Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

SGMDD

Sugarmade, Inc.

Common Stock

0.005

-0.015

-75.00%

0.005 / 0.019 (1 x 1)

Real-Time Best Bid & Ask: 01:20pm 10/20/2023

Delayed (15 Min) Trade Data: 12:35pm 10/20/2023

Overview

Quote

Company Profile

Security Details

News

Financials

Disclosure

Research

Warning! This security is eligible for Unsolicited Quotes Only

This stock is not eligible for proprietary broker-dealer quotations. All quotes in this stock reflect unsolicited customer orders. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. An initial review by a broker-dealer under SEC Rule15c2-11 is required for brokers to publish competing quotes and provide continuous market making.

SGMD one for 200 reverse split:

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

Rinse n Repeat, 1:200

These crooks should be arrested. I never got my Bud Cars

Interesting price, run maybe

My post is 100% accurate!

Debt conversion allows brokers to short sell at the higher price, then they get the debt diluted shares cheap to cover the shorts. The float rises and the price falls.

-A company starts with 100,000,000 shares

-The company adds debt on the books (budcars or whatever)

-Debt diluters give the CEO $100,000 (Paying off the fake debt) for 100,000,000 shares restricted

-Debt diluters show they paid debt and the benefit is the 100,000,000 become free trading.

-Debt diluters do that 20 times and end up with 2,000,000,000 free trading shares

-The CEO makes less and less for each 100,000,000 so the CEO may make only $1,000,000 at best.

-Debt diluters PUMP the crap out of the stock at $.15 per share BUDCARS, NASDAQ, $100,000,000 in sales etc.

-Investors believe with only 100,000,000 in the float, once they are sold the price will rise.

-PROBLEM

-Brokers are NOT selling just 100,000,000, they are selling short 1,000,000,000 at the same $.15 but no one sees the increased float YET.

-Once the shorted shares are sold at $.15 and the brokers took in $150,000,000 CASH! they pay the debt investors $20,000,000.00

-The debt investors issue to the brokers the 1,000,000,000 shares to cover the shorts.

-Since the debt investors shares are NO LONGER owned by the company, ALL investors are doing is giving money to the brokers and private person NOT the company.

-The brokers cover the shorts, and the float increases to 1,000,000,000 or more.

-Brokers make $130,000,000 (Plus all the commissions)

-Debt investors make $19,000,000

-CEO makes $1,000,000

-CAN YOU GUESS WHO LOSES? ALL OF YOU!

They said they would file to go to NASDAQ and people took that as they are. Investors are so DUMB they didn't even realize SGMD did not have the requirements to be approved to be listed on NASDAQ. No marijuana filed, no PPE orders, no nudge ave or what ever you call it, no bud cars, no nothing.

This is what they have: A website, a PO box and diluted shares to sell as long as idiots keep buying them. No company, No assets, No office, No revenue. NOT to mention when you buy SGMD shares they are not shares owned by the company any more so NONE of the money people spend on shares ever gets to the company. WAKE UP!

People have only themselves to blame for losing on this stock. I try to educate others but they think they are so smart. My guess investors favorite color is RED because that is all the see in their stock accounts.

Bud cars never existed. Bud cars was a photoshopped creation.

Terrible what happened here

Open 0.0002 buy 0.0001 and be up 100% and buy 0.0002 be down 50%

$$$$ After a long and arduous wait, it looks like the SAFER Banking Act, the renamed version of the bipartisan law that would allow banks to work with cannabis businesses without penalties, is finally showing some traction after languishing in Congress. Today, the Senate Committee on Banking, Housing and Urban Affairs held a “markup” on the legislation and as expected, the bill passed decisively.

Although members of the House did overwhelmingly vote for the SAFE Banking Act, the bill’s earlier version, several times before, today’s vote marks the first time that Senate members have voted in favor of the measure.

Now it’s off to the Senate and the House for more debate, amendment and votes before hopefully proceeding to President Biden’s desk. If all goes well, the banking ban that has been the scourge of the legal cannabis industry since its inception will be lifted.

$MMNFF

I told people buyer beware when the shares were at $.15!

Buyer's Beware!Warning! This security is eligible for Unsolicited Quotes Only

This stock is not eligible for proprietary broker-dealer quotations. All quotes in this stock reflect unsolicited customer orders. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. An initial review by a broker-dealer under SEC Rule15c2-11 is required for brokers to publish competing quotes and provide continuous market making.

Thanks captain obvious

ECGI is just another reverse merger pump and dump. they are also affiliated with NUGS scheme and ECGI is run by the same Chinese associates that destroyed SGMD. You are welcome.

ECGI Has A Low Float You Are Welcome To Join In On It Under 15 Million .

Sugarmade Is A Scam Billions Of Shares Dumped Nothing Here But A Revers Split ! ATM Shut Down !

www.otcmarkets.com

Warning! This security is eligible for Unsolicited Quotes Only

This stock is not eligible for proprietary broker-dealer quotations. All quotes in this stock reflect unsolicited customer orders. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. An initial review by a broker-dealer under SEC Rule15c2-11 is required for brokers to publish competing quotes and provide continuous market making.

Anyone buy at 0.0001 and then to sell when

0.0001 go up or reverse split

Volume = Dilution not liquidity when the share price drops.

Liquidity is not dilution if the share price rises.

Liquidity and dilution are one and the same, the word chosen depends on the price.

Since all these schemes drop in price, its all dilution because liquid means you can sell shares easily but at a lower price. buy high sell low what a strategy.

They still going to NASDAQ? lol

What are the chances of a reverse split

Sugarmade Inc. holders, jimmy chan (all lowercase), bought hubs (Sugarmade.com), land, and vehicles with Shareholders' money, and now he's pocketing off your dime. Call FINRA, OTCMarkets, and The Sec. of State of California and explain to them about all the assets he bought with Shareholders Money. Now, he's the only one benefiting after all the misleading statements he put out there.

Smart to invest in bud cars

Anyone get 0.0001 recently, have not been here for a while

|

Followers

|

480

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

53241

|

|

Created

|

08/11/06

|

Type

|

Free

|

| Moderators | |||

Email: info@sugarmade.com Phone: (626) 346-9512

OTC MARKETS - QUICK LINKS

QUOTE

NEWS

DISCLOSURE

SECURITY DETAILS

SEC (EDGAR) - (OTCQB:SQMD) FILINGS

SEC FILINGS

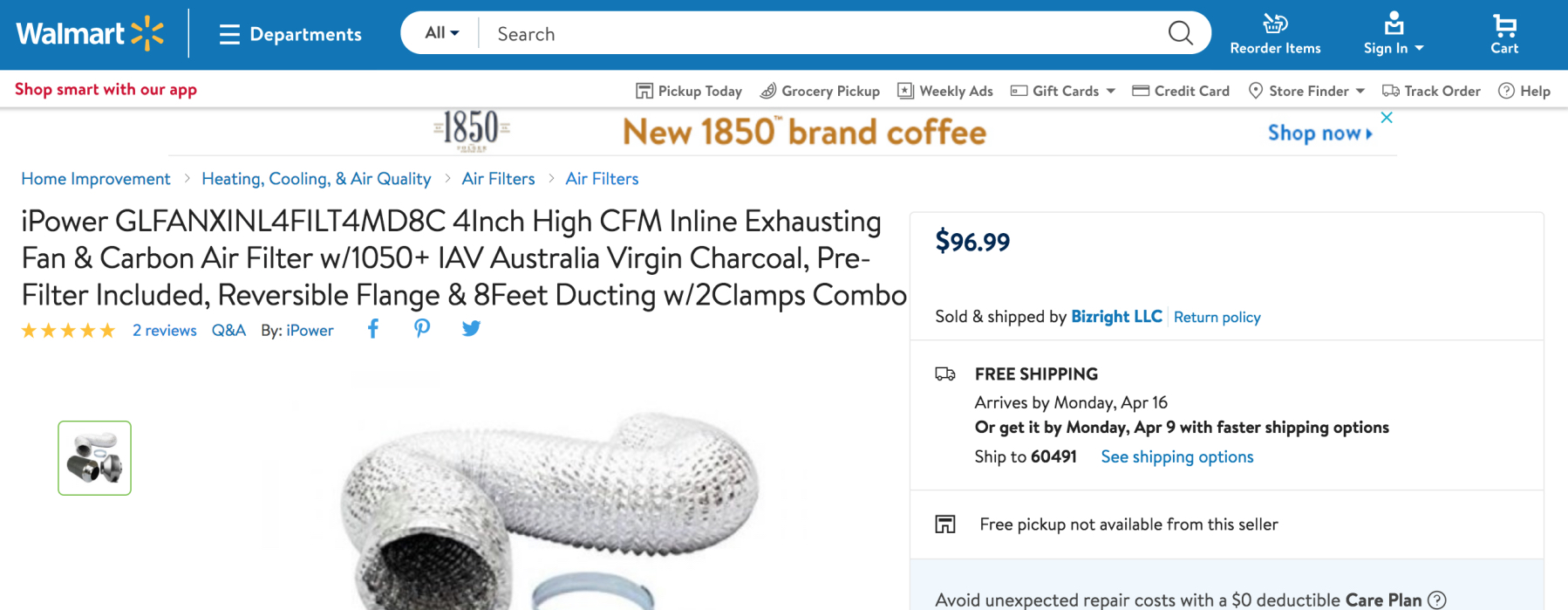

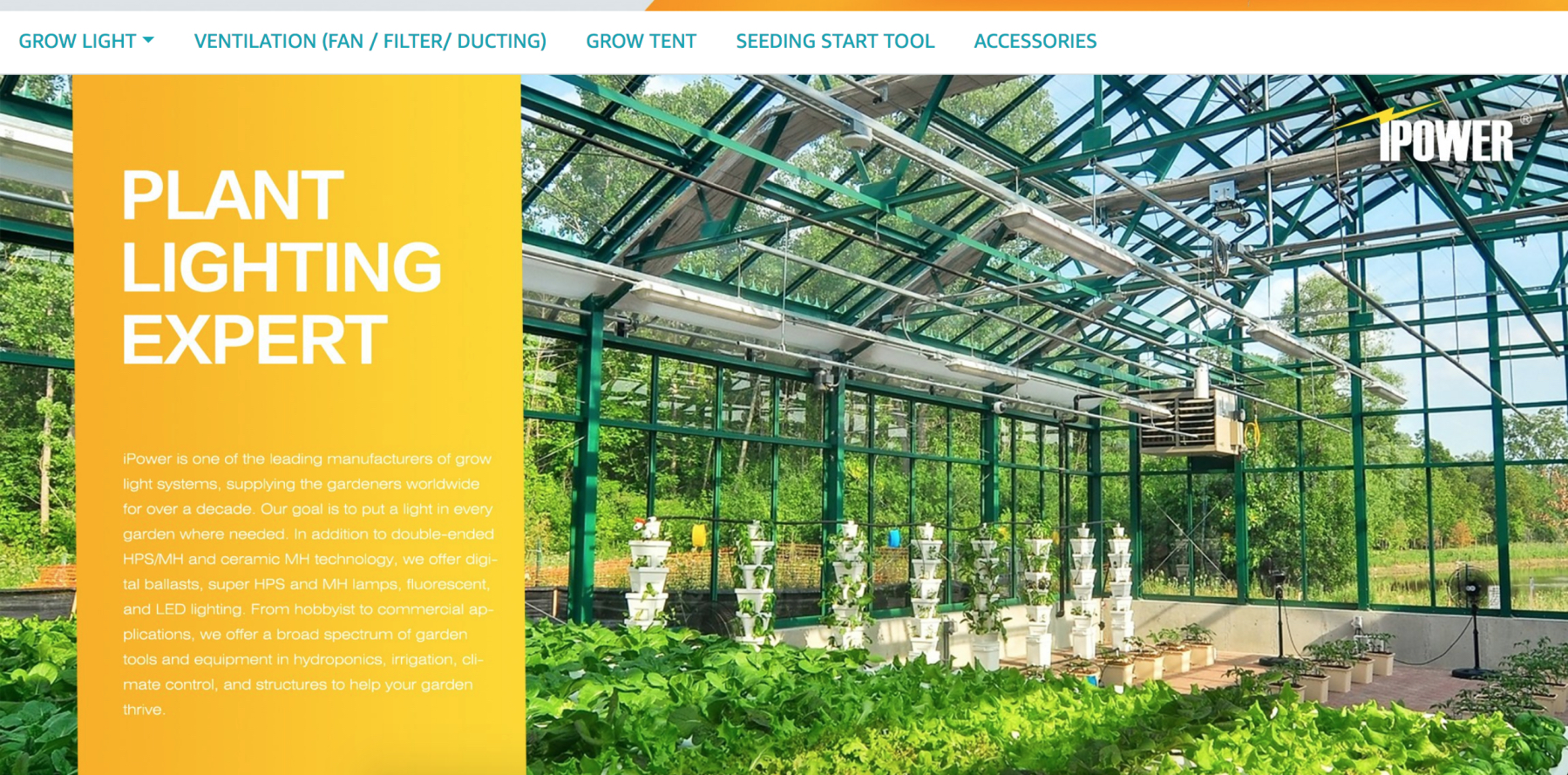

On January 23, 2019 Sugarmade, Inc. (the “Company”) announced the signing of a Letter of Intent (the “LOI”) to acquire a retail location of Washington State-based Hydro4Less. The LOI outlines the general terms of a possible acquisition transaction. Pending the signing of a definitive agreement, Sugarmade will issue Five Million Dollars ($5,000,000) of its common shares at a price pegged at Ten Cents ($0.10) to the owners of Hydro4Less in exchange for the single retail operation, not including inventories on hand.

Additionally, via the pending transaction, Sugarmade will gain an option, at an acquisition price to be determined later, to purchase two additional Hydro4Less retail operations, which are currently producing in excess of Twenty Million Dollars ($20,000,000) annually. The single location acquisition that is the subject of the LOI, is expected to produce approximately Five Million Dollars ($5,000,000) for calendar year 2019 and is currently operating at a profit with positive operating cash flow. The Company believes the single location the acquisition would be accretive to earning for Sugarmade. Should all three acquisitions close, Sugarmade will increase its annual revenues by approximately Twenty Five Million Dollars ($25,000,000) million per year.

Hydro4Less is significant supplier to the growing hydroponic cultivation sector. Neither the Company nor Hydro4Less conduct any business involving the sale of any cannabis product or relating to any products containing cannabis.

BUDLIFE CANNABIS STORAGE

World's First And Only Patented Storage For Preserving Cannabis Flowers. Maximizing the Power of Medical Cannabis.

SUMMARY - Sugarmade, Inc. (OTCQB:SGMD) plans a leadership role in the market for cannabis storage via introduction of patented storage containers that utilize modified intelligent atmosphere packaging to extend the life of cannabis, preserve terpenes and THC/CBC levels, prevent spoilage, and reduce dangerous pathogens.

| | Authorized Shares | 1,990,000,000 | 12/31/2018 |

| | Outstanding Shares | 646,888,318 | 12/31/2018 |

| | -Restricted | 454,296,711 | 12/31/2018 |

| | -Unrestricted | 192,591,607 | 12/31/2018 |

| | Held at DTC | 184,493,775 | 12/31/2018 |

| | Float | 190,091,607 | 12/27/2018 |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |