Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

solid state uses very little lithium

$ABEPF with $TSL News

https://wallstreetpublication.com/tesla-and-rivian-in-the-battle-for-lithium/

VISION LITHIUM LAUNCHES FIRST DRILL PROGRAM ON DOME LEMIEUX COPPER PROPERTY AND COMPLETES RED BROOK COPPER-ZINC DRILL CAMPAIGN

The initial drill hole will be testing an interpreted deep copper porphyry/skarn target on the Dôme Lemieux. The drill targets were generated from the compilation and interpretation of multiple previous geophysical, geological, geochemical and gravity surveys and drilling programs augmented by a recently completed property-wide 1,600 line-km helicopter-borne high resolution magnetic survey (MAG).

VISION LITHIUM LAUNCHES INAUGURAL DRILL PROGRAM ON RED BROOK COPPER/ZINC PROPERTY

Val-d’Or, Quebec, July 14, 2021 – Vision Lithium Inc. (TSXV: VLI) (OTCQB: ABEPF) (FSE: 1AJ2) (the “Company” or “Vision Lithium”) is pleased to announce the start of a 1,500 metre drill program on its Red Brook Cu-Zn property located in Northern New Brunswick, Canada. The drill program on Red Brook will test at least six high-priority targets on the property. (See Figure 1) These targets were generated from historical Induced Polarization (IP) and recent airborne Electro Magnetic (EM) anomalies. Drill and assay results will be released when available.

https://visionlithium.com/vision-lithium-launches-inaugural-drill-program-on-red-brook-copper-zinc-property/

Three-month copper on the London Metal Exchange was up 1.4% at $9,505 a tonne, as of 0710 GMT, and the most-traded August copper contract on the Shanghai Futures Exchange closed 1.7% higher at 69,520 yuan ($10,761.28) a tonne. Vision's Dôme Lemieux is located in a prolific corridor for past producing copper mines.

Vision Lithium should be announcing drill targets on Red Brook soon

Vision has a lot of prospective properties that are actively being worked on lots of news to follow.

The Sirmac Lithium Project has had more than $2 million of exploration work. Multiple intersections returned over 2% Li2O.One hole intersected up to 2.98% Li2O. This is close to the grade of the highest grade hard rock deposit in the world.

The Godslith property acquired in March 2021, located in Manitoba has

an historical resource of 9.4 million short tons @1.20% Li20

Copper price is hot, Vision Lithium's Dôme Lemieux property covers 12,056 ha (120.6 km2) in Eastern Québec in the Gaspésie region and is located in a structural corridor that hosted past producing copper mines (e.g., the Madeleine Mine, which produced 8,134,000T @ 1.08% Cu and 9.0 g/t Ag prior to 1982, the Gaspé Copper Mine in Murdochville, which produced 141,655,000T @ 0.85% Cu from 1955 to 1999, and the Sullipek deposit, which has estimated historical resources of 1.84MT @ 1.39% Cu).*

MAG-EM survey over its Red Brook property in New Brunswick, Canada has identified two high priority EM target areas. The conductive zones identified by the survey are likely related to the porphyry and skarn-type mineralization.

There are those that chain themselves onto a tree to prevent trees from being cut down, even though the trees in that patch were grown to be harvested. You simply can’t please everyone and the media will be on the side of money and power, never the truth. Those days are long gone.

LCJR

$ABEPF - Vision Lithium to Webcast Live at VirtualInvestorConferences.com March 30th

Company invites individual and institutional investors, as well as advisors and analysts, to attend real-time, interactive presentations on VirtualInvestorConferences.com

PR Newswire

VAL-D'OR, QC, March 22, 2021

VAL-D'OR, QC, March 22, 2021 /PRNewswire/ -- Vision Lithium ((TSXV:VLI, OTC PINK: ABEPF), based in Quebec, focused on mining exploration, today announced that Victor Cantore, Executive Chairman, will present live at VirtualInvestorConferences.com on March 30th

(PRNewsfoto/VirtualInvestorConferences.com)

DATE: March 30th

TIME: 1:00pm ET

LINK: https://bit.ly/2O4IcXP

This will be a live, interactive online event where investors are invited to ask the company questions in real-time. If attendees are not able to join the event live on the day of the conference, an archived webcast will also be made available after the event.

It is recommended that investors pre-register and run the online system check to expedite participation and receive event updates.

Learn more about the event at www.virtualinvestorconferences.com.

Recent Company Highlights

Completing the acquisition of the Godslith lithium project in Manitoba which has a sizeable historical resource with the potential to become world class asset

Successfully produces battery grade lithium carbonate sample from Sirmac Lithium project

Engages Geo Data Solutions to perform a high-resolution helicopter supported Mag-EM survey on its 100% owned Red Brook copper property

Field work is planned on new claims recently added to the Sirmac lithium project in Quebec.

LCJR

$ABEPF - Vision Lithium Completes Acquisition of Godslith Lithium Property

https://www.otcmarkets.com/stock/ABEPF/news/Vision-Lithium-Completes-Acquisition-of-Godslith-Lithium-Property?id=294528

Canada NewsWire

VAL-D'OR, QC, March 22, 2021

VAL-D'OR, QC, March 22, 2021 /CNW/ - Vision Lithium Inc. (TSXV: VLI) (OTCQB: ABEPF) (Frankfurt: 1AJ2) (the "Company" or "Vision Lithium") is pleased to announce the closing of its acquisition (the "Transaction") of a 100% undivided interest in the non-surveyed, unpatented mining claim known as the Godslith claim from Messrs. James C. Campbell and Peter C. Dunlop (the "Vendors") pursuant to the terms and conditions of a property purchase agreement entered into between the parties, dated March 19, 2021 (the "Purchase Agreement"). In connection with the Transaction, Vision Lithium has applied for a mineral exploration licence, which together with the Godslith claim, covers a total area of approximately 5,560 hectares (the "Property"). The Property is located less than 1 km Northwest of Gods River, Manitoba, within and surrounding the traditional territory of the Manto Sipi Cree Nation (the "MSCN"), in the God's Lake area of the province of Manitoba.

Vision Lithium Inc. Logo (CNW Group/Vision Lithium Inc.)

Yves Rougerie, President and CEO of Vision Lithium commented, "We are keen to commence work on the Property and to bring the historical lithium resource into current NI 43-101 standards. After careful review and modelling of the historical exploration data, I am confident that we can expand on the work done to date and identify additional lithium mineralization on the Property, making for a sizeable and important North American lithium project."

The Transaction

Pursuant to the terms of the Purchase Agreement, Vision Lithium issued to the Vendors 4,000,000 common shares of the Company (the "Shares") and granted the Vendors a 3% net smelter returns royalty on the Property (the "Royalty"). In addition to the statutory hold period of four months and one day from the date of issuance, the Shares are subject to an escrow agreement and will be released in four equal tranches of 1,000,000 Shares over an 18-month period. One-third of the Royalty (1%) may be repurchased by the Company for $1,000,000 and an additional one-third (1%) may be repurchased by the Company for an additional $2,000,000. The Transaction remains subject to the final approval of the TSX Venture Exchange.

A separate exploration agreement is to be negotiated and entered into between Vision Lithium and the MSCN to establish a long-term, mutually beneficial, cooperative and respectful relationship based on trust and certainty concerning the exploration program to be carried out by Vision Lithium on the Property.

The Godslith Property

The historical exploration information presented herein is sourced from an independent technical report on the Property (the "Technical Report"), dated August 26, 2009, that was prepared for First Lithium Resources Inc. by qualified person Mark Fedikow Ph.D., P.Eng., P.Geo., C.P.G. in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

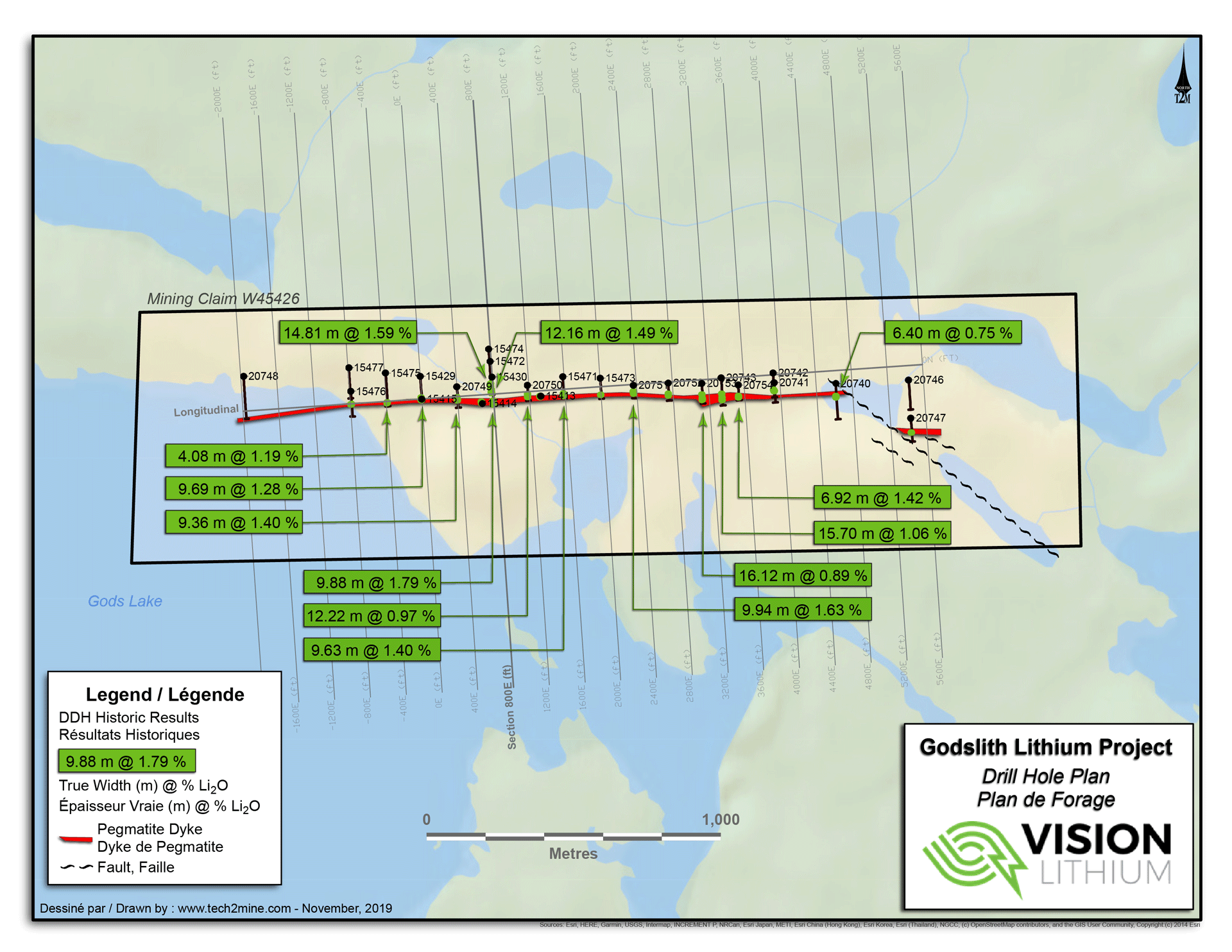

The Godslith pegmatite dyke is classified as a rare metal spodumene pegmatite. The lithium-bearing mineralization has an approximate 2.3 km drill-indicated strike-length and dips 70 degrees North. The Technical Report details the geological setting of the Property's lithium-bearing pegmatite and reviews the historical exploration results. Between 1958-1961, INCO completed 25 wide-spaced drill holes for a total of 9,421 ft (2,871.5 m). In 1986, W.C. Hood Geological Consulting completed an internal report wherein they reported the following resource estimate:

Zone

Resource

Classification

Cut-off Grade

% Li2O

Short

Tons*

Grade

% Li2O

Weighted Average

True Width (Metres)

Upper Zone

Historic Indicated

0.70

4,800,000

1.27

11.04

Lower Zone

Historic Probable

0.70

4,600,000

1.14

*1 short ton = 0.9072 metric tonnes.

While the Company considers these historical estimates to be relevant to investors, as they may indicate the presence of mineralization, a qualified person has not done sufficient work for Vision Lithium to classify the historical estimates as current "mineral resources" or "mineral reserves" (as defined in NI 43-101). The foregoing historical estimates were calculated prior to the implementation of NI 43-101 and the Company is not treating these historical estimates as current "mineral resources" or "mineral reserves".

The Technical Report provides recommendations for future exploration work and includes an initial program of prospecting and geological mapping followed by soil geochemical surveys designed to assess the area for additional pegmatite dykes and base and precious metals. A diamond drill program has also been recommended for the purpose of extending the lithium-bearing pegmatite on the Property to depths below those indicated by the historic Inco drilling.

The scientific and technical information in this release has been reviewed and approved by Yves Rougerie, Geologist, President and CEO of the Company. Mr. Rougerie is a "qualified person" as defined in NI 43–101.

LCJR

$ABEPF - Vision Lithium Provides Exploration Update, Initiates Airborne Mag-EM Survey at Red Brook Copper-Zinc-Gold Project and Field Work on Sirmac Lithium Project:

https://www.otcmarkets.com/stock/ABEPF/news/Vision-Lithium-Provides-Exploration-Update-Initiates-Airborne-Mag-EM-Survey-at-Red-Brook-Copper-Zinc-Gold-Project-and-Fi?id=292895

PR Newswire

VAL-D'OR, QC, March 9, 2021

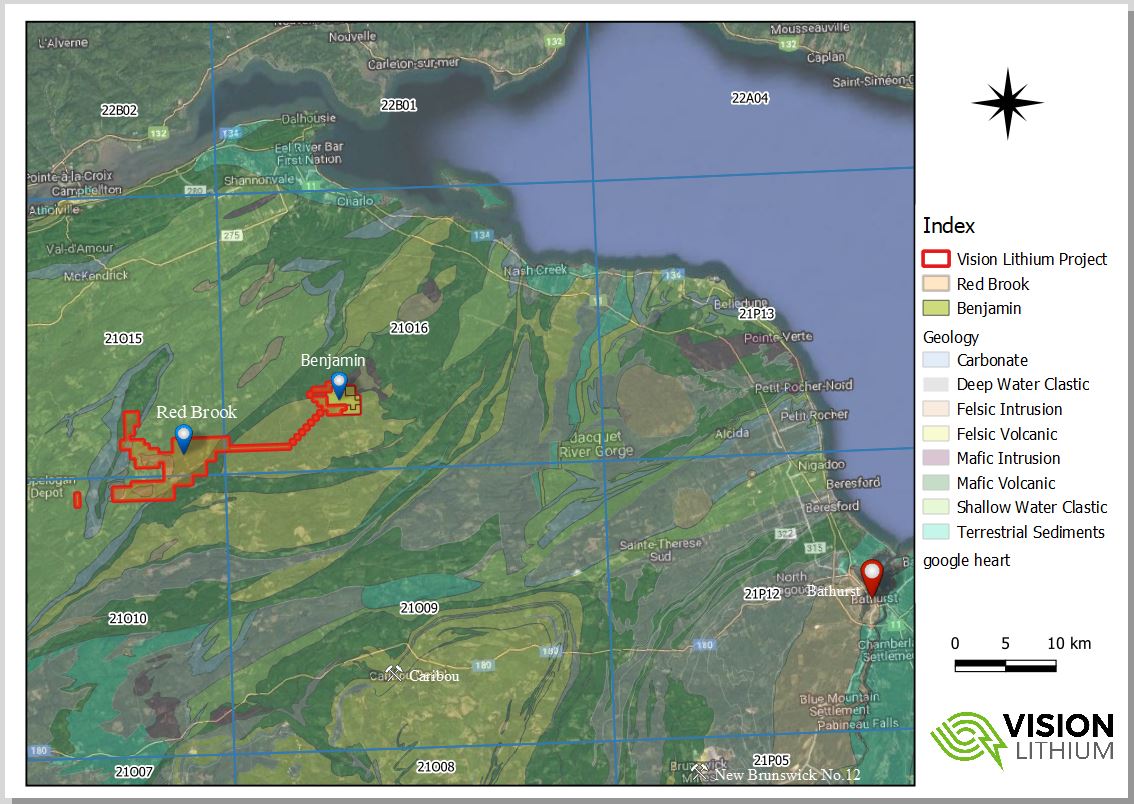

VAL-D'OR, QC, March 9, 2021 /PRNewswire/ - Vision Lithium Inc. (TSXV: VLI) (OTC PINK: ABEPF) (the "Company" or "Vision Lithium") has engaged Geo Data Solutions, a well-established geophysical contractor based in Laval, Quebec, to perform a high-resolution helicopter supported Mag-EM survey on its 100% owned Red Brook property (the "Property") to be carried out in March 2021. The Property covers approximately 2,780 hectares located West of the Bathurst mining district of New Brunswick, Canada. In addition, Vision Lithium is planning a field exploration program on the newly staked lithium claims that are proximal to the East Zone of the Sirmac lithium project in Quebec, Canada. The program will consist of prospecting, geochemical soil sampling and handheld XRF testing.

Yves Rougerie, President and CEO of Vision Lithium stated, "I am very excited by the copper potential on the Red Brook property which is in a similar geological setting as our Dôme Lemieux copper project in the nearby Gaspé Peninsula. Both are exciting copper targets for exploration. We are very bullish on the general market for copper as a critical metal in the battery materials supply chain and especially critical in the global electric infrastructure that will support electric vehicles."

Rougerie continued, "We are also planning field work on the new claims recently added to our Sirmac lithium project in Quebec. This area needs planning and exploration data and our work here will assist in providing targets for future drilling. Finally, we are continuing to advance closing matters to complete the acquisition of the Godslith lithium project in Manitoba pursuant to the previously announced binding letter of intent. Vision Lithium offers investors exposure to both copper and lithium, two critical battery materials. We have an enviable and prospective portfolio of battery material projects in our stable and I believe the Company has never been better positioned when it comes to the quality of the projects and the exploration potential they offer."

The proposed 871-line-kilometre high-resolution helicopter supported Mag-EM (magnetic and electro-magnetic) survey will be flown at 50-metre line spacings, covering an area of approximately 40 km2. The survey, flown at low altitude, will collect high resolution data that will be used to identify geological features that may be related to mineralization. Mineralization identified on the Property to date is often associated with pyrrhotite which is readily identified by these methods. A previous operator completed a series of wide-spaced ground IP lines which identified several large, buried chargeability anomalies. Vision Lithium expects the airborne Mag-EM survey may better map these anomalies in 3 dimensions and potentially identify new ones which could be drill-tested later in 2021. The Company is hopeful that the survey may identify buried mineralized zones which could be related to the source of the porphyry and skarn-type mineralization that has been identified to date on the Property.

The Property is in the Popelogan sector West of the Bathurst VMS District. "The Popelogan sector is host to Ordovician volcanic rocks and sediments of the Silurian intruded by a series of felsic to intermediate intrusives of Devonian age, similar to the geological context of the former Gaspé Mine in Quebec. This region is not part of the Bathurst volcanic belt, it is more of a Gaspé Copper type environment" (Geominex Inc., JAN 2017, report of work 478129). This is also the context of the Company's other properties in the area, namely the large Dôme Lemieux Copper-Zinc porphyry-skarn project approximately 50 km North of the Property and the Benjamin porphyry Copper project 20 km to the East. Polymetallic Copper-Zinc-Silver-Lead-Gold mineralization has been exposed at surface at several locations on the Property. It is interpreted as skarn and porphyry type and related to the Red Brook granitoid intrusive complex which underlies the claim area.

Previous work on the "A" Zone, a stripped gossan area on the Property, has returned significant results as listed below:

Zinc Zone

Zn %

Cu %

Au g/t

15.05

0.21

0.04

12.10

0.19

0.04

8.79

0.25

0.03

8.20

0.20

<0.01

8.13

0.18

<0.01

7.70

0.17

0,02

7.02

0.17

<0.01

6.98

0.18

0.01

Gold-Copper Zone

Cu %

Au g/t

Zn %

0.55

0.79

0.02

0.47

0.28

0.02

0.45

0.95

0.02

0.45

0.27

0.06

0.44

2.62

0.01

0.43

0.21

0.01

0.43

0.53

0.02

0.36

1.61

0.01

0.34

0.33

0.01

0.33

0.22

0.07

0.32

0.19

0.03

0.31

0.24

0.01

0.29

0.44

0.01

0.26

0.32

0.01

0.22

0.13

0.02

0.18

0.91

0.00

The Company anticipates the Mag-EM survey will take approximately two weeks to complete in the field and the results should be available within a month. Planning for a drill program to test high-priority targets identified by the survey will follow.

The scientific and technical information in this release has been reviewed and approved by Yves Rougerie, Geologist, President and CEO of the Company. Mr. Rougerie is a "qualified person" as defined in NI 43-101.

LCJR

$ABEPF up over 46% on the Frankfurt market.

https://www.boerse-frankfurt.de/equity/vision-lithium

Let's see what happens at opening here today.

LCJR

I'm hearing we've hit bottom and can start recovering now. I hope it's true. Hard on a Friday but I think we'll start moving up now.

LCJR

Yep, I’m not going anywhere. When the whole market is down it sucks, but also feels good to know there’s nothing wrong with this ticker. Recovery is going to be sweet!

LCJR

Looking for a huge rebound here!

I can watch this throughout the day over here in Europe on the Frankfurt Exchange: https://www.boerse-frankfurt.de/aktie/vision-lithium

Just have to remember the price data is in Euro.

LCJR

Super excited! Glad I found this gem.

LCJR

ABEPF~ready to run

Got in today with 22,307 shares at .2351. Hey, it’s all the extra cash I had on hand. LOL

LCJR

Its all about lithium and the BIG $$$$.

He on the board of ATAO, SXOOF and BRLL EOM

Oh and also the $$$$

So Pelosi is on the boards of BRLL and ABEPF. Very interesting. Lithium is the reason to be sure.

Pelosi Jr. joined the board. EOM

loading as much as I can

Same board members. Lithium and EV battery sector. Both are exploring and developing high quality mineral assets in lithium.

What’s the relationship with Vision Lithium?

Vision Lithium Expands Sirmac Lithium Project

https://www.prnewswire.com/news-releases/vision-lithium-expands-sirmac-lithium-project-301230626.html

Holding up very strong after 1000% move! I'm still holding about 50% of shares, this could be a real long-term winner honestly

Nice! Here’s the video about this news.

February 16,2021 Vision Lithium Announces Agreement to Acquire Godslith Lithium Deposit with Historic Resource of 9,400,000 Short Tons at 1.21% Li2O https://www.prnewswire.com/news-releases/vision-lithium-announces-agreement-to-acquire-godslith-lithium-deposit-with-historic-resource-of-9-400-000-short-tons-at-1-21-li2o-301228800.html

Should I buy the SOX, lithium, or Nikkei? I'm so confused and conflicted......will have to look at the NEXT resource that comes to mind. ![]()

You are on our board, ABEPF here, So disrespectful of you.

Sorry -

Am afraid it's far too "visual" for "explanation"

Yer gonna hafta head to a library or something (or try someone else's phone, etc)

I’m not quite getting it, partly because the formatting on my app is messed up. Can you explain it?

|

Followers

|

19

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

135

|

|

Created

|

01/10/18

|

Type

|

Free

|

| Moderators | |||

Vision Lithium Inc. (TSXV: VLI) (OTC : ABEPF) is a junior exploration company focused on exploring and developing high quality mineral assets including gold, copper and lithium in safe jurisdictions, primarily in Canada. The Company is led by skilled and qualified mineral exploration experts and business professionals. Vision Lithium is committed to discovering new world class assets and bringing these assets to production, starting with the Dôme Lemieux copper-zinc property in Quebec's Gaspé region, its polymetallic properties in New Brunswick, the Sirmac lithium property located in Northern Quebec and the Godslith Lithium property less than 1 km northwest of Gods River, Mantioba.

For further information on the Company, please visit our website at www.visionlithium.com

Godslith Property

Acquired by Vision Lithium in March 2021, the Godslith Property 100% ownership, is located less than 1 km Northwest of Gods River, Manitoba, within and surrounding the traditional territory of the Manto Sipi Cree Nation in the God’s Lake area of the province of Manitoba. The Godslith claim covers a total area of approximately 5,560 hectares.

Historical Drilling down to 243 m Homogenous and continuous mineralization 1.54% Li2O at surface and similar grade of 1.54% in deepest hole. Majority of historical of the drilling down to 125 m level.

Vision Lithium has applied for a Mineral Exploration License and is engaging in discussions with the Manto Sipi Cree Nation to sign an exploration agreement. Once the agreement is in place, the Company expects to immediately deploy a geological prospecting team to site to conduct ground proofing, terrain reconnaissance and sampling, as well as verify historical drill collars. Vision Lithium expects to initiate a 15,000 m to 20,000 m drill program targeting the historical Godslith lithium deposit over a 2 km strike length on 100 m sections down to 300 m vertical depth. In addition, the Company will commence a geochemical sample survey (MMI) in the vicinity of the deposit to test for addition mineralized zones outside the known deposit area.

Resource Estimate:

Zone Resource Classification Cut off Grade %Li2O Short Tons Grade % Li2O Weighted Average True Width (m)

Upper Zone Historic Indicated .70 4,800,000 1.27 11.04

Lower Zone Historic Propbable .70 4,600,000 1.14

Sirmac Mine: "The Highest grade hard rock lithium deposit in the world"

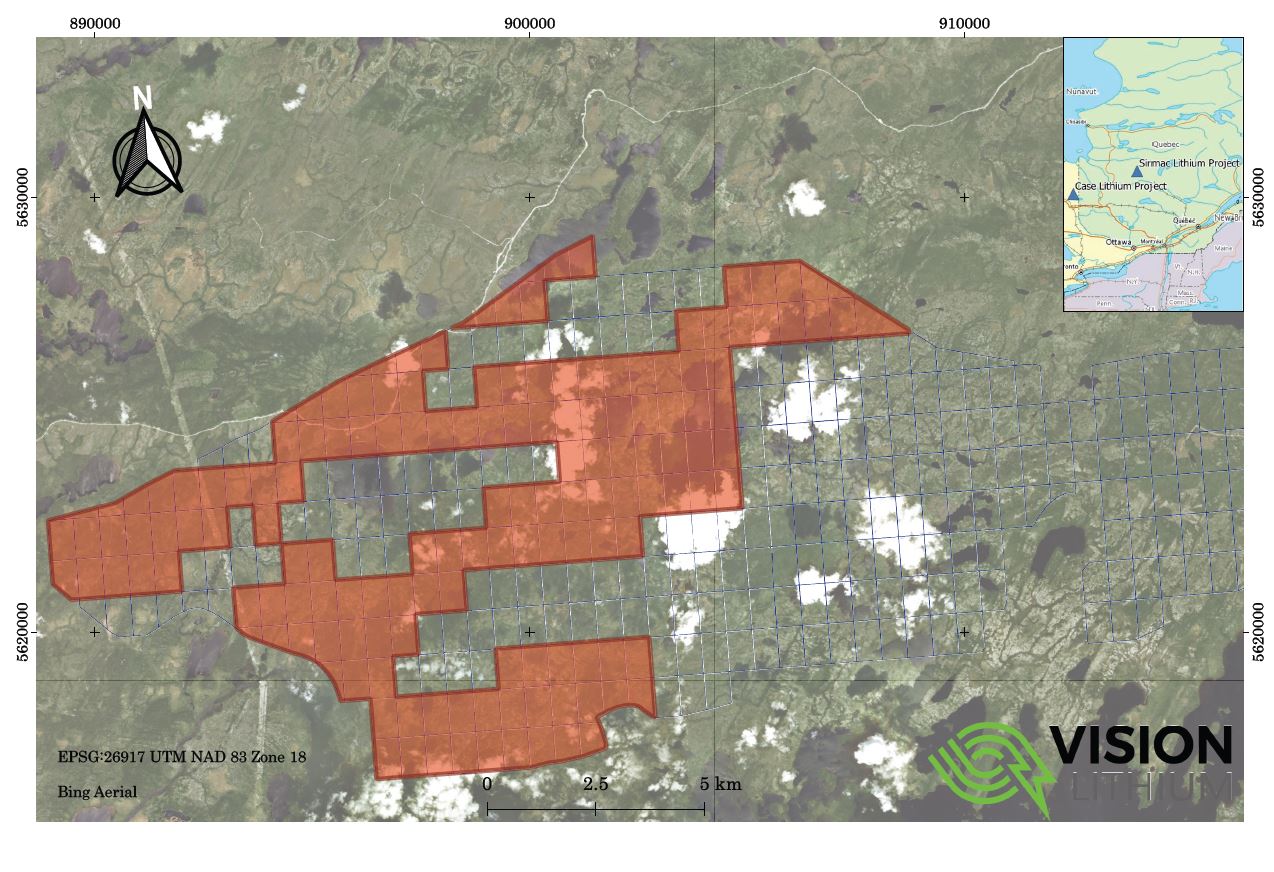

The Sirmac Property 100% owned, consists of 155 mining claims having a total area of approximately 7,670 hectares located approximately 180 kilometres North-West of Chibougamau, in the province of Québec. Metallurgical testing completed by SGS-Lakefield (‘SGS”) in the previous period from samples from the Sirmac property were successful in recovering 88.3% of the Lithium at a grade of 6.23% Li2O. Following receipt of these excellent results, SGS produced an amount 91.9 grams of very high purity Lithium Carbonate grading above 99.5%.

NEMASKA LITHIUM RELATIONSHIP

On December 14, 2017, Vision Lithium announced the signing of a definitive asset purchase agreement for a 100% undivided interest in the Sirmac Lithium Property from Nemaska Lithium Inc. Vision Lithium issued $250,000 cash payment and 15,000,000 common shares of Vision Lithium to Nemaska Lithium bringing its ownership of Vision Lithium to approximately 19.9% of Vision Lithium shares. In addition, Vision Lithium assumed a pre-existing 1% NSR on certain claims comprising the Sirmac Property.

According to the agreement, Nemaska Lithium will have a pre-emptive right to participate in any future equity financing as long as it holds at least 10% of Vision Lithium’s issued and outstanding common shares. In addition, Nemaska Lithium was granted the following additional rights:

• a right of first refusal to purchase any concentrate originating from the Sirmac Property for further processing at its Shawinigan hydro-metallurgical facility;

• the right to act as exclusive marketing agent for all lithium salts from concentrate originating from the Sirmac Property;

• the right to receive a 2% marketing fee, in cash, on the gross proceeds from the sale of lithium products derived from concentrate originating from the Sirmac Property sold by Nemaska Lithium (and from any concentrate otherwise sold by Vision Lithium that is not purchased by Nemaska Lithium); and

• a right of first refusal to reacquire the Sirmac Property in the event that Vision Lithium wishes to sell or otherwise assign and transfer its right, title and interest in and to the Sirmac Property.

Approval from the TSX Venture was received in January 2018.

GEOLOGY

The Sirmac property is located in the North-East part of the Superior geological province, in the Frotet-Evans volcano-sedimentary belt. Four types of rocks outcrop on the Sirmac property: quartz-biotite-hornblende schists, amphibolitized flows or mafic sills, syenite pluton, and pegmatites, some of which are spodumene-bearing. The main foliation strikes E-W and has a steep dip. More than twelve granitic pegmatite dykes, whose thickness ranges from 1 to 100 m, have been identified. All of these cut the host schists and generally strike NNW-SSE (315°/350°), with an apparent sub-vertical dip and steep contacts with host rocks.

As soon as spring thaw is completed in Q2 2021, Vision Lithium intends to deploy a ground crew to site to conduct a property wide prospecting and geochemical sampling (MMI) campaign with a goal to discover additional mineralized pegmatite Dikes on the property for follow up drilling. Assuming a successful prospecting season, the Company will initiate a drill campaign this summer/fall.

MINERALIZATION

The type of deposit associated with the lithium mineralization of the Sirmac property is a granitic, rare element-bearing pegmatite due to the presence of spodumene. In dyke #5—the known deposit—spodumene crystals are euhedral, with color and size varying from white to greenish- or grayish-white and from 1 to 30 cm in size, with an average size of 10 cm. The amount of spodumene found in the pegmatite ranges from 5 to 30% in volume. In general, the crystals are slightly altered and frequently contain rounded inclusions of quartz. A historical resource estimate was performed on the deposit by Wrightbar Mines Ltd. in 1994, with results indicating a total of 314,328 tonnes grading 2.04% Li2O.

HISTORICAL RESOURCE ESTIMATE

In 2012, Nemaska Lithium conducted a successful exploration campaign. In total, 9 sites were mechanically stripped for a surface area of approximately 13,000 m2. There were 29 channels completed over 739 metres for a total of 506 samples (selected results below, for full results see the Nemaska Lithium news release dated November 5, 2012).

Also as part of the same exploration program, Nemaska Lithium completed a diamond drill campaign of 72 shallow drill holes (3,414.5 m). A total of 1,953 samples, including quality control samples (13%), were sent to the lab for assay (selected results below, for full results see the Nemaska Lithium news release dated November 13, 2012).

Drill results from this program reported multiple intersections over 2% Li2O. More specifically, Nemaska Lithium intersected mineralization of up to 2.98% Li2O. This grade approaches the grade found at the Greenbushes deposit, which is the highest grade hard rock lithium deposit in the world.

From this work a mineral resources estimate was produced:

Historical Estimates

The existing Technical Report includes the following historical estimates for the Sirmac Property:

Table 1: Historical Estimates for the Sirmac Property with 0.50% Li2O Cut-Off Grade

Li2O%(1) Category(1)(2) Tonnage (t)(1)(3) Average Grade Li2O%(1) Average Grade Ta2O5 (ppm)(1)(4)

0.50 Measured 185,000 1.40 70

0.50 Indicated 79,000 1.40 80

0.50 Inferred 40,000 1.10 60

Notes:

(1) Effective date of December 2013.

(2) The historical estimates were calculated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definitions Standards for mineral resources in accordance with NI 43-101. Mineral resources which are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are exclusive of the measured and indicated resources.

(3) Bulk density of 2.70 t/m3 is used. Rounded to the nearest thousand.

(4) Ta2O5 mineralization has yet to demonstrate recoverability and potential for economic extraction.

While the Company considers these historical estimates to be relevant to investors, as they may indicate the presence of mineralization, a qualified person has not done sufficient work for Vision Lithium to classify the historical estimates as current “mineral resources” or “mineral reserves” (as defined in NI 43-101) and the Company is not treating these historical estimates as current “mineral resources” or “mineral reserves”.

All block modelling, 3D solid generation and geological interpretation was conducted by SGS Geostat. Modelling and block interpolation was done using Genesis © software. As of December 2013, no other deposit in the Sirmac Property has mineral resources stated or estimated. In order to limit the mineral resources representing “a reasonable prospect of economic extraction”, a Whittle © Pit optimization was completed using the Lerchs-Grossman 3D algorithm. Considering the blocks limited to the optimized pit shell and a cut-off grade of 0.50% Li2O, the Sirmac Property comprises 185kt of measured resources at 1.40% Li2O, 79kt of indicated resources at 1.40% Li2O, and 40kt of inferred resources at 1.10% Li2O (see Table 1 above). These historical estimates of mineral resources do not represent mining reserves since they have not shown economic viability.

The existing Technical Report confirms that all sample assay results were independently monitored through a QA/QC program including the insertion of blind standards, blanks and the reanalysis of duplicate samples at a second umpire laboratory. The results of the QA/QC program and the resampling program indicate that the sample database is of sufficient accuracy and precision to be used for the generation of the historical estimates.

The technical information in the following section was reviewed by Yves Rougerie, geologist and President & CEO of Vision Lithium Inc. Mr. Rougerie is a Qualified Person within the meaning of the term as defined in of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The Company has an interest or option to acquire an interest in the following properties:

https://visionlithium.com/sirmac/

-------------------------------------------

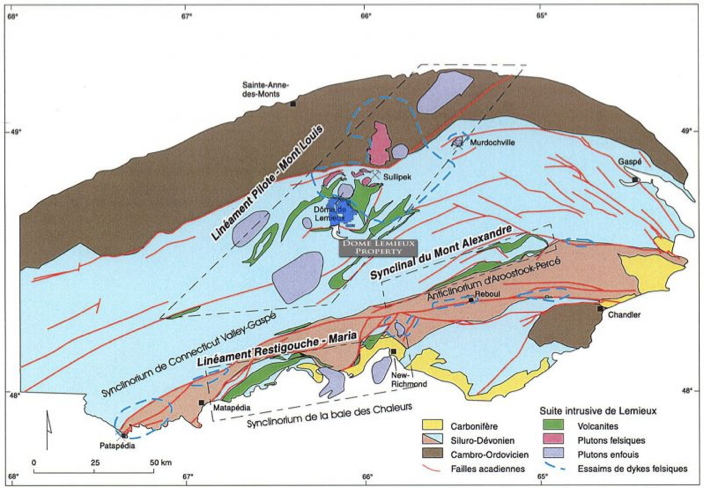

Dôme Lemieux, QC

The Dôme Lemieux is 100% owned. Consists of 225 map-designated claims totalling 12,056 ha or roughly 120 km2. The property is located in eastern Québec in the Gaspésie region, approximately 32 km SSE of the town of Sainte-Anne-des-Monts, Québec, as the crow flies. The Dôme Lemieux property has a rich history of low grade to high grade lead, zinc and copper discoveries. The Dome Lemieux property is located less than 200km north by road from the newly acquired New Brunswick, creating synergies for the exploration of both sites.

Accordingly, Vision Lithium has planned a 1,600 km helicopter-borne magnetic survey (MAG) in Q2. Interpretation of the survey will follow and be released in this quarter. These results will be correlated with historical work done on the property to identify drill targets. Following geophysics interpretation, the Company expects to launch a minimum of a 3,000-metre diamond drilling program, testing multiple deep porphyry copper targets and several shallower polymetallic (Cu-Zn; Zn-Pb-Ag, Au) targets.

New Brunswick Properties

Red Brook, NB Epithermal, NB and Benjamin, NB. The three contiguous Properties comprise 17 mineral claims covering 4,760 hectares (47.6 km2) located approximately 60 km West of the mining centre of Bathurst in Northern New Brunswick.

Wholly owned 100% Interest

On June 3 , 2020, Vision Lithium announced the signing of a definitive purchase agreement for the arm’s length

acquisition of a 100% undivided interest in the Red Brook, (Red Brook)-Epithermal and Benjamin mineral exploration properties from 9248-7792 Quebec Inc. and Prospect Or Corp. The three contiguous Properties comprise 17 mineral claims covering 4,760 hectares (47.6 km2) located approximately 60 km West of the mining centre of Bathurst in Northern New Brunswick. The Properties are easily accessible by year-round, well-maintained forestry road infrastructure. An additional 30 claim-units were added to the Epithermal group in the summer.

Under the agreement, Vision Lithium issued 6,000,000 common shares of the Company to 9248-7792 Quebec Inc. and 4,000,000 common shares to Prospect Or Corp and granted the vendors a 2% net smelter return royalty on the Properties, one-half of which may be repurchased by Vision Lithium for $1,000,000.

The Properties are located west of the Bathurst VMS District. A sequence of Ordovician and Silurian supracrustal rocks is intruded by Middle Devonian Granodiorite as well as other Siluro-Devonian felsic intrusions with which porphyry, skarn and other mineralization is genetically and spatially related. Similar Cu porphyry-base metal skarn related mineralization occurs at Gaspé-Needle Mountain porphyry copper deposit and at the Company’s Dôme Lemieux property associated with Devonian intrusives in the Gaspésie region of Quebec. Work on these properties was delayed due to COVID related access restrictions and significant work is now planned for the next fiscal year.

Red Brook Property

Following the discovery by prospectors of rocks with a high zinc content of up to 13%, a large stripping program was completed by previous operators on two highly altered zones (A and B). Zone “A” returned values of up to 15% Zn as well as gold and copper values up to 2.62 g/t Au and 0.5% Cu.

Best Selected Samples from Zone “A” on the Red Brook Property:

the Red Brook property has never been tested by drilling. In 2021 the Company was active on the Red Brook copper asset and flew a ~900 km helicopter-borne magnetic and electromagnetic survey (MAG-EM) flown at 50-metre spacings over the property. The survey was flown at low altitude and collected high resolution data which is now being interpreted and correlated with historical sample results and drilling to identify high-priority drill targets.

Geophysics results and details of a planned 1,500-metre drill program, testing targets will be released in Q2, with assay results to follow. Ground exploration of the Benjamin and Epithermal properties which are east of Red Brook is also planned for the summer. Groundwork will include prospecting, trenching, and sampling. Results are to be expected in Q3.

Epithermal Property

The Epithermal property is located in between and contiguous to both the Red Brook and Benjamin properties. It was only recently staked following construction of new forestry access roads. The vendors discovered a large outcrop of sericite-altered rhyolite with apparent breccia textures and quartz veins. A single sample assayed 40 ppb Au, indicating a fertile environment for gold mineralization. The occurrence has no reported prospecting or drilling history. Field work is required to advance this new and exciting prospect.

Benjamin Property

The Benjamin property is located east of the Epithermal property. The property covers approximately 15 sq. km. and is host to a copper-molybdenum porphyry type deposit in intensely altered and fractured granodiorite porphyry, part of a Devonian intrusive complex. Best historical intersections include 218m @ 0.22% Cu, 312m @ 0.12% Cu, 52m @ 0.20% Cu, 10m @ 0.39% Cu and 10m @ 0.30% Cu.

Stratmat first explored the area in 1954, followed by Soquem-Temex in the 1970’s. In the summer of 2019, the Vendors located two old trenches using a Lidar map, and resampled the old trench of hole 7014, as well as the old trench in the South C zone. The trenches exhibit altered and mineralized rocks. The trench along hole 7014 returned values of up to 1.14 g/t Au. The description of the drill hole in the Soquem report describes a 200m hole with mineralized rhyolite, which appears to coincide with the surface rocks found in the trench. Drill holes were not assayed for gold at the time of drilling. The core for several of the historic drill holes is preserved and may be available for resampling and assaying for gold.

The Benjamin property has been recognized as a porphyry copper-moly type. It is near a large granite intrusive. Only a relatively small area near the intrusive has been tested. A thorough prospecting program is recommended along with trenching and sampling and ground IP surveys. In addition, a review of the porphyry deposit is warranted to model the deposit, evaluate its potential at depth and its gold potential. The property warrants a further evaluation for porphyry deposits and contact related skarn deposits and their gold potential.

The Company is planning exploration programs for these Properties in 2021.

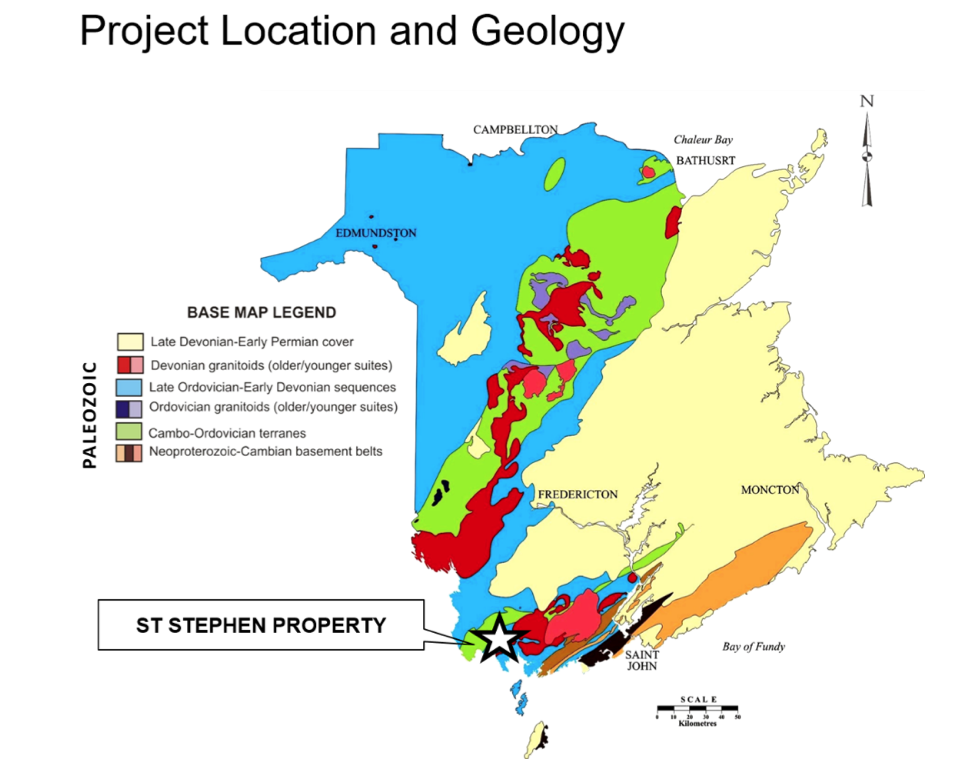

St-Stephen Property

The St-Stephen Property 50% owned, comprises 189 claims located near the town of St. Stephen in the southwest corner of New Brunswick. VLI staked the property in 2004 and 2005 and there are no underlying royalties. Indiana Resources (“IMX”) has acquired an initial 50% interest in the property following a 4-year, million-dollar expenditure on the claims. Indiana is the operator of the works.

The Property hosts numerous historic zones of magmatic Ni-Cu-Co mineralization, including several significant occurrences. The most significant zones are found at the Roger’s Farm deposit which was the object of underground development and exploration in 1959-1960. IMX drilled several historic and newly discovered zones and has expanded and enhanced their potential.

BBOARD OF DIRECTORS & MANAGEMENT

(Val-d’Or, Quebec) Yves Rougerie, P.Geo. is a graduate of the University of Quebec in Earth Sciences and brings 35 years of experience in the mining exploration and development business. Mr. Rougerie was named President and CEO of the Company in March 2007. Throughout his career, Mr. Rougerie has worked for several companies, including AREVA and AUR Resources, and has spent the last 20 years with the ABE group. He played a significant role in the exploration and development phases of Aur Resources’ Louvicourt Cu-Zn-Ag-Au Mine near Val-d’Or, and participated in the discovery and definition of the “L” uranium-gold deposit in the Otish Mountains, Quebec. Mr. Rougerie has acquired a wide range of experience in exploration techniques and project management pertaining to narrow-vein Gold, VMS Cu-Zn and uranium deposits. Mr. Rougerie was also a founding Director of Scorpio Mining Corporation.

(Montreal, Quebec) Mr. Victor Cantore, was elected as director on December 22, 2016. Mr. Cantore has been involved in the lithium industry through his role as capital markets advisor to Nemaska Lithium since 2011. In fact, Mr. Cantore was the property vendor of the Whabouchi Lithium property which he sold to Nemaska Lithium in 2009. Prior to that Mr. Cantore began his investment career in 1992 as an advisor for Tasse & Associates. In 1993 he moved to RBC Dominion Securities, one of the largest brokerage firms in Canada. Since 1999, Mr. Cantore has worked with both public and private companies organizing and structuring financings mainly in the resources and high tech sector. He has held directorships on the boards of directors of various private and public companies, including Amex Exploration Inc.

(Val-d’Or, Quebec) Robert C. Bryce, P.Eng., MBA is a graduate of the University of Toronto (B.Sc. Mining Engineering 1960) and of Western University (MBA 1964) withmore than 50 years of practical and executive mining experience at all levels. From 1975 to 1990, he led the Selbaie project from an advanced exploration project through feasibility to a 7,500 tpd producing mine. The Selbaie mine was Quebec’s largest base metal producer for a quarter century. From 1990 to 1994, Mr Bryce was VP Mining for Aur Resources where he led the 280M$ development and start-up of the 4,000 tpd Louvicourt Cu-Zn-Ag-Au mine near Val-d’Or, Quebec. Mr. Bryce founded ABE Resources in 1996 (now Vision Lithium) and presided over the Company until 2007. He is a director of several listed junior resource companies, including Integra Gold Corp. and a technical advisor to others.

(Sudbury, Ontario) Dr. Jobin-Bevans has almost 30 years in the mineral exploration business. Scott is the President & CEO and Principal Geoscientist at Caracle Creek International Consulting Inc., a private geological and geophysical consulting group which he co-founded in 2001. He is a registered geoscientist with the Association of Professional Geoscientists of Ontario (APGO), an Adjunct Professor in the Department of Geology, Lakehead University, and a certified Project Management Professional (PMP). Scott served as the President (2010-2012), a Director (2002-2010), and is a Past President of the Prospectors and Developers Association of Canada.

(Montreal, Quebec) Jonathan Gagné, P.Eng., MBA, has a B.Sc. in mining engineering from the École Polytechnique de Montréal and an MBA with specialization in corporate finance from the University of Quebec in Montreal. Mr. Gagné has more than 12 years of experience in the mining field, both in technical knowledge and in management. From the start of his career, he participated in the construction and commissioning of the Meadowbank gold project located in Nunavut, was responsible for the mine engineering department for the consulting company SGS Geostat and was the engineer in charge to support the in-pit operations for Glencore Zinc, and this around the world. More recently, he was managing director of Sayona Quebec, a company aiming to develop the Authier lithium project and currently works for the company Greenstone Gold Mines.

(Val-d’Or, Quebec) Ms Nancy Lacoursière was named Interim Chief Financial Officer, effective November 10th, 2016. Ms Lacoursière holds a BA in Accounting from UQAT (the Université du Québec en Abitibi-Témiscamingue). She has over 17 years of experience in accounting, including 8 years in the mining industry. Nancy is currently the Interim CFO for Cartier.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |