Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

The Rees connection is really strong. This is from KSL local news.

BOUNTIFUL — Top Hat Video had already beaten a lot of odds by May 2020.

The video rental store in Bountiful, which opened back in 1983, had outlasted corporate competitors like Blockbuster and even the shift to streaming services like Netflix. But when the COVID-19 pandemic hit, many customers who previously frequented the small store at 521 W. 2600 South finally switched to online streaming due to health and safety concerns. The business was losing money and owners Lee and Lona Earl began preparing to close permanently.

That's when Melissa Handley and her boyfriend David Rees stepped in.

Handley said her son, Cade, is a Top Hat employee and came home upset one night that the store would be closing. After speaking with the Earls, she and Rees decided to take over.

Handley and Rees' intervention ultimately gave Top Hat about 2½ more years. The store announced Oct. 18 that it will close its doors in December, marking the end of its 39-year run.

Handley said the goal when she and Rees bought Top Hat was simply to break even; but "the pandemic accelerated what was already happening," she said. "Once we reopened the store ... it just never fully recovered after that."

Now, she and Rees are losing more money than they can afford to, Handley said.

I do see several Rees connections to Melissa via several other companies. West Bountiful is a dump. Its on the wrong side of the freeway in the smelly salt water swamps bordering The Great Salt Lake. There is a lot going on in NY related to Third Bench. This case is just one example. Our friends being sued for breech of contract in the New York Supreme court system.

https://trellis.law/case/36069/135245-2023/samson-mca-llc-v-santa-fe-flooring-llc-ll-industries-inc-third-bench-holdings-llc-okane-enterprises-llc-david-robert-fair-melissa-handley-ogb-architectural-millwork

Another TA update today. OS unchanged. Last week I was assured on this very board that there would be more dilution disclosed late last week or this week at the latest. That gives the prognosticator one more day to be correct.

As usual you linked the wrong company. That’s O’Kane Enterprises Ltd in Garnerville, New York.

No relation to Okane Enterprises KLC in West Bountiful, UT which has David Rees name all over it.

If investors thought there would be no more shares to be issued in the future from this company they would be buying hand over fist.

Everyone knows that is not the case when Canouse/Hicks are holding preferred stock.

Everyone left because this scam is burnt.

It'll happen. When they get desperate to move shares, they can run it down to $0.0006, since they are sitting on the bid at $0.0005 now.

Where did everyone go? I miss my friends!

Is Melissa is going to bring Okane under the same roof as Third Bench?

https://okaneenterprises.com/

Transfer agent updated for today. No change as always. Dilution is done. Sellers look to be about done as well.

POS…nothing to talk about here….

I'll believe it when I see it. But I have time and can wait. Just like Melissa. She has been waiting as long as David.

It'll happen once they have a large enough bid to dump into.

No OS change in today's update as usual. Dilution is done. Time to go pink current!

How does Fair get hooked up with someone like Rees? A NY/CA private equity guy and a shady SLC lawyer buying AZ, NM , and UT companies. Like an episode of Let’s Call Saul.

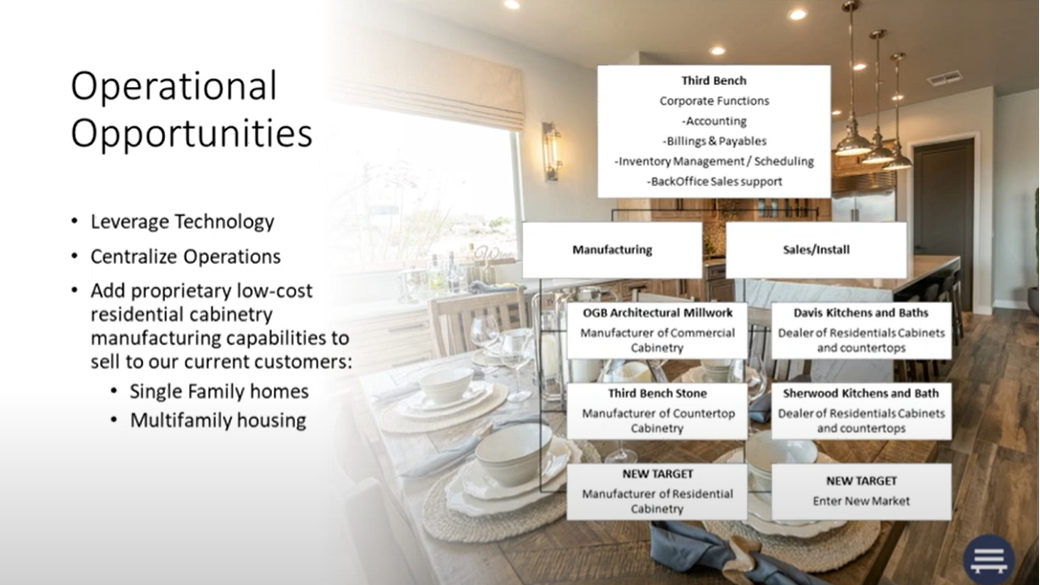

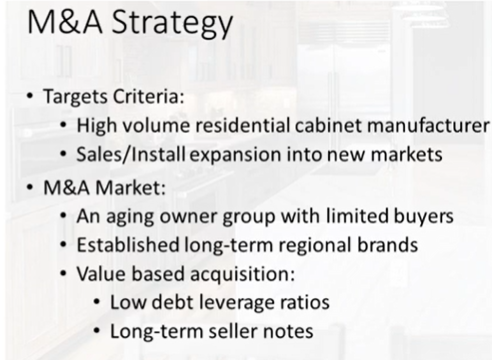

There were a number of companies they tried to buy and mine was the first after Davis Kitchens. Originally they were proposing a high percentage of cash upfront and a payout over two to three years. They were working with a couple of investor groups that provide high cost funding for highly leveraged transactions. As due diligence was completed, they became part of NECA and wanted to fund the deal through the sale of shares to be issued. I sat across the table from Rees and just laughed. There was no way they could sell the stock at a price that would fund the deal. They went across town to a competitor and that guy threw them out too.

Thanks for clearing that up. I previously thought M Handley may have been Fair’s significant other but Rees makes far more sense. The only company that I know TBI tried to buy was Rasmussen although it’s possible there were many more that were not disclosed.

Sher-wood brothers seemed to have gotten shafted and don’t know if they ever recovered funds from a lawsuit one of the brother’s filed.

The EEOC suit may wind up shutting the company…..

This whole thing is a scam. Rees is behind this but his shares are held by his girlfriend because he can’t own anything. Fair is an earnest guy who was led by the nose by Rees with visions of grandeur, but they could never raise any investor capital hence the original NECA situation. Rees is on probation for other shenanigans and is not an honest guy. I dealt with him when third bench tried to buy the company I was associated with. It didn’t take long to realize it is a scam.

Yes, they need to file for large public offerings or changes to restricted shares. Conversion from debt holders does need a separate filing because the possibility is already defined in the quarterly or annual filings and is already considered part of the company structure. The AS is just a limit to the number of shares a company can move into the world. They can change that number with proper approval.

So there was no need for this filing to sell shares since they were already available in the AS? And the many others like it over the years.

https://www.otcmarkets.com/filing/html?id=8778215&guid=C3d-kpE91wv_B3h

No. Its a publicly traded company already. They can change the AS with a filing. I've seen countless OTC stocks increase their AS over time. They normally start low, and slowly increase as needed. Eventually they get to the point were they decide to do a RS again.

So in your world a company registers shares with the SEC by changing the AS? No registration filings required?

Next week sometime.

No share count update today on OTC markets and the one yesterday showed the OS unchanged. Looks like no dilution occurred this week. People on the board have been posting that the updates happen immediately when there is dilution and I have noticed the same.

They did. The AS was 50B originally. They can increase it from the 5B we are at latter if they need to.

They would have to Issue more shares to support the conversion. If they were going to do that they would have created those shares a long time back.

Hopefully. Maybe they wanted to get those filings revised first, and then get the attorney letter out.

Its been a long road and the journey is now years long. I've enjoyed the ride with the exception of the count down timer on the website. After this is over that will be what a lot of investors recall.

If the shares were "exhausted" as you say, the OS would be 5,670,596,606 shares, which is what would happen if all the debt holders converted their shares to common stock and dumped them into the market at the same time.

There has been a lot of uncertainty with the company in yield sign territory and the annual and quarterly filings issued without attorney letters and subsequently reissued. I am predicting that we will see attorney letters related to those filings very quickly with the company back to pink current on OTC Markets. That is the sign that I await that would move the company into the final phase of the cycle.

The note holders in the background waiting to sell are going to be waiting a very long time if the Issued Shares are exhausted as I believe they are. Share price started to move up today as investors are realizing that the selling cycle has completed. Some posters on this board seem to believe that the company insiders can convert up to the full AS without first issuing shares. That is not true. People with that belief can read up on share issuanceon Investopedia. If they desired to issue more shares they had a window over a year long with an open offering. They could easily have issued treasury stock but they chose not to. My guess is that there is a contract with the toxic lenders that prevents the company from increasing the issued shares and as a result of financing activity in the past they are limited to the shares currently issued which as I posted earlier this week are probably mostly in the OS with the exception of some Treasury Stock retained to fund the pending promo activity. The company has not reported the number of issued shares anywhere that I can find so one needs to watch the trading and OS reporting on OTC Markets to form an opinion about the remaining Treasury Stock. If someone has found it then please post.

That's my guess also. It allows them to build up some bid support to dump into, and then they don't need to lower their own bid (which is still sitting at $0.0005 now).

Yep, looks that way.

IMO , MM’s sucking some buyers in by raising the bid/ask to create the illusion of strength in the stock. As we all know, note holders hiding in background waiting to sell.

What they keep changing (or updating) is the dividend, voting, liquidation, and conversion rights of Hicks and Canouse’s(Jeff and Joe) preferred stock. Probably due to Third Bench’s default on two notes.

All that work to keep the company at breakeven then they default on two convertible note to Canouse and Hicks.Which of course is never good for shareholders.

NOTE 13 – DEFAULT PROVISION ON CONVERTIBLE NOTES

The notes issued in July and September 2021 have step-up provisions which allow for the notes and accrued interest to be stepped up by 50% once these notes are in default. This occurred in the current period and as such, the face value of these notes and accrued interest was increased by approximately $460,000 and $100,000, respectively.

If you look at the last page of the report you can see the damage cause to shareholder from the conversion of preferred shares. The company spins it as they are retiring preferred debt. But in actuality it is costing shareholders significant common share dilution . 10,000 - 16,000 common shares for each 1 preferred share retired.

Quarterly out now (revised Nov 30 2023)-

Interesting how they keep revising these filings.

https://www.otcmarkets.com/otcapi/company/financial-report/394074/content

The last two share increase updates have occurred about 5 days after the shares were traded in the market.

We should see an update today, but maybe Monday. They don't have the bid support right now to move the amount of shares they want to, so sometimes it takes longer.

Oh come on. You excitement transcends your words.

So you expect a Friday update for the week that differs? You seem quite sure. Like you are connected enough to know and not speculate like I do.

They will update it to the real number once they meet their quota for the week or day.

OTC pink soon. Maybe very soon. So many deals coming around the OTC. Gotta do this one before all the mergers start and the fed crashes the market.

But yet the TA updated OTC Markets late today with no change in OS. That's new. Usually they update when something changes. Now updates to tell investors no more dilution is taking place. It's close. If there were billions of issued shares available why did they issue shares for the last offering and why didn't they issue more when they had the open offering? Maybe it's part of the deal with Trillium Partners.

LMAO, nothing they do at this point matters at all!!!👎

Nearly time for the attorney letter and Pink Current.

I like those guys. I got some .0007's this morning.

|

Followers

|

684

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

84586

|

|

Created

|

10/31/11

|

Type

|

Free

|

| Moderators bri123 BearRickPunch | |||

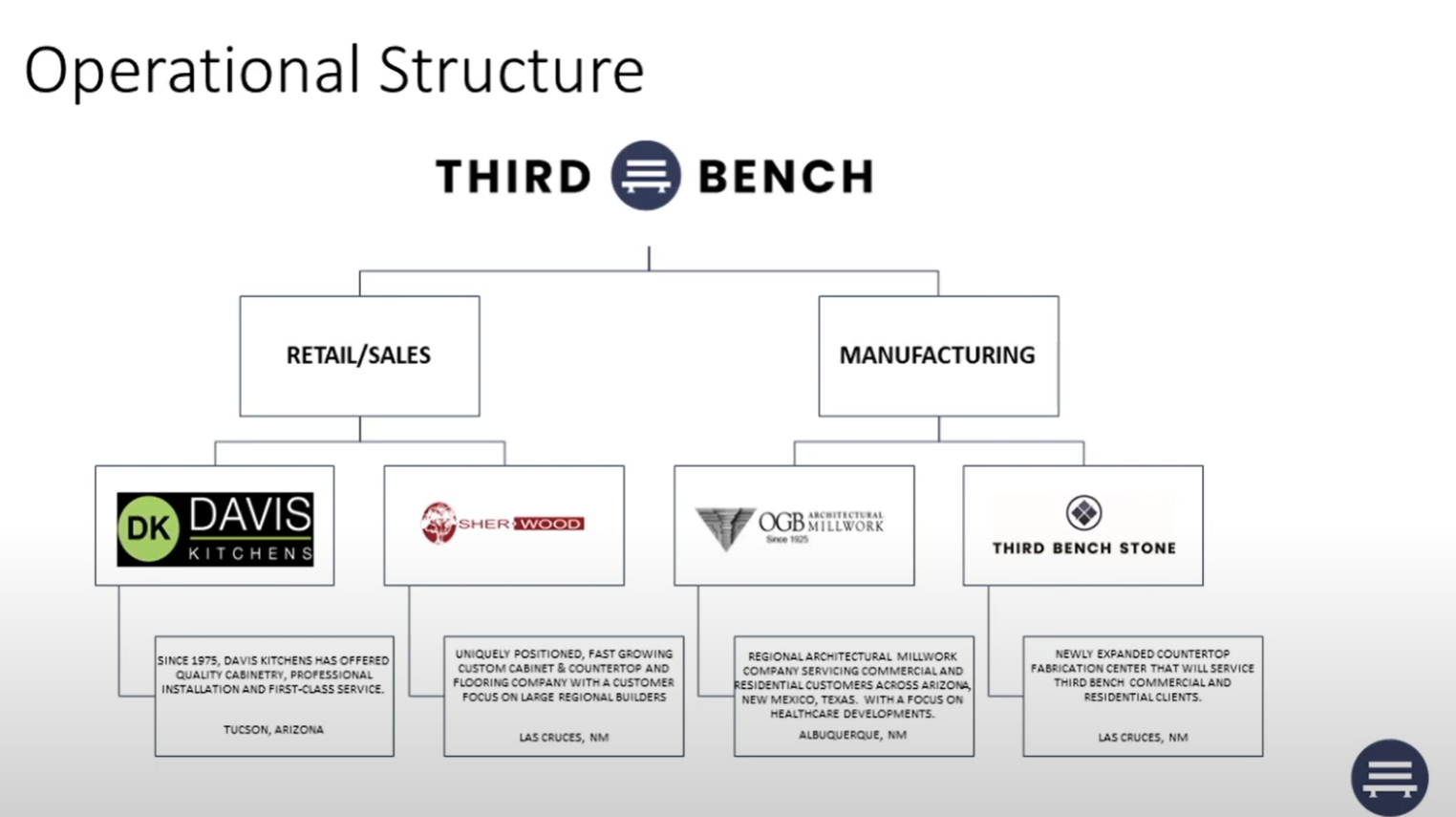

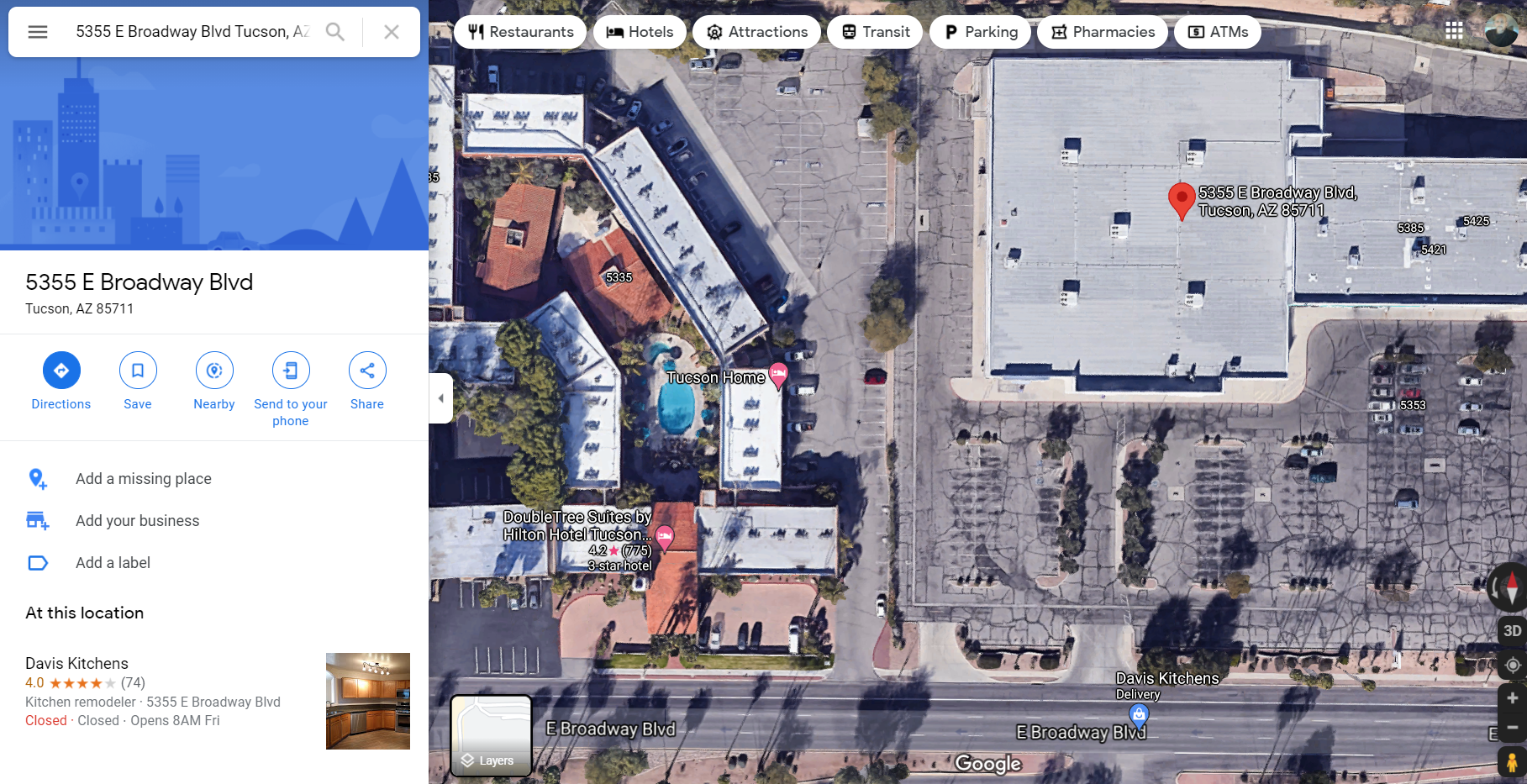

Since 1975, Davis Kitchens has offered striking design, quality cabinetry,professional installation and first-class service. Davis Kitchens is Southern Arizona’s leader in cabinetry. We are a major Tucson, Arizona cabinet distributor for remodeling and new construction alike. We provide professional cabinet designs and installation for your kitchen remodeling, bathroom remodels, room addition, or new home construction.

Watch Video Here

Visit Website Here

DAVID FAIR

FOUNDING PARTNER & CHIEF EXECUTIVE OFFICER

David Fair Named in 2021 Wood Industry 40 Under 40

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |