Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

KLP, established in 1949, is Norway's largest pension fund, and is owned by municipalities, companies and health enterprises with public-sector occupational …

Are there any Stationary Power sites using PLUG equipment ?

What Stationary Power applications make sense ?

Another MULAG ?

If you are still LONG PLUG ...(why?) ...

You are getting an expensive education in Alternative Energy and Comparative Economics.

I haven't been on that long,

He thinks that developing countries that have no infrastructure (which means no pot to piss in) will somehow build an enormous hydrogen infrastructure……out of…nothing….using money from….who knows?…

Lol

You should have listened and followed my lead ..... and SHORTED PLUG.

Hyroad Energy, Bosch Rexroth & GenH2 Launch First Zero-Loss Liquid Hydrogen Refueling Station in Dallas Texas

https://fuelcellsworks.com/2025/04/08/clean-energy/hyroad-energy-bosch-rexroth-and-genh2-launch-first-zero-loss-liquid-hydrogen-refueling-station-in-dallas-texas

I would have take cash.

Bragging Rights.

Hooray for you. What did that get you?

A few months ago I said, "Under $1.00 !!"

Now it's only a matter of time....

Viking claims hydrogen-powered cruise ship world first for Viking Libra

https://www.marinelog.com/passenger/cruiseships/viking-claims-hydrogen-powered-cruise-ship-world-first-for-viking-libra/

Aviation consortium celebrates first piloted hydrogen-powered flight

https://www.cjme.com/2025/04/08/aviation-consortium-celebrates-first-piloted-hydrogen-powered-flight/

You are correct :

"Plug Power price target lowered to 75c from $1 at Seaport Research

Seaport Research lowered the firm’s on PP to 75c from $1 and keeps a Sell rating on the shares. The firm believes the company remains “too broad and busy,” and seems set to generate negative cash flow from operations through 2026, the analyst tells investors."

Looks like this POS is going under a buck soon

Nice to see the jet, but most have given up on the idea. I hope they succeed.

H2Go: How experts, industry leaders say US hydrogen is fuel for the future of agriculture, energy, security

https://www.foxnews.com/politics/how-experts-industry-leaders-say-us-hydrogen-fuel-future

Hydrogen Energy Storage Market to Surge at 4.8% CAGR, Reaching $24.32 Billion by 2032

https://www.globalbankingandfinance.com/hydrogen-energy-storage-market-to-surge-at-4-8-cagr-reaching-24-32-billion-by-2032

Zero-emissions hydrogen-electric jet disrupts conventional flights

https://www.foxnews.com/tech/zero-emissions-hydrogen-electric-jet-disrupts-conventional-flights

$PLUG : KLP Kapitalforvaltning AS Acquires Shares of 150,000 Plug Power Inc. (NASDAQ:PLUG)

newer ships and making money. They are even thinking about buying back the company and taking it private. I think this one work more like an MLP and pays out a percentage of revenue in dividends. Suggested a few weeks back by Zip Trader.

i dont know much about ships and shipping...but for long term holds and dividend plays, i like the tried and true companies...the blue chips...

if you are thinking of a swing trade, betting on Israel cutting a tariff deal with Trump and having the stock rebound a bit, sure, that might be doable...

shipping is difficult....how old are the ships?...when they drydock for repairs, they are making no money and repairs are very expensive...strikes at various docks can keep them floating around for days and weeks, making no money...fluctuating fuel prices are always an issue...pirates and houthis and trying to get around them costs them money and time, which is money...weather, hurricanes, climate change etc etc etc...

and why such a large dividend?...usually thats because they are trying to attract investors which are scarce because the risk is high...

mind you, i havent looked into ZIM itself but thats my take on the industry...

any particular reason or just the current tariff situation?

Steve - Zim's not for me.

Hey, Jack and others (off subject) what do you think of ZIM? Looks very interesting to me and the 50%+ dividend and low price and profitable makes it look even better.

“ I think we can give hydrogen/fuel cells a few more years.”

It’s not about the cars…although that’s an issue as well…it’s really about the infrastructure…

How long does it take to be profitable when you sell cars that can’t be fueled up anywhere?…

EV’s never had that problem…

10 years? If we only gave things 10 years to be profitable, we wouldn't have EVs.

GM EV-1 came out in 1996, and the Tesla Roadster came out in 2008. Tesla wasn't profitable until 2020 (profitable due to carbon credits). That's 24 years.

I think we can give hydrogen/fuel cells a few more years.

EVERYBODY SELL !

Taxes are due soon. Time to sell your DOG Stocks .

PLUG has to be your worst stock and therefore the best stock to DUMP.

You're most likely right in the short-term. Long-term although appearing blight is unknown, and speculation on the outcome is just that.

Special - True ... But even if this were to happen, PLUG isn't worth $10.00, and this rally will be short - lived.

Every Plug rally has faded within days.

Any apparent dying stock can go from a $1.00 to $10.00 quickly. Is $PLUG a potential candidate, only time will tell.

Oh Look :

Someone is building a hydrogen station.

https://cleantechnica.com/2025/04/05/british-columbia-pays-htec-millions-for-another-hydrogen-station-nobody-needs/amp/

"No. I am just saying give it more time, we are not there yet."

more time?...like an eternity?...the first fcev in the US was 10 years ago...they now have 50 places in calif to fuel up and they are just about giving away the cars...wowza

ev's have 64 thousand public charging stations in the US with 205 thousand chargers with 500 thousand homes, just in calif, equipped to charge ev's...

hydrogen has been around long enough...if it was ever going to a thing, they would surely have more than 50 fueling stations...half of which are always down...

" if hydrogen isn't there now, it will never be there."

correct...

"It doesn't matter that hydrogen production is growing every year."

sure it is...

"It doesn't matter that new products that use hydrogen are being developed."

lol

"it doesn't matter that research is developing possibly less expensive methods for hydrogen production."

maybe they are developing possibly less expensive methods??...smh

"It seems like denial for the sake of denial."

on your part?...i agree 100%

No. I am just saying give it more time, we are not there yet.

The argument I'm hearing is, if hydrogen isn't there now, it will never be there. It doesn't matter that hydrogen production is growing every year. It doesn't matter that new products that use hydrogen are being developed. It doesn't matter that new hydrogen production plans are being developed. it doesn't matter that research is developing possibly less expensive methods for hydrogen production.

It seems like denial for the sake of denial.

"Whether any company hits or misses a profit right, now, hardly determines the long term viability of the industry."

the thing is, you dont seem to see anything wrong anywhere when it comes to hydrogen...lol...its all possible no matter how impossible...

theres no infrastructure, but so what?...it will take trillions to build it...so what?...many countries are calling it quits with hydrogen...so what?...its not economical...so what?...the numbers dont add up...so what?...

"so what" isnt a business plan or a real promotion for hydrogen...

And the correct answer is, NO.

Can anyone name just one Hydrogen Fuel Cell company that is profitable ? NO

Can anyone name just one Green Hydrogen producer that is profitable ? NO

Can anyone name just one Hydrogen station that is profitable ? NO

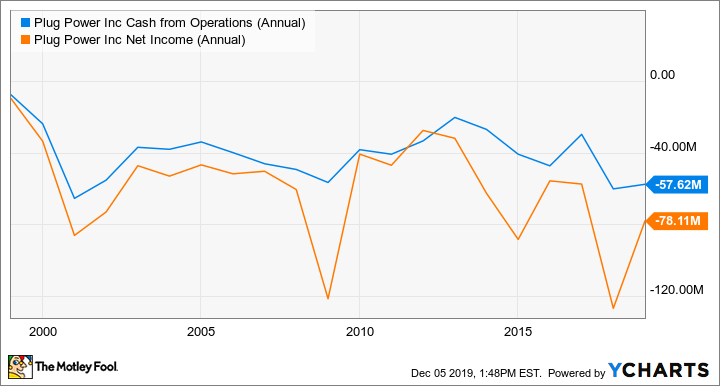

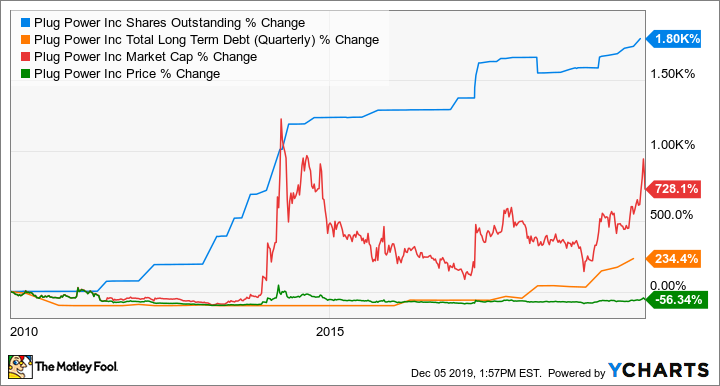

rick - PLUG has been projecting a gross profit for 10 of the Last 12 Years.

Please excuse me if I call Over Promise / Under Deliver ....AGAIN.

Trump Team Proposes Ending Clean Energy Office, Cutting Billions

https://www.msn.com/en-us/money/markets/trump-team-proposes-ending-clean-energy-office-cutting-billions/ar-AA1Ckakg?ocid=BingNewsSerp

Under the plan, which isn’t final, the $27 billion agency’s staff would be reduced to 35 employees, and about $10 billion in projects, including $3 billion for so-called hydrogen hubs, would be kept “as is” and transferred to other parts of the Energy Department.

Plug is projecting a gross profit this year.

Whether any company hits or misses a profit right, now, hardly determines the long term viability of the industry.

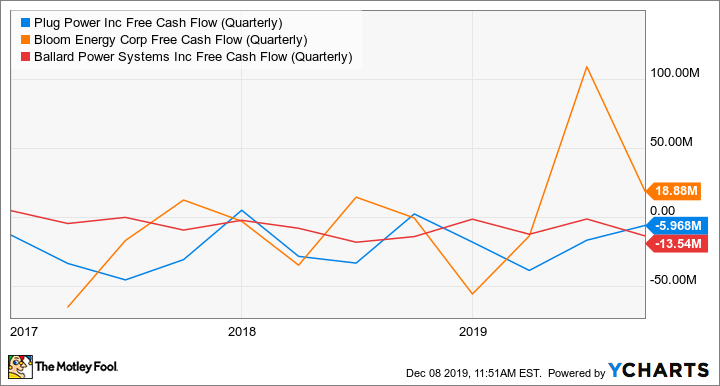

rick - I said Hydrogen Fuel Cells.

Bloom is successful because of their Natural Gas Fuel Cells. which have much better economics than Hydrogen.

Natural Gas Fuel Cells are the ones being taken seriously for back up power for data centers NOT Hydrogen.

I think Bloom Energy generated a positive operating income last year. Not that that proves anything.

Most BEVs are generating a loss for car manufacturers. They haven't reached the scale to generate a profit.

Mid - EV's work because they are VERY ECONOMICAL even without Government subsidies.

Cost per mile. Overall cost of ownership. BEV's win by every economic metric.

Hydrogen fails in every transportation application except indoor material handling and Spacecraft.

EV also works but it was subsidized like ethanol for E85. Subsidies are necessary to get new innovation going ie: building out plants, fueling stations etc

Can anyone name just one Hydrogen Fuel Cell company that is profitable ?

Can anyone name just one Green Hydrogen producer that is profitable ?

Can anyone name just one Hydrogen station that is profitable ?

rick - Can you see a pattern ?

P.S. - Hydrogen works. Hydrogen Economics don't work.

Who is going to Build Hydrogen Stations ?

https://www.hydrogeninsight.com/transport/bp-axes-low-carbon-transport-team-that-had-been-focusing-on-hydrogen-for-trucks-and-shipping/2-1-1802347

Who thinks hydrogen is Cheap and Easy?

https://cleantechnica.com/2025/04/03/bps-exit-is-part-of-a-broader-collapse-in-hydrogen-for-transportation-among-majors/amp/

It sounded expensive to me too.

But, the price of Ruthenium is about $630 an ounce compared to about $900/oz for Platinum. They used one third the amount (Ru versus Pt) and got 4.4 times the performance. The article didn't mention the processing costs.

Wow . Sounds Really Expensive.

And yes you can put Hydrogen in cars, but why would you pay $30+ / gallon equivalent ?

|

Followers

|

745

|

Posters

|

|

|

Posts (Today)

|

2

|

Posts (Total)

|

60038

|

|

Created

|

03/01/05

|

Type

|

Free

|

| Moderators uksausage WeTheMarket Jack_Bolander JOHNNY-VEGAS | |||

Page is currently being updated - watch for more information about their recent acquisitions and competitors

Welcome to Plug Power

http://www.plugpower.com/Home.aspx

Plug Power is the leading provider of clean hydrogen and zero-emission fuel cell solutions that are both cost-effective and reliable.

In 2020/21 Plug Power cemented two major partnerships

https://www.plugpower.com/plug-power-and-sk-group-partnership/

https://www.ir.plugpower.com/Press-Releases/Press-Release-Details/2021/Groupe-Renault--Plug-Power-Join-Forces-to-Become-Leader-in-Hydrogen-LCV/default.aspx

The architect of modern hydrogen and fuel cell technology, Plug Power is the innovator that has taken hydrogen and fuel cell technology from concept to commercialization. Plug Power has revolutionized the material handling industry with its full-service GenKey solution, which is designed to increase productivity, lower operating costs and reduce carbon footprints in a reliable, cost-effective way. The Company’s GenKey solution couples together all the necessary elements to power, fuel and serve a customer. With proven hydrogen and fuel cell products, Plug Power replaces lead-acid batteries to power electric industrial vehicles, such as the lift trucks customers use in their distribution centers.

Extending its reach into the on-road electric vehicle market, Plug Power’s ProGen platform of modular fuel cell engines empowers OEMs and system integrators to rapidly adopt hydrogen fuel cell technology. ProGen engines are proven today, with thousands in service, supporting some of the most rugged operations in the world. Plug Power is the partner that customers trust to take their businesses into the future.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |