Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

SWRL in default on loan from parent company

RMCF declared that effective October 28, 2015, interest on the obligations will accrue at the default rate of 15% per annum.

Yikes...not so great reviews for the parent company. Long story short here is an abundance of greed. These guys clearly lined their pockets and left little for shareholders. What's the use in high yield dividend when the stock price is falling due to these guys failing at building an ice cream/yogurt stand giant? RMCF might ultimately survive but SWRL will continue to SWIRL IMO.

http://seekingalpha.com/article/3573526-rocky-mountain-chocolate-factorys-q2-results-good-chocolate-still-a-bad-investment?utm_source=advfn&utm_medium=cpc&utm_campaign=investorshub

Merriman should be in stripes - A scam is a scam whether its on pinksheets or Nasdaq and this POS deserves to be shut down based on the self dealing of insiders and 18% interest....... I know loansharks that charge less than these crooks are charging themselves.

I see SWRL going BK and Merriman and his goons stealing anything of value just before the filing of CH11.

Wouldn't be caught dead supporting this company seeing as how horrible management is.

Isn't it amazing how these thieves work? The same group uses it's subsidiary to cash in what they knew was going to be a default. Guess who loses in the end????...common shareholders.

The Company had negative working capital at August 31, 2015 as a result of the loan agreement. Because of this, there is substantial doubt about its ability to continue as a going concern. The Company’s continued existence will depend on its future performance and the actions of RMCF concerning the loan agreement. We do not have a strategy that we believe will cause us to become compliant with the covenants of the note between now and the maturity date. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

During the three months ended August 31, 2015 the Company continued to be in default of covenants within its loan agreement with its lender, Rocky Mountain Chocolate Factory, Inc. (“RMCF”). The loan covenants require the Company to maintain consolidated adjusted EBITDA of $1,804,000 for the most recent twelve months. For the twelve months ended August 31, 2015 the Company had reported $1,423,000 of adjusted EBITDA. In the event of default, RMCF may charge interest on all amounts due under the loan agreement with the Company at the default rate of 15% per annum, accelerate payment of all amounts due under the Loan Agreement, and foreclose on its security interest. At August 31, 2015 the conversion of the loan into preferred stock as settlement of the obligation would result in approximately 66% more preferred shares issued when compared to the amount issuable if the Company was compliant with the loan covenants.

During the three months ended August 31, 2015 the Company continued discussions with RMCF regarding the event of default. The loan matures in January 2016. RMCF has expressed its intent to exercise any option available to it, as the lender, as a result of the event of default.

NO you get nothing unless you own RMCF stock. This will reverse split before you could ever hope for a divi.

Think about it - If there was a divi on SWRL insiders wouldn't be knocking each other down to dump their stock.

This used to be $1 a share before the RMCF took control..........Just sayin

So based off the August 20th recent news. If I buy this stock right now at 9 cents a share before Sept 1st I will receive a dividend of 12 cents for each share I own??? This sounds to good to be true. Why this stock isn't taking off?

So based off the August 20th recent news. If I buy this stock right now at 9 cents a share before Sept 1st I will receive a dividend of 12 cents for each share I own??? This sounds to good to be true. Why this stock isn't taking off?

Looks like Jones is selling 1% a day so if buying dries up this could go sub penny.

Looks like Dallas Jones wants out and still has 3.8 million more shares to dump - this is heading to sub penny if the selling continues.

Jones obviously doesn't see any value in holding shares in SWRL which begs the question, why should I?

Damn glad I sold out at $1.05 - think of the carnage insiders have caused by their relentless selling.

Closing stores that don't make money would be a nice start. Think about it, why would someone sell a successful brand unless it was losing money.

Seems "old" SWRL management was better than the RMCF gang - they are using SWRL as their loss leader.

That's what I meant by the guys selling over the past year...they knew the true cost of acquiring all of these stores/brands. Maybe they will find a way to significantly lower real estate costs.

There's an insane amount of competition in the frozen yogurt arena. Their claim of "economy of scale" may work for product but the real cost is the real estate leases that their "economy of scale" doesn't save them squat. And think about the hundreds of landlords all with different lease requirements.

Yep..that's him...I wonder how many he's going to sell. Seems the fellows at the top here knew this was coming and sold some last year/early this year IMO. Maybe they knew buying up a bunch of brands/stores wouldn't pay off so they built up the story to sell their shares. Now former owner of Cherry Berry is likely left to sell for near pennies/share.

On the other hand....maybe SWRL makes a nice profit in the next Q...Summer months and all.

https://www.linkedin.com/pub/dallas-jones/6a/637/41b

Makes sense - it is about a year - Looking for a nickel or lower.

I think Dallas Jones is the previous CEO of Cherry Berry...the shares he got from the acquisition I presume?

Low teen or high pennies

They blame it on closure/sale of some of their company owned stores...LOL. Well, let's see what the next Q looks like...that will include late Spring/early Summer revs. Maybe we see more revs? Might be a good time to buy in a couple months IMO...wait and see.

For the three months ended May 31, 2015, company-owned U-Swirl cafés generated $1,030,957 in sales, net of discounts, as compared to sales of $1,478,188 for the comparable period in 2014, a decrease of 30%. The decrease is due primarily to the closure or sale of certain locations in the prior fiscal year. There were 9 company-owned cafés for the three months ended May 31, 2015, as compared to 13 for the three months ended May 31, 2014.

About a 30% hit on sales............. with all the added stores????? Seems the dream may be melting.

U-Swirl to Launch Innovative Mobile Loyalty Program Powered by Mobivity

http://finance.yahoo.com/news/u-swirl-launch-innovative-mobile-120000467.html

U-Swirl to Launch Innovative Mobile Loyalty Program Powered by Mobivity

PHOENIX, AZ--(Marketwired - Jun 1, 2015) - Mobivity Holdings Corp. (OTCQB: MFON), an award-winning provider of proprietary SmartReceipt POS marketing solutions and patented mobile marketing technologies, announced today that U-Swirl, Inc. (OTCQB: SWRL) ("U-Swirl" or "the Company"), parent to U-SWIRL International, Inc., through which it owns and franchises self-serve frozen yogurt cafés, has selected Mobivity to launch a new mobile loyalty program that will integrate SMS text messaging with its SmartReceipt technology. U-Swirl, Inc. is an operator and franchisor of self-serve frozen yogurt cafés that operate under the following names: U-Swirl Frozen Yogurt, CherryBerry, Yogurtini, Fuzzy Peach, Aspen Leaf Yogurt, Yogli Mogli, Gracie Bleu, and Josie's Frozen Yogurt. As of January 2015, the Company and its franchisees operated 255 self-serve frozen yogurt cafés in 37 states and four foreign countries. U-Swirl, Inc. is headquartered in Durango, Colorado.

Customers of U-Swirl stores will have the opportunity to join various loyalty and rewards programs, as well as receive targeted offers and promotions, by subscribing to text messaging programs or through relevant content on their receipts.

"Our early tests have been extremely well received by our customers," commented Carell Grass, Vice President of Operations of U-Swirl. "Response rates to text messaging promotions have been as high as 71%, which is unparalleled. The ability to anchor our digital loyalty program to our point-of-sale systems and receipt content was a key differentiator that attracted us to the Mobivity solutions, and the results speak for themselves."

By leveraging Mobivity's SmartReceipt technology, U-Swirl will have the ability to craft highly targeted and relevant loyalty messages through SMS text messaging and via receipts given to consumers at the point of sale. Survey participation, subscribing to a text messaging program, bounce back offers, and other targeted calls-to-action are all dynamically generated on the receipt through the SmartReceipt technology, and continued customer participation is as easy as providing their mobile phone number at the point-of-sale. SmartReceipt reads purchase data in real-time, which enables U-Swirl to deliver the right message to the right people at the right time, rather than delivering them generic, non-targeted offers.

"We are elated to be partnering with another world-class brand to pioneer the next generation of consumer loyalty," stated Dennis Becker, CEO of Mobivity. "U-Swirl shares our vision of a future where consumers enjoy relevant and timely engagement from their favorite brands, and it's a privilege to play a key part in the support of that mission."

Who knows what Merryman will do here....

The Company’s derivative fair value adjustment of $381,000 reflects, in part, the failure of the Company to achieve the adjusted EBITDA covenant required in the loan agreement outstanding with RMCF. The loan covenants required the Company to maintain consolidated adjusted EBTIDA of $1,804,000 for the year ended February 28, 2015. At February 28, 2015 U-Swirl had reported $1,284,000 of adjusted EBITDA. In the event of default, RMCF may charge interest on all amounts due under the loan agreement with U-Swirl at the default rate of 15% per annum, accelerate payment of all amounts due under the Loan Agreement, and foreclose on its security interest. At February 28, 2015 we believe that the conversion of the loan into preferred stock as settlement of the obligation would result in 70% more preferred shares issued when compared to the amount issuable if U-Swirl was compliant with the loan covenants.

This doesn't sound too good.

During the fourth quarter of FY2015, U-Swirl did not achieve the adjusted EBITDA covenant of $1,804,000 for a rolling four quarters as defined by the loan agreement with RMCF. This covenant default enables RMCF, as the lender, the right to certain actions defined by the loan agreement.

Merryman gets another 50,000 common shares...as compensation.

Ya know, back when the Cartwrights owned this compensation shares were less than 2K per person if I remember correctly.

Merriman and his group are killing the ticker by putting the money in their pockets - doesn't really seem they are very good at what the claim they do.

Looks like SWRL gave out 50k shares to 4 directors....good ole' Clyde got another 50k to dump soon...LOL.

Explanation of Responses:

( 1) Shares granted as compensation.

Just came across this article - not very promising IMO.

http://seekingalpha.com/article/2832496-rocky-mountain-chocolate-factory-a-slow-motion-train-wreck

Looks like Cyde is out - Form 4 shows he's down to 1K shares........less than most outsiders................ Strong gains today without any reason.

This is one weird stock

Looks like SWRL might be getting some attention now. Loading here?

The complete lack of interest is deafening.

More sells today....not dried up yet...looking for another form 4 here soon? Just when you think they stop selling its starts up again. Let's see if SWRL holds .20's this time.

It appears they have put a bottom in where they are willing to sell. Trades are drying up.

The certification filing is an annual requirement. I think that 95k trade was behind the scenes. May have been an AON trade but it was probably someone selling their block of shares to known buyer IMO. I'm not convinced the annual certification is enough for me to load up 30,000 dollars worth of SWRL. But someone must think different. Maybe they know more than me or they're just taking a huge gamble.

Looks like this may have sparked that buy.

Dec 2, 2014

SWRL

Initial OTCQB Certification Initial OTCQB Certification Dec 2, 2014

95,0000 share trade for over $30,000 just went through at .32 Now CSTI on the ask with 10k.

I wish I knew the answer, it is either an incredible buy down here or a suckers bet to lose. I felt much more comfortable before all the RMCF insiders started selling.

Something to note is the fact that the Cartwrights and Conte don't show as selling any of their shares (which were awarded very conservatively when they owned the company) - This may be Merryman's way to eliminate them completely with a "restructuring" - we all know insiders get out before they kill a stock by "restructuring"

JMO - I've only followed this since 2010 and finally sold my shares back when I saw it dropping from the $1.30 area, it took me some time to make the hard decision to sell at $1.05 but now I'm glad I pulled the trigger since Merryman and the insiders seem intent on killing SWRL one way or another.

I'm going to contact them today and ask explicitly what will happen with SWRL when the holding company is approved. Reading that proposal, there is no indicating of what happens to us. It seems the holding company would 'hold' SWRL separately for capital and other purposes. So why are insiders selling????

It would seem silly to set up a holding company for two entities, and then phase out one of them, begging the question why set up the holding company in the first place? The dumping however seems to suggest something amiss is brewing....

Looking at the last quarter data, it's hard to understand what is wrong here. They are making money, just expanded, are majority owned by a respectable chocolatemaker, which is cross marketing with them. Where is it all going wrong???

$SWRL DD Notes ~ http://www.ddnotesmaker.com/SWRL

bullish

good price action

$SWRL recent news/filings

## source: finance.yahoo.com

Mon, 10 Nov 2014 21:30:00 GMT ~ Rocky Mountain Chocolate Factory, Inc. Announces Annual Shareholders Meeting and Proposed Holding Company Reorganization

[Marketwired] - Rocky Mountain Chocolate Factory, Inc. today announced that it will host its Annual Meeting of Shareholders on Thursday, February 19, 2015, at 10:00 a.m. local time . The meeting will be held at The Doubletree ...

read full: http://finance.yahoo.com/news/rocky-mountain-chocolate-factory-inc-213000910.html

*********************************************************

Wed, 22 Oct 2014 17:04:10 GMT ~ U-SWIRL, INC. Financials

read full: http://finance.yahoo.com/q/is?s=swrl

*********************************************************

Wed, 15 Oct 2014 19:50:20 GMT ~ U-SWIRL, INC. Files SEC form 10-Q, Quarterly Report

read full: http://biz.yahoo.com/e/141015/swrl10-q.html

*********************************************************

Tue, 14 Oct 2014 20:10:18 GMT ~ U-SWIRL, INC. Files SEC form 8-K, Results of Operations and Financial Condition, Financial Statements and Exhibits

read full: http://biz.yahoo.com/e/141014/swrl8-k.html

*********************************************************

Tue, 14 Oct 2014 17:02:17 GMT ~ CORRECTION - U-Swirl, Inc. Reports Record Net Income for First Half of FY2015

[Marketwired] - In the news release, "U-Swirl, Inc. Reports Record Net Income for First Half of FY2015," issued earlier today by U-Swirl, Inc. , we are advised by the company that the data in the "Non-GAAP, ...

read full: http://finance.yahoo.com/news/correction-u-swirl-inc-reports-170217340.html

*********************************************************

$SWRL charts

basic chart ## source: stockcharts.com

basic chart ## source: stockscores.com

big daily chart ## source: stockcharts.com

big weekly chart ## source: stockcharts.com

$SWRL company information

## source: otcmarkets.com

Link: http://www.otcmarkets.com/stock/SWRL/company-info

Ticker: $SWRL

OTC Market Place: OTCQB

CIK code: 0001355304

Company name: U-Swirl, Inc.

Company website: http://www.u-swirl.com

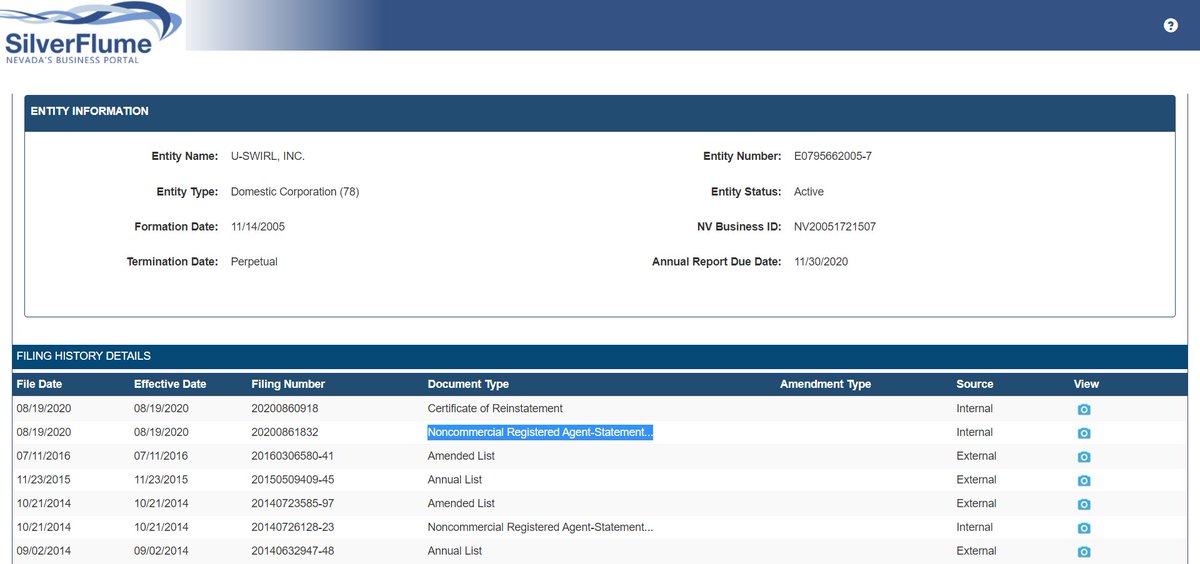

Incorporated In: NV, USA

Business Description: Headquartered in Henderson, Nevada, U-SWIRL, Inc. is on a mission to deliver consumers a smarter alternative to America's favorite meals and snacks. In October 2008, the Company acquired the worldwide rights to U-SWIRL Frozen Yogurt and has commenced executing an aggressive strategy to build the brand into a globally recognized chain of highly experiential frozen yogurt cafes.

$SWRL share structure

## source: otcmarkets.com

Market Value: $8,373,277 a/o Nov 24, 2014

Shares Outstanding: 17,815,484 a/o May 31, 2014

Float: Not Available

Authorized Shares: Not Available

Par Value: 0.001

$SWRL extra dd links

Company name: U-Swirl, Inc.

Company website: http://www.u-swirl.com

## STOCK DETAILS ##

After Hours Quote (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/after-hours

Option Chain (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/option-chain

Historical Prices (yahoo.com): http://finance.yahoo.com/q/hp?s=SWRL+Historical+Prices

Company Profile (yahoo.com): http://finance.yahoo.com/q/pr?s=SWRL+Profile

Industry (yahoo.com): http://finance.yahoo.com/q/in?s=SWRL+Industry

## COMPANY NEWS ##

Market Stream (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/stream

Latest news (otcmarkets.com): http://www.otcmarkets.com/stock/SWRL/news - http://finance.yahoo.com/q/h?s=SWRL+Headlines

## STOCK ANALYSIS ##

Analyst Research (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/analyst-research

Guru Analysis (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/guru-analysis

Stock Report (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/stock-report

Competitors (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/competitors

Stock Consultant (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/stock-consultant

Stock Comparison (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/stock-comparison

Investopedia (investopedia.com): http://www.investopedia.com/markets/stocks/SWRL/?wa=0

Research Reports (otcmarkets.com): http://www.otcmarkets.com/stock/SWRL/research

Basic Tech. Analysis (yahoo.com): http://finance.yahoo.com/q/ta?s=SWRL+Basic+Tech.+Analysis

Barchart (barchart.com): http://www.barchart.com/quotes/stocks/SWRL

DTCC (dtcc.com): http://search2.dtcc.com/?q=U-Swirl%2C+Inc.&x=10&y=8&sp_p=all&sp_f=ISO-8859-1

Spoke company information (spoke.com): http://www.spoke.com/search?utf8=%E2%9C%93&q=U-Swirl%2C+Inc.

Corporation WIKI (corporationwiki.com): http://www.corporationwiki.com/search/results?term=U-Swirl%2C+Inc.&x=0&y=0

WHOIS (domaintools.com): http://whois.domaintools.com/http://www.u-swirl.com

Alexa (alexa.com): http://www.alexa.com/siteinfo/http://www.u-swirl.com#

Corporate website internet archive (archive.org): http://web.archive.org/web/*/http://www.u-swirl.com

## FUNDAMENTALS ##

Call Transcripts (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/call-transcripts

Annual Report (companyspotlight.com): http://www.companyspotlight.com/library/companies/keyword/SWRL

Income Statement (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/financials?query=income-statement

Revenue/EPS (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/revenue-eps

SEC Filings (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/sec-filings

Edgar filings (sec.gov): http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001355304&owner=exclude&count=40

Latest filings (otcmarkets.com): http://www.otcmarkets.com/stock/SWRL/filings

Latest financials (otcmarkets.com): http://www.otcmarkets.com/stock/SWRL/financials

Short Interest (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/short-interest

Dividend History (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/dividend-history

RegSho (regsho.com): http://www.regsho.com/tools/symbol_stats.php?sym=SWRL&search=search

OTC Short Report (otcshortreport.com): http://otcshortreport.com/index.php?index=SWRL

Short Sales (otcmarkets.com): http://www.otcmarkets.com/stock/SWRL/short-sales

Key Statistics (yahoo.com): http://finance.yahoo.com/q/ks?s=SWRL+Key+Statistics

Insider Roster (yahoo.com): http://finance.yahoo.com/q/ir?s=SWRL+Insider+Roster

Income Statement (yahoo.com): http://finance.yahoo.com/q/is?s=SWRL

Balance Sheet (yahoo.com): http://finance.yahoo.com/q/bs?s=SWRL

Cash Flow (yahoo.com): http://finance.yahoo.com/q/cf?s=SWRL+Cash+Flow&annual

## HOLDINGS ##

Major holdings (cnbc.com): http://data.cnbc.com/quotes/SWRL/tab/8.1

Insider transactions (yahoo.com): http://finance.yahoo.com/q/it?s=SWRL+Insider+Transactions

Insider transactions (secform4.com): http://www.secform4.com/insider-trading/SWRL.htm

Insider transactions (insidercrow.com): http://www.insidercow.com/history/company.jsp?company=SWRL

Ownership Summary (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/ownership-summary

Institutional Holdings (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/institutional-holdings

Insiders (SEC Form 4) (nasdaq.com): http://www.nasdaq.com/symbol/SWRL/insider-trades

Insider Disclosure (otcmarkets.com): http://www.otcmarkets.com/stock/SWRL/insider-transactions

## SOCIAL MEDIA AND OTHER VARIOUS SOURCES ##

PST (pennystocktweets.com): http://www.pennystocktweets.com/stocks/profile/SWRL

Market Watch (marketwatch.com): http://www.marketwatch.com/investing/stock/SWRL

Bloomberg (bloomberg.com): http://www.bloomberg.com/quote/SWRL:US

Morningstar (morningstar.com): http://quotes.morningstar.com/stock/s?t=SWRL

Bussinessweek (businessweek.com): http://investing.businessweek.com/research/stocks/snapshot/snapshot_article.asp?ticker=SWRL

$SWRL DD Notes ~ http://www.ddnotesmaker.com/SWRL

Dumping increasing and pps is dropping.

Go insiders go.

New 52 wk low - Form 4s should start hitting soon.

Wow the .20s have peeked out today, definitely not a good thing if you happen to be holding.

I got my buy target set and if it hits - WOWWWWWWWWWWW

But by keeping the subs separate there is no "economy of scale" and the benefit of being a holding company only benefits the company.

I'm not really into the benefits of being a holding company other than reducing their exposure to liabilities of the subbies and they can BK a subbie without effecting the insiders and debt holders.

Wouldn't this be the opposite of a holding company's plan....as far as rolling a subsidiary into the parent company? The idea is they have subsidiary companies under one umbrella. Each operates separately from the company but the holding company provides a means of capital when needed among other protections. This is the way RMCF is operating now.

I'm still trying to figure out why the insiders are selling as well.

This could be the reason insider Merryman has been dumping his SWRL shares. The OS here is 3 times that of RMCF and I would suspect that they will RS SWRL and roll it into RMCF so SWRL no longer trades.

THIS IS JUST MY THOUGHTS AND HAS NO BASIS OTHER THAN INSIDERS REALLY WANTED OUT OF SWRL SHARES.

Watch for more dumping by the insiders at any price, then I would say that could be the plan, about a 70% chance if you're a betting man/woman.

I would be a buyer under .20 to start a new position but only if the selling ends.

RMCF-parent company of SWRL is restructuring into a holding company. They filed a 8k today about restructuring into a holding company in the state of Delaware. I wonder why this wasn't tagged as news on SWRL? What is your take on this move by the parent company?

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. ANNOUNCES ANNUAL SHAREHOLDERS MEETING AND PROPOSED HOLDING COMPANY REORGANIZATION

DURANGO, Colorado (November 10, 2014) – Rocky Mountain Chocolate Factory, Inc. (Nasdaq Global Market: RMCF) (the “Company”) today announced that it will host its Annual Meeting of Shareholders on Thursday, February 19, 2015, at 10:00 a.m. local time (MST). The meeting will be held at The Doubletree Hotel, which is located at 501 Camino Del Rio in Durango Colorado.

At the meeting, the Company’s shareholders will be asked, among other things, to consider and vote on a proposal to approve the reorganization (the “Reorganization”) of the company pursuant to which the present company will become a subsidiary of a newly formed Delaware corporation with the same name, Rocky Mountain Chocolate Factory, Inc. (the “Holding Company”). Pending approval of the Reorganization at the Annual Meeting and effectiveness of the Reorganization, the Company’s shareholders will become stockholders of the new Holding Company. Each share of the Company’s common stock outstanding at the time of the Reorganization would be converted automatically into one share of common stock in the Holding Company. The Reorganization is intended to be tax-free for the Company and its shareholders for U.S. federal income tax purposes..

Upon completion of the Reorganization, the Holding Company will replace the present company as the publicly held corporation. The Holding Company, through its subsidiaries, will continue to conduct all of the operations currently conducted by the Company and its subsidiaries, and the directors and executive officers of the Company prior to the Reorganization will be the same as the directors and executive officers of the Holding Company following the Reorganization.

“We expect the shares of Rocky Mountain Chocolate Factory, Inc. common stock to continue to trade under the ticker symbol ‘RMCF’ on the NASDAQ Global Market,” commented Franklin Crail, Chief Executive Officer of Rocky Mountain Chocolate Factory, Inc. “Our Board of Directors and management team believe that implementing the holding company structure will provide the Company with strategic, operational and financing flexibility, and incorporating the new Holding Company in Delaware should allow the Company to take advantage of the flexibility, predictability and responsiveness that Delaware corporate law provides.”

“We believe the proposed change in structure more accurately reflects the scope of our current operations and our future direction,” added Bryan Merryman, the Company’s Chief Operating Officer and Chief Financial Officer. “We are no longer solely in the business of franchising and operating retail chocolate stores and manufacturing premium chocolates and other confections. In recent years, we have become a company that extends beyond the original Rocky Mountain Chocolate Factory concept and brand. In particular, our acquisition of a majority interest in U-Swirl, Inc. (OTCQB: SWRL) in January 2013, along with subsequent acquisitions by U-Swirl, has positioned our Company as majority owner of the fourth largest franchisor of self-serve frozen yogurt cafés in the world. We expect the holding company structure to enable us to leverage our infrastructure, while allowing each brand to focus intently on delivering a great experience to its customers.”

If approved at the Annual Meeting, the Company expects that the Reorganization will become effective on or about March 1, 2015. At the Annual Meeting, the Company’s shareholders will also be asked to elect six directors and ratify the Company’s auditors.

Congrats - I've never figured out options.

|

Followers

|

15

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

526

|

|

Created

|

11/02/10

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |