Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Some more research on the bottom P.P.S. Gold/Silver sector;

According to Golddrivers.com...

http://www.golddrivers.com/Juniors/juniorpageytd.htm

...at the end of 2005, there were 45 Mining companies trading for under 10 cents per share... now (just 5 months later) there are only 12 actively traded companies under 10 cents per share...

and out of those 12 trading for under 10 cents per share, only 3 trade for under 1 cent per share.

Some more research on the bottom P.P.S. Gold/Silver sector;

According to Golddrivers.com...

http://www.golddrivers.com/Juniors/juniorpageytd.htm

...at the end of 2005, there were 45 Mining companies trading for under 10 cents per share... now (just 5 months later) there are only 12 actively traded companies under 10 cents per share...

and out of those 12 trading for under 10 cents per share, only 3 trade for under 1 cent per share.

Research on the bottom P.P.S. of the Gold/Silver sector...

For those interested in playing the very bottom of the Gold/Silver sector based on a price-per-share basis, I just finished some Gold/Silver stock research you might find useful... using Golddrivers.com as the info source, I found...

http://www.golddrivers.com/Juniors/juniorpageytd.htm

Out of 547 Mining companies listed at... http://www.golddrivers.com/Juniors/juniorpageytd.htm

... only 3 Gold/Silver companies remain at a price per share under 1 cent, which are GWGOE.OB, PAIM.PK, and UNCN.OB ...

and it looks like I found 1 more Pink Sheet Gold stock under 1 cent not listed at Golddrivers.com, which would bring the total to 4 companies that trade under 1 cent pps.

More research notes to follow later.

Sub Penny Gold/Silver stock research...

I just finished some Gold/Silver stock research... here's some of what I found using Golddrivers.com as the info source...

http://www.golddrivers.com/Juniors/juniorpageytd.htm

Out of 547 Mining companies listed at... http://www.golddrivers.com/Juniors/juniorpageytd.htm

... only 3 Gold/Silver companies remain at a price per share under 1 cent, which are GWGOE.OB, PAIM.PK, and UNCN.OB

More research notes to follow later.

Chinese economists urging China to quadruple its Gold reserves...

http://money.cnn.com/2006/05/09/markets/gold.reut/

Yes, and now that there is no longer M3 reporting as of March 23/06...

http://www.federalreserve.gov/releases/h6/discm3.htm

... Gold has been acting like it's a new defacto M3 yardstick.

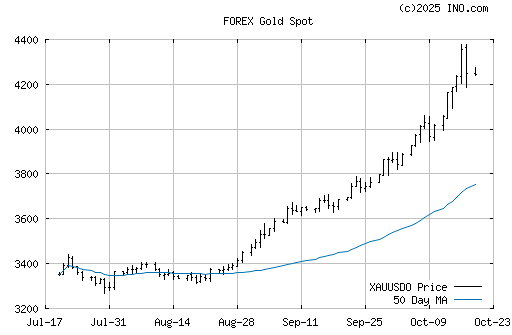

You can see from this chart.... that since the day the FED discontinued reporting M3 (March 23/06) Gold has been acting like it a new M3 measurement (and it has alot of catching up to do)...

The current value of all the gold in the world approximates $2.5 trillion. US gold which is supposed to approximate 261 million ounces is worth roughly $135 billion. We say “supposed to” because the gold hasn’t been audited for a very long time and with all the gold leasing that has gone on over the past 20 years it is very unlikely that everyone is still holding the gold they claim. Comparing this with the US only M3 money supply - $10 trillion and the world bond market - $35 trillion, and gold would have to appreciate over 18 times or $9306 per ounce...

... Jason Hommel of goldismoney.com uses the M3 figure of $10 trillion and divides it by the 261 million ounces and comes up with $38,314 per ounce which I believe will ultimately be closer than my two conservative targets.

http://www.thundercapital.com/gold_at_fahrenheit_451.htm

Gold just getting started IMO... after adjusting for inflation, Gold heading towards $2,000 per oz. ...

http://www.zealllc.com/2006/cpigold.htm

Iran sets up Euro-based Oil Bourse...

TEHRAN: Iran's oil ministry took a step toward establishing an oil trading market denominated in euros, rather than the US dollar, by granting a license for the bourse, state-run television reported yesterday.

http://www.gulf-daily-news.com/Story.asp?Article=142830&Sn=BUSI&IssueID=29047

=======================================

Iran signs its own death warrant...

Last week, Iran's oil ministry granted a license to establish an Iranian oil bourse on the Gulf island of Kish, an economic free zone, to price and trade oil in the Euro, not in the dollar. This idea – strongly backed by the administration of President Mahmoud Ahmadinejad – may well be the final straw that draws the United States into war against Iran...

http://worldnetdaily.com/news/article.asp?ARTICLE_ID=50100

Major Hurricane season brewing in the Atlantic

Associated Press

FREDERICTON -- In what could signal a frightening new fact of life in the age of global warming, Canadian and U.S. forecasters are warning that another major hurricane season is brewing in the Atlantic Ocean.

The 2006 hurricane season officially opens on June 1, and already scientists are telling people living in eastern North America that numerous storms are predicted, with as many as five major hurricanes packing winds of 180 km/h or greater...

http://www.ctv.ca/servlet/ArticleNews/story/CTVNews/20060508/hurricanes_atlantic_060508/20060508?hub...

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

Long summer of confrontation with Iran...

BBC -- An intense period of diplomatic activity is underway as Western countries try to get a Security Council resolution ordering Iran to suspend its enrichment of uranium.

http://news.bbc.co.uk/1/hi/world/middle_east/4955438.stm

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

May 7/06 - Venezuela to impose new oil extraction Tax...

CARACAS, Venezuela - President Hugo Chavez said Sunday that Venezuela would impose a new tax on companies that extract oil from the country to increase revenues from its petroleum industry.

Venezuelan Oil Minister Rafael Ramirez said the government was considering a 33.3 percent extraction tax. Oil companies would be able to detract whatever they pay in royalties from tax bills, he told Union Radio.........

http://www.fortwayne.com/mld/newssentinel/business/14524969.htm

May 8/06 - International Energy Agency (IEA) director Claude Mandil said on Monday he expected oil prices to stay high for at least two to three years because of high global demand and tight supply.

"They (oil companies) have not invested enough for the last 20 years," Mandil said.........

http://www.boston.com/news/world/asia/articles/2006/05/08/oil_firm_above_70_on_concerns_over_global_...

May 8/06 - Iran promises it will defy UN nuclear resolution...

http://news.scotsman.com/international.cfm?id=687232006

May 8/06 - US pushes for Iran financial sanctions...

http://news.ft.com/cms/s/4e0aa9d2-de2f-11da-af29-0000779e2340.html

May 8/06 - Oil prices rose in Asian trade Monday as tensions between Iran and the West over its nuclear program continued to stir the market ahead of a key meeting among world powers, dealers said.

At 1310 AEDT, New York's main contract, light sweet crude for June delivery was up 32 cents at $US70.51 a barrel from its close of $US70.19 in New York on Friday....

http://www.heraldsun.news.com.au/common/story_page/0,5478,19063296%255E31037,00.html

If FMNJ can enter into a secure Joint-Venture contract with COMIBOL for Cerro Rico, I think FMNJ could then move itself forward substantially (and quickly)....

another letter-of-intent news release regarding COMIBOL may keep the consolidation going with a small upward bias... but any meaningful move will come with a non-subject J.V. contract...

FMNJ price/chart looks like it is now at the point where investors need a greater degree of certainty to go explosive again, more so now with the Bolivian Energy Politics.

Interesting chart comparing the 1975/1980 Gold run to the 2001/2006 Gold run...

http://12.42.70.96/GoldOverlayChart.asp

Adjusted for inflation, Gold could run to $2,000-plus this time around...

http://www.zealllc.com/2006/cpigold.htm

Appearently they are supposed to file their SEC docs to remove the "E"...

my guess is, if they file by the deadline, the pps should pop a bit... but combined with Gold heading towards $700, that pop, could become a bang.

Sub-Penny Gold stock (GWGO)E at .0009

http://www.investorshub.com/boards/board.asp?board_id=3111

Sub-Penny Gold/Silver stock (UNCN) .002 breakout...

http://finance.yahoo.com/q/bc?s=UNCN.OB&t=5d

Well, at least the price is right for a new entrant at .0009, I noticed UNCN started a run from a similar price level 2 days ago...

http://finance.yahoo.com/q/bc?s=UNCN.OB&t=5d&l=on&z=m&q=l&c=

I wont be suprised if $700 Gold triggers a small stampede of buying into all the sub-penny Gold's... with $800 Gold triggering the beginning of much larger moves across the entire sector.

The weakening US Dollar virtually guarantees the trend in Oil price remains to the upside, as opposed to softening...

http://quotes.ino.com/chart/?s=NYBOT_DX&v=d6

I think the probability favors heading back towards $75 Oil next week, as opposed to going towards $65...

OT - wolfandbear: I was going to post on your sub penny board... but I couldn't, a page comes up that says I need a premium subscription to post on your thread.

I'll tell you one thing... the next time Oil makes a run for $75... the stock bands on FPPL have become spring loaded...

and it's not just on FPPL, the stock bands on a number of the micro-cap Oil's are all tightening and should produce a spring loaded effect on the next $75 Oil test.

Now that we are just weeks away from a new hurricane season, fully 23% of Gulf of Mexico production remains shut-in after last year’s hurricanes. Recently the Department of Energy acknowledged that most of that would never be rebuilt due to high investment costs at mature and post-mature reservoirs. Aside from the fact that it’s not cost effective, this is also because of rig shortages....

http://www.fromthewilderness.com/free/ww3/042706_paradigm_speech.shtml

Notice the run in Oil (well above the 50 DMA) last year from June to Oct.... I think we are going to see something similar with Oil this year...

there is less and less room to recover from or adjust to any oil supply surprises that might come along...what are some of these possible surprises?...

• Just one more major hurricane

• A major earthquake in any oil producing region or pipeline corridor from Russia ’s far east, to Iran , to Alberta

• Any one of a dozen possible side effects from global warming, whether from melting tundra that might sink pipelines, to rising sea levels that might endanger offshore production

• Civil unrest in any oil-producing region that gets out of control and damages more infrastructure than can be quickly repaired

• A decision by Venezuela ’s Hugo Chavez to redirect just 10 or 15% of his US exports to other customers

• A successful attack on Saudi Arabia ’s Abqaiq terminal

• Political unrest in our second-largest oil supplier, Mexico

• Major unrest in the Caspian basin – another region where covert operations are now probably the second- or third-largest GDP component for several nations.

http://www.fromthewilderness.com/free/ww3/042706_paradigm_speech.shtml

In the last year we have seen the collapse of Kuwait ’s super-giant field Burgan; accelerated decline in the world’s second-largest field, Mexico ’s Cantarell; and an overall global decline rate approaching 8%. We have seen Saudi Arabia fail to increase production while at the same time finding it more difficult to hide deteriorating reservoir conditions in all of its mature fields, including Ghawar. As of tonight, more than 30 of the world’s largest producing nations have entered steep decline.

Discoveries continue to fall off a cliff. Over the last four years the world has been consuming 6 barrels of oil for every new one found.

http://www.fromthewilderness.com/free/ww3/042706_paradigm_speech.shtml

May 3/06 -- Bush, Merkel in united front on Iran nuke plans...

Western powers offer new U.N. resolution that could trigger sanctions ...

http://www.msnbc.msn.com/id/12541482/

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

May 3/06 -- As Hurricanes loom, many in Florida Keys flee...

http://today.reuters.com/news/articlenews.aspx?type=domesticNews&storyid=2006-05-03T145439Z_01_N...

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

May 3/06 -- USA can work outside the UN...

(Washington) With no clear sign that America can win United Nations support for sanctions against Iran, the Bush administration says it could work with like-minded nations to "punish" Tehran for its nuclear programmes...

http://www.news24.com/News24/World/News/0,,2-10-1462_1926090,00.html

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

Short term indicators indicating a 100% buy at barchart.com... and "mid" and "long-term" indicators have been strengthening over the past few days...

http://quote.barchart.com/texadv.asp?sym=fppl

May 02/06 -- Exxon CEO says there's nothing in the short-term that can be done to bring down high energy prices...

http://www.mercurynews.com/mld/mercurynews/news/politics/14483695.htm

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

May 02/06 -- Exxon CEO says there's nothing in the short-term that can be done to bring down high energy prices...

http://www.mercurynews.com/mld/mercurynews/news/politics/14483695.htm

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

May 2, 2006 -- Five Factors for Favoring Silver... by Robert Kiyosaki ...

http://finance.yahoo.com/columnist/article/richricher/4027

May 2 2006 -- Saudi fears over attacks drive Oil prices higher...

Oil prices rose on Tuesday, propelled by supply fears that were exacerbated after the Saudi oil minister said he expected more attacks on oil infrastructure in the Gulf kingdom following February’s attack on the Abqaiq oil refinery.

http://news.ft.com/cms/s/6a832386-d9f3-11da-b7de-0000779e2340.html

============================================================================

US Energy Independence starts at home... by developing domestic energy supplies... IN SAFE LOCATIONS.

May 2 2006 -- Saudi fears over attacks drive Oil prices higher...

Oil prices rose on Tuesday, propelled by supply fears that were exacerbated after the Saudi oil minister said he expected more attacks on oil infrastructure in the Gulf kingdom following February’s attack on the Abqaiq oil refinery.

http://news.ft.com/cms/s/6a832386-d9f3-11da-b7de-0000779e2340.html