Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Surf, you don't know how sorry I am to say this, but I guess I was right all along about this crook. We just witnessed another obvious example of blatant insider trading. Too bad even with a case like this it's almost impossible to prove. Even at .035 he keeps trying to squeeze every last cent out of Alda before it's game over. New product... give me a break.

drum............... Agreed

Surf, look at the pps now. Right back to where it started. Same old same old with Alda. So sad, but unfortunately I'm convinced nothing's going to change as long as TO's in charge. 4 years of watching now... it's as clear as the nose on your face. He uses these NRs to try and influence a short lived selling opportunity for himself and his associates I'm sure. By the looks of things I'd say the golden goose is getting very tired. I'll guess that the reason we haven't heard any news for so long is that finances are low. But that's what they get for not developing the fundamentals when times were better. Love to see a real marketer take over. If we are to believe that in fact the intellectual property they have is true, then the door is wide open.

could be...... he was buying some at .03..... so, he could have sold some for a penny profit.... I still have a bunch of this stock, so it was nice to hear something..... I give it a very low probability of success at this point, but, will be interesting to see if they can sell any of the stuff... and, it was mostly buying today, so someone around it was accumulating...

Surf, wonder who the dumper was. I could give you 3 guesses, but the 1st 2 don't count. TO & co. playing the same old games I'm afraid.

somebody pretty quick to dump....oh well, at least some activity

Today's News: VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 8, 2011) - ALDA Pharmaceuticals Corp. (TSX VENTURE:APH - News; OTCQB:APCSF) (the "Company" or "ALDA") announces that Natural Product Number ("NPN") 80026033 has been issued for a 0.5% hydrocortisone (0.5% HC) ointment. The Company is authorized to sell this product in Canada for temporary relief of minor skin irritations, rashes, itching and redness due to eczema, insect bites, poison ivy and other irritating plants; contact dermatitis caused by soaps, detergents, cosmetics, jewellery and other materials that irritate the skin; seborrheic dermatitis and psoriasis.

Typically, skin conditions of these types (which affect over 75% of Canadian adults at one time or another) begin as an inflammatory condition, but are often worsened or prolonged by secondary infection with bacteria or fungi (such as the fungi that causes athlete's foot). The combination of an effective anti-microbial product (such as the T36® formulation) with an anti-inflammatory agent (such as 0.5% hydrocortisone) would address this common medical condition more effectively and make treatment recommendations more straightforward for the health care provider and much easier to carry out for the patient. This innovative combination of an anti-microbial and anti-inflammatory therapy (avoiding the need to apply separate products to treat a single condition) represents an important step forward in the non-prescription therapeutic market. It is also consistent with the current approach favoured by a number of health providers encouraging Canadians to take charge in a positive way of their own care. Obtaining registration of a hydrocortisone ointment is a first step for the Company in bringing this approach to market.

Over 800,000 shares bought in 10 minutes- .03-.035- ALDA lives?

from Stockhouse- No confirmation if any of it is true(except for the "selling")......

"Hello

I am new to this board. But definitely i would say this is an extended shake out. I have heard that over seas investors are involved and that the company is working with a new investment firm. I think they have the pp

lined up but are trying to shakeout scared investors for all they are worth. Also some people are selling to raise cash to buy the pp- this has been going on for a while. Mr Terry and cohorts bought in at 10 cents in January and he and his buddies certainly are not ready/planning to lose all this money. This is just all planned. Once the pp is announced (God knows when) we should move up and more news will come forth. I am in between 5 cent to 10 cents. If I could I would be buying more. Terry is too well connected me believes. "

woodstock....... I don't know..... It's a glimmer of hope anyway.... I aleady have plenty from before, so I'm good!.

Almost tempted to buy some more.

That's good news for ALDA- apparantly still alive!.... First US patent(if granted), for therapeutic use of T36 compound... I think this is significant news....

ALDA Enters National Phase with New Patent Application

Vancouver, BC - ALDA Pharmaceuticals Corp. (APH:TSX-V, APCSF:OTCQB) (the “Company” or “ALDA”) has filed its patent application, “Antiseptic Compositions for the Treatment of Infections”, with the US Patent and Trademark Office (Serial #12/933,358). The application, first submitted to the Canadian Intellectual Property office for review in March, 2008 under the Patent Cooperation Treaty, seeks protection for the composition and preparation of T36® formulations that also contain steroids, anesthetics or analgesics for use on topical infections and, in particular, inflamed infections. Typically, infections with associated inflammation are treated with separate antiseptic and anti-inflammatory preparations. The new T36® formulations combine these properties into a single treatment, making the prescription process easier for the physician and the application easier for the patient. Submissions to the European and Canadian patent offices are also planned. This patent is the third in a series of patents providing protection for the T36® technology that have been issued or are pending.

The first patent, providing protection for the composition and production methods for ALDA's T36® formulation until August 20, 2022, is:

· issued in Australia (#2002322916), the US (#7,338,927) and China (#ZL02829642.7),

· allowed and pending in Canada (Patent Application #2,495,938) and

· pending in the EU (Patent Application #02754054.1-2113).

The second patent, providing protection for the use of T36® as a component of a personal lubricant, in a method of preventing or reducing the transmission of a sexually transmitted diseases including Herpes, Chlamydia and HIV and for use in sanitizers and cleansers in creams, ointments and wipes until August 20, 2022, is

· issued in Australia (#2007237333) and the US (#7,560,422),

· allowed and is pending in Canada (Patent Application #2,495,938) and

· pending in China (Chinese Divisional Patent Application #200710142798.3) and the EU (Patent Application #02754054.1-2113).

According to Dr. Terrance Owen, President & CEO, “Intellectual property protection is one of the key assets of emerging pharmaceutical companies. We are committed to building the Company’s patent portfolio so that we have the protection required in the main international markets that we are targeting with the therapeutic products derived from the T36® technology”.

I don't think T.O. is a highly structured kind of guy.

Ron.

NR- Pretty vague about the relationship.... Who gets the profits, if any?..... Is this a "rent to buy" relationship?... Will ALDA's potential profits go to Seavan for purchase?.... At this point it doesn't really matter much to remaining shareholders, so why not detail the "relationship".....

Finally, it's the best thing they ever did, I hope???

ALDA Enters Into Joint Venture with Seavan

Vancouver, BC - ALDA Pharmaceuticals Corp. (APH:TSX-V) (the “Company” or “ALDA”) announces that a joint venture agreement has been established with Seavan Health & Beauty Partnership (“Seavan”). Under the terms of the agreement, Seavan will manufacture ALDA’s products and ALDA’s personnel will undertake the marketing and sales of Seavan’s products and services in addition to those of ALDA. The acquisition of substantially all of the assets and undertakings of Seavan by ALDA is still in progress.

Dr. Terrance Owen, President & CEO states, “During our discussions with Seavan, it became clear that it would be beneficial for us to work together now because the two companies are very complimentary and can benefit from each other’s strengths. This joint venture will allow us to combine our resources, fine-tune our delivery of both ALDA’s and Seavan’s products and services and grow both businesses as we work on the acquisition. The ultimate goals are for ALDA to manufacture as well as distribute T36® products, acquire expertise in R&D, quality assurance and regulatory matters and re-focus on the therapeutic applications of the T36® technology”.

About Seavan Health & Beauty Partnership (www.seavanlabs.com)

Seavan, located in Vancouver, manufactures pharmaceutical, nutritional and personal care products under licenses from Health Canada and the FDA. Examples of products manufactured at Seavan include glucosamine and magnesium supplements, sun screens, topical delivery systems, pain relievers, body washes, hair care products and ALDA’s T36® products.

The only thing new there(I think), is the Canadian patent allows for therapeutic use of the product?.... the onlt value to this pr, would be garner interest in an upcoming PP?......imo At what point is it impossible to revive a comatose patient?

ALDA news today:

VANCOUVER, BRITISH COLUMBIA--(Marketwire - April 6, 2011) - ALDA Pharmaceuticals Corp. (TSX VENTURE:APH - News; OTCQB:APCSF) ("ALDA") has been notified that the Canadian Intellectual Property Office ("CIPO") has accepted ALDA's patent application that describes the composition, production methods and certain therapeutic uses for ALDA's T36® formulation.

In addition, the Company has two patents issued in the both the US and Australia, one issued in China and one pending in both China and the EU. An additional patent application, seeking protection for the T36® formula in combination with anesthetics, analgesics and anti-inflammatories for the treatment of a wide range of topical infections has been filed in the US and the EU.

Dr. Terrance Owen, President & CEO, states, "Notification that the patent will now be issued in Canada provides further evidence that our intellectual property is very robust. We are gratified to see rapid allowance of the patent applications in a number of jurisdictions. Clearly, ALDA's T36® formulation is unique and is a significant asset to the company."

Surf, this is from SH. Any thoughts? Not very encouraging...

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=APH&t=LIST&m=29481237&l=0&pd=2&r=0

China... right, what ever happened to that. Maybe I'm just naively idealistic, but they had the goods, but no ability to market. The Olympic opportunity was totally squandered. I can't help thinking they lacked the intention. TO's constant excuse of market conditions, give me a break. If they are so interested in the therapeutic applications, why were'nt they at the HIV/AIDS conference in South Africa last year. They could have been part of the Candian delagation even. And the big slap in the face with that was there was a vaginal lubricant concept presented by another company... unbelievable!

drum.............well, as that poster from stockhouse said, selling the sanitizer was never the main goal, but a means(by selling enough of it), to finance ongoing development of the therapeutic products..... But, the stuff didn't sell as planned...... Maybe they shuld have gone right for the therapeutics.... who knows... I do think the sanitizer had a rough road- too much competition in that arena... They were supposed to manufacture and sell in China- there was never any follow up info on that- 1st bad sign...

Surf, I really sorry to see that all my ranting against TO, was pretty well true. I have no faith in anything this guy says. He squandered so many opportunities, the Olympics last year being the big l. If he couldn't get it going with that, how can we seriously expect anything to be any different now,

I really can't understand the problem, other than incompetence, or simply a lack of intention. It's so too bad. I can only imagine where this company could be today with a commited and skillful management. So much potential down the drain.

Copnsidering the latest, whatever is going on if anything, I expect it to go nowhere.

When will aph be sub .01, that's the only question I have.

Like the last post says, "strike 3 or home run".............

I assume that poster knows whats coming- it fits with recent history- PP's at ever declining prices.... They don't need deep pockets anymore- just a bunch of shallow ones....

from stockhouse:

Expect a PP at $.06

So, lets break it down:

40,000,000 shares at $.06 = $2,400,000 (Perhaps in 2 tranches)

$1,000,000 for the facility

$400,000 to get it fixed up plus merge plus market

$500,000 to start new product testing

$500,000 payment to Olympic Committe installment

Plus 3,000,000 shares of course.

At least there is no need to worry about previous warrant dillution, this is so far off the money it is ridiculous.

Seavan building will be a must completion for APH as its do or die time to get revenues going, pay off bills, build product line and start the long long overdue testing procedures.

Besides, with a real mnfg building on the books, easier to get line of credit or debt financing instead of constant PPs. NOT TO MENTION LOOKS BETTER FOR TAKEOVER WHICH WE ALL WANT AND NEED!

SHBP is hard to track down but looks like they had a satellite office in seattle back in 2005 with product lines including SPA Luna, UltraCare Labs and Vivian Woodard Cosmetics in the production cue. Ultracare Labs even today appears to have the same address as Seavan - HMMM. They had a President until 2008 but looks like one of the partners took over to date.

So looks like there is product being produced. We should learn more as time goes on.

Not happy about dilution but looks like a necessity now. If this falls through, what are we left with?? TO's record of blaming everyone else aint too impressive as validated per the many rants and raves of fellow posters - me included.

This is definately going to be strike three or a home run scenario playing out. How much longer can we afford PPs just to pay salaries and option bonuses without pushing forward with the new holy grail product lines.

The Sanitizer business was to provide revenues for this, facts are it hasn't worked thus we REALLY need this manufacturing plant and related product revenues coming in to faster track our future product lines.

I hope it's a share swap rather than another pp.

Ron.

from Scott: (I asked him about financing for the manufacturing deal) .............................................

"our financing plans should become more evident in the next week or so - can't tell you much more at his time" sy

from the PR:

The Term Sheet is non-binding and contains a list of key terms and conditions precedent for the establishment of commercial arrangements between the parties. Definitive agreements will be negotiated and prepared after further due diligence, anticipated to be completed by March 11, 2011,

ALDA's financials "ouch".....

http://secfilings.com/searchresultswide.aspx?link=2&filingid=7772017

No updates from ADLA- I still can't imaging how they will get $1mil for the manufacturing facility(although, it sounds like a good idea, as that facility is already manufacturing their own products).... maybe a rich uncle died? anyway, from Agoracom:

It's about time that TO put out a letter to shareholders. Although it sounds like there is still a breath of life in the co. I still think that Alda is still on life support. I am glad that Alda is moving forward and at least working on something. It remains to be seen how purchasing this manufacturing and distribution entity will help Alda move it's products. From what I have seen, their existing products have not been flying off the shelves. I was actually quite surprise to see that Shoppers has restocked their T36 hand sanitizer and spray disinefectant, but now in only travel sizes.

What irks me is how TO asserts that they were too busy during 2010 with the Olympics to focus on other strategic initiatives. That's just poppycock. Unless Terry and Peter were driving personally to the few venues that had dispensers, Alda was sadly absent from a lot of the games. In addition, the games only lasted into March. What happened during the other 3 quarters of 2010?

Let's hope 2011 will be different and look ahead instead of the past blunders.

drum......... cool...... if your selling makes it spike, I'll buy you a drink......

I still can't believe how they blew the Olympic opportunity. I lost a lot on this company as I'm sure I've made quite clear to you guys over the years. Just about to try & cash in what I got left and put it into something else, finally. I sell and watch it spike.

ro4..... Don't know if you still read this board(I hardly do), but, I thought the same thing- the hareholder letter was to pelican.... lol

yeah...........seems like they had their shot at the deep pockets, with the Olympic exposure, etc..... and they're not going to be able to raise much money with the pps at .08/share... so not sure how they can go forward.... I always thought, if they could develop the therapeutic products, they might get bought out.... but, takes money

Need to pull a rabbit out of the hat. No cash, grand ideas, and very little to show for what they have been up to over the last 9 months! Could have probably used this update when s/p was in free fall a year and half ago. Silence then (should have remained silent IMO) At least then we could have speculated on big news around the corner. This s/p continues to grind into the sand without a joint venter announcement imo - (becomes a lottery pick at or just under .05 to me) - Paul

So I guess ALDA is still around- Letter to Shareholders.... No new info really- just reiterating the pending purchase of the manufacturing facility.... (would have been nice if they explained where they will get the $1mil to pay fot it?).... The rest, re-hash of their old, existing goals for therapeutics... Whether the company is still really viable remains to be seen....(or, possibly just trying to garner some interest to dump shares?)........

Letter to Shareholders:

RICHMOND, BRITISH COLUMBIA--(Marketwire - Feb. 16, 2011) - ALDA Pharmaceuticals Corp. (TSX VENTURE:APH - News; OTCQB:APCSF) -

An extensive amount of company information is available in our quarterly reports, these documents have become quite lengthy. There is a requirement for management to provide a snapshot of the Company at the time of a report, including its history and development so that someone looking at the Company for the first time can have a complete understanding without having to go back to earlier reports. As a result, much of the information is carried over from one report to the next, making them appear to be repetitive. For example, testing of T36® conducted over 10 years ago is still contained in the current reports to provide the historical information and because the testing is still relevant to the on-going therapeutic registration program. Here, then, is a summary of the status of the Company's projects. More detailed information up to December 30, 2010 can be found in the Form 20-F dated posted on EDGAR, the electronic reporting system for the SEC(1).

Sales

After a $1 Million quarter at the end of 2009, another $400,000 in sales were generated during the first three months of 2010, mostly from the sales of T36® Antiseptic Hand Sanitizer. Sales were boosted by ALDA's appointment as a supplier to the 2010 Winter Games. Supplies of raw material were a challenge and, had they been available, even more products would have been sold. After the Olympics, the market for hand sanitizers collapsed due to a complete lack of interest and the general feeling that the World Health Organization had oversold the prospect of an H1N1 pandemic. As a result, there are reports that the number of Canadians receiving flu shots this winter is down by nearly half and that the number of flu cases are up compared to normal levels in previous years. Nothing lasts forever and such complacency will likely be balanced in future years with demand for flu shots and sanitation products returning to normal levels. The Company will continue to use its status as a supplier to the Canadian Olympic Committee the Canadian Olympic Team until the end of 2012 to promote its products.

During the boom times, it was difficult to focus on anything other than meeting the demand for ALDA's products. Now in quieter times, it has been possible to pursue the other initiatives described below.

Seavan Health & Beauty Partnership ("SHBP")

As reported in a news release issued on February 4, 2011, ALDA has entered into a non-binding term sheet to acquire the assets of SHBP. Management has been interested in controlling ALDA's manufacturing needs for some time due to the high cost of having products made by outside parties and having little, if any, control over production schedules. Building a new manufacturing facility for ALDA's needs was not considered to be a viable alternative because the volume requirements have been difficult to define and there is a lengthy regulatory process involved in obtaining the required approvals. Acquiring an existing manufacturing business with its own facilities, equipment, products, revenues and regulatory approvals was seen to be a more desirable approach. SHBP, located in Vancouver, fits this strategy very well. It has an active business in contract manufacturing with over 750 formulations, including a number of its own products, for pharmaceutical, nutritional and personal care markets in Canada and the US. SHBP also has experience in manufacturing T36® products for ALDA. The acquisition of SHBP by ALDA will reduce the cost of ALDA's products, increase its product offerings, revenue stream and asset base, improve its production scheduling, provide a broader customer base, enhance regulatory expertise, create opportunities for further growth and provide more ways to promote the Olympic sponsorship. There is virtually no overlap of personnel between ALDA and SHBP so a smooth and synergistic transition is anticipated. Once the acquisition is consummated and production and sales are contained within the new subsidiary, management will again be able to focus more energy on the T36® therapeutic products.

Therapeutics

The products in progress are described below along with a summary of our market research on each category. In all cases, T36® is anticipated to have a competitive advantage because of its broad spectrum of activities against all types of infectious micro-organisms including bacteria, fungi and viruses, relatively low production costs due to the availability of the active ingredients used to prepare T36® formulations and the absence of toxicity, side effects or microbial resistance. Many of the products currently serving the target markets may be effective against only one type of infectious agent, expensive to prepare, have serious side effects or lead to the development of resistant organisms.

-- Pre-surgical skin antiseptics - This product line requires the least regulatory work due to the need for only a single application on intact skin. The significance of the market for skin antiseptics was illustrated by the acquisition of Enturia, a provider of preparative skin antiseptics by Cardinal Health in May, 2008 for $490 Million. Most skin antiseptics have a limited spectrum of activity while T36(R) is effective against all classes of infectious agents. Market research suggests the global market for skin antiseptics is $1.6 Billion per year.-- Hand hygiene products - Registration of personal and professional hand rubs and surgical scrubs requires a higher level of testing to establish safety on intact skin after repeated and continuous use and to support competitive claims of superior effectiveness, such as anti-viral and anti-fungal activity. The combination of household and institutional markets for hand hygiene products is estimated to be $2.5 Billion globally per year.-- Topical treatments for skin infections - An even higher level of testing is required due to the need for multiple applications to broken skin and the inclusion of additives such as anti-inflammatories, anesthetics and analgesics. Topical treatments include first aid preparations, treatments for skin infections, such as athlete's foot, diaper rash, toenail infections and resolving infections associated with other skin conditions. such as eczema. T36(R) formulations containing steroids have been tested in a clinical setting against a variety of topical infections and has been demonstrated to have a high level of effectiveness. The broad range of conditions that can potentially be treated with T36(R) preparations is estimated to be worth over $6 Billion globally per year.-- Internal treatments - Products for the treatment of internal infections require the highest level of testing due to use on mucosal membranes and for the approval of competitive claims. Although a number of products are available to treat yeast infections, fungi account for only one- third of such infections while bacteria, parasites and combinations of fungi and bacteria account for the remaining two-thirds. The ability of T36(R) to treat all types of infections provides access to a global market estimated to be $2 Billion per year.

Further testing needs to be done, including toxicity testing with a suitable animal model, laboratory testing against specific infectious micro-organisms, standard tests for hand hygiene effectiveness, preliminary clinical trials to establish human safety and full clinical trials on specific treatments, such as athlete's foot and genital infections. The regulatory plan has taken shape and the most current technical information on the progress of the therapeutic plan is available on pages 17 to 28 of the MD&A posted on EDGAR in the Form 20-F dated December 30, 2010(1).

Patents

Two patents have been issued in both the US and Australia covering the composition, methods of preparation and certain therapeutic and commercial uses of T36®. In China, one patent has been issued covering the composition and methods of preparation. The final amendments to a second patent covering therapeutic and commercial uses have been provided to the Chinese patent office for review. In Europe and Canada, single patent applications covering composition, methods of preparation and certain therapeutic and commercial uses of T36® are undergoing final reviews in the respective patent offices. A comprehensive patent application covering a wide range of therapeutic applications of T36® containing additives such as anti-inflammatories, anesthetics and analgesics is in the national review stage in Canada, the US, and the EU.

About ALDA Pharmaceuticals Corp.

ALDA is focused on the development of infection-control therapeutics derived from its patented T36® technology. The company trades on the TSX Venture Exchange under the symbol APH and on the OTCQB under the symbol APCSF. The Company was the Official Supplier to the Vancouver 2010 Olympic Winter Games and the Vancouver 2010 Paralympic Winter Games and is the Official Supplier to the Canadian Olympic Committee, the 2010 Canadian Olympic Team and the 2012 Canadian Olympic Team for antiseptic hand sanitizer, disinfectant and disinfectant cleaning products. The Company was also selected as one of the TSX Venture 50 companies in the Technology and Life Sciences sector for 2010.

Terrance G. Owen, Ph.D., MBA, President & CEO

ALDA Pharmaceuticals Corp.

Cautionary Note Regarding Forward-looking Statements: Information in this press release that involves ALDA's expectations, plans, intentions or strategies regarding the future are forward-looking statements that are not facts and involve a number of risks and uncertainties. ALDA generally uses words such as "outlook", "will", "could", "would", "might", "remains", "to be", "plans", "believes", "may", "expects", "intends", "anticipates", "estimate", "future", "plan", "positioned", "potential", "project", "remain", "scheduled", "set to", "subject to", "upcoming", and similar expressions to help identify forward-looking statements. The forward-looking statements in this release are based upon information available to ALDA as of the date of this release, and ALDA assumes no obligation to update any such forward-looking statements. Forward-looking statements believed to be true when made may ultimately prove to be incorrect. These statements are not guarantees of the future performance of ALDA and are subject to risks, uncertainties and other factors, some of which are beyond its control and may cause actual results to differ materially from current expectations.

(1) (http://www.sec.gov/Archives/edgar/data/1355736/000132531010000086/alda_201020ffinal.htm)

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Can only wish TO would leave. I'm sure sp would bounce on that alone.

Probably depends on the whims of T.O.

Ron.

"IF" the deal does go through, we should spike quickly back to .20-.25 level, I would think..... then we watch what develops from there... Seems like a big "if" right now, though...

I doubt very much that anyone will buy into this news except for some day trading. I can't wait to check Canadian Insider to see if any of our friends at Alda bought or sold any of the shares traded today. That would tell you all you need to know about their intentions. This deal has got to go through this time or this company is toast!

bouch..........."I have decided not to jump in here" Can't blame you for that.... No pump here.... This seemed to be just slowly selling off for quite some time....I was surprised to see they are still viable.... (of course, it could be a last-ditch effort to generate a small run, so everyone can get out....)

As a disclaimer...I only hold 18K aph of a one-time position of 230k. I kept that small amount as a type of "suicide protection position". In case T.O. was able to bring this puppy back to life and at least in the back of my mind would re-invest if I were to see light at the end of the tunnel. Now that there is a pulse, and IMO an over reaction of share buying, I have decided not to jump in here. This is simply the product of 3+ years of wittnessing the errosion of confidence in the shareholder base of this company. I wish everyone here the absolute best of luck with this latest oppertunity, and sincerly hope that T.O. knows what he is doing as Woodstock would say....on perhaps his last shot at making a company here....-thebouch

He must realize that if he fails again that any confidence left in this company will be completely eroded away. This deal, in my opinion, is a make or break for Alda. All we can do is hope that he did his homework this time. We can also hope for the announcement to come in as a done deal and the share price to rise dramatically on that and a couple of other quick NRs before a PP.

bouch...... are u sayin that TO doesn't have $1 mil laying around somewhere?..... darn....

Like the idea of the purchase. Don't like the idea of the $1m - can see a PP at far too low pps. don't get overly excited as memory not that bad...we tried this once before !!! - Paul

NEWS....(hot damn- time to recoup losses?)..........

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Feb. 4, 2011) - ALDA Pharmaceuticals Corp. (TSX VENTURE:APH - News; OTCQB:APCSF) (the "Company" or "ALDA") announces the signing of a non-binding term sheet (the "Term Sheet") to purchase substantially all of the assets and undertakings of Seavan Health & Beauty Partnership ("SHBP") which is operating a manufacturing facility in Vancouver, British Columbia with approvals to sell pharmaceutical, nutritional and personal care products in Canada and the USA. The proposed acquisition provides ALDA with the direct ability to manufacture its own T(3)6® products, to continue the manufacture of SHBP's own related product lines, which it will retain, and the capacity for future expansion.

Pursuant to the Term Sheet , ALDA will pay $1 Million in cash and, subject to applicable securities laws and the policies of the TSX Venture Exchange, issue 3,000,000 common shares (subject to adjustment based on the average trading price of ALDA's shares prior to closing).

Dr. Terrance Owen, President & CEO states, "On completion of this acquisition, the Company attains a long-standing goal of controlling the manufacturing of T(3)6® products, increases its revenue stream and allows management to focus its energies on the therapeutic applications of the T(3)6® technology. It will also be beneficial for ALDA to have its own approved facility for manufacturing products required for anticipated clinical trials of T(3)6® infection-control therapeutics".

The Term Sheet is non-binding and contains a list of key terms and conditions precedent for the establishment of commercial arrangements between the parties. Definitive agreements will be negotiated and prepared after further due diligence, anticipated to be completed by March 11, 2011, is conducted by the Company. Completion may occur any time up August 8, 2011 and is subject to a number of conditions, including but not limited to, execution and delivery of all requisite definitive agreements by the respective parties thereto; applicable regulatory approvals and/or acceptance; and, if applicable, requisite director and shareholder approval. There can be no assurance that the proposed acquisition will be completed as proposed or at all.

About ALDA Pharmaceuticals Corp.

"IT'S ALIVE"........... 900,000 bought at .09- .10...... what up dog..?

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Jan. 13, 2011) - ALDA Pharmaceuticals Corp. (TSX VENTURE:APH - News; OTCQB:APCSF) (the "Company") is pleased to announce that it has closed the private placement announced December 8th, 2010. The Company has issued a total of 2,000,000 Units at a price of $0.10 per Unit for gross proceeds of $200,000. Each Unit consists of one common share of ALDA and one non-transferable share purchase warrant entitling the holder to acquire one additional common share of ALDA at a price of $0.20 per common share until January 12, 2013 subject to a forced exercise provision attached to each warrant commencing on the day following the expiry of any applicable hold period on the underlying Common Shares, stating that if, for ten consecutive trading days, the closing price of the listed shares of the Company exceeds $0.40 then the exercise period of the warrants will be reduced to a period of 10 days following such trading days.

Insiders of ALDA subscribed for 1,670,000 Units on the same terms as arm's length investors, constituting a related party transaction pursuant to Multilateral Instrument 61-101 and TSX Venture Exchange Policy 5.9. Such Insider participation was exempt from the requirement to obtain an independent valuation pursuant to Section 5.5(b) of MI 61-101 and the requirement to obtain minority shareholder approval pursuant to Section 5.7(1)(b) of MI 61-101.

All securities issued with respect to the private placement are subject to a hold period expiring on May 13, 2011 in accordance with the policies of the TSX Venture Exchange and applicable Canadian securities laws.

Surf, this is from the same guy on Stockhouse.

Open letter to Dr. Brian Conway, world renown HIV/AIDS expert, and scientific advisor to Alda.

Hi, got a question for you. I understand that you are, or were a scientific advisor to Alda Pharma. I also know that you are a recognized expert regarding HIV/AIDS.

Bear with me here, but you must be aware of the world conference on HIV/AIDS that took place in South Africa last summer. And you must also be aware that the Canadian government was in attendence,

I heard that a novel new product idea was presented by an American company I believe. This was in the form of a vaginal gel, brilliant idea. What I found intereesting was that Terry Owen had floated the potential of such a product a few years ago. Of course it would contain Alda's T36 formula which has been proven to kill the virus in 15 seconds in labratory tests.

Now here's the stumper. I have heard that Mr. Owen was not even aware of the South African Conference. Since you are an adviser to Alda for which I'm sure you receive compensation, how could it be possible that not only was someone from Alda not there, as part of the Canadian delagation for instance, but this extremely important event was not even on the radar screen. Yes I'm 1 of many frustrated Alda investors, and it's these kinds of situations that explain the pitiful state of the company as far as I'm concerned.

I'd love to hear your comments.

Wow Surf, sounds exactly what I've been saying for a l;ong time. TO & co. are either out of their league, or they couldn't care less. True they.ve blown every single opportunity. Can only hope for new blood to step forward. A monkey couldn't screw things up more.

|

Followers

|

26

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

4094

|

|

Created

|

08/07/04

|

Type

|

Free

|

| Moderators | |||

INVESTMENT SUMMARY

- Received a Drug Establishment License ("DEL") and approvals from Health Canada for 30 of its 49 prescription generics products; already has manufacturing approved, labeling and packing secured, and is establishing a sales force 1Q15 salesforc

- Simple business model: Vanc sources drugs that have already obtained FDA equivalent approvals through affiliated companies in China and India, in exchange for manufacturing rights when the drugs are approved by Health Canada

- Potential to scale quickly, comparable to another Canadian company, Paladin Labs, that got bought out for $1.6 billion in 2013 by Endo Health (NASDAQ:ENDP)

- CEO, Arun Nayyar has an extensive track record in the industry - specifically generics - having held executive positions with pharma companies in Latin America, Asia, and Canada and played an instrumental role opening up new markets abroad

- Pre-revenue, albeit with all of the components in place to immediately impact the generics market in Western Canada, and unlock shareholder value through a number of visible, value-unlocking events throughout 2015

Between 2010 and August 2013, brand-name drugs with sales totaling $6 billion a year in Canada lost their patent protection - opening the door to far cheaper generic copies, according to the IMS Brogan market-research company.

Compounding the so-called "patent cliff," a growing list of insurance companies that manage private, workplace drug plans have recently made substituting generics for brands a mandatory policy - a step that most government plans took years ago. The result: more then two thirds of prescriptions in Canada are now filled with generics, while some brand manufacturers lack new drugs in the pipeline to take up the slack.

COMPANY OVERVIEW

Vanc Pharmaceuticals Inc. ("Vancpharma") (OTCQB: NUVPF) is a Canadian company (TSX-V: NPH) focused on providing Canadian health care professionals and consumers with high quality, affordable generics and over-the-counter ("OTC") healthcare products. They are the first Canadian generics company in Western Canada.

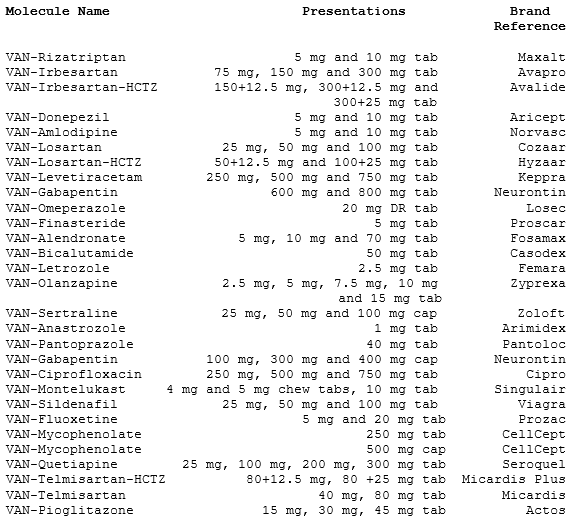

GENERICS PORTFOLIO

The company's currently approved in-licensed generics portfolio consists of 30 molecules, comprising of 67 dosage forms across various therapeutic categories: including both chronic (long-term) therapy and acute (short-term) therapy. Management estimates that the aggregate annual Canadian sales of its 30 approved products represents "a $1-billion market opportunity". Furthermore, the company plans to launch "with additional products and we will provide further updates in the coming months," said Arun.

The generics division of the company was only launched last Spring, since then the new management team has reached a number of significant milestones including:

On April 15th, 2014 Vancpharma announced that it had signed Cross Referencing Agreements ("CRA") "for prescription generic products for Canadian markets. These agreements are with three large pharmaceutical companies and cover 48 prescription generic products. The suppliers will handle manufacturing, and Vancpharma will market and sell these new product lines under its own label.

On November 18th, 2014 the company received approval via a Notice of Compliance ("NOC") from Health Canada for 22 generic molecules, comprising 51 dosage forms.

On December 10th, 2014 the company announced that it had been issued a drug establishment licence ("DEL") (licence No. 102220-A) by Health Canada. "The issuance of a drug establishment licence, along with the approval of our partner's GMP manufacturing site, is a key step towards the commercialization of our generic drug portfolio," said Arun Nayyar, CEO. The licence allows Vancpharma to import pharmaceutical products and distribute them within Canada.

This news was particularly important for the company and shareholders because: it positioned Vancpharma to become one of the only 40 companies in Canada that are licensed to manufacture current and future drugs at its GMP facility; allows Vancpharma to import from other manufacturers across the world and faces less barriers to entry; allows for importing both generic and non-generic drugs thus allowing the company to compete with other companies in branded drugs as well as their core generics business; and adds major clout when negotiating for exclusivity rights across Canada. Previously, manufacturers wouldn't commit their exclusively to Vancpharma as they were unsure if it could make good on importing and selling their products.

On December 15th, 2014 the company received an NOC from Health Canada for 7 additional generic molecules, comprising 15 dosage forms.

Lastly, on January 14th, 2015 Vancpharma placed inventory purchase orders for 30 generic molecules and expects to deliver these products 2Q 2015. "We are excited to take this important step towards commercialization and look forward to launching sales in Q2 2015. These 30 molecules represent best-selling generics in the Canadian market and our aim to provide Canadians with quality and cost-effective products is well served by them," said Arun. "Our initial marketing and outreach activities with select pharmacy customers in Western Canada have been positive and we look forward to working with our partners."

Figure 1: Generics Portfolio

Source: Press Release/Company Website

*Note: I'm aware that's only 29, however the 30th hasn't been updated on the website although it's been mentioned as approved (new approvals could come at any time)

Here are the next steps with the generics portfolio:

Figure 2: Generics Through Global Partnership

For those wondering what Vancpharma's margins are, the company has not made that public yet. As you can imagine, they don't want to expose their margins for specific drugs too early. Investors will be able to see them in the financial statements at a later date. However, generics are quite lucrative. Vancpharma will be taking on the risk of inventory, licensing, approvals, sales and marketing, whereas the manufacturer takes and fills an order from Vancpharma as necessary and collects payment. Accordingly, the reward follows the risk and in this case, Vancpharma would pay a fixed price to the manufacturer depending on the size of the manufacturing run. If you look at the financials of another generics company, Biosyent (TSX-V: RX) you will see margins typically ~70%-75%.

The margins generated from strategic cross-reference partnerships, while very enticing, pale in comparison to the financial opportunities presented by exclusive or co-development partnerships which management has indicated they want to pursue in the future.

OTC PRODUCTS

The OTC Products Division is focused on the marketing and sales of novel and proprietary healthcare products and consists of four (4) such products, all of which now have a Natural Product Number.

Figure 3: Vancpharma Pharmaceuticals OTC Products

It can't and won't be the cash cow for Vancpharma like its generics portfolio - the Canadian market for these OTC products is only ~$60-70 million - but it should actually start generating revenue sooner. Manufacturing should commence in January, with the first sales hopefully starting to come sometime during March.

Looking ahead at the future pipeline of OTC products, they include nutraceuticals, vitamin supplements, and skin care products.

MANAGEMENT

The team has extensive experience and expertise that spans across various functions such as research, development, manufacturing, and marketing of generics and OTC health care products in the global pharmaceuticals industry. This understanding of industry best practices and strong insight allows the company to identify emerging trends in medicine and the marketplace.

The secret to being able to license so many drugs within such a short period of time, less than a year after being restructured is CEO, Arun Nayyar.

Arun only joined the company November 25th, 2013, but came with an extensive track record in the industry - specifically generics - having held executive positions with pharmaceutical companies in Latin America, Asia, and Canada. He has been instrumental in opening up new markets abroad, and domestically his accomplishments include Director, Business Development and International Sales for Shoppers Drug Mart ("SDM"), and consulting for Sanis Healthcare, George Weston Ltd. (Loblaws group), and SDM. To have a more extensive look at Arun's resume and job history, you can view his LinkedIn here.

Some information that you won't find on LinkedIn is that he's an owner of a few Shoppers Drug stores in the Vancpharmaouver area, and also has deep-ties, and solid connections in India. This helps to secure licensing of the generics in exchange for manufacturing rights when Health Canada approves the products.

The newest hire, replacing Jamie Lewin as director and CFO and announced December 3rd, 2014 was Aman Parmar. "I look forward to working with the team at Vancpharma Pharmaceuticals and am impressed by how far they have progressed with limited capital," said Mr. Parmar. "Capital efficiency and creating shareholder value will be my primary focus at Vancpharma." Since joining Vancpharma, Aman has purchased 135,000 shares on the open market ranging from 19 to 24 cents - clearly indicative that he believes the company is undervalued at these levels.

Given the fact that the company is ramping up its business, they've already started putting together a sales and marketing team, it wouldn't surprise me if another executive was brought in to help.

You can read more about the entire Vancpharma team by clicking this link (note, this page needs to be updated with Jamie/Aman).

FINANCIALS

Although Vancpharma is a pre-revenue company, I see a multiple number of visible, value-unlocking events through 2015 that can meaningfully impact stock performance.

Figure 4: Summary of Quarterly Results

The company closed an oversubscribed, non-brokered private placement for gross proceeds of $1,141,000 by issuing 7,607,332 units at $0.15/unit on December 11th, 2014. "This round of funding enables us to move our portfolio of generic drugs and OTC products into commercialization," said Arun Nayyar. "Specifically we will be acquiring generic drug inventory and building our sales team to target pharmacy customers."

The company is financed for the time being, but may have to do another round in March depending on how the roll-outs are going, and for general working capital purposes. If so, I'm sure that it would be strategic - I would think at least >$0.20, comprised primarily by sophisticated retailers and brokers, and it would not be a raise of much more than $1 million. Management only wants to raise whatever money they believe is necessary right now because they know as soon as the company starts generating revenue that its valuation has easily be many multiples of where it sits today.

SHARE STRUCTURE

Shares outstanding: 44,374,407

Stock Options: 3,975,000

Warrants: 16,212,252

Fully Diluted: 64,561,659

Major shareholders of the company, and percentage owned include:

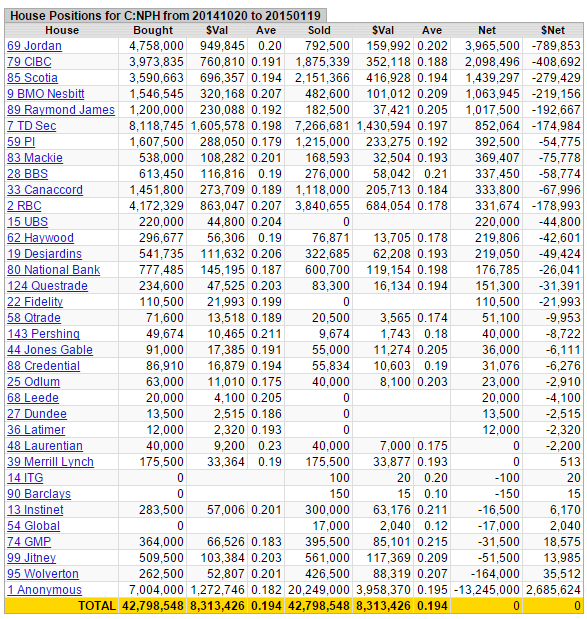

It's a tight share structure, the 'effective' float is ~9 million shares - much less than what's been traded the past few months - 42,798,548 shares at an average price of $0.194:

Figure 5: House Positions

Source: Stockwatch

Figure 6: Management Insider Filings

REVENUE RAMP/VALUATION

It's a little early for me to try and assign a valuation, or forecast revenue and earnings for the company, however I anticipate doing so before year-end. The company hasn't informed investors of the specific margins and obviously we don't know the adoption rate because we don't know how good the sales team will be. Take a look at this article though, "The Top 11 Fastest-Growing Generis Companies", when compared some of the other generics companies, Vancpharma looks very undervalued based solely off of its standing drug portfolio.

The two best examples that come to my mind are: Paladin Labs and BioSyent (OTCPK:BIOYF).

Former pharma sales rep., and Cantech Letter contributor Hogan Mullally wrote that Paladin "became the poster child for Canadian specialty pharma. They built a remarkably successful business by acquiring the Canadian rights to a wide variety of drugs. These drugs were either too small for medium/big pharma, or were developed by a company without a Canadian commercial footprint, whatever the reason, Paladin was able to amass an eclectic and diverse portfolio of prescription and OTC drugs for the Canadian market. Through their "sum of the parts" strategy, Paladin grew to over $200 million in annual sales and in 2013 was acquired by Endo Pharmaceuticals for approximately $1.6 billion.

BioSyent is in between Vancpharma and Paladin, as it has already amassed an impressive portfolio by searching the globe to in-license or acquire innovative pharmaceutical products for the Canadian market. It too focuses on products that are too small for medium/big pharma, and have a competitive angle that can be exploited by a modest sales force. BioSyent's business model is structured to minimize risk, and to produce high growth. For the four years ended December 31, 2013 the company experienced a CAGR of 67% while consistently growing profits:

Figure 7: BioSyent Financials at a Glance

Source: Fact Sheet

There is an exit strategy for the company and shareholders - take-out target for an M&A transaction. It might take getting into a few hundred pharmacies, but the precedent has already been set. The initial adoption rate risk is reduced from the outset because between members of the management team, they own a little more than a dozen pharmacies. Not to mention now that Health Canada has granted the company a Drug Establish License it can pursue additional revenue opportunities and further de-risked the investment.

RISKS

Vancpharma is still considered an early stage company, as such there are a number of risks associated with making an investment at this point in time, including but not limited to:

(1) The company just hired a new CFO, and has a management team has dozens of years of business experience, most dealing with generic pharmaceuticals.

(2) The company plans to manufacture its products at four certified GMP pharmaceuticals factories in Canada, India and China. These U.S. FDA approved plants are capable of manufacturing a wide range of Generic Pharmaceuticals and OTC Health care products at these facilities, under the VANCPHARM label.

(3) Like I mentioned before, management controls a number of pharmacies which will de-risk the rollout process and immediately start generating revenue form the company's generics portfolio.

(4) Arun has built deep, extensive relationships in India and China, and has a lot of ideas to add more products to the portfolio (not to mention the future potential to co-development or development exclusively).

(5) The company sources its products from big products that are already approved by either the U.S. FDA or UPHRA, and also approved by Health Canada. As long as the company is in compliance with Health Canada guidelines then the ANDS application gets expedited, updated and faster tracked. The company hasn't had so much of a hiccup yet, because of the experienced team in place filing all of the paperwork.

(6) The company hasn't had an issue raising money despite the poor market for companies trading on the TSX Venture. The last PP was oversubscribed, and the shares were spread around to strong, strategic hands. Presuming management continues to achieve its milestones, I anticipate lots of eagerness for the next round.

CONCLUSION

Vancpharma set forth some ambitious goals, but has already accomplished so much in such a short amount of time that I really have large aspirations for it (and shareholders).

The company has a tried and tested business model which is simple to understand. Vancpharma enters into Cross-Referencing agreements with affiliated companies whom source products from China and India which are already approved, in exchange for manufacturing rights when the drugs are approved by Health Canada. This is very economical as there is a minimal cross-referencing fee paid to Health Canada, and a very large market opportunity (>$1 billion for current generics portfolio), with margins typically ~70%-75%.

Source: StockCharts.com

Taking a look at recent trading, there has been some healthy consolidation after the initial big run-up, ~33% off its 52-week high. MACD and RSI indicators are now in 'oversold' territory, and the stock is approaching its 200-day moving average. Up until a few months ago this stock traded 'by appointment only'. Since the middle of October, 42,798,548 shares at an average price of $0.194 have traded.

Now that the company has received 30 of its 49 Health Canada approvals (with the rest to be submitted shortly), there is a bit of work that needs to be done in order advance it from being a purely speculative growth biotech with Health Canada approvals, to one that's one being noticed by institutions and an American audience.

In the meantime, investors have two options: (1) buy now, taking the risk knowing that the company may need to finance further, but is extremely close to generating revenue; or (2) sit on the sidelines and wait until the second quarter financials are released, and make a decision then.

The latter is much less risky, however if management successfully executes on its business plan and stays on track with milestones, then I'm sure its share price will reflect it this, and it will be at a significant premium.

Bottom line, I think that there is a very compelling opportunity to invest right now given: (1) the recent pullback in share price; (2) the significance of forthcoming news releases to act as catalysts to unlock shareholder value; (3) management's achievements to date and their track record to deliver results; (4) market opportunity (>$1 billion on current portfolio) and attractive valuations of sector peers; and (5) lack of competition in the Western Canadian generics market and the opportunity to generate imminent revenue.

(For additional liquidity, NUVPF. trades in Canada on the TSX Venture as "NPH". 3-month average volume 637,531 shares/day.)

Please feel free to comment below or send me an inbox message if you have any questions or comments about this article.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |