Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I loaded up 0n this back around $89 when the NVDA crazy train was starting to really take off, and I couldn't be happier. Slow and steady wins the race.

~bought 4/19 $140 calls @.09c made this nonsense ends later today

~average down to .10c here

TSMC gets $6.6 billion in chipmaking cash from Biden while pledging to build a third Arizona plant

Ben Werschkul

Ben Werschkul·Washington Correspondent

Updated Mon, Apr 8, 2024, 8:34 AM EDT

The Biden administration said Monday it plans to send up to $6.6 billion in federal grants to the Taiwan Semiconductor Manufacturing Company (TSM) as the chipmaking giant promises a $25 billion Arizona expansion that will bring a third TSMC fabrication plant to that state.

The deal, the second major US chipmaking grant announcement of the last three weeks, is part of President Joe Biden's effort to restart advanced semiconductor manufacturing in the US.

In March Biden said the US would provide up to $8.5 billion in grants in the years ahead to Intel (INTC) to support a range of new projects in Arizona, Ohio, New Mexico, and Oregon.

The money for both companies is coming from 2022's CHIPs and Science law, a signature accomplishment of Biden's current term.

TSMC will use the grants to fund the continued construction of two manufacturing plants already being built in the Phoenix area. The company also announced Monday it would build a third facility there in the years ahead.

The goal is for all three plants to be online by the end of the decade and producing TSMC's most advanced chips. Some of the plants even hope to use a forthcoming 2 nanometer fabrication process and make even more advanced chips than are currently available.

"These are the chips that underpin all artificial intelligence and they are the chips that are necessary components for the technology that we need to underpin our economy," Commerce Secretary Gina Raimondo told reporters ahead of the announcement.

President Joe Biden, left, shakes hands with Taiwan Semiconductor Manufacturing Company Chairman Mark Liu, right, as the two meet on stage after touring the TSMC facility under construction in Phoenix, Tuesday, Dec. 6, 2022. (AP Photo/Ross D. Franklin)

President Joe Biden shakes hands with Taiwan Semiconductor Manufacturing Company Chairman Mark Liu during a tour of the TSMC facility under construction in Phoenix in Dec. 2022. (AP Photo/Ross D. Franklin) (ASSOCIATED PRESS)

The $6.6 billion in grants to be doled out in the years ahead include an allotment of $50 million for workforce development as well as additional authorization for up to $5 billion in government loans. That inflow comes in addition to manufacturing tax credits in the 2022 law that could be worth additional billions.

The government money will pair with TSMC's plans to invest over $65 billion in its Arizona operations. It had previously announced $40 billion and said today it would add an additional $25 billion largely to fund construction of the third fabrication facility.

Monday's news underlines the central role that Arizona is playing in the effort to bring back semiconductor manufacturing to the US.

President Biden has made multiple semiconductor-themed trips to the state in recent years including a stop last month to announce the grants for Intel, which is also building in the state.

"It’s an exciting day for Arizona, where we are leading the way in bringing the most advanced microchip manufacturing back to America," Arizona Senator Mark Kelly, a negotiator of the 2022 law, told Yahoo Finance.

Monday's announcement is the fifth manufacturing award from the law.

In addition to TSMC and Intel, three smaller manufacturing awards had been previously announced. There was roughly $35 million for BAE Systems (BAESY), $162 million for Microchip Technology, and $1.5 billion for GlobalFoundries (GFS) largely to fund the manufacturing of less advanced but still crucial chips.

The 20-month-old law allows the White House to spend a total of about $50 billion — $39 billion specifically earmarked for manufacturing — to try and help reignite the sector in the years ahead.

A focus on the labor market

Arizona's path to semiconductor centrality began back in May 2020 when TSMC announced new plans for the state.

It's an effort that has also been marked by struggles to ensure that enough Americans will be trained for the coming positions; TSMC recently announced a delay in their first US plant's full-scale launch from 2024 to 2025 and cited worker shortages as a reason and brought in Taiwanese workers to help keep up.

"I do expect that immigration and bringing in expertise from Taiwan both on the facilities side and the construction side will continue to be really important," a senior Biden administration official said ahead of the announcement. The official added that government and TSMC workforce development efforts will nevertheless mean "the overwhelming effects of this investment is going to be to create thousands and thousands of American jobs."

TSMC has also said that they expect some of the worker shortages will lessen in each subsequent project with Chairman Dr. Mark Liu saying recently of the first two projects that "even though we encountered challenges in Arizona for our first fab construction...we believe the construction of our second fab will continue to be much smoother."

Biden officials call TSMC's overall project the largest foreign direct investment in a completely new project in US history and is expected to create at least 6,000 direct permanent jobs in addition to 20,000 temporary construction jobs.

The project is also expected to lead to "tens of thousands" of additional jobs as other companies work to supply the new massive facilities.

The increased investment is due to an ever increasing demand from US companies for chips as well as for chips that are made inside the United States, says Lael Brainard who is the director of Biden's National Economic Council.

She notes that top officials like Apple (AAPL) CEO Tim Cook and NVIDIA (NVDA) CEO Jensen Huang attended a 2022 groundbreaking for TSMC's second facility in Arizona. Both Apple and NVIDIA currently rely almost exclusively on chips from the company that are manufactured in Taiwan.

In a statement Monday, Chairman Liu said the government's funding allowed for this increased investment adding "our U.S. operations allow us to better support our U.S. customers, which include several of the world’s leading technology companies."

Apple CEO Tim Cook listens to US President Joe Biden deliver remarks on his economic plan at TSMC Semiconductor Manufacturing Facility in Phoenix, Arizona, on December 6, 2022. (Photo by Brendan SMIALOWSKI / AFP) (Photo by BRENDAN SMIALOWSKI/AFP via Getty Images)

Apple CEO Tim Cook listens as President Joe Biden deliver remarks at a TSMC Semiconductor Manufacturing Facility in Phoenix in December 2022. (BRENDAN SMIALOWSKI/AFP via Getty Images) (BRENDAN SMIALOWSKI via Getty Images)

Monday's announcement is part of the Biden administration's ambitious overall goal of having the US produce 20% of the world's most advanced semiconductor chips by the end of the decade.

Secretary Raimondo oversees a team implementing the law and often notes the high challenge ahead with America currently producing 0% of these advanced chips (and only 10% of chips overall).

This post has been updated with additional context.

https://finance.yahoo.com/news/tsmc-gets-66-billion-in-chipmaking-cash-from-biden-while-pledging-to-build-a-third-arizona-plant-090026550.html

~just trying to time a potential run up before earnings.

It may be declining in the last month (it's called healthy consolidation). Try looking at the 3 month chart, or 6 month, or 1 year and then tell me again how it's declining.

I bought in around $89 back in September 2023. It doesn't look to me like it's declining.

It's all about perspective.

Is there any reason for you to buy these again and again? the stock is declining. Could not find any information about it.

~holding 3/28 $200 calls @.10c average

~bought more 3/22 $200 calls average is .21c now

bouncing off 140 twice already. this IMO will be higher than 150 by friday. TSM

~bought 3/22 $200 calls @.33c seems like a good deal this may be @ $200 SP next week TSM

~sold half 3/28 $200 calls @.63 :) bank profits before monthly sales report tomorrow

~sold 3/15 $175 calls @.15c

~sold 3/28 $175 calls @.40c :)

Earnings spotlight: Thursday, July 20 - Johnson & Johnson (JNJ), Abbott Laboratories (ABT), Taiwan Semiconductor Manufacturing (TSM), Philip Morris International (PM), Travelers (TRV), American Airlines (AAL), Capital One (COF), and CSX (CSX). Seeking Alpha analyst JR Research said: "Taiwan Semiconductor Manufacturing Company (TSMC) stock is still undervalued compared to its peers."

I'm out. For me right now, it's just not worth the risk.

https://fortune.com/2023/04/12/warren-buffett-tsmc-taiwan-chipmaker-china-war-foxconn-terry-gou-emmanuel-macron/

I bought this one because the story I came to believe made sense: Whoever the winners of the AI war may be, they will buy their “unrefined” chips from TSM. Not unlike Intel during the Microsoft-Apple war for dominance in PCs.

Maybe I’m naive on this one??

As for China, would it be in their interest to wreck this company? I suspect they would want it to be as profitable as possible.

Something to ponder...

Are your customers concerned,” one financial analyst asked Taiwan Semiconductor Manufacturing Company (TSMC) chairman Mark Liu last summer, when China from time to time threatens “a war against Taiwan?” CEOs are used to tough questions about capital expenditures and profit margins. Executives at the world’s largest producer of the semiconductors that power phones, computers, and data centers face more existential questions.

Making advanced chips requires using complex software, explosive chemicals, ultra-pure silicon, and machines costing hundreds of millions of dollars to pattern billions and billions of nanometer-sized transistors onto silicon wafers. For the past half-decade, TSMC has been the world’s leader, its engineers pioneering secret methods to pattern chips with unprecedented accuracy at unparalleled scale. TSMC has around 55% of the global market for contract chip fabrication, far above OPEC’s 40% market share for oil. And unlike the oil market, where each barrel is more or less the same, there are vast differences between types of chip. Taiwan produces almost all the most advanced processors, a market position that makes Saudi Arabia’s 12% share of global oil production look unimpressive.

Watch More

Each year, nearly a third of the new computing power we rely on each is fabricated in Taiwan. This has made TSMC one of the most valuable companies in the world. It has also left the entire world’s digital infrastructure dependent on a small island that China considers a rogue province and that America has pledged to defend by force.

The more indispensable TSMC has become to the global economy, the more risk has risen. Even investors who for years chose to ignore the growing severity of the U.S.-China antagonism began looking nervously at the map of TSMC’s chip fabs, arrayed along the western coast of the Taiwan Strait. TSMC’s chairman insists that there is no reason for concern. “As to the invasion of China, let me tell you,” he declared in 2021, “everybody wants to have a peaceful Taiwan Strait.” Taipei-born, Berkeley-educated, and Bell Labs-trained, Liu has an impeccable chipmaking record. His skill in assessing the risk of war, however, has yet to be tested. Peace in the Taiwan Strait “is to every country’s benefit,” he argued, given the world’s reliance on “the semiconductor supply chain in Taiwan. No one wants to disrupt it.”

Everyone would be losers including China.

No company is more singularly important to the global economy than the Taiwan Semiconductor Manufacturing Company, or TSMC. TSMC's advanced microchips are indispensable to iPhones, medical devices, missile launch platforms and many other technologies, and they are largely unrivalled.

What would happen to tsm if that were to actually happen?

TAIWAN PREPARES TO BE INVADED

If China wants to do something drastic, President Tsai Ing-wen told me, “Xi has to weigh the costs. He has to think twice.”

https://www.theatlantic.com/magazine/archive/2022/12/china-takeover-taiwan-xi-tsai-ing-wen/671895 $TSM

Ha, funny to bump into you so soon, Peter!

I got in TSM AH for the early morning ER.

I rarely play ERs but the R/R looked good. Acting strong.

Still, pretty sure the devil made me do it :)

Let's see, said the blind man.

MG

Taiwan Semiconductor Manufacturing is a foundry that produces cutting-edge AI chips designed by Nvidia, Apple Inc. (AAPL), Qualcomm Inc. (QCOM) and other semiconductor leaders. TSM also funds its own in-house AI hardware research in specialized areas such as near-memory and in-memory computing, embedded non-volatile memory technologies, 3D integration and error-resilient computing. A semiconductor shortage is supporting margins, and analyst Robin Cheng says the company is perfectly positioned to benefit from a period of high semiconductor industry growth driven by the digital transformation of the global economy. Bank of America has a "buy" rating and a $147 price target for TSM stock, which closed at $128.47 on Jan. 6.

Source: https://money.usnews.com/investing/stock-market-news/slideshows/artificial-intelligence-stocks-the-10-best-ai-companies?slide=9

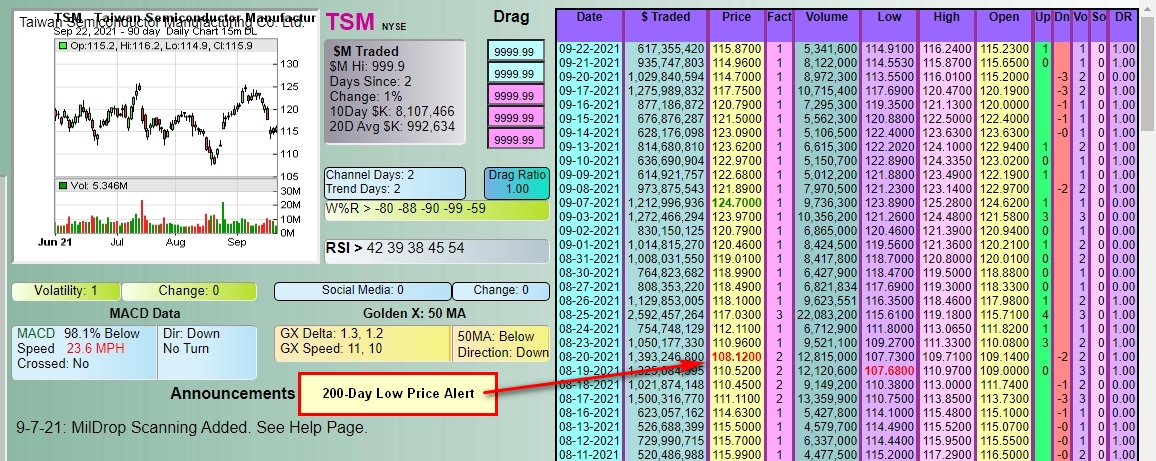

#DDAmanda Chart on: $TSM

You can scan for these before they run.

#DDAmanda Promo Code: dsh888

What the Fact (Factor) Column is:

The Factor is a proprietary indicator used for scanning in #DDAmanda.

It's defined as Today's $Traded divided by the average daily $Traded (20 day avg).

SO, if a stock has say a 10 Factor that day, it means she traded 10 Times the $ she normally trades.

That's significant, and many times indicates that a run in the stock is coming.

|

Followers

|

36

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

82

|

|

Created

|

08/16/16

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |