Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

#USLVF: LOOKING FOR $100...![]()

NAK Pebble Mine, Alaska. Pebble Mine is one of the largest undeveloped reserves of copper, molybdenum, and gold in the world.

https://www.instituteforenergyresearch.org/renewable/pebble-mine-could-reduce-dependence-on-china-for-critical-metals/

Where's everyone at? Heard there's a party going on...

#USLVF: BREAK OUT $25.60...![]() $43 SILVER HERE WE COME ..

$43 SILVER HERE WE COME ..![]()

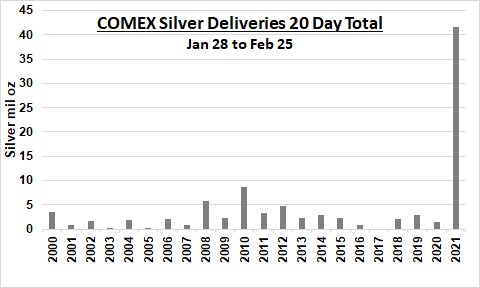

#USLVF: 29.5 mil silver oz were delivered at COMEX yesterday.

This is one of the top 5 amounts since 2000.

20 day total is now 41.5 mil.

5X higher than 2010 the next closest year

29.5 mil silver oz were delivered at COMEX yesterday.

— Garrett Goggin, CFA & CMT (@GarrettGoggin) February 26, 2021

This is one of the top 5 amounts since 2000.

20 day total is now 41.5 mil.

5X higher than 2010 the next closest year pic.twitter.com/ovRFVML7BF

#SIL; Silver Miners ETF (SIL)(SILJ) Testing 9-Year Resistance Level!

But silver prices are elevated and the Silver Miners (SIL) are hanging around this level. IF SIL can break out above resistance at (1) its upside target would be the $75 level at (2). Stay tuned!

https://www.seeitmarket.com/silver-miners-etf-testing-9-year-breakout-level/

https://www.zerohedge.com/news/2021-02-04/silver-miners-etf-testing-9-year-resistance-level

In less than a year’s time, the price of Silver has rallied from around $12 dollars to the recent highs just over $30.

That’s quite a rally!

And when Silver is in rally mode, it benefits the entire industry, including the Silver Miners.

Today’s chart is a long-term “monthly” view of the Silver Miners ETF (SIL). As you can see, the $52 mark at (1) has been support and resistance for the past 9-years or so. Though SIL has seen some big rallies from deep lows, it has been confined by this resistance level.

And it appears to be the case again in the early going of this month. On February 2nd, $SIL popped to just over $51.35 intraday before reversing lower (and now trading around $42).

But silver prices are elevated and the Silver Miners (SIL) are hanging around a 9-year resistance, which is heavy until proven differently!

. IF SIL can break out above resistance at (1) its upside target would be the $75 level at (2). Stay tuned!

This article was first written for See It Markets.com. To see the original post CLICK HERE.

https://www.seeitmarket.com/silver-miners-etf-testing-9-year-breakout-level/

#USLVF: $50 SILVER IN FEBRUARY 2021...:-}

https://goldswitzerland.com/maldistribution-of-wealth-silver-investment-of-the-decade/

https://goldswitzerland.com/wp-content/uploads/2020/10/adj.jpg

MALDISTRIBUTION OF WEALTH & SILVER – INVESTMENT OF THE DECADE

October 15, 2020

By Egon von Greyerz

The Founding Father and President Thomas Jefferson understood the extreme danger in handing over the issuance of the money to the bankers:

“The central bank is an institution of the most deadly hostility existing against the Principles and form of our Constitution. I am an Enemy to all banks discounting bills, or notes for anything but Coin. If the American People allow private banks to control the issuance of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the People of all their Property until their Children will wake up homeless on the continent their Fathers conquered.” – Thomas Jefferson. (1743-1826).

If we look at just one example of “depriving the People of their Property” as Jefferson stated, the consequences for the ordinary man are devastating.

According to Federal Reserve Data, the richest 59 Americans have a wealth of $2 trillion which is the same as the wealth of poorest 50% or 165 million people. If we instead take the richest 1%, their wealth in Q2 2020 is $34 trillion or 17x the poorest 50%.

MALDISTRIBUTION OF WEALTH

This maldistribution of wealth leads to extreme poverty as Jefferson said and eventually to social unrest or revolution. This is what we are seeing the beginning of in the US currently.

Central banks and bankers robbing the poor and favouring the rich whilst destroying the economy and the currency have been the norm in history rather than the exception. I have quoted the Jefferson contemporary, Mayer Amsel Rothschild’s (1744-1812) words numerous times: “Permit me to issue and control the money of a nation and I care not who makes the laws.” Jefferson clearly didn’t appreciate bankers like Rothschild.

JOHN LAW & JEKYLL ISLAND

The world is now entering the end of yet another century long era when bankers and central bankers have managed to issue and control the money in an unlimited and immoral manner. But unscrupulous bankers have existed throughout history. John Law in France and his Mississippi Company during the early 1700s comes to mind. He obtained control of the money from King Louis XV, and quickly destroyed the currency and bankrupted a lot of people.

The plans for a similar coup as Law’s was performed by a number of bankers and the US Treasury Secretary on Jekyll Island in 1910. This is where the idea of the Fed was born as a private bank, owned and controlled by private bankers with the right to issue the nation’s currency.

THE FED AND THE BANKERS CAN ONLY WIN

From the banks point of view, the Fed has been the most beautiful construction and much more robust than Law’s bank since it is a century old. As a result of the Fed’s creation, private bankers have not only been in a position to create unlimited wealth for themselves and their friends like hedge funds and private equity companies. But they have also avoided taking any losses. In 2007-09 as the financial system was on the verge of collapse, governments had to absorb $10s of trillions of losses whilst the bankers had their normal major bonuses paid out that year too. The New York Fed was in charge of $29 trillion in bailouts. Congress never approved the bailout funds nor was it aware that they existed!

Morgan Stanley was one of the biggest recipients of the bailout, receiving $2 trillion. Interestingly, Morgan Stanley’s Hedge Fund Front Point LLC also received Fed support. This was the fund featured in the book and film “The Big Short” (a must read/see). So the Fed was forced to support a hedge fund which was shorting all the banks the Fed was forced to rescue. By the end of 2007 Morgan Stanley’s leverage was nearer 40%. No wonder they had to be saved by the Fed.

PLUS ÇA CHANGE ….. THE MORE IT CHANGES, THE MORE IT STAYS THE SAME

Interestingly, the New York Fed is in the same position today and is responsible for handing out funds from a number of lending facilities to rescue many US banks which are in trouble again. As always, the names of the banks receiving support and the amounts are kept confidential.

On top of the special facilities, the Fed started Repos in September 2019. In January 2020 these Repos had reached $6 trillion. By March the Repos were at $9 trillion. According to a report by the BIS, four large banks and hedge funds were the beneficiaries of the Repo debacle.

So who are the largest shareholders of the New York Fed? Surprise, surprise, they are the same people that had to be rescued in 2008, Morgan Stanley, Goldman Sachs, JP Morgan Chase, and Citigroup. Incidentally, these banks also have the biggest/riskiest derivative positions of all US banks.

What a wonderful position to be in. These major banks can take unlimited positions and risk, knowing that as major shareholders of the central bank, they can always rescue themselves at the expense of the government and the taxpayers. And this naturally at no cost to either their own banks and nor to the Fed that they control and own.

POWER CORRUPTS

What a marvellous construction, devised by the bankers over a century ago on Jekyll Island. They were the true descendants of Mayer Amschel Rothschild. But they did not just set up a structure so that they could control the money. They also succeeded in conning both congress and the government to hand over control of the whole caboodle to give them ultimate control and power.

Power corrupts and ultimate power even more so. And corruption eventually leads to the downfall of not just of the perpetrators but of the whole bogus edifice they have created. Unlimited money printing and credit creation will inevitably destroy the currency and the financial system as von Mises said: “There is no means of avoiding the final collapse of a boom brought about by credit expansion….”

IT IS ALL ABOUT RISK

The expertise of myself and our company is to analyse and understand risk and come up with solutions to protect wealth. We clearly don’t possess the ability or means to save the world or the financial system. Instead our passion is to advise and assist the people who are interested in preserving or insuring their assets.

We are now approaching the end of century long chapter in the world economy which will make financial history. Like most eras of excessive debts and spending combined with false markets and fake money, this one will end badly too. But the difference this time is that there is not just one nation or continent which is involved but virtually every country in the world. Thus, we have reached the end of the road and the central bankers’ safety net will not be strong enough as it only consists of worthless fake money.

The only hope is Deus ex Machina or god from the machine. This was how hopeless situations were rescued in the ancient Greek plays. A figure (god) was lowered onto the stage to solve the insoluble problem. Sadly, I doubt that this will be the case this time.

(The picture below was made for an article I wrote back in 2011.)

WEALTH PRESERVATION

I have for 18 years, in numerous articles on KWN and on our website – GoldSwitzerland.com – discussed the virtues of wealth preservation in the form of physical gold stored outside the banking system.

The acceleration of deficits and debts will further speed up money creation on a global scale, never seen before in history. This will lead to a total debasement of all currencies as they decline to their intrinsic value of ZERO. They are already down 97-99% in real terms since 1971 which means measured in gold. The death of the dollar and most major currencies is likely to take place in the next 2-5 years as governments print unlimited amounts.

Gold is the king of the metals and is the only money which has survived in history. But the crown prince of the precious metals is silver and in the next few years, silver is likely to have the most spectacular surge.

Silver was $50 in 1980 and again reached that level in 2011. At $25 today, silver is the most incredible bargain of any asset. Just as gold has been money for 5,000 years, silver has during many periods in history been the principal currency. For example the French word Argent means both silver and money.

SILVER – THE INVESTMENT OF THE DECADE

Silver is both an industrial as well as precious metal. It is used in many electric and electronic products. Also, the demand for photo-voltaic or solar panels is expected to explode in the next 5-10 years.

Out of 850 million ounces ($21 billion) of annual mine production, (27,000 tonnes), 66% is for industrial use. With a major increase in production of solar panels, that percentage is likely to grow substantially. As jewellery absorbs 25% of mine production, there is only 10% left for making coins and bars. Scrap silver makes up some of the difference but there is normally an annual shortage of silver.

As demand for gold increases, silver demand will grow substantially as we have seen in 2020. Silver has always been seen as the poor man’s gold and as gold prices will become too expensive for many investors, they will instead buy silver.

The gold silver ratio reached almost 130 in April which was an extreme. See chart. It is now down to 77 and likely to initially reach 30 where it was in 2011. Eventually we are likely to see the ratio back to the historical average of 15 or even 10 which the ratio of silver to gold in nature.

The Brokers Are Breaking... Again

Monday, Feb 01 2021 - 9:49

With another day of most shorted stocks ramping higher, most notably the squeeze in silver, users of multiple discount retail brokerages are reporting issues or outages.

https://www.zerohedge.com/markets/brokers-are-breaking-again?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+zerohedge%2Ffeed+%28zero+hedge+-+on+a+long+enough+timeline%2C+the+survival+rate+for+everyone+drops+to+zero%29

Where is this trading? E*TRADE doesn’t have

SSSHHHH! I wanna buy some at the open...

I don’t know if they can move a silver futures market. Maybe. This the best bang for the buck or AGQ?

Both should respond to slv running

#USLVF: Reddit Investors Talking About Targeting Silver...:-}

https://www.silverdoctors.com/silver/silver-news/now-reddit-investors-are-talking-about-targeting-silver-and-that-could-change-everything/

http://theeconomiccollapseblog.com/now-reddit-investors-are-talking-about-targeting-silver-and-that-could-change-everything/

Now Reddit Investors Are Talking About Targeting Silver, And That Could Change EVERYTHING...!

The small fish are fighting back, and the big fish have good reasons to be quite scared…

by Michael Snyder of The Economic Collapse Blog

For decades, the big fish on Wall Street have been able to do virtually anything that they want, but now the small fish are fighting back and it has been a beautiful thing to watch. Finally it is payback time, and the losses have been absolutely staggering. In fact, Reuters is reporting that short sellers have lost more than 70 BILLION dollars so far this year. But nobody should be crying for the short sellers. As Charles Payne pointed out during an epic rant on Fox Business, the short sellers have ruthlessly crushed countless businesses over the years, and they did so without showing any mercy whatsoever.

So now the big hedge funds want mercy themselves?

It’s not likely to happen.

After sending GameStop, AMC and other beleaguered stocks into the stratosphere, now investors on Reddit are talking about going after a really huge whale.

The silver market is perfectly primed for an epic short squeeze, and a coordinated assault by retail investors could make it happen.

The following is an excerpt from the post on the “WallStreetBets” Reddit subgroup that everyone is talking about…

The silver futures market has oscillated between having roughly 100-1 and 500-1 ratio of paper traded silver to physical silver, but lets call it 250-1 for now. This means that for every 250 ounces in open interest in the futures market, only 1 actually gets delivered. Most traders would rather settle with cash rather than take delivery of thousands of ounces of silver and have to figure out to store and transport it in the future.

The people naked shorting silver via the futures markets are a couple of large banks and making them pay dearly for their over leveraged naked shorts would be incredible. It’s not Melvin capital on the other side of this trade, its JP Morgan. Time to get some payback for the bailouts and manipulation they’ve done for decades (look up silver manipulation fines that JPM has paid over the years).

The way the squeeze could occur is by forcing a much higher percentage of the futures contracts to actually deliver physical silver. There is very little silver in the COMEX vaults or available to actually be use to deliver, and if they have to start buying en masse on the open market they will drive the price massively higher. There is no way to magically create more physical silver in the world that is ready to be delivered. With a stock you can eventually just issue more shares if the price rises too much, but this simply isn’t the case here. The futures market is kind of the wild west of the financial world. Real commodities are being traded, and if you are short, you literally have to deliver thousands of ounces of silver per contract if the holder on the other side demands it. If you remember oil going negative back in May, that was possible because futures are allowed to trade to their true value. They aren’t halted and that’s what will make this so fun when the true squeeze happens.

That post has already been upvoted more than 9,400 times, and it appears that a consensus is building that this is going to be the next big thing after the raid on GameStop short sellers is done.

On Thursday, the price of gold was up 4.5 percent in anticipation that something might happen, and much of that price movement was apparently caused by short sellers that feverishly rushed to close their positions…

“After watching GameStop (NYSE:GME) and other shorts getting blasted, rumours that silver could be targeted has traders preemptively covering shorts just in case,” said Tai Wong, a trader at investment bank BMO in New York.

Of course the other side doesn’t exactly play fair.

On Thursday, Robinhood and other trading platforms suddenly restricted trading in some of the key stocks that retail investors have been targeting…

Shares of AMC Entertainment Holdings, BlackBerry Ltd., Bed Bath & Beyond Inc., Express Inc., GameStop Corp., Koss Corp., Naked Brand Group and Nokia Corp. have been restricted to “position closing only,” Robinhood said in a blog post.

The decision means traders cannot initiate new positions in shares of those companies and can only sell existing holdings. The company also raised margin requirements for certain securities.

There are allegations that Robinhood and other trading platforms were persuaded to shut down trading in those stocks by the big fish on Wall Street, but Robinhood and the other trading platforms are denying this.

And Robinhood is also denying that it forced some users to suddenly dump their shares in GameStop and other key stocks…

No, Robinhood tells The Verge, it didn’t sell off full shares of GameStop, AMC, and other buzzy stocks without permission from its traders.

That contradicts the stories of twelve people who spoke with The Verge, saying that the app unexpectedly sold off their holdings in some of these companies. Quite a number of Robinhood users expressed their surprise on social media today that the app was selling off their stakes, and we tracked down a dozen of them. These traders didn’t believe they had prompted the sales, and they said they weren’t aware of anything on their account that would have automatically triggered them.

Hopefully authorities will investigate and get to the bottom of what actually happened.

At this point, Robinhood has already been slapped with two lawsuits because of what took place on Thursday…

Two Robinhood users filed separate lawsuits against the brokerage app Thursday after it and other apps restricted trading of certain securities.

The first lawsuit filed in the Southern District Court of New York alleges that Robinhood “purposefully, willingly, and knowingly” restricted certain securities transactions, including GameStop. The other filed in the Northern District Court of Illinois alleges that the app manipulated its platform.

And it is being reported that the House and the Senate will both be holding hearings on the matter…

The U.S. House Financial Services and Senate Banking committees said on Thursday they will hold hearings on the stock market after users of investment apps faced trading limits following the “Reddit rally” that put a charge into GameStop and other volatile stocks that were touted in online forums.

“We must deal with the hedge funds whose unethical conduct directly led to the recent market volatility and we must examine the market in general and how it has been manipulated by hedge funds and their financial partners to benefit themselves while others pay the price,” said Representative Maxine Waters, a Democrat who heads the House panel.

After everything that just went down, I don’t know how Robinhood is going to survive.

There are also rumors of a “liquidity crisis” at Robinhood, but the company insists that those rumors are simply not true.

Meanwhile, the firm has “tapped at least several hundred million dollars” in emergency credit in recent days…

Robinhood Markets, the trading app that’s popular with investors behind this month’s wildest stock swings, has drawn down some of its bank credit lines to ensure it has enough cash to clear trades, according to people with knowledge of the matter.

The firm, according to one of the people, has tapped at least several hundred million dollars, a significant amount of money for a firm that was valued at about $12 billion a few months ago. Robinhood’s lenders include JPMorgan Chase & Co. and Goldman Sachs Group Inc., according to data compiled by Bloomberg. Representatives for Robinhood and those banks declined to comment.

I have a feeling that this story is not going to end well for Robinhood.

But for the retail investors that are changing the course of history, this is truly an amazing time.

Finally, the small fish are standing up for themselves and are fighting back against the big fish, and the big fish have good reason to be quite scared.

***Michael’s new book entitled “Lost Prophecies Of The Future Of America” is now available in paperback and for the Kindle on Amazon.***

About the Author: My name is Michael Snyder and my brand new book entitled “Lost Prophecies Of The Future Of America” is now available on Amazon.com. In addition to my new book, I have written four others that are available on Amazon.com including The Beginning Of The End, Get Prepared Now, and Living A Life That Really Matters. (#CommissionsEarned) By purchasing the books you help to support the work that my wife and I are doing, and by giving it to others you help to multiply the impact that we are having on people all over the globe. I have published thousands of articles on The Economic Collapse Blog, End Of The American Dream and The Most Important News, and the articles that I publish on those sites are republished on dozens of other prominent websites all over the globe. I always freely and happily allow others to republish my articles on their own websites, but I also ask that they include this “About the Author” section with each article. The material contained in this article is for general information purposes only, and readers should consult licensed professionals before making any legal, business, financial or health decisions. I encourage you to follow me on social media on Facebook, Twitter and Parler, and any way that you can share these articles with others is a great help. During these very challenging times, people will need hope more than ever before, and it is our goal to share the gospel of Jesus Christ with as many people as we possibly can.

#USLVF: : READY TO DOUBLE...![]()

#USLVF: The Silver Roadmap...:-}

My target price over the next few years is for silver to reach at least $300. How I reach that number is a topic for a future article. But before you think I’m crazy, I can assure you that it’s an estimate relating to the gold price, and based on how gold and silver have performed in previous bull markets.

If silver reaches my target of $300, that will be a 1,150% return from its current price near $25.

https://www.silverdoctors.com/silver/silver-news/the-silver-roadmap/

Still hasn't hit $19 yet...

Good dd. .

Thanks for the heads up . .

You on ta duty . . lets have a good year . .

Last year was epic for silver . .

Covid. . not so much . .

#USLVF: Silver: A Powerful Advance Believed Imminent....:-} $43 SILVER

https://www.silverdoctors.com/silver/silver-news/silver-a-powerful-advance-believed-imminent/

The silver setup could scarcely look better…

by Clive Maund of Streetwise Reports

The silver setup could scarcely look better. We have already seen how gold is in position to slingshot vertically higher out of a giant Bowl pattern, having already made new highs last year. While silver’s chart does not look as strong as gold’s—yet—that is normal at this stage in the cycle.

On silver’s latest 13-yeat chart we can see how, after breaking out of its giant base pattern in the middle of last year, it was beaten back by the resistance shown to then successfully test the breakout point, and has already started higher again and this time it should have little trouble driving through this resistance because the dollar is collapsing. Note how strong the volume indicators are on this chart, with the Accumulation line already making new highs.

The 1-year chart is most interesting as it shows us in detail all that has happened during what has turned out to be an eventful year for silver. Back last March silver suffered a false breakdown from the giant Double Bottom base pattern shown on the 13-year chart, which was triggered by the general market crash at that time. It then recovered and went on to make a decisive breakout from the base pattern in July which sparked a strong rally. This rally was capped by a quite strong zone of resistance whose origins are visible on the 13-year chart, leading to a normal reaction back to test what had become support at the upper boundary of the giant base pattern, after which it has started higher again with what is believed to be a major new uptrend now gaining traction. With the dollar believed to be heading for freefall, silver looks set to have little trouble driving through the resistance shown and could soon ascend to challenge its 2011 highs surprisingly quickly.

On the 6-month chart we can see recent action in more detail, and in particular how silver looks like it is on the point of breaking out of the small bull Pennant that has formed over the past week or two. Note the bullish volume pattern as this Pennant has formed, how momentum (MACD) is swinging positive and the strongly bullish alignment of price and moving averages.

The conclusion is that silver is headed much higher and soon, and so therefore are silver ETFs and most silver mining stocks.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London

#USLVF: We got the close over $27...![]() NOW WE FLY dubc....

NOW WE FLY dubc....![]() Holding for $34-$38.....USLVF $323....!

Holding for $34-$38.....USLVF $323....!

Happy New Year . .

140 . . 150 . . it is . .

. . ; )

200000* 119.50 = $23,900,000 = peter s type ish . .

. . ; )

Have a good Christmas everyone !!!

Saw that 200000 @119.50 . . Interesting . .

Should be starting soon hopefully . .

#USLVF: WHO BUYS 200'000 SHARES @$120....?

Volume is so low actually jks . .

Friday consolidation . .

140 this week . . tGiM . .

(Or 90)

. . ; )

Hindsight is 2020 . .

(Chart shows nov 23~30 reversal . . I think)

. . ; )

#USLVF: THE. NEXT LEG WILL START WITH A CLOSE OVER $27 ...![]()

#USLVF: We will SEE $300 PPS in 2021...:-}

To bad for those that don't see what is coming/...:-}

Watch the scale on the left of this chart...:-]

DOLLAR SPIKES COMING....!

http://www.kitco.com/images/live/silver.gif

I think its less diluted that way . . new year run might start soon though . . glta . . ts2021 . .

USLVF volume is so bad. No one cares about this even though silver is going up...

#USLVF: WoW ! Increase In U.S. Money Supply In Past Two Weeks...!

$100 SILVER coming in 2021...:-}

https://www.silverdoctors.com/headlines/world-news/shocking-increase-in-u-s-money-supply-in-past-two-weeks/

#USLVF: Almost at $19 Silver...:-]

http://www.kitco.com/images/live/silver.gif

Silver needs to reset and hit $19 first IMO. Will be a perfect retrace to previous highs, then we can go for $49...

#USLVF:.The.First.Leg is coming to an END...:-}$36 SILVER COMING SOON...!

https://www.silverdoctors.com/silver/silver-news/silver-the-former-industrial-metal-silver-price-surges-as-copper-crude-oil-get-crushed/

Silver, The FORMER Industrial Metal: Silver Price Surges As Copper & Crude Oil Get Crushed

USLVF....=.....$320.00

The notion that silver is just an “Industrial Metal” was utterly destroyed today. The silver market is rapidly changing...

by Steve St Angelo of SRSrocco Report

The notion that silver is just an “Industrial Metal” was utterly destroyed today as both the copper and oil prices were crushed as silver surged higher. This is precisely what I was looking for as a positive sign showing that silver is now disconnecting itself from the INDUSTRIAL METAL BALL & CHAIN.

While analysts will continue to regurgitate that the future silver price depends on industrial demand, we can now take this analysis and throw it into the dustbin. The world is heading into a new paradigm of “Building Wealth to Protecting Wealth.” And let me tell you, you cannot protect wealth in most STOCKS, BONDS, or REAL ESTATE. Those days are over for good.

Unfortunately, 99% of investors still haven’t figured that one out yet… but they will.

Today, it was quite an impressive day for silver (and gold) as the metals surged higher while copper, the king industrial metal, got destroyed. Here is a chart of the copper price versus silver.

https://www.silverdoctors.com/wp-content/uploads/2020/10/Copper-Silver-Price-OCT-01-2020-768x567-1.jpg

As we can see, copper is down 5% while silver is up 2%. Thus, the leading indicator of the global economy, COPPER, just put out a very BAD SIGNAL, indeed. Now, if silver was just a mere industrial commodity, why didn’t its price follow along with copper???

And, if that isn’t bad enough, take a look at the WTI Oil price. The West Texas Intermediate oil price was down 5% as well.

https://www.silverdoctors.com/wp-content/uploads/2020/10/WTI-OIL-Silver-Price-OCT-01-2020-768x579-1.jpg

With the U.S. oil price falling $2 in one day, that just wiped out $21 million in oil revenues to the oil companies. This is also terrible news for the U.S. Shale Oil Industry is being held together by DUCT TAPE, BAILING WIRE, and ELMERS GLUE.

David Brady: The Next Silver Rally will Dwarf the Gold Rally

Mark O'Byrne: Silver Should be 10x Higher

146.66 d@ng . .

Have to see . .

Still low volume with bid ask shuffle . .

. . tgim . . glta . .

. . ; )

. . 153 pm . .

. . tgim . .

. . ; )

Anyone trying to buy more shares? Its not allowing me to buy on open market...have to call brokerage to place trade. No problem of selling. Anyone has similar experience?

. . still can't get over the low volume . .

|

Followers

|

99

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

6921

|

|

Created

|

10/18/11

|

Type

|

Free

|

| Moderators | |||

https://www.velocityshares.com/etns/product/uslv/

![]() Fact Sheet VelocitySharesTM 3x Long Silver

Fact Sheet VelocitySharesTM 3x Long Silver ![]() Prospectus

Prospectus

| Live Spot Silver Price |

| Live Spot Gold Pirice |

|  |

|

|

|

|

http://www.velocityshares.com/

https://www.facebook.com/JanusHendersonUS

https://twitter.com/JHIAdvisorsUS

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |