Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Uranium stocks rise in latest metal trader craze

Might pick up some $URG types

Uranium price jumps to 15-year high as top miner flags shortfall

Cecilia Jamasmie | January 12, 2024 | 5:53 am Energy Markets Asia Uranium

Uranium jumps to 15-year high as top miner flags shortfall

State-controlled Kazatomprom mines uranium in Kazakhstan both independently and through joint ventures. (Image courtesy of Kazatomprom.)

Uranium prices jumped on Friday to an almost 15-year high after the world’s largest producer, Kazakhstan’s Kazatomprom (LON: KAP), warned it’s likely to fall short of its output targets over the next two years.

The miner cited shortages of sulfuric acid and construction delays at newly developed deposits as the main factors behind ongoing production challenges, which it said could persist into 2025. A detailed assessment of the potential impacts on output will be released in a trading update by Feb. 1, it added.

“Despite the ongoing active search for alternative sources of sulfuric acid supply, current forecasts indicate that the company may find it difficult to achieve 90% production levels compared to subsoil use contract levels,” Kazatomprom said in the statement.

Sulfuric acid is a favourite among producers to extract uranium from the raw ore due to its low-cost and efficiency for different types of ores.

Kazatomprom noted its guidance for next year could also be affected if supply snags continue throughout 2024 and if it isn’t able to comply with scheduled construction works.

The spot price of the radioactive metal has more-than doubled in 2023 and it is currently trading at $97.45 a pound — still far from the triple-digit figures achieved in 2007 and the fallout after the 2011 Fukushima disaster in Japan.

The price increase comes as 24 nations, including the United States, Japan, Canada, Britain and France pledged last month in Dubai at the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change, known as COP28, to triple nuclear power capacity by 2050.

Uranium jumps to 15-year high as top miner flags shortfall

China, which wasn’t part of that promise, still leads global nuclear plant construction with plans to nearly double capacity to 100 gigawatts by the end of this decade. The Asian country has 22 of 58 plants being built worldwide.

Recent legislation in the US could also affect uranium prices, even sooner than other factors. Seeking to cut its reliance on Russia, which supplies more than one-fifth of its uranium, Congress passed a bill in December that would require the US to source a portion of its nuclear fuel domestically. The bill calls for 20 tonnes of HALEU — high-assay low enriched uranium fuel needed to run most advanced reactors in the country — to come from domestic sources by the end of 2027. It now awaits President Joe Biden’s signature.

Bank of America and Berenberg Bank said this week in separate research notes that continued tightness in the uranium market could push prices over $100 in coming days.

https://www.mining.com/uranium-jumps-to-15-year-high-as-top-miner-flags-shortfall/

You got it Lurch .....Everybody lovs a good run

YOU RANG !

2024 reveals a GOLD BEAR TRAP - LFTV Ep 155 Timestamps:

Kinesis Money

40.7K subscribers

20,053 views Jan 12, 2024

In this week’s episode of Live from the Vault, Andrew Maguire shares his yearly outlook and provides a long-term analysis of what we should expect as 2024 trading begins - will we see a gold price over $2500 by the end of the year?

The precious metals expert examines the bullish drivers that could propel gold forward this year, including Russian-chaired BRICS developments, globally accelerating de-dollarisation and the impact of geopolitical escalations.

Ask your questions for Andy here: https://forum.kinesis.money/threads/q...

00:00 Start

02:05 What to expect as 2024 trading starts

12:15 A look at gold prices for 2024

18:00 The immediate outlook

24:00 How the paper market is changing

27:50 2024 for Silver

36:00 Looking further out

38:00 Dedollarisation

That City of Pride, Wickedness, and Lust for Power

with MMGYS Soundtrack

"Seneca had made the bargain that many good men have made when agreeing to aid bad regimes. On the one hand, their presence strengthens the regime and helps it endure. But their moral influence may also improve the regime's behavior or save the lives of its enemies. For many, this has been a bargain worth making, even if it has cost them—as it may have cost Seneca—their immortal soul...

The Rome he has been trained to serve, the Rome of Augustus and Germanicus, was gone. In its place stood Neropolis, ruled by a megalomaniac brat.”

James Romm, Dying Every Day: Seneca at the Court of Nero

"We live in a world where love itself is condemned. People call it weakness, something to grow out of. Some are saying: 'Let each one become as strong as he can, and let the weak perish.' They say that the Christian religion with its preaching about love is a thing of the past. The neo-paganism [of the Nazis] may well cast off love but, in spite of everything, history teaches us that we shall be the victors over this. We shall not forsake love."

Titus Brandsma, executed at Dachau, 26 July 1942

"Caesar was swimming in blood, Rome and the whole pagan world was mad. But those who had had enough of transgression and madness, those who were trampled upon, those whose lives were misery and oppression, all the weighed down, all the sad, all the unfortunate, came to hear the wonderful tidings of God, who out of love for men had given Himself to be crucified and redeem their sins. When they found a God whom they could love, they had found that which the society of the time could not give any one, — happiness and love.

And Peter understood that neither Nero, nor all his legions, could overcome the living truth— that they could not overwhelm it with tears or blood, and that now its victory was beginning. He understood with equal force why the Lord had turned him back on the road. That city of pride, of crime, of wickedness, and of a lust for power, was beginning to be His city."

Henryk Sienkiewicz, Quo Vadis, 1905

Stocks did their usual wide ranging wash and rinse, ending the day slightly higher.

Gold and silver soared in the morning, and held on to much of their gains, giving up a goodly portion of them during the day.

VIX continues in its complacency.

The conflict in the Mideast is metastasizing, and the unpriced risk it carries continues to grow.

The US presidential election season kicks off next week with the Iowa Primary.

Exceptionalism, in terms of bad judgement and shamelessness, will be on display for all.

Tossing aside the moral high ground and civilized behaviour seems to be a general trend globally.

The Beast is rising.

US markets will be closed on Monday in observance of Martin Luther King day.

Option expiration next week Friday.

Have a pleasant holiday weekend.

https://jessescrossroadscafe.blogspot.com/

...........................

MARKET MOVERS

COMPANY CHANGE LAST TRADE

Franco-Nevada 5.14 3.62 $147.01

Cameco 4.45 7.12 $66.96

Royal Gold 1.59 1.32 $122.47

Agnico Eagle Mines 1.31 1.89 $70.48

Endeavour Mining 1.20 4.99 $25.25

NexGen Energy 1.05 11.11 $10.50

Pan American Silver 1.02 5.16 $20.77

Wheaton Precious Metals 1.02 1.59 $65.00

Osisko Gold Royalties 0.89 4.80 $19.45

Filo 0.88 3.86 $23.70

Uranium Energy 0.82 11.83 $7.75

Energy Fuels 0.80 8.45 $10.27

Eldorado Gold 0.79 4.86 $17.05

Gold Fields 0.76 6.08 $13.25

Torex Gold Resources 0.69 4.83 $14.97

HIGH VOLUME

COMPANY VOLUME LAST TRADE

Uranium Energy 29,116,510 $7.75

Fission Uranium 6,272,785 $1.24

Denison Mines 5,395,888 $2.64

NexGen Energy 5,027,533 $10.50

GoviEx Uranium 4,343,228 $0.18

Kinross Gold 3,154,593 $7.88

Argonaut Gold 2,822,789 $0.42

Cameco 2,735,410 $66.96

Anfield Energy 2,601,794 $0.09

Calibre Mining 2,515,084 $1.32

B2Gold 2,490,591 $4.15

Mega Uranium 2,395,219 $0.49

Prime Mining 2,342,784 $1.89

First Quantum Minerals 2,180,820 $13.15

Marathon Gold 2,047,778 $0.81

Moloch Metropolis Miners Lament

with MMGYS Fritz Lang's 1927 German Expressionist silent sci-fi film Metropolis soundtracks

The Consumer Price Index came in on the high side this morning.

With dreams of plentiful rate cuts challenged, stocks slumped.

But by the end of the day traders' dementia reasserted its calming influence and stocks regained much of their losses.

Gold ans silver had an intraday yo-yo wash and rinse.

VIX continues to wallow.

We're heading into a three day weekend.

Have a pleasant evening.

full read here....

https://jessescrossroadscafe.blogspot.com/

About That Idris Elba Gold Documentary

Folding Ideas

908K subscribers

Jan 10, 2024 #8 on Trending

Clickbait Title: Can this magical metal make you immortal? Godkings hate this one weird trick!

This was a lot of fun to work on because I got to spend a lot of time learning THE TRUTH ABOUT GOLD and by that I mean actually interesting facts about how humans use gold. The mythology of gold actually makes a lot of sense through the lens of its physical properties, the fact that ancient humans could make things out of it and those things would outlive generations. It's just rare enough that societal elites can monopolize it, but common enough you can gather enough to actually make stuff with it. So these things, namely jewellery for the leaders, are so resistant to the elements that you can see how the gold itself became representative of the power of the kings, of their claimed immortality.

How to out smart predator mining

Gold CEO firing deals fresh blow to mining’s battered reputation

Bloomberg News | January 7, 2024 | 11:38 am Top Companies Africa Canada Europe Latin America USA Copper Gold Lithium Nickel

Endeavour Mining’s former CEO Se´bastien de Montessus. (Image by Endeavour Mining).

Endeavour Mining Plc’s shock firing of its chief executive has capped a miserable three months for the global mining industry — and an equally painful period for its shareholders.

The world’s biggest producers have spent much of the past decade trying to rebuild mining’s reputation, after a slew of bad deals and billion-dollar writedowns sent investors fleeing from a business already viewed by many as dirty and risky

That attempted makeover has taken a battering in recent months: The mining industry has suffered blow after blow, costing investors billions and shaking faith in some of the industry’s biggest names.

In Panama, mass protests against one of the world’s largest and newest copper mines culminated in an order to permanently shut it down, and wiped out more than half of the market value of owner First Quantum Minerals Ltd. Canada’s Teck Resources Ltd. dropped 9% on a single day in October after revealing the latest cost blowout at its flagship Chilean project, while larger rival Anglo American Plc’s surprise cut to its planned copper production sent shares plunging 19% on Dec. 8.

In South Africa, Sibanye Stillwater Ltd. dropped as much as 25% in November after announcing a convertible bond sale. while an accident at rival Impala Platinum Holdings Ltd. left 12 people dead and dozens injured.

The latest jolt came on Thursday, when Endeavour — the biggest gold miner listed in the UK — announced it fired CEO Sébastien de Montessus for “serious misconduct” after discovering an alleged “irregular payment instruction” of $5.9 million related to an asset sale. The shares plunged as much as 15%. De Montessus has separately said that the relevant decision didn’t cost the company anything and had no benefit for himself.

For the mining industry broadly, the fresh wave of setbacks comes as the sector is seeking to position itself as a vital part of the green transition because of its role supplying materials like copper, nickel and lithium that are needed to decarbonize the global economy. But to do that, the producers need supportive governments and local populations, as well as investors willing to fund them.

While the setbacks vary in nature, they reflect many of the perennial challenges facing the companies responsible for digging up the world’s metals and minerals. Miners are fighting a growing battle with rising costs to build and operate mines, and many of the remaining deposits are in poorer countries, where governments and local populations are increasingly determined to seek a greater share of profits.

Panama’s move to “definitively” close First Quantum’s $10 billion copper mine — which opened just four years earlier and still has decades worth of copper to dig up — has sent shockwaves through the mining industry. The shares ended the year more than 60% lower after the loss of its biggest profit generator, and analysts have raised questions about the company’s balance sheet, with billions of dollars of debt maturing in the coming years.

Anglo American has also punished mining investors. The century-old company, long seen as one of the best mine operators, stunned shareholders by announcing it was slashing its copper production for the next two years, including a significant cut at its Los Bronces mine in Chile, as well as lowering output for nearly all the other commodities it mines.

The announcement wiped more than $6 billion off Anglo’s market capitalization in the steepest single-day fall since the global financial crisis.

The series of disappointments for the mining industry also comes against the backdrop of weak prices for its commodities — although gold has been an exception after hitting a record late last year — and soft demand from key markets such as China.

At Endeavour, the company said that de Montessus was fired after the board discovered an “irregular payment instruction” of $5.9 million. The company said it discovered the payment when it was reviewing previous acquisitions and disposals. That review is ongoing, with more deals still being assessed.

In a statement, de Montessus said he instructed a creditor of Endeavor to make the payment in 2021 to a security company, to offset money owed for essential security equipment.

The payment was connected to the sale of Endeavour’s Agbaou mine in Ivory Coast in 2021 to Allied Gold Corp., according to people familiar with the situation, who asked not to be identified discussing private information. De Montessus instructed Allied Gold to pay $5.9 million owed to Endeavour to another company, the people said.

“The decision had no additional cost to the company and did not benefit me personally in any way,” de Montessus said. “I omitted to inform the board that I had arranged for this offset, which I have freely accepted was a lapse in judgment.”

(By Thomas Biesheuvel)

https://www.mining.com/web/gold-ceo-firing-deals-fresh-blow-to-minings-battered-reputation/

Ten Junior Resource Stock Investing Lessons Learned in 2023 by Bill Powers (most fail at #4) 0:00 Introduction

MiningStockEducation.com

Jan 4, 2024 #commodities #miningstocks #resourceinvesting

Bill Powers shares ten junior resource stock investing lessons he learned in 2023 in this MSE episode.

1:40 #1 View junior resource stocks as call options with limited time value

5:29 #2 Consider intrinsic value as much greater than time value…Don’t let big profits slip away

8:33 #3 Remember non-captured unrealized gains are not losses

10:16 #4 Choose to be a self-directed investor and not a victim

14:47 #5 Lack of information/coverage in small caps allows for dishonest bashers

18:15 #6 Do not invest unless you have a (legal) competitive advantage

23:52 #7 You’ll never out-smart Vancouver insiders, but you can outperform dumb retail

25:39 #8 Stay liquid (private deals and private placements are becoming increasingly unattractive)

28:03 #9 Be willing to change your mind

31:08 #10 Increased wealth will only amplify your existing character (for better or worse)

The 2024 Gold Market Amidst Banking Volatility and Rising Federal Deficits

Trevor Hall

Jan 3, 2024

We kick off 2024 with a conversation with Dave Kranzler of Investment Research Dynamics. We start off the conversation with a little bit of reflection on the previous year. What surprised him the most in these markets. And now that we move into 2024, what are his expectations regarding the national deficit, gold's move into a new year, and if the junior equities can find a more supporting market than in the past 2 years.

US Banking System Ripe For Another Crisis

With MMGYS Soundtrack

"Day by day the money-masters of America become more aware of their danger, they draw together, they grow more class-conscious, more aggressive. The [first world] war has taught them the possibilities of propaganda ; it has accustomed them to the idea of enormous campaigns which sway the minds of millions and make them pliable to any purpose.

American political corruption was the buying up of legislatures and assemblies to keep them from doing the people's will and protecting the people's interests; it was the exploiter entrenching himself in power, it was financial autocracy undermining and destroying political democracy. By the blindness and greed of ruling classes the people have been plunged into infinite misery."

Upton Sinclair, The Brass Check

"Following the second, third and fourth largest bank failures in U.S. history in the spring of last year, Federal Reserve Chair Jerome Powell gave his semiannual monetary policy report to the House Financial Services Committee and the Senate Banking Committee in June. During both appearances, Powell stated the same thing: 'The U.S. banking system is sound and resilient.'

But according to a report last week from the federal agency whose mandate is to keep federal regulators apprised of the true condition of the U.S. banking system, it is actually ripe for another crisis and its condition is 'fragile and uncertain.'”

WSOP, Federal Agency Finds US Banking System 'Ripe for Another Crisis, January 2, 2024

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair, I, Candidate for Governor: And How I Got Licked

The talking heads were assuring us today that stocks were retreating because they had become extremely over bought last week/year/

Funny how they only tell us these things after the fact.

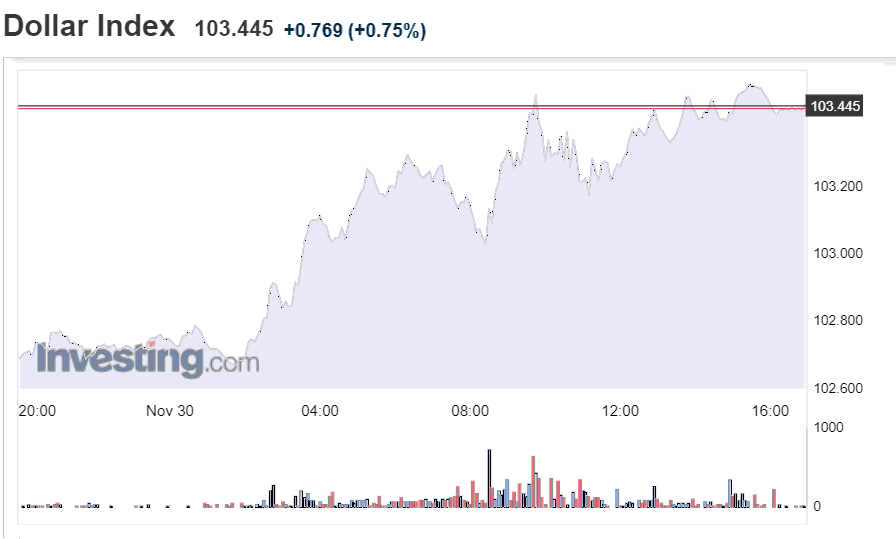

The Dollar strengthened.

Gold and silver were lower.

The VIX remains fairly complacent.

And so the new year begins.

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

The biggest global mining news of 2023

with MMGYS Soundtrack

by Frik Els | December 27, 2023 | 10:01 am Battery Metals Energy Markets Suppliers & Equipment Aluminum Bauxite Boron Chrome Coal Cobalt Copper Diamond Gold Graphite Iron Ore Lead Lithium Manganese Molybdenum Nickel Oil & Gas Palladium Platinum Potash Rare Earth Rhodium Silver Specialty Minerals Tin Uranium Vanadium Zinc

The mining world was pulled in all directions in 2023: the collapse of lithium prices, furious M&A activity, a bad year for cobalt and nickel, Chinese critical mineral moves, gold’s new record, and state intervention in mining on a scale not seen in decades. Here’s a roundup of some the biggest stories in mining in 2023.

A year where the gold price sets an all-time record should be unalloyed good news for the mining and exploration industry, which despite all the buzz surrounding battery metals and the energy transition still represents the backbone of the junior market.

Metal and mineral markets are volatile at the best of times – the nickel, cobalt and lithium price collapse in 2023 was extreme but not entirely unprecedented. Rare earth producers, platinum group metal watchers, iron ore followers, and gold and silver bugs for that matter, have been through worse.

Mining companies have become better at navigating choppy waters, but the forced closure of one of the biggest copper mines to come into production in recent decades served as a stark reminder of the outsized risks miners face over and above market swings.

Panama shuts down giant copper mine

After months of protests and political pressure, at the end of November the Panama government ordered the closure of First Quantum Minerals’ Cobre Panama mine following a ruling by the Supreme Court that declared the mining contract for the operation unconstitutional.

Public figures including climate activist Greta Thunberg and Hollywood actor Leonardo Di Caprio backed the protests and shared a video calling for the “mega mine” to cease operations, which quickly went viral.

FQM’s latest statement on Friday said Panama’s government hasn’t provided a legal basis to the Vancouver-based company for pursuing the closure plan, a plan that the industries ministry of the central American nation said will only be presented in June next year.

FQM has filed two notices of arbitration over the closure of the mine, which has not been operating since protesters blocked access to its shipping port in October. However, arbitration would not be the company’s preferred outcome, said CEO Tristan Pascall.

In the aftermath of the unrest, FQM has said it should have better communicated the value of the $10 billion mine to the wider public, and will now spend more time engaging with Panamanians ahead of a national election next year. FQM shares have bounced in the past week, but is still trading more than 50% below the high hit during July this year.

Projected copper deficit evaporates

Cobre Panama’s shutdown and unexpected operational disruptions forcing copper mining companies to slash output has seen the sudden removal of around 600,000 tons of expected supply would, moving the market from a large expected surplus into balance, or even a deficit.

The next couple of years were supposed to be a time of plenty for copper, thanks to a series of big new projects starting up around the world.

The expectation across most of the industry was for a comfortable surplus before the market tightens again later this decade when surging demand for electric vehicles and renewable energy infrastructure is expected to collide with a lack of new mines.

Instead, the mining industry has highlighted how vulnerable supply can be — whether due to political and social opposition, the difficulty of developing new operations, or simply the day-to-day challenge of pulling rocks up from deep beneath the earth.

Lithium price routed on supply surge

The price of lithium was decimated in 2023, but predictions for next year are far from rosy. Lithium demand from electric vehicles is still growing rapidly, but the supply response has overwhelmed the market.

Global lithium supply, meanwhile, will jump by 40% in 2024, UBS said earlier this month, to more than 1.4 million tons of lithium carbonate equivalent.

Output in top producers Australia and Latin America will rise 22% and 29% respectively, while that in Africa is expected to double, driven by projects in Zimbabwe, the bank said.

Chinese production will also jump 40% in the next two years, said UBS, driven by a major CATL project in southern Jiangxi province.

The investment bank expects Chinese lithium carbonate prices could fall by more than 30% next year, dipping as low as 80,000 yuan ($14,800) per tonne in 2024, averaging at around 100,000 yuan, equivalent to production costs in Jiangxi, China’s biggest producing region of the chemical.

Lithium assets still in high demand

In October, Albemarle Corp. walked away from its $4.2 billion takeover of Liontown Resources Ltd., after Australia’s richest woman built up a blocking minority and effectively scuppered one of the largest battery-metals deals to date.

Eager to add new supply, Albemarle had pursued its Perth-based target for months, eying its Kathleen Valley project — one of Australia’s most promising deposits. Liontown agreed to the US company’s “best and final” offer of A$3 a share in September — a near 100% premium to the price before Albemarle’s takeover interest was made public in March.

Albemarle had to contend with the arrival of combative mining tycoon Gina Rinehart, as her Hancock Prospecting steadily built up a 19.9% stake in Liontown. Last week, she became the single largest investor, with enough clout to potentially block a shareholder vote on the deal.

In December, SQM teamed up with Hancock Prospecting to make a sweetened A$1.7 billion ($1.14 billion) bid for Australian lithium developer Azure Minerals, the three parties said on Tuesday.

The deal would give the world’s no.2 lithium producer SQM a foothold in Australia with a stake in Azure’s Andover project and a partnership with Hancock, which has rail infrastructure and local experience in developing mines.

Chile, Mexico take control of lithium

Chile’s President Gabriel Boric announced in April that his government would bring the country’s lithium industry under state control, applying a model in which the state will partner with companies to enable local development.

The long-awaited policy in the world’s second-largest producer of the battery metal includes the creation of a national lithium company, Boric said on national television.

Mexican President Andrés Manuel López Obrador in September said the country’s lithium concessions are being reviewed, after China’s Ganfeng last month indicated that its Mexican lithium concessions were being cancelled.

López Obrador formally nationalized Mexico’s lithium reserves earlier this year and in August, Ganfeng said Mexico’s mining authorities had issued a notice to its local subsidiaries indicating nine of its concessions had been terminated.

Gold to build on record-setting year

The New York futures price of gold set an all-time high at the beginning of December and looks set to surpass the peak going into the new year.

London’s gold price benchmark hit an all-time high of $2,069.40 per troy ounce at an afternoon auction on Wednesday, surpassing the previous record of $2,067.15 set in August 2020, the London Bullion Market Association (LBMA) said.

“I can think of no clearer demonstration of gold’s role as a store of value than the enthusiasm with which investors across the world have turned to the metal during the recent economic and geopolitical turmoils,” said LMBA’s chief executive officer Ruth Crowell.

JPMorgan predicted a new record back in July but expected the new high to occur in the second quarter of 2024. The basis of JPMorgan’s optimism for 2024 – falling US interest rates – remains intact:

“The bank has an average price target of $2,175 an ounce for bullion in the final quarter of 2024, with risks skewed to the upside on a forecast for a mild US recession that’s likely to hit sometime before the Fed starts easing.”

Even as gold climbed new peaks, exploration spending on the precious metal dipped. A study published in November overall mining exploration budgets fell this year for the first time since 2020, dropping 3% to $12.8 billion at the 2,235 companies that allocated funds to find or expand deposits.

Despite the sparkling gold price, gold exploration budgets, which historically have been driven more by the junior mining sector than any other metal or mineral, dropped by 16% or $1.1 billion year-on-year to just under $6 billion, representing 46% of the global total.

That’s down from 54% in 2022 amid higher spending on lithium, nickel and other battery metals, a surge in spending on uranium and rare earths and an uptick for copper.

Mining’s year of M&A, spin-offs, IPOs, and SPAC deals

In December, speculation about Anglo American (LON: AAL) becoming the target of a takeover by a rival or a private equity firm mounted, as weakness in the shares of the diversified miner persisted.

If Anglo American doesn’t turn operations around and its share price continues to lag, Jefferies analysts say they can’t “rule out the possibility that Anglo is involved in the broader trend of industry consolidation,” according to their research note.

In October, Newcrest Mining shareholders voted strongly in favour of accepting the roughly $17 billion buyout bid from global gold mining giant Newmont Corporation.

Newmont (NYSE: NEM) plans to raise $2 billion in cash through mine sales and project divestments following the acquisition. The acquisition brings the company’s value to around $50 billion and adds five active mines and two advanced projects to Newmont’s portfolio.

Breakups and spin-offs were also a big part of 2023 corporate developments.

After being rebuffed several times in its bid to buy all of Teck Resources, Glencore and its Japanese partner are in a better position to bring the $9 billion bid for the diversified Canadian miner’s coal unit to a close. Glencore CEO Gary Nagle’s initial bid for the entire company faced stiff opposition from Justin Trudeau’s Liberal government and from the premier of British Columbia, where the company is based.

Vale (NYSE: VALE) is not seeking new partners for its base metals unit following a recent equity sale, but could consider an IPO for the unit within three or four years, CEO Eduardo Bartolomeo said in October.

Vale recruited former Anglo American Plc boss Mark Cutifani in April to lead an independent board to oversee the $26-billion copper and nickel unit created in July when the Brazilian parent company sold 10% to Saudi fund Manara Minerals.

Shares in Indonesian copper and gold miner, PT Amman Mineral Internasional, have surged more than fourfold since listing in July and are set to keep rising after its inclusion in major emerging market indexes in November.

Amman Mineral’s $715 million IPO was the largest in Southeast Asia’s biggest economy this year and counted on strong demand by global and domestic funds.

Not all dealmaking went smoothly this year.

Announced in June, a $1 billion metals deal by blank-cheque fund ACG Acquisition Co to acquire a Brazilian nickel and and a copper-gold mine from Appian Capital, was terminated in September.

The deal was backed by Glencore, Chrysler parent Stellantis and Volkswagen’s battery unit PowerCo through an equity investment, but as nickel prices slumped there was a lack of interest from minority investors at the stage of the $300 million equity offering which ACG planned as part of the deal.

Talks in 2022 to acquire the mines also fell through after bidder Sibanye-Stillwater pulled out. That transaction is now the subject of legal proceedings after Appian filed a $1.2 billion claim against the South African miner.

Nickel nosedive

In April, Indonesia’s PT Trimegah Bangun Persada, better known as Harita Nickel, raised 10 trillion rupiah ($672 million) in what was then Indonesia’s largest initial public offering of the year.

Harita Nickel’s IPO quickly turned sour for investors, however, as prices for the metal entered a steady and long decline. Nickel is the worst performer among the base metals, nearly halving in value after starting 2023 trading above $30,000 a tonne.

Next year is not looking great for the devil’s copper either with top producer Nornickel predicting a widening surplus due to lacklustre demand from electric vehicles and a ramp-up in supply from Indonesia, which also comes with a thick layer of cobalt:

“…due to the continuing destocking cycle in the EV supply chain, a greater share of non-nickel LFP batteries, and a partial shift from BEV to PHEV sales in China. Meanwhile, the launch of new Indonesian nickel capacities continued at a high pace.”

Palladium also had a rough year, down by more than a third in 2023 despite a late charge from multi-year lows hit at the start of December. Palladium was last trading at $1,150 an ounce.

China flexes its critical mineral muscle

In July China announced it will clamp down on exports of two obscure yet crucial metals in an escalation of the trade war on technology with the US and Europe.

Beijing said exporters will need to apply for licenses from the commerce ministry if they want to start or continue to ship gallium and germanium out of the country and will be required to report details of the overseas buyers and their applications.

China is overwhelmingly the top source of both metals — accounting for 94% of gallium supply and 83% of germanium, according to a European Union study on critical raw materials this year. The two metals have a vast array of specialist uses across chipmaking, communications equipment and defence.

In October, China said it would require export permits for some graphite products to protect national security. China is the world’s top graphite producer and exporter. It also refines more than 90% of the world’s graphite into the material that is used in virtually all EV battery anodes, which is the negatively charged portion of a battery.

US miners said China’s move underscores the need for Washington to ease its own permit review process. Nearly one-third of the graphite consumed in the United States comes from China, according to the Alliance for Automotive Innovation, which represents auto supply chain companies.

In December, Beijing banned the export of technology to make rare earth magnets on Thursday, adding it to a ban already in place on technology to extract and separate the critical materials.

Rare earths are a group of 17 metals used to make magnets that turn power into motion for use in electric vehicles, wind turbines and electronics.

While Western countries are trying to launch their own rare earth processing operations, the ban is expected to have the biggest impact on so-called “heavy rare earths,” used in electric vehicle motors, medical devices and weaponry, where China has a virtual monopoly on refining.

https://www.mining.com/the-biggest-global-mining-news-of-2023/

A Detailed Explanation of the Electric Arc Furnace - What It is and How It Works

Can beaten-up junior miners fight illegal short-selling?

with MMGYS Soundtrack

Alisha Hiyate | December 22, 2023 | 7:33 am Careers Education Markets Canada

Terry Lynch began to notice unusual price movements in Power Nickel (TSXV: PNPN; US-OTC: PNPNF)’s stock (then called Chilean Metals) years ago.

The shares consistently traded down at the end of the day, regardless of news, with late day trades often made anonymously.

Now the stock is stuck in a range of C25¢ to C30¢ — despite a recently released initial nickel-sulphide resource for the company’s optioned Nisk project in Quebec, and a staged deal with battery and defence supplier CVMR to fund engineering studies.

It’s not unusual for a junior mining CEO to be unhappy with his share price, but Lynch says Power Nickel isn’t alone and something is amiss in the junior sector. The disconnect between the commodity markets and the junior mining-heavy TSX Venture Index, which is at an all-time low, has reached its widest point.

“When I first started talking about this, people thought, Terry, you should have a tinfoil hat on your head. They thought I was a crazy conspiracy theorist,” he told The Northern Miner in early December. “But you know what? I got proof. Man, this is really happening and I’m not the only one that sees it.”

In search of answers to the sector’s woes, he formed the Save Canadian Mining group in 2019, recruiting big names like Eric Sprott, Rob McEwen and Sean Roosen as supporters. Now, he can point to exactly what’s bleeding the junior market dry: Predatory short-selling.

“We’re in a market where the governments, to their credit, federally and provincially, have put out some amazing incentives for miners to actually get out there and explore and develop mines,” he said. “So really, we should be in our glory years and we’re instead about to go extinct.”

Short selling is a legal way for traders to profit from a falling stock price. Traders sell borrowed shares in the hope of buying them on the market at a lower price. It serves an important function in helping the market discover the true value of a company’s shares and has even helped uncover frauds like Enron. But it can also be done illegally, if traders don’t “cover” their position — meaning the trader is selling shares they haven’t borrowed, located, or confirmed are available for them to buy.

Lynch and others say “naked” shorting is a widespread and destructive problem in the junior mining sector. Last week he filed a formal complaint with the Canadian Investment Regulatory Organization (CIRO) and FINRA (Financial Industry Regulatory Authority) in the United States asking them to act on illegal short selling and restore investor confidence in the market.

‘Neverending bear market’

Any sector with declining values will attract short selling, which plays an important role in ensuring overvalued stocks don’t stay that way.

But veteran junior mining investors say that the removal of the “tick test” restrictions on short selling in 2012 have unleashed algorithmic trading programs onto the market that prey on both companies and retail investors. The “tick test” or uptick rule only allowed short sales at a price that was higher than the last sales price of a security.

Often this activity happens in the shadows, in places only institutions like banks and their clients can access, said long-time junior mining analyst John Kaiser of Kaiser Research Online.

“Banks and professional traders are selling stock they don’t even have a means to borrow,” he said in December. “With no downtick rule to get in the way, they just lean into the bid and then everybody’s who’s been a ‘long,’ they get this feeling of despair and they sell.”

Kaiser said these traders take advantage of the share volume rise that happens when companies release news, depressing any rallies.

Any new investors are left with nothing but buyers’ regret — and juniors are stuck in a “neverending” bear market.

Kaiser said a lot of this trading must be predatory because junior mining stock is not easy to borrow.

“None of it’s high enough to be marginable and margin accounts probably don’t own this sort of stuff,” he said. And large shareholders aren’t likely to make stock available to short-sellers.

“Properly covered short selling, if that was enforced, would not be that big a problem.”

Meanwhile, junior mining CEOs, many of whom are geologists with a distaste for or lack of knowledge of the capital markets, have proven hapless and helpless.

John Feneck, an Arizona-based technical analyst and consultant who helps mining companies raise their profiles, said many CEOs believe they can let their drill results speak for themselves. But that hasn’t been the case for the last couple of years.

“Our sector is really thinly traded,” he explained in a phone interview in early December. “Certain stocks are susceptible to larger moves based on their daily trading volume – many trade less than 100,000 shares a day.”

Feneck said better disclosure could help market transparency. He notes that in the U.S., FINRA requires short-selling information to be reported only twice a month. The long gap allows for potentially deceptive activities to take place.

“It’s whatever happens between those reports that’s frustrating people,” he said.

What are the regulators doing?

Regulators have looked at the issue of naked short-selling many times over the past decade. But they’ve found scant evidence that there’s a widespread problem.

In August 2022, CIRO predecessor IIROC did clarify that naked short selling is in fact illegal in Canada. Guidance issued at the time stated that entering into a short order without “reasonable expectation” the trader will be able to access enough securities to settle it within two trading days is prohibited, and considered manipulative and deceptive behaviour.

CIRO’s latest review concluded in November without recommending any regulatory changes.

But it does expect to publish new proposals outlining how it can further “clarify and support” the reasonable expectation requirement in early 2024.

Finally, CIRO and the Canadian Securities Administrators are forming a working group early in the year to study short selling in Canada, including an analysis of stronger requirements to settle trades when they’re due. It will also look more closely at suggestions raised in the previous consultation, including the imposition of “pre-borrow” requirements before a short sale can be entered, and whether short selling of junior stocks should be treated differently. In a response to emailed questions, a CIRO spokesperson confirmed there would also be discussion around suggestions it received to bring back the tick test.

Investor protection momentum

In early 2023, several small-cap companies in the U.S. announced plans to take legal action against short-sellers targeting their stocks.

In November, South Korea placed a temporary ban on short selling until next June. The move was supported by the country’s powerful lobby of retail investors, who believe big banks are suppressing share values through short selling. Over a quarter of the nation’s population invest in the stock market.

And in September, a judge in the Harrington Global Opportunity Fund market manipulation case against CIBC and big banks in the U.S. denied the defendants’ motion to dismiss the case. In her decision, she found that banks and brokerage firms can be held liable for their clients’ illegal trading, if they fail to provide proper oversight.

Banks have previously argued that they’re not responsible for clients’ illegal trading.

Lynch is encouraged by the momentum.

During an “emergency” Save Canadian Mining virtual event in late November, Sprott exhorted junior executives to take action to protect their share prices. “CEOs must realize almost everyone’s working against you,” he said. “If the price sucks, why don’t you wake up and do something about it!”

While Lynch doesn’t want to take the banks to court, he wants to let them know industry is willing to go that far.

“Nobody wants to really fight them, but we need to show them, hey, we’ve got the evidence,” he said. “The banks and the regulators, once they decide they want to do something, they can move very swiftly. They can change all these rules overnight.”

That could usher in the biggest mining boom in human history, he posited.

To the banks, he offers this message:

“The money on the shorting side of this business is almost done. You’ve almost killed us. You need to invest in the long side, and then everyone’s gonna make out like crazy.”

https://www.mining.com/can-beaten-up-junior-miners-fight-illegal-short-selling/

Merry Christmas ........

Mog’s Christmas Calamity

Merry Christmas

Gold doesn’t follow, it leads Feat. Michael Oliver - LFTV Ep 154 Timestamps:

Kinesis Money

Dec 22, 2023

In this year’s final episode of Live from the Vault, Andrew Maguire is joined by Michael Oliver, creator of Momentum Structural Analysis, to pull back the curtain on the global trade of precious metals and debate what drives the industry forward.

The experts discuss the Fed’s interest rate policy decisions and a prospective pivot to rate cuts in 2024, before analysing how precious metals stand strong while the integrity of the US government bond market hangs in the balance.

00:00 Start

02:45 What’s going on with interest rates

07:00 What happens when the Fed starts cutting rates

18:10 How deep will the next stock bear market be?

25:00 A look at previous rallies and declines

34:00 Silver momentum: can it outperform gold?

39:45 Is now a good time to get into mining stocks?

51:00 Does Michael cover cryptocurrencies?

$STRFF Canadian Gold Corp. Highlights Transformative 2023 for Shareholders

Provides Exploration & Development Plans for Coming Year

Toronto, Ontario – December 21, 2023 – Canadian Gold Corp. (TSXV: CGC) (“Canadian Gold” or the “Company”) is pleased to announce a summary of the work completed in 2023, in what has been a transformative year, and in addition, presents the Company’s early exploration and development plans for 2024.

Flin Flon Snow Lake Greenstone Belt

Canadian Gold Corp.’s Tartan Mine project remains the Company’s flag ship project, and sees opportunity being located in the prolific, world class Flin Flon Snow Lake Greenstone Belt, where roughly 50% of all mines developed in Manitoba were established (in this area), representing just under 2% of the Province’s total surface area.

Canadian Gold Highlights and Path Forward

Tartan Mine 2023 Exploration Drilling: Completed Phase 1 drilling in September with highlights that included an impressive 12.0 gpt gold over 8.0 metres, inside the widest and deepest intersection in Tartan Mine history, namely, 4.2 gpt gold over 53.7 metres. This hole increased the vertical extent of the high-grade by 61%. Phase 2 drilling started in November with 3 holes having been completed prior to the winter break (Fig. 1). Assays from the 3 holes are currently pending and drilling is scheduled to resume early January 2024.

2024 Exploration Program: The Company will be completing its Phase 2 drill program during Q1-2024. In addition to targeting extensions of the gold mineralization at the Tartan Mine’s Main Zone, the program has been expanded to follow-up on encouraging holes from the South Zone (Fig. 2) that remains open for expansion and includes 9.6 gpt gold over 11.8 metres, and 8.8 gpt gold over 4.8 metres. The South Zone, which occurs approximately 100 metres south of the Main Zone, was also accessed by underground development for the purpose of drilling underground. Exploration drilling will also target west of the current resource estimate (Fig. 2), where high-grade gold was encountered by the previous owner between 2003-2006, and which included 11.3 gpt gold over 2.7 metres. The overall objective of 2024 is to drive resource growth and materially expand the ore system at the Tartan Mine.

Tartan Mine Engineering: During 2023, the Company reviewed the original process plant and mill design, and considered alternatives to maximize gold recoveries, while also reducing operating costs and technical risks. It is the Company’s belief that a simplified design should achieve these objectives. The Company intends to complete further testing in 2024 in order to determine if the projected gold recoveries can be further increased using a finer grind size. In addition, an evaluation will be completed on the existing processing plant/mill infrastructure in order to identify equipment that may require replacement. The Company intends to work with an equipment broker to help source replacements. Lastly, an underwater drone will be used during spring to map the condition of the underground mine, for the purposes of determining refurbishment costs.

Volcanogenic Massive Sulphide (VMS) Potential: A VTEM and IP survey was conducted in 2011 and 2022 over the Tartan Mine property. The results of these surveys, combined with other prior historical work and current desk-top analyses, has outlined potential for a VMS discovery within the project area. This could be an exciting development, as the region around Flin Flon, Manitoba is well known for hosting “world class” VMS orebodies, many of which have been developed into mines. Since 1915, 34 of the 71 mines that have been developed in Manitoba were situated in the world class, prolific Snow Lake Flin-Flon greenstone belt. Canadian Gold will be completing its data compilation and the results, including next steps, will be shared with shareholders early in 2024.

Property Acquisitions: During 2023 Canadian Gold acquired three early-stage exploration projects situated adjacent to some of the largest gold mines and undeveloped deposits in Canada. In 2024, the primary focus will be on the Hammond Reef North/South (Ontario) and Malartic South projects (Quebec) – being located next to Agnico Eagle’s Hammond Reef deposit and the Canadian Malartic Mine. Work at both projects will continue to advance these projects to a drill ready stage. It is the Company’s intention to apply for various government funding programs to help finance this exploration. Canadian Gold is also open to evaluating neighbouring gold properties in the Flin Flon area.

Financing: The Company raised approximately $4.1 million during 2023. Rob McEwen, the founder and former CEO and Chairman of Goldcorp personally invested $2.0 million and now owns approximately 36% of the Company. Other sources of funding included $300,000 from the Manitoba Mineral Development Fund (“MMDF”) and approximately $1.6 million from new investors.

Tartan Mine Tax Incentives: Manitoba Finance confirmed during the year that the Tartan Mine would be considered a “Major Expansion” and eligible for a tax holiday should it re-enter production. Major Expansions by mining companies in Manitoba are exempt from paying Mining Tax until profits equal the amount of capital spent to open the mine. At the end of the tax holiday, a company is allowed to depreciate the undepreciated balance against future Mining Tax.

Board of Directors/Management Additions: During 2023 the Company has added several members to its board of directors and management team to strengthen its presence within Manitoba. Key additions include Ed Huebert as President and CEO (formerly Special Advisor on Mining to the Cabinet Secretary of Economic Development for Manitoba) and Senior Environmental Manager with Debeers Canada (NWT Projects), Jim Downey (former Minister of Energy and Mines and Deputy Premier of Manitoba) and Alex McEwen, son of Rob McEwen and founder/owner of Remote Power Corp.

For Further Information, Please Contact:

Ed Huebert

President & CEO

Canadian Gold Corp.

(204) 771-2180

ed@canadiangoldcorp.com

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the company, and a Qualified Person as defined under National Instrument 43-101.

About Canadian Gold Corp.

Canadian Gold Corp. is a Toronto-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The Company holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada’s largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). The Company is 36% owned by Robert McEwen, who was the founder and CEO of Goldcorp and is Chairman and CEO of McEwen Mining.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of Company contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

https://canadiangoldcorp.com/canadian-gold-corp-highlights-transformative-2023-for-shareholders/

Welcome to the first day at US Steel

with MMGYS Soundtracks

Continuing Coverage

After U.S. Steel announces sale, reactions range from outrage to concern

90.5 WESA | By Oliver Morrison

Published December 21, 2023 at 5:34 AM EST

/

90.5 WESA

George DeBolt's father and grandfather worked for U.S. Steel in different capacities and he now gives tours of the region's industrial past — and he has a theory about why U.S. Steel's sale struck such a chord.

For decades, George DeBolt has given tours of former industrial sites around Pittsburgh. DeBolt’s grandfather worked for the union during the “Battle of Homestead,” where 16 people died during an armed confrontation between striking steelworkers and Pinkerton agents employed by Carnegie Steel, a predecessor to U.S. Steel. DeBolt’s father helped haul large pieces of metal for U.S. Steel as the owner of a trucking business.

DeBolt has carried on that steel-related lineage, albeit in a less hands-on way — he provides tours of significant sites related to the region’s industrial past.

“My claim to fame,” he said. “is that when he came to Pittsburgh, Prince Charles asked me to give him a tour of the industrial Valley here.”

So, Debolt had some opinions when U.S. Steel announced on Monday that it was being purchased by Nippon Steel Corporation — a larger Japanese steelmaker — for $14.9 billion.

Shareholders were happy about the announcement; U.S. Steel share prices surged at the news. But in and around Pittsburgh, the news elicited a range of negative reactions: from concern over national security implications voiced by elected representatives to outrage from the United Steelworkers union, which represents many U.S. Steel employees.

DeBolt said an important clue to why there was such a strong reaction was sitting about six miles down the Mon River from U.S. Steel’s Downtown corporate headquarters at the Waterfront, an open-air shopping complex that opened in 1999. The site was once home to the largest steel mill in the world, the Homestead Works, built by the Carnegie Steel Company, which eventually merged with the Federal Steel Company to and become U.S. Steel.

In a parking lot behind a Lowe’s hardware store, sits the 12,000 Pound Press — a 120-year-old steel press that was used to smash large steel ingots into sheets toward the end of the steelmaking process. Next to the press a sign reads, “Many World War Two battleships were outfitted with armor plate from this press, including the U.S.S. Missouri, the ship on which the Japanese signed the articles of surrender that ended the war.”

Many of the people who spoke to WESA for this article emphasized that steel made here helped win World Wars. It helped establish the U.S. as a global superpower. U.S. Steel, in a way, became synonymous with U.S. might. So, DeBolt suggests, people weren’t upset just because U.S. Steel was being sold. Rather, people were upset about it being sold to a foreign company — and a Japanese one at that.

“How about that for irony?” he said.

“This is just deja vu”

But for others, Monday’s announcement seemed to produce a sense that history was repeating itself.

American steel production peaked in the early 1970s. But, as the industry became more globalized and buyers began to buy cheaper steel elsewhere, production plummeted, bottoming out in the mid-80s. “Black Monday” in September 1977 — when Youngstown Sheet and Tube abruptly closed its Campbell Works plant in Youngstown, Ohio — was one of the first surprise announcements that upended the American steel industry — but it would be nowhere near the last.

The wave of mill closures during the next decade finally hit the Homestead Works in 1986. Mike Stout was the plant’s union representative and the last worker out before the plant shuttered for good.

The Edgar Thomson Steel Works on the day U.S. Steel announced that it was being purchased for $14.9 billion.

Oliver Morrison

/

90.5 WESA

The Edgar Thomson Steel Works on the day U.S. Steel announced that it was being purchased for $14.9 billion.

“Tens of thousands of steelworkers lost their jobs illegally, were denied pensions, were denied severance pay,” Stout said. “And the result was the complete [and] utter destruction of the Monongahela Valley and towns like Homestead and McKeesport and Duquesne.”

Many of those towns and cities are now beset by poverty and health problems, some of which are a legacy of their close proximity to sources of industrial pollution. Stout spent years fighting U.S. Steel in court for millions of dollars in back pay and pensions for the plant’s workers. And for him, and many of the people who lived through that time, the sting of U.S. Steel’s announcement this week felt familiar.

“This is just deja vu. I mean, this is exactly what they did in the 1980s,” he said.

According to Stout, the company broke its promises to the steel workers repeatedly. The most recent betrayal, Stout said, was just a couple years ago — when U.S. Steel backpedaled on a promise to invest more than a billion dollars into its remaining Mon Valley steel plants. The plan would’ve modernized the equipment and reduced pollution. Instead, U.S. Steel announced it was investing billions of dollars in new non-union steel plants in Arkansas.

Those mills will utilize cleaner, more efficient electric arc furnaces, a technological investment that Chris Briem, an economist at the University of Pittsburgh, said U.S. Steel is making decades later than it should have.

“Electric arc steel mini mills were described once as the prototypical disruptive technology,” Briem said. “It completely changed the nature of the steel industry and U.S. [Steel] ignored it. And they're paying the price.”

Briem said that’s been the pattern the past half-century. The last vestiges of steel production in the Pittsburgh region might be in jeopardy, Briem said — but it’s not because of who will be owning U.S. Steel moving forward. Instead, he said, it’s because decades passed without U.S. Steel making necessary investments in its Mon Valley operations to ensure that it remained competitive.

“So, it doesn't really matter whether it's retained by U.S. Steel or bought by Nippon Steel or one of the other potential competitors,” he said. “Without a lot of investment, it probably isn't going to stay open.”

Concerns over foreign ownership

Meanwhile, the United Steelworkers union is deeply opposed to the sale. President Dave McCall said he’s worried the company won’t honor commitments to union pensions and healthcare. He said he has seen evidence that Nippon plans to further steer investment to non-union plants in Arkansas, neglecting legacy facilities up north.

But he also said the union’s opposition to a foreign buyer is a matter of principle, no matter that Japan is one of the U.S.’s closest allies.

“We've got to be able to make things here in America and control things here in America,” he said. “And then suddenly … they decide that [a Japanese company is] going to be the supplier for steel in America, for key products? I'm concerned about that.”

Pennsylvania U.S. Senator Bob Casey agrees. The Democrat has voted for new laws that he said aim to bring back manufacturing to the U.S. The CHIPS Act and the Inflation Reduction Act offer billions of dollars in incentives for companies that build factories in the U.S. for things like electric car batteries and computer chips.

“You can't exist as a nation if you don't have a manufacturing base and steel is a big part of that,” Casey said.

George DeBolt shows an ash tray made at the Homestead Works that was given to his family and a picture of a giant piece of steel that his father moved with two trailers tied together back when DeBolt was still a kid.

Oliver Morrison

/

90.5 WESA

George DeBolt shows an ash tray made at the Homestead Works that was given to his family and a picture of a giant piece of steel that his father moved with two trailers tied together back when DeBolt was still a kid.

Casey, Fetterman and Rep. Chris Deluzio sent a letter to Nippon’s leaders this week asking them for additional information about their plans. They also sent a letter to Treasury Secretary Janet Yellen urging her to block the proposed sale, arguing that the country’s core industries should not be dependent upon foreign actors.

Some, though, hold out hope that a sale might represent rebirth, rather than a death knell. Charlie McCollester, a retired academic and founding member of the Battle of Homestead Foundation, wrote a book about the steel industry from a labor perspective. He thinks Japanese ownership could end up being the industry’s saving grace in the region. U.S. Steel has clearly failed, he said, and he thinks Japanese owners might make better decisions.

“They had a certain responsibility towards their workers and ... they have been geniuses at involving workers in the production process from below,” he said.

Back in Homestead, Debolt said that the tension between Pennsylvania workers and foreign owners isn’t anything new. In fact, it was given the Hollywood treatment in 1986 — the same year the Homestead Works plant closed. Pittsburgh-native Michael Keaton starred in the movie, “Gung Ho,” about a Japanese company that agrees to revive an ailing manufacturing plant that had just closed.

“And of course, at the end,” he said, “the workers and the new Japanese owners are getting along fine.”

https://www.wesa.fm/economy-business/2023-12-21/us-steel-sale-reactions

$X

Ghosts of Bubbles Past - Yulletide Wash and Rinse

with MMGYS Soundtrack bottom of page

“You are fettered,” said Scrooge, trembling. “Tell me why?”

“I wear the chain I forged in life,” replied the Ghost. “I made it link by link, and yard by yard; I girded it on of my own free will, and of my own free will I wore it. Is its pattern strange to you?” Scrooge trembled more and more.

“Or would you know,” pursued the Ghost, “the weight and length of the strong coil you bear yourself? It was full as heavy and as long as this, seven Christmas Eves ago. You have laboured on it, since. It is a ponderous chain!..."

“But you were always a good man of business, Jacob,' faltered Scrooge, who now began to apply this to himself.

Business!' cried the Ghost, wringing its hands again. "Mankind was my business; charity, mercy, forbearance, and benevolence, were, all, my business. The deals of my trade were but a drop of water in the comprehensive ocean of my business!”

Charles Dickens, A Christmas Carol

"The people who walked in darkness have seen a great light; those who dwelt in a land of deep darkness, on them a light has shined."

Isaiah 9:1

After reaching new highs and the pinnacle of another vaporous overbought risk bubble, stocks sold off hard this afternoon.

Wash and rinse complete.

Ho, ho, ho.

Gold and silver sold, while the Dollar rose.

VIX rebounded strongly from its recent supine levels.

It never ends.

Have a pleasant evening.

https://jessescrossroadscafe.blogspot.com/

Growing bipartisan opposition to US Steel purchase by Japanese might not be enough to block deal

with MMGYS A,I. Soundtrack U,S. Steels new Japan theme song "World is Mine"

New York (CNN) — Bipartisan opposition is growing to the proposed $14.1 billion acquisition of US Steel by Japan’s largest steelmaker, but that is unlikely to be enough to block the purchase, according to an expert in foreign investment deals.

Posted 12:18 p.m. Today - Updated 12:17 p.m. Today

By Matt Egan and Chris Isidore, CNN

New York (CNN) — Bipartisan opposition is growing to the proposed $14.1 billion acquisition of US Steel by Japan’s largest steelmaker, but that is unlikely to be enough to block the purchase, according to an expert in foreign investment deals.

A trio of Republican senators Tuesday called for a panel of US officials to block Nippon Steel’s takeover of US Steel due to national security concerns.

WRAL News Brief

Sens. JD Vance, Josh Hawley and Marco Rubio wrote Treasury Secretary Janet Yellen a letter on Tuesday warning the US Steel deal has “dire implications for the industrial base of the United States” and “was not entered into with US national security in mind.”

Yellen chairs the Committee on Foreign Investment in the United States (CFIUS), an interagency panel empowered to review transactions involving foreign investment in America to determine the impact on national security. CFIUS members include the heads of the Department of Defense, State, Homeland Security and Justice.

CFIUS “can and should block the acquisition of US Steel by NSC, a company whose allegiances clearly lie with a foreign state and whose record in the United States is deeply flawed,” Vance, Hawley and Rubio said. They argued CFIUS should launch a review of the deal unilaterally, especially because US Steel received competitive bids from American companies.

The lawmakers note that domestic steel production is “vital to US national security” and cited steps taken by Republican and Democratic administrations to bolster the steel industry. Vance is the junior senator from Ohio, while Hawley and Rubio represent Missouri and Florida, respectively.

“Allowing foreign companies to buy out American companies and enjoy our trade protections subverts the very purpose for which those protections were put in place,” the Republican lawmakers wrote.

Vance, Hawley and Rubio cautioned that Nippon Steel “does not share US Steel’s storied connection to the United States and its financial interests are tied to those of Japan.” The lawmakers note that Nippon has previously been found guilty of unlawfully dumping flat-rolled steel products in the United States.

Ohio’s other senator, Democrat Sherrod Brown, also issued a statement Monday opposing the deal.

“A foreign company should not be able to swoop in, ignore the voices of union workers, and buy a major American steel manufacturer behind closed doors,” said Brown, who faces reelection in 2024. “Nippon and US Steel have insulted American steelworkers by refusing to give them a seat at the table and raised grave concerns about their commitment to the future of the American steel industry.”

Brown said that if US Steel is going to be sold, it should be purchased by Ohio-based Cleveland Cliffs, which had the support of the United Steelworkers union in its failed effort earlier this year to buy US Steel.

Sen. Joe Manchin, the West Virginia Democrat who is not seeking reelection but is still considering an independent campaign for president, also attacked the sale of the company to a foreign rival.

“This is a major blow to the American steel industry which has been instrumental in making us the superpower of the world and a direct threat to our national security,” he said in a statement Tuesday. “At a time when domestic manufacturing – including in the US steel market – is facing increased competition from unfair trade, we must be doing everything we can to prevent any further deterioration of American ownership

Sen. John Fetterman, a Pennsylvania Democrat, also decried the proposed sale.

“It’s absolutely outrageous that US Steel has agreed to sell themselves to a foreign company,” Fetterman said Monday in a statement. “Steel is always about security – both our national security and the economic security of our steel communities. I am committed to doing anything I can do, using my platform and my position, to block this foreign sale.”

And the United Steelworkers union is also on record opposing the deal.

The proposed deal “demonstrates the same greedy, shortsighted attitude that has guided US Steel for far too long,” said USW President David McCall. “We remained open throughout this process to working with US Steel to keep this iconic American company domestically owned and operated, but instead it chose to push aside the concerns of its dedicated workforce and sell to a foreign-owned company.”

Blocking deal still is ‘quite unlikely’

Despite the growing political opposition to the deal from politicians and the United Steelworkers union, it is unlikely that CFIUS would block the deal by a close US ally such as Japan, said Michael Leiter, head of the CFIUS and national security practices at law firm Skadden, Arps.

“This has never happened before for a Japanese buyer of a US business - even in the height of US-Japan trade tensions in the 1980s and 1990s - and it seems quite unlikely that it would do so here,” he told CNN.

No matter the recommendation of CFIUS, the final decision rests with the president, Leiter said. Even with the political pressure from the both parties and the importance of Ohio and Pennsylvania in next year’s election, Leiter doesn’t think Biden would act to block the deal.

“Were President Biden to reject the deal this would immediately create a significant issue with our Japanese allies given the importance of collaboration on other critical issues such as China and semiconductor production and supply chains,” he said.

Representatives from US Steel did not respond to requests for comment on the letter or Brown and Fetterman’s objections. Treasury declined to comment.

US Steel officials touted the deal on Monday, arguing it’s in the best interest of all parties, including the United States. And they said they are confident it will be able to win regulatory approval.

Although US Steel was once the world’s most valuable company, it has been in decline for decades along with the broader domestic steel industry

The-CNN-Wire™ & © 2023 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.

https://www.wral.com/story/growing-bipartisan-opposition-to-us-steel-purchase-by-japanese-might-not-be-enough-to-block-deal/21202784/

American's furious after biggest auto steel supplier sold off to Japan

Rob McEwen: To me, these are opportune times

GOLDINVEST

Premiered 22 hours ago #robmcewen #mining #miningstocks

In this extensive Goldinvest.de interview with mining legend, Goldcorp founder, and McEwen Mining CEO Rob McEwen we talk about the state of the (gold) mining industry and the need for changes in the sector to be able to attract sufficient funding going forward, to continue fulfilling its essential role in modern society.

Rob also tells us, why he is investing in the junior mining / exploration space and we talk about two interesting companies in particular that we at Goldinvest.de are following, too.

Sorry America loses U S Steel

with MMGYS Soundtrack

Continuing full coverage

US Steel accepts $14.1 billion Nippon bid after rejecting Cliffs

Bloomberg News | December 18, 2023 | 6:48 am Markets Asia USA Iron Ore

Credit: US Steel

Nippon Steel Corp. will buy United States Steel Corp. for $14.1 billion to create the world’s second-largest steel company — and the biggest outside of China — with a key role in supplying American manufacturers and automakers.

The deal caps months of uncertainty over the future of US Steel, an icon of American industry, which has been considering potential transactions since it rejected an offer from rival Cleveland-Cliffs Inc. for $7.25 billion in mid-August.

For Nippon, Japan’s biggest steel producer, the transaction provides a large foothold in the American steel industry at a time when domestic demand is poised to benefit from rising infrastructure spending. US Steel is a key supplier to the lucrative automotive market in particular. The Japanese company has been seeking growth overseas to offset a litany of challenges facing its current operations.

Nippon will pay $55 a share in cash, the companies said in a statement. The deal announced Monday is a 142% premium to US Steel’s share price on the last trading day before it announced the review and Cliffs revealed it had made a bid. The company’s shares jumped 25% to $49.30 at 9:36 a.m. in New York. Cliffs was up 7.2%.

The deal would create a steel giant with plants stretching from Slovakia to Osaka to Pennsylvania. It would be the world’s second-biggest steelmaker with more than 86 million tons of capacity, leapfrogging Luxembourg-headquartered ArcelorMittal SA, according to a company presentation and Bloomberg calculations. Only China’s state-owned China Baowu Steel Group Corp. would have more.

Nippon has been seeking growth abroad as it struggles with a slowdown in domestic demand, the rapidly weakening yen and a surge in competition across Asia. The firm has been shutting blast furnaces in Japan due to weak needs.

In a presentation, Nippon said it was expanding its US presence to benefit from a growing population, cheap energy and renewed focus on building infrastructure. The company said it had secured commitments to finance the transaction from Japanese banks.

For American industry, the takeover will mark the end of an era. US Steel traces its roots back to 1901 when J. Pierpont Morgan merged a collection of assets with Andrew Carnegie’s Carnegie Steel Co.

It has undergone a dramatic shift in recent years under CEO David B. Burritt, as its investment focus pivoted away from traditional blast-furnace production of steel from iron ore, toward more modern and less-polluting plants that remelt metal scrap instead.

The company took center stage in the global steel industry in August, when it revealed it had rejected an offer from Cliffs and begun a strategic review.

The announcement kicked off a dramatic few weeks, as the influential United Steelworkers union threw its support behind Cliffs’ pugnacious chief executive, while a little-known buyer startled the industry with an even larger offer, before abruptly pulling its interest days later.

As US Steel considered its options, analysts have speculated certain buyers would be more focused the firm’s Big River Steel plant in Arkansas, which uses the greener and more efficient modern electric arc furnaces, while seeking to offload the older blast furnace assets.

Nippon Steel executive vice president Takahiro Mori said Nippon’s plan is to continue with US Steel’s existing plans for the company, including completing the Big River project and continuing to operate the legacy steelmaking assets. Mori didn’t rule out changes down the road.

“We are supportive of US Steel’s plan,” Miro said in an interview. “After a few years we may think in another way, but at this moment we are just following the current plan.”

Passing CFIUS

The deal requires US Steel shareholder approval, and will need to clear regulators, including the Committee on Foreign Investment in the US, or CFIUS. Some US politicians had already come out criticizing the idea of a foreign purchaser of the iconic American company while US Steel was assessing potential bids.

Nippon’s Mori said he is confident on clearing the hurdle, pointing to Japan’s strong relationship with the US. “I don’t have any concern about passing CFIUS,” he said.

The two companies have agreed that US Steel will keep its name and headquarters. Nippon also said it will honor all agreements US Steel has with the USW, which has repeatedly said it won’t support any foreign bidders.

Relations between the USW and US Steel have remained strained. USW president David McCall said he received a call at 6 a.m. New York time from US Steel CEO Burritt, who left a voicemail. McCall said it would have been the first time he had spoken to the executive since becoming the union’s top official in September, following the death of former president Tom Conway.

“This is not how this is going to work,” McCall said in an interview. “We don’t know Nippon.”

The union has a transferable right — which it has said it would pass on to Cliffs — to counterbid after an offer for US Steel as part of its collective bargaining agreement.

However, Cliffs said in a statement it congratulated US Steel on the deal and wished it well with the transaction. Cliffs will refocus its capital allocation priorities towards more aggressive share buybacks, CEO Lourenco Goncalves said.

Citigroup Inc. is acting as financial adviser to Nippon Steel, while Barclays Plc, Goldman Sachs Group Inc. and Evercore Inc. are advising US Steel.

(By Joe Deaux, Eddie Spence and Stephen Stapczynski)

https://www.mining.com/web/nippon-steel-agrees-to-buy-us-steel-for-14-1-billion/

United Steelworkers union blasts $15B U.S. Steel-Nippon deal

by Nathan Bomey

, author of

Axios Closer

The United Steelworkers (USW) union on Monday ripped U.S. Steel and its proposed acquirer, Nippon Steel, for agreeing to a $15 billion deal without its approval.

Why it matters: The USW's response sets the stage for a fight over the transaction. The union has said previously that its contract with U.S. Steel requires any prospective buyer to agree to a new labor deal before a sale can be finalized.

Driving the news: On Monday, Japan-based Nippon's announced a bid for U.S. Steel — an iconic American company that powered the nation's building boom in the 1900s, but later became a symbol of industrial decline.

However, the deal is likely to attract tough regulatory scrutiny, especially given the prospective buyer is not US-based.

Anti-trust scrutiny is not a concern "because they have very little footprint in North America," CFRA Research's Matthew Miller tells Axios.

But, he adds, the deal could face scrutiny from the U.S. government over the fact that a foreign company would be acquiring critical American assets.

What they're saying: USW President David McCall hammered the deal as "greedy" and "shortsighted" and pledged to "exercise the full measure of our agreements to ensure that whatever happens next with U.S. Steel, we protect the good, family-sustaining jobs we bargained."

"Neither U.S. Steel nor Nippon reached out to our union regarding the deal, which is in itself a violation of our partnership agreement that requires U.S. Steel to notify us of a change in control or business conditions," McCall said.

"Based on this alone, the USW does not believe that Nippon understands the full breadth of the obligations of all our agreements, and we do not know whether it has the capacity to live up to our existing contract."

He also criticized U.S. Steel for arranging a deal to "sell to a foreign-owned company."

Flashback: Earlier this year, U.S. Steel rejected a bid by U.S.-based Cleveland-Cliffs, and said it would explore strategic alternatives.