Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

When compared to some of the other generics companies, Vancpharma looks very undervalued based solely off of its standing drug portfolio, not to mention its ability to scale quickly.

The two best comparables that come to my mind are: Paladin Labs and BioSyent.

Vanc Pharmaceuticals is nothing like the company it used to be.

Since the new management team stepped in, Vanc has completed revamped its business model and is now focusing on providing Canadian healthcare professionals and consumers with high-quality, affordable generics and over-the-counter ("OTC") healthcare products.

This company looks like its going to be a great one. I just started looking into it. It all Sounds Good!

NPH Vanc Pharma

Has anybody had a chance to visit this place in Richmond?

New Web Site: http://www.nuvapharm.com

Alda Pharmaceuticals Corp. changed to Nuva Pharmaceuticals Inc.

http://www.otcbb.com/asp/dailylist_detail.asp?d=07/25/2013&mkt_ctg=NON-OTCBB

Alda Pharmaceuticals director McCoy resigns

2012-12-05 16:12 ET - News Release

Dr. Terrance Owen reports

DR. MCCOY RESIGNS AS A DIRECTOR AND JOINS ALDA'S ADVISORY BOARD

Alda Pharmaceuticals Corp. director Dr. William McCoy has resigned, effective Nov. 28, 2012, and has joined the company's advisory board.

In 2005, Dr. McCoy became a director of Alda and chief technology officer of Phigenics LLC, a life sciences technology company based in Chicago, Ill. In 2001, he received the Intellectual Property Law Association inventor of the year award, and a medal for outstanding contribution to management and science from the International Water Association in Berlin. He has served the American Society of Heating, Refrigerating and Air-conditioning Engineers (ASHRAE) as chair of the environmental health committee, and is presently chair of the committee developing a new standard: preventing legionellosis associated with building water systems. Dr. McCoy authored a full-length book, "Preventing Legionellosis," in 2006, and holds 29 patents in diagnostics, control and manufacturing of anti-microbials. Dr. McCoy's expertise in infection control will be an important asset to the company as it continues the development of its T36 technology.

The company wishes to thank Dr. McCoy for his service as a director and welcomes him to the advisory board. He joins Dr. Brian Conway, who is an internationally recognized researcher in the field of infectious diseases. The company is expecting to appoint additional equally qualified individuals to its advisory board to reflect its focus on the acquisition of the global marketing and sales rights to novel generic, over-the-counter and natural pharmaceutical products.

The company currently has a vacancy on its board of directors and is seeking a qualified person who can contribute to this new international pharmaceutical marketing effort.

We seek Safe Harbor.

Alda Pharmaceuticals arranges $1-million financing

2012-12-03 18:46 ET - News Release

Mr. Terrance Owen reports

NON BROKERED PRIVATE PLACEMENT FINANCING

Alda Pharmaceuticals Corp. has arranged a non-brokered private placement of up to 10 million units at a price of 10 cents per unit for gross proceeds of up to $1-million.

Each unit will consist of one common share of the company and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share of the company for a period of 24 months at a price of 20 cents per common share.

Any finder's fee will be paid by the company in accordance with the policies of the TSX Venture Exchange.

Proceeds from the offering will be used by Alda for general corporate and working capital purposes.

The above private placement is subject to all regulatory and board approvals.

Alda appoints Beukman, Kennedy directors

2012-11-15 18:04 ET - News Release

Mr. Terrance Owen reports

NEW DIRECTORS JOIN THE BOARD OF ALDA

Eugene Beukman and Tom Kennedy have joined the board of directors of Alda Pharmaceuticals Corp., effective immediately.

Mr. Beukman is the corporate counsel of the Pender group of companies, a position he has held since January, 1994. He graduated from the Rand University of Johannesburg, South Africa, with a bachelor of law degree and a bachelor of law honours postgraduate degree in 1987. He has over 30 years experience in the acquisition of assets and joint ventures. He is president and director of a number of publically traded companies on the TSX Venture Exchange.

Mr. Kennedy is a graduate of the University of British Columbia, having received his bachelor of commerce and business administration degree in 1973 and his juris doctor degree in 1974. Mr. Kennedy was admitted to the B.C. bar in 1975 and has practised law for 36 years. After seven years of employment with the Canadian Federal Department of Justice, Mr. Kennedy has primarily focused as a legal, financial and business consultant to publicly traded companies. Mr. Kennedy is currently a member of the Law Society of British Columbia, the Canadian Bar Association and the British Columbia Bar Association and an associate member of the American Bar Association. Mr. Kennedy currently serves in positions as chief executive officer, president, vice-president and secretary of several TSX Venture Exchange and Canadian National Stock Exchange publicly traded companies, primarily focused on mineral exploration.

Mr. Beukman and Mr. Kennedy replace Dr. Ronald Zokol and Dr. Linda Allison, who have served as directors since 2003 and have resigned from the board as of Nov. 13, 2012. The company wishes to express its gratitude to Dr. Zokol and Dr. Allison for their long service as directors and wishes them well in their future endeavours.

We seek Safe Harbor.

Dr. Owen:

I have to say that you are doing a fantastic job at growing the company since the consolidation. We are all extremely impressed with your ability to operate a company in such an exemplary manner. Bravo and keep up the great work. We are all looking forward to hearing about all of the wonderful new ideas coming down the pipeline. Good day to you sir and may life bring you nothing but happiness and good health.

*******

__________________________________________________________________

Do I sense a hint of sarcasm in your message?

Progress has not been as rapid as I had hoped. If you were in my shoes, you would see that much of what needs to be done in public companies is laying ground work and waiting. It is frustrating but comes with the territory.

Regards,

Terry Owen

Nanotech Systems apppoints Owen as Chief Executive Officer, effective May 1, 2012.

(RTTNews) - Nanotech Systems, Inc. said Tuesday that it has appointed Dr. Terrance Owen as Chief Executive Officer, effective May 1, 2012.

Dr. Owen is the co-founder and has been the President and CEO of ALDA Pharmaceuticals Corp., which has developed novel, patented, OTC infection control therapeutics for topical use, since 2000. From 1980 to 2002, he was the President of Helix Biotech , which provided DNA testing services for paternity, immigration and forensic cases across Canada. From 1995 to 1998, he was also the President of Helix BioPharma Corp.

Dr. Owen has 25 years of executive experience with publicly-traded life sciences companies in Canada and the US. He will be responsible for maintaining Nanotech's listing on the Frankfurt Stock Exchange, which is eliminating its First Quotation Board and requiring companies to meet the Entry Standard listing requirements by December 15,2012.

by RTT Staff Writer

http://www.rttnews.com/1929544/nanotech-systems-appoints-terrance-owen-as-ceo.aspx?type=qf&utm_source=google&utm_campaign=sitemap

NR on Stockhouse re: debts

So as you should see, sp back down now. This POS slime-bag Owen, is nothing but a crook. Instead of building Alda into a real company, with real products, he preferred to screw investors, and run with the $$$. He is the lowest of the low, and I hope he's reading this.

As long as Owen is in control you can be sure this has nothing to do with production or sale of any product... I should also add promotion of those products.

Darned if I know ... is there actually a location with product that is being sold and moved ... is the downtown office all there is and is it about business deals only rather than Alda's products?

Someone dropped $56,000 into Alda in April. What's going on?

Interesting, but it's not surprising to see that the Alda gang were never that focused on making Alda a success.

Here's something I found on SH, and it might be an option for Alda.

"I'm not sure if this idea is feasible, but maybe Alda could license their products to a good MLM networking company. If only the hand sanitizer itself is everything it's cracked up to be I'm sure there would be interested parties. They got the patents, FDA approval, etc. Alda dosen't have to do any of the leg work, which we know they are incapable of anyway. They would still own the brand, well receiving royalties on sales. What's wrong with this idea?"

Seems like a good solution to me

Alda gang and Fortunate Sun Mining

May 08, 2012

Fortunate Sun Mining Grants Stock Options

VANCOUVER, BRITISH COLUMBIA--( May 8th, 2012) - Fortunate Sun Mining Company Ltd. (TSX VENTURE:FSM) announces that pursuant to its stock option plan, the Company has granted incentive stock options to its directors, officers and consultants to purchase in the total of 1,725,000 common shares in the capital stock of the company, subject to regulatory approval, exercisable for a period of five years, at a price of $0.20 per share. Fortunate Sun Mining Company Ltd. is a junior mining expl... (2 KB)

May 02, 2012

Fortunate Sun Mining Board of Directors Re-Elected at Annual General Meeting

VANCOUVER CANADA: Fortunate Sun Mining Company Ltd. (TSX-V: FSM) (Fortunate Sun or, the "Company") is pleased to announce that at the Company's Annual General Meeting held on April 27, 2012 the following individuals were re-elected to the board of directors: Reg Advocaat, Peter Chen, Gary Nordin, Scott Young and Terrance Owen. In addition, Reg Advocaat has been re-appointed President & CEO of the Company and Peter Chen has been re-appointed as Chief Financial Officer. Reg Advocaat, ... (3 KB)

Fortunate Sun

Mining Company Ltd,

Suite 1502 - 1166

Alberni Street,

Vancouver, BC, V6E 3Z3

Canada

Complaining on Boards about the stock or the CEO,s is worth what is worth.......

The best way you can help..... is to write to all Presidents in the Whole World.......

Checking me out? For your information that other scam, FXIT, is run by a bunch of crooks just like Alda.

No I do not understand you Drumstick!!!

I lost $400K and I had the very best Co,s......I was using the best Broker either......So NOI do NOT understand you at all???

Alda had no money for BIG PUBLICITY and no one seem to be willing to buy is product ?????.....

Lets give it a rest to Alda......

BY the way, I noticed you are complaining as well on others stock .....is it worth it to go on and on and on ????......

You're right, I did'nt loose everything. Maybe I got a few hundred bucks left of the original 60,000 I invested. Again, there where spots when I should have bailed. But in 2009, when the Olympic deal was happening, along with the SD distribution, I thought that Alada was finally on it's way. What followed, I don't have to explain. I then came to 2 conclusions. Either these people were totally stupid, or there were other reasons for getting into the Olympics in the 1st place. That's when everything became clear. I then understood the game they were playing. Put out a positive NR, and the suckers would come running. SP then spikes, as insiders dumped. The last of these as I recall was the FDA approval. I firmly believe that this Owen crook was not stupid. This then leaves me to the conclusion that he, and his people, were screwing investors. I guess in the short term, when running a public funded company it's easier to take advantage of the cash flowing in via the market, than to actually market, and sell product. I believed in this company. I believed that considering all what was going on, H1N1, and hospital infections spelled a huge market potential for the Alda product line. There was, but unfortunately the person in charge was corrupt, and had no interest in doing the work required. Instead he preferred to do what was easiest. The cash was there, and he took it. Do you understand why I'm so pissed off?

Write to the POPE!!!- he is the first BANDIT!!!.....

I was referring to the whole crooked economic system in general. The US$ is on life support. It can't go on much longer. Even Canada is going to get hit. The system we live in is unsustainable. Just look at oil. This 1 industry makes up to 10% of the world's economy. I think it's safe to say that the majority of the environmental destruction on planet earth is related to the petrol industry. There are safe friendly alternatives to most of the products derived from the petrol industry. Just consider industrial hemp. This single plant, that has so many uses is illegal to grow in the US. This is pure insanity. There are many other examples, but my point for using the petrol industry as an example is that unfortunately the greed of those in power will not stop until they've destroyed everything. We could have free non-polluting energy today. The technology exists. So why don't we? Thousands of children starve to death every day around the world. On the other end investment bankers get 100 million dollar bonuses for stealing. We are all experiencing a repeat play of what's happened many times before. I guess this is kind of what it was like in the last days of the Roman Empire. You don't have to be a genius to see where this is all headed.

Do not understand why you are so "Resentful" toward Dr. Owen

He his not worse than the Majority of CEO's that run Co's.....

The WHOLE society has change for the worse.....greed is everywhere in every sector..... The Whole World is having problem

Me too I lost all my money but I "blame myself" for my stupidity

no use to play the "naive"card.....

I am sure you did not lost everything with Alda, not possible you invested all your money there.... to me,you do not seem to be so naive beside you had time to get out with not so great loss.....

Have a great day,

janet

I'm not interested in any stocks period. As far as I'm concerned the whole thing, the market in general is rigged. It's all about greed, with deceitful scum like this Owen prick running the show. Of course I realize that there are good companies out there like Apple for example, but even there, in many respects it's the same game. You see Janet when you honestly think about it, earning money for doing nothing dosen't make sense. Take a look at the pitiful state the US economy is in today. In my opinion this is the result of years, and years of these greedy, cheating psychos, Owen types, but on a much larger scale, who've been ripping off the system. Things got a lot worse with the internet, because it became too easy for people like me to get involved. I learned the hard way. I got into Alda 5 years ago because I liked what I saw based on the products, and what I saw as a huge market potential. Problem was that due to my naivety I've lost everything. I still believe logically Alda should have done well. Call me stupid, but I also believed that the CEO would be doing everything possible to achieve that. I know now that this was not the case to say the least. If you read the letter that Woodstock posted from the MF, you see he shows no remorse. I'm sure he feels no guilt either. So I'm not interested in any of your latest pumps, but I wish you luck in all your investment activities.

Do not know what make you say this:

<< At least 1 thing is for sure though, it won't last much longer.>> ????

If for sure there would be a change that very good because YES we do need a change for the better !!!......

I don't involve myself in the scam market anymore. I've had too many experiences with BS operations like Alda, run by slime- balls like Terry Owen. If the markets were run properly this arrogant prick would be in jail by now, but it's all rigged, and most of these crooks get rewarded instead of punished. At least 1 thing is for sure though, it won't last much longer.

In your words....Alda is so very deceiptful .....but hey, here a good stock for you:RIOCAN symbol REI.UN- Contrary to Alda "REI.UN" pay nice dividend as well.....

Sweet Dreams,

janet

I love the line where he says rather than keeping Alda moving forward. You got to admire the arrogance of this bastard. Alda already is an empty shell, and it didn't have to be this way if there'd been an honest hard working, well intentioned management. Dr.Owen, Dr. of scam.

This is in answer to my latest correspondence with Dr Owen. I received the answer to my email on the same day, which was yesterday. It does not say much; but at least he always answers. Don't know if this company will ever get back on its feet again; but until Alda is a total bust, I will continue to check in to see if its heart is still beating.

"Of course you realize that I cannot disclose anything that is not already public information.

As you know, we have a Memorandum of Understanding with a private pharmaceutical company to acquire certain of their products. Further, ALDA is still in possession of its intellectual property for which a very detailed plan is presented in the MD&A, subject to financing, of course.

Beyond that, I am not at liberty to disclose any plans, as it would be a violation of securities laws to do so.

Further, as our plans are consummated, we can only disclose what is accomplished at the time regardless of how that may fit into a larger strategy that cannot be disclosed until that also unfolds. No matter what we do, someone will be displeased but what we are doing is, in our opinion, in the best interests of shareholders.

Shareholders who contemplate "action" may not realize that, rather than keeping ALDA moving forward as a pharmaceutical company, we could have walked away and let it become an empty shell on the NEX which, at some time in the indeterminate future, may eventually have become a mining company. That alternative would have been a much longer wait than what we have pursued and I am aware of no "action" that has been successfully pursued against the principals of companies that have legitimately followed this course.

As always, I am working towards moving the company forward."

Regards,

Terry Owen

Let's face it, the whole system is rigged. It doesn't take a rocket scientist to figure out what happened to Alda. Every-time he put out a NR you'd see a brief rally, then the dumping began. I know that actual physical products existed, but there was never any marketing, or the kind of real efforts made that you'd expect from a company in this type of business. Even with the Olympic sponsorship, they failed, miserably. Then news comes out not that long ago, that Owen has a partner, Harry Chew, a fine outstanding gentleman with alleged ties to Hong Kong organized crime.

Yes I think a criminal investigation is warranted, on moral grounds, but hey, this is the Venture exchange. Probably 1/2 the companies there should be investigated. A low life, POS, slime-ball like Terence Owen might not be interested, or have the ability to build a real company, no matter how great the products, simply because it's much easier to screw the investors, and cry his tired, "market conditions" excuse, all the way to the bank. It should be much more difficult for these crooks to get a public listing.

If in fact there has been unethical behaviour rather than just an exceptional degree of incompetence (rooted in hubris, seems like), is there no recourse? Or is proof the issue?

Looks like aph has sunk into the category of a worthless shell. It's got nothing to do with the creation, distribution, and sales of physical products for which many investors were unfortunately led to believe by a small group of white collared criminals, led by Terry Owen. Maybe this is nowhere the scope of an Enron, but the inherent criminal activity that has moat likely been committed is not much different... in spirit anyway.

Alda Pharmaceuticals reinstated for trading

2012-03-09 20:19 ET - Cease Trade Company Rescinded

Further to the TSX Venture Exchange bulletins dated Nov. 4, 2011, and March 7, 2012, the exchange has been advised that the cease trade order issued by the British Columbia Securities Commission on Nov. 4, 2011, has been revoked.

Effective at the opening Monday, March 12, 2012, trading will be reinstated in the securities of Alda Pharmaceuticals Corp. (Cusip 01407W 20 5).

ALDA PHARMACEUTICALS CORP. ("APH")

BULLETIN TYPE: Consolidation, Remain Suspended

BULLETIN DATE: March 7, 2012

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders January 27, 2012, the Company has consolidated its capital on a 10 old for 1 new basis and has subsequently increased its authorized capital. The name of the Company has not been changed.

Effective at the opening, Thursday, March 8, 2012, the shares of ALDA Pharmaceuticals Corp. will be listed on TSX Venture Exchange on a consolidated basis; however, the shares of the Company will remain suspended from trading. The Company is classified as a 'Developing, manufacturing and selling infection control products' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of which

6,399,680 shares are issued and outstanding

Escrow: Nil shares are subject to escrow

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: APH (UNCHANGED)

CUSIP Number: 01407W 20 5 (new)

Great... so Owen & his little band of crooks will continue to lead Alda into its ultimate demise.

Alda Pharmaceuticals shareholders pass AGM resolutions

2012-01-30 17:14 ET - News Release

Mr. Terrance Owen reports

ALDA AGM HELD ON JANUARY 27, 2012

Alda Pharmaceuticals Corp.'s annual general meeting of shareholders was held in Vancouver, B.C., on Jan. 27, 2012, at which:

The number of directors was set at five.

Five incumbent directors of the company, being Terrance Owen, Peter Chen, Linda Allison, Ronald Zokol and William F. McCoy were re-elected as directors of Alda for the coming year.

MNP LLP, chartered accountants, was appointed as the new auditor of Alda for the coming year, in accordance with the policies of the TSX Venture Exchange.

The company's rolling 2003 incentive stock option plan, as amended, was ratified for the coming year.

A consolidation of the company's common shares such that one new common share would be issued for every 20 old common shares outstanding, or such lower consolidation ratio as may be determined by the directors of Alda Pharmaceuticals, was approved.

We seek Safe Harbor.

Hi guys, which is the best broker in Canada? Questrade? Do they have iPad application?

Actually the meeting is tomorrow.

Anybody know what happened regarding the share consolidation these crooks were trying to pull off at the meeting last monday.

Check out PYN. Maybe we can make back our money there.

Ron.

News Release re: MoU for acquisition of market-ready products at Stockhouse ...NR is not on Alda's homepage ?? that surprises me, although maybe it shouldn't

Terence G Owen = dishonest, thief, incompetent, arrogant, evil, greedy, deceitful, useless, lazy, egotistic, prick, POS bastard.

Owen is a crook. He's blown all opportunities going back 4 years. Great products, but no intentions of following through other than using every forward step as an opportunity to suck the life out of Alda with serious insider dumping, and this is easily done without involving company officials names. The news is out now that he's involved with Chinese organized crime. C'mon guys, the guy's been BSing us for years. He's needs to be investigated by the police.

woodstock..............Thanks for the info- Sounds like the company is in the final deaththrows...... I'm sure the reverse split will be approved, probably leading to more decline in the price..... The climate for financing is not going to improve anytime soon, so if they couldn't raise money the past year, not likely that pumping up the price will help secure in the coming year- At least if they get the stock trading again, they have a chance to put out a couple pr's, and sell off shares- Bottom line- It sounds like, even with their intellectual property, and "promise" of great therapeutic products, they do not have any backers....

This is the answer to my latest correspondence to Dr Owen.

Hello #####.

The news release, which is a formal announcement, states: "up to 20 times" or some lower level that the board decides. Consolidation is a common strategy under these circumstances.

The reason is as follows.

The minimum price at which any financing can occur is 5 cents. When trading fell below that level in May it was not possible to finance the company. To be reinstated by the Exchange, we need to demonstrate a plan whereby the company meets the Continuous Listing Requirements. Without a financing, it is unlikely that can be achieved. If the share roll back is accepted by the shareholders, it is more likely that financing can occur. If the roll back is not approved by the shareholders, the Company will likely end up on the NEX board from which it is much harder to be reinstated.

The AGM is scheduled for January 27 and the Information Circular will be distributed prior to that.

Management is recommending that the share consolidation be approved.

Regards,

Terry Owen

Same to you, sorry I'm late.

There's a Fan Club... Where do I sign up... Merry Christmas Drumstick! :)

|

Followers

|

26

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

4094

|

|

Created

|

08/07/04

|

Type

|

Free

|

| Moderators | |||

INVESTMENT SUMMARY

- Received a Drug Establishment License ("DEL") and approvals from Health Canada for 30 of its 49 prescription generics products; already has manufacturing approved, labeling and packing secured, and is establishing a sales force 1Q15 salesforc

- Simple business model: Vanc sources drugs that have already obtained FDA equivalent approvals through affiliated companies in China and India, in exchange for manufacturing rights when the drugs are approved by Health Canada

- Potential to scale quickly, comparable to another Canadian company, Paladin Labs, that got bought out for $1.6 billion in 2013 by Endo Health (NASDAQ:ENDP)

- CEO, Arun Nayyar has an extensive track record in the industry - specifically generics - having held executive positions with pharma companies in Latin America, Asia, and Canada and played an instrumental role opening up new markets abroad

- Pre-revenue, albeit with all of the components in place to immediately impact the generics market in Western Canada, and unlock shareholder value through a number of visible, value-unlocking events throughout 2015

Between 2010 and August 2013, brand-name drugs with sales totaling $6 billion a year in Canada lost their patent protection - opening the door to far cheaper generic copies, according to the IMS Brogan market-research company.

Compounding the so-called "patent cliff," a growing list of insurance companies that manage private, workplace drug plans have recently made substituting generics for brands a mandatory policy - a step that most government plans took years ago. The result: more then two thirds of prescriptions in Canada are now filled with generics, while some brand manufacturers lack new drugs in the pipeline to take up the slack.

COMPANY OVERVIEW

Vanc Pharmaceuticals Inc. ("Vancpharma") (OTCQB: NUVPF) is a Canadian company (TSX-V: NPH) focused on providing Canadian health care professionals and consumers with high quality, affordable generics and over-the-counter ("OTC") healthcare products. They are the first Canadian generics company in Western Canada.

GENERICS PORTFOLIO

The company's currently approved in-licensed generics portfolio consists of 30 molecules, comprising of 67 dosage forms across various therapeutic categories: including both chronic (long-term) therapy and acute (short-term) therapy. Management estimates that the aggregate annual Canadian sales of its 30 approved products represents "a $1-billion market opportunity". Furthermore, the company plans to launch "with additional products and we will provide further updates in the coming months," said Arun.

The generics division of the company was only launched last Spring, since then the new management team has reached a number of significant milestones including:

On April 15th, 2014 Vancpharma announced that it had signed Cross Referencing Agreements ("CRA") "for prescription generic products for Canadian markets. These agreements are with three large pharmaceutical companies and cover 48 prescription generic products. The suppliers will handle manufacturing, and Vancpharma will market and sell these new product lines under its own label.

On November 18th, 2014 the company received approval via a Notice of Compliance ("NOC") from Health Canada for 22 generic molecules, comprising 51 dosage forms.

On December 10th, 2014 the company announced that it had been issued a drug establishment licence ("DEL") (licence No. 102220-A) by Health Canada. "The issuance of a drug establishment licence, along with the approval of our partner's GMP manufacturing site, is a key step towards the commercialization of our generic drug portfolio," said Arun Nayyar, CEO. The licence allows Vancpharma to import pharmaceutical products and distribute them within Canada.

This news was particularly important for the company and shareholders because: it positioned Vancpharma to become one of the only 40 companies in Canada that are licensed to manufacture current and future drugs at its GMP facility; allows Vancpharma to import from other manufacturers across the world and faces less barriers to entry; allows for importing both generic and non-generic drugs thus allowing the company to compete with other companies in branded drugs as well as their core generics business; and adds major clout when negotiating for exclusivity rights across Canada. Previously, manufacturers wouldn't commit their exclusively to Vancpharma as they were unsure if it could make good on importing and selling their products.

On December 15th, 2014 the company received an NOC from Health Canada for 7 additional generic molecules, comprising 15 dosage forms.

Lastly, on January 14th, 2015 Vancpharma placed inventory purchase orders for 30 generic molecules and expects to deliver these products 2Q 2015. "We are excited to take this important step towards commercialization and look forward to launching sales in Q2 2015. These 30 molecules represent best-selling generics in the Canadian market and our aim to provide Canadians with quality and cost-effective products is well served by them," said Arun. "Our initial marketing and outreach activities with select pharmacy customers in Western Canada have been positive and we look forward to working with our partners."

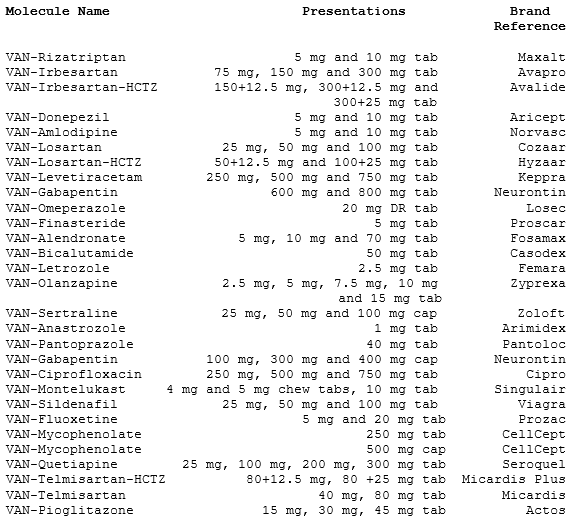

Figure 1: Generics Portfolio

Source: Press Release/Company Website

*Note: I'm aware that's only 29, however the 30th hasn't been updated on the website although it's been mentioned as approved (new approvals could come at any time)

Here are the next steps with the generics portfolio:

Figure 2: Generics Through Global Partnership

For those wondering what Vancpharma's margins are, the company has not made that public yet. As you can imagine, they don't want to expose their margins for specific drugs too early. Investors will be able to see them in the financial statements at a later date. However, generics are quite lucrative. Vancpharma will be taking on the risk of inventory, licensing, approvals, sales and marketing, whereas the manufacturer takes and fills an order from Vancpharma as necessary and collects payment. Accordingly, the reward follows the risk and in this case, Vancpharma would pay a fixed price to the manufacturer depending on the size of the manufacturing run. If you look at the financials of another generics company, Biosyent (TSX-V: RX) you will see margins typically ~70%-75%.

The margins generated from strategic cross-reference partnerships, while very enticing, pale in comparison to the financial opportunities presented by exclusive or co-development partnerships which management has indicated they want to pursue in the future.

OTC PRODUCTS

The OTC Products Division is focused on the marketing and sales of novel and proprietary healthcare products and consists of four (4) such products, all of which now have a Natural Product Number.

Figure 3: Vancpharma Pharmaceuticals OTC Products

It can't and won't be the cash cow for Vancpharma like its generics portfolio - the Canadian market for these OTC products is only ~$60-70 million - but it should actually start generating revenue sooner. Manufacturing should commence in January, with the first sales hopefully starting to come sometime during March.

Looking ahead at the future pipeline of OTC products, they include nutraceuticals, vitamin supplements, and skin care products.

MANAGEMENT

The team has extensive experience and expertise that spans across various functions such as research, development, manufacturing, and marketing of generics and OTC health care products in the global pharmaceuticals industry. This understanding of industry best practices and strong insight allows the company to identify emerging trends in medicine and the marketplace.

The secret to being able to license so many drugs within such a short period of time, less than a year after being restructured is CEO, Arun Nayyar.

Arun only joined the company November 25th, 2013, but came with an extensive track record in the industry - specifically generics - having held executive positions with pharmaceutical companies in Latin America, Asia, and Canada. He has been instrumental in opening up new markets abroad, and domestically his accomplishments include Director, Business Development and International Sales for Shoppers Drug Mart ("SDM"), and consulting for Sanis Healthcare, George Weston Ltd. (Loblaws group), and SDM. To have a more extensive look at Arun's resume and job history, you can view his LinkedIn here.

Some information that you won't find on LinkedIn is that he's an owner of a few Shoppers Drug stores in the Vancpharmaouver area, and also has deep-ties, and solid connections in India. This helps to secure licensing of the generics in exchange for manufacturing rights when Health Canada approves the products.

The newest hire, replacing Jamie Lewin as director and CFO and announced December 3rd, 2014 was Aman Parmar. "I look forward to working with the team at Vancpharma Pharmaceuticals and am impressed by how far they have progressed with limited capital," said Mr. Parmar. "Capital efficiency and creating shareholder value will be my primary focus at Vancpharma." Since joining Vancpharma, Aman has purchased 135,000 shares on the open market ranging from 19 to 24 cents - clearly indicative that he believes the company is undervalued at these levels.

Given the fact that the company is ramping up its business, they've already started putting together a sales and marketing team, it wouldn't surprise me if another executive was brought in to help.

You can read more about the entire Vancpharma team by clicking this link (note, this page needs to be updated with Jamie/Aman).

FINANCIALS

Although Vancpharma is a pre-revenue company, I see a multiple number of visible, value-unlocking events through 2015 that can meaningfully impact stock performance.

Figure 4: Summary of Quarterly Results

The company closed an oversubscribed, non-brokered private placement for gross proceeds of $1,141,000 by issuing 7,607,332 units at $0.15/unit on December 11th, 2014. "This round of funding enables us to move our portfolio of generic drugs and OTC products into commercialization," said Arun Nayyar. "Specifically we will be acquiring generic drug inventory and building our sales team to target pharmacy customers."

The company is financed for the time being, but may have to do another round in March depending on how the roll-outs are going, and for general working capital purposes. If so, I'm sure that it would be strategic - I would think at least >$0.20, comprised primarily by sophisticated retailers and brokers, and it would not be a raise of much more than $1 million. Management only wants to raise whatever money they believe is necessary right now because they know as soon as the company starts generating revenue that its valuation has easily be many multiples of where it sits today.

SHARE STRUCTURE

Shares outstanding: 44,374,407

Stock Options: 3,975,000

Warrants: 16,212,252

Fully Diluted: 64,561,659

Major shareholders of the company, and percentage owned include:

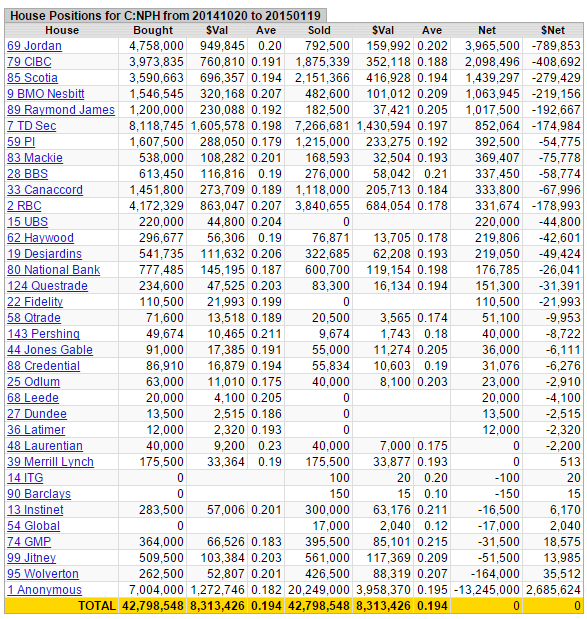

It's a tight share structure, the 'effective' float is ~9 million shares - much less than what's been traded the past few months - 42,798,548 shares at an average price of $0.194:

Figure 5: House Positions

Source: Stockwatch

Figure 6: Management Insider Filings

REVENUE RAMP/VALUATION

It's a little early for me to try and assign a valuation, or forecast revenue and earnings for the company, however I anticipate doing so before year-end. The company hasn't informed investors of the specific margins and obviously we don't know the adoption rate because we don't know how good the sales team will be. Take a look at this article though, "The Top 11 Fastest-Growing Generis Companies", when compared some of the other generics companies, Vancpharma looks very undervalued based solely off of its standing drug portfolio.

The two best examples that come to my mind are: Paladin Labs and BioSyent (OTCPK:BIOYF).

Former pharma sales rep., and Cantech Letter contributor Hogan Mullally wrote that Paladin "became the poster child for Canadian specialty pharma. They built a remarkably successful business by acquiring the Canadian rights to a wide variety of drugs. These drugs were either too small for medium/big pharma, or were developed by a company without a Canadian commercial footprint, whatever the reason, Paladin was able to amass an eclectic and diverse portfolio of prescription and OTC drugs for the Canadian market. Through their "sum of the parts" strategy, Paladin grew to over $200 million in annual sales and in 2013 was acquired by Endo Pharmaceuticals for approximately $1.6 billion.

BioSyent is in between Vancpharma and Paladin, as it has already amassed an impressive portfolio by searching the globe to in-license or acquire innovative pharmaceutical products for the Canadian market. It too focuses on products that are too small for medium/big pharma, and have a competitive angle that can be exploited by a modest sales force. BioSyent's business model is structured to minimize risk, and to produce high growth. For the four years ended December 31, 2013 the company experienced a CAGR of 67% while consistently growing profits:

Figure 7: BioSyent Financials at a Glance

Source: Fact Sheet

There is an exit strategy for the company and shareholders - take-out target for an M&A transaction. It might take getting into a few hundred pharmacies, but the precedent has already been set. The initial adoption rate risk is reduced from the outset because between members of the management team, they own a little more than a dozen pharmacies. Not to mention now that Health Canada has granted the company a Drug Establish License it can pursue additional revenue opportunities and further de-risked the investment.

RISKS

Vancpharma is still considered an early stage company, as such there are a number of risks associated with making an investment at this point in time, including but not limited to:

(1) The company just hired a new CFO, and has a management team has dozens of years of business experience, most dealing with generic pharmaceuticals.

(2) The company plans to manufacture its products at four certified GMP pharmaceuticals factories in Canada, India and China. These U.S. FDA approved plants are capable of manufacturing a wide range of Generic Pharmaceuticals and OTC Health care products at these facilities, under the VANCPHARM label.

(3) Like I mentioned before, management controls a number of pharmacies which will de-risk the rollout process and immediately start generating revenue form the company's generics portfolio.

(4) Arun has built deep, extensive relationships in India and China, and has a lot of ideas to add more products to the portfolio (not to mention the future potential to co-development or development exclusively).

(5) The company sources its products from big products that are already approved by either the U.S. FDA or UPHRA, and also approved by Health Canada. As long as the company is in compliance with Health Canada guidelines then the ANDS application gets expedited, updated and faster tracked. The company hasn't had so much of a hiccup yet, because of the experienced team in place filing all of the paperwork.

(6) The company hasn't had an issue raising money despite the poor market for companies trading on the TSX Venture. The last PP was oversubscribed, and the shares were spread around to strong, strategic hands. Presuming management continues to achieve its milestones, I anticipate lots of eagerness for the next round.

CONCLUSION

Vancpharma set forth some ambitious goals, but has already accomplished so much in such a short amount of time that I really have large aspirations for it (and shareholders).

The company has a tried and tested business model which is simple to understand. Vancpharma enters into Cross-Referencing agreements with affiliated companies whom source products from China and India which are already approved, in exchange for manufacturing rights when the drugs are approved by Health Canada. This is very economical as there is a minimal cross-referencing fee paid to Health Canada, and a very large market opportunity (>$1 billion for current generics portfolio), with margins typically ~70%-75%.

Source: StockCharts.com

Taking a look at recent trading, there has been some healthy consolidation after the initial big run-up, ~33% off its 52-week high. MACD and RSI indicators are now in 'oversold' territory, and the stock is approaching its 200-day moving average. Up until a few months ago this stock traded 'by appointment only'. Since the middle of October, 42,798,548 shares at an average price of $0.194 have traded.

Now that the company has received 30 of its 49 Health Canada approvals (with the rest to be submitted shortly), there is a bit of work that needs to be done in order advance it from being a purely speculative growth biotech with Health Canada approvals, to one that's one being noticed by institutions and an American audience.

In the meantime, investors have two options: (1) buy now, taking the risk knowing that the company may need to finance further, but is extremely close to generating revenue; or (2) sit on the sidelines and wait until the second quarter financials are released, and make a decision then.

The latter is much less risky, however if management successfully executes on its business plan and stays on track with milestones, then I'm sure its share price will reflect it this, and it will be at a significant premium.

Bottom line, I think that there is a very compelling opportunity to invest right now given: (1) the recent pullback in share price; (2) the significance of forthcoming news releases to act as catalysts to unlock shareholder value; (3) management's achievements to date and their track record to deliver results; (4) market opportunity (>$1 billion on current portfolio) and attractive valuations of sector peers; and (5) lack of competition in the Western Canadian generics market and the opportunity to generate imminent revenue.

(For additional liquidity, NUVPF. trades in Canada on the TSX Venture as "NPH". 3-month average volume 637,531 shares/day.)

Please feel free to comment below or send me an inbox message if you have any questions or comments about this article.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |