Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Yahoo’s Board Is Said to Weigh Selling Off Core Business

By MICHAEL J. de la MERCED and VINDU GOEL

As chief of Yahoo, Marissa Mayer has stabilized the company but faces thorny challenges.

Elijah Nouvelage/Reuters

As chief of Yahoo, Marissa Mayer has stabilized the company but faces thorny challenges.

The board of Yahoo will consider major changes during meetings this week, people briefed on the plans said, as well as review plans for the sale of its valuable stake in Alibaba.

http://www.nytimes.com/2015/12/02/business/dealbook/yahoos-board-is-said-to-weigh-selling-off-core-business.html?ref=dealbook

Diageo and Heineken Agree to Swap Assets in Beer Businesses

By CHAD BRAY 5:01 AM ET

Diageo will receive $780.5 million in cash and Heineken’s holdings in a Ghanaian brewer, and Heineken will get the distribution rights for Red Stripe in the United States.

http://www.nytimes.com/2015/10/08/business/dealbook/diageo-and-heineken-agree-to-swap-assets-in-beer-businesses.html?ref=dealbook

Anheuser-Busch InBev Raises Bid for SABMiller

By CHAD BRAY 5:28 AM ET

Any merger of the brewing giants Anheuser-Busch InBev and SABMiller would be closely scrutinized by regulators.

Scott Olson/Getty Images

Any merger of the brewing giants Anheuser-Busch InBev and SABMiller would be closely scrutinized by regulators.

Anheuser-Busch InBev said it had offered to pay about $63.97 a share in cash for SABMiller, a 44 percent premium to its closing price in mid-September before speculation on a possible bid.

http://www.nytimes.com/2015/10/08/business/dealbook/anheuser-busch-inbev-sabmiller.html?ref=dealbook

To Get More Out of Workers, Invest More in Them

OCT. 2, 2015

We perform better when our most pressing needs are met. That is common sense, and it is also supported by a raft of research. Even so, it’s far easier to treat people like machines, without worrying about how they’re feeling.

When I ask business leaders whether they believe that their employees perform better when they are happier, healthier and more fulfilled, the answer is always yes. When I then ask if they systematically invest in making their employees happier, healthier and more fulfilled, the answer is almost invariably no.

The truth is that most leaders don’t think much about what the people who work for them are feeling or how meeting their needs influences their productivity.

What fuels people at work is deceptively simple. We want to feel valued and valuable — cared for by our bosses and colleagues and encouraged to develop and express our talents.

We want to matter and we also want the work we do to matter. We hunger to make our own mark and to be a part of a larger community engaged in a mission beyond ourselves.

These needs begin at the earliest stages of our lives. Feeling loved and cared for is critical to our survival and to our sense of security and trust throughout life – something the researcher and psychologist John Bowlby called “a secure base.”

At the same time, we have a need to separate and individuate – to establish our own identities. In a perfect world, our need for individuality would smoothly coexist with our need to be intimately connected with others and part of a larger community.

Instead, our early experiences are more complex, our needs aren’t always met, and they bump up against one another. The consequence is that we grow up with varying degrees of insecurity about ourselves and our relationships.

All this plays out in the workplace. Whether we are conscious of it or not, we transfer our core childhood needs into our adult relationships. It’s no wonder that the highest drivers of employee satisfaction and engagement on the job include “my supervisor genuinely cares about my well-being” and “I have the opportunity to do what I do best at work.” Feeling valued and valuable is the optimal fuel.

No chief executive I have met appreciates and articulates this deeply human drama more clearly than Bob Chapman, who owns and runs a company called Barry-Wehmiller Companies, based in St. Louis. Over the last 40 years, Mr. Chapman has taken a small, failing tool-and-die business founded by his father and built it into a company with an annual revenue of $2 billion. Along the way, Barry-Wehmiller has achieved a 15 percent compounded rate of return to investors.

Mr. Chapman has also become an evangelist for something he calls truly human leadership, which he defines as “sending people home safe, healthy and fulfilled.” I first heard him speak seven months ago at an event sponsored by the organization Conscious Capitalism. Over the last couple of weeks, I read “Everyone Matters: The Extraordinary Power of Caring for Your People Like Family,” a book that Mr. Chapman wrote with Raj Sisodia, a founder of Conscious Capitalism.

The book tells the story of Mr. Chapman’s transformation as a leader and a human being, and how he translated that into his company.

“My business education had ignored the question of how my leadership would impact the lives of other people,” he wrote. “It was mostly about how to use people to further my own financial success. I was taught to view people as functions and objects to be used and manipulated to achieve my own goals rather than as full-fledged human beings with hopes, dreams, fears and aspirations every bit as legitimate as my own.”

Today, the company is built around this guiding principle: “We measure success by the way we touch the lives of people.”

Mr. Chapman explained what that means by saying, “We have seven thousand people, and each and every one of them is somebody’s precious child. Everyone wants to be valued as someone’s precious child, and no adult wants to be treated as a child.”

A turning point in Mr. Chapman’s journey was the day he walked past a locked storeroom containing inventory parts in one of his factories.

“That practice said loudly to our people, ‘We don’t trust you,’” he wrote. “It was humiliating. We began doing away with all such trust-destroying and demeaning practices.”

“It’s a fundamentally optimistic view of people and their possibilities,” said Rhonda Spencer, the company’s head of human resources. “Trust is given here, not earned. It’s our belief that given the opportunity, people want to do a great job and perform and make things better every day.”

During the economic downturn in 2008, the company suffered financially. “We asked ourselves, ‘What would a caring family do in this situation?’” Mr. Chapman said. “Rather than layoffs, we started offering furloughs. People could take them whenever they wanted to, and some took them to help ensure that needier colleagues wouldn’t have to do so. We didn’t have to lay off anyone.”

Days at Barry-Wehmiller factories begin with a 15-minute “touch” meeting for all employees. Rather than focus on weaknesses and shortcomings at these meetings, the emphasis is on recognizing and celebrating people for what they have done right and well.

I’m not in a position to assess how well Mr. Chapman and his leaders live their message, and there are doubtlessly ways they fall short. They don’t pay above-average wages, for example, and except in a couple of factories, they don’t offer employees any form of profit-sharing. At the same time, they offer flexible hours, opportunities to rise rapidly through the ranks, time off to do service in the community, educational assistance and a powerful commitment to treating people as whole human beings.

For too long, the primary value exchange between employees and their employers has been time for money, and not much more. Bob Chapman is suggesting a deeper, richer value exchange: We will invest in you not just as a worker but also as a human being. You’ll get better at both, and so will we.

http://www.nytimes.com/2015/10/03/business/dealbook/to-get-more-out-of-workers-invest-more-in-them.html?partner=rss&emc=rss

Grim Jobs Report Is Likely to Delay a Move by the Fed on Rates

By PATRICIA COHEN

The Labor Department reported a gain of 142,000 jobs in September, and the August figure was revised downward, though unemployment remained at 5.1 percent.

http://www.nytimes.com/2015/10/03/business/economy/jobs-report-hiring-unemployment-wages-fed-rates.html?ref=business

Volkswagen Debacle on Financial Par With BP Oil Spill

By ANTONY CURRIE and OLAF STORBECK

The final bill under the Clean Water Act for BP’s Gulf of Mexico oil spill was $5.5 billion; for Volkswagen, it could be as much as $18 billion.

http://www.nytimes.com/2015/09/23/business/dealbook/volkswagen-debacle-on-financial-par-with-bp-oil-spill.html?ref=dealbook

The Plot Twist: E-Book Sales Slip, and Print Is Far From Dead

By ALEXANDRA ALTER

With readers on a reverse migration to print, the “e-book terror has kind of subsided” for bookstores and publishers.

http://www.nytimes.com/2015/09/23/business/media/the-plot-twist-e-book-sales-slip-and-print-is-far-from-dead.html?ref=business

Strong Salary Increases Expected in 2016 Despite Economic Uncertainty, Aon Survey Reveals

Employers Turn to Variable Pay to Drive Better Performance, Keep Costs in Check

MARKET WIRE 10:00 AM ET 9/21/2015

Symbol Last Price Change

AON 90.22down +0.91 (+1.02%)

QUOTES AS OF 11:48:34 AM ET 09/21/2015

TORONTO, ON -- (Marketwired) -- 09/21/15 --

Aon plc (AON) , the leading global provider of risk management and human resource consulting and outsourcing, today released its annual Canadian Salary Increase Survey, which found that Canadian employees can expect an average total salary increase of 3.0 percent in 2016. That is up from this year's estimated average salary increase of 2.8%, and suggests that employers are expecting an improvement in business conditions in 2016.

Aon surveyed more than 475 organizations across the country on expected salary increases through 2015 and next year, and found that there was wide variation in remuneration among industry and employee groups. For instance, resource-based industries are lagging other sectors this year and anticipate lower increases in 2016. As well, within their organizations, employers are increasingly emphasizing the importance of variable pay versus general increases, with sharp divisions arising between performance levels.

"Given the divergence in the fortunes of different sectors this year, it's not surprising to see that employers are rewarding their workers in response to business conditions," said Suzanne Thomson, Senior Consultant, Global Data Solutions, Aon Hewitt. "On the other hand, our survey shows that employers across sectors remain under immense pressure to keep costs in line while still attracting and retaining top talent. As a result, they are turning to variable pay as a way to recognize and reward performance without growing their fixed costs."

Professional Services, Aerospace to see the highest increases, while resource sector lags

The Canadian economy in 2015 has been a tale of two realities: a decline in energy and other resource-related sectors, spurred by the oil price shock and global weakness in commodities demand; and a strengthening of manufacturing and services-oriented sectors, which benefit from a recovering U.S. economy and a devalued Canadian dollar. Aon's Canadian Salary Increase Survey demonstrates how those two realities are impacting employee pay.

In the Services industry, the sector with the highest expected salary increase next year is Professional Services, which includes Advertising/PR, Accounting, Consulting and Legal Firms. 2016 increases are anticipated to average 3.5 percent in the sector, following a strong 2015 in which increases are averaging 3.7 percent. Also in Services, increases projected for employees in Application Services/Consulting (3.2 percent), IT Enabled Services (3.4 percent) and Retail (3.3 percent) are above the national average.

In Manufacturing, meanwhile, Aerospace leads the way, with anticipated increases of 3.4 percent next year, followed closely by the Consumer Products (3.3 percent) and Pharmaceutical (3.1 percent) sectors.

It is a far different story for resource-related sectors. After being at the top of all industries for the last few years, Oil & Gas reported a 2.5 percent actual total salary increase in 2015 and is projecting 3.0 percent in 2016. Other sectors with the lowest projected increases are Mining (2.7 percent), Forest & Paper Products (2.6 percent) and Metals (2.1 percent).

The challenges in resources are reflected by geographical disparities. For example, Alberta in 2014 led the country in average salary increase, at 3.6 percent. In 2015, however, increases averaged only 2.6 percent, according to the survey. In resource-rich Saskatchewan, meanwhile, salary increases will average just 2.2 percent -- the lowest among all provinces. By contrast, Ontario (3 percent for 2015 and 2016, up from 2.8 in 2014) has seen consistent increases year over year.

"The level of rewards that industries are able to offer employees vary widely and are typically based on competitive pressures and company performance," added Thomson. "With the oil price shock and weakness in commodities, we are seeing a real impact on resource-sector compensation."

Paying more for performance

In general, Canadian employers forecast higher salary growth in 2016 over 2015, largely in expectation of a strengthening economic recovery. According to the Aon survey, however, these increases are unlikely to apply equally to all employees. In fact, employers expect general salary increases across employee groups to average only 1.3 percent in 2016; factoring in the effect of salary freezes and pay cuts, that number falls to 0.8 percent. Both of those general increases are lower than the 2015 levels of 1.5 percent and 0.9 percent, respectively.

In contrast, employers are emphasizing variable pay practices that reward more highly engaged employees with higher salary increases. While overall merit increases are expected to average 2.7% next year, the Aon survey revealed wide variance among different performance tiers. Top performers can clearly expect higher increases in 2015.

According to the survey, the expected variable pay averages across performance tiers for 2016 are:

4.5% for those who Far Exceed Expectations;

3.6% for those who Often Exceed Expectations;

2.5% for those who Meet Expectations.

"Competitive pressures are intense, and we are seeing many companies shifting more of their spending to variable pay," said Aon Hewitt's Thomson. "Pay is a top engagement driver for employees, and as the market continues to improve, organizations will need to differentiate through variable pay programs to attract and retain top talent."

About the Survey

Aon Hewitt's Salary Planning Report -- 2015-2016 represents the 28th annual study focusing on overall changes in employee compensation for the calendar year 2015 and current projections for 2016. Information was collected during June and July. Visit http://www.globalcompensation.net/ for more information.

About Aon

Aon plc (AON) is a leading global provider of risk management, insurance brokerage and reinsurance brokerage, and human resources solutions and outsourcing services. Through its more than 69,000 colleagues worldwide, Aon unites to empower results for clients in over 120 countries via innovative risk and people solutions. For further information on our capabilities and to learn how we empower results for clients, please visit: http://aon.mediaroom.com.

Follow Aon on Twitter: @AonHewittCA

Sign up for News Alerts: aon.mediaroom.com

Risk. Reinsurance. Human Resources.

Media Contacts

Rosa Damonte

rosa.damonte@aonhewitt.com

+1.416.227.5718

Alexandre Daudelin

alexandre.daudelin@aonhewitt.com

+1.514.982.4910

Source: Aon Hewitt

Puerto Rico’s Debt Rescue Plan Called Into Question

By MARY WILLIAMS WALSHSEPT. 16, 2015

A week after the governor of Puerto Rico laid out a plan for attacking the island’s heavy debt, analysts are beginning to publicly question the proposals and even the financial assumptions on which they are based.

The doubts suggest that Gov. Alejandro García Padilla’s strategy to persuade bondholders and other investors to voluntarily help the island restructure the debt — and take losses on their investments as a result — is a long shot.

One credit analyst, Ryan Brady of Morgan Stanley, said it appeared that the planners had greatly overstated Puerto Rico’s financial needs over the next five years. As a result, he said in a private presentation to clients, Puerto Rico was hoping to get $14 billion in concessions from its creditors, when in fact it might need as little as $5.7 billion.

And Sergio M. Marxuach, public policy director for the Center for a New Economy, a research institute in San Juan, P.R., said on Wednesday that the five-year plan appeared to be “tilted toward austerity rather than growth,” which could undermine its key goal of reviving the island’s economy.

Mr. Marxuach also questioned whether the Puerto Rican government could carry out the plan, because it relies on an independent control board to enforce politically unpalatable austerity measures. Mr. Marxuach said it was not clear how the board would function.

The Puerto Rican legislature is expected to take up the issue of a control board in the next two weeks, but lawmakers have said other elements of the five-year plan will not be considered until January.

Barbara Morgan, a spokeswoman for Puerto Rico’s Government Development Bank, which arranges the island’s borrowing and liquidity needs, said the bank did not have access to the data underlying the Morgan Stanley assessment. But in an email, she said, “This analysis appears, at best, sloppy and, worse, a disservice to the 3.5 million American citizens of Puerto Rico.”

She added, “It’s incredibly unfortunate that something of such quality was used to inform an investment bank’s clients or the public at large.”

Puerto Rico’s governor warned in June that its debt was “unpayable,” and the only hope was to reduce scheduled payments for a few years while reforming the island’s deeply depressed economy. He assigned a team of government finance specialists to develop a plan, which was released to the public last week.

The planners projected the total cost of providing government services on the island for the next five years, and found that it would be about $28 billion more than the resources available. They then devised a number of austerity measures and tax changes, which they said could whittle the projected five-year shortfall down to $14 billion.

Over the same period, they said, the Puerto Rican government is scheduled to pay about $18 billion to a large group of creditors. The plan calls for withholding about $14 billion of those payments and using the money to fill the gap.

In a slide show that accompanied a client briefing last week, Mr. Brady discussed the assumptions that led the planners to those numbers, saying that a different set of assumptions could produce a much smaller shortfall, just $5.7 billion.

Mr. Brady’s slides suggested that Puerto Rico’s planners had excluded the effects of certain tax changes in arriving at a five-year shortfall of $14 billion. For example, the working group accounted for a sharp increase in sales taxes on the island in a way that increased the five-year shortfall by $5.3 billion, Mr. Brady concluded.

Mr. Brady declined to comment on his presentation, a copy of which was reviewed by The New York Times. Disclaimers at the end of the report said it was a “sales and trading commentary,” prepared for institutional clients considering derivatives transactions with the bank. It said it did not necessarily reflect the opinions of Morgan Stanley’s research department.

At the Center for a New Economy, Mr. Marxuach said that he had turned to research on other debt crises by Carmen M. Reinhart and other economists. Their work showed that “kick the can” strategies that pushed debt payments farther into the future did not provide enough change in countries with very protracted sovereign debt crises, he said, adding, “You still have people unwilling to invest in your country because of the huge debt cloud over it.”

In those cases, something more powerful was needed, such as the “Brady bonds” that ultimately resolved a decade-long debt crisis in the 1980s, which engulfed much of Latin America, and parts of Africa and Eastern Europe. That program was named after Nicholas F. Brady, the Treasury secretary who served under Presidents Ronald Reagan and George H. W. Bush. They allowed existing debt owed by Latin American countries to be converted into new bonds that were backed by a special type of United States Treasury bond, which the debtors could buy and pledge as collateral.

Mr. Marxuach said he was closely watching a second report, on Puerto Rico’s available cash, which was issued on the same day as the five-year debt-adjustment plan but has received much less attention. It showed that Puerto Rico’s treasury would exhaust its cash in November, despite taking “extraordinary measures” to conserve cash whenever possible.

In addition, the island’s development bank is expected to exhaust all of its cash at the end of December. That will coincide with a large payment due on the island’s general obligation bonds in early January. Those bonds were sold with an explicit constitutional guarantee, and Mr. Marxuach said that not making the payment on time, from the investor’s perspective, would be “a declaration of war.”

“If you don’t pay, you’re losing any chance of negotiations with the bondholders,” he said.

On the other hand, if Puerto Rico runs out of cash in December, it might have to shut down the government for a time. It did so once before, during a fiscal crisis in 2006, causing an outcry.

“Are you really going to send government workers home in the middle of the Christmas season, without a paycheck? Are you really going to default on January 1?” Mr. Marxuach asked. “Those are really tough decisions, but those are the kind of decisions we may have to make.”

Governor García Padilla may have signaled the answer to that question in a recent speech that was televised in Puerto Rico. He said that if Puerto Rico’s creditors would not negotiate concessions, he would have to execute the five-year plan without them.

http://www.nytimes.com/2015/09/17/business/dealbook/puerto-ricos-debt-rescue-plan-called-into-question.html?ref=dealbook

Why Yellen Blinked on Interest Rates

SEPT. 17, 2015

It has been seven years of zero percent interest rates. What’s another two or three months among friends?

That’s the conclusion that Janet Yellen and her colleagues at the Federal Reserve reached in their policy meeting on Thursday. They left interest rates unchanged at the same near-zero level where they have been lodged since December 2008. For them, the risk of changing course prematurely just seemed higher than another couple of months of zero rates.

Ms. Yellen blinked, which is not to say she made a mistake. Sometimes blinking is a very sensible thing to do.

http://www.nytimes.com/2015/09/18/upshot/yellen-blinks-on-interest-rates.html?ref=business

Dovish Tone of Fed’s Monetary Policy Statement Surprises Economists

By NELSON D. SCHWARTZ

While many on Wall Street expected the Fed to delay raising rates, few expected its language about future moves to be so dovish.

http://www.nytimes.com/2015/09/18/business/economy/feds-hesitance-not-its-decision-surprises-economists.html?ref=business

$900 Million Penalty for G.M.’s Deadly Defect Leaves Many Cold

By DANIELLE IVORY and BILL VLASIC

In a settlement, no individual employees were charged, and the Justice Department agreed to defer prosecution of G.M. for three years.

...“I don’t understand how they can basically buy their way out of it,” said Margie Beskau, whose daughter Amy Rademaker was killed in an October 2006 crash in Wisconsin. She added, “They knew what they were doing and they kept doing it.”

...Mr. Bharara emphasized that individuals could still be charged, but bringing a case against employees faces higher legal hurdles than in some other industries. Two employees in particular were singled out in the complaint as playing a central role in concealing information from regulators, but they were identified only by a vague job description.

...“This outcome fails to require adequate and explicit admission of criminal culpability from G.M. and individual criminal actions,” said Senators Richard Blumenthal of Connecticut and Edward J. Markey of Massachusetts, both Democrats, in a joint statement. “This outcome is extremely disappointing.”

http://www.nytimes.com/2015/09/18/business/gm-to-pay-us-900-million-over-ignition-switch-flaw.html

China’s Response to Stock Plunge Rattles Traders

????????? Read in Chinese

By EDWARD WONG, NEIL GOUGH and ALEXANDRA STEVENSONSEPT. 9, 2015

BEIJING — The police have been dropping in on investment firms and downloading their transaction records. Senior executives at China’s biggest investment bank have been arrested on suspicion of illegal trading. A business journalist has been detained and shown apologizing on national television for writing an article that could have hurt the market.

The Communist Party’s response to China’s monthslong stock market crisis has been swift and forceful. In addition to spending as much as $235 billion to buy shares and bolster prices, the authorities have imposed a range of extraordinary restrictions on the sale of stocks — and backed them with the full weight of a security apparatus usually more focused on political dissent than equity trades.

The strategy appears to have succeeded, at least for now, in softening the impact of the Chinese market’s biggest rout since the global financial crisis of 2008. But the new limits on trading and the efforts by the police and regulators to enforce them have unsettled investors at home and abroad who are unsure exactly what types of transactions are being banned or criminalized.

After decades of watching China make slow but steady progress in building Western-style financial markets, many are now asking whether the party is reversing course — and whether Chinese officials are willing to tolerate the sometimes turbulent waves of selling that are inherent to such markets.

“What’s happening in China is definitively spooking people,” said Dawn Fitzpatrick, the chief investment officer of O’Connor, a $5.6 billion hedge fund owned by UBS. “They’ve set themselves back a couple of years” in terms of attracting investment, she added.

Anxiety in the industry surged last week after Li Yifei, the prominent China chief of the world’s largest publicly traded hedge fund, disappeared and Bloomberg News reported that she had been taken into custody to assist a police inquiry into market volatility. Her employer, the London-based Man Group, did little to dispel fears, declining to comment on her whereabouts.

Ms. Li resurfaced on Sunday and denied that she had been detained, saying that she had been in “an industry meeting” and “meditating” at a Taoist retreat. But many in the finance sector are unconvinced.

“There is, generally, a very nervous atmosphere, as people wait to see the outcome of some of these investigations and how deep the rabbit hole goes,” said Effie Vasilopoulos, a partner at the Hong Kong office of the Sidley Austin law firm who works with hedge funds that invest in mainland China. “How wide a net is the government going to cast in terms of looking at foreign firms and their operations — not just onshore, but also offshore as well?”

The authorities are canvassing industry players in several cities, including Beijing and Shanghai. Police officers under the Chinese Ministry of Public Security specializing in economic crimes have joined agents from the nation’s securities regulator on inspections of investment funds and brokerage firms. The authorities are combing records and questioning transactions that appear to profit from or contribute to a falling market, according to employees of investment firms who, like others who spoke anonymously, said they feared reprisals.

Police officers have downloaded extensive trading data and asked fund managers why they sold shares when the market was going down, prompting discussions about basic investment strategy. Officers have bluntly told some fund managers to just stop selling.

While regulators and law enforcement elsewhere in the world routinely meet with investment companies to monitor trading for potential abuse and illegal activity, they seldom do so with the aim of steering the direction of the markets.

The government has offered few details about the various investigations, contributing to the atmosphere of uncertainty. In late August, it announced the arrests of eight executives at state-owned Citic Securities, the country’s largest brokerage firm and investment bank, including four members of its senior management, on suspicion of insider trading.

At least four other brokerage firms said last month that they were being investigated by regulators for failing to properly identify their clients.

While insider trading is common in China’s relatively opaque markets, the investigations also serve the government’s short-term goal of discouraging sales and stabilizing prices, said Chris Powers, a senior consultant at Z-Ben Advisors, a financial consulting firm in Shanghai. “Is this more about limiting supposed market manipulation, or is it about sending a message to the market as a whole and using these cases as examples?” he asked.

Starting in the middle of last year, China’s markets enjoyed a breathtaking rally driven by record levels of margin financing, or borrowing to invest in stocks, and strong signals of government support, including cheery reports on the bull market in official news outlets like People’s Daily. But the Shanghai composite index has fallen 37 percent since the sell-off began in June, and the government has intervened directly and repeatedly in an attempt to support prices.

The measures include restrictions on short-selling, or betting that stocks will fall. Regulators in the United States took similar action for a month at the height of the 2008 financial crisis, but the Chinese authorities have been vague about what kinds of transactions have been prohibited and for how long. The police have said they are investigating “malicious” short-selling but have not said what that entails.

The crackdown on short-selling and other trading strategies has been particularly disruptive for hedge funds, which depend on such trades to balance risks and limit losses.

“They seem to be harassing anybody that they thought was selling or was short,” said one hedge fund manager in Hong Kong who does not have investments on the mainland. “Hello, it’s a hedge fund — they are long and short — but China is only looking at the short side.”

The government has also suspended initial public offerings and prohibited investors who own more than 5 percent of a company from selling shares.

While central banks in the United States, Europe and Japan have used unconventional monetary policy in recent years to stimulate growth and lift markets, China’s intervention has been more direct, with the government ordering brokerage firms to contribute to a bailout fund. In a report this week, analysts at Goldman Sachs estimated that entities directed by the Chinese government have spent about 1.5 trillion renminbi, or $235 billion, buying shares to support the market.

While opening its wallet, the state is also wielding a cudgel. At the end of August, Wang Xiaolu, a journalist for the respected financial newsmagazine Caijing, was detained by the police and shown on state television apologizing for an article suggesting the government might scale back its bailout of the market. Nearly 200 others have been punished in a special police campaign against “spreading rumors,” including some detained for discussing the stock market.

Censors have ordered the Chinese news media to avoid any reporting that might result in a market sell-off. With the economy growing at its slowest pace in a quarter-century and the party leadership worried about social unrest, discussion of the markets can draw official scrutiny almost as quickly as political speech.

“Like many other bad ideas, the Chinese have finally adopted the Western practice” of discouraging financial critics and banning short-selling when markets turn down, said James S. Chanos, the prominent American short-seller who has bet on a downturn in China for more than five years. “It has never worked here, and does not appear to be working there, either.”

One hedge-fund manager based in Hong Kong said that he was cashing out most of the nearly $500 million he has invested in the mainland because of fears that his money could get tied up by new rules, with no legal recourse. “I’m worried about more systemic risks” and “the witch hunt that is going on,” he said.

Another fund manager, in Singapore, said his colleagues in China were finding ways to take vacations outside of China because of a perception in the industry that the environment was becoming increasingly hostile.

The state news media has stoked the flames in the campaign against short-sellers, hedge funds and other investors, especially foreign ones. In July, the official newspaper of China’s state banks, Financial News, ran an editorial that accused Morgan Stanley, Goldman Sachs and other foreign investment banks of trying to cause a market “stampede” and said that outsiders wanted to prevent China from becoming a strong financial power.

Another article, on the popular Chinese website Sina, criticized Citadel Securities, a Chicago-based investment firm. One of the firm’s accounts in China was among a group of 34 that officials suspended in July and August for suspicious automated trading activity.

Though foreign investors are being singled out, only about 1 percent of China’s $6.4 trillion domestic market value is owned by such investors, according to estimates by UBS, the investment bank.

In recent years, some financial officials and regulators have started developing more sophisticated investment tools for the Chinese stock market, like futures and derivatives. But regulators are unlikely in the current environment to continue with such experiments, analysts said. On Sept. 2, China’s futures exchange, an important platform for hedging, announced new restrictions that quickly led to a severe drop in trading volume.

“Now we’re seeing the regulators trying to stuff the genie back into the bottle,” said Victor Shih, a political economist at the University of California, San Diego, who has worked for a hedge fund.

“For investors, if you can’t hedge, it makes it hard to mitigate any sort of risk,” he added, arguing that would “ultimately limit the wealth of the equities market” in China.

Anne Stevenson-Yang, co-founder of J Capital Research, which analyzes the Chinese economy for investors, said the restrictions on selling had turned the Chinese stock market into “a roach motel for capital.”

“You can enter,” she said, “but if you want to leave, you have to be really fleet about it because you’re mostly not going to get out.”

Edward Wong reported from Beijing, Neil Gough from Hong Kong and Alexandra Stevenson from New York. Mia Li and Kiki Zhao contributed research.

http://www.nytimes.com/2015/09/10/world/asia/in-china-a-forceful-crackdown-in-response-to-stock-market-crisis.html?ref=dealbook

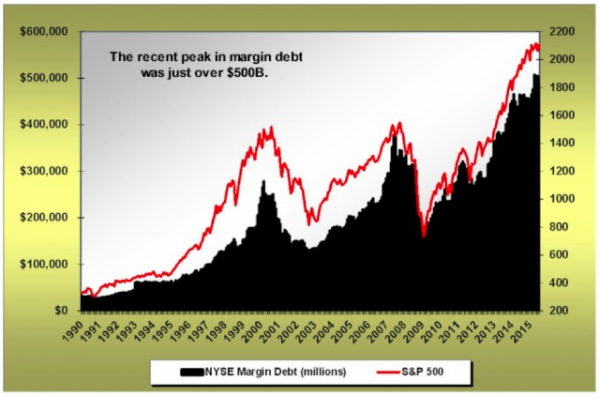

The Margin Debt Time-Bomb

A terrible threat created by terrible decision-making

by Brian Pretti

Friday, September 4, 2015, 9:00 PM

http://www.peakprosperity.com/blog/94263/margin-debt-time-bomb

What is perhaps the greatest risk to individual investors these days?

Is it the potential for a decline in corporate earnings based on a slowing global economy? Is it that current valuation levels in both equities and fixed income instruments are much nearer historic highs than not? Is the biggest risk a US Fed that will soon raise interest rates for the first time in close to a decade?

Although all of these are specific investment risks we face in the current cycle, my contention is that the single largest risk to investors is a risk that has been present since the beginning of what we have come to know as modern financial markets. The single largest risk to investors is themselves. By that, I mean the influence of human emotion and psychology in decision making.

We Are Our Own Worst Enemies...

Human Emotions Meet Animal Spirits...

The Margin Debt Time-Bomb...

Fed Report Shows Autos and Housing Fueling US Growth

By THE ASSOCIATED PRESSSEPT. 2, 2015, 4:30 P.M. E.D.T.

WASHINGTON — While U.S. housing and auto sales showed strength over the summer, manufacturers were feeling pressure from China's economic slowdown and the oil industry was squeezed by lower energy prices.

That's the U.S. economic picture that emerges from the Federal Reserve's latest look at business conditions around the country. The Fed said 11 of its 12 regional banks reported that the economy grew at least modestly in July through mid-August. One of the Fed's regions — Cleveland — reported only slight growth.

The Fed report, known as the beige book, will be used for discussion when the central bank meets next on Sept. 16-17. The gathering will be closely watched because of the possibility it will decide to start raising interest rates from record lows near zero.

The recent stock market turbulence, triggered by worries about China's slowdown, has led some analysts to lower the odds for a Fed move in September. But other economists still believe a Fed rate hike this month is likely, especially if markets stabilize and Friday's unemployment report shows strong job gains continued in August.

Jennifer Lee, senior economist at BMO Capital Economics, viewed the overall tone of the survey as "a tad more positive" than the previous report.

"It doesn't appear that economic activity has slowed much since July, at least as of a week ago," she said. "No reason, here at least, for a delay in tightening" Fed interest rates.

The survey was based on information collected before Aug. 24, which means it doesn't reflect the stock market turmoil that occurred at the end of August.

Analysts at TD Economics said in a research that while there was little overlap with the recent wild market swings, the report did show that the strong dollar and Chinese economic slowdown were weighing on activity, particularly in manufacturing.

The beige book revealed a mixed picture for manufacturing, with 10 regions reporting stable or positive growth overall but New York and Kansas City seeing declines.

The Boston, Philadelphia, Cleveland, Richmond and Dallas districts all said that a strong dollar had dampened manufacturing activity. Three districts cited China's deceleration as dragging on some business. The Chinese slowdown hurt demand for wood products in the San Francisco district, chemicals in the Boston area and high-tech goods in the Dallas region.

The survey found that real estate activity improved throughout the country, with home sales and home prices climbing in all 12 districts. Auto sales were also a bright spot in most regions.

"Expectations are generally optimistic that auto sales will improve or continue to be strong through the end of the year," the report said.

Wages were reported to be "relatively stable" in most regions, although several districts noted wages heading higher in some industries. St. Louis said that almost three-fourths of the businesses surveyed reported rising wages in the last three months, while Cleveland reported intensifying wage pressure in construction, retail and transportation sectors. Kansas City and Dallas, both regions hit by layoffs in the oil industry, reported wage growth had either slowed or was flat.

The overall economy expanded at a healthy annual rate of 3.7 percent in the April-June quarter. Most forecasters believe growth has moderated slightly to around 2.5 percent in the current July-September quarter but are looking for an acceleration to around 3 percent growth in the final three months of the year.

http://www.nytimes.com/aponline/2015/09/02/us/politics/ap-us-fed-beige-book.html?ref=business

Fed Officials Say a September Rate Increase Is Still on the Table

By BINYAMIN APPELBAUM

Economic conditions will govern any decision, the officials emphasize, though continued market volatility would make a move less likely.

http://www.nytimes.com/2015/08/29/business/economy/fed-official-fischer-leaves-door-open-for-september-rate-increase.html?ref=business

Salesforce Ventures and Microsoft Join Informatica Buyout

By MICHAEL J. de la MERCEDAUG. 6, 2015

SAN FRANCISCO — As Informatica closes its $5.3 billion sale to private equity on Thursday, the enterprise software maker will count two of its big technology partners as new investors as well.

Joining Permira and the Canada Pension Plan Investment Board in buying Informatica are Microsoft and Salesforce Ventures.

The two will join the biggest leveraged buyout of the year to date, taking ownership stakes in the company, whose products combine and analyze customers’ data.

Under the terms of the transaction, Informatica shareholders will receive $48.75 a share in cash.

According to Brian Ruder, the co-head of Permira’s technology investment team, his firm had been in talks with both Microsoft and Salesforce Ventures, the latter of which is the investment arm of Salesforce.com, even before striking the leveraged buyout in April.

Part of the rationale behind bringing them on board were the relationships that each had with Informatica. The company had established a relationship with Salesforce years ago and is a regular participant in the big Dreamforce conference every year, while it also makes use of Microsoft’s cloud offerings.

“We’ve had great relationships investing alongside technology giants for a long time,” Mr. Ruder said in a telephone interview. “The key motivation was around aligning the companies with our strategy.”

Already, Permira and its co-investors have helped push for change at Informatica. The chairman and chief executive at the time the deal was struck, Sohaib Abbasi, will drop his chief executive title. Picking it up on an interim basis is Anil Chakravarthy, currently the company’s chief product officer.

Under private ownership, Informatica will continue to focus on its main product areas, including cloud services, data security and “big data” analysis. But the company, with the support of its new backers, will also search for potential takeover targets as part of an effort to be a consolidator.

“In going private, it gives us a great opportunity to plan for the long term,” Mr. Chakravarthy said. “It lets us invest in products that can really shape our future.”

In a statement, Microsoft said, “Informatica has been a strong part of Microsoft’s partner ecosystem as a data integration leader and we are excited to support Informatica in this new stage of growth as a private company.”

http://www.nytimes.com/2015/08/07/business/dealbook/salesforce-ventures-and-microsoft-join-informatica-buyout.html?ref=dealbook

Puerto Rico Defaults on Bond Payment

By MARY WILLIAMS WALSH

The Government Development Bank for Puerto Rico did not make a $58 million bond payment, saying it lacked the funds to meet the amount due.

http://www.nytimes.com/2015/08/04/business/dealbook/puerto-rico-decides-to-skip-bond-payment.html?ref=dealbook

Pimco May Face S.E.C. Action Over a Fund

By MATTHEW GOLDSTEIN

The asset manager said it had received a Wells notice from the regulator over potential trading infractions concerning an exchange-traded fund in 2012.

http://www.nytimes.com/2015/08/04/business/dealbook/pimco-may-face-sec-action-over-a-fund.html?ref=business

Exor Triumphs in Battle for Bermuda Insurer PartnerRe

The Italian investment company will pay $6.9 billion in cash after wresting the Bermuda insurer away from Axis Capital Holdings.

http://www.nytimes.com/2015/08/04/business/dealbook/exor-triumphs-in-battle-for-bermuda-insurer-partnerre.html

Aon Reports Second Quarter 2015 Results

Second Quarter Key Metrics

- Total revenue was $2.8 billion with organic revenue growth of 2%

- Operating margin was 9.9%, and operating margin, adjusted for certain items, increased 80 basis points to 19.0%

- EPS was $0.62, and EPS, adjusted for certain items, increased 5% to $1.31

- For the first six months of 2015, cash flow from operations increased 10% to $365 million, and free cash flow increased 2% to $223 million

Second Quarter Highlights

- Repurchased 3.0 million Class A Ordinary Shares for approximately $300 million

- Announced a 20% increase to the quarterly cash dividend

https://finance.yahoo.com/news/aon-reports-second-quarter-2015-103000114.html

Ford easily tops expectations on 2nd-qtr profit

Reuters

49 minutes ago

By Bernie Woodall

DETROIT, July 28 (Reuters) - Ford Motor Co on Tuesday reported second-quarter earnings that handily beat expectations, based on the continued strength of North American sales, led by its popular F-150 pickup truck.

Ford posted net quarterly profit of $1.89 billion, or 47 cents per share. Analysts estimated profit of 37 cents per share, according to Thomson Reuters I/B/E/S.

Ford shares were up 2.7 percent to $14.95 before the market opened.

Operating profit totaled nearly $2.6 billion in North America, a company record for any quarter, and was linked to better pricing on new product launches, said Bob Shanks, Ford's chief financial officer.

Ford maintained its full-year 2015 forecast of an operating profit of between $8.5 billion and $9.5 billion.

Ford also maintained a forecast of North American profit margin between 8.5 percent and 9.5 percent. Shanks said he now expects the margin to end the year at the high end of that range.

Operating profit in Asia Pacific rose 21 percent to $192 million despite a dip in industry sales in China, the world's biggest auto market.

"As this has been happening, we have been adjusting our production all along" due to the lower demand, said Shanks.

Ford lowered its 2015 forecast for industry sales in China to 23 million to 24 million vehicles, from 24.5 million to 26.5 million at the start of the year. Sales in China in 2014 were about 24 million. Shanks said Ford sees China sales of 30 million by the end of the decade.

Ford's quarterly revenue of $37.3 billion beat expectations of $35.34 billion.

Shanks said the company also achieved stronger pricing in North America because of the rollout of new versions of several models, including the F-150 truck and the Edge and Explorer SUVs.

(Editing by Jeremy Gaunt and Jeffrey Benkoe)

https://finance.yahoo.com/news/ford-easily-tops-expectations-2nd-120704579.html

?

?

?

?

.

Hillary Clinton Eyes Corporations in Proposals for Economy

By MAGGIE HABERMANJULY 24, 2015

Hillary Rodham Clinton made a case on Friday for weaning Wall Street from an addiction to profits, calling for a change to capital gains taxes for the highest earners and a string of measures to adjust the balance of power between corporate titans and their employees.

She also supported raising the minimum wage for fast-food workers to $15 an hour in New York, where a wage board this week suggested such an increase, but she also insisted that such a rise was not a one-size-fits-all approach for the whole country.

Amid pressure from the left to take a more aggressive approach toward the financial industry, Mrs. Clinton presented her proposals in a speech at New York University, the second major address of her campaign that focused on economic issues. The approach — suggesting, among other things, increasing transparency involving stock buybacks and executive compensation — is her first effort to take on Wall Street, without the gate-rattling that some more liberal elements of the Democratic Party have called for.

While the speech had a Wall Street overlay, it was more broadly about changes to corporate culture. Mrs. Clinton’s aides say she plans to give a speech specific to Wall Street in the coming weeks.

Her plans won praise from a key centrist think tank but came under criticism from anti-tax groups and some liberal analysts, who were skeptical about how much change would result.

Among the splashiest ideas was a call to overhaul capital gains taxes imposed on those in the highest income bracket, families making more than $465,000 a year, so that people would hold on to stocks for longer, reducing corporate obsession with quarterly profits. That would encourage companies to focus more on investing in long-term growth and their work forces.

The new rate, along a sliding scale over six years of holding an equity, would increase from 20 percent to nearly 40 percent for investments that taxpayers maintain for one to two years, and would gradually decrease after that, back to 20 percent. The top rate would be the same as the highest tax rate for normal income.

“The current definition of a long-term holding period, just one year, is woefully inadequate,” Mrs. Clinton said in the speech, without mentioning the specifics of the plan. “That may count as long-term for my baby granddaughter, but not for the American economy.”

She added that businesses needed “to break free from the tyranny of today’s earnings report so they can do what they do best: innovate, invest and build tomorrow’s prosperity.”

Mrs. Clinton’s proposal to change capital gains rates for the highest earners is a plan that many of her Wall Street supporters endorse.

But at least some critics on the left raised questions about her overall approach. Len Berman of the Tax Policy Center described himself as “skeptical” about whether it would encourage companies to do more to treat workers as assets.

“The purpose seems to be to encourage companies to make longer-term investments,” he said. “I don’t know that it’ll really accomplish that goal.”

Others praised the plan.

“It was a thoughtful approach to reform that would actually help people, help the middle class, instead of a symbolic thing that might make people feel better but wouldn’t have any impact on people’s lives,” said Matt Bennett, head of the center-left think tank Third Way.

“I think this is a very good-faith effort to find every possible opportunity for government to improve the system, and sometimes that’s going to be marginal, sometimes that’s going to be substantial, but they’re doing their best.”

Mrs. Clinton strongly criticized “quarterly capitalism” and the focus on generating profits for short-term earnings reports.

“A survey of corporate executives found that more than half would hold off making a successful long-term investment if it meant missing a target in the next quarterly earnings report,” Mrs. Clinton said.

“Large public companies now return eight or nine out of every 10 dollars they earn directly back to shareholders, either in the form of dividends or stock buybacks, which can temporarily boost share prices,” she said. “Last year, the total reached a record $900 billion. That doesn’t leave much money to build a new factory or a research lab, or to train workers, or to give them a raise.”

She cited a report that said some Standard & Poor’s companies in the last decade had doubled “the share of cash flow they spent on dividends and stock buybacks” and “actually cut capital expenditures on things like new plants and equipment.”

Dominic Barton, the global managing director of McKinsey & Company, who coined the term “quarterly capitalism,” praised Mrs. Clinton for focusing on “more long-term capitalism, more investment.” But he did not endorse any of her specific prescriptions, and suggested that caution was important in terms of how changes to buybacks and dividends would be addressed.

http://www.nytimes.com/2015/07/25/us/politics/hillary-clinton-offers-plans-for-changes-on-wall-street.html?&moduleDetail=section-news-4&action=click&contentCollection=DealBook®ion=Footer&module=MoreInSection&version=WhatsNext&contentID=WhatsNext&pgtype=article

In Connecticut, the Twilight of a Trading Hub

By NATHANIEL POPPERJULY 23, 2015

The UBS building near the Stamford train station once boasted the world’s largest trading floor. Credit Bryan Thomas for The New York Times

Stamford had the bad luck of housing the American headquarters of two European banks, which are facing particular challenges as the Continent has struggled to cope with several debt crises. RBS, or Royal Bank of Scotland, which is now controlled by the British government, has fewer than half the 225,000 employees worldwide that it had at its peak in 2007, when it was constructing its Connecticut campus. It recently announced plans to reduce its work force in Connecticut, which was once 2,400 people, to fewer than a thousand, making its gleaming building far too large a home. The number of UBS employees in Stamford fell to 2,000 last year, from 4,400 before the crisis, and more cuts are likely. HSBC and Deutsche Bank are the most recent banks to announce major global overhauls.

http://www.nytimes.com/2015/07/26/business/dealbook/wall-street-pulls-in-its-horns-in-connecticut.html?ref=business

Amazon Reports Unexpected Profit, and Stock Soars

By DAVID STREITFELD

A reason for the company’s success has been its cloud computing division, Amazon Web Services, which generated $1.82 billion in revenue last quarter.

http://www.nytimes.com/2015/07/24/technology/amazon-earnings-q2.html?ref=business

Anthem to Buy Cigna in Deal Valued at $54.2 Billion

By CHAD BRAY

6:43 AM ET

A combined Anthem-Cigna would have estimated revenue of about $115 billion and serve more than 53 million people with medical

coverage.

http://www.nytimes.com/2015/07/25/business/dealbook/anthem-cigna-health-insurance-deal.html?ref=business

A $7 Billion Charge at Microsoft Leads to Its Largest Loss Ever

By NICK WINGFIELDJULY 21, 2015

http://www.nytimes.com/2015/07/22/technology/microsoft-earnings-q4.html?ref=business

Wells Fargo’s Earnings Slip in Second Quarter

By MICHAEL CORKERYJULY 14, 2015

Wells Fargo, a bank known for its machine-like ability to increase its profits and beat Wall Street expectations, reported mixed results on Tuesday.

The San Francisco-based bank said its second-quarter profit fell to $5.72 billion from $5.73 billion a year earlier.

On an earnings per share basis, the bank’s profits rose to $1.03 up from $1.01 a year ago. That was in line with a consensus of analysts’ estimates of $1.03 a share, according to Thomson Reuters.

But Wells’ revenue of $21.3 billion came in 1.8 percent lower than the $21.7 billion that analysts had expected.

The middling results from Wells reflect the challenges facing big banks today.

Long gone are the days when mortgage losses and other problems from the financial crisis posed a threat to their balance sheets.

Today’s challenges are more mundane: Large consumer banks are trying to keep their expenses under control while grappling with low interest rates.

At Wells Fargo, some of these challenge were highlighted by the decline in the bank’s net interest margin, which in the second quarter fell to 2.97 percent from 3.15 percent a year earlier.

Net interest margin is the difference between what the bank makes on lending and what it pays to customers with deposits.

The bank said it was able to lower expenses from the first quarter, but some of the decline was offset by increases in legal costs and higher salaries and advertising expenses. The bank’s efficiency ratio, a key measure of the bank’s expenses control measures, rose to 58.5 percent from 57.9 percent a year earlier.

There were other signs that Wells Fargo’s profitability was slipping. The bank’s return on assets and return on equity both fell in the second quarter from a year ago.

In a statement, Wells Fargo’s chief executive and chairman, John Stumpf, said, “Wells Fargo’s second-quarter results reflected continued strength in the fundamental drivers of long term growth. Compared with a year ago, we grew loans, deposits and capital, and our balance sheet remained strong.”

Earlier on Tuesday, JPMorgan Chase reported earnings that were stronger than expected.

Bank of America’s Earnings Surge in Quarter

By MICHAEL CORKERYJULY 15, 2015

Bank of America, seeking to move on from its legal and mortgage troubles and get on with the business of banking, said on Wednesday that its second-quarter profit more than doubled from a year ago, easily surpassing analysts’ expectations.

The bank earned $5.3 billion in the quarter, up from $2.3 billion in the quarter a year ago. On an earnings-per-share basis, the bank earned 45 cents a share in the second quarter, up from 19 cents a share from a year ago. Those results far exceeded analysts expectations of 36 cents at a time when many critics had begun questioning the bank’s stagnant share price and recent history of lackluster performance.

Its revenue also increased 2 percent, to $22.3 billion from a year ago. Analysts had been expecting revenue of $21.3 billion, according to a survey by Thomson Reuters.

Plagued for years by soaring litigation costs related to its mortgage problems, the bank reported a broad decline in expenses. Excluding litigation costs in the second quarter, Bank of America said its expenses declined 6 percent from a year ago, while the costs of servicing its troubled mortgage portfolio dropped 37 percent. Investors have been clamoring to see the bank make more progress in cutting expenses in recent quarters to offset the impact of low interest rates.

After years of working to bring down expenses, particularly in its legacy mortgage unit, bank executives said the fruits of that effort were finally paying off.

“We think it was a giant step forward this quarter for the company,” Bruce R. Thompson, Bank of America’s chief financial officer, said in a conference call with reporters on Wednesday morning.

The bank’s chief executive, Brian T. Moynihan, said in a statement: “Solid core loan growth, higher mortgage originations and the lowest expenses since 2008 contributed to our strongest earnings in several years, as we continued to build broader and deeper relationships with our customers and clients.”

The bank was also helped by an increase in long-term interest rates in the quarter, which bolstered the value of its vast holding of Treasury and other debt securities. Bank of America uses a mark-to-market valuation for its debt securities holdings, which can cause their value to swing more immediately than other big banks.

The impact of the interest rate move generated $669 million, or 4 cents a share, in income in the second quarter. A year ago, the impact of rates at the time on the bank’s debt portfolio related in negative adjustments of $175 million.

The move in the bank’s debt securities holding foreshadowed that boon that Bank of America and other large banks could receive if the Federal Reserve raises rates in the next few months. Many bank investors have been patiently waiting out the struggles at banks like Bank of America in hopes that the companies’ share prices would increase as interest rates rise from historic lows.

In premarket trading, shares of Bank of America were up about 2 percent.

http://www.nytimes.com/2015/07/16/business/dealbook/bank-of-americas-earnings-surge-in-quarter.html?ref=business

European and Asian Markets Fall After Greek Referendum

By DAVID JOLLY and KEITH BRADSHERJULY 5, 2015

PARIS — European and Asian stock markets dropped on Monday but did not plunge, as investors reacted with muted dismay to the results of the Greek referendum and showed nervousness about steep declines in China’s stock market over the past three weeks.

The Euro Stoxx 50 index, which groups big blue-chip shares from across the eurozone, was down 1.4 percent in early afternoon trading, after falling more than 2 percent at the opening. In London, the benchmark FTSE 100 index had dipped by only 0.4 percent at midday.

The euro currency slipped 0.6 percent to $1.1081.

In Asia on Monday, the Shanghai market jumped sharply in early trading as the Chinese government poured money into brokerage firms to help them and their customers buy shares. The market leapt 7.8 percent at the start, but it surrendered half of those gains in the first 10 minutes of trading and closed 2.4 percent higher. The smaller Shenzhen stock market also started strongly but fell 2.7 percent by the end of trading.

Trading in Standard & Poor’s 500 index futures indicated that stocks would fall slightly at the opening in New York.

Philippe Gijsels, head of research at BNP Paribas Fortis Global Markets in Brussels, said the relatively subdued reaction showed “the market has gotten used to the strange things that have been going on with Greece.”

He said it also reflected investors’ confidence that Mario Draghi, the president of the European Central Bank, would take whatever action was necessary to soothe tensions at a moment of crisis.

“That’s preventing markets from going down too much,” Mr. Gijsels added.

That sentiment was reflected in the bond market’s muted response. Bonds in Italy, Portugal and Spain, seen as the most exposed to any potential contagion from the Greek crisis, all fell, with their yields, which move in the opposition direction of prices, spiking higher — indicating that those governments’ borrowing costs could rise.

In contrast, yields on British, German and United States government bonds fell, as investors turned toward assets they considered safer.

The major exception was in yields on Greek bonds, which have been little traded since the country’s financial markets were closed last week. The price of the Greek two-year crashed, to leave an astonishingly high yield of 48 percent — almost 15 percentage points higher than on Friday. That is in stark contrast to a yield of less than 1 percent for comparable German debt.

The Greek bonds’ movement has little practical effect on the government’s borrowing costs, as the country has been shut out of the capital markets and has issued no new bonds lately. But their plummeting value further undermines the Greek banks, which are the biggest private holders of the country’s sovereign debt.

And because the Greek banks use their government’s bonds as collateral against loans from the European Central Bank, the plunge could make it even more difficult for the central bank to agree to continue lending to the banks.

The European Central Bank was to discuss its response to the latest developments later on Monday.

Addressing the possibility that the central bank might force Greece’s hand before European political leaders had been able to formulate their own response, the French finance minister, Michel Sapin, on Monday told Europe 1 radio that the European Central Bank “must not cut” its support for Greek banks.

Oil prices fell as much as 3.2 percent early Monday, as traders placed bets that recent events could lead to slower global economic activity and weaker demand. Brent crude, a benchmark, fell below $60 a barrel for the first time since mid-April.

Bond prices rallied in Australia, and gold and silver prices climbed, as investors sought safety in response to uncertainty about whether Greece would stop using the euro and about whether mainland China’s economy would slow after investors there lost $2.7 trillion in the stock market over the past three weeks.

The Nikkei 225-share index in Japan closed 2.1 percent lower, and the Kospi in South Korea dropped 2.5 percent. The stock market in Australia, where mining companies are heavily dependent on Chinese demand, finished down 1.1 percent.

Kymberly Martin, a currency strategist at the Bank of New Zealand, said that the Greek vote and China’s stock market decline both tended to have similar effects on currencies and stock markets.

“It’s very difficult to disentangle what proportion is the eurozone and what proportion is China,” she said. “Probably both factors are affecting the market in the same direction.”

But other economists saw the events in Greece as more influential.

“It’s more Greece, but those China concerns are also there,” said Richard Grace, a currency and fixed-income strategist at the Commonwealth Bank of Australia.

He also questioned whether the sharp gains for Australian bonds would endure, saying that those bonds often jump in value in response to overseas events that prompt investors to seek safety. But the jumps are often transitory, he noted, and recede after European and American markets begin trading.

E. William Stone, the executive vice president and chief investment strategist at the PNC Asset Management Group in Philadelphia, said that most investors had been expecting a yes vote on the Greek referendum. Instead, with more than 90 percent of the vote tallied, more than 60 percent of the voters had chosen no.

“I won’t be surprised if we get some larger sell-offs” as the day progresses, he said.

Unlike Ms. Martin, he said that Greece would be the dominant influence on markets, particularly in Europe and the United States. While the Shanghai stock market has lost more than a quarter of its value since June 12, it is still up nearly 80 percent from a year ago.

“It almost seems like the Chinese authorities are overreacting,” he said.

On Monday, China’s state-run news media issued a volley of commentaries declaring faith in the government’s ability to restore confidence to the stock market.

“After the storm, comes the rainbow,” said a commentary in People’s Daily, the Communist Party’s leading newspaper. Investors were mistaken to worry about the level of debt behind the rise in stock prices, it said.

“What the broad numbers of investors need at this instant is confidence, not panic,” it said.

In Hong Kong, where shares closed 3.2 percent lower, investors appeared to be paying considerably more attention to China than Greece.

“The Greek referendum should not influence too much the Asian stocks — the actions of China, with its huge economy, will have more impact,” said Roger Lam, a 63-year-old retired office worker, as he watched computer monitors at a downtown brokerage. “Anyone who says China does not have the ability to hold up the stock markets in China is a fool. They have just not seen the mighty power of the Chinese government.”

http://www.nytimes.com/2015/07/07/business/daily-stock-market-activity.html

Towers Watson Shareholders Are Getting A Bad Deal In $18 Billion Willis Merger

It’s being pitched as a strategic tie-up that combines two highly complementary businesses, but shareholders in Arlington, Virginia-based consultancy Towers Watson, which closed Friday trading at a near $9.8 billion market cap, may be wondering what’s so great about the company’s $18 billion all-stock “merger of equals” with London-based re-insurance and property and casualty broker Willis Group.

After all, Towers Watson shareholders appear to own the better business, but they are only getting a 49.9% stake in the combined company, a global broking giant that’s diversifying into professional services, consulting, risk management and IT services through the merger. A look at the structure and timing of Tuesday’s deal indicates that Towers Watson shareholders may be leaving a lot on the table, and entering a transaction with significant strategic risks, all for the benefit of revenue synergies and the tax savings that would come from shifting its corporate tax headquarters to London, where Willis is based.

Prior to Tuesday, Towers Watson shares had surged 25% over the past 12-months, as revenue rose to $3.5 billion and profits surged 13% to $357 million during 2014. Analysts polled by Bloomberg expect Towers Watson’s revenue to rise 4% to $3.7 billion this year, while profits are expected to accelerate nearly 20% to $425 million, as the company’s corporate benefits, healthcare exchange, and financial services-based operations expand. With Obamacare upheld by the Supreme Court, a major uncertainty’s been removed from one of Towers Watson’s largest and fastest-growing business lines.

Those figures contrast with Willis Group’s falling profits and relatively stagnant share price over the year.

As a broker, Willis faces headwinds from rising interest rates, and the company has seen its premiums punished by a litany of new entrants in the marketplace, including hedge funds. Operating income at Willis Group fell 3% in 2014 to $647 million. In the first quarter, Willis reported falling revenue and a 10% drop in operating profits. Analysts polled by Bloomberg expect only a modest rebound in profitability through the course of 2015.

Since the beginning of 2012, Towers Watson stock has more than tripled the total return of Willis shares, making it a questionable time to dramatically shift corporate strategy via a merger of equals. The combined company will more closely resemble AON, which acquired consultancy Hewitt in 2010, and Marsh & McLennan MMC +0.92%, the parent of Mercer and Oliver Wyman, but such a transformation is a long way off. Both companies forecast $125 million in annual cost savings within three years of a deal’s close, and that figure is exclusive of potential tax savings.*

However, the most obvious benefit of Tuesday’s deal – tax savings – may actually get in the way of a fair price. (Towers Watson characterizes tax savings as ‘a nice consequence’ the deal, but says it is driven by business purposes). As the deal’s presently structured, Towers Watson will move its tax headquarters to Ireland where Willis Group enjoys a tax rate of just over 20%. That rate compares favorably to Towers Watson’s 34% corporate tax rate. The combined company’s tax rate is expected to be in the mid-20% range.

To maintain tax savings in a deal, Towers Watson shareholders have to own less than 60% of the combined company. However, it had a $9.7 billion market cap as of the close on Friday, while Willis had a market cap of roughly $8.4 billion. Tuesday’s deal comes with a $4.87 a share special cash dividend for Towers Watson shareholders. That payment, in addition to expected pro forma tax synergies, appear to be the upside for Towers Watson shareholders.

When challenged by analysts on how the price of Tuesday’s deal was set, Roger Millay, CFO of Towers Watson, said on a conference call both companies began working on a deal in April when their market caps were roughly the same, and the exchange ratio was then set in May.

“At the end of May, if we took a 60-[day] moving average of the two companies, market caps, and we adjusted for the dividend of $4.87 that we had there, that’s how we came to the 50.1-49.9 split. This is a deal that we believe was struck on a market-value basis. It wasn’t done on the spot price at a single day, but it was done on a two-month moving average,” Millay said.

But, given Towers Watson’s growth rates and diversification into markets with a healthy outlook, the company should command a premium to be combine with Willis Group. But an appropriate premium - for instance a 60% stake in the combined company – would trigger the U.S. Treasury’s anti-inversion rules. Willis also may be hamstrung from issuing significant new debt for a higher cash bid given its ratings-reliant operations.

One other issue with Tuesday’s merger: It is a fully taxable transaction for Towers Watson shareholders, according to independent tax expert Robert Willens. Towers Watson, the acquired company, was trading lower by 3.5% in early Monday trading, while shares in the acquirer Willis Group were rising nearly 6%.

Towers Watson CEO John Haley said Willis’ global distribution network and reinsurance broking business will bolster the company’s organic growth rates domestically and abroad, and highlighted a benefit to its Exchange Solutions division. ”This is a tremendous combination of two highly compatible companies with complementary strategic priorities, product and service offerings, and geographies that we expect to deliver significant value for both sets of shareholders,” Haley said in a statement.

To be seen is whether shareholders agree. ValueAct Capital, a 10% stakeholder in Willis Group will vote its shares in favor of the $18 billion merger, and over 50% of Towers Watson stockholders will also have to vote in favor of a deal.

While Tuesday’s $18 billion mega merger has a now commonplace benefit to the acquiring company, the same may not hold true for the target.

http://www.forbes.com/sites/antoinegara/2015/06/30/towers-watson-shareholders-are-getting-a-bad-deal-in-18-billion-willis-merger/?utm_campaign=yahootix&partner=yahootix

Puerto Rico’s Governor Says Island’s Debts Are ‘Not Payable’

By MICHAEL CORKERY and MARY WILLIAMS WALSHJUNE 28, 2015

Puerto Rico’s governor, saying he needs to pull the island out of a “death spiral,” has concluded that the commonwealth cannot pay its roughly $72 billion in debts, an admission that will probably have wide-reaching financial repercussions.

The governor, Alejandro García Padilla, and senior members of his staff said in an interview last week that they would probably seek significant concessions from as many as all of the island’s creditors, which could include deferring some debt payments for as long as five years or extending the timetable for repayment.

“The debt is not payable,” Mr. García Padilla said. “There is no other option. I would love to have an easier option. This is not politics, this is math.”

It is a startling admission from the governor of an island of 3.6 million people, which has piled on more municipal bond debt per capita than any American state.

“People before the debt” proclaimed a Spanish-language sign at a protest last week in San Juan. Proposals to help Puerto Rico manage its debt, like a fuel tax, have angered some island residents.

A broad restructuring by Puerto Rico sets the stage for an unprecedented test of the United States municipal bond market, which cities and states rely on to pay for their most basic needs, like road construction and public hospitals.

That market has already been shaken by municipal bankruptcies in Detroit; Stockton, Calif.; and elsewhere, which undercut assumptions that local governments in the United States would always pay back their debt.

Puerto Rico’s bonds have a face value roughly eight times that of Detroit’s bonds. Its call for debt relief on such a vast scale could raise borrowing costs for other local governments as investors become more wary of lending.

Perhaps more important, much of Puerto Rico’s debt is widely held by individual investors on the United States mainland, in mutual funds or other investment accounts, and they may not be aware of it.

Puerto Rico, as a commonwealth, does not have the option of bankruptcy. A default on its debts would most likely leave the island, its creditors and its residents in a legal and financial limbo that, like the debt crisis in Greece, could take years to sort out.

Still, Mr. García Padilla said that his government could not continue to borrow money to address budget deficits while asking its residents, already struggling with high rates of poverty and crime, to shoulder most of the burden through tax increases and pension cuts.

He said creditors must now “share the sacrifices” that he has imposed on the island’s residents.

“If they don’t come to the table, it will be bad for them,” said Mr. García Padilla, who plans to speak about the fiscal crisis in a televised address to Puerto Rico residents on Monday evening. “What will happen is that our economy will get into a worse situation and we’ll have less money to pay them. They will be shooting themselves in the foot.”

With some creditors, the restructuring process is already underway. Late last week, Puerto Rico officials and creditors of the island’s electric power authority were close to a deal that would avoid a default on a $416 million payment due on Wednesday.

With other payment deadlines looming, Mr. García Padilla and his staff said they would begin looking for possible concessions on all forms of government debt.

The central government must set aside about $93 million each month to pay its general obligation bonds — a crucial action in Puerto Rico because its constitution requires such bonds to be paid before any other expense. No American state has restructured its general obligation debt in living memory.

The government’s Public Finance Corporation, which has issued bonds to finance budget deficits in the past, owes $94 million on July 15. The Government Development Bank — the commonwealth’s fiscal agent — must repay $140 million of bond principal by Aug. 1.

“My administration is doing everything not to default,” Mr. García Padilla said. “But we have to make the economy grow,” he added. “If not, we will be in a death spiral.”

A proposed debt exchange, where creditors would replace their current debt with new bonds with terms more favorable to Puerto Rico, signals a significant shift for Mr. García Padilla, a member of the Popular Democratic Party, who was elected in 2012. His party is aligned with the Democrats on the mainland and favors maintaining the island’s legal status as a commonwealth.

He said that when he took office, he tried to balance the fiscal situation through austerity measures and fresh borrowing. But he saw that the island was caught in a vicious circle where it borrowed to balance the budget, raised the debt and had an even bigger budget deficit the next year.

Residents began leaving for the mainland in droves, and Puerto Rico’s credit was downgraded to junk, making borrowing extremely expensive.