Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Sure, why not? Give PQ something to seize. Customs & Immigration and DHS will have similar interest especially now that they have amended their focus. Now issuing total bans from US for terms of either 3 years, 10 years or lifetime. Feel certain Laliberte could quickly become a person of interest. Stench of fraud still permeates the air near UAMA. Give it a try....that'll be fun!

Could UAMA be coming back.. Crypto / AI / Telecoms all exploding.. Fertile ground. 😎😂

Could UAMA be coming back.. Crypto / AI / Telecoms all exploding.. Fertile ground. 😎😂

Prognostications all came true. UAMA total fraud.

CCAA Proceedings gutted assets and employees.

UAMA CEO Benoit Laliberte now facing criminal charges on the same CRA issues raised by this poster in 2020, 2021 and 2022.

CRA, Province of Quebec and RCMP should all talk to UAMA, Investel and TNW principal resident in Ottawa.

For the RCMP it's only a few minutes drive from their headquarters.

Heck, just ask me and I'll give the name and address.

Benoit Laliberte & Lawry Trevor-Deutsch should be arrested .

How UAMA got here. Google search "Benoit Laliberte fraud"

Arrest them all! Whole management team!

Fraud is fraud particularly as Benoit Laliberte was convicted of 44 counts of fraud by a Quebec Court (Canada).

Ask me nicely and I'll post the court's decision and the accompanying press releases.

Serious violations and had the convictions come 6 months later he'd have gone to the slammer.

Government dropped the ball on CRA payments though sounds like they will right the wrong with a stiff jail sentence now.

Long overdue for Mr. Laliberte.

Claims he is mentally ill and some truth, though considering likely conspiracy it was a team effort.

Hope they look closely at accomplices like Laurie Trevor-Deutsch. He likely has dirty hands as well. RCMP should interview him as he lives only a few minutes from national RCMP headquarters.

Suggesting that they are not corrupt is tantamount to approving fraud as business as usual.

Wow! Buyer Beware when dealing with these guys!

Who besides Laliberte will be arrested?

Fraud is fraud particularly as Benoit Laliberte was convicted of 44 counts of fraud by a Quebec Court (Canada).

Ask me nicely and I'll post the court's decision and the accompanying press releases.

Serious violations and had the convictions come 6 months later he'd have gone to the slammer.

Government dropped the ball on CRA payments though sounds like they will right the wrong with a stiff jail sentence now.

Long overdue for Mr. Laliberte.

Claims he is mentally ill and some truth, though considering the conspiracy it was a team effort.

Hope they look closely at accomplices like Laurie Trevor-Deutsch. He likely has dirty hands as well. RCMP should interview him as he lives only a few minutes from national RCMP headquarters.

Suggesting that they are not corrupt is tantamount to approving fraud as business as usual.

Wow! Buyer Beware when dealing with these guys!

Prognostications all came true. UAMA total fraud.

CCAA Proceedings gutted assets and employees.

UAMA CEO Benoit Laliberte now facing criminal charges on the same CRA issues raised by this poster in 2020, 2021 and 2022.

CRA, Province of Quebec and RCMP should all talk to UAMA, Investel and TNW principal resident in Ottawa.

For the RCMP it's only a few minutes drive from their headquarters.

Heck, ask me nicely and I'll give the address.

Posted back in 2020, Wow! UAMA rotten to core!

Benoit Laliberte, record of mediocrity and fraud.

Facts are clear that Mr. Laliberte should have gone to JAIL for his 44 convictions for stock fraud, market manipulation and deceiving investors. He'd have been sent to jail in any other Province in Canada at the time and certainly in the US. He was lucky to have dodged a jail sentence.

Not only has he been an undischarged bankrupt for the past ten (10) years, but also morally bankrupt. Dig into the bankruptcy proceedings and the many documented breaches of contract. Serious enough that one judge went on the record commenting that it appeared that such breaches seemed a business practice of Mr. Laliberte.

The record shows that Mr. Laliberte is a poor manager and leader. He's screwed up and caused the failure of numerous companies the largest of which was Teliphone-Navigata-Westel. That $47M bankruptcy totally GUTTED the asset base and employee talent base. Nothing is left except for a pile of legal bills and potential action against Mr. Laliberte for his written threats to an Officer of the Court and his failure to remit employee tax withholdings to the CRA in Canada. Will this bring charges against Mr. Laliberte? Time will tell.

In retrospect not sure why Investel, UAMA, Laliberte bought RuralCom. RuralCom became TNW Wireless Inc and that has totally failed. Time has clearly demonstrated that Mr. Laliberte doesn't understand wireless. RuralCom was "market ready" with institutional investor support garnered through the RuralCom CEO. It could have been quickly built into a significant regional carrier and could be generating $40-80M today in annual revenues with really decent EBITDAs, except Benoit's EGO got in the way and it was all for naught. The CEO was set free along with his financial supporters and the record will show that when Laliberte approached those institutional investors he was shown the door! Funny how the investor community eschews convicted criminals.

Don't see the greatness that some other posters seem to want to see in Mr. Laliberte. He's a fraudster with an unremarkable track record. Predictably the past is the best clue to the future of UAMA and it is bleak!

CRA, RCMP, PQ should interview UAMA Ottawa principal.

Long-time principal of many of the frauds resides in Ottawa.

Accessory before the fact, accessory after the fact or both?

Teliphone-Navigata-Westel, Investel, United American Corp. et al

Long-time resident of Ottawa and only minutes away from RCMP HQ.

Ask me nicely and I'll provide the address.

Fiat Justitia Ruat Caelum - let justice be done

CRA & PQ should look at UAMA principal living in Ottawa.

Accessory before the fact or after the fact, maybe both.

Resides a few minutes from RCMP HQ.

Definitely worth an interview.

CRA, PQ violations in this archive.

Look back. Subject came up a number to times and there is abundant evidence or leads that can assist any investigation in search of the facts.

Yes, even this poster noted the CRA obligations in the CCAA Proceedings, and submitted comments.

Fiat Justitia Ruat Caelum.

UAMA principal residing in Ottawa likely accessory re CRA.

Only minutes from RCMP HQ.

Accessory before the fact or accessory after the fact.

Prosecutors can figure that out.

One UAMA principal in Ottawa re CRA, etc.

The UAMA principal who resides in Ottawa is only minutes away from RCMP HQ.

An interview with that person may reveal untold details of the fraud.

PQ Government should also interview UAMA principals.

A short drive to Ottawa to visit one principal.

Could be that many more fish can be caught by spreading out the net

CRA, etc. should interview UAMA principals!

One is conveniently located in Ottawa only a few minutes drive from the RCMP HQ.

I'm sure they could learn a lot about how this fraud has operated over the years.

Maybe spread the net out a little wider to capture all the fish!

More bad news for UAMA CEO.

https://www.conseiller.ca/nouvelles/fiscalite/il-doit-beaucoup-aux-impots/

Seems the government now has something to prove and that's always a great catalyst towards timely indictments.

Justice is about to pay UAMA CEO a visit.

Flatlined just like underlying businesses!

UAMA CEO facing serious criminal charges.

https://actualnewsmagazine.com/english/tax-evasion-bankrupt-benoit-laliberte-faces-serious-criminal-charges/

Caveat Emptor valid advice for UAMA.

Fraud, fraud and more fraud.

UAMA CEO labeled as convicted criminal by The Canadian Press.

And now.....Federal Government and PQ Government motivated to prosecute.

The man belongs in jail.........and maybe those who engage in marketing the fraud.

Contrary position, never has there ever been a better time to invest in UAMA

But really don’t. Some say management are corrupted etc…. Not true… however stock is is dead.

More bad news for UAMA shareholders!

https://actualnewsmagazine.com/english/tax-evasion-bankrupt-benoit-laliberte-faces-serious-criminal-charges/

More unfavorable news on UAMA!

From the Canadian Broadcasting Corporation spelling out news that should be troubling to all shareholders.

https://ici-radio--canada-ca.translate.goog/nouvelle/1932946/benoit-laliberte-installations-cryptomonnaie-hydro?_x_tr_sl=fr&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Just look at all the fraud here.

La Presse to be commended for exposing Benoit Laliberte's reputation as a fraud.

https://www.lapresse.ca/affaires/2022-11-16/benoit-laliberte-dans-l-immobilier-et-la-cryptomonnaie/exploiter-des-loopholes-grace-a-la-chaine-de-blocs.php

If not in English there is a translate option at the top right of the linked opening page.

UAMA CEO faces serious criminal charges!

Anyone (including his gang of supportive posters) would have known in following the bankruptcy proceedings started in November 2016 that payroll taxes had not been remitted to any government agency Federal or Provincial. See the linked article:

https://www.lapresse.ca/affaires/2022-11-15/evasion-fiscale/en-faillite-benoit-laliberte-fait-face-a-de-graves-accusations-penales.php

The LaPresse article can be easily translated from French to English

What was the Board of RuralCom thinking?

What was the Board of Directors of RuralCom thinking when they sold RuralCom to these fraudsters

According to the records any due diligence would have found at least the major items of the frauds committed by Mr. Benoit Laliberte and his accomplice Mr. Lawry Trevor-Deutsch.

https://www-lapresse-ca.translate.goog/affaires/2022-11-14/evasion-fiscale/plus-de-56-millions-dus-a-l-etat-depuis-11-ans.php?_x_tr_sl=fr&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Click on the link to open the La Press acticle and use the translate option to convert to English

The article is long and in-depth and clearly illustrates the character of these two miscreants.

Benoit Laliberte & Lawry Trevor-Deustch & La Presse

Wow! Nice long article truly exposing the frauds of these two. https://www-lapresse-ca.translate.goog/affaires/2022-11-14/evasion-fiscale/plus-de-56-millions-dus-a-l-etat-depuis-11-ans.php?_x_tr_sl=fr&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

Click on the link and then select translate to review the extensive article in English.

"More than 56 million owed to the State...for 11 years.

FTX failure should warn on Housebit

Say it isn't so! Everything these guys touch turns to dirt.

Canadian Press labeled CEO as convicted criminal.

UAMA, Investel, TNW, Teliphone, Navigata, Westel et al run by Benoit Laliberte who has been labeled a convicted criminal by The Canadian Press. Now surfacing again with Housebit with same failure-prone management team. Rinse and repeat!

TNW Wireless MIA (missing in action)

Recent CRTC announcement opens doors for MVNOs in Canada.

Laliberte and Trevor-Deutsch have another opportunity to display their incompetence though seem MIA (missing in action). It was never about the building the business and more about building the appearance of building the business. Fraud is an integral part of what Bert and Ernie do here. Though their boat looking pretty empty these says as even their implicated supporters have fled the scene. Doubt Housebit has much of a future with a convicted criminal (per The Canadian Press) as CEO.

TNW Wireless MIA (missing in action)

Recent CRTC announcement opens doors for MVNOs in Canada.

Laliberte and Trevor-Deutsch have another opportunity to display their incompetence though seem MIA (missing in action). It was never about the building the business and more about building the appearance of building the business. Fraud is an integral part of what Bert and Ernie do here. Though their boat looking pretty empty these says as even their implicated supporters have fled the scene.

Housebit not worth trusting!

Benoit Laliberte labeled a convicted criminal by The Canadian Press.

Why on earth would you trust him with your money or property deed?

Housebit. Emerging play? Trust the limiting factor!

Same old team, "The Gang that Couldn't Shoot Straight", working on a real estate play. Their track record and convicted criminal CEO (per The Canadian Press) won't engender confidence. Their track record as a team is well known and their bogus claims of past success as a management team are laughable. Would you permit these people to get their hands on your property title?

UAMA management killed all opportunities.

Wireless dead and buried.

Crypto mining also appears to be dead meat.

Hard to raise money from institutional investors when CEO is a convicted criminal per The Canadian Press.

Telephone-Navigata-Westel just recently wrapped up a 5-year bankruptcy proceeding in Canada and nothing left.

Now some evidence that this gang of miscreants planning a block-chain real estate play.

Would you trust this gang with your money or property title?

UAMA management includes convicted criminal.

Look back at prior posts to identify those who posted most of the supporting posts. Much of the evidence now easily reviewed from court records has been known to many for several years.

Here's the link to the CCAA Proceedings (bankruptcy of Telephone-Navigata-Westel) over the past 5+ years. Link: ey.com/ca/restructuring

While a boring read, it's a "tome" on the astounding level of incompetence of Benoit Laliberte and Lawry Trevor-Deutsch. Truly astounding.

Together they have never built a business of lasting value. Ever!

Benoit Laliberte has been labeled a convicted criminal by The Canadian Press and they are not to be trusted.

UAMA et al, the gift that keeps on giving!

This link to the CCAA Proceedings (bankruptcy of Telephone-Navigata-Westel) over the past 5+ years. ey.com/ca/restructuring

While a boring read a "tome" on the astounding level of incompetence of Benoit Laliberte and Lawry Trevor-Deutsch.

Together they have never built a business of lasting value. Ever!

Benoit Laliberte has been labeled a convicted criminal by The Canadian Press and they are not to be trusted.

Given track record, I'd stay away from UAMA!

Benoit Laliberte labeled a convicted criminal by The Canadian Press. Now it looks like they're going into the real estate business. Just think your RE title and funds being managed by a "convicted criminal". Boggles the mind!

Interesting

https://housebit.com/

Meet the team, looks great.

Scary thought, UAMA may launch again!

Seems team hasn't changed and led by convicted criminal Benoit Laliberte (per the Canadian Press) and that's not good news! Expect them to "uncork" the next fraud with grandiose claims of future success. Caveat Emptor should be the watchword here as this team has never demonstrated any success. Teliphone, Navigata, West was a bust finally buried by the bankruptcy proceedings. Wireless was market ready, had a CEO with term sheets, and they fired him, couldn't raise needed capital and proceeded to manage the former RuralCom into oblivion. Crypto currency mining apparently created some revenue though their twisted business strategy was a loser from the start. While everyone else in that space was mining, mining, mining, UAMA wasted time trying to convince the world that their sophomoric solution was a viable path forward. The numerous failures of this management team is legendary and their ability to make good on their grandiose claims as management experts is laughable.

Has UAMA abandoned wireless, crypto-mining, etc.

Seems like this is the plan. My guess cellular license fees not paid and no signs any part or portion of the cellular network is operational. Crypto mining seems to have been doomed by land-use violations and rather than invest to move, they're just going to shut it down and grow vegetables on the land. Maybe the best plan for that land though can't get past abysmal track record of this management team. Really bad and seems everything they touch turns to dirt.

Is Housebit the big secret?

Same old team, "The Gang that Couldn't Shoot Straight", working on a real estate play. Their track record and convicted criminal CEO (per The Canadian Press) won't change just the business vehicle. Their track record as a team is well known and their bogus claims of past success as a management team is laughable.

"The Gang That Couldn't Shoot Straight". Movie from 1971.

Says it all about track record of Laliberte (convicted criminal per The Canadian Press) and Trevor-Deutsch who can never built a winning team.

Rumor says it management needs to bury the past.

Going to try something new maybe. Divert focus away from abysmal performance of the past. Failed at telecom, cryptocurrency mining, patent litigation and truly these guys are "The Gang That Couldn't Shoot Straight". Movie from 1971.

iPCS is dead, carrier-grade Wi-Fi 6 (6E) is it!

UAMA should park iPCS or completely trash it. It never had any traction in the market except in UAMA CEO's head and ego. Carriers now embracing carrier grade Wi-Fi 6 (6E) in USA and abundant opportunity. Where's UAMA or TNW Wireless? Nowhere it appears!

Broadband HOT, UAMA NOT!

US Fed Gov has/is pumping over $65 Billion into Broadband.

Reminds me of land-rush expansion of cellular in 80s and 90s and that without Fed Gov subsidies.

Broadband land-rush already underway across America and to someone who was in thick of cellular I can attest it feels the same.

UAMA CEO Benoit Laliberte made much to their "expertise" in wireless. So where are they now?

Opportunities in US broadband abound!

|

Followers

|

53

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

12542

|

|

Created

|

08/23/04

|

Type

|

Free

|

| Moderators | |||

(UAMA) United American Corp

(UAMA) United American Corp

BlockNum is a Distributed Ledger Technology (“DLT”) which uses the Public Switched Telephone Network to support secure transactions for the GIGA token through the development of a Public Switched Teliphone Blockchain Network or PSTBN. BlockNum is a highly permissioned blockchain with an access control layer for the blockchain nodes based on SIP messages with communication occurring solely via SIP-based message over IP protocol.

The PSTN provides an immense installed decentralized network base and when combined with SIP message, is an immensely secure system which is instantly scalable to allow the BlockNum to reach any person in the world who has a phone and phone number.

BlockNum will operate on the principle of “Proof of Consensus” or PoC as opposed to “Proof of Work” “Proof of Stake” blockchains. Proof of Consensus focusses on determining that consensus has been achieved (the “consensus event”) within a network of decentralized distributed ledgers and where the ledgers are held within a combination of trusted and independent anonymous nodes. Transaction “consensus” is achieved through a second layer of token nodes which sole function is to approve or deny a transaction in a consensus event.

The GIGA is a new form of token which can be viewed as a “transport token”. It is defined as a transport token because it “transports” transactions between parties in a seamless and transparent manner.

The GIGA transports all transactions in the BlockNum which includes the transfer of GIGAs between BlockNum wallets well as other future transaction modules such as seamless and instant currency exchange (fiat to fiat, crypto to crypto, fiat to crypto and crypto to fiat).

In the future, the GIGA will also be available for the payment of services in real time. As such, it will become the first “consumable” token – i.e. it will be consumed as services are used. For example, one of the BlockNum modules currently under development is iPCS, an IP-only mobile service. iPCS will accept the GIGA for services provided and GIGAs will be consumed as the services are provided.

The GIGA using BlockNum blockchain technology will become a secure, trusted and transparent mechanism for BlockNum transactions.

Anyone with a BlockNum wallet will be able to transact in GIGAs or fiat/crypto equivalents using the BlockNum standalone application, the BlockNum website accessed through their smartphone, or a BlockNum application embedded in a third party service. Returning to the example of iPCS, the mobile service will provide an embedded BlockNum option within the iPCS app.

GIGAs will be issued by Internet PCS Inc. (BVI) (iPCS BVI).

iPCS has developed a patent pending technology that brings all its SoIP subscribers in compliant with international rules, regulations and roaming agreements and therefore provides a new generation of wireless services, at lower cost with much more flexibility for its users.

When an iPCS subscriber device is connected to an internet Wi-Fi network, the 3G/LTE cellular radio is automatically deactivated on the device and therefore not using the roaming partner network and spectrum. At the same time, all connections seamlessly switch to a remote access of iPCS’ own licensed spectrum, Cloud Spectrum-over-WiFi (CSoW). Therefore users are not permanently using partner networks roaming service and remain at all time in compliance of such usage agreements. iPCS can use several different roaming partner networks (if available) for each WiFi to 3G/LTE transfer between network session switches to obtain best quality of service.

iPCS features unlimited calling and MMS services when on Wi-Fi, and this represents a valuable alternative for international mobile roaming services. Only calls made outside the continental US and Canada can incur additional charges.

All personal information such as SMS texts, call logs, contact information and voicemail reside on secured cloud servers which can only be accessed under a secured user session. This means that when a user chooses to log out of the service the information cannot be accessed on the smartphone and 911 emergency services are available.

Users can have multiple profiles on their device, each with different usernames and different phone numbers, SMS text number, voicemails etc. Therefore several iPCS™ users can share the same smartphone device if they choose. iPCS™ SIM cards are not tied to a specific subscriber as in traditional mobile services so iPCS™ users can access their TNW Mobile service on any phone with a TNW Mobile SIM.

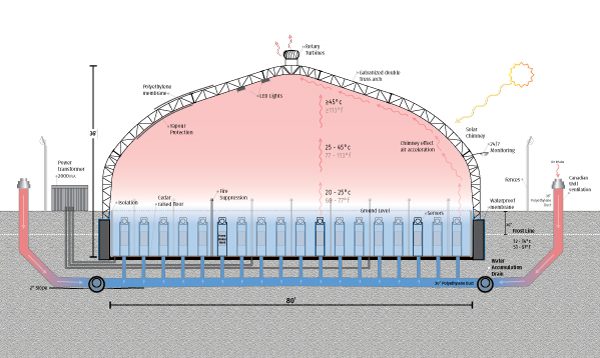

BlockChainDomes / BlockChainDatacenters

The BlockchainDomes™ are cryptocurrency mining facilities that will house mining servers and will provide both ASIC (application-specific integrated circuit) and GPU (graphics processing unit) based capability enabling the mining of both Bitcoin and Ethereum. It further incorporates highly innovative energy features which provide passive cooling using the ground as a natural source of cold air which induced through a chimney effect through its design.

In the past year, Cryptocurrency mining has become exceedingly popular at both with individuals and commercial operations. This is due to the rising value of cryptocurrencies as well as an increased awareness of the financial opportunities from mining. However establishing cryptocurrency mining operations is still a complex and expensive process and provides variable returns on investment based on available technical skills and direct costs of operations which are often linked to economies of scale.

It is well established for example, that mining operations are extremely energy intensive and as such the profitability of mining operations is highly dependent on the efficiency of the mining rigs and more importantly, the cost of electricity used for both the rigs themselves and the massive cooling requirements from the heat they generate. Some current reports indicate that for Bitcoin alone, mining operations consume as much electricity annually as the whole of Ireland and the electrical consumption per transaction is equivalent to what 9 average US households would use in a day. Therefore there is intense pressure on mining operations to both reduce the amount of energy required in the process and to seek out the lowest possible cost of electricity.

The Blockchain DomeTM

The Blockchain Dome is cryptocurrency mining facility that will house up to 1,000 mining servers and will provide both ASIC (application-specific integrated circuit) and GPU (graphics processing unit) based capability enabling the mining of both Bitcoin and Ethereum.

Servers will be sold to investors (individual, group or corporate) and these be operated by United American Corp through its wholly-owned subsidiary, United Blockchain Corp (United Blockchain) through its subsidiary, Blockchain Data Centers Inc., under a profit sharing agreement with the owners of the servers (half to the owners, half to United Blockchain) in an operationally innovative environment which minimizes costs and maximizes financial returns.

Under the Blockchain Dome business model, mining proceeds will be exchanged for US or Canadian dollars at a minimum once per month. As such United Blockchain will at no time hold any cryptocurrency on behalf of itself or owners of Blockchain Dome mining servers.

The Blockchain Dome will the first facility of its kind that will provide complete cryptocurrency mining capacity to individuals, groups of individuals and commercial operations on a reasonable investment basis and that allows all participants to own their own rigs and benefit from economies of scale. These economies of scale are realized through lower capital costs (though volume purchasing), lower which take advantage of Quebec’s unique electrical price structure as well as very basic overhead costs which can be amortized over all the mining servers in a specific Blockchain Dome.

The Blockchain Dome will appeal to various levels and demographics of miners ranging from individuals (or groups of individuals) who want to get into the mining business, to commercial operations and to general investors who want a turnkey managed play in cryptocurrency mining.

The Blockchain Dome has been designed for rapid deployment and easy to be replicated with some 25 facilities planned for the Province of Quebec based on demand over the next 24 months.

Chief Executive Officer | Benoit Lalibertehttp://www.google.com/url?sa=t&source=web&cd=1&sqi=2&ved=0CCIQFjAA&url=http%3A%2F%2Fen.wikipedia.org%2Fwiki%2FBeno%25C3%25AEt_Lalibert%25C3%25A9&ei=pfu5Tab5CcHGgAeJvqXPDw&usg=AFQjCNHhNOvMmBE9WQjTmORVuGoY_26phw |

Vice President / Corporate Affairs | Lawry Trevor-Deutsch |

Chief Opperating Officer | Sandeep Panasar |

President iFramed | Mike Schmidt |

Chief of Engineering Services | Maxime Brazeau |

Chief Programmer | Martin Reidy |

Token Engineering | Eric Cadieux |

Conceptualizer | Denis LaManna |

Director of Public Relations | Jenna Trevor-Deutsch |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |