Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

When's this stock gonna start coming down? lol... Fundamentals don't make any sense but keeps on going and going. Strong IPO's like VMW makes my occasional ipo plays very profitable.

multiples are crazy high but chart looks like it's gonna go up a bit more.. geezuzzz

multiples are crazy high but chart looks like it's gonna go up a bit more.. geezuzzz

multiples are crazy high but chart looks like it's gonna go up a bit more.. geezuzzz

VMware (NYSE: VMW) Is On Fire

Today VMware, the hottest tech stock of the year, confirmed that its profits increased 125% in the second quarter. Based in Palo Alto California, the company’s earnings rose to $34.2 million from $15.2 million, an increase of 10 cents a share compared to 5 cents a share for the same period last year.

License revenue rose to $204 million over last year's $113.3 million, while services sales more than doubled to $92.8 million from $43 million a year ago. The company ended the quarter with $280 million in cash and cash equivalents, compared with $94.6 million in the second quarter of 2006.

Sales for the second quarter rose almost 89% to $296.8 million, up from $156.4 million. Shelby Seyrafi, an analyst for Caris & Company has given VMware a target of $90 a share. Forbes recently rated Seyrafi one of the top analyst in the computer technology sector.

going down a bit from here for a little while...

lol this thing refuses to drop down.

EMC has a controlling stake on VMW... simple as that. lol

I'm somewhat a newbee and I don't quite understand how owning EMC with respect to VM is a good thing. Can you tell me how I will benefit from EMC as opposed to VMWare?

Beyond VMWare, how investors can ride virtualization wave

12:59p ET September 10, 2007 (MarketWatch)

SAN FRANCISCO (MarketWatch) -- Looking to make money from the next big wave in corporate IT spending? Just think like a surfer and remember that the biggest waves usually come in sets.

The monster IPO from VMWare Inc. may have convinced some investors that most of the money from the fast-growing market for virtualization software has already been made by those who were on board for that epic one-day ride.

That sentiment is understandable, given that VMWare executed the largest tech IPO since Google Inc.'s in August, 2004. It also notched the biggest first-day gain for any new stock issue this year, giving VMWare a market capitalization of $26 billion and making it more valuable than hardware giant Sun Microsystems Inc.

But according to those who have long followed the technology, which is used to boost the performance of corporate servers, less than 10% of those machines have been "virtualized."

"There's a lot of white space left in this market," said Nick Sturiale, a partner in the Palo Alto, Calif. office of venture firm Sevin Rosen Funds. "It's the biggest wave in IT right now."

That means there's still opportunity to make money from virtualization beyond the IPO of VMWare, which because of its ownership structure, essentially remains a controlled subsidiary of storage kingpin EMC Corp.

Thanks to its technology and links to EMC, which has a long-established sales presence among the largest corporate IT buyers, VMWare appears poised to capture the lion's share of the market.

Yet it's not the only player.

On Aug. 15, the day after VMWare exploded by 75% on its first trading day, Citrix Systems Inc. agreed to acquire virtualization startup XenSource for $500 million.

It was the largest acquisition ever for Citrix , which provides and manages applications for large corporate customers. The deal shows that strategic investors are betting virtualization technology will be applied not just to servers but to personal computers as well.

XenSource software improves the performance of desktop PCs and servers that run either on common operating systems -- such as Microsoft Corp.'s Windows OS -- or in a Web-based computing environment.

Hewlett-Packard Co. has also made its big virtualization play, buying Opsware Inc. in July for $1.6 billion. Opsware, originally called Loudcloud and founded by Netscape Communications technology guru Marc Andreesen, had sales of just over $100 million for its last full fiscal year.

Big market, hundreds of startups

Venture capitalists are placing their bets, too. Sturiale of Sevin Rosen, an early investor in XenSource, estimates that between 100 and 200 VC-backed startups are operating right now, "all of whom will have products that either compete with or complement VMWare" offerings.

The easiest way for stock market investors to place a bet on virtualization would be to buy shares of one of the public companies that have bet on it. Buying shares of VMWare would be the purest play, especially for buy-and-hold investors. While the shares look a little frothy right now on a price-to-earnings basis, the virtualization market might just get big enough to support that valuation.

The research firm IDC expects the virtualization market to post a compound annual growth rate of 40% for the five years ending in 2010. IDC estimates the market will be worth at least $3 billion by then.

Other investors think that's conservative, especially if the technology gets applied widely beyond its most-typical use in file servers running on the common computer-chip architecture known as x86.

In one sense, corporations are returning to the computing model used in the 1970s, when workers used "dumb" desktop terminals to remotely access applications stored on mainframes.

Now, virtualization holds the promise of allowing big enterprises to host, manage and update application programs -- and even operating systems -- for a fraction of what it would cost to buy additional hardware for the same task.

"We're going back to the timeshare model of putting the computing somewhere else, but (at the same time) we're creating the factory of the future," said Roland Van der Meer, a partner with the Silicon Valley venture firm ComVentures.

His company has invested in PANO Logic Inc., a startup working on technology that will allow server-based programs to run with virtually no management needed, an approach that's known as thin-client computing.

"If you can virtualize the server, you can virtualize the desktop, you can virtualize the screen. It's the thin-client idea, but it's 'no client,'" said Van der Meer, who's been a VC for two decades and was an early investor in companies such as Broadcom Corp. and Ascend Communications.

This will be my last column for MarketWatch, as I'm leaving to become managing editor of vator.tv, a social media site for innovators. Many thanks to all the readers who've sent feedback over the last three years. Remember, buy when the blood runs in the streets and sell when your relatives start asking you whether it's too late to buy.

nope. hasnt been an announcement.

Hey stockscientist, can i be an assistant board moderator? =]

it cums out when they make some money...lol

Do we know when earnings are coming out yet?

LMAOOO!!!! Cramerzzz good one LOL

GME for short? thanks for the tip.

As far as large caps go I think tommarrow there might be a sell-off on GME gamestop on earnings. I think the stock is $50-60 during the christmas season.

Cramer is in a no win situation, because people follow him like sheep he should be nicknamed Cramerzzzzzzz.

LOL 206 p/e ratio on quotemedia. Reminds me of a few chinese ADRs...

he's got the general idea right for sure... but he can't even beat the average market performance. It's better to just buy an index fund than to listen to his calls.

As for VMW, last week after the dip technicals were turning up and I just didn't feel the need to sell. I tend to think that it's the crowd frenzy that move the market anyway... and to reap the most benefits.

Today however, things are different. It is probably a very good time to take some profits. I'm on free shares anyway, so I'm not that concerned.. if it drops I'll be buying more.

hope it goes higher though.

The logic cramer used was that Google never traded at multiple higher then 30. VMW is sitting at a multiple over 60. I banked from the move from 50-60 and will walk away happy.

I agree any IPO is risky. Matter of fact, some call it IPO = It's Probably Overpriced. I think graham and buffet both said that. lol

Most investors invested potential of the technology,

and if it's even 1/3 as significant as google, then it will hold up nicely. There are competitors, but so does bidu/yahoo/msft/oracle

The whole reason why VMW went public is to raise money... they aren't going to spend that on vacations to cancun, it's being used to (hopefully) generate more earnings. Gonna take some time for the earnings multiple to catch up though.

VMW is just way too risky at $75 a share and a earning multiple over 60.

It would be extremely reckless for anyone to recommend the stock on a nation show like cramers.

I am sure some idiot out there hears a cramer recommendation and puts his life savings in it.

Cramer called VMW a "sell" last week or so and it went up to record highs. lmao.

One could make decent profit on average doing exactly the opposite of what he sayz... lol here's how:

http://online.barrons.com/article/SB118681265755995100.html

woops, $74.00 in like 5 min. lol

sweet....... i say it hits $74.00 today..... yee hawwwww!!

nice.. i got in at 49.87

sitting pretty as well :)

i got tickets at $49.51 so my account is looking pretty sweet now.. I'm not stepping off either, it's to fast!!! lol

just broke 60 again.. what a beast

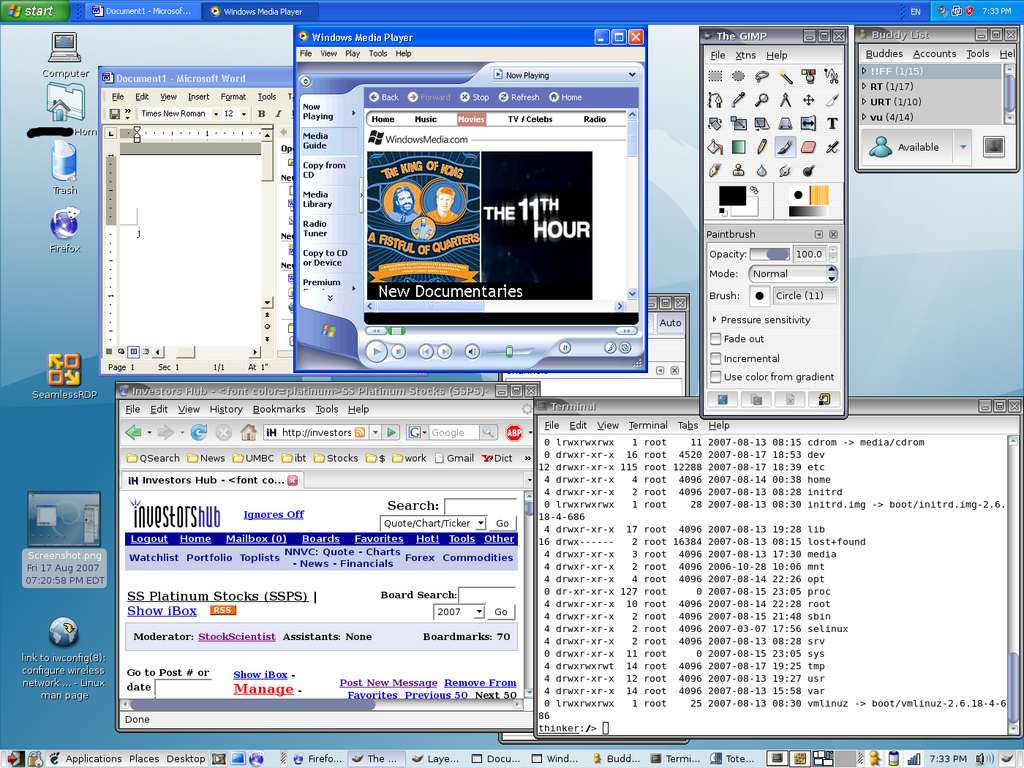

Windows and Linux Symbiosis. Just scratching the surface of the power of VMware, lets you have multiple OS coexist in one computer.

This is a screen shot of my very own laptop.

Windows XP running on Debian Linux with remote desktop feature enabled.

It works the other way around too. Simply Amazing.

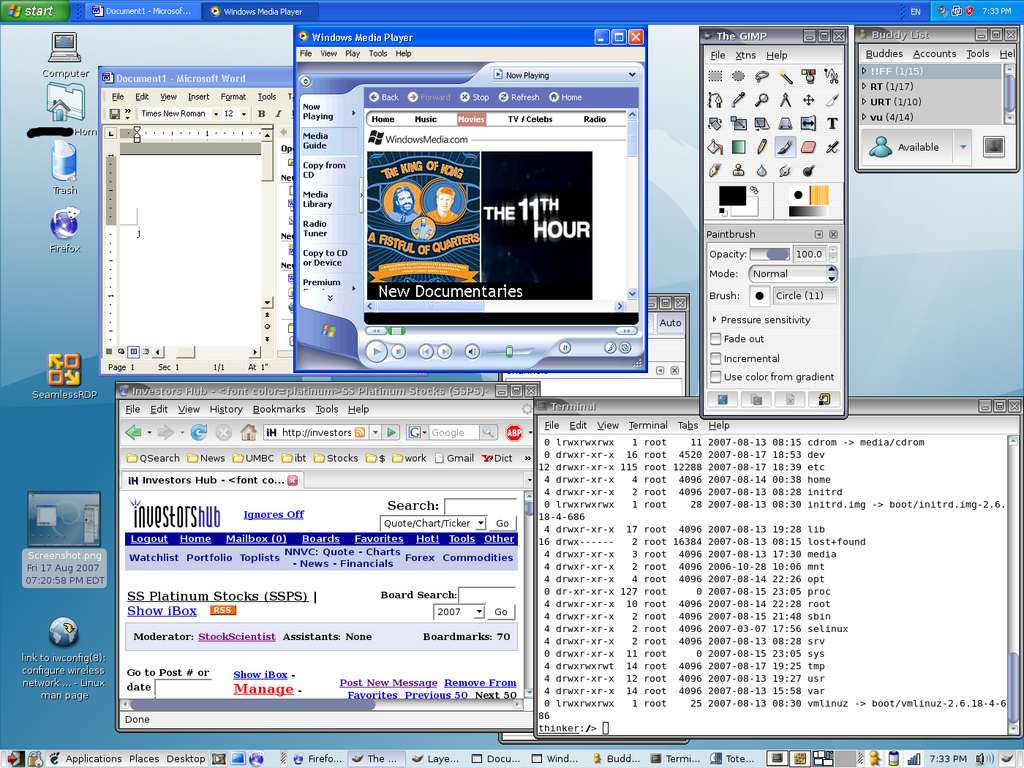

Windows and Linux Symbiosis. Just scratching the surface of the power of VMware, lets you have multiple OS coexist in one computer.

This is a screen shot of my very own laptop.

Windows XP running on Debian Linux with remote desktop feature enabled.

It works the other way around too. Simply Amazing.

i've heard him mention that VMW is a sell twice now. He feels that its too overpriced because he originally had a price target of 60 for the company. Even he underestimated the 100% increase VMW would have =P

Cramer calls vmw sell... did anyone see him talk last night?

Quote media says VMW's PE ratio is 180... lol

damn it, i shoulda bought more~!!!

awesome video thanks stockscientist.

There was some big resistance at 58.00 today. If it breaks through 58, then the P/E is getting pretty high even for a tech stock. I just want it to hold 50.

I don't know about vmware's other products so i can only speak of the vmware server. The vmware server lets you run several other operating systems within your existing OS.

I got XP, Vista and Solaris (running off vmware) in my linux box. And Red Hat running off my windows Vista box. lol. It works surprisingly well both ways but u need some basic computer knowledge in order to install/configure properly.

The crucial difference between other emulators is that vmware's products are exactly what the name says: having a virtual computer within your own computer and quite robust too. You can even set BIOS settings/ restart / set boot options / configure memory/etc of your vmware based virtual computer like how you would set your real one.

No i have never used it but i have talked to people who have and they all say its amazing.

What do you think is so amazing about it that it stands out from other products?

Yeah, agreed to that. Do you use Vmware?

It's an amazing product, imo.

No i think this will go lower, but im praying it holds the 50 mark.

I made over a 2000 yesterday and then lost about 200 mid afternoon before selling for a total of 1800 gain, lol. I then had to run out for errands and couldn't buy back, lol

Do u think it has bottomed out? markets set for a weak open this morning.

|

Followers

|

20

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

150

|

|

Created

|

08/14/07

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |