Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Trucept, Inc. (DBA Afinida) Reports Substantial Increase in Revenue and Gross Profit for the Second Quarter of 2024Press Release | 08/19/2024

Trucept, Inc. (DBA Afinida) Reports Substantial Increase in Revenue and Gross Profit for the Second Quarter of 2024

PR Newswire

ESCONDIDO, Calif., Aug. 19, 2024

ESCONDIDO, Calif., Aug. 19, 2024 /PRNewswire/ -- Trucept, Inc. (OTC Pink: TREP) DBA Afinida, is pleased to announce significant achievements in its financial performance for the Second Quarter of 2024

(PRNewsfoto/Trucept Inc.)

Highlights include:

A $867,657 or 25% increase in gross profit for Q2 - quarter over quarter.

Recorded an impressive 24% increase in income from operations quarter over quarter.

Recognized a 10% increase in net and comprehensive income.

"We are pleased to announce that Trucept, Inc. has continued its momentum with strong financial gains in the second quarter, reflecting our commitment to delivering consistent value to our shareholders. Our strategic initiatives and unwavering focus on operational excellence have positioned us for sustained growth. We look forward to building on this success in the coming quarters." - Norman Tipton, CEO.

Trucept Inc. (DBA Afinida) continues to innovate and adapt to meet the evolving needs of its clients while driving sustainable growth and delivering shareholder value. It's portfolio of professional services includes:

Afinida Marketing - Data Driven Marketing, Technology, and Accessibility Act compliance.

Afinida Insurance -Insurance Offerings and Third-party Administrator (TPA) services

Afinida Payroll - Full-Service Payroll

Afinida HR - Human Resources and Management

Afinida Accounting – Financial Accounting Services

Afinida Risk Management - Safety and Risk Management

About Trucept Inc.

Trucept Inc. is a renowned name in the business solutions sector, dedicated to helping companies focus on their core operations while it takes care of the peripheral business processes. With its extensive suite of services and a commitment to excellence, Trucept has been a trusted partner for countless businesses, aiding their growth and success.

Cision View original content to download multimedia:https://www.prnewswire.com/news-releases/trucept-inc-dba-afinida-reports-substantial-increase-in-revenue-and-gross-profit-for-the-second-quarter-of-2024-302224681.html

SOURCE Trucept Inc.

Trucept, Inc. (DBA Afinida) Reports Substantial Increase in Revenue and Gross Profit for the Second Quarter of 2024Press Release | 08/19/2024

Trucept, Inc. (DBA Afinida) Reports Substantial Increase in Revenue and Gross Profit for the Second Quarter of 2024

PR Newswire

ESCONDIDO, Calif., Aug. 19, 2024

ESCONDIDO, Calif., Aug. 19, 2024 /PRNewswire/ -- Trucept, Inc. (OTC Pink: TREP) DBA Afinida, is pleased to announce significant achievements in its financial performance for the Second Quarter of 2024

(PRNewsfoto/Trucept Inc.)

Highlights include:

A $867,657 or 25% increase in gross profit for Q2 - quarter over quarter.

Recorded an impressive 24% increase in income from operations quarter over quarter.

Recognized a 10% increase in net and comprehensive income.

"We are pleased to announce that Trucept, Inc. has continued its momentum with strong financial gains in the second quarter, reflecting our commitment to delivering consistent value to our shareholders. Our strategic initiatives and unwavering focus on operational excellence have positioned us for sustained growth. We look forward to building on this success in the coming quarters." - Norman Tipton, CEO.

Trucept Inc. (DBA Afinida) continues to innovate and adapt to meet the evolving needs of its clients while driving sustainable growth and delivering shareholder value. It's portfolio of professional services includes:

Afinida Marketing - Data Driven Marketing, Technology, and Accessibility Act compliance.

Afinida Insurance -Insurance Offerings and Third-party Administrator (TPA) services

Afinida Payroll - Full-Service Payroll

Afinida HR - Human Resources and Management

Afinida Accounting – Financial Accounting Services

Afinida Risk Management - Safety and Risk Management

About Trucept Inc.

Trucept Inc. is a renowned name in the business solutions sector, dedicated to helping companies focus on their core operations while it takes care of the peripheral business processes. With its extensive suite of services and a commitment to excellence, Trucept has been a trusted partner for countless businesses, aiding their growth and success.

Cision View original content to download multimedia:https://www.prnewswire.com/news-releases/trucept-inc-dba-afinida-reports-substantial-increase-in-revenue-and-gross-profit-for-the-second-quarter-of-2024-302224681.html

SOURCE Trucept Inc.

Afinida Promotes Rachel Henton to Vice President of Human ResourcesPress Release | 05/13/2024

Afinida Promotes Rachel Henton to Vice President of Human Resources

PR Newswire

SAN DIEGO, May 13, 2024

SAN DIEGO, May 13, 2024 /PRNewswire/ -- Afinida, (OTC Pink TREP) a leading firm in the integration and management of business services, is pleased to announce the promotion of Rachel Henton to Vice President of Human Resources, effective immediately. With nearly two decades of comprehensive experience in HR, Rachel has been instrumental in shaping Afinida's human resources strategy, aligning it with our overall business goals and values.

Afinida Corporate Logo

Her professional journey began overseeing HR for a prominent hospitality employer, subsequently extending her expertise across a diverse range of industries including finance, sales, software development, and healthcare. Prior to joining Afinida, Rachel successfully ran her own HR consulting firm, servicing a wide array of clients throughout the greater San Diego and Los Angeles areas.

Rachel's educational background includes a Bachelor's degree from the University of California, Santa Barbara, and an MBA from Southern New Hampshire University, which she pursued while working full-time. Further strengthening her HR acumen, Rachel also holds a certification in Human Resource Management from the University of California, San Diego.

"Rachel's broad experience and deep commitment to fostering an inclusive and dynamic workplace have been invaluable to Afinida," said COO Julie Neill. "Her strategic vision and proven leadership are exactly what Afinida needs as we continue to grow and evolve."

In her new role as Vice President, Rachel will continue to oversee all HR client relations and support functions, focusing on client resources, leadership coaching and scaling the HR infrastructure to support Afinida's expansion plans.

"I am thrilled to step into this role and to continue to build on the strong foundation our fantastic client support teams have established," said Rachel. "I look forward to expanding our innovative HR practices, supporting our clients as they build and grow."

About Afinida

Afinida is committed to providing integrated business solutions that foster growth and efficiency for diverse industries. We specialize in combining technology with expert services to deliver comprehensive, customized business strategies that meet the unique needs of our clients. For more information, visit our website at Afinida.com

Cision View original content to download multimedia:https://www.prnewswire.com/news-releases/afinida-promotes-rachel-henton-to-vice-president-of-human-resources-302142819.html

SOURCE Afinida

Every stock offering that Brian Bonar has done for close to 50 years has been a scam...

Why did IBM kick him out?

Probably because they knew he was a crook.

BRIAN BONAR has a decades old record of pump and dumps.

Yes, he may run another scam with Trucept... but the reverse merger will make any current stockholder's portion worthless.

Start reading this thread on his current pump and dump here:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174213274

Did you know he lost control of one of his shells because he sold it to Nigerian money laundering interests and they were busted by the Feds?

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174217160

Yeah, it's probably not a scam, it just feels like it when they don't do what they say. That's never a great sign. I've never seen the business in person, and sometimes scammers will go through great lengths to seem legit with pictures of smiling employees and professional office spaces, etc. It's hard to tell if you don't see it in person.

I’m disappointed too re the lack of audited results + uplist as Management promised a couple years ago. But I don’t believe this is a scam. I’ve connected with a few folks that have worked there over the years and they are normal folks and said it’s a legit company. I’ve also been in this since STTN-days. Trep has been around for a LONG time!

I'll hold my share too, because I bought more than I'm able to sell...ever LOL

Trucept website https://trucept.com/our-company/#contact-us The name of some of the company's clients are provided. I will continue to hold my share.

The numbers are too good for this market cap. Not sure they're real. I doubled down when they hired an auditor a couple of years ago and they still have unaudited numbers. That was the one thing I thought would get this garbage to run. But they didn't do it. Probably a stock scam.

(PRNewsfoto/Trucept Inc.)

"We are thrilled to announce these outstanding financial achievements for the fiscal year 2023," said Norman Tipton, CEO of Trucept Inc. "Our relentless dedication to enhancing financial stability, operational efficiency, and sustainable growth has yielded exceptional results. We remain committed to delivering value to our stakeholders while maintaining a strong financial foundation."

Highlights include:

Successful Accounts Receivable Collection Efforts: Trucept focused its Accounts Receivable collection efforts in 2023, resulting in a substantial reduction in its AR balance by $4,118,457. This concerted effort underscores Trucept's commitment to financial stability and efficient operations.

Impressive Increase in Working Capital: Trucept accomplished a remarkable 111% increase in Working Capital during 2023. The increase of $1,063,214 brought Trucept's working capital ratio into positive territory. This achievement directly correlates with the successful cash collection efforts mentioned earlier, and reflects Trucept's sound financial management practices.

Sustained Operational Efficiencies and Corporate Growth: While focusing on corporate growth initiatives, Trucept also maintained its operational efficiencies throughout 2023. This is evidenced by the remarkable 44% year-over-year increase in "Profit from Operations" and the notable improvement in Net Profit Percentage from 8% in 2022 to 9% in 2023. These results underscore Trucept's ability to balance growth with operational excellence.

Trucept Inc. continues to innovate and adapt to meet the evolving needs of its clients while driving sustainable growth and delivering shareholder value. It's portfolio of professional services includes:

Data Driven Marketing, Technology, and Accessibility Act compliance

Insurance Offerings and Third-party Administrator (TPA) services

Full-Service Payroll

Human Resources and Management

Accounting Support

This one seems to be dead...

The six new business units include:

Afinida Marketing: Catering to the dynamic needs of modern businesses, Afinida Marketing will provide cutting-edge full-service marketing solutions and strategies to enhance brand visibility and drive growth.

Afinida Risk Management: With an emphasis on mitigating business risks, this subsidiary will offer comprehensive risk management solutions, helping clients navigate the ever-evolving business landscape with confidence.

Afinida Payroll: Ensuring smooth and efficient payroll processes, Afinida Payroll will offer both standardized and customizable payroll solutions tailored to the specific needs of each business.

Afinida Accounting: This subsidiary will focus on providing top-tier accounting services, from bookkeeping to financial analysis, assisting businesses in maintaining accurate records and making informed financial decisions.

Afinida Insurance: Addressing the diverse insurance needs of businesses, Afinida Insurance will offer a range of products and services, from general liability to specialized coverage options.

Afinida HR Services: Recognizing the importance of effective human resources management, this unit will offer HR solutions that help businesses recruit, train, and retain the best talent, while also ensuring compliance with labor laws and regulations.

02/08/24 0.0394 0.0394 0.0394 0.0394 10,000

02/07/24 0.0394 0.0394 0.0394 0.0394 1,960

02/06/24 0.0408 0.0408 0.0408 0.0408 4,060

02/05/24 0.0394 0.0394 0.0394 0.0394 4,000

01/31/24 0.0394 0.0394 0.0394 0.0394 5,024

01/25/24 0.045 0.045 0.045 0.045 2,500

01/24/24 0.0394 0.0394 0.0394 0.0394 700

01/23/24 0.045 0.045 0.045 0.045 100

01/22/24 0.038 0.038 0.038 0.038 300

01/16/24 0.046 0.046 0.046 0.046 1,000

01/11/24 0.0435 0.046 0.039 0.039 1,780

01/08/24 0.048 0.048 0.048 0.048 100

01/04/24 0.0435 0.048 0.0435 0.0435 2,500

01/02/24 0.0452 0.0452 0.043 0.043 10,400

12/29/23 0.0371 0.045 0.0371 0.045 24,002

12/28/23 0.041 0.045 0.0395 0.045 84,708

12/27/23 0.04 0.0451 0.04 0.0451 7,829

12/26/23 0.04 0.04 0.04 0.04 2,000

12/22/23 0.0479 0.0479 0.0479 0.0479 8,003

12/20/23 0.0465 0.052 0.037 0.044 69,000

12/18/23 0.0365 0.047 0.0365 0.047 8,550

12/14/23 0.0385 0.0469 0.0385 0.0469 10,000

12/13/23 0.0365 0.0469 0.0365 0.0469 4,090

12/12/23 0.0448 0.0448 0.0385 0.0385 3,000

12/11/23 0.0469 0.0469 0.0385 0.0385 22,833

12/08/23 0.0385 0.047 0.0385 0.047 9,000

12/07/23 0.0415 0.0428 0.0415 0.0428 5,400

12/06/23 0.047 0.047 0.047 0.047 2,404

12/04/23 0.0463 0.0463 0.0463 0.0463 7,312

12/01/23 0.045 0.049 0.0385 0.045 182,2

11/30/23 0.045 0.05 0.044 0.044 120,100

11/29/23 0.048 0.048 0.047 0.047 31,000

11/28/23 0.0445 0.0445 0.0445 0.0445 3,013

11/22/23 0.041 0.0435 0.041 0.042 65,002

11/21/23 0.052 0.052 0.038 0.0385 325,800

11/20/23 0.055 0.055 0.05 0.05 26,000

11/17/23 0.0535 0.055 0.052 0.055 59,920

11/16/23 0.055 0.055 0.0513 0.0535 14,193

11/15/23 0.047 0.055 0.047 0.05 151,080

11/14/23 0.045 0.046 0.0425 0.045 67,400

11/13/23 0.0449 0.045 0.044 0.045 140,100

11/08/23 0.0375 0.0375 0.0375 0.0375 21,878

11/07/23 0.0361 0.0361 0.036 0.036 15,002

11/06/23 0.035 0.0428 0.035 0.0428 57,400

11/02/23 0.043 0.048 0.036 0.048 14,101

11/01/23 0.039 0.039 0.039 0.039 20,000

10/31/23 0.039 0.039 0.039 0.039 20,000

10/30/23 0.039 0.039 0.039 0.039 118

10/26/23 0.0435 0.0446 0.0435 0.0444 36,400

10/25/23 0.0435 0.0435 0.0435 0.0435 10,000

10/24/23 0.0445 0.0445 0.039 0.039 4,900

10/23/23 0.0421 0.0421 0.0421 0.0421 10,000

10/20/23 0.0425 0.0425 0.0425 0.0425 60,000

10/19/23 0.0425 0.0425 0.0425 0.0425 420

10/18/23 0.0425 0.0425 0.0425 0.0425 30,300

10/16/23 0.043 0.043 0.043 0.043 1,000

It was just an observation, hence the ????.

Day after day no trades are reflected on the IHUB chart.

I just looked up volume and delisting does seem to be on the horizon... there is no coherent business plan here.

10/16/23 0.043 0.043 0.043 0.043 1,000

10/12/23 0.0425 0.0425 0.0425 0.0425 6,203

10/10/23 0.0519 0.0519 0.0488 0.0488 5,600

10/09/23 0.0488 0.0488 0.0488 0.0488 100

10/05/23 0.0488 0.0488 0.0488 0.0488 250

10/04/23 0.0515 0.055 0.045 0.045 29,200

10/03/23 0.0475 0.0535 0.0475 0.05 2,350

10/02/23 0.0451 0.0451 0.0451 0.0451 7,500

09/29/23 0.045 0.045 0.045 0.045 2,155

09/28/23 0.057 0.057 0.0486 0.0486 3,955

09/27/23 0.05 0.0576 0.05 0.0576 7,300

09/26/23 0.0525 0.0525 0.048 0.048 10,143

09/22/23 0.057 0.059 0.0525 0.0525 127,239

09/20/23 0.056 0.057 0.056 0.057 1,266

09/19/23 0.0558 0.0558 0.0558 0.0558 5,100

09/18/23 0.0525 0.056 0.0525 0.056 20,266

09/13/23 0.0525 0.0525 0.0525 0.0525 500

09/12/23 0.054 0.0569 0.054 0.0569 33,474

OTC website doesn’t indicate that at all. What data points or news prompts you to suggest delist?

IncomePress Release | 11/15/2023

Trucept Announces 427% Increase In Operating Income

PR Newswire

SAN DIEGO, Nov. 15, 2023

SAN DIEGO, Nov. 15, 2023 /PRNewswire/ -- Trucept Inc. (OTC Pink: TREP) Trucept has increased operating Income by 160% and 427% for the 3 and 9 months ending September 30, 2023 as compared to the same periods the prior year. Trucept has also increased Net Income by 130% and 154% for the 3 and 9 months ending September 30, 2023 as compared to the same periods in the prior year. Trucept reduced Operating Expenses by 36% and 22% for the 3 and 9 months ending September 30, 2023 as compared to the same periods the prior year.

(PRNewsfoto/Trucept Inc.)

CEO Norman Tipton commented:

"We are incredibly grateful for our dedicated team's unwavering commitment and our valued customers' trust, which have led to our outstanding quarterly financial results. This achievement is a testament to our collective efforts and resilience. We remain focused on delivering innovative solutions, exceptional service, and sustainable growth as we move forward. Thank you all for being a vital part of our success story."

Trucept, offers professional services that help businesses navigate growth. The company's professional services now encompass the following:

Data Driven Marketing, Technology, and Accessibility Act compliance Services

Insurance Offerings and Third-party Administrator (TPA) services

Full-Service Payroll

Human Resources and Management

Employee Benefits Administration

Accounting Support

Safety and Risk Management

For additional information, visit www.trucept.com

Cision View original content to download multimedia:https://www.prnewswire.com/news-releases/trucept-announces-427-increase-in-operating-income-301988262.html

SOURCE Trucept Inc.

Back to News Headlines

Corporate masturbation --- typical BOANR/

Corporate masturbation --- typical BOANR/

Hopefully this is in preparation for more news next month!

SAN DIEGO, Oct. 23, 2023 /PRNewswire/ -- A leader in business solutions, Trucept Inc., (OTC Pink: TREP) is proud to announce six new wholly owned subsidiaries, further expanding its portfolio and deepening its commitment to provide comprehensive business solutions. These new entities are based out of San Diego, CA, and each will focus on specific niches, ensuring targeted and expert solutions for clients.

(PRNewsfoto/Trucept Inc.)

The six new business units include:

Afinida Marketing: Catering to the dynamic needs of modern businesses, Afinida Marketing will provide cutting-edge full-service marketing solutions and strategies to enhance brand visibility and drive growth.

Afinida Risk Management: With an emphasis on mitigating business risks, this subsidiary will offer comprehensive risk management solutions, helping clients navigate the ever-evolving business landscape with confidence.

Afinida Payroll: Ensuring smooth and efficient payroll processes, Afinida Payroll will offer both standardized and customizable payroll solutions tailored to the specific needs of each business.

Afinida Accounting: This subsidiary will focus on providing top-tier accounting services, from bookkeeping to financial analysis, assisting businesses in maintaining accurate records and making informed financial decisions.

Afinida Insurance: Addressing the diverse insurance needs of businesses, Afinida Insurance will offer a range of products and services, from general liability to specialized coverage options.

Afinida HR Services: Recognizing the importance of effective human resources management, this unit will offer HR solutions that help businesses recruit, train, and retain the best talent, while also ensuring compliance with labor laws and regulations.

"By introducing these new subsidiaries, we are not only broadening our spectrum of services but also underscoring our commitment to excellence and specialization," said Norman Tipton, CEO of Trucept Inc. "With the Afinida range of services, businesses can now have a one-stop solution, addressing all their operational needs under one umbrella, or they can choose one or more specific solutions based on their specific needs. Each of the business units are led by industry veterans with deep experience in each core function, further adding value to our customer relationships."

About Trucept Inc.:

Trucept Inc. is a renowned name in the business solutions sector, dedicated to helping companies focus on their core operations while it takes care of the peripheral business processes. With its extensive suite of services and a commitment to excellence, Trucept has been a trusted partner for countless businesses, aiding their growth and success.

ath, SA News Editor

Trucept (OTCPK:TREP) said Monday it has formed six new wholly owned subsidiaries, further expanding its portfolio and deepening its commitment to provide comprehensive business solutions.

The six new business units include Afinida Marketing, Afinida Risk Management, Afinida Payroll, Afinida Accounting, Afinida Insurance, Afinida HR Services.

I worry about the auditing firm...super small, top line is strong, margins increasing

He's a BONAR BUDDY...

Leader Norman Tipton CEO

Norman Tipton

Chief Executive Officer

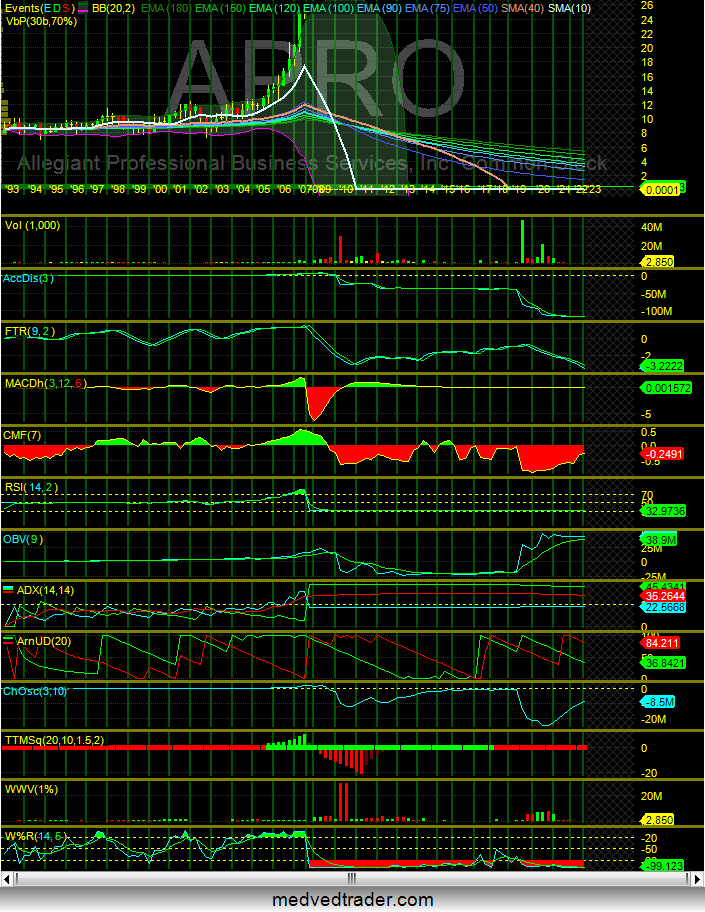

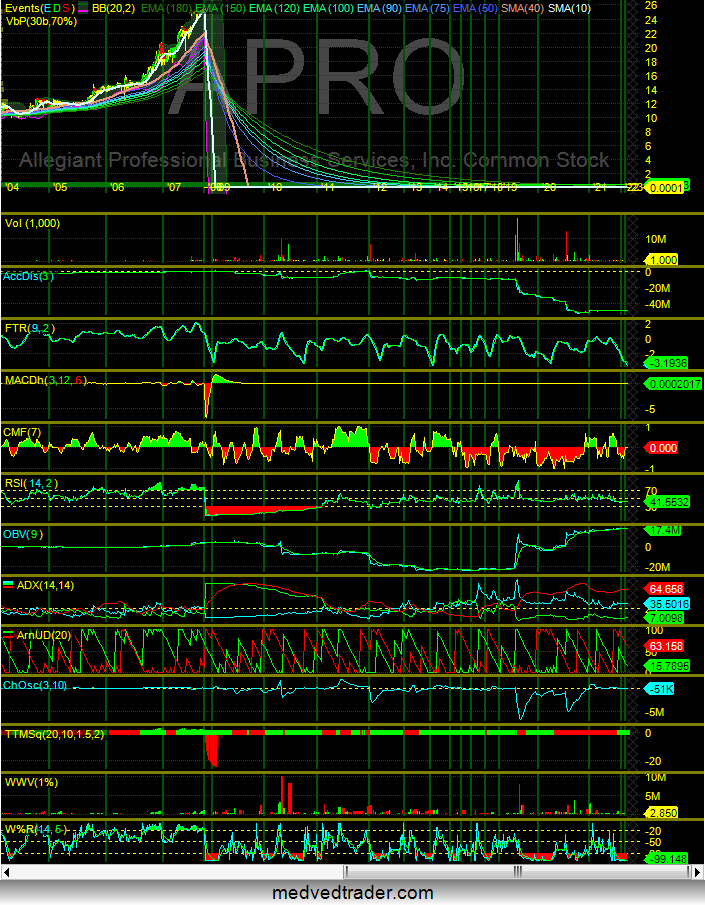

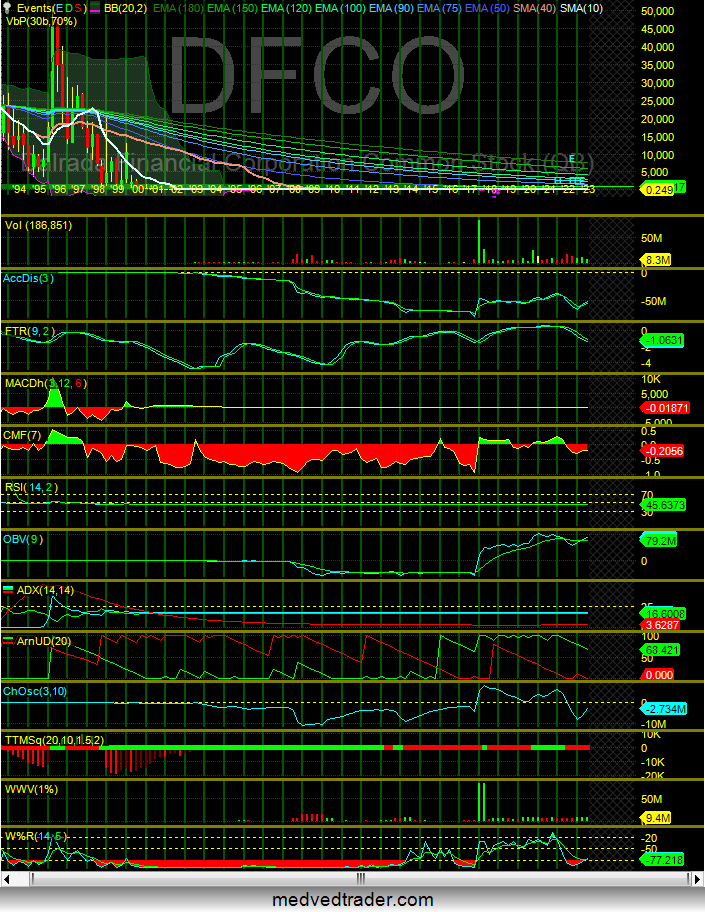

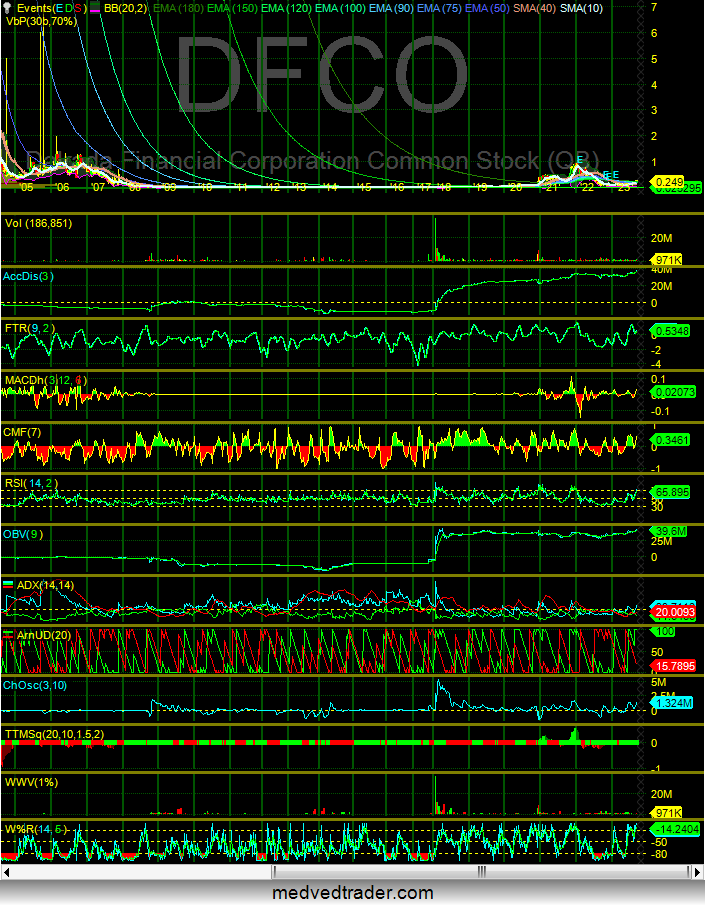

Trucept, Inc. is headed by Chief Executive Officer, Norman Tipton, a native of San Diego. For the past 10 years, he has served as Vice President and General Counsel of the company. Since 2007, Tipton has been an advisor to several publicly-traded company boards, including Allegiant Professional Business Services Inc. and Dalrada Financial Corp.

Can anyone tell me what the connections are from TREP to DFCO.

Thanks

All BONAR stocks are junk stocks....

I feel like they have a good chance for that too!

IMO $TREP will move back up to test it's long term ceiling in the upper teens, and ultimately break that to new long term highs. I don't know what that path will look like or how long it all takes, but I think both $TREP and $DFCO are setting up to run hard.

I keep waiting for this to be more established and settle much higher. And I keep getting let down.

Think that means Audited results this report?

Reason for Delay in Posting Financial Report: State below in reasonable detail why the Annual/Quarterly

Report could not be filed within the prescribed time period.

Outside CPA is still reviewing the financial statements.

Here you go again. Dalrada has nothing to do with payroll services. Not relevant

Yep, not worried. Probably just one person getting tired of waiting.

Looks like someone is dumping a bit today. Whelp, at least some movement, lol!

I honestly don’t know at this point. Ping them on Twitter and let’s apply some pressure.

Are they really going to have audited financials? Or is that a bunch of fluff? Been holding for over a year now. I double my position when I heard they were going to get audited to add some legitimacy to their numbers. Is this just more penny-BS?

Based on their most recent quarterly report, they still do provide accounting services, amongst several other offerings, (including this new marketing offering). And that’s part of their $4M most recent quarterly revenue reporting.

Need management to come through on their promises (audited results ++ uplist), and $trep should re-rate higher based on fins and the associated news!

In 2018 BONAR and Tipton were pumping an accounting service.

*** SCAM ALERT ***

... see replied to post.

SAN DIEGO, CA – June 12th, 2023 – Trucept Inc. (OTC Pink: TREP) a leading provider of comprehensive business solutions, proudly announces today the establishment of its new marketing subsidiary, Afinida Marketing. This move is part of the company’s continued commitment to provide more comprehensive and innovative services to its clients.

Afinida Marketing is poised to offer a broad array of marketing services, from digital advertising and search engine optimization (SEO) to content creation, social media management, and market analytics. It is aimed at helping businesses to not only navigate, but also thrive in the rapidly evolving digital marketplace.

“This is a milestone in Trucept’s growth strategy,”says Norman Tipton, CEO of Trucept Inc. “Our mission has always been to empower businesses by handling their administrative functions, allowing them to focus on their core competencies. With the establishment of Afinida Marketing, we are now able to provide a full suite of marketing services tailored to the needs of our clients in the digital era.”

Afinida Marketing’s solutions will harness the power of artificial intelligence, big data, and the latest in marketing related technology tools aimed at providing clients with the most advanced and effective marketing strategies available.

“The formation of Afinida Marketing signifies our commitment to continuously evolve and adapt to the changing needs of businesses in the digital age”adds industry veteran and EVP of Sales and Marketing Kevin Brewer. “We are thrilled to be taking this step forward, and we believe it will bring immense value to our clients.”

For additional information, visit www.afinidamarketing.com

Go Back to All News

Typical BONAR move -- lots of smoke and mirrors...

then WHAM...

they're broke.

Your question was/is fundamentally flawed; how is $trep not profitable?

So the fact that BONAR hasn't been involved with a single profitable public company for 20-30 years doesn't bother you????

|

Followers

|

221

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

28886

|

|

Created

|

11/21/05

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |