Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Any thoughts on this stock is been growing for the past 30 yrs is there something I’m missing or regular turmoil ?

This 5yr DCF implies $HCP Inc has 20% downside before earnings Monday:

DCF Analysis

Oh no one likes to talk here huh? This stock is doing good glad I held

I bought this at 26.60 I believe this has some good potential to keep going up !!!

looks like we've reached the bottom, and are holding here.

GREAT value down here. $HCP adding strong

~ Tuesday! $HCP ~ Q1 Earnings posted, pending or coming soon! In Charts and Links Below!

~ $HCP ~ Earnings expected on Tuesday *

Want more like this? Search Keyword: MACMONEY >>> http://tinyurl.com/MACMONEY <<<

One or more of many earnings sites has alerted this security has or will be posting earnings on or around the day of this message.

http://stockcharts.com/h-sc/ui?s=HCP&p=D&b=3&g=0&id=p88783918276&a=237480049

http://stockcharts.com/h-sc/ui?s=HCP&p=W&b=3&g=0&id=p54550695994

~ Google Finance: http://www.google.com/finance?q=HCP

~ Google Finance: http://www.google.com/finance?q=HCP

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=HCP#

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=HCP#

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=HCP+Key+Statistics

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=HCP+Key+Statistics

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=HCP

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=HCP

Finviz: http://finviz.com/quote.ashx?t=HCP

Finviz: http://finviz.com/quote.ashx?t=HCP

~ BusyStock: http://busystock.com/i.php?s=HCP&v=2

~ BusyStock: http://busystock.com/i.php?s=HCP&v=2

<<<<<< http://www.earningswhispers.com/stocks.asp?symbol=HCP >>>>>>

http://investorshub.advfn.com/boards/post_prvt.aspx?user=251916

*If the earnings date is in error please ignore error. I do my best.

<<< $HCP Links! >>> ~ MAC's Quick DD Links without the charts.

Open these links (or the ones you desire) in background tabs

http://help.opera.com/Linux/9.52/en/keyboard.html

http://lifehacker.com/263940/force-links-to-open-in-the-background

PennyStockTweets ~ http://www.pennystocktweets.com/stocks/profile/HCP

OTC Markets Company Info ~ http://www.otcmarkets.com/stock/HCP/company-info

OTC Markets Charts ~ http://www.otcmarkets.com/stock/HCP/chart

OTC Markets Quote ~ http://www.otcmarkets.com/stock/HCP/quote

OTC Markets News ~ http://www.otcmarkets.com/stock/HCP/news

OTC Markets Financials ~ http://www.otcmarkets.com/stock/HCP/financials

OTC Markets Short Sales ~ http://www.otcmarkets.com/stock/HCP/short-sales

OTC Markets Insider Disclosure ~ http://www.otcmarkets.com/stock/HCP/insider-transactions

OTC Markets Research Reports ~ http://www.otcmarkets.com/stock/HCP/research

Google Finance Summary ~ http://www.google.com/finance?q=HCP

Google Finance News ~ http://www.google.com/finance/company_news?q=HCP

Google Finance Option chain ~ http://www.google.com/finance/option_chain?q=HCP

Google Finance Financials ~ http://www.google.com/finance?q=HCP&fstype=ii#

Google Finance Historical prices Daily ~ http://www.google.com/finance/historical?q=HCP

Google Finance Historical prices Weekly ~ http://www.google.com/finance/historical?q=HCP&histperiod=weekly#

Y! < Company >

Y! Profile ~ http://finance.yahoo.com/q/pr?s=HCP+Profile

Y! Key Stat's ~ http://finance.yahoo.com/q/ks?s=HCP+Key+Statistics

Y! Headlines ~ http://finance.yahoo.com/q/h?s=HCP+Headlines

Y! Summary ~ http://finance.yahoo.com/q?s=HCP

Y! Historical Prices ~ http://finance.yahoo.com/q/hp?s=HCP+Historical+Prices

Y! Order Book ~ http://finance.yahoo.com/q/ecn?s=HCP+Order+Book

Y! Message Boards ~ http://messages.finance.yahoo.com/mb/HCP

Y! Market Pulse ~ http://finance.yahoo.com/marketpulse/HCP

Y! Technical Analysis ~ http://finance.yahoo.com/q/ta?s=HCP+Basic+Tech.+Analysis

Y! < Analyst Coverage >

Y! Analyst Opinion ~ http://finance.yahoo.com/q/ao?s=HCP+Analyst+Opinion

Y! Analyst Estimates ~ http://finance.yahoo.com/q/ae?s=HCP+Analyst+Estimates

Y! Research Reports ~ http://finance.yahoo.com/q/rr?s=HCP+Research+Reports

Y! Star Analysts ~ http://finance.yahoo.com/q/sa?s=HCP+Star+Analysts

Y! < Ownership >

Y! Major Holders ~ http://finance.yahoo.com/q/mh?s=HCP+Major+Holders

Y! Insider Transactions ~ http://finance.yahoo.com/q/it?s=HCP+Insider+Transactions

Y! Insider Roster ~ http://finance.yahoo.com/q/ir?s=HCP+Insider+Roster

Y! < Financials >

Y! Income Statement ~ http://finance.yahoo.com/q/is?s=HCP+Income+Statement&annual

Y! Balance Sheet ~ http://finance.yahoo.com/q/bs?s=HCP+Balance+Sheet&annual

Y! Cash Flow ~ http://finance.yahoo.com/q/cf?s=HCP+Cash+Flow&annual

FINVIZ ~ http://finviz.com/quote.ashx?t=HCP&ty=c&ta=0&p=d

Investorshub Trades ~ http://ih.advfn.com/p.php?pid=trades&symbol=HCP

Investorshub Board Search ~ http://investorshub.advfn.com/boards/getboards.aspx?searchstr=HCP

Investorshub PostStream ~ http://investorshub.advfn.com/boards/poststream.aspx?ticker=HCP

Investorshub Messages ~ http://investorshub.advfn.com/boards/msgsearch.aspx?SearchStr=HCP

Investorshub Videos ~ http://ih.advfn.com/p.php?pid=ihvse&ihvqu=HCP

Investorshub News ~ http://ih.advfn.com/p.php?pid=news&btn=s_ok&ctl00%24sb3%24tbq1=Get+Quote&as_values_IH=&ctl00%24sb3%24stb1=Search+iHub&symbol=HCP&s_ok=OK&from_month=3&from_day=15&from_year=2012&order=desc&selsrc%5B%5D=prnca&selsrc%5B%5D=prnus&selsrc%5B%5D=zacks&selsrc%5B%5D=money2&selsrc%5B%5D=djn&selsrc%5B%5D=bw&selsrc%5B%5D=globe&selsrc%5B%5D=edgar&selsrc%5B%5D=mwus&force=1&last_ts=1331855999&p_n=1&p_count=&p_ts=1331794260

CandlestickChart ~ http://www.candlestickchart.com/cgi/chart.cgi?symbol=HCP&exchange=US

Barchart Quote ~ http://barchart.com/quotes/stocks/HCP?

Barchart Detailed Quote ~ http://barchart.com/detailedquote/stocks/HCP

Barchart Options Quotes ~ http://barchart.com/options/stocks/HCP

Barchart Technical Chart ~ http://barchart.com/charts/stocks/HCP&style=technical

Barchart Interactive Chart ~ http://barchart.com/charts/stocks/HCP&style=interactive

Barchart Technical Analysis ~ http://barchart.com/technicals/stocks/HCP

Barchart Trader's Cheat Sheet ~ http://barchart.com/cheatsheet.php?sym=HCP

Barchart Barchart Opinion ~ http://barchart.com/opinions/stocks/HCP

Barchart Snapshot Opinion ~ http://barchart.com/snapopinion/stocks/HCP

Barchart News Headlines ~ http://barchart.com/news/stocks/HCP

Barchart Profile ~ http://barchart.com/profile//HCP

Barchart Key Statistics ~ http://barchart.com/profile.php?sym=HCP&view=key_statistics

OTC: American Bulls ~ http://www.americanbulls.com/StockPage.asp?CompanyTicker=HCP&MarketTicker=OTC&TYP=S

NASDAQ: American Bulls ~ http://www.americanbulls.com/StockPage.asp?CompanyTicker=HCP&MarketTicker=NASD&TYP=S

NYSE: American Bulls ~ http://www.americanbulls.com/StockPage.asp?CompanyTicker=HCP&MarketTicker=NYSE&Typ=S

Marketwatch Profile ~ http://www.marketwatch.com/investing/stock/HCP/profile

Marketwatch Analyst Estimates ~ http://www.marketwatch.com/investing/stock/HCP/analystestimates

Marketwatch Historical Quotes ~ http://www.marketwatch.com/investing/stock/HCP/historical

Marketwatch Financials ~ http://www.marketwatch.com/investing/stock/HCP/financials

Marketwatch Overview ~ http://www.marketwatch.com/investing/stock/HCP

Marketwatch SEC Filings ~ http://www.marketwatch.com/investing/stock/HCP/secfilings

Marketwatch Picks ~ http://www.marketwatch.com/investing/stock/HCP/picks

Marketwatch Hulbert ~ http://www.marketwatch.com/investing/stock/HCP/hulbert

Marketwatch Insider Actions ~ http://www.marketwatch.com/investing/stock/HCP/insideractions

Marketwatch Options ~ http://www.marketwatch.com/investing/stock/HCP/options

Marketwatch Charts ~ http://www.marketwatch.com/investing/stock/HCP/charts

Marketwatch News ~ http://bigcharts.marketwatch.com/news/symbolsearch/symbolnews.asp?news=markadv&symb=HCP&sid=1795093&framed=False

The Lion ~ http://thelion.com/bin/aio_msg.cgi?cmd=search&msg=&si=1&tw=1&tt=1&rb=1&ih=1&fo=1&iv=1&yf=1&sa=1&fb=1&gg=1&symbol=HCP

Search NYSE ~ http://www.nyse.com/about/listed/lcddata.html?ticker=HCP

StockTA ~ http://www.stockta.com/cgi-bin/analysis.pl?symb=HCP&num1=567&cobrand=&mode=stock

StockHouse ~ http://www.stockhouse.com/financialtools/sn_overview.aspx?qm_symbol=HCP

StockHouse Delayed LII ~ http://www.stockhouse.com/financialtools/sn_level2.aspx?qm_page=46140&qm_symbol=HCP

AlphaTrade ~ http://tools.alphatrade.com/index.php?t1=mc_quote_module&t2=mc_quote_module2&t3=historical&template=historical2html&sym=HCP&client_id=2740&a_width=680&a_height=1000&language=english&showVol=1&chtype=8

Reuters ~ http://www.reuters.com/finance/stocks/companyOfficers?symbol=HCP.PK&WTmodLOC=C4-Officers-5

StockWatch ~ http://www.stockwatch.com/Quote/Detail.aspx?symbol=HCP®ion=U

Search NASDAQ ~ http://www.nasdaq.com/symbol/HCP

NASDAQ Divy History ~ http://www.nasdaq.com/symbol/HCP/dividend-history

NASDAQ Short Interest ~ http://www.nasdaq.com/symbol/HCP/short-interest

NASDAQ Institutional Ownership ~ http://www.nasdaq.com/symbol/HCP/institutional-holdings

NASDAQ FlashQuotes ~ http://www.nasdaq.com/aspx/flashquotes.aspx?symbol=HCP&selected=HCP

NASDAQ InfoQuotes ~ http://www.nasdaq.com/aspx/infoquotes.aspx?symbol=HCP&selected=HCP

NASDAQ After Hours Quote ~ http://www.nasdaq.com/symbol/HCP/after-hours

NASDAQ Pre-Market Quote ~ http://www.nasdaq.com/symbol/HCP/premarket

NASDAQ Historical Quote ~ http://www.nasdaq.com/symbol/HCP/historical

NASDAQ Option Chain ~ http://www.nasdaq.com/symbol/HCP/option-chain

NASDAQ Company Headlines ~ http://www.nasdaq.com/symbol/HCP/news-headlines

NASDAQ Press Releases ~ http://www.nasdaq.com/symbol/HCP/news-headlines

NASDAQ Sentiment ~ http://www.nasdaq.com/symbol/HCP/sentiment

NASDAQ Analyst Summary ~ http://www.nasdaq.com/symbol/HCP/analyst-research

NASDAQ Guru Analysis~ http://www.nasdaq.com/symbol/HCP/guru-analysis

NASDAQ Stock Report ~ http://www.nasdaq.com/symbol/HCP/stock-report

NASDAQ Competitors ~ http://www.nasdaq.com/symbol/HCP/competitors

NASDAQ Stock Consultant ~ http://www.nasdaq.com/symbol/HCP/stock-consultant

NASDAQ Stock Comparison ~ http://www.nasdaq.com/symbol/HCP/stock-comparison

NASDAQ Call Transcripts ~ http://www.nasdaq.com/symbol/HCP/call-transcripts

NASDAQ Annual Reports ~ http://www.nasdaq.com/aspx/annualreport.aspx?symbol=HCP&selected=HCP

NASDAQ Financials ~ http://www.nasdaq.com/symbol/HCP/financials

NASDAQ Revenue & Earnings Per Share (EPS) ~ http://www.nasdaq.com/symbol/HCP/revenue-eps

NASDAQ SEC Filings ~ http://www.nasdaq.com/symbol/HCP/sec-filings

NASDAQ Ownership Summary ~ http://www.nasdaq.com/symbol/HCP/ownership-summary

NASDAQ Institutional Ownership ~ http://www.nasdaq.com/symbol/HCP/institutional-holdings

NASDAQ (SEC Form 4) ~

--------- All Trades ~ http://www.nasdaq.com/symbol/HCP/insider-trades

--------- Buys ~ http://www.nasdaq.com/symbol/HCP/insider-trades/buys

--------- Sells ~ http://www.nasdaq.com/symbol/HCP/insider-trades/sells

The Motley Fool ~ http://caps.fool.com/Ticker/HCP.aspx

The Motley Fool Earnings/Growth ~ http://caps.fool.com/Ticker/HCP/EarningsGrowthRates.aspx?source=itxsittst0000001

The Motley Fool Ratios ~ http://caps.fool.com/Ticker/HCP/Ratios.aspx?source=itxsittst0000001

The Motley Fool Stats ~ http://caps.fool.com/Ticker/HCP/Stats.aspx?source=icasittab0000006

The Motley Fool Historical ~ http://caps.fool.com/Ticker/HCP/Historical.aspx?source=icasittab0000004

The Motley Fool Scorecard ~ http://caps.fool.com/Ticker/HCP/Scorecard.aspx?source=icasittab0000003

The Motley Fool Statements ~ http://caps.fool.com/Ticker/HCP/Statements.aspx?source=icasittab0000009

MSN Money ~ http://investing.money.msn.com/investments/stock-ratings?symbol=HCP

YCharts ~ http://ycharts.com/companies/HCP

YCharts Performance ~ http://ycharts.com/companies/HCP/performance

YCharts Dashboard ~ http://ycharts.com/companies/HCP/dashboard

InsideStocks Opinion ~ http://www.insidestocks.com/texpert.asp?sym=HCP&code=XDAILY

InsideStocks Profile ~ http://www.insidestocks.com/profile.asp?sym=HCP&code=XDAILY

InsideStocks Quote ~ http://www.insidestocks.com/quote.asp?sym=HCP&code=XDAILY

InsideStocks Projection ~ http://charts3.barchart.com/procal.asp?sym=HCP

Zacks Quote ~ http://www.zacks.com/stock/quote/HCP

Zacks Estimates ~ http://www.zacks.com/research/report.php?type=estimates&t=HCP

Zacks Company Reports ~ http://www.zacks.com/research/report.php?type=report&t=HCP

Knobias ~ http://knobias.10kwizard.com/files.php?sym=HCP

StockScores ~ http://www.stockscores.com/quickreport.asp?ticker=HCP

Trade-Ideas ~ http://www.trade-ideas.com/StockInfo/HCP/HOT_TOPIC.html

Morningstar ~ http://performance.morningstar.com/stock/performance-return.action?region=USA&t=HCP&culture=en-US

Morningstar Shareholders ~ http://investors.morningstar.com/ownership/shareholders-overview.html?t=HCP®ion=USA&culture=en-us

Morningstar Transcripts~ http://www.morningstar.com/earnings/NoTranscript.aspx?t=HCP®ion=USA

Morningstar Key Ratios ~ http://financials.morningstar.com/ratios/r.html?t=HCP®ion=USA&culture=en-US

Morningstar Executive Compensation ~ http://insiders.morningstar.com/trading/executive-compensation.action?t=HCP®ion=USA&culture=en-us

Morningstar Valuation ~ http://financials.morningstar.com/valuation/price-ratio.html?t=HCP®ion=USA&culture=en-us

CCBN (Thompson Reuters) ~ http://ccbn.aol.com/company.asp?client=aol&ticker=HCP

TradingMarkets ~ http://pr.tradingmarkets.com/?lid=leftPRbox&sym=HCP

OTCBB ~ http://www.otcbb.com/asp/SiteSearch.asp?Criteria=HCP&searcharea=e&image1.x=0&image1.y=0

Insidercow ~ http://www.insidercow.com/history/company.jsp?company=HCP&B1=Search%21

Forbes News ~ http://search.forbes.com/search/find?tab=searchtabgeneraldark&MT=HCP

Forbes Press Releases ~ http://search.forbes.com/search/find?&start=1&tab=searchtabgeneraldark&MT=HCP&pub=businesswire,prnewswire&searchResults=pressRelease&tag=pr&premium=on

Forbes Web ~ http://search.forbes.com/search/web?MT=UNGS&start=1&max=10&searchResults=web&tag=web&sort=null

YouTube Symbol Search ~ http://www.youtube.com/results?search_query=HCP

Buy-Ins ~ http://www.buyins.net/tools/symbol_stats.php?sym=HCP

Quotemedia ~ http://www.quotemedia.com/results.php?qm_page=47556&qm_symbol=HCP

Earnings Whispers ~ http://www.earningswhispers.com/stocks.asp?symbol=HCP

Bloomberg Snapshot ~ http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=HCP

Bloomberg People ~ http://investing.businessweek.com/research/stocks/people/people.asp?ticker=HCP

Financial Times ~ http://markets.ft.com/Research/Markets/Tearsheets/Summary?s=HCP

Investorpoint ~ http://www.investorpoint.com/ enter "HCP" and click search.

Hotstocked ~ http://www.hotstocked.com/ enter "HCP" and click search.

Raging Bull ~ http://ragingbull.quote.com/mboard/boards.cgi?board=HCP

Hoovers ~ http://www.hoovers.com/search/company-search-results/100003765-1.html?type=company&term=HCP

DD Machine ~ http://www.ddmachine.com/default.asp?m=stocktool_frame.asp?symbol=HCP

SEC Form 4 ~ http://www.secform4.com/insider/showhistory.php?cik=HCP

OTCBB Pulse ~ http://www.otcbbpulse.com/cgi-bin/pulsequote.cgi?symbol=HCP

Failures To Deliver ~ http://failurestodeliver.com/default2.aspx enter "HCP" and click search.

http://www.coordinatedlegal.com/SecretaryOfState.html

http://regsho.finra.org/regsho-Index.html

http://www.shortsqueeze.com/?symbol=HCP&submit=Short+Quote%99

DTCC (PENSON/TDA) Check - (otc and pinks) - Note ~ I did not check for this chart blast. However, I try and help you to do so with the following links.

IHUB DTCC BOARD SEARCH #1 http://investorshub.advfn.com/boards/msgsearchbyboard.aspx?boardID=18682&srchyr=2011&SearchStr=HCP

IHUB DTCC BOARD SEARCH #2: http://investorshub.advfn.com/boards/msgsearchbyboard.aspx?boardID=14482&srchyr=2011&SearchStr=HCP

Check those searches for recent HCP mentions. If HCP is showing up on older posts and not on new posts found in link below, The DTCC issues may have been addressed and fixed. Always call the broker if your security turns up on any DTCC/PENSON list.

http://investorshub.advfn.com/boards/msgsearchbyboard.aspx?boardID=18682&srchyr=2011&SearchStr=Complete+list

For a complete list see the pinned threads at the top here ---> http://tinyurl.com/TWO-OLD-FARTS

MACDlinks

MACDlinks

~ Tuesday! $HCP ~ Earnings posted, pending or coming soon! In Charts and Links Below!

~ $HCP ~ Earnings expected on Tuesday *

Want more like this? Search Keyword: MACMONEY >>> http://tinyurl.com/MACMONEY <<<

One or more of many earnings sites has alerted this security has or will be posting earnings on or around the day of this message.

http://stockcharts.com/h-sc/ui?s=HCP&p=D&b=3&g=0&id=p88783918276&a=237480049

http://stockcharts.com/h-sc/ui?s=HCP&p=W&b=3&g=0&id=p54550695994

~ Google Finance: http://www.google.com/finance?q=HCP

~ Google Finance: http://www.google.com/finance?q=HCP

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=HCP#

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=HCP#

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=HCP+Key+Statistics

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=HCP+Key+Statistics

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=HCP

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=HCP

Finviz: http://finviz.com/quote.ashx?t=HCP

Finviz: http://finviz.com/quote.ashx?t=HCP

~ BusyStock: http://busystock.com/i.php?s=HCP&v=2

~ BusyStock: http://busystock.com/i.php?s=HCP&v=2

<<<<<< http://www.earningswhispers.com/stocks.asp?symbol=HCP >>>>>>

http://investorshub.advfn.com/boards/post_prvt.aspx?user=251916

*If the earnings date is in error please ignore error. I do my best.

Q3 Adj EPS 52c vs 72c Misses 53c Est; Guidance In-Line with Consensus

Tuesday , November 03, 2009 08:58ET

QUARTER RESULTS

Health Care Property Investors, Inc. (HCP) reported Q3 results ended September 2009. Q3 Revenues were $255.33M; -4.67% vs yr-ago; MISSING revenue consensus by -6.83%. Q3 EPS was 11c. Adjusted Q3 EPS was 52c; -27.78% vs yr-ago; MISSING earnings consensus by -1.89%.

Q3 RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISEGUIDANCE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $255.33M $267.85M -4.67% $274.04M -6.83%

---------- ------------ ------------ ---------- ------------ ----------

EPS: 11c N/A N/A N/A N/A

Adj EPS: 52c 72c -27.78% 53c -1.89%

---------- ------------ ------------ ---------- ------------ ----------

Ventas Prevails in Litigation against HCP, Inc.

Friday , September 04, 2009 11:32ET

CHICAGO, Sep 04, 2009 (BUSINESS WIRE) -- Ventas, Inc. (NYSE: VTR) ("Ventas" or the "Company") today announced that the jury has ruled in Ventas's favor in the Company's lawsuit against HCP, Inc. ("HCP") for tortious interference with business expectation arising out of the Company's acquisition of Sunrise Senior Living REIT ("Sunrise REIT") in April 2007. In connection with the ruling, the jury awarded the Company over $101 million in damages. The case was tried in United States District Court for the Western District of Kentucky.

"We are pleased that the jury recognized HCP's significantly wrongful actions in improperly interfering with Ventas's acquisition of Sunrise REIT," said Ventas Chairman, President and Chief Executive Officer Debra A. Cafaro. "The damages awarded by the jury, at least in part, will help compensate Ventas for the injury caused by HCP. We thank the jury members for their time and making the right decision."

http://www.knobias.com/story.htm?eid=3.1.02a494e365eed712baaef787e34b2e555b0730c934780e56290a8c2bfc554657

------------------------------------------------

HCP Announces Jury Verdict in Ventas Litigation

Friday , September 04, 2009 12:44ET

LONG BEACH, Calif., Sep 04, 2009 (BUSINESS WIRE) -- HCP (NYSE:HCP) announced that a jury reached a verdict in favor of Ventas, Inc., in an action brought against HCP in the United States District Court for the Western District of Kentucky for tortious interference with prospective business advantage in connection with Ventas's 2007 acquisition of Sunrise Senior Living REIT. The jury awarded Ventas approximately $101 million in compensatory damages. During the trial, the court dismissed Ventas's claims for punitive damages. Ventas originally sought approximately $300 million in compensatory damages as well as punitive damages. HCP will appeal the adverse jury verdict.

http://www.knobias.com/story.htm?eid=3.1.8f9f8fb1051a845bbef694570b8c888be50dacb4a21405ace788dd31525fc585

Form 424B3 - Common Stock offered: 11.5 mil shares

http://xml.10kwizard.com/filing_raw.php?repo=tenk&ipage=6447601

Recent DevelopmentsOn August 3, 2009, we purchased a $720 million participation in first mortgage debt of HCR ManorCare at a discount for approximately $590 million. The $720 million participation bears interest at LIBOR plus 1.25% and represents 45% of the $1.6 billion most senior tranche of HCR ManorCare's mortgage debt. The mortgage debt matures in January 2012, with a one-year extension available at the borrower's option subject to certain conditions, and is secured by a first lien on 331 facilities located in 30 states. HCP obtained financing to fund 72% of the purchase price, resulting in a cash payment by HCP of $165 million. We intend to use a portion of the net proceeds from the offering to repay all borrowings under our revolving credit facility, including borrowings that were applied toward this cash payment. See "Use of Proceeds."

The OfferingCommon Stock offered by HCP: 11,500,000 shares. Common Stock outstanding after this offering(*1)

Use of ProceedsWe intend to use the net proceeds from the offering to repay all borrowings under our revolving credit facility, including borrowings that were applied toward the cash payment of $165 million for the participation in first mortgage debt of HCR ManorCare, with the remainder to be used for general corporate purposes. See "Use of Proceeds."

New York Stock Exchange symbol HCP--------------------------------------------------------------------------------

Q2 Adj EPS 55c vs 50c Beats 51c Est; Guidance Above Consensus

Tuesday , August 04, 2009 08:52ET

QUARTER RESULTS

Health Care Property Investors, Inc. (HCP) reported Q2 results ended June 2009. Q2 Revenues were $267.34M; +7.46% vs yr-ago; BEATING revenue consensus by +5.36%. Q2 EPS was 35c. Adjusted Q2 EPS was 55c; +10.00% vs yr-ago; BEATING earnings consensus by +7.84%.

Q2 RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISEGUIDANCE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $267.34M $248.78M +7.46% $253.74M +5.36%

---------- ------------ ------------ ---------- ------------ ----------

EPS: 35c N/A N/A N/A N/A

Adj EPS: 55c 50c +10.00% 51c +7.84%

---------- ------------ ------------ ---------- ------------ ----------

Purchases $720Mil Participation in HCR ManorCare's First Mortgage Debt

Monday , August 03, 2009 16:05ET

LONG BEACH, Calif., Aug 03, 2009 (BUSINESS WIRE) -- HCP (NYSE:HCP) announced that it has purchased a $720 million participation in first mortgage debt of HCR ManorCare at a discount for approximately $590 million. The $720 million participation represents 45% of the $1.6 billion most senior tranche of HCR ManorCare's mortgage debt which bears interest at LIBOR plus 1.25%. HCP obtained favorable financing to fund 72% of the purchase price, resulting in a net cash payment by HCP of $165 million. HCP expects that the participation will have an effective unlevered internal rate of return of approximately 13%.

HCR ManorCare incurred $3 billion in mortgage debt as part of the financing for The Carlyle Group's $6.3 billion acquisition of Manor Care, Inc. in December 2007. The mortgage debt matures in January 2012, with a one-year extension available at the borrower's option subject to certain conditions, and is secured by a first lien on 331 facilities located in 30 states. The $1.6 billion most senior tranche had a debt service coverage ratio of 21 times for the most recently reported quarter and 10 times on a trailing twelve month basis ending that same quarter. HCP previously invested in mezzanine loans of HCR ManorCare having an aggregate face amount of $1.0 billion.

"HCR ManorCare is the premier provider of post-acute care services in the country, and the performance of its portfolio has exceeded our expectations," said Jay Flaherty, HCP's Chairman and Chief Executive Officer. "We are excited about our opportunity to accretively invest in this senior debt tranche and enhance the tactical options of our strategic investment in HCR ManorCare. We look forward to expanding our partnership with Chief Executive Officer Paul Ormond, his strong management team and The Carlyle Group."

http://www.hcr-manorcare.com/Default.aspx

BUYINS.NET: Healthcare REIT Stocks Expected To Be Higher After 6 of Top 6 Correlated Stocks Fire Buy Signal.

Tuesday , July 14, 2009 04:31ET

Jul 14, 2009 (M2 PRESSWIRE via COMTEX) -- BUYINS.NET / http://www.squeezetrigger.com is monitoring the top 6 most highly correlated Healthcare REIT stocks and 100% of them have fired a buy signal as of July 13, 2009. HCP Inc. (NYSE: HCP), Ventas (NYSE: VTR), Nationwide Health Properties (NYSE: NHP), Health Care REIT (NYSE: HCN), Healthcare Realty Trust (NYSE: HR) and Omega Healthcare (NYSE: OHI) are all expected to be higher as 6 of the top 6 stocks in the sector have fired a buy signal. Group rotation is a phenomenon where institutions exert buying or selling pressure in an industry group, pushing prices of the group higher or higher relative to the general market. An industry can often lead or lag the market, and the most highly correlated stocks (mirror closest to the overall move in that group) usually move in unison. The technology used to make these predictions is available for a low monthly fee at http://www.squeezetrigger.com/services/strat/mh.php . The chart below displays the correlation, beta and relative strength of the top 6 most highly correlated stocks in the highlighted industry group:

Name Symbol Correlation Beta RelStr Sector

HCP INC HCP 0.98 1.2 1 REIT - Healthcare Facilities

VENTAS INC VTR 0.97 1.13 1 REIT - Healthcare Facilities

NATIONWIDE HEALTH PROP NHP 0.93 0.9 1 REIT - Healthcare Facilities

HEALTH CARE REIT INC HCN 0.9 0.74 1.01 REIT - Healthcare Facilities

HEALTHCARE REALTY TRUST HR 0.86 1.31 1 REIT - Healthcare Facilities

OMEGA HEALTHCARE INVEST OHI 0.85 0.88 0.98 REIT - Healthcare Facilities

We automatically calculate correlation to help find the stocks that most closely match their groupas movement and generate powerful group consensus trading signals to profit from the herd mentality. When multiple stocks in a group turn at the same time and the rotation of that group is confirmed, an explosive move typically occurs. Correlation measures the tendency for a symbol to move in unison with the group, beta measures the amount the symbol is expected to move relative to the group and relative strength looks back at the recent past to show how the stock has been moving relative to the group.

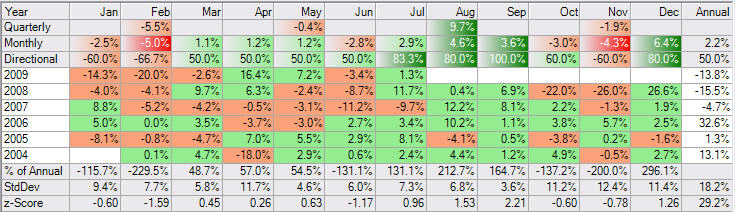

The chart below looks at average seasonal moves (Seasonality) over the past 5 years of the stocks mentioned above and predicts an expected move up or down based on the odds (# of times it has happened in the past). Healthcare REIT stocks as a group have been up an average of +2.9% in July, +4.6% in August and +3.6% in September, a collective +11.1% in the next 10 weeks.

CLICK TO VIEW GRAPH: http://www.buyins.com/images/grouphealthreit7-13-09.jpg

Health Care Property Investors, Inc. (NYSE: HCP) operates as a real estate investment trust in the United States. The company, through its subsidiaries and joint ventures, invests in health care-related properties and provides mortgage financing on health care facilities. It acquires health care facilities and leases them to health care providers. As of December 31, 2005, the companyas real estate portfolio, including properties held through joint ventures and mortgage loans, consisted of interests in 527 facilities located in 42 states. Its properties include senior housing facilities, medical office buildings, hospitals, skilled nursing facilities, and other healthcare facilities, including laboratory and office buildings. Health Care Property Investors has elected to be treated as a REIT for federal income tax purposes and would not be subject to income tax, if it distributes approximately 90% of its taxable income to its share holders. The company was founded in 1985 and is headquartered in Long Beach, California.

Ventas, Inc. (NYSE: VTR), through its subsidiaries, operates as a healthcare real estate investment trust in the United States. It finances, owns, and leases healthcare related and senior housing facilities. As of December 31, 2005, Ventas owned 200 nursing facilities, 41 hospitals, and 139 seniors housing and other facilities in 42 states. It also leased 225 facilities, as of the above date. The company has elected to be taxed as a real estate investment trust. As a result, it would not be subject to corporate income tax on that portion of its net income that is distributed to shareholders. Ventas was founded in 1983 and is based in Louisville, Kentucky.

Nationwide Health Properties, Inc. (NYSE: NHP) operates as a real estate investment trust (REIT) that invests primarily in healthcare-related senior housing and long-term care facilities in the United States. As of February 8, 2006, the company had investments in 447 facilities in 39 states in the United States. It also provides financing to healthcare providers. As a REIT under the Internal Revenue Code, the company would not be subject to federal income tax, provided it distributes at least 90% of its REIT taxable income to its shareholders. Nationwide Health Properties was founded in 1985 and is based in Newport Beach, California.

Health Care REIT, Inc. (NYSE: HCN) is an equity real estate investment trust. The firm engages in investment, development, and management of properties. It primarily invests in health care properties. The firm invests across the full spectrum of senior housing and health care real estate, including independent living/continuing care retirement communities, assisted living facilities, skilled nursing facilities, hospitals, long-term acute care hospitals, and medical office buildings. Health Care REIT was founded in 1970 and is based in Toledo, Ohio.

Healthcare Realty Trust Incorporated (NYSE: HR), a real estate investment trust, engages in the ownership, acquisition, management, and development of real estate properties associated with the delivery of healthcare services in the United States. It also provides mortgage financing on healthcare facilities. As of December 31, 2005, the company had invested in real estate properties, including medical office/outpatient facilities, assisted living facilities, skilled nursing facilities, inpatient rehab facilities, independent living facilities, and other inpatient facilities. As of the above date, it owned 237 properties. As of the same date, the company provided property management services for 138 healthcare-related properties. Healthcare Realty Trust qualifies as a real estate investment trust for federal income tax purposes. The trust would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was founded by David R. Emery in 1992. The company is headquartered in Nashville, Tennessee.

Omega Healthcare Investors, Inc. (NYSE: OHI), a self-administered real estate investment trust (REIT), invests primarily in long-term healthcare facilities in the United States. The company provides lease or mortgage financing to qualified operators of skilled nursing facilities (SNFs), as well as to assisted living facilities (ALFs), independent living facilities (ILFs), and rehabilitation and acute care facilities. As of December 31, 2008, its portfolio of investments consisted of 256 healthcare facilities, including 227 SNFs, 7 ALFs, 2 rehabilitation hospitals owned and leased to third parties, and 2 ILFs; fixed rate mortgages on 15 long-term healthcare facilities; 2 SNFs owned and operated by us; and 1 SNF as held-for-sale. For federal income tax purposes, the company is structured as a real estate investment trust (REIT). As a REIT, it would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its shareholders. Omega Healthcare Investors, Inc. was founded in 1992 and is based in Hunt Valley, Maryland.

SqueezeTrigger.com has built a massive database that collects, analyzes and publishes multiple proprietary trading strategies that predict price moves in stocks, commodities and currencies. The data has then been integrated into an automated trading platform which can be used to connect to a live online broker and automate your trading of each of the strategies highlighted. It is extremely powerful with lightening fast execution at a very low price. Both the trading software and SqueezeTrigger data feed are available at http://www.squeezetrigger.com

One example from the SqueezeTrigger database is approximately 2.65 billion short sale transactions going back to January 1, 2005, and SqueezeTrigger calculates the exact price at which the Total Short Interest is short in each stock. This data was never before available prior to January 1, 2005 because the Self Regulatory Organizations (primary exchanges) guarded it aggressively. After the SEC passed Regulation SHO, exchanges were forced to allow data processors like SqueezeTrigger.com to access the data. Total Short Interest is the number of shares shorted but not yet covered, and is different from total short volume. To access SqueezeTrigger Prices ahead of potential short squeezes beginning, visit http://www.squeezetrigger.com

Go to http://www.SqueezeTrigger.com to find out the exact price that the entire Total Short Interest will start covering!

HCP Initiates Litigation against Sunrise Senior Living

Monday , June 29, 2009 16:05ET

LONG BEACH, Calif., Jun 29, 2009 (BUSINESS WIRE) -- HCP (NYSE:HCP) announced that it, together with three of its tenants, has filed complaints against Sunrise Senior Living, Inc. and its subsidiaries ("Sunrise") based on Sunrise's defaults under management and related agreements covering 64 HCP-owned properties operated by Sunrise. The complaints, filed in the Delaware Chancery Court on June 29, 2009, allege, among other things, that Sunrise systematically breached various contractual and fiduciary duties, including operating the properties in a manner that impermissibly favored the interests of Sunrise and its affiliates at the expense of HCP and its tenants. In addition to equitable relief and money damages relating to the defaults, HCP and its tenants are seeking judicial confirmation of rights to terminate the agreements on the 64 properties.

HCP became the owner of 101 senior housing communities operated by Sunrise through its 2006 acquisition of CNL Retirement Properties, Inc. As previously disclosed, HCP transitioned 11 of those communities to a new operator in December 2008, and shortly thereafter notified Sunrise that it was in default of its obligations under the agreements for the remaining 90 communities. Sunrise responded to HCP's default notices by denying that it was in violation of its agreements in any material respect. The agreements provide Sunrise with various periods to cure the defaults, which periods have now expired. More recently, HCP announced that the management agreements on 15 additional Sunrise-managed communities were terminated effective October 1, 2009.

http://www.knobias.com/story.htm?eid=3.1.a5867d867ac911c5abff1108dc702ae138d2f3574ae5ce3705774c8cd621da97

........................................................................

Sunrise Responds to HCP Announcement

Monday , June 29, 2009 17:55ET

Believes Litigation is without Merit; Continues Management of 75 HCP Communities

MCLEAN, Va., June 29 /PRNewswire-FirstCall/ -- Sunrise Senior Living, Inc. (NYSE: SRZ) learned today that HCP has filed complaints against Sunrise and certain of its subsidiaries in the Delaware Chancery Court alleging a variety of breaches of contract and certain fiduciary duty with respect to 64 HCP-owned communities managed by Sunrise.

"HCP purchased these communities under long-term management contracts with many years remaining. The communities have steadily improved their performance yet HCP has continually expressed their desire to terminate their agreements," said Mark Ordan, Sunrise's chief executive officer. "We see today's announcement as just another attempt to unlawfully terminate our agreements and we will enforce our rights vigorously on behalf of all Sunrise stakeholders. We are proud of the care and service we deliver to all of our residents and families, and we look forward to continuing to serve these communities."

The majority of Sunrise's management agreements with HCP have expiration dates ranging from 2028 to 2038 and include extension options held by Sunrise.

HCP to Transition 15 Additional Sunrise Senior Housing Communities

Thursday , June 18, 2009 16:05ET

LONG BEACH, Calif., Jun 18, 2009 (BUSINESS WIRE) -- HCP (NYSE:HCP) announced that the management agreements on 15 communities operated by Sunrise Senior Living, Inc. or its subsidiaries ("Sunrise") have been terminated effective October 1, 2009, for Sunrise's failure to achieve certain performance thresholds. The termination of the agreements does not require the payment of a termination fee by HCP or its tenant. HCP expects to transition these facilities to new operators during the second half of 2009, reducing the Sunrise-managed properties in its portfolio to 75 communities from the original 101 communities HCP acquired in the 2006 CNL Retirement Properties, Inc. transaction.

HCP intends to enter into new arrangements for the 15 communities that are expected to improve the operating margins of the communities in a manner similar to HCP's successful transition of 11 former Sunrise communities to a new operator in December 2008. The management agreements for those 11 communities were also terminated for Sunrise's failure to achieve certain performance thresholds and did not require the payment of a termination fee by HCP or its tenant.

"This transaction highlights the most recent example of HCP's active approach to asset management as we continue to find ways in this challenging environment to unlock value in our portfolio. Discussions with new senior housing operators for the 15 communities are at an advanced stage and we look forward to closing these transactions in the near future," said HCP Chairman and Chief Executive Officer, Jay Flaherty.

http://www.knobias.com/story.htm?eid=3.1.378a965d66aeb1c3ad1666ae8d926b026ee124c5a370ff037a364f38b4e867b6

HCP to Offer 12,500,000 Shares

Monday , May 04, 2009 16:02ET

LONG BEACH, Calif., May 04, 2009 (BUSINESS WIRE) -- HCP (NYSE:HCP) announced that it intends to issue 12,500,000 shares of its common stock. UBS Investment Bank and Merrill Lynch & Co. will act as joint book-running managers for the offering.

Net proceeds from the offering will be used to repay a portion of the indebtedness outstanding under HCP's bridge loan facility. The shares are being offered pursuant to an effective registration statement filed with the Securities and Exchange Commission.

8-K .... http://xml.10kwizard.com/filing_raw.php?repo=tenk&ipage=6300672

Form 424B3, Rule 424-b3 Prospectus .... http://xml.10kwizard.com/filing_raw.php?repo=tenk&ipage=6300943

Q1 Adj EPS 50c vs 56c Misses 53c Est; Guidance In-Line with Consensus

Tuesday , April 28, 2009 08:48ET

QUARTER RESULTS

Health Care Property Investors, Inc. (HCP) reported Q1 results ended March 2009. Q1 Revenues were $251.62M; +2.79% vs yr-ago; MISSING revenue consensus by -1.99%. Q1 EPS was 17c. Adjusted Q1 EPS was 50c; -10.71% vs yr-ago; MISSING earnings consensus by -5.66%.

Q1 RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISEGUIDANCE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $251.62M $244.79M +2.79% $256.74M -1.99%

---------- ------------ ------------ ---------- ------------ ----------

EPS: 17c N/A N/A N/A N/A

Adj EPS: 50c 56c -10.71% 53c -5.66%

---------- ------------ ------------ ---------- ------------ ----------

Ventas Prevails Against HCP Counterclaims

Wednesday, March 25, 2009 12:43ET

CHICAGO, Mar 25, 2009 (BUSINESS WIRE) -- Ventas, Inc. (NYSE: VTR) ("Ventas" or the "Company") said today that the United States District Court for Western District of Kentucky, has granted Ventas judgment on the pleadings against all counterclaims brought by HCP, Inc. (NYSE: HCP) against Ventas. The Court dismissed HCP's claims with prejudice because the Court found that HCP's pleadings were inadequate to state a claim on which relief can be granted.

In its complaint, filed in May 2007, Ventas alleges that HCP interfered with its purchase agreement to acquire the assets and liabilities of Sunrise REIT and with the process for voting on Ventas's acquisition agreement. Ventas's complaint also alleges that HCP made certain improper and misleading public statements related to a purported and contractually-prohibited bid to purchase Sunrise REIT. Ventas is seeking substantial monetary relief and punitive damages against HCP.

The District Court for the Western District of Kentucky has scheduled a trial by jury in this matter for August 2009. Ventas intends to pursue its claims against HCP vigorously. However, there can be no assurance that Ventas will prevail in its claims against HCP or the amount of any potential recovery Ventas may obtain from HCP.

The Court's opinion can be found on the Company's website at www.ventasreit.com.

Ventas, Inc. is a leading healthcare real estate investment trust. Its diverse portfolio of properties located in 43 states and two Canadian provinces includes seniors housing communities, skilled nursing facilities, hospitals, medical office buildings and other properties. More information about Ventas can be found on its website at www.ventasreit.com.

http://www.knobias.com/story.htm?eid=3.1.2b5f227d7f7452c9d06bb6d18d3b5809e736996400d4f6985ae24561593d055d

Notice of Annual Meeting of Stockholders (4-23-09)

SCHEDULE 14A ~ http://xml.10kwizard.com/filing_raw.php?repo=tenk&ipage=6194707

To Be Held on April 23, 2009

NOTICE IS HEREBY GIVEN that the 2009 annual meeting of stockholders (the "Annual Meeting") of HCP, Inc. (the "Company") will be held at the Long Beach Marriott, 4700 Airport Plaza Drive, Long Beach, CA 90815, on Thursday, April 23, 2009, at 9:30 a.m., California time, for the following purposes:

(1) To elect to the Board of Directors the eleven (11) nominees named in the attached Proxy Statement to serve until the Company's 2010 annual meeting of stockholders and until their successors are duly elected and qualified;

(2) To approve amendments to the Company's 2006 Performance Incentive Plan;

(3) To ratify the appointment of Ernst & Young LLP as the Company's independent auditors for the fiscal year ending December 31, 2009; and

(4) To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only holders of record of the Company's common stock, par value $0.01 per share, as of the close of business on March 3, 2009, are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments thereof.

Stifel Nicolaus Ups to Buy from Hold; Sets Tgt @ $24; Analyst Notes

Friday , February 27, 2009 09:04ET

Issuer: Health Care Property Investors, Inc. (NYSE: HCP)

Analyst Firm: Stifel Nicolaus

Ratings Action: UPGRADE

Current Rating: Buy (from Hold)

Target Price: $24.00

Analyst Comments: Stifel upgraded HCP Inc. based on valuation and reduced balance sheet risk.

This rating information was reported by TheFlyOnTheWall.

http://www.knobias.com/story.htm?eid=3.1.330f787c82aff939c848ec8242947a2744cbb3f233cfbdc782d8345f235c4484

HCP: $0.46 Cash Dividend Payable Today

Monday , February 23, 2009 07:00ET

According to the NYSE Corp Action List, today is the expected Payment Date for the $0.46 cash dividend previously declared for Health Care Property Investors, Inc. (NYSE: HCP).

DECL-DATE X-DATE REC-DATE PAY-DATE

----------- ----------- ----------- -----------

02/02/2009 02/05/2009 02/09/2009 02/23/2009

Q4 Adj EPS 48c vs 54c Misses 55c Est

Tuesday , February 10, 2009 08:33ET

QUARTER RESULTS

Health Care Property Investors, Inc. (HCP) reported Q4 results ended December 2008. Q4 Revenues were $263.27M; +3.53% vs yr-ago; MISSING revenue consensus by -9.63%. Q4 EPS was 14c. Adjusted Q4 EPS was 48c; -11.11% vs yr-ago; MISSING earnings consensus by -12.73%.

Q4 RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISEORIGINAL EARNINGS RELEASE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $263.27M $254.28M +3.53% $291.31M -9.63%

---------- ------------ ------------ ---------- ------------ ----------

EPS: 14c N/A N/A N/A N/A

Adj EPS: 48c 54c -11.11% 55c -12.73%

---------- ------------ ------------ ---------- ------------ ----------

YEAR-END RESULTS

Co. also reported Year-End results ended December 2008. FY Revenues were $1,025.82M; +13.06% vs yr-ago; MISSING revenue consensus by -14.16%. FY EPS was $1.79. Adjusted FY EPS was $2.25; +5.14% vs yr-ago; MISSING earnings consensus by -3.02%.

FY RESULTS Reported Year-Ago Y/Y Chg Estimate SURPRISE

---------- ------------ ------------ ---------- ------------ ----------

Revenues: $1,025.82M $907.36M +13.06% $1,195.04M -14.16%

---------- ------------ ------------ ---------- ------------ ----------

EPS: $1.79 N/A N/A N/A N/A

Adj EPS: $2.25 $2.14 +5.14% $2.32 -3.02%

---------- ------------ ------------ ---------- ------------ ----------

No one posting here yet..

Great.

Who ever reads this, remember one thing.

It was me... I beat you to the punch!

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

30

|

|

Created

|

02/06/09

|

Type

|

Free

|

| Moderators | |||

~ Click image for Health Care Property Investors, Inc. Home Site ~

Investor Relations ~ Contact Us .

Overview: HCP, an S&P 500 company, focuses on properties serving the healthcare industry. The healthcare industry is growing and is expected to represent 16.6% of U.S. Gross Domestic Product (GDP) in 2008(1).

Established in 1985, HCP is a publicly traded company (NYSE:HCP) with $13.3 billion(2) in assets under management as of September 30, 2008. HCP's management team, with an array of experience in real estate acquisition, portfolio management and development, actively manages our holdings. Our portfolio includes 704 properties located in 43 states and Mexico, as well as mezzanine loans and other debt instruments, distributed among distinct sectors of healthcare including: senior housing, medical office, life science, hospital and skilled nursing.

As a REIT, HCP is required to distribute a large share of its profits to its shareholders. During 2007, HCP paid a dividend of $1.78 per common share and its annualized dividend for 2008 is expected to be $1.82 per common share.

HCP has produced an 18% compounded annual total return to shareholders since its IPO on May 23, 1985 through September 30, 2008.

(1) Source: Centers for Medicare and Medicaid Services (CMS), based on the National Health Expenditures report released in January 2008.

(2) Represents the historical cost of real estate owned by HCP, the carrying amount of mortgage loans and 100% of the cost of real estate owned by unconsolidated joint ventures as of September 30, 2008.

30-Day (60-Min)

6-Month (Daily)

10-Year (Weekly)

CIK 0000765880 .

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |