Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

VMEMQ: BK PLAN effective. All shares cancelled.

http://otce.finra.org/DLDeletions

Articles:

https://www.lexisnexis.com/legalnewsroom/litigation/b/newsheadlines/archive/2017/02/08/violin-memory-gets-nod-for-ch-11-plan-pact-with-soros-unit.aspx?Redirected=true

https://www.wsj.com/articles/soros-backed-firm-to-fund-violin-memory-restructuring-1486497446?mod=wsjde_finanzen_wsj_barron_tickers

https://www.theregister.co.uk/2017/02/01/soros_group_violin_auction/

LoL. Thanks for that HDOGTX. I haven't been following this, so I had to go back and re-read that filing:

On February 8, 2017, the Bankruptcy Court entered an Order Authorizing the Debtor’s Entry Into and Performance Under a Plan Support Agreement (the “Order”) pursuant to Sections 105(a) and 363(b) of Title 11 of the Bankruptcy Code. The Order was issued in response to the Debtor’s motion filed on February 6, 2017 to enter into that certain Plan Sponsor Agreement, among the Company, Soros, and the Official Committee of Unsecured Creditors appointed in the Company’s Chapter 11 Case (the “Plan Sponsor Agreement”), which was executed among the parties thereto on February 15, 2017 following the issuance of the Order, substantially in the form submitted to the Bankruptcy Court.

Did any yall see where Soros is getting VMEMQ

http://archive.fast-edgar.com/20170222/AS2ZM22CZZ2RB2Z222JQ22XP2WGNZZ22NI92

Wait...'preservation of certain avoidance actions for the benefit of unsecured creditors'...what dat mean?

Gonna have-ta watch see if the market tells me.

Yeah, the reoganisation proposal was approved by a judge yesterday. This man is a criminal.

I just can't believe CEO Kevin Denuccio negotiated with creditors to swap all stockholders shares.

VMEMQ is going to sell all the assets and all shares will be cancelled and Wiped out!

I stopped looking into it. Didn't like what I was finding.

GL

Quantum Partners LP will receive all equity interest(All shares) instead of cash under the plan of reorganisation. Kevin A. Denuccio basically erases all stockholders. And he said he would increase shareholders value. Kevin is a liar, an evil person.

Check this link: http://bankruptcompanynews.com/violin-memory-bankruptcy-news-2-7-17/

Unsure. Still doing DD on the deal.

Will all stockholders shares be canceled?

I believe a unit of the Soros Fund Management might have purchased it. Lots of new articles starting to surface about it. VM Bidco LLC is the winning bidder. $VMEMQ

I'm wondering what happen to this message board. it has really become inactive.

Did CEO kevin sell the company? We hear nothing from them about the bankruptcy auction.

VMEM changed to VMEMQ, bankruptcy:

http://otce.finra.org/DLSymbolNameChanges

More like 1 cent come on down.

Business Operations Continue while Violin Memory Pursues Chapter 11 Operational and Financial Reorganization and Sale Process

MarketwiredDecember 14, 2016

SANTA CLARA, CA--(Marketwired - December 14, 2016) - Violin Memory®, Inc. (VMEM) announced today that it has commenced a process to streamline its operations and balance sheet, while simultaneously pursuing a sale of its business to a buyer committed to supporting its core customer base.

To facilitate this restructuring, Violin Memory has filed a voluntary petition for reorganization under chapter 11 of the U.S. Bankruptcy Code in the Bankruptcy Court for the District of Delaware, and is seeking to hold an auction in early January for the business.

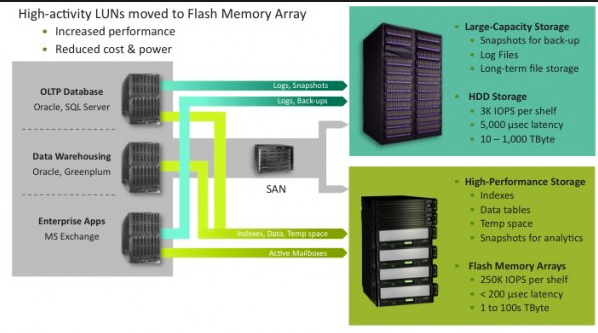

Violin Memory, founded in 2005, is credited with being the creator of the flash storage market. Over the past eleven years, Violin Memory has built a strong franchise through ongoing innovation by serving the needs of the most exacting enterprises. Violin Memory continues to have core strengths that it believes can lead to value creation, including leveraging the company's:

•Annual recurring service revenue

•Broad patent portfolio ?58 US Patents/24 pending

?64 Foreign Patents/38 pending

•58 US Patents/24 pending

•64 Foreign Patents/38 pending

•Single O/S for public, private and hybrid cloud environments

•Proven integrated hardware and software solutions

•Customer base that includes some of the largest enterprises in the world

Kevin A. DeNuccio, Violin Memory's President and CEO stated: "We are taking this action, which should conclude by the end of January 2017, to bolster Violin's ability to serve the needs of its customers. Violin intends to continue to sell solutions to customers and prospects as well as service and support customers during this restructuring."

Additional Information:

If you have questions about the chapter 11 proceeding, please call (855) 934-8766 (domestic) or +1 (917) 877-5963 (international), email VMEMinfo@primeclerk.com, or visit: https://cases.primeclerk.com/VMEM.

Five cents come on down.

I bashed NYSE for all of this, and ill keep on bashing them directly. Nyse kept a piece of shit on its stock exchange all time long. Now, look at this garbage trading on OTC board. The worst thing now is that it seems that the stock is being manipulated. Its unbelievable that this stock is being traded below $1. Its even more that its being below 20 cents. And that CEO, Kevin Denuccio. You are just big dissapointments over and over. Just do what you good for. File for bankruptcy so i can write off this shit.

I don't know what to do; I just want to get out of this POS stock.

VMEM .32 low vol setup and pushing

All that Kevin Denuccio wants is to dilute stockholders shares to nothing then file for bankruptcy. This is not good. the company was valued at around$14-$15; now, it is trading at $0.13-$0.21/share.

This man, Kevin A. Denuccio, was in charge of a company named redback Networks he took over as new CEO. The company was traded at 35 by the time he took over. He basically drain the stock price to low zero point just like VMEM destroying stockholders. Once he's done diluting shareholders shares, he file for bankruptcy wiping out them.

Right now, im really worried. He haD showed no compassion for Redback shareholders; hes basically doing the same thing to VMEM shareholders. Hes going to file for bankruptcy wiping out shareholders and create new shares for new stochholders. That's his style. Now, I have no idea what to doo. My portfolio will be gone. I don't trust this CEO. Its his intention to keep diluting shares.

Is this man, Kevin A. Denuccio, planning to file for bankruptcy now to wipe out stockholders. Hes been very silent. This would be the second company he lead to bankrupcy.

Is this man, Kevin A. Denuccio, planning to file for bankruptcy now to wipe out stockholders. Hes been very silent. This would be the second company he lead to bankrupcy.

I swear if vmem was not traded on NYSE i wouldn't buy it. Now, it is on otc, and you know what happen to stocks there. Things will get worse.

I swear if vmem was not traded on NYSE i wouldn't buy it. Now, it is on otc, and you know what happen to stocks there. Things will get worse.

So, are we basically toasted? I even tried to contact the company, i get no reply.

i still can't believe this shit. Everyday this stock hit a new low. vmem is traded at 17 cents($.17)/share.

This POS kills my portfolio. That stupid CEO didn't want to sell the company. Now, look at us. VMEM is on OTC stock exchange, and we know things will get worse over there

Any ideas when this might start trading again? How long does it usually take?

VMEM: effective immediately VMEM delisted from the NYSE to the OTC.:

http://otce.finra.org/DLAdditions

NYSE Moves to Delist Violin Memory (VMEM)

By James Garrett Baldwin | October 28, 2016 — 8:26 AM EDT

On Oct. 27, the New York Stock Exchange announced in post-market hours that it will move to delistshares of flash storage firm Violin Memory (VMEM).

The exchange also said that it would immediately suspend the company's common stock.

The NYSE said the move to delist VMEM stock is in accordance with Section 802.01B of the NYSE's Listed Company Manual. According to exchange guidelines, company shares can be delisted if the firm falls below the NYSE's continued listing standard regarding its market capitalization. (See also: The Dirt On Delisted Stocks.)

This standard requires a company to maintain an average market capitalization of at least $15 million over a 30-day trading period.

The announcement comes a week after the firm received a notice from the NYSE regarding another violation of its continued listing standard. The exchange’s continued listing standard also requires that a company maintain an average common stock closing price at or above $1.00 per share for at least 30 consecutive days. VMEM stock was last valued at $1.00 per share on Sept. 12, 2016. (See also: What are the rules behind the delisting of a stock?)

The firm said in a statement on Oct. 20 that it planned to meet with the exchange to discuss future efforts to curb its ongoing price decline. (See also: Is Violin Memory on the Verge of Delisting?)

Before shares were suspended on Thursday, shares had dropped by 86.34% over the last three months. In the last 30 days, shares fell 52.74%.

Thursday’s decline pushed Violin Memory’s market capitalization down to $9.51 million. (See also: Is Violin Memory Bankruptcy Bound?)

The company will still have the right to a hearing by a Committee of the Board of Directors of the Exchange. The company may also appeal that decision. Should that appeal be denied, the exchange will file an application to the Securities and Exchange Commission to delist VMEM common stock.

The announcement comes at a difficult time for Violin Memory. Its financial condition has deteriorated over the last four quarters. The firm has aggressively marketed new products to generate buzz for its products. However, its decline has been well noted. The stock's 52-week high was $7.28 per share. The stock closed on Thursday at $0.36 per share just before the delisting announcement. (See also: If a stock is delisted, do shareholders still own the stock?)

Read more: NYSE Moves to Delist Violin Memory (VMEM) | Investopedia http://www.investopedia.com/news/nyse-moves-delist-violin-memory-vmem/#ixzz4OONirEPr

Follow us: Investopedia on Facebook

Look at this blockade at .3899! What a joke. Wall Str hedge fund scum.

NEWS! Violin Memory Expands Support for Private and Hybrid Cloud Infrastructures with RedHat OpenStack Liberty

http://sports.yahoo.com/news/violin-memory-expands-support-private-160000775.html

|

Followers

|

13

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

356

|

|

Created

|

10/30/13

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |