Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

9/22 Weekly Market Review & Outlook - An Abrupt Change in Leadership

http://stockcharts.com/members/articles/arthurhill/2017/09/weekly-market-review--outlook---an-abrupt-change-in-leadership.html

9/14 RSI(5) versus RSI(10) - Working with Zones, Alerts and Price Action

http://stockcharts.com/members/articles/arthurhill/2017/09/rsi5-versus-rsi10---working-with-zones-alerts-and-price-action.html

9/12 TDAmeritrade and Etrade Lead Broker-Dealer ETF - Delta and American Lead Airlines

http://stockcharts.com/members/articles/arthurhill/2017/09/tdameritrade-and-etrade-lead-broker-dealer-etf---delta-and-american-lead-airlines--.html

9/8 Weekly Market Review & Outlook - New Highs Dwindle and Banks Fall Hard

http://stockcharts.com/members/articles/arthurhill/2017/09/weekly-market-review--outlook---new-highs-dwindle-and-banks-falls.html

9/7 Bands Contract for DIA - QQQ Holds Breakout - Charts for Top 5 QQQ Stocks and More....

http://stockcharts.com/members/articles/arthurhill/2017/09/bands-contract-for-dia---qqq-holds-breakout---charts-for-top-5-qqq-stocks-and-more.html

9/5 10-yr Yield Tests June Low - Correlations to the 10-yr Yield - A Breakout for Brent

http://stockcharts.com/members/articles/arthurhill/2017/09/10-yr-yield-tests-june-low---correlations-to-the-10-yr-yield---a-breakout-for-brent-.html

9/1 Weekly Market Review & Outlook (w/ Video) - Tech and Healthcare Lead as Finance Lags

http://stockcharts.com/members/articles/arthurhill/2017/09/weekly-market-review--outlook-w-video---tech-and-healthcare-lead-as-finance-lags-.html

8/29 Measuring the Risk Appetite - 4 Inside Days and No Follow Thru - 6 Stock Charts

http://stockcharts.com/members/articles/arthurhill/2017/08/measuring-the-risk-appetite---4-inside-days-and-no-follow-thru---6-stock-charts.html

8/25 Weekly Market Review & Outlook (w/ Video) - When is Volatility a Problem? - Energy Stocks Buck Oil

http://stockcharts.com/members/articles/arthurhill/2017/08/weekly-market-review--outlook-w-video---when-is-volatility-a-problem---energy-stocks-buck-oil.html

8/24 Minding the Gaps in QQQ and SPY - Plus Bullish Setups in Tech-related ETF and Stocks

http://stockcharts.com/members/articles/arthurhill/2017/08/minding-the-gaps-in-qqq-and-spy---plus-bullish-setups-in-tech-related-etf-and-stocks.html

8/22 S&P 500, Five Percent and the 200-day SMA - Plus Scanning for Relative Strength within Sectors

http://stockcharts.com/members/articles/arthurhill/2017/08/sp-500-five-percent-and-the-200-day-sma---plus-scanning-for-relative-strength-within-sectors.html

8/18 bull market will end until the S&P 500 cries uncle

Those Noisy Small and Mid Caps

One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend. This is also true with broad market analysis. The selling pressure over the last four weeks was certainly intense, but is it enough to end the bull market? The chart below shows the S&P 500 SPDR (SPY), S&P MidCap SPDR (MDY) and S&P SmallCap iShares (IJR) as line charts with the 5% Zigzag. This indicator changes direction when there is a move greater than 5% (except for the most recent move).

Notice that MDY declined more than 5% on three different occasions since April 2016 (red areas) and IJR did the same on five different occasions. SPY, on the other hand, only experienced one pullback that exceeded 5% (closing basis). Deeper pullbacks and choppier price action in small-caps and mid-caps have defined the current bull run, pre and post election. As concerning as it is to see relative weakness in small-caps, I don't not think the bull market will end until the S&P 500 cries uncle.

8/18 Weekly Market Review & Outlook - Those Noisy Small and Mid Caps

http://stockcharts.com/members/articles/arthurhill/2017/08/weekly-market-review--outlook---those-noisy-small-and-mid-caps.html

8/15 Transport ETF Holds Breakout, Semiconductor ETF Holds Support, Fab 5 Tech Stocks

http://stockcharts.com/members/articles/arthurhill/2017/08/transport-etf-holds-breakout-semiconductor-etf-holds-support-fab-5-tech-stocks-.html

8/11 Weekly Market Review & Outlook - A New High and a Big Decline

http://stockcharts.com/members/articles/arthurhill/2017/08/weekly-market-review--outlook---a-new-high-and-a-big-decline-.html

8/10 SystemTrader - Tempering Volatility by Using RSI to Rank Stocks

RSI dampens volatility by measuring the gains relative to the losses.

http://stockcharts.com/members/articles/arthurhill/2017/08/systemtrader---tempering-volatility-by-using-rsi-to-rank-stocks---.html

8/8 Key note.

Note that these systems do not care about earnings, valuations, extended trends or even the Fed!

extended trends = Starting to see this too.

8/8 Another Mean-Reversion Setup for Small-caps and Mid-Caps - Oil and XES Break Up - Six Stock Setups

http://stockcharts.com/members/articles/arthurhill/2017/08/another-mean-reversion-setup-for-small-caps-and-mid-caps---oil-and-xes-break-up---six-stock-setups.html

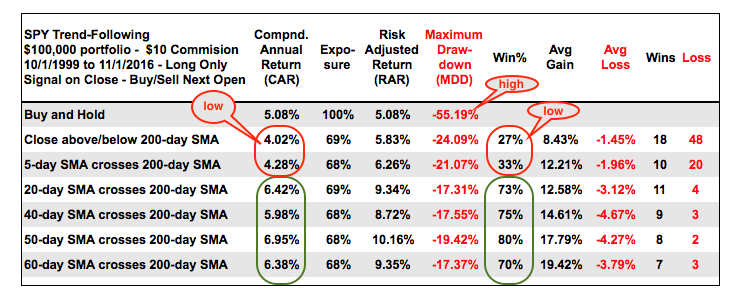

50 SMA ABOVE 200 SMA 10.16 % RISK ADJUSTED RETURN ......EXPOSURE 68 %

Backtesting Moving Average Performance

The two most popular moving average periods are 50 days and 200 days. I would also venture a guess that simple moving averages are used more than exponential moving averages. Taken together, the S&P 500 is the most widely followed index, and the 50-day and 200-day SMAs are the most widely used moving averages. It seems that the S&P 500 with these two moving averages is important just because so many pundits follow this combination. It kind of becomes a self-fulfilling prophecy. Let's look at some backtest result to see just how well this moving average pair works.

See 6 th row

http://stockcharts.com/members/articles/arthurhill/2016/11/systemtrader---how-to-become-a-smooth-operator-with-moving-averages---backtesting-different-moving-average-pairs.html

6/18 IJR MEAN REV RSI 5 STUDY OF CLOSING TRADE

http://stockcharts.com/members/articles/arthurhill/2017/05/mean-reversion-for-ijr-china-asia-aluminum-railroads-and-six-stocks-to-watch.html

8/4 Weekly Market Review & Outlook - We've Seen this Movie Before

http://stockcharts.com/members/articles/arthurhill/2017/08/weekly-market-review--outlook---weve-seen-this-movie-before-ijr-rsp-spy-tlt.html

8/3 SystemTrader - Reworking the ChartCon Momentum Rotation Strategy - Cut your Profits and don't Worry about Stops

http://stockcharts.com/members/articles/arthurhill/2017/08/systemtrader---reworking-the-chartcon-momentum-rotation-strategy---cut-your-profits-and-dont-worry-about-stops--.html

8/1 Oil Could Hit Resistance Soon - Equipment and Services ETF Lags - Plus XOM, CVS, GS, SCHW, L, TRV and BMY

http://stockcharts.com/members/articles/arthurhill/2017/08/oil-could-hit-resistance-soon---equipment-and-services-etf-lags---plus-xom-cvs-gs-schw-l-trv-and-bmy.html

7/28 Weekly Market Review & Outlook - Breadth is Bullish Enough

http://stockcharts.com/members/articles/arthurhill/2017/07/weekly-market-review--outlook---breadth-is-bullish-enough-.html

7/27 Customizing CandleGlance with 6 Homebuilders, Diamonds are Not Bearish and 3 Asian ETFs Poised for an Upturn

http://stockcharts.com/members/articles/arthurhill/2017/07/customizing-candleglance-with-6-homebuilders-diamonds-are-not-bearish-and-3-asian-etfs-poised-for-an-upturn.html

77/25 SPY Hits Another New High - Are Rates Turning Up? - Regional Banks Lead Market Higher

Arthur Hill | July 25, 2017 at 11:49 AM

http://stockcharts.com/members/articles/arthurhill/2017/07/spy-hits-another-new-high---are-rates-turning-up---regional-banks-lead-market-higher.html

7/7 Weekly Market Review & Outlook (w/ Video) - Analyzing the Correction Evidence

http://stockcharts.com/members/articles/arthurhill/2017/07/weekly-market-review--outlook-w-video---analyzing-the-correction-evidence.html

7/6 Homebuilders March Higher - Customizing CandleGlance - Plus 2 Housing Stocks, 3 Biotechs, 3 Cyber Security Plays and 3 for the Road

http://stockcharts.com/members/articles/arthurhill/2017/07/homebuilders-march-higher---plus-2-related-stocks-3-biotechs-3-cyber-security-plays-and-3-for-the-road.html

6/30 Weekly Market Review & Outlook - QQQ Starts Correction as SPY and IJR Hold Up

http://stockcharts.com/members/articles/arthurhill/2017/06/weekly-market-review--outlook---qqq-starts-correction-as-spy-and-ijr-hold-up-.html

9/29 The Great Rate Debate - 4 Regional Banks and 3 Steel Stocks Bid to End Corrections

http://stockcharts.com/members/articles/arthurhill/2017/06/the-great-rate-debate---4-regional-banks-and-3-steel-stocks-bid-to-end-corrections.html

6/27 Bearish Candles Hit Big Tech Stocks - Plus two Brokers, Two Big Banks and More

http://stockcharts.com/members/articles/arthurhill/2017/06/bearish-candles-hit-big-tech-stocks---plus-two-brokers-two-big-banks-and-more.html

6/23 Weekly Market Review & Outlook - Two of Nine Sector SPDRs Hit New Highs

http://stockcharts.com/members/articles/arthurhill/2017/06/weekly-market-review--outlook---two-of-nine-sector-spdrs-hit-new-highs.html

6/22 ADRs, ETFs and Currency - Analysis for EEM, Poland, China, Italy and Spain

http://stockcharts.com/members/articles/arthurhill/2017/06/adrs-etfs-and-currency---analysis-for-eem-poland-china-italy-and-spain.html

6/20 Market Shows Broad Strength, Techs Get Mojo Back, Bank ETFs Stall and 12 Stock Setups

http://stockcharts.com/members/articles/arthurhill/2017/06/market-shows-broad-strength-techs-get-mojo-back-bank-etfs-stall-and-12-stock-setups.html

6/18 IJR MEAN REV RSI 5 STUDY OF CLOSING TRADE

http://stockcharts.com/members/articles/arthurhill/2017/05/mean-reversion-for-ijr-china-asia-aluminum-railroads-and-six-stocks-to-watch.html

6/16 Weekly Market Review & Outlook - New Highs for Major Index ETFs and New Sector Leadership

http://stockcharts.com/members/articles/arthurhill/2017/06/weekly-market-review--outlook---new-highs-for-major-index-etfs-and-new-sector-leadership.html

6/15 SystemTrader - Put the VIX Through the Wringer and Testing Signals with SPY

http://stockcharts.com/members/articles/arthurhill/2017/06/systemtrader---put-the-vix-through-the-wringer-and-testing-signals-with-spy.html

6/13 QQQ Takes a Hit, Two Leading EW Sectors and Eight Stock Setups

http://stockcharts.com/members/articles/arthurhill/2017/06/qqq-takes-a-hit-two-leading-ew-sectors-and-eight-stock-setups.html

6/9 Weekly Market Review & Outlook - Small-caps, Finance and Miners Bid to End Corrections

http://stockcharts.com/members/articles/arthurhill/2017/06/weekly-market-review--outlook---small-caps-finance-and-miners-bid-to-end-corrections.html

6/8 Determining Trend Direction and Trend Strength with Simple Indicators - Plus Scan Code

http://stockcharts.com/members/articles/arthurhill/2017/06/determining-trend-direction-and-trend-strength-with-simple-indicators---plus-scan-code.html

6/6 Using EMA Ribbons to Define Strong Trends - Gold Leaves the Gold Miners Behind

http://stockcharts.com/members/articles/arthurhill/2017/06/using-ema-ribbons-to-define-strong-trends---gold-leaves-the-gold-miners-behind.html

6/2 Weekly Market Review & Outlook - Participation is Broad Enough as New Highs Expand

http://stockcharts.com/members/articles/arthurhill/2017/06/weekly-market-review--outlook---participation-is-broad-enough-as-new-highs-expand.html

6/1 Small-caps Rebound - Plus A Big Chemical Breakout, an Industrial Breakout, Four Tech Corrections and Two Big Pharmas Perk Up

http://stockcharts.com/members/articles/arthurhill/2017/06/small-caps-bounce-rebound---plus-a-big-chemical-stock-breakout-an-industrial-breakout-four-tech-corrections-and-two-big-pharmas-perk-up.html

5/30 Mean-Reversion for IJR, China, Asia, Aluminum, Railroads and Six Stocks to Watch

http://stockcharts.com/members/articles/arthurhill/2017/05/mean-reversion-for-ijr-china-asia-aluminum-railroads-and-six-stocks-to-watch.html

5/26 Weekly Market Review & Outlook - It is Still a Large-cap World

http://stockcharts.com/members/articles/arthurhill/2017/05/weekly-market-review--outlook---it-is-still-a-large-cap-world-.html

5/25 SystemTrader - Trailing Stops versus Profit Targets for a Moving Average Crossover System

http://stockcharts.com/members/articles/arthurhill/2017/05/systemtrader---trailing-stops-versus-profit-targets-for-a-moving-average-crossover-system.html

5/23 Five Sectors Lead New High List - 10 Bullish Stock Setups

http://stockcharts.com/members/articles/arthurhill/2017/05/five-sectors-lead-new-high-list---10-bullish-stock-setups.html

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

461

|

|

Created

|

06/20/15

|

Type

|

Premium

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |