wages Take on China's

By TIMOTHY AEPPEL

CANTON, Mich.—For the past four weeks, a team of 45 workers in gray

smocks have been doing something here that hasn't been attempted

on a large scale in America for at least four years.

They're making TVs.

The new assembly line is tucked inside a cavernous factory in this

Detroit suburb that once made old-style tube televisions. Their

first product: a 46-inch flat-screen model going on sale soon at

Target stores for $499.

The project is the unusual result of a partnership between a U.S.

branding company and a Chinese producer and is as much about

marketing a U.S.-made television as it is about a global shift

in manufacturing costs.

Making TVs in the U.S.A.

View Slideshow

Justin Parks worked at Element Electronics in Canton, Mich. Brian

"We think the economics favor this," says Michael O'Shaughnessy,

chief executive of Element Electronics Corp., the Eden Prairie,

Minn., company that has sold Chinese-made televisions in the U.S.

under its Element brand name for six years.

To be sure, costs in China are going up as worker pay and other

expenses, such as transportation, rise. Meanwhile, muted wage gains

in the U.S. and fast productivity advances have reshaped many U.S.

factories into tougher competitors. A recent survey of large U.S.-

based producers by the Boston Consulting Group found more than a

third plan to or actively considering bringing work home from China.

But Element's televisions also illustrate the limitations in

restoring some types of production on U.S. soil. The only other

domestically assembled televisions today come from a tiny

California producer of waterproof models designed for use outdoors

and there is virtually no domestic supply base for crucial parts,

such as glass screens. The upshot: Virtually all the key parts

needed to make a television today are imported.

Few industries have fallen as hard as television manufacturing.

In the 1950s, there were some 150 domestic producers and with

employment peaking at about 100,000 people in the 1960s. Then came

the imports, first from Japan and later from other parts of Asia.

TV manufacturing in the U.S. went all but extinct in the last

decade. Syntax-Brillian Corp., a Tempe, Ariz.-based, company opened

a production facility in Ontario, Calif., in 2006 to much fanfare—

but that operation lasted only two years.

Flat screens tipped the scales even more in favor of the Far East,

because as tube televisions grew bigger, the weight and size of the

glass made shipping increasingly costly. That was the one thing

that kept U.S. production going even in the face of imports. Flat

screens, however, are a fraction of the weight and much more

compact.

Element says the decision to produce in Detroit hinges on savings

they gained by avoiding the roughly 5% duty on imported televisions

and the reduced cost of shipping final products from the heartland

of the U.S. to retailers. All the parts are initially being

imported— which is one reason the products can only be marketed as

"U.S. assembled."

Mr. O'Shaughnessy estimates the average savings on duties is about

$27 for a 46-inch television—enough "to account for the increase

in labor costs" in Detroit. The company declined to give more

specifics, but noted that production methods in the U.S. are

streamlined, involving component assemblies that in China might

be separate steps on the production line.

The first televisions being made for Target have 52 pieces and

require 24 production steps, including testing and final packaging.

Mickey Cho, chief operating officer of Tongfang-Global, the

television-making arm of state-owned Tsinghua Tongfang Co., the

Chinese partner, says Canton is only its first move toward what

he calls global localization, making more products closer to where

they are sold.

"Our Chinese suppliers want to invest domestically, too," he said.

"They'll follow someone who shows them how to do it."

Shawn DuBravac, chief economist for trade group Consumer

Electronics Association, says there are "definitely financial

reasons" television companies are looking again at domestic

production—though so far only Element has taken the plunge with

a U.S. factory. "The labor cost differential isn't as great as it

once was" compared with China, he says, and automation has reduced

the amount of labor needed in to put together a television in any

locale.

The project does have skeptics. Paul Gagnon, director of North

American TV research at NPD DisplaySearch, a Santa Clara, Calif.-

based market research company, says the real competition for

Element is factories just over the border in Mexico, not China.

About half the televisions sold in the U.S. every year are made in

Mexico, using parts imported from Asia—a model that avoids import

tariffs and benefits from lower-cost Mexican labor.

"I just don't see any advantage to doing it here, other than for

marketing purposes," says Mr. Gagnon.

Mr. O'Shaughnessy, however, insists there is reason to do it here.

He notes that televisions made in Mexico, though benefiting from

cheaper labor, end up costing more to ship to customers. The final

cost of a set made in Mexico or Michigan "would be very similar,"

he says.

Enlarge Image

An Element worker in Michigan inspected a flat-panel set last month.

To be sure, being able to market a U.S. assembled product is part

of Element's strategy which the company is convinced also carries

value. The company's U.S.-made televisions are being sold in boxes

emblazoned with a red-white-and-blue flag splashed across the side.

Mr. O'Shaughnessy says he began by showing retailers a more subtle

design, but they requested the big flag. The image of a television

on the box, meanwhile, displays a picture of American workers on

the line assembling televisions in Detroit. The company had to hire

actors to stage the work when they were developing the packaging

because production hadn't yet begun.

But even the boxes illustrate the difficulty of sourcing things

domestically. The first wave of product is going out in boxes

imported from China. Mr. O'Shaughnessy says he hopes to have a

domestic supplier for those and the plastic pads and other

packaging by the end of the year.

Scott Nygaard, Target Corp.'s TGT +0.65% vice president of

electronics, said in a statement that he views the domestic origins

of the televisions an "added bonus" to the product. QVC Inc.,

which also plans to market the Detroit-made sets, said the new

factory shows how Element can "zig while others zag."

For now, the production is starting small, but could rise to

200,000 TVs a year if a second shift were added on the line. The

factory, owned by Lotus International Co., a U.S. company that

mostly does television repair on behalf of Element and other TV

producers, has opened up floor space for up to five assembly lines.

Walking through the factory, Mr. O'Shaughnessy stops next to one of

the flag-splashed boxes near the assembly line. "You get no points

for subtlety in the TV market," he says.

Write to Timothy Aeppel at timothy.aeppel@wsj.com

http://online.wsj.com/news/articles/SB10001424052702303716204577384113745825098

The pictures from the slideshow may be helpful to view. However,

without a subscription perhaps they may not be available.

Hope this helps!!

BTW, if it WASN'T Clear "Element" is a BRAND of Tong-Fang Global,

the parent company of Seiki & may be ACCESSED by the Seiki site,

which should ALSO tell the reader something.

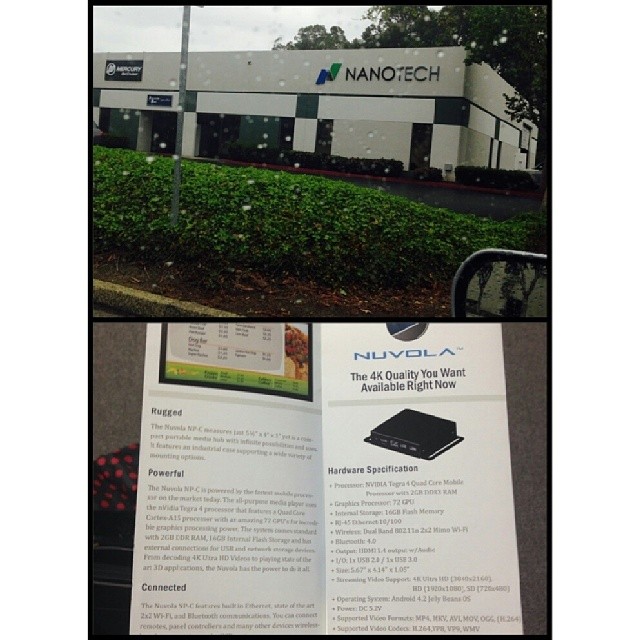

Moreover, NanoTech has ALREADY announced doing business with the

ONLY OTHER U.S. Manufacturing entity named in the article. See if

you can NAME who they are...NTEK has a partnership with them too!!

NTEK

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM