Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

He knows that

In his previous post:

"in the pinksheets most of us are speculating, mostly based on chartpatterns, using a hit-and-run tactique, and moving on to the next breakout stock.

and if by chance we find a company with a future, why not stay for a while...?"

That's why their concurrence is appearing less and less coincidental to me.

You are mistaken

I was disproving your statement "but indeed, the fact that you were treated as an annoying intruder"

If your referring to the question that was wrapped with ridicule, and abuse (the message was deleted for that) it has already been answered by Bala.

Selfish: Holding one’s self-interest as the standard for decision making

Here's straightforward for you

1. From first post: After reading like 200 posts, I have yet to find out the real deal for SYNJ.

Implies everyone who has posted here, especially the last 200, does not talk about anything substantial.

2. From first post: Please advise on our SYNJ investments, rather than talking about price charts...

See number one above and is bordering on gimme, gimme, gimme.

3. One person replied and said to read some more. Maybe they don't like being asked "please do my work for me."

4. Words used in second post: Useless, blabbering, pointless, pathetic.

Are you saying because someone told them to read some more, their very next post was to lambaste and ridicule? Come on, this person had his mind made up a long time ago and only came here to stir things up.

I was in spng way before 1.5cts and I didn't go into the board the way this person has, and I never asked anyone "prove to me." It's just selfish and wrong. Your right about one thing, they will miss the train.

Phase 4 - 10.4 million gallon facility in - TBD

He seems completely aware on how to assume and malign.

Where did you pull your numbers out of?

Please define the method of your deep analysis so we can understand your numbers, but first I have a few questions.

For the seed, are you assuming soy - why not canola? The difference of 18 percent oil yield from soy as compared to 40 percent oil yield from canola resulting in 48 gal/acre and 127 gal/acre respectively is pretty important to know.

Did you consider the possibility that they would crush the seed themselves? This would reduce the oil cost which is the major component, about 65 percent, of production.

Did you include co-product revenue in your crushing margin? If so, do the co-products include glycerin, fatty acids, meal, and magnesol cakes? Have you ever thought about the possibility of reducing the fourth largest component cost, energy, using glycerin gasification?

What sort of credits and incentives did you include? Production tax credit, blenders tax credit, State, Fed, blah, blah, blah.

This is only the biodiesel part - solar and wind later.

I'm not here, nor is anyone else, to convince you to invest. It's fine if you would like to have a civil discussion, but don't come here to berate people who have put a LOT more effort into this than you have.

Sure does.

It seems they have a lot of the pieces in place.

Carlos Serrano

Inter-American Investment Corporation

1350 New York Avenue, N.W.

Washington, DC 20577

http://www.iic.int/home.asp

Carlos Serrano

Washington, DC

(202) 623-2877

http://www.iadb.org/aboutus/IV/directory_detail.cfm?notemplate&id=20462&lg=EN

Since June 2005, Carlos serves as Senior Financial Specialist at the Inter-American Development Bank in Washington D.C. Before joining the IADB, he was a Senior Vice-president & Head of The Americas Group & Europe at BBVA International Financial Institutions, in Madrid. In total he spent 18 years with BBVA, where he has held numerous positions both in Spain and overseas, including several years in Tokyo as Chief Representative for Capital Markets & Investment Banking for Asia-Pacific.

The Inter-American Investment Corporation is a multilateral financial institution that is a member of the Inter-American Development Bank (IDB) Group.

The IDB Group is composed of the Inter-American Development Bank, the Inter-American Investment Corporation (IIC) and the Multilateral Investment Fund (MIF). The IIC focuses on support for small and medium-sized businesses, while the MIF promotes private sector growth through grants and investments, with an emphasis on microenterprise.

Inter-American Development Bank

Headquarters

United States of America

1300 New York Avenue, N.W.

Washington, D.C. 20577, USA

Costa Rica

Edificio Centro Colón, Piso 12

Paseo Colón, entre calles 38 y 40

Apartado postal 1145-1007

San José, Costa Rica

www.iadb.org

Board of Governors

United States

Timothy F. Geithner

Ben S. Bernanke - alternate

Costa Rica

Guillermo Zúñiga Chaves - Minister of Finance Governor

Francisco de Paula Gutiérrez - President Central Bank of Costa Rica - alternate

www.iadb.org/aboutus/IV/go_governors.cfm?language=English

http://www.sentinelrenewableenergy.com/aboutus.php

http://www.methes.com/team%20members.html

http://www.methes.com/Profiles/michelglaporte.html

www.methes.com

domains using this as mailserver and namesever under another name:

www.new-shore.com

New Shore

Parque Emp. Forum Torre G, Piso 1, CDN Center

Santa Ana, Costa Rica 126-6155

www.new-shore.com

Registrant: Michel G. Laporte

SunSi Energies

In January 2009, SunSi Energies began its due diligence process to acquire, via a joint venture in China, 90% of a newly formed company. This new company will own all of the assets of the Zibo Baoyun Chemical Plant in Zibo, China and the assets of the Zibo Baoxin Transportation Co Ltd., which transports the finished product from the production facility to clients across China.

http://sunsienergies.com/

January 24, 2008

Yesterday, the 57 days of completing its 57 years of age, Guillermo Zúñiga, Minister of Finance abandoned its eloquence and showed the side of his elusive personality.

Despite good news on hand to announce the country that China-made millionaire buying a bond of our national debt - the Minister was silent on the transaction.

Zuniga, who has successfully led the country's fiscal recovery is justified in the existence of a directive from the National Treasury, which said "secret" for those transactions.

This Herediana economist, father of four children and recognized academic finance, yesterday used his entire strategy to circumvent the verbal questions to detail the historic and important transaction, the first diplomat to the country's new friend.

Alleged disregard details of what state china bought the bonds and what is the amount of the transaction and your interest rate.

He did so despite the fact that he was one of the precursors of relations with China. 1. St June last year when it signed the beginning of diplomatic links, Zúñiga Chancellor Bruno Stagno accompanied on his visit to Beijing.

That visit was secret because it was not until June 6 when they announced the relationship with China. And now talking about buying bonds.

http://www.nacion.com/ln_ee/2008/enero/24/pais1396146.html

I thought it was already a rule...lol

Beluga Petroleum System Equipment

Kébir Ratnani

Director

Mr.Ratnani is an experience executive having spent 22 years in the natural gas, electricity, windmill and energy sectors. Over the course of his career, Mr Ratani has held many different management and technical positions and own 13 patents relating to the natural gas, petrochemical and environment technologies.

At the international level, Mr Ratani has concluded numerous cooperation agreements with different governments in Algeria, Tunisia, Senegal, Libya, Gambia , Burkina Faso , Ivory Coast , Egypt , Lebanon , Syria , Saudi Arabia as well as Kuwait , Malaysia, Vietnam, Pakistan and France.

In 1991, he directed the launch of the Natural Gas Technologies Centre, a research organisation associated with Gaz Métropolitain, Gaz de France, Brooklyn Union Gas and Osaka Gas. Mr Ratnami has recently joined Beluga Composite Corporation as a director.

http://www.belugacorporation.com/html/modules.php?name=News&file=categories&op=newindex&catid=1

Beluga Composites Corporation is a manufacturer of UST, related accessories and oil/water separators. Member of the Petroleum Equipment Institute, Beluga has the technology and holds the Underwriters Laboratories UL 1316 and ULC-615-S certifications for fiber glass reinforced plastic (FRP) underground storage tanks for petroleum products.

Beluga is the only company in the world which presently holds both the UL 1316 and the ULC-615-S. These two certifications were obtained after having produced a number of tank samples and undergone a series of exacting tests supervised by the Underwriters Laboratories.

Beluga’s UST are products of the next generation technology (male technology) using continuous fibers to produce a uniform filament-wound FRP UST which is technically and structurally superior as the application of resin and fiberglass are constant over the entire tank.

The filament-winding process involves winding long strands of resin impregnated fiberglass around a suitably shaped mandrel. The winding can be radial or helical, depending on the structural characteristics required and then the computer is programmed accordingly.

This type of construction produces higher quality FRP tanks that are at least six times stronger than the FRP UST produced by the first-generation, short fiber, spray up inside a mold, (female technology).

In fact, it is the highest performing technology in the storage of petroleum products because of its resistance to internal and external corrosion, structural strength characteristics and flexibility of use.

BELUGA COMPOSITES CORPORATION

6830 av du Parc – suite 572

Montreal Qc

H3N 1W7

1-514-278-7856

www.belugacorporation.com

I think it went up because of the well timed press release announcing Mack as the President and Chairman for Pinnacle along with declining shorts and almost no FTD's.

I'm not aware of a new rule, but just enforcing the T+3 would be nice.

2 weeks is great! It used to be quarterly up until a month ago! I don't think it will get any more current than that because then it starts to tred in the "proprietary trading strategies" area.

In the meantime, please no more posts like the list of hundreds of mailboxes and saying 'which one?' It just comes off as antagonistic while being truly unproductive.

It just won't stop...

Lamont A. Hale, Senior Vice President and Chief of Business Development

Lamont A. Hale, Vice President

Mr. Hale has been with SRE since its founding. He is a retired United States Marine who served from 1982 to 2003. During this time, he held various senior staff positions as an advisor, instructor, and operations chief.

In 2003, he incorporated LH International Consultancy, which specializes in assisting companies write and implement policies, procedures, and training programs for staff operations in both the US and abroad. His firm has worked with leading media organizations, oil companies, security companies, and various Fortune 500 corporations. Mr. Hale has a proven track record managing and maximizing profits and saving for multimillion dollar projects in the military and private industry.

Malek Z. Majzoub, Director of Product and Business Development

Mr. Majzoub joined SRE in July of 2008. He brings thirty-three years of industrial management experience to the team. During his career at Ford Motor Company, he was a manager in production operations and an engineering manager in charge of process and industrial engineering on a number of vehicle lines.

Mr. Majzoub has also been a project manager for a number of multi-million dollar facilities and product lines. He was the Production System Lean Manager at a three thousand-man site, where he was coordinating lean systems in the areas of Leadership, Work Groups, Training, Station Process Control, Maintenance, Engineering, Material Flow, Environmental Systems, and Plant Safety.

Devin Tullis, Business Development Consultant

Mr. Tullis spent ten years working in the security industry before joining SRE and has managed and conducted protective operations for several Fortune 500 companies as well as numerous foreign dignitaries. He was the Senior Security Specialist and a special investigator for the Office of Ethics and Compliance at US Foodservices, where he was responsible for ensuring that day-to-day operations were properly conducted per state and federal laws.

Tremond Hale, Director of Business Strategy

Mr. Hale is a very well accomplished and focused business professional. His college education coupled with his real world, on the job experience, gives him an edge when it comes to pursuing business endeavors of old and new. He possesses a B.S. degree in Psychology and a Masters degree in Business.

Mr. Hale also has nearly 8 years of experience in the banking industry where he worked his way up in the companies from a day to day processor to a business consultant and business analyst and project management for two of the nation’s top 5 banks. His banking knowledge extends from the mortgage industry to retail credit and servicing. Mr. Hale is very detailed oriented, hardworking, stands for integrity and understands the big picture. Mr. Hale is also President of Trademark Investment Group, based out of Charlotte, NC in which he oversees investments of small business and real estate ventures.

Our Corporate vision for Wind Power:

Sentinel Renewable Energies (SRE) will produce electric power by way of a wind farm.

We will sell this power to established Utilities or create a COOP to buy the power.

SRE will focus its efforts on developing wind farms in both US and foreign markets.

SRE will implement a production and distribution plan for power harvested from a wind farm beginning in mid to late 2009.

Implementation:

We work with governments to maximize incentives for a wind farm.

Once the company identifies the location, we will start developing a customer base for the power produced.

Sentinel Renewable Energies will secure a site for construction.

SRE will evaluate and improve on business operations for a minimum of 60 90 days, improving the efficiency and lowering operational cost.

Sentinel Renewable Energies will set its business model, which will be replicated at additional locations.

SRE will adapt this wind farm model for US and foreign markets.

Environmental benefits of Wind Power:

Wind power does not produce any air or water emissions.

Wind power does not produce any hazardous waste.

Wind power will not deplete natural resources.

Wind power has no environmental damage like oil spills.

Wind power reduces global warming by reducing the burning of fossil fuels.

Economic benefits Present and Future of Wind Power:

Wind is the lowest cost renewable energy.

Economic benefits on Labor incurred.

FAQ's on Wind Farm:

Wind farms can be deployed on land or at sea.

Wind farms are compatible with agriculture.

Average price for a wind farm turbine is $2000 USD per Kilowatt.

Renewable Energy Sources will be at least 20%, by 2020 in the EU.

The EU's directive for Cyprus is to be using 6% RES by the year 2010.

Cyrus's "New Enhanced Grant Scheme" objective is 9% RES by 2010.

The leading source of potential power in Cyprus is Wind Power.

Cyprus’ "New Enhanced Grant Scheme" for Renewable Energy Sources:

Financial incentives (30-55% of investments) in the form of government grants and feed-in tariffs.

Cyprus needs 200 Mega/watts from wind power to meet its targets.

Phase 4 - 10.4 million gallon facility in - TBD

SRE will purchase crushing equipment at approximately $2mil with the capacity to crush raw rapeseed and convert it into de-gummed oil for sale to SRE's production division, and for sale to other SC biodiesel producers at a fair price (enabling them to produce fuel at a profit also). There is also the option for cooperatives to partner in this endeavor also. This partnership would decrease SRE's cost and risk as well as provide the local farmers with another revenue stream.

SRE will partner with a local SC trucking company (with an existing fleet of trucks) to transport raw feedstock to the crusher, transport de-gummed oil to SRE's own production facility and transport de-gummed oil to other SC biodiesel producers. They will also transport processed biodiesel from SRE's production facility to state/county fueling depots for sale at below market pricing under a 20-25 year (long term) purchase agreement.

You won't find me on that list of people who have posted that they talked with Brian, even though I did talk to him once (doh! now I'm going to be on that search list, so I guess you will...lol)

I get the feeling that you are almost reminding people that there are scams out there. I think everybody knows this, or at least they should if they are here, and trade accordingly.

Not necessarily in this company, but in general, you can see the level of belief/scepticism, swing wildly daily. IMO that's a huge portion in one's decision to buy or sell, and there it is, one's decision.

I know from my own experience that early on nothing anybody said would make me think about the "other" possibility. It wasn't until I had a few losses, and learned a lot, that I finally started to do my own DD. From what I have found I like my chances here and I'm going to stick it out, that's my decision, other's have theirs. I'm not going to criticize them or cast them out as "unbelievers" if they choose otherwise.

So to get back on point, I'm still asking myself why are you now asking these questions and making these statements. Is this a critical tipping point? Is it to help?

I'm not trying to come down on you, just trying to figure it out like I do for most things.

Record Rapeseed Crush Contributes to Decline in EU Soybean Demand

A biofuel consumption mandate, tax incentives, previously high petroleum prices, and preference for rapeseed oil are pushing rapeseed crush to a record volume, nearly double the level of just 5 years ago. Crush expansion is further supported by record production and a 3-fold rise in imports primarily from Ukraine.

Whereas EU soybean crush has trended lower over the years, this year’s drop is caused by confluence of events. Larger supplies of rape meal, sun meal, and record feed grain supplies have displaced the need for soybean meal.

The EU’s recent announcement of punitive duties on U.S. biodiesel could further boost crush for rapeseed as its oil is the major feedstock for biodiesel.

United States Department of Agriculture

Foreign Agricultural Service

Circular Series FOP 3-09 March 2009

Yes I know, Syndication inc has a PO Box also.

I'm not sure what you're trying to get at...

Hey thx everyone

gofor, cougar, and drifter for the mark.

I'm caught in a dilemma though.

Somebody said something about Rossi having five(?) PR's ready to put out right? Well, today I felt like I found one of them, that's cool, it seemed I didn't bust up anyone's "master plan."

The thing is I've found more already and if I keep going at this rate they won't need to put any out! So now I'm starting to feel a little weird about it.

There's more on the way

Today has been a goldmine

This is from 10 days ago

I think it's wrong to charge

Overall I think it was a good day

See y'all later

Good fortune smiles upon us all

Don't forget to add Carlos in bold

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=40319338

Your absolutely right

Without the Methes info from Bala, I never would have found Sunsi either. It's like starting a puzzle - with the first piece.

Great team we have here.

Yep, your friend Carlos

Thanks Rob

They amended that shortly thereafter

I never ordered it from the SOS

So you want confirmation

Then I'll give you confirmation

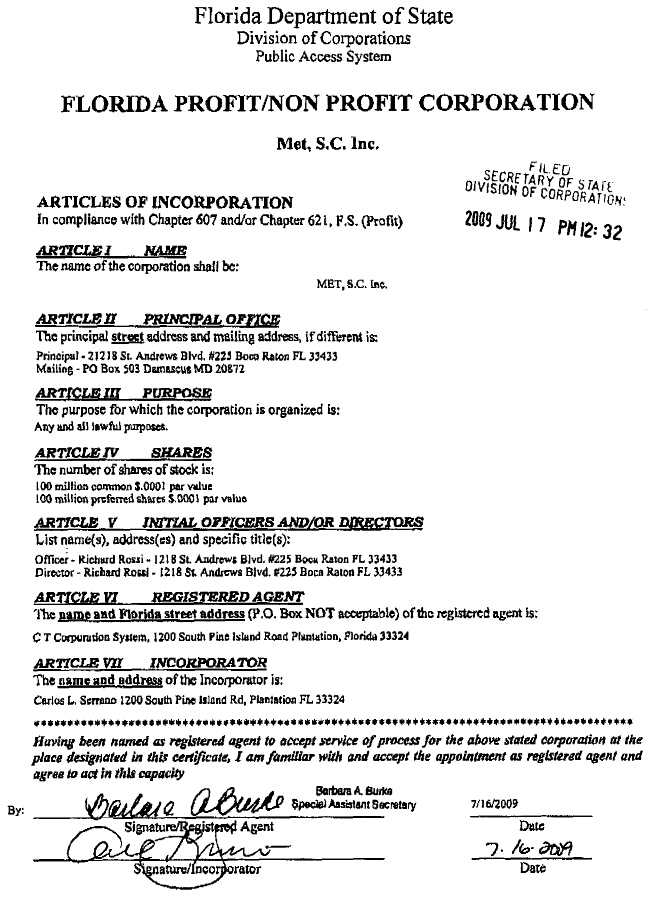

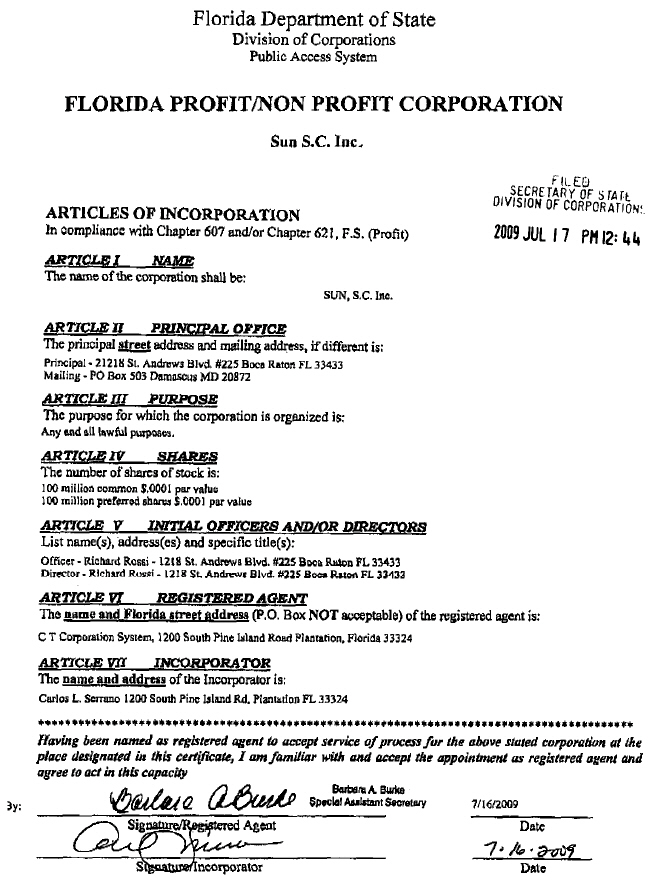

First check out who is the incorporator for SRE S.C., then look who incorporated Met S.C. and Sun S.C.

Thx haven't heard that in a while... lol

Thx Vis and Brad

I'm excited about the Met part

I see green in our future

Yessssss

Rossi has a lot to do with SYNJ!

It's going to be a green day!

Newly registered companies

Florida Profit Corporation

SUN, S.C. INC.

Filing Information

Document Number - P09000061341

FEI/EIN Number NONE

Date Filed - 07/17/2009

State - FL

Status - ACTIVE

Principal Address

21218 ST. ANDREWS BLVD. #225

BOCA RATON FL 33433

Mailing Address

POST OFFICE BOX 503

DAMASCUS MD 20872

Registered Agent Name & Address

C T CORPORATION SYSTEM

1200 SOUTH PINE ISLAND ROAD

PLANTATION FL 33324 US

Officer/Director Detail

Name & Address

Title OD

ROSSI, RICHARD

21218 ST. ANDREWS BLVD. #225

BOCA RATON FL 33433

http://www.sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=P09000061341&inq_came_from=OFFFWD&cor_web_names_seq_number=0001&names_name_ind=P&ret_names_cor_number=&ret_cor_web_names_seq_number=&ret_names_name_ind=&ret_names_comp_name=&ret_names_filing_type=&ret_cor_web_princ_seq=&ret_princ_comp_name=ROSSIRICHARD&ret_princ_type=

Florida Profit Corporation

MET, S.C. INC.

Filing Information

Document Number - P09000061337

FEI/EIN Number NONE

Date Filed - 07/17/2009

State - FL

Status - ACTIVE

Principal Address

21218 ST. ANDREWS BLVD. #225

BOCA RATON FL 33433

Mailing Address

POST OFFICE BOX 503

DAMASCUS MD 20872

Registered Agent Name & Address

C T CORPORATION SYSTEM

1200 SOUTH PINE ISLAND ROAD

PLANTATION FL 33324 US

Officer/Director Detail

Name & Address

Title OD

ROSSI, RICHARD

21218 ST. ANDREWS BLVD. #225

BOCA RATON FL 33433

http://www.sunbiz.org/scripts/cordet.exe?action=DETFIL&inq_doc_number=P09000061337&inq_came_from=OFFFWD&cor_web_names_seq_number=0001&names_name_ind=P&ret_names_cor_number=&ret_cor_web_names_seq_number=&ret_names_name_ind=&ret_names_comp_name=&ret_names_filing_type=&ret_cor_web_princ_seq=&ret_princ_comp_name=ROSSIRICHARD&ret_princ_type=

Under most state corporation statutes, an affirmative vote by the board of directors is sufficient to approve a spin-off—the parent need not obtain stockholder approval. Whether the parent distributes some or all of the subsidiary's stock, the subsidiary will become a publicly held company if the parent is publicly held. The spun-off company can access the equity markets directly by selling its own securities. It can also sell its own debt securities and establish a separate line of credit.

How do you know this?

"he has been involved with ihub for years."

"if one has noticed, brian reads and posts regularly under various alias's."

It was mine