Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

There are two big obstacles affecting this company right now. It is DIR FEES and SEC compliance. Get news on both of these and we are in great shape as a company in whole. We are stealing market share from major chains month over month, and that isn't easy, unless you have a competitive advantage over that competition. Apparently ProgressiveCare has that something.

I didn't sense any concern or worries from Ms.Mars during conference call other than DIR fees which seemed to be a topic she would be willing to discuss with anyone, including legislators at length.

We have not been at that level since January 2018. That's why that cost basis is not possible. Thanks

You said it. Let's let the company take care of business. My expectations are increased volumes and sales as business gets back to normal, Florida ahead of many states in that respect.

Really, the price dropped all day before the conference call even occurred, CC had nothing to do with anything. If it was on Monday, the day traders would have still sold on Friday. Lol. That's their way.

I assume you mean many years ago.

I only had to state it once and everyone else agreed. Hmm, what's that mean.

Lol, funny

Why would they have to reverse split. Management doesn't even mention it,other than to say they have no intention too or plans to because of these posts.

What's wrong with being in a stock 4 years?

There will be a separate call with Stuart from Smallcapvoice on questions and further information not on conference call.

I don't think that is what the event is about. It is about the whole Covid thing and their plans for community, back to work plans, testing, etc.

You don't understand the longs here. The longs here are invested long term, retirement account style even. No long is parting with shares for 8-9 cents. Lol. Day traders are only ones gone.

$RXMD $9 Million 1st Qtr Revs 100% increase

MIAMI, FL, May 18, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE ? Progressive Care Inc. (RXMD) (OTCQB: RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology company, is pleased to report financial results for the quarter ended March 31, 2020, which featured very strong revenue growth, especially considering the unique operating conditions during February and March due to the SARS-CoV-2 global pandemic health crisis. During the associated earnings call, management outlined specific competitive advantages and new initiatives positioning the Company for strong growth across all major metrics throughout 2020.

S. Parikh Mars, CEO of Progressive Care, commented, “The novel coronavirus has dramatically changed the landscape in countless ways, and many businesses are suffering from a pervasive lack of predictability and a torrent of new and unique existential challenges. Yet, despite it all, Progressive Care continues to see dramatic overall growth driven by strong execution, flexibility, and efficient positioning. We remain better positioned than most of our competitors to respond effectively to these extraordinary and unusual challenges, and to take full advantage of the many exciting opportunities for growth that lie ahead.”

First Quarter 2020 Highlights

Consolidated quarterly year-over-year growth in Net Sales of 75% to surpass $9 Million for Q1 2020Prescriptions filled surpasses 134,000 in Q1 2020, up 59% versus Q1 2019March 2020 set new Company record for monthly prescriptions filled340B Agency Revenue jumped 76% (vs Q1 2019) to nearly 200,000Net Loss of $795 K almost entirely attributable to PBM fees, with Q1 impact exaggerated due to seasonality of performance reimbursements

During the earnings call, Mars discussed dynamics important to interpreting the Company’s Q1 data and outlined a series of additional initiatives and projects currently underway that will further improve the Company’s financial performance and competitive positioning in 2020.

As discussed on the call, the root cause of the Company’s consolidated Net Loss for the quarter centered on a combination of major increases in fees charged by PBMs in 2020 and the seasonal timing offer accrual versus performance incentive reimbursements. This was further accentuated by the fact that many insurance carriers switched to PBMs that charge high fees to pharmacies in an attempt to keep the cost of prescription benefits low. These changes have resulted in a high concentration of the Company’s claims being processed by a single PBM, which has, itself, increased its fees nearly 3-fold in 2020. As of 2020, only one PBM offers the ability to receive refunds of fees through performance.

Fees charged by PBMs are not transparent at the time of adjudication, but the Company’s robust analytics gave it a reason to believe an accrual of high fees was necessary even though they have yet to be taken from remittances. The Company recorded approximately $643,000 in fees for the quarter.

The costs associated with producing audited financial data for 2019 were included in Q1 data, representing an additional non-recurring item boosting the apparent Net Loss for the quarter.

Looking ahead, the Company is extremely excited about dramatic gains already being seen in Q2 in terms of growth in new patients. Progressive Care has already added over 1,000 new patients in Q2, which may represent as many as 5,000 additional prescriptions filled per month during the current quarter.

In addition, the Company has recently launched a full e-commerce segment as well as its new COVID-19 IgG/IgM rapid result antibody and diagnostic testing program. Both are now up and running on a nationwide scale.

Key Q2 Initiatives and Projects

Build out of 400 Ansin. Consolidation of operations is underway in 2020 and is expected to yield approximately$300,000 in savings in 2021.E-commerce. Progressive Care is currently expanding the range of products available on its e-commerce platform, as well as upgrading platform functionality. Despite a nominal advertising budget, e-commerce has steadily increased in volume since the platform was launched in April 2020.COVID-19 Antibody Testing. Testing is underway at the PharmCo Miami location. The Company secured a supply of tests manufactured by a company that has filed for EUA registration with the FDA. Tests are currently being offered through: 1) health care providers, 2) a testing service for employers, 3) through retail to individual consumers. Tests must be performed by a health care professional. The Company anticipates rapid growth in this program as the lockdown phase gradually winds down.RXMD Therapeutics. The Company has adopted an acquisition strategy for RXMD Therapeutics for compliance and risk mitigation purposes. The Company has already issued a proposal to an existing brand of cannabidiol products.SEC Registration. The S-1 filing and the uplisting process is now the most important priority for the Corporate team. The Company is updating its prospectus information in the draft of the S-1. The timeline continues to be 2020 with the S-1 filing to be in the coming weeks.

Mars continued, “Progressive Care has demonstrated that it is uniquely well prepared for the challenges presented by the current context, and we continue to drive strong growth with very encouraging trends already in place in Q2. Through our services, patients and healthcare providers can get the support they need no matter the restrictions placed on their lives. We pride ourselves on our ability to deliver best-in-class care for our patients under any conditions.”

MIAMI, FL, May 18, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE ? Progressive Care Inc. (RXMD) (OTCQB: RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology company, is pleased to report financial results for the quarter ended March 31, 2020, which featured very strong revenue growth, especially considering the unique operating conditions during February and March due to the SARS-CoV-2 global pandemic health crisis. During the associated earnings call, management outlined specific competitive advantages and new initiatives positioning the Company for strong growth across all major metrics throughout 2020.

S. Parikh Mars, CEO of Progressive Care, commented, “The novel coronavirus has dramatically changed the landscape in countless ways, and many businesses are suffering from a pervasive lack of predictability and a torrent of new and unique existential challenges. Yet, despite it all, Progressive Care continues to see dramatic overall growth driven by strong execution, flexibility, and efficient positioning. We remain better positioned than most of our competitors to respond effectively to these extraordinary and unusual challenges, and to take full advantage of the many exciting opportunities for growth that lie ahead.”

First Quarter 2020 Highlights

Consolidated quarterly year-over-year growth in Net Sales of 75% to surpass $9 Million for Q1 2020

Prescriptions filled surpasses 134,000 in Q1 2020, up 59% versus Q1 2019

March 2020 set new Company record for monthly prescriptions filled

340B Agency Revenue jumped 76% (vs Q1 2019) to nearly 200,000

Net Loss of $795 K almost entirely attributable to PBM fees, with Q1 impact exaggerated due to seasonality of performance reimbursements

During the earnings call, Mars discussed dynamics important to interpreting the Company’s Q1 data and outlined a series of additional initiatives and projects currently underway that will further improve the Company’s financial performance and competitive positioning in 2020.

As discussed on the call, the root cause of the Company’s consolidated Net Loss for the quarter centered on a combination of major increases in fees charged by PBMs in 2020 and the seasonal timing offer accrual versus performance incentive reimbursements. This was further accentuated by the fact that many insurance carriers switched to PBMs that charge high fees to pharmacies in an attempt to keep the cost of prescription benefits low. These changes have resulted in a high concentration of the Company’s claims being processed by a single PBM, which has, itself, increased its fees nearly 3-fold in 2020. As of 2020, only one PBM offers the ability to receive refunds of fees through performance.

Fees charged by PBMs are not transparent at the time of adjudication, but the Company’s robust analytics gave it a reason to believe an accrual of high fees was necessary even though they have yet to be taken from remittances. The Company recorded approximately $643,000 in fees for the quarter.

The costs associated with producing audited financial data for 2019 were included in Q1 data, representing an additional non-recurring item boosting the apparent Net Loss for the quarter.

Looking ahead, the Company is extremely excited about dramatic gains already being seen in Q2 in terms of growth in new patients. Progressive Care has already added over 1,000 new patients in Q2, which may represent as many as 5,000 additional prescriptions filled per month during the current quarter.

In addition, the Company has recently launched a full e-commerce segment as well as its new COVID-19 IgG/IgM rapid result antibody and diagnostic testing program. Both are now up and running on a nationwide scale.

Key Q2 Initiatives and Projects

Build out of 400 Ansin. Consolidation of operations is underway in 2020 and is expected to yield approximately$300,000 in savings in 2021.

E-commerce. Progressive Care is currently expanding the range of products available on its e-commerce platform, as well as upgrading platform functionality. Despite a nominal advertising budget, e-commerce has steadily increased in volume since the platform was launched in April 2020.

COVID-19 Antibody Testing. Testing is underway at the PharmCo Miami location. The Company secured a supply of tests manufactured by a company that has filed for EUA registration with the FDA. Tests are currently being offered through: 1) health care providers, 2) a testing service for employers, 3) through retail to individual consumers. Tests must be performed by a health care professional. The Company anticipates rapid growth in this program as the lockdown phase gradually winds down.

RXMD Therapeutics. The Company has adopted an acquisition strategy for RXMD Therapeutics for compliance and risk mitigation purposes. The Company has already issued a proposal to an existing brand of cannabidiol products.

SEC Registration. The S-1 filing and the uplisting process is now the most important priority for the Corporate team. The Company is updating its prospectus information in the draft of the S-1. The timeline continues to be 2020 with the S-1 filing to be in the coming weeks.

Mars continued, “Progressive Care has demonstrated that it is uniquely well prepared for the challenges presented by the current context, and we continue to drive strong growth with very encouraging trends already in place in Q2. Through our services, patients and healthcare providers can get the support they need no matter the restrictions placed on their lives. We pride ourselves on our ability to deliver best-in-class care for our patients under any conditions.”

I deducted the 10 million from my total, when determining. $47.5/$443 million.

This is not correct garrox. The poster was accurate about float. Total OS is 453 million less 10 million. Officially 443 million.

As I stated earlier, they likely will get $400k of those $637K DIR fees from 1st qtr back at end of year. DIR fees total will be like $2.5 million possibly, unless legislation kicks in, and payback of those fees for meeting performance measures might be $1.6 million.

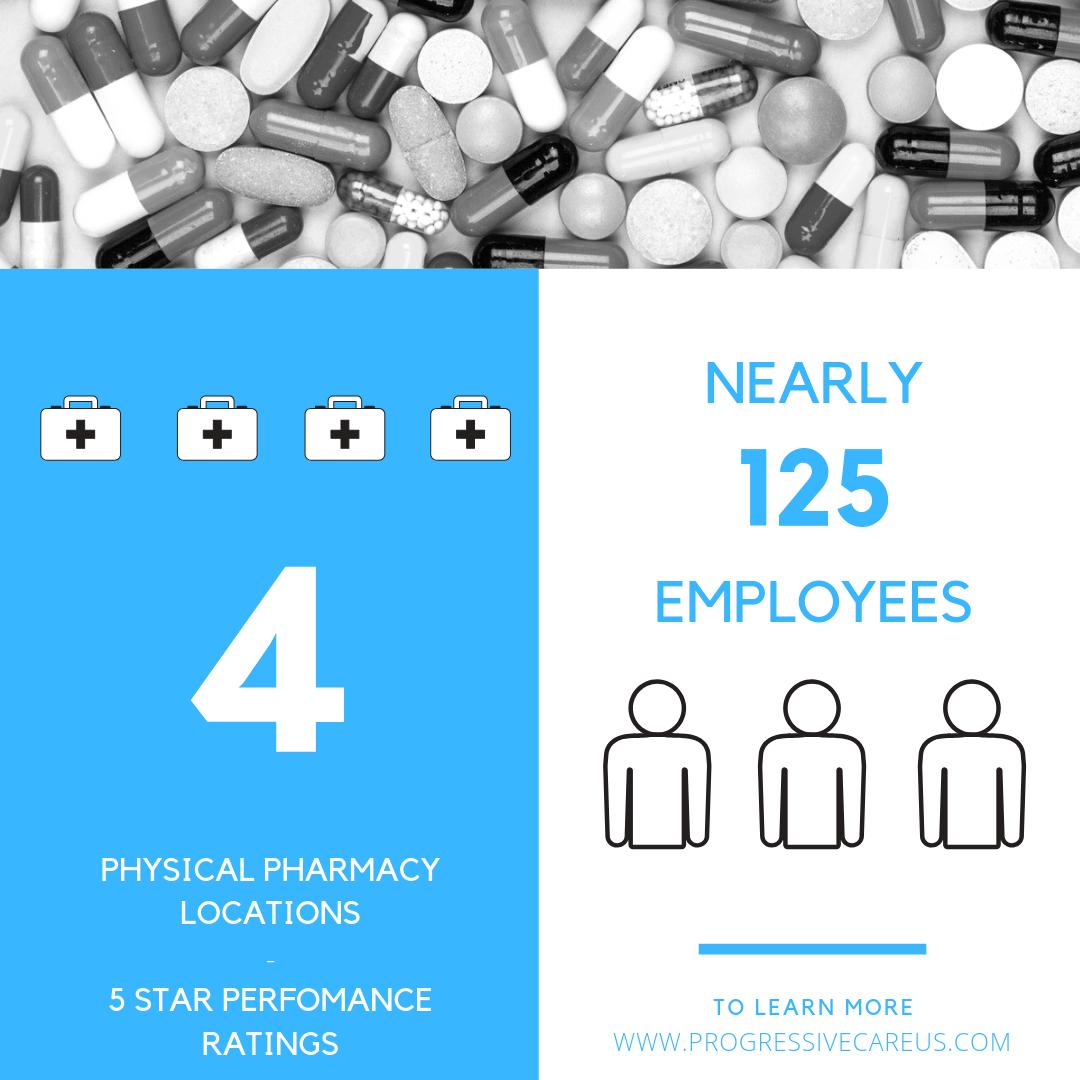

We added two new locations and about 50-55 staff, SG&A is going to increase, and like you said the numbers are in line with where we were before. Only thing not in line is the DIR fees increase, which PharmcoRx has no control over. Legislation is going to fix that. It's all over Washington and CMS as we speak. Just look up "DIR FEE RELIEF" INMAR Intelligence DIR FY19 report is another good source.

The OS on 12/31/2015 was actually 352 million. Only a 91 million increase from where we are today, and 43.5 million of those went to management and are restricted shares. That leaves 47.5 million that have been administered for acquisitions over the last 4.5 years. That's 11% of the total shares outstanding. How do you like them apples??

He also stated the RSI would be reset at $.06.

Haven't seen any BOD fees, they gave 500k shares years ago. Haven't seen anything since. I will do it for free, I have plenty of shares.

I will post the charts when I can. Last year was 19% 1st Qtr, and will be happy to post every quarters coming down the pipe for FY2020

Not available yet, but Seeking Alpha will publish. I will post entire transcript here when they do.

I think we got all power behind us now. The bulls are still in charge here.

That's EXACTLY what I heard too. Shhhhhsshhh. We both need more shares at these cheap prices.

To be honest, I didn't see where they booked an accrual last year for second quarter either. On call she mentioned she would for 2nd quarter, so maybe that is a change for the better.

Yes, but we going to have those every quarter, and did previous year as well, this quarter was ridiculous, $637k I think. Last year total DIR fee I think was $1 million. We have to overcome that, as well as book accruals each quarter for expected refund, which may be more than I stated a bit ago, because we got $648k back, which is closer to 65% of total. So refunded fees back on that would be roughly $414k for the quarter.

This would allow everyone to see results more clearly. Not booking the accrual but fully booking fees really messes with the gross profit % in 1st and 3rd quarters particularly.

I didn't get to listen real-time, so just listened to replay. I felt way better after hearing what she had to say. I definitely wanted a little better transparency on profitability leading up to call. Those DIR fees are tricky though. I work in pharmacy and you literally have no clue what they are going to bill you for, just discussed those this week even. Hence much needed legislation.

SEC S1 completed in next 2 weeks. NASDAQ by end of year.

One other thing, the DIR fees are booked in this quarter, but there is no accrual for those they expect to get refunded. Last year that total was $648k on 32 million revenue. This year I would expect it to be $800-900k, so subtract $200-225k from that loss.

I believe she said they would book accrual in 2nd quarter once they have a better idea of performance. They need to come up with a quarterly accrual, since they have been consistently meeting those measures annually.

I am with you on that. I never expected a clear profit with the debt still on the books, but something closer to even. DIR fees seem to have been the item that broke the donkey's back. Their is legislation, government and Medicare, that is working to provide DIR fee relief. On a positive, while it has hurt us in April and Early may. It sounds like COVID has allowed us to acquire a large number of patients that we will see impact June and 3rd quarter to end of year particularly. This will have to be seen in those monthly numbers leading up to those quarter ends. Like 55k scripts $4 million plus a month revenues. From her discussion that's where we are headed.

Did you hear that, they are looking at adding additional BODs. Pick me! Pick me! LOL

I don't believe so, just 1 inpatient seller that cut and run. Instead of waiting for SEC S-1 filing news, etc.

Well I kind of disagree with both of you. That $40 million in revenues is pretty much set in stone, and the $32.6 million from FY2019 is actual. Last half of the year we had two back to back over $10 million revenue quarters subsequent to the acquisition. $40 million is lowballing revenues for the year, that's assuming no increases in additional services or additional acquisitions. We have added I believe 3 340B deals, a Ready StEP deal, and you have seen all the recent news regarding online portal, that doesn't include CBD either. These last 2 items are all cash based with good margins, the other 2 I believe are both fee based arrangements per script filled. But yes Actual is good to know, but projections are just as important.

The convertible note has been included and discussed at length in every conference call, including the intent to pay it off and secure traditional financing in it's place. Right now RXMD is siting on $2.4 million in cash, $800k at 12/31/19, $600K received in April for Performance paybacks; and $1 Million from the Cares Act. You won't see the two later amounts in the 3/31/20 F/S, but they will disclose them.

Let's just assume that 1.45 million shares yesterday was for the convertible note. That was 3.2% of all shares traded yesterday, and they are limited to 10% of trading volume and can't even hold more than 4.99% of common stock outstanding at any point in time. They have to request new tranches when they are out. Point I am making is they are of no significance at this time when volume is high. We flew to $.27 last time while they were converting shares used for another previous aquisition.

Yep, stop losses are worst thing you can do on OTC, all the MMs are looking to do is execute a trade. Stop losses are easy money.

Even the Progressive Facebook Group membership has risen like 33%, that's investors that really like what they see here, not traders.

Conference CALL INFORMATION

Progressive Care Announces First Quarter 2020 Quarterly Report Earnings Call and Business Update on May 15th, 2020

4:30 PM ET on Friday, May 15th, 2020.

To access the call:

Dial-In Number: 1-857-232-0157 Access Code: 422095

May 11 2020 - 08:18AM

InvestorsHub NewsWire Print

MIAMI, FL -- May 11, 2020 -- InvestorsHub NewsWire -- Progressive Care Inc. (RXMD), a personalized healthcare services and technology company, is pleased to announce that the Company has scheduled an investor conference call at 4:30 PM ET on Friday, May 15th, 2020.

Progressive Care Inc.:RXMD Automated Pharmacy Dispensing Robot

“COVID-19 has dramatically changed the economic landscape of all industries and few have been able to adapt and lead in the manner we have,” stated S. Parikh Mars, CEO. “We are looking forward to discussing the financial performance of the Company as well as all of the initiatives currently underway.”

In addition, interested parties may submit questions concerning the Company prior to the call to Stuart Smith at SmallCapVoice.Com, Inc. via email: ssmith@smallcapvoice.com by 5:00 PM EST on Wednesday, May 13th, 2020. Mr. Smith will compile a list of questions and submit them to the Company prior to the conference call. Which questions will be addressed will be based on the relevance to the shareholder base, and the question’s appropriateness in light of public disclosure rules.

For those unable to participate in the live conference call, a replay will be available at https://www.smallcapvoice.com/tag/rxmd/ shortly after the call has concluded. An archived version of the webcast will also be available https://progressivecareus.com/progressive-care-inc-investors-section/.

Connect and stay in touch with us on social media:

Progressive Care Inc.

https://www.facebook.com/ProgressiveCareUS/

https://twitter.com/ProgressCareUS

PharmCo Rx

https://www.facebook.com/pharmcorx/

https://twitter.com/PharmCoRx

Five Star RX

https://www.fivestarrx.com/ https://www.facebook.com/fivestarrx/

Don't worry, it will bust through soon enough. Investors just feeling things out this morning. There are so many eyes ready to jump in at sign of this going North quick again today.

Very good point, hadn't thought about that.

Let's ride this wave up now. RXMD is a gem on the OTCQB

This is the real deal. Can't stop what the company is doing, none of us can, they have a great plan and have been executing it over the course of the last several years. It's happening in 2020.

$RXMD $40+ MILLION REVS, SEC FILING SOON, PROFITS, THE NEXT RITE-AID

REAL COMPANY - OTCQB – Penny Stock Exempt, 3 YEARS AUDITED FINANCIALS, Will be over 40+ MILLION NET ANNUAL REVS for 2020 – HUGE LONGTERM INVESTMENT POTENTIAL. Will be double in Revenues, scripts, and assets in FY 2020 from FY 2018 when it ran to $.27.

OH MY, HOW RXMD HAS GROWN UP OVER THE YEARS

What's happening for RXMD?

10 things specifically come to mind, and they keep generating more "Game Changers" by the week.

1. $SEC S-1 filing to occur in the month of May 2020 (See 2 below)

2. RXMD Doubles March Sales, Successfully Utilizing Its Market Leading Contactless RX Delivery Due to Covid-19 Pandemic

MIAMI, FL – April 15 2020 Progressive Care Inc. (OTCQB: RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology company, is pleased to announce operational performance data for March 2020, which featured breakthrough growth in total sales and a new Company record in total number of prescriptions filled on sharp market share gains:

· Consolidated monthly gross sales across all locations totaled $3.6 million, representing year-over-year growth of 105% compared to March 2019,

· Prescriptions filled during the month came in at 47,467, representing year-over-year growth of 76% compared to March 2019,

· Prescriptions filled hit a new all-time monthly record for the Company in March,

· “Ready, Set, PrEP” Program for HIV prevention launched,

· Seeing continued growth in services targeting non-profit organizations,

· Will file with SEC for fully reporting status.

MIAMI, FL, May 11, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE –Progressive Care Inc. (OTCQB: RXMD), a personalized healthcare services and technology company, is pleased to announce that the Company has scheduled an investor conference call at 4:30 PM ET on Friday, May 15th, 2020.

“COVID-19 has dramatically changed the economic landscape of all industries and few have been able to adapt and lead in the manner we have,” stated S. Parikh Mars, CEO. “We are looking forward to discussing the financial performance of the Company as well as all of the initiatives currently underway.”

In addition, interested parties may submit questions concerning the Company prior to the call to Stuart Smith at SmallCapVoice.Com, Inc. via email: ssmith@smallcapvoice.com by 5:00 PM EST on Wednesday, May 13th, 2020. Mr. Smith will compile a list of questions and submit them to the Company prior to the conference call. Which questions will be addressed will be based on the relevance to the shareholder base, and the question’s appropriateness in light of public disclosure rules.

To access the call:

Dial-In Number: 1-857-232-0157 Access Code: 422095

For those unable to participate in the live conference call, a replay will be available at https://www.smallcapvoice.com/tag/rxmd/ shortly after the call has concluded. An archived version of the webcast will also be available https://progressivecareus.com/progressive-care-inc-investors-section/.

MIAMI, FL, April 30, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Progressive Care Inc. (OTCQB: RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology company, is excited to announce that it has expanded the scope of its new ecommerce portal (PharmcoRX.com) to serve the entire US domestic market. The Company started filling and shipping orders nationwide this week.

The PharmcoRX.com site includes online access to prescriptions, essential goods, personal protection equipment, guidance on COVID-19 prevention and care, information about custom compounding, and access to services for patients, payors, and providers.

“We are preparing for a large-scale uptick in order volume,” noted S. Parikh Mars, CEO of Progressive Care. “It’s also important for our shareholders to know that our decision to ramp up ecommerce at this time isn’t just about COVID-19. Certainly, the unusual context, with so many consumers conducting all of their activity online, acted as a motivating factor to move in this direction now, rather than later. But this step represents more than a simple short-term strategy. It’s a powerful evolutionary leap for Progressive Care – a natural escalation of our scope and reach as an emerging leader in the pharmacy and healthcare services marketplace.”

Management expects that the Company’s successful implementation of its ecommerce strategy will positively impact anticipated performance in coming quarters and overall in 2020.

Progressive Care OUTLOOK

2020 Strategic Goals

• Achieve 60,000 prescriptions filled in a single month

• Strive to achieve over $44 million in sales

• Recognize performance bonuses for all 4 locations

• Consolidate locations to the Hallandale Beach location

• Expand market presence to account for all urban centers in Florida

• Secure additional not-for-profit healthcare contracts and long-term care facility relationships

• Achieve full enterprise profitability and earnings growth

• Launch RXMD Therapeutics exclusive line of CBD products

• Acquire software platform for the development of proprietary telemedicine product

• Develop backend healthcare administration platform for monetization of expertise in data analytics

• Become SEC-registered and fully reporting

• File an application to uplist to a national exchange

MIAMI, Oct. 01, 2019 (GLOBE NEWSWIRE) -- Progressive Care Inc. (OTCQB: RXMD), a personalized healthcare services and technology company, today announces formation of its wholly owned subsidiary, RXMD Therapeutics Inc., specializing in cannabinoid-based and alternative therapy product lines.

“We are excited to make this official announcement, RXMD Therapeutics Inc. has been in the planning stages this past year” said S. Parikh Mars, CEO of Progressive Care Inc. “We believe we have finally found a pathway where we can provide cannabinoid and homeopathic products that meet our strict quality requirements while also being able to manage these therapies from a health and wellbeing perspective.”

Progressive Care Inc. will develop and produce proprietary cannabinoid and homeopathic products that will be solely offered from RXMD Therapeutics Inc. The first line of production will consist of tinctures, skin creams, roll-ons and gel capsules which are the dosage forms most easily managed by retail patients. RXMD Therapeutics brands will be tested for consistency and quality assurance prior to release and periodically thereafter.

The formation of RXMD Therapeutics Inc. was discussed with Progressive Care Inc.’s shareholders during the first quarter 2019 quarterly report conference call on May 15, 2019. The Company announced plans to market current CBD brands and leverage the cash buying customer base to fortify against insurance rate compression and increase profitability. The Company discussed plans to produce an exclusive line of products that incorporates the Company’s brand and mission to further develop its core market base and healthcare capabilities.

MIAMI, FL -- March 31, 2020 -- InvestorsHub NewsWire -- Progressive Care Inc. (RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology company, is very excited to announce the release of the Company’s audited Annual Report for 2019. The Company posted record-breaking data, which was defined by sequential quarterly improvement throughout the year in all major financial performance metrics, including EBITDA profitability in Q4 2019. In addition, the Company is pleased to report that this momentum has continued to define results so far in 2020, as the Company sees market share gains based on its established leadership position in-home delivery and disease prevention protocols which have become a critical competitive advantage due to concerns over the spread of Coronavirus Disease 2019 (“COVID-19”).

S. Parikh Mars, CEO of Progressive Care, commented, “2019 was an extraordinary year for Progressive Care. We confronted difficult challenges and put together the most impressive stretch of performance in our history in response. Each quarter – each month – was better than the last and now defines a fresh context for 2020.”

THEY are doing everything to expand their reach for revenues. Loving their approach to building this company and expanding it. Remember they have have some irons in the fire for a partnership.

FROM MARCH 31, 2020 CONFERENCE CALL TRANSCRIPT

Stuart Smith, SmallCapVoice Host

All right. Well let's wrap it up with this question then with such a robust acquisition strategy in your recent history, is there an acquisition plan in place for 2020?

Shital Mars, CEO ProgressiveCare

So we had a number of conversations and we've gotten into different points of our lives. We have different things standing out where we're negotiating on our lives and negotiating on other things and we're trying to bring other companies on board. We're also looking at partnerships for ourselves whereby may be and we're either preliminary but the thought process if a combination with another company that is already listed on a national exchange would be beneficial to us or combining our forces with another company that has a strong market presence, we are ready in negotiations with a couple of companies. We've put preliminary LOI out there and we're waiting response.

COVID-19 the crisis has put a hold on a lot of business development aspects, a lot of the company's business plans over the next 90 days for a lot of the companies were talking to our healthcare companies and so their primary concern right now is care and providing care. New York City has been pretty hit hard. A lot of metropolitan areas are being hit pretty hard. So that's their focus right now.

So we're just -- not at all moving pattern but trying to reach out and be very ginger with how we approach this situation because we want to make sure that we also are keeping our eyes on the delivery of care for our patients. So I think an acquisition is not necessarily probable in 2020 but we're hopeful that one of these that we have out there is going to close one. .

Progressive Care, Inc CEO Recognized by Forbes as a Unique Leader

MIAMI – April 29, 2019 – InvestorsHub NewsWire -- Progressive Care Inc. (OTCQB: RXMD), a personalized healthcare services and technology company, today announced that it has garnered media coverage in Forbes in an article titled, A Unique Path Towards Leadership Creates a Unique Leader.