Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Suggest you study more about the company and CEO. He got $30M from hedge funds!!! That’s no joke

$VMNT has so much coming!!! CEO is one of a kind

Solid close on VMNT today. With Gold and Silver demand only increasing their acquisition of Marena is looking like a great investment. IMO we can see $4 easily with uplisting and could go a lot more if gold and silver demands continue.

Always so much talk surrounding these pumps. Nasdaq is a bit of a stretch right now as great as Vemanti is. HOLDING!

Getting some of this, looking good!

I know what he has said but the extraneous chatter by others is --->

going to uplist to OTXQX and then to NAZ

I doubt those muttering that crap have any clue as to what it takes to get to naz.

Look at Tan Tran’s LinkedIn profile. He has experience with this and the connections

$VMNT to the moon. Great company with a simple and profitable business model. A rare find in OTC.

QB very very soon and PRs will start rolling afterwards

Ezekel that one guy will just send you PM and try to shake you out of VMNT..

Non pumping and she is going higher and higher weeeeeeeee$$$

At least one of my positions is in a good place today....

If you have been keeping track of the company, it's obvious which one I'm talking about.

You cant be serious? Are you aware of the requirement for uplisting to the NAZ?

If you're taking about OTCQX -- well then, that's no big deal.

Please clarify????

Once uplisting is complete, PR will hit

I've done my homework...

She will keep going higher and higher...

Ceo goal... Nasdaq SPAC this year

Check CEO twitter @tanctran

What makes you say that? Where is this heading?

Yep yep..

She is trading like investors holding

Only going higher and higher!!

Tan Tran

@tanctran

·

2h

Some updates to share. We've received the final audit reports from

@RJICPAs

for

@Vemanti

$VMNT. We're finalizing our Form S-1. OTCQB is a given...we're of course looking beyond that. We've identified and already engaged in SPAC/reverse merger talks with target companies. (1/4)

I been holding VMNT for some time..

2021 will be a big year for VMNT

Dare I say one dollar cometh our way!

You mean this statement. "Yes, we're looking at target companies and working with investment bankers to fast-track our way to NASDAQ. Will have more news!"

$$VMNT$$

Did you see CEO's tweet today?

Tan must not being putting out money for promotion. All those tweets and updates on progress and the price dropped at opening. I think there has been about 2,200 shares bought this morning. There is almost no interest in this.

I suppose if Vemanti posted actual documents of these tweeted milestones instead of only tweets, more interest would develop.

JP Morgan just wants gold price to go down so they can load at cheaper prices. That’s all these analysts do.

Meanwhile Moodys just completed a credit rating of Mali...

Moody's announces completion of a periodic review of ratings of Mali

You have to register and/or pay for their service but Mali's credit rating was downgraded to a "negative outlook" and Caa1 after the coup earlier this year.

Caa1

A rating within speculative grade Moody's Long-term Corporate Obligation Rating. Obligations rated Caa1 are judged to be of poor standing and are subject to very high credit risk. Rating one notch higher is B3. Rating one notch lower is Caa2

Go here

Certainly not a place where any serious investor would want to have their gold stored.

First, VMNT is not even close to Bitcoin. It is involved, at the moment in lending money. Much like Helio if you follow them.

There is not a lot of difference than if a pawn shop started hoarding gold. When one goes in with their watch and gets a loan based on the value of the watch, they can keep the rate from fluctuating or becoming voltage if the watch owner knows the pawn shop has gold to back their overall worth.

The idea is the same as how the USD was previously a gold standard, prior to the modern economy-based currency value.

Will the value of cryptocurrency go up? I suppose by residual effect it could, but it doesn't have to. Im sure the USD go went up when gold went up, because the US had a reserve, making us wealthier, therefore residual effect on our currency. This increased confidence in USD.

It is shady, even more than when a government uses something as currency backing. But it is also how we place a value on something. No different than an arbitrary stock price that goes up or down based on a value we feel is appropriate.

There are 1000s of papers on how currencies are influenced by precious metals. It is an economy course standard topic.

VMNT/Fvndit are trying to capitalize on this concept since they aren't a country which can depend on import export trading to value their currency.

So explain how it WORKS

If Bitcoin is a currency HOW IS IT BACKED BY GOLD?

If Gold goes up, does the price of Bitcoin go up?

If Bitcoin goes up, does the price of Gold go up

What if Gold goes down, does it take Bitcoin down with it

And if Bitcoin goes down, would it take gold down with it.

What if the price of Bitcoin goes up and gold goes down?

...and let's not forget, when we refer to price WE MEAN PRICE IN USD BECAUSE RIGHT NOW -- ITS THE DOLLAR THAT RULES.

The only reason one buys bitcoin or gold is because they believe they will become worth MORE DOLLARS.

You are not going to create any doubt into my mind and I am not selling VMNT!!!

VMNT I am up big and I am holding for as long as the stock market will stay alive!!

If a currency has a backing, the value remains more consistent and stable. Take TSChips (Triple Star Currency). If TSChips are backed by gold in my vault or through partnership will a gold producer or investor, then TSChips will let investors and users have more confidence.

It will also feel, or better yet, act as insurance to cover lending or backing in the event of catastrophic event. Much like FDIC. Your TSChips are insured by the gold in my vault if the TSChips Exchange goes down.

Overall I feel its for confidence. The problem right now is how easy it is to create a gold backed currency or lending. There is not a standard nor and oversight ensuring the unscrupulous aren't involved.

Again, how exactly are they going to back the crypto with gold?

JPMorgan Says Gold Will Suffer for Years Because of Bitcoin

article here

Tan Tran's latest tweet.

Got the 1st draft of our Form S-1 today. We're fully engaged with the uplisting process for #Vemanti $VMNT. Will keep everyone posted. Thanks for your patience and support!

I understand, got it.

RE: Seems he has plans of crypto backed by gold in peer to peer lending.

perhaps you can illustrate how this will work. feel free to use a model from this article.

Warning Credit Risk for Vietnamese Commercial Banks

Here's the link that didnt work - its a PDF with lots of complicated lending equations

Warning Credit Risk for Vietnamese Commercial Banks

If you like the post it allows you hit the recommend button and when you search the subject relevant/worthy posts have the most recos.

Not sure what that button is.

I wish iHub had a reco button like SI. :)

I appreciate your words in the first sentence. I am business owner of two companies and consult for another which is partnered with a major defense and intelligence industry corporation. I understand how to objectively look at information and am very aware of how to ask real and tough questions in expectation of real answers.

I do have a position with VMNT, though I recently cut it in half as the stock sits there like moss growing on a stone in the forest that no one walks through. There is zero catalyst for this stock. There has been some exciting news from the CEO, but it does not translate to the investor. No one is investing, no one is trading. SEC filing have very limited restricted shareholders, and the daily volume is minimal.

You are correct, many OTC traders on message boards or social media are looking for the next big lottery ticket. Very similar to the bleacher seats at a horse track, just there to make a buck. I get it, nothing wrong with that. There is very little interest in understanding the fundamentals or history of a company to determine the viability of put money into their ticker. I'll admit, I take chances on pure momentum at times and have zero knowledge of the company, including the name. I am in it for 5 minutes and out. But I don't do that with serious money.

Reading the article you listed, as well as the one Tran tweeted, makes Vietnam sound like what Vegas was back in the 50s, run by those with some money and they get to make the rules, without regard to the consequences. Maybe it is more like the boomtowns of early western America.... Dodge City, Deadwood, and Tombstone, make the rules by those who got in first. There are so many companies listed on the graphic in Tran's tweet. It looks like a listing for payday loan companies in the southern US 10 years ago. That was a rise and fall just like the Shake Weight and Ronco Rotisserie Chicken Cooker.

here's a recent article that highlights the high demand for SME loans in Vietnam.

SMEs are struggling and need money - no doubt. But making money in lending is more about collecting on the debt than it is on lending (or having money to lend)

Fintech lending platforms to answer Vietnam’s SME funding crunch

So, its all good if Fvndit has money to lend -- because demand is high. What one needs to do is track the performance of the company and its ability not just to lend - but to collect on their loans.

_____________

ps... I personally carry private loans (one secured by real estate) that are default, so I know what I'm talking about.

Dood, gotta say, I like you. You seem to be sincere and you appear to be willing to look objectively at your investment (I'm assuming you're a shareholder here).

Most of the time with penny stocks those who hold them only want to hear good things about their company. There is so much hype and so little objectivity.

Peter Lynch once said something that has stuck with me for decades. He said there's no need to jump into a stock, you can watch it from the sidelines and track its earnings over time and if they develop a successful track record you're safer buying in later even if the stock price is higher. (he had many multi baggers). My guess is the majority of ihubbers holding shares of VMNT have very little understanding of the lending business.

Here's an article from THE VIETNAM INVESTMENT REVIEW earlier this year worth a read:

Consumers risk higher defaults amid lending sector fluctuation

SNIPS:

According to Moody’s, the consumer finance industry in Vietnam is vulnerable to the disruptions given its risky borrower profile and heavy reliance on wholesale funding....Particularly, these three finance firms are of high exposure to unsecured products and are targeting the low-income sector, which is the most vulnerable to economic fallout.

[FULL ARTICLE HERE]

ps... I have a fundamental grasp of lending but nothing near what the pros have --- check out the equations in this article.

Credit risk for Vietnamese Commercial Banks

Here's another article - older but relevant:

Why are foreign banks fleeing Vietnam?

SNIP: Recent reports indicate that bad debts at Vietnamese banks have hit 600 trillion dong (US$26.6 billion), most of which has not been rehabilitated through bankruptcy or market clearing distressed asset sales.

[full article here

Yes I understand, but it is not international. To become an international financial institutional takes a lot of effort, way beyond P2P funding and loans.

Since it is in Vietnam there is not any conflict of business interest.

A US customer is not going to be confused by trying to get a loan from eloan.vn unless they have a bank account in Vietnam, then maybe..just doubtful. If there was conflict or trademark infringement U.S. based E-Loan would be in court with them.

One isn't stealing business from the other.

This https://www.eloan.com/ is a Puerto Rico company.

I'm just sayin' there's a lot of other eloans out there.

While I can't answer for their business actions, it appears to be a company registered in Vietnam, hence the .vn in the URL. The eLoan you added the link to is a U.S. based company from Puerto Rico and falls under U.S. banking laws on U.S. originated loans.

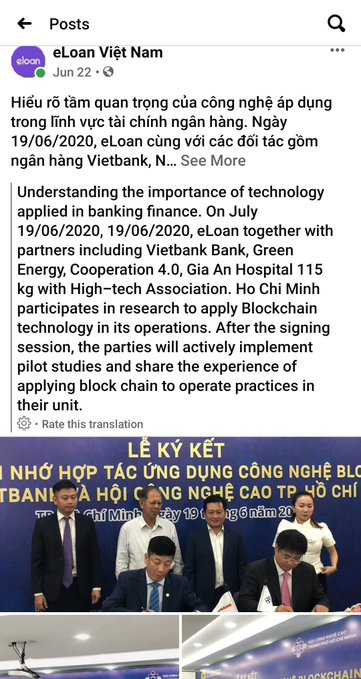

The eLoan from Fvndit likely does finance in Vietnam subject to their government's laws.

Appears to be two different companies, two different countries, not in conflict with each other as their business does not overlap.

Why did Fvundit use the name eloan which is already in use

https://www.eloan.com/

and trademarked by so many others?

https://trademarks.justia.com/search?q=eloan

I just read that article he tweeted.

|

Followers

|

47

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1462

|

|

Created

|

07/01/16

|

Type

|

Free

|

| Moderators | |||

About Us

Vemanti Group is a holding company that seeks to grow and create value through acquisitions, integration, investment, and development of emerging technology companies. We team up with game-changing entrepreneurs to build market-transforming businesses. As managers and investors, we strive to be the best partners for entrepreneurs building solid companies with significant growth potential. We aim to create partnerships with management at the earliest stages of creation and support them as their companies grow and evolve. We focus in mainly high-growth markets, seeking to create value and growth for our businesses and shareholders throughout economic cycles. We plan and operate our businesses in an integrated "ecosystem” manner which we believe distinguishes us from other companies.

Our Strategy

Vemanti invests in small, privately held early-stage companies, utilizing their unique high-tech talent, to serve the emerging, fast-growing markets of Vietnam and SE Asia. We mainly target FinTech and E-Commerce firms with the potential for explosive growth.

Our management team, including Board of Directors and Board of Advisors, has decades of experience creating and managing businesses in the high-tech industry along with deep experience in International deals. We understand cross-border transactions, what drives deal flow, and how to successfully integrate and accelerate the growth of portfolio companies.

The team was assembled for the express purpose of sourcing attractive investment and M&A opportunities, developing and scaling them, and building valuation for Vemanti shareholders.

Our Advantage

When it's time to execute, everything comes down to ground-level experience. Most fintech innovations are coming from the emerging economies of SE Asia where most people are underbanked, or in some cases, unbanked. Instead of just focusing on startups that are replicating solutions that have already been proven successful in developed economics, we specifically target ones with products and technologies that are truly disruptive and foundational to local/regional consumers and businesses. Examples are financial technology startups in the Southeast Asian countries of Vietnam, the Philippines, Cambodia, Laos, and Myanmar – countries where the financial infrastructure is still relatively underdeveloped despite their hot economic growths. Having to deal with unique cultures and styles of doing business, very few US investment companies have the actual understanding and experience of building up a startup business in Asia. Our team is comprised of seasoned executives who have deep business ties and connections from years of doing business in the region.

.png)

.png)

NEWS:

NEWS:

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |