Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Alio Gold (ALO) acquired by Argonaut Gold (ARNGF).

( Argonaut ticker in Canada is AR. )

ARNGF trades on OTC in USA.

7/14/2020: ARNGF PPS @ 1.80 , market cap @ ~ $427 Million

$$$$ glta

That conlcludes this lesson.

This board will now self destruct.

100 shares of ALO will convert to 67 shares of ARNGF.

So u get 67 shares for every 100 shares u have trading at ARGO price correct?

7/1/2020: ALO shares will now convert to Argonaut Gold shares. Conversion ratio is .67

Conversion process should take max. of aboot 2 weeks, probably less than that.

Example: 100 shares of ALO will automatically convert to 67 shares of Argonaut Gold (ARNGF).

ARNGF trades on OTC.

AR is TSE (Toronto/Canada) ticker.

$$$ GLTA

ARNGF

argonautgold.com

Is that a add on of shares or a reduction?

67 for 1 a RS?

ALO shares will convert to Argonaut Gold shares.

Every ALO share converts to .67 ARNGF.

I'm hoping that the New Argonaut will (eventually) up-list from OTC to the NYSE or other exchange (?)

Gold now at $1785.

glta

If so what will the price be? Higher,lower or remain the same(moving with market)

I think the exchange of shares happens Monday.

Management virtual meeting May 20th

https://finance.yahoo.com/news/argonaut-gold-alio-gold-mail-211510730.html

Mexico Extends suspension of non-essential businesses till at least May 30th.

http://www.dof.gob.mx/nota_detalle.php?codigo=5592067&fecha=21/04/2020

Looks good, but in the short term miners will sell off with the markets.

Load them after this last panic.

(Panic could be dramatic)

First quarter looks fun!

Interesting to see that Sprott is involved with ALO financing to improve/expand gold production at Florida Canyon Mine in Nevada.

ALO is investing $$$$ to increase efficiency and increase production at Florida Canyon.

Hopefully, 2nd half of 2020 will show good returns on investment ! $

Gold now at $1475/oz.

GLTA

Rising tide raises all ships. $ALO no different.

Much, Much more to come for $GOLD.. ;^)

Prefer the small market cap gems like ALO due to the possibility of monster gains. The volatility doesn't bother me cause I'm seriously long gold..

Great potential here. Companies will usually start pumping out good news once the breakout/trend reversal is confirmed, but I like to buy before and avg down on dips if possible..

I'm more of a long term trader. I can trade short term quite well, but there's just too many bull traps.

Looks like they’ve come back down. I haven’t heard much of anything lately that points to success outside gold price going up... which is good for them.

Anyone else checking out ALO lately? Anything interesting you've found? I once saw another Canadian mining stock shoot up from a point like this... I'm wondering if this will happen to ALO as well. They were down down in their production though and started back up. ALO hasn't stopped production, they are going through hard times though. Somehow, they need to move forward.

Idk... we've stagnated it seems. Another Canadian miner also did this then shot up. Not sure this one will. The quality of their mines just don't seem like they're good. Their all in costs appear to be at or barely above market gold price.

Are you seeing something else? I want to have hope (shouldn't be hope in investing), but I'm sure I should've sold it after the split.

Not sure where from here... Their numbers need to improve.

Chart looks better and better. Thise time it is a buy position.

Whew... Low g/t on that last release from 10-18-18.

Measured & Indicated Mineral Resource Estimate:

132.9 million tonnes at 0.40 g/t gold1.7 million ounces contained gold, an increase of 52% compared with the PEA

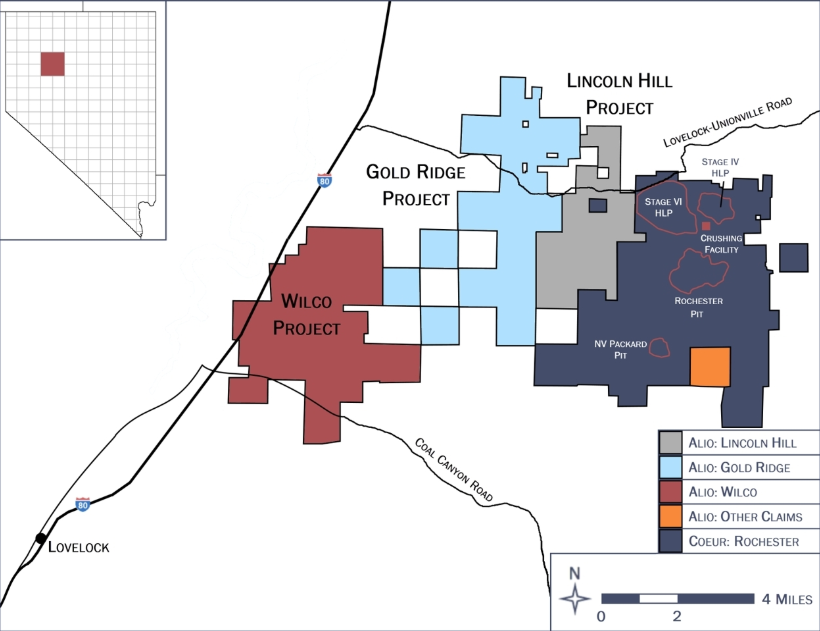

what's interesting... if you look at the Map below, you see all of what ALIO sold. I know ALIO has decent cash reserves for not, but these companies are being hit hard with the lower prices for Gold (and market sentiment). Yes, they received a small amount of cash up front... but I wonder if they should've held out and mined it to get as much value as possible. Where to from here, ALO?

Referenced Seeking Alpha Article:

https://seekingalpha.com/article/4212144-alio-gold-coeur-mining-deal-win-win

Well ... It seems the property was close enough Coeur and was non-core to ALO. So they sold the property. I suppose this makes some sense then ... if they wanted to get a quick $19 million.

However, do you think this is still a bad thing? It would be interesting to see what royalties ... if there are any. Investors should be privy to that information. If it was a deal where they were getting x amount of the Coeur find, ALO should publicize it.

https://www.google.com/maps/place/Rye+Patch,+NV+89419/@40.2836073,-118.1113937,54489m/data=!3m1!1e3!4m5!3m4!1s0x80a19530cc7e7253:0xd76cc70f94f3c4f2!8m2!3d40.4474067!4d-118.2895906

I know why it was purchased by coeur. Be interesting to see what royalties are attached.

I think even worse is not understanding what's going on with the company. It's curious. They go through an acquisition. Maybe that was a mistake and they over extended themselves? I'm going to look into what they sold and see why. I doubt it will be easy to figure out why it was sold - but I plan to give their investor services a call.

Do you (or anyone else) have a read on this? I figured a big part of the stock's fall was pricing in Gold sentiment and not seeing a relief from that sentiment in the foreseeable future.

Selling assets is never a good sign!

https://ih.advfn.com/p.php?pid=nmona&article=78469991

So what do you all think about the latest Alio Gold news?

Stopping Ana Paula exploration. CFO Colette "resigns." 2 Project managers leave... shares tank.

Think this is about to implode? Or do you see an opportunity here that they COULD recover... but it's just a rough time right now.

Gold prices don't help either.

Price is going the wrong way ALO! Other direction, buddy.

I noticed as well. What's up with that?

The last 8 EPS have been positive. I know there are creative accounting 'things' that could happen with EPS... but even with the miss they were positive.

They have a merger that will expand offerings. Their last cores came back with decent results... I realize decent is subjective.

P/E is not a ridiculous multiplier - showing 6.40. ROE is showing at 5.20... we want higher, but it's not horrible or negative like so many tech stocks right now.

Price to sales - 1.30... not paying a huge premium for their sales figures.

Granted I believe this numbers are all from Quarter end 3/31/18 numbers.

ALO doesn't move with the rest of gold, learned that a long time ago

From what I see... the Rye Patch merger may not be a bad thing. Yes, dilution...

The question is... how much more in the way of gold can they find? Gold prices are dipping at this point in time... so that's not helping.

Doing more DD on the Deal... but this could actually (in the long run) increase share price. Again... doing more DD... but I wouldn't doubt seeing PT's returning to $6 range.

The vote is for the merger. What are your thoughts about the merger and reasoning?

So it seems all of the board of directors are recommending voters vote in favor of the Rye Patch acquisition... at least that's what the voicemail they left me stated.

Per another announcement:

ISS, GLASS LEWIS HAVE RECOMMENDED ALIO GOLD & RYE PATCH SHAREHOLDERS VOTE FOR TRANSACTION WHERE ALIO GOLD WILL BUY ALL SHARES OF RYE PATCH Source text for Eikon: Further company coverage

Attention Alio Gold Shareholders

Alio Gold shareholders are reminded to vote their proxy before 10:00 a.m. (Vancouver time), on Wednesday, May 16, 2018. Alio Gold’s Board of Directors unanimously recommend that their shareholders vote IN FAVOUR of the proposed Transaction.

I posted something on this deal awhile back... need to do some more DD... did it actually complete?

This should give a bump to ALO ... I know there is dilution... but ... If they are pulling more gold from the ground, it should only go up.

So one would think. It would be nice to see ALO hit $5-6 again - USD. It'd take C$6.50 too... but no such luck for now it appears.

I did

Not sure wtf is wrong with this stock

Any idea on what's going on right now?

The last Earnings report was a tad harsh... they put out news that they are on schedule for 2018's numbers.

The price is still hovering. I bought in again to lower my PPS... starting to wonder if I should just cut losses and move on.

Then we should leave it with them it AIN'T WORTH IT.

Rye patch shareholders will force you to pay more!

Shit, market stream is down here and on my TD account, wonder what the hell is going on!

Wow, someone is buying a ton of shares, Tape is all green and black.

New HOD coming for Power Hour!!

Sorry, that's NGD, all these miners are cheap right now. Rates going up today may be a good time to get in any of them

It certainly does LOL.

For reference... at current exchange, C$6,50 = $5.01 USD

|

Followers

|

34

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1185

|

|

Created

|

01/11/08

|

Type

|

Free

|

| Moderators | |||

Overview

Timmins Gold Corp is well positioned for continuous growth as a gold production and development company. The Company owns and operates the open pit heap leach San Francisco Gold Mine in Sonora State, Mexico.

Timmins Gold’s experienced management team has delivered increased mine life and expanded production year over year since commercial production began in 2010.

On the exploration front, Timmins Gold has over 200,000 hectares of claims contiguous to the Mine along the highly prolific Northern Sonora Gold District. Past exploration success around the Mine has significantly increased gold resources and reserves.

Timmins Gold has delivered increased revenues, profits and earnings while maintaining low all-in cash costs.

The combination of production, free cash flow generation and exploration success positions Timmins Gold to deliver increased shareholder value. Timmins Gold trades on the TSX under the symbol TMM and the NYSE-MKT under the symbol TGD.

700 West Pender Street, Suite 615

Vancouver, British Columbia

(604) 682-4002

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System

111 Eighth Avenue, 13th Floor

New York, New York 10011

(212) 894-8700

355,628,602 Common Shares as of Feb. 2017

http://www.timminsgold.com/investors/share_structure/

8 Analysts cover TGD

http://www.timminsgold.com/investors/analyst_coverage/

FISCAL 2016 HIGHLIGHTS

- Stable balance sheet with $33.9 million in cash and working capital of $37.8 million.

- Metal revenues of $123.9 million from 100,480 ounces of gold sold at $1,234/oz.

- Cash provided by operating activities of $34.1 million after changes in non-cash working capital.

- Earnings and comprehensive income of $31.7 million ($0.10/share).

- Cash costs1 of $734/oz and All-in Sustaining Costs1 of $853/oz.

Financial performance

- Metal revenues were $123.9 million compared to $109.2 million during fiscal 2015. This represents a 13.4% increase from the prior year. The primary factor for the increase was an increase in gold ounces sold of 100,480 compared to 93,196 ounces during fiscal 2015. The average realized gold price increased to $1,234 per ounce compared to $1,172 during fiscal 2015.

- Earnings from operations were $37.4 million compared to a loss of $241.8 million during fiscal 2015. The difference was primarily due to an impairment reversal of $23.7 million during fiscal 2016 compared to an impairment charge of $228.4 million -during 2015. Additionally, earnings from mine operations were $34.9 million compared to a loss of $2.9 million during fiscal 2015.

- Earnings and comprehensive income were $31.7 million or $0.10 per share compared to loss and comprehensive loss of $190.3 million or $0.77 per share during fiscal 2015.

- Cash provided by operating activities was $34.1 million or $0.11 per share1 compared to $13.3 million or $0.05 per share during fiscal 2015.

- Cash and cash equivalents at December 31, 2016 were $33.9 million, an increase of $24.7 million from the prior year end. During the year, the Company generated $34.1 million from operations, received $9.2 million in receipts from the sale of the -Caballo Blanco Property ("Caballo Blanco") and received $13.8 million in proceeds from an equity financing. The Company invested $3.8 million on expansion programs, $2.0 million on exploration and evaluation projects, and $13.2 million on the Ana Paula gold project ("Ana Paula" or "the Project"). Also, the Company received $16.0 million of its VAT receivable in cash. Subsequent to December 31, 2016, the Company received $3.5 million of the $4.9 million VAT receivable.

- Working capital at December 31, 2016 was $37.8 million, an improvement of $51.5 million from December 31, 2015. This increase is a result of cash provided by operating activities of $34.1 million compared to $13.3 million during fiscal 2015. - During the year ended December 31, 2016, the Company sold the Caballo Blanco Property and completed a bought deal financing increasing cash by $9.2 million and $13.8 million, respectively. Repayment of the $10.2 million loan facility and $1.5 million debenture leaves the Company debt free.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |