Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I hope to hear your comments during the celebration with the lift off of P20 with sustainable production and suprisingly large production numbers. Wishing you peace regardless. Regards

Totally agree and, enjoyed hearing your thoughts.

JBII - I know that B9 and Bueno have labeled JBII as just another penny scam.

Sorry, guys, but that is complete nonsense. Yes, JB has done a commendable job unnecessarily destroying the reputation of the company.

There is enough third party verification of the quality of the output from the machine, when it is not busy clogging itself up.

Anybody who thinks it is JB working by his lonesome to come up with the solutions for the technical problems encountered as they have scaled up is not thinking this through. Compare the first "commercial ready" processor to this new one. They are worlds apart in appearance and quality.

http://www.plastic2oil.com/site/news-releases-master/2013/06/13/jbi-inc-announces-completion-of-its-third-plastic2oil-processor

Is this the one? That remains to be seen. But I think the chances are good that this one will be able to process controlled plastic with decent up times and good, if not outstanding, margins. Enough to keep the lights on and enable them to begin get reasonable financing for a roll-out of additional processors to RockTenn and other locations.

Unless the engineers who worked on this design were not able to make good design choices, this story is not "all over except for the shouting." It really could be just the beginning of what investors were expecting two years ago.

There will be a much clearer picture by the end of the third quarter.

DDAmanda Chart on SGGH:

See DDAmanda.com for more info.

STT Radio Show on DDAmanda: http://ih.advfn.com/videos/educational/stt-radio-covers-dd-amanda-our-favorite-trading-tool-a-must-have-for-traders_2MmO4m5Kz08

z

ISR

getting me more than even (b9) booshing

[chart]http://stockcharts.com/h-sc/ui?s=ISR&p=D&yr=0&mn=6&dy=0&id=p72437070524[\chart]

GL to all..

ddbl

CTDT

Interesting chart, though a little squirrely intraday.

CTDT has developed and is perfecting a method to inexpensively produce large synthetic diamonds using collapsing magnetic fields.

CEO Alvin A.Snaper is a respected engineer and inventor, is credited with inventing or helping develop the IBM Selectric Type Ball, Tang, the NASA Apollo Photo-Pack and a coating process for Gillette razor blades, among many other things.

I made a good return on NVLX; I might jump back on to it. Meanwhile I've staked a position in CTDT.

What do you think of JCDS

Chart here.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=87370468

JCDS DD post.

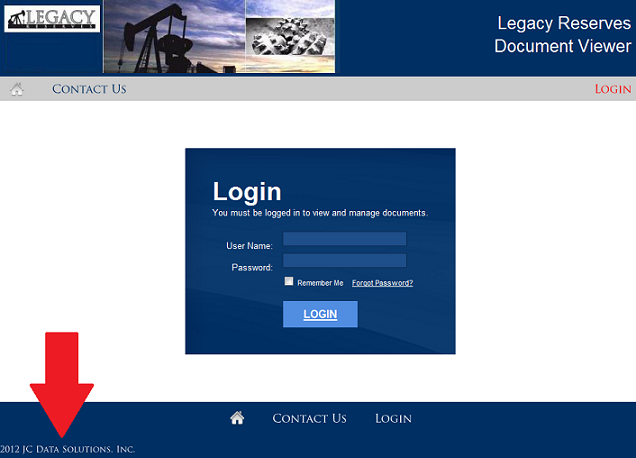

We know through the links to the Legacy Reserves website that JC Data Solutions provides services to this NASDAQ-traded company, LGCY.

https://www.legacylpdocs.com/Account/LogOn?ReturnUrl=%2f

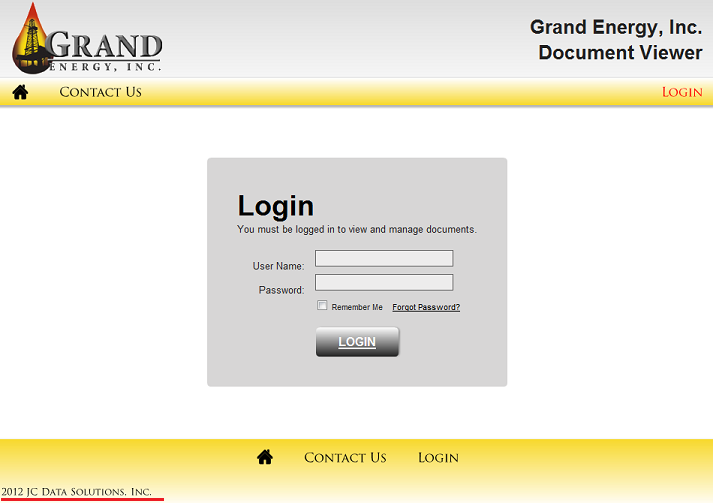

JC Data Solutions is now providing services for Grand Energy, Inc.

https://grandenergydocs.com/Account/LogOn?ReturnUrl=%2f

Grand Energy provides oil and gas to several companies including British Petroleum (NYSE:BP,) ConocoPhillips (NYSE:COP,) Sunoco Logistics (NYSE: SXL,) El Paso Pipeline Partners (NYSE: EPB,)and Oneok(NYSE: OKE)(NYSE: OKS)

http://www.grandenergy.com/html/product_purchasers.htm

Grand Energy also has several big board companies as service providers including Baker Hughes Incorporated (NYSE: BHI,) Halliburton (NYSE: HAL,) Schlumberger Limited(NYSE: SLB,) and Patterson-UTI Energy, Inc. (NASDAQ: PTEN)

http://www.grandenergy.com/html/service_providers.htm

It has also been documented that JC Data Solutions is a partner with Avatar Systems.

http://www.avatarsystems.net/

![]()

![]()

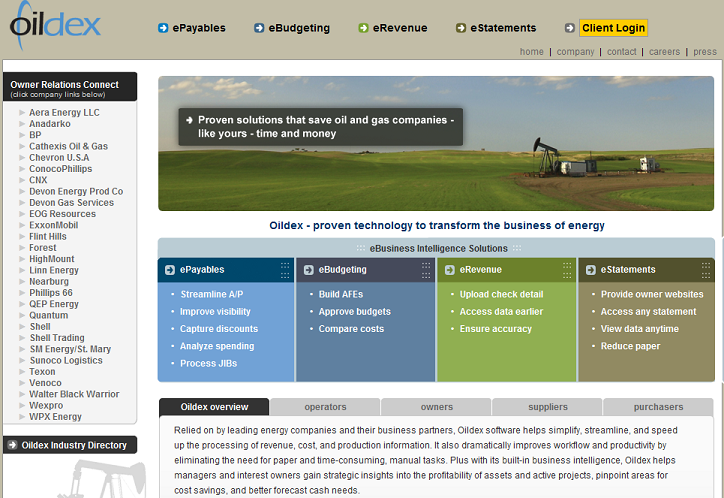

Avatar Systems is partnered with a few companies to provide services to the oil and gas industry including Oildex.com that has an impressive client list.

http://www.oildex.com/

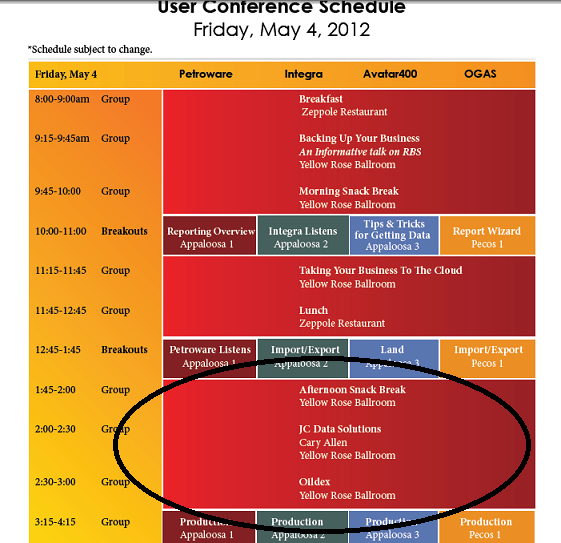

Early in 2012 JC Data Solutions CEO Cary Allen presented at a free software training seminar at the Avatar user conference in the same hour as Oildex. This was from page 7 of the Avatar schedule PDF.

http://www.avatarsystems.net/AvatarBrochureWEB.pdf

This user conference was a training session that highlighted products offered through Avatar Systems. The fact that Cary Allen presented in the same hour as Oildex seems to suggest some overlap or integration between JC Data Solutions and Oildex products.

The JC Data Solutions Website was updated in 2012 to reflect its expanded product offerings to include an Email Dispatch Center.

http://jcdata.com/products/email-dispatch-center/

JC Data Solutions also owns 50% of two private companies that were recently incorporated in Texas. The first company is Claims Expeditors, LLC which recently rolled out a new product offering called Appeal Manager™.

http://jwmdiagnostics.com/Physicians/appeal_manager.htm

The second company, Aeris Solutions has a new product in development and is scheduled for completion by the end of April, 2013.

Cary Allen, CEO of JCDS then hopes to have unaudited financials posted according to the latest PR.

IMO and FWIW.

MTSL looks like a nice buy here.

It looks a lot better than from where I bought it at least.

Check it out.

JCDS still looking good also.

I talked to the CEO today it is posted on the board.

JCDS Zero-Dilution, swift growth, Low O/S, Announcements SOON!$

JCDS No Dilution .... see DD..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=86698107

Bought on the way up, down, and now up again.

Sold? None.

Waiting for the bigger prize, also away from the computer:)

ah now I know where I saw you ..EP's board

glad you made it

JCDS

JCDS

Interesting. Subpenny, but serious DD on its IH page shows it could be one of those fractional rarities on the up-and-up.

I think this qualifies

and going higher

JCDS

http://stockcharts.com/h-sc/ui?s=JCDS&p=D&yr=1&mn=0&dy=0&id=p29211397529

No been buying more all the way up.

check out the DD on the board.

Excellent run. Taken any profits yet?

JCDS continues Its course upward.

HPOL ! Weekly chart looks booshable.

http://stockcharts.com/h-sc/ui?s=HPOL

Check out JCDS great information and DD on the board.

A few of the locals have bought in.

S looking good. Link back for chart.

Can anyone read EXBX chart and make sense of it?

Is a buy recommended?

NVLX

I just got into it for the extraordinary potential, and good results phases I and II.

Large outstanding for a penny biotech however. Do your DD, well duh.

CDOC NEWS: First Quarter 2013 Results

Lakeland, FL March 19th, 2013 – Coda Octopus Group, Inc. (OTC: CDOC.PK) yesterday announced its unaudited financial results for Q1 fiscal year 2013.

For the three months ending January 31, 2013, the Group achieved revenues of $4.5m, up from $4.1m for the previous year, and Net Income of $651k up from $436k in the previous year. The Group also generated a positive cash flow from its operating activities of $510k. These results are in keeping with progress the Group is making under its restructuring.

ISNS looking good. Chart back.

Doesn't look like them best time to ask you this(lol) but where the heck have ya been? Enjoy your posts on the jbii board

WTF! Hell no! Back to the engine room Johann!

EP, Enjoy your time away! As you know, we always appreciate your willingness and unselfishness in sharing your knowledge and charting expertise. Good luck on your book, we'll look foward to seeing it on the Best Seller's list!

Buford T.

Oh Sure. Wait till the poor guy promises to take a self appointed mental health break to offer YOUR 'services'. Lol

Can i have your board?....been kinda lookin' for another one....has 265 followers but i bet i can trim that number down day one with just the new name "The Asshole Board"....then whittle on down from there.....just whittlin'

Take a look at SMAA. Here's the chart:

http://stockcharts.com/h-sc/ui?s=smaa

EP ~ You'll be missed..and thanks for

being the 'backstage pass' for so many here on the charts!

Would like a copy of that book if ya getter done...I "know your gonna shine"!

...and thanks for still being 'available'!

EP... Enjoy... and...

Thanks for putting that Symphony of Science video. I did not know they were out there.

Very enjoyable. And, I was pulling myself away from the computer to catch up with domestic responsibilities and, oh well, a neat series of videos pulled me back (chuckle).

Enjoy your hiatus. May you find another level of sanity or insanity, which ever you choose.

"..moving with a pinch of grace.."

hope you can check-in bye and bye

Going on haitus...

I've found that I have less and less time in life for everything I like to do. Unfortunately, I would describe my reading and participating in message boards as a bad addiction. It chews up a lot of my time and thought, and crowds out a lot of the more productive tasks life calls for.

I've taken a few hiatuses in the last few years, and they were always cathartic. I read the boards far less as I restrict myself from participating, and then you start to view the message board world as alien and crazy. You become glad that you aren't going down this or that spiral in the group think. I've had many others describe this feeling as well.

It's also been very fun and rewarding to share ideas, explore possibilities, and interact with like-minded people. I cherish a lot of the relationships built through these boards.

If anyone wants to chat, exchange emails, or have some questions, feel free to email me. I don't think I can post my email here, but you can always PM yours through I-hub during the free happy hour on Friday from 4-5 Eastern.

One of the things on my to-do list is I'd like to write a book on technical trading. I definitely don't think it would make money, or something that would get a huge response, but feel I could write a very concise speculator, risk/reward, money management, technical analysis book that could benefit people in some way. I've seen quite a few of you here see the "boosher way" of looking at a chart, and it's always so exciting to see others get it.

Rainbows end down that highway where ocean breezes blow...

GLD falling into support here now. We'll see if the bulls can now repeat last summer, but I don't think it's likely beyond a quick bounce.

RMBS boosh! Thanks for bringing it to our attention Buford!

RMBS news after the bell. 6.15 last!

Got the RMBS break, now we'll see if it can boosh into the 6's over the next several days.

PPRTF and RMBS are my favorites at this point.

RMBS should run a buck if the market melts up, watch 5.65 break.

PPRTF is a great long term base chart, with a fairly sexy business model. Potash could get hot this year, as you can figure, and they are expecting data out before the end of the quarter on their property.

Courtesy of the Fed policy, all global assets are once again becoming overpriced. This reminds me of the idea sometimes attributed to Einstein that a workable definition of madness is constantly repeating the same actions but expecting a different outcome!

When one combines the apparent determination and influence of those who do the bullying with the career risk and short-termism of the bullied and the desire of the general public to believe unbelievable good news, these over pricings can go much further and the Fed can win another round or two. That’s the problem. A clue to timing would be when we begin to hear more passionate new era arguments: profit margins will always be higher; growth will snap back to 3% for the developed world; and new ones I can’t think of ... maybe “when the discount rate is this low the Dow should sell at, perhaps, 36,000.” In the meantime, prudent managers should be increasingly careful. Same ole, same ole.

Edward Chancellor

|

Followers

|

231

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

33456

|

|

Created

|

09/16/04

|

Type

|

Free

|

| Moderator Estimated_Prophet | |||

| Assistants wyobuford wharfrat | |||

This site is designed to give speculative stock trading ideas that hopefully give a higher potential upside than downside, and over relatively short periods of time. If you are using these ideas, it should be from spare money. One should not use retirement based funds for speculative trading ideas. Think of the children.

Most trade ideas are based on a technical approach, rather than by a fundamental one.

The common technical look and things to watch for in a "boosher":

Perceived reward 2 or more times larger than the risk(trend or consolidation break with stop loss).

Defined consolidation; Tight range with defined risk(stop loss) and defined boosh point(stop buy), with fairly measurable reward. Consolidations above previous highs from months or years ago, or just below all-time highs is ideal.

13ema above the 50 ema: Watch for the common kiss, and use the possible kiss area to initiate or add to a position. Cross can often be the kiss of death, but not always, especially if price reverses within a few days of the cross. This is the common measure of a bull or bear market for a particular stock.

ADX below 20: The longer the better. Shows high energy explosion or implosion.

13ema/20sma: Trademark boosh event. In a very bullish market, the 13 ema will stay above the 20sma and the kiss event is a great entry or addition point. Minimizes time risk, and dollar risk.

The only JBII discussion allowed here is for technical reasons.

Recommended Book Readings:

Reminiscences of a Stock Operator by Lefevre (Read it twice)

Trading For A Living by Elder

*Disclaimer-All investment decisions are the sole responsibility of the individual reading this crazy

little message board talking about stocks. One should always do proper due diligence and determine the suitability of that investment for themselves and the people that depend on them for daily bread. You could lose all of your money if you purchase an opinion from this board. Don't do something stupid and gamble your money away on booshers. Think of the children...think of the children.

|

Posts Today

|

0

|

|

Posts (Total)

|

33456

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |