Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I do it with limit orders,

did not want/mean to seem arrogant really try to not get involved with people on the boards. Iknow Boiler Room, we never get into anything some though like smart money just love pushing buttons guess it gets them off.

I know they have a plan as do I we should just do our own things rather than back and forth chatter/arguing its childish.

Sorry for the back and forth and indiscernible posts I get a bit ticked and think faster than I type.

Got lucky made a ton in the market and short when I do where I have a good feeling what it can run to and take a size small enough I know no margin call will be coming. So time is always on my side so to speak, no great trading ability etc the stock is already just way out there in price but know doubt they may pop it to 10 judging the AH's trading, maybe a bit more, but when it goes it will go fast as you know, I am not telling you anything you do not already know.

Sorry the long post, I replied to you from this post as I am not one to trust Ihub, literally and would never give a CC to them. Take care, I am ThomadCutts on twitter I am no BSer I do short and trade as I say on Ihub. Peace out.

Good luck next week.

Also, I assume you did not see on baa board:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=130486299

Good luck with your Linn hearing. Nice job going for it.

I take it you mean they did not let you participate, meaning they did not convert to equity for you, even though you owned unsecured bonds where other unsecured were in fact converted.

unfortunately I am.

but I'm not to concerned due to this.

http://marcellusdrilling.com/2017/02/titan-energy-puts-494k-appalachian-acres-up-for-sale/

I think off shore is way to risky.

Only doing land based.

I'm actually have a court appearance in Texas cause Linn energy didn't let me participate in the rights offering

on April 27 I argue my case

Chief United States Bankruptcy Judge David R. Jones

http://www.txs.uscourts.gov/content/chief-united-states-bankruptcy-judge-david-r-jones

I get the hint that the judge will grant my motion.

Rocks, see post 1222 as well.

Seems reasonable that as an accounting measure the original debt acquision should be accounted for somewhere at sometime on one's personal tax return. If not for the same year as this new debt cancellation's effective income then for a previous year (on a K-1) where possibly a prior tax return (and those subsequently filed) can be amended to account for and to balance out the income from the current cancelled debt income, the CODI.

As a partner in Atlas, the cancellation of debt, debt which as a partner you shared in, is technically income beneficial to all owners/partners. And then, per the IRS, is taxable as income. The only way to have avoided this debt write-off CODI 'benefit' would have been for you to have sold all your near worthless shares of Atlas stock prior to the BK debt conversion.

Congo, you still in this thing with TTEN?

Down almost 50% now from issue.

To early to be concerned?

Priced so low to begin with after the conversion.

You doing any other distresseds?

Here's one, wondering if you're aware, in it, interested, etc. I know nothing on it.

Gulfmark Offshore

http://seekingalpha.com/article/4055340-gulfmark-offshore-finally-prepares-bankruptcy-expect-equityholders-wiped

See CODI, and past discussions here.

Being a partner with owned lots of ownership compared to a Common shareholder results in a significant taxable difference when a company folds and/or experiences a big loss.

See past post:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124850603

"CODI is Cancellation of Debt Income

Since a lot of these are MLPs where ALL income is passed to the partners (holders of the shares) for tax purposes, the IRS considers CODI as income. The shareholders are then responsible for paying income tax on the cancelled debt. The per share CODI can be as much as $5+. So if one had 10,000 shares of common that got completely wiped out, they would still owe short term income tax on a $50,000 gain. At 30% tax bracket that would be a $15,000 tax bill.

So, obviously, it is something to be aware of. That being said, contrary to popular opinion, CODI is not applicable in every BK case. My brief survey of BK cases shows CODI in about 30-40%."

You are not. I just got the same statement and I call BS when I LOST Money like everyone else who played this as a Q

Just got K-1 and shows a huge business ordinary income gain. My cpa says it's taxable even tho I lost money on the investment. How can someone have 165,000 business income on a k-1 when they lost money! Does anyone have an answer? I may owe 50k. I can't be the only one asking this?

Ha. Yeah, it's about the investment time frame on Banro.

It will be there with higher POG.

With decent to significantly higher POG, and then as an annual 200K-250K producer... wow! I'm wondering if those accumulating are reasoning likewise.

I do have sense that 'super nice' mngt could give a rats' ass about Commons. In fact, they may be mild mannered thieves. Something is off.

As for Pres D, genuinely curious of those who were and/or still in support. Things are getting kind of whacky, Flynn thing seems quite significant, and is substantial beyond surface.

Banro has been pretty disappointing. I recall looking thoroughly at EGI and GSS and determining that BAA was the better bet. Only saving grace is that I was able to book a small profit of about 5k...that's nothing considering that I was up as much as 100k on two occasions. But I guess if your shooting for a grand slam....it doesn't always work out.

Geo-politically and geographically BAA has always been challenged.

Geo-politically I'm pretty hardcore on certain attributes of society. That's all I'll ever say unless you take me up on that date.

CM, curious, you still like your guy (pres)?

Yeah they're at a discount if you want to hold for a few years.

No pop in the near term.

trading at 0.44/1.00

Thanks CM, will look more into it. Time limited right now.

Seems you're mentioning commons to jump into. Have you looked at the MEMP bonds? Are bonds discounted? Are they trading?

I'm sure you heard about the opec deal.

there's an mlp that is due to make a bond payment on the 16th.

Complicated story.

take a look at MEMP they got an extension from their lenders till the 16th.

they were crimped by the reduction in their credit facility right before they had to make a 24 million bond payment.

Their EBITDA is 77 million a quarter...do the math and read the PR's and you'll see why they got the extension.

obviously you don't want to own if they don't make the payment but you might want to be ready to jump in hard when they do.

look at Market cap vs. the value of their assets.

I'm taking an very small initial position as an edjucated gamble that they'll pay.

Will sell immediately if they don't.

Oil to slide? Record commercial net short contract interest.

http://www.reuters.com/article/us-opec-oil-idUSKBN12Z1FM?il=0

http://www.eia.gov/todayinenergy/detail.php?id=28472

https://www.barchart.com/futures/quotes/CL*0/all-futures

You're welcome. No prob.

Thanks for the info.

From about two weeks ago, IR says to call them with any questions (standard closing), yet first stated that they "are in the process of transferring to a major exchange and we expect an announcement to be made in the near term." That was it. And 'signed' generally by IR, no person's name.

Thanks so much for the info.

yes # 5 is here.

I expect MEMP to not make their bond payment next week and have sold all common before today. I pan to hold 60k worth of unsecured.

SDOC canceled their stock and converted to new equity.

curious if you could seed me a copy of the whole e-mail.

would be appreciated.

Congo, how're your unsecureds all going?

And, I imagine, congrats on #5.

By the way, after a long non response Titan replied to my email about a week or two ago saying they were working on and expect soon to move to a bigger board, and off the Grays.

Yes, the line of reasoning I had assumed likewise.

Yeah! Quite a holding. Fir Tree / Titan Grove seems a pretty cool fund company. I guess they were a predominant owner of Atlas as converted to TTEN. There is strong tax benefit owning oil and gas holdings. I think the 80% oil/gas tax shelters should be disbanded and shifted to solar. If so, the U.S. would have a massive solar infrustructure boom, and we need it. Solar investment dollars would pour-in with equivalent solar tax sheltering investment opportunities. R&D would move solar technology to efficencies. Jobs created. Et al.

Interesting the 13D from Sept. 28th is an amendment. The share ownership at 1,071,123 is identical, yet the amended listing percentage of common share ownership has declined (as listed) from 21.4% to 19.8%.

I just calculated, and there was a simple accounting error from the outset of the initial Fir Tree 13D filing, as 1,071,123 of a total 5,416,667 Titan Energy shares is indeed as amended, just under and rounded up to 19.8%.

Seems the longer term strategy is further supported by the low number (5.4M) of shares issued, and maybe too per the low valuation. Thinking the low valuation likely may result in a rather healthy accounting write-off for Atlas Resource equity owners, for 2016, as a beneficial offset (or carry-over) to any profitable gains experienced elsewhere in the fund, and for other owners likewise.

If I'm correct here, and this Atlas-to-Titan transfer is in fact a tax basis accounting loss for Atlas Resource equity holders, then it seems moving forward from Sept.1st, 2016, TTEN low share price (or even higher) has little future accounting and tax consequence bearing in and for 2016, as long as shares are not sold or distributed by said owners. However, if TTEN equity ownership valuation in fact is computed and assessed as a tax event for 2016 tax purposes come the very end of the 2016 year (not sure how, if at all, or in fact relevant), then if there is any benefit with a loss write-down there would be benefit and motivation for benefit to maintain TTEN share price low for the remainder of 2016.

Definitely going to keep watching, Learning much here. And was able to acquire a small profit. Not hopeful dreams (like conversion at or near bond face), yet profit is profit.

Good luck.

Titan contiknurs the them of Atlas. They are both Greek Elder gods. Atlas held up the sky; Prometheus gave us fire; I forgot what Titan did.

now I know why it is called Titan.

http://phx.corporate-ir.net/phoenix.zhtml?c=251151&p=irol-SECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTExMTU3MzcxJkRTRVE9MCZTRVE9MCZTUURFU0M9U0VDVElPTl9FTlRJUkUmc3Vic2lkPTU3

http://www.titangrove.com/

these guys are long term strategic. which is what I'm trying to be. GLTY

I'm out! Those were mine today, and a few previous in low 30s.

Looks like a potential bottom technically too. Ha! We'll see.

Other places to place funds which will grow faster.

Unless you think TTEN get to 50%-100% higher in next few months.

Plus, i dont like these guys. They turned previous equity holders into new commons greatly under valued where there is no liquidity, nor a fair market, at 5.4M shares.

I'll keep watching, of course. Let me know.

Again, it comes down to equity equivalent of new Sandridge Commons. Same as with Atlas Resources. Why is it the proposal of the reorganized company does not list intended Commons' share price = reorganized company equity? Why? Damn straight they already know what they want. Same situation as with AR.

Good article you posted on SR.

Current pre-BK Sandridge upside is current Preferreds and Commons may get a piece of reorganized company. This will eat into first lien, secured and unsecured equity upon conversion. But then also, if Reserves are in fact much greater as SEC is interested in establishing as per the whistleblower, then more equity for everyone.

So, one can aquire the unsecured bonds now, but currently for the peasants it's guess work on after conversion. CM, your play is longer term with presumption of future increased oil prices. Might not happen. Sandrdg and Atlas may know this too and are just extending their ride before another BK filing in several years. Seems if we don't go alternate energies and infrustructure we're dealing with significant and costly remediation.

Would you not feel more comfortable knowing what your bonds will, or are projected,mto convert to in new Sandridge equity?

Where is your comfort level, solely on anticipation/speculation of stronger oil prices in months and years ahead?

Curious too, your Breitburn gain was a double in bond prices when you sold?

Think SRdg bonds may do likewise? I'd like to understand what those in the know, know. Atlas Resources bonds were priced right above bond trading value at time of conversion. You bet those in the know knew this. Seems likewise why Breitburn bonds doubled so fast. I'm not getting the value calculations others must be understanding, to know what bond trading prices are, become, should be, etc.

Sandridge bonds... are they priced as per expected equity conversion now, or should their value be significantly higher? I think you get my quandry of inquiry. I want a bond buy-in with a little greater road map, and this map does not seem to be calculable per current supplied information. Is it just speculation on future oil prices? Seems others understand more, and of info we do not have.

yeah...long term.

This is also the recent SEC filling

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=125072051

.......................

my calcs

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=124778895

other

http://www.insiderfinancial.com/an-update-on-sandridge-energy-inc-otcmktssdocq/116836/

I see they still trade. Piqued interest of inquiry.

Is Class 5 a BK term, or position in line of rights to recovery? Or something else.

Sandridge unsecured will get 15% of commons, is this correct as I remember reading previously?

How do you see this translating into gains upon conversion, relative to current and your average bonds acquisition price?

And/or how about over time once converted? Sounds like you're inclined to hold longer term with Sandridge as with Titan Energy.

Well some of my bright-burn went here. I accumulated my entire position in Titan from Brightburn sales.

I also bought Linn Energy bonds, Sandridge bonds,

along with MCEP stock and EVEP stock.

I did a lot of work on Sandridge...it's still trading cheap. You might want to take a look at the posts.

Unsecured are Class five.

https://cases.primeclerk.com/sandridge/Home-DocketInfo

I'm here long term...like all situations i would trim on the way up but I will be here several years if data doesn't change my mind.

CM, Sandridge as good as you think? I see you took 70% of your Breitburn winnings into Sandridge.

I get the cash back aspect on the bonds.

Otherwise what are do you anticipate?

CM, you expect TTEN to appreciate well, and nicely?

And your time horizon?

Didn't want to be patient. Conversion so low, wanted out. Atlas mngt seems slick.

I'm not selling so low in 20s or low 30s either, however.

Yet, nice find on monthly operating report. Cash on hand is 1/4th of common share equity, based on current gray market share trading price.

Tempers my impatience. Fuels my patience.

it's the gray market...we'll have to be patient.

Here's the good news.

Positive cash flow for the month and they doubled their cash balance.

Look at docket # 153

page 4 has a clear cut cash flow statement for the month (non-gap).

Volume now 597 shares today.

When I posted, it was zero.

On zero volume a dropped bid/ask before any trades.

And zero to 600 share volume drops price this much... No.

Price is being played.

Today's Vol 200 @28.50-29.50

Obviously the price is falling because there are no buyers because this isn't on an open and public market.

Fairly disgusted with Atlas. I understand filing paperwork takes time but they need to be open about expected time frames.

OTC says no volume on TTEN today. Yesterday total volume was 44 shares.

Yesterday's spread was .28 X .31.

Today's spread on no volume, and effectively none yesterday, is .27 X .30.

ATLS just hit $1.50.

Was wrong, not a month, but just under two, from 10 cents to $1.50.

From $.70 to $1.50 in five days.

They haven't had anyone in the IR department since February.

I've emailed and called Atlas with this same quesion. No response, not even an acknowledgement that I called or emailed.

Don't know, probably when ATLS is done its current move.

any Idea when we get on an exchange...?

ATLS from $0.10 to $1.13 in under 1 month.

I haven't dug that deep into it. I'll take your word on it.

Yes, this is well known. 2% is not much relatively to expect reciprocity of upward movement in TTEN. But the sizeable reduction in debt which flowed through from Atlas Resources to Atlas Energy Group (ATLS), along with elimination of Atlas Resources' Commons and Preferreds, effectively an ATLS 'reverse split' divestment, has made the oversold ATLS a super value, hence the multiple times share price increase. The bull they delivered about risk of going concern and liquidity required an appropriate assessment and interpretation reading; as window dressing contrary to the message's face value. Seems neither you nor I understood this manuever, and the grander picture. We just funded/collateralized ATLS.

|

Followers

|

23

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1227

|

|

Created

|

03/21/12

|

Type

|

Free

|

| Moderators | |||

Atlas Resource is on course for a lightning-quick bankruptcy case, winning court approvals to continue operating under chapter 11 protection and further its goal of completing its restructuring by Labor Day.

Judge Sean Lane of the U.S. Bankruptcy Court in Manhattan on Friday granted Atlas's request to spend $17 million in cash it has on hand to fund its operations, in addition to a number of other approved requests that allow the company to pay bills and employees, as well as manage its cash.

Judge Lane also set a tentative date of Aug. 26 to consider Atlas's bankruptcy-exit plan, although that date will be nailed down next month.

Atlas filed for bankruptcy proceedings on Wednesday, with a fully prepackaged bankruptcy agreement in hand. The deal would slash $900 million in debt from the oil and gas producer's books and has the support of 90% of the company's debtholders, including 33 separate lenders and bondholders, the company's lawyers said during the hearing on Friday.

Atlas lawyer Ron Meisler of Skadden, Arps, Slate, Meagher & Flom said the company is one of 85 oil and gas exploration companies to falter under the weight of what he called an "epic downturn."

But the company is one of only a handful that has been able to execute a fully prepackaged bankruptcy, meaning creditors already have voted formally to accept the restructuring plan, he said. The ability to complete this feat is "a vote of confidence for the debtors' assets and management team," he added.

Under the terms of the plan, two sets of bondholders would exchange $668 million in debt for a 90% ownership stake in the restructured company.

Atlas's current revolving loan, under which the company owes more than $670 million, would be repaid via the liquidation of its hedge positions, and a new $410 million facility would be provided when Atlas exits bankruptcy.

The holders of $250 million in junior loan debt would receive the remaining 10% equity in Atlas in exchange for an interest-rate reduction.

Upon completion of the deal, Atlas's tax status will change to a traditional corporation and its name will be changed to Titan Energy. Its current investors will see their stakes eliminated and could face a tax bill as a result of the company's debt elimination.

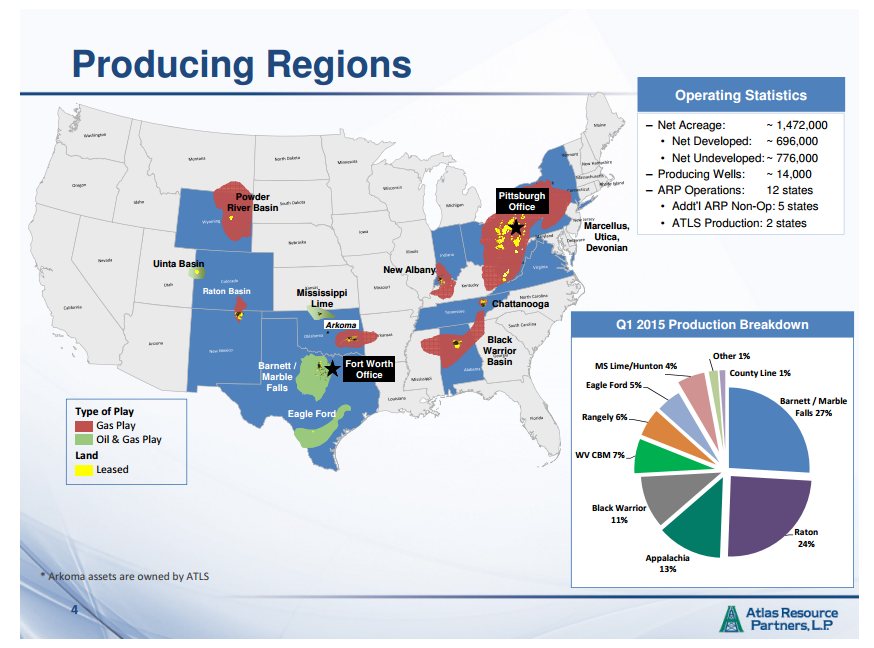

Atlas is based in Pittsburgh and has 14,000 producing wells in 17 states.

Atlas Resource Partners filed for chapter 11 bankruptcy 7/27/16 after negotiating a plan to slash some $900 million in debt off its books.

Although the restructuring will substantially reduce the oil and gas producer's debt, its status as a partnership could leave its investors with a hefty tax bill.

Under the pre-negotiated plan, announced last week, the company's unit holders will receive no recovery and their ownership stakes will be canceled, Atlas said. As unit holders in a partnership, rather than shareholders in a corporation, these investors could also face a tax bill for the debt that Atlas cancels in chapter 11.

Atlas's proposed restructuring plan is a debt-for-equity swap with senior bondholders, 80% of which have formally signed on to the deal. The company filed for bankruptcy to execute the agreement.

Under the terms of the agreement, two sets of bondholders would exchange $668 million in debt for a 90% ownership stake in the restructured company.

Atlas's current revolving loan, under which the company owes more than $670 million, would be repaid through the liquidation of its hedge positions, and a new $410 million facility would be provided when Atlas exits bankruptcy.

The holders of $250 million in junior loan debt would receive the remaining 10% equity in Atlas in exchange for an interest-rate reduction.

Upon completion of the deal, Atlas's tax status will change to a traditional corporation and its name will be changed to Titan Energy.

Atlas Resources, based in Pittsburgh, filed for bankruptcy with the U.S. Bankruptcy Court in Manhattan, claiming assets in the range of $1 billion to $10 billion, with liabilities in the same range. The oil and gas producer has 14,000 producing wells in 17 states. It said in its most recent financial statement that "lower commodity prices have negatively impacted our revenues, earnings and cash flows. Sustained low commodity prices will have a material and adverse effect on our liquidity position."

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |