Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Have not been here for a while

Interesting share structure

Probably 0.0001 speculating 1,000,000%

Think, they will get there in no time

Interesting with cars a while back

Like share structure will they dump to billions shares

Wow up 0.0012 on hardly any volume

Feel bad shareholders with r s

Hardly any shares outstanding

Shareholders new and old post

Interesting cars a while back

Buz cars interesting a while back

How's that going? Jimmy Chan and Joe Noel?

Could have potential, is that right 66,000,000 ish outstanding

Not many shares outstanding

Last three months 0.002 any buyers still here

|

Followers

|

480

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

53215

|

|

Created

|

08/11/06

|

Type

|

Free

|

| Moderators | |||

Email: info@sugarmade.com Phone: (626) 346-9512

OTC MARKETS - QUICK LINKS

QUOTE

NEWS

DISCLOSURE

SECURITY DETAILS

SEC (EDGAR) - (OTCQB:SQMD) FILINGS

SEC FILINGS

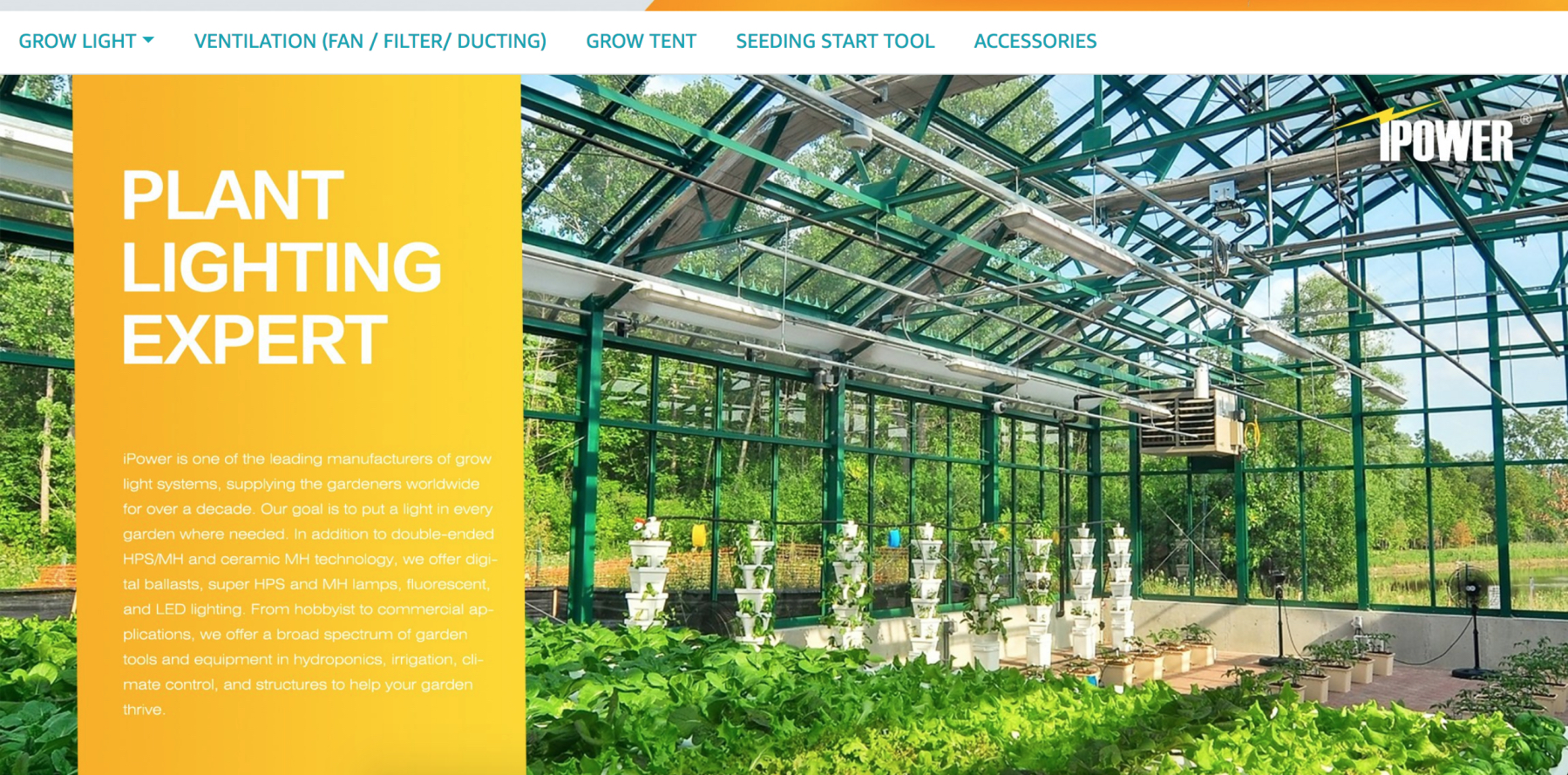

On January 23, 2019 Sugarmade, Inc. (the “Company”) announced the signing of a Letter of Intent (the “LOI”) to acquire a retail location of Washington State-based Hydro4Less. The LOI outlines the general terms of a possible acquisition transaction. Pending the signing of a definitive agreement, Sugarmade will issue Five Million Dollars ($5,000,000) of its common shares at a price pegged at Ten Cents ($0.10) to the owners of Hydro4Less in exchange for the single retail operation, not including inventories on hand.

Additionally, via the pending transaction, Sugarmade will gain an option, at an acquisition price to be determined later, to purchase two additional Hydro4Less retail operations, which are currently producing in excess of Twenty Million Dollars ($20,000,000) annually. The single location acquisition that is the subject of the LOI, is expected to produce approximately Five Million Dollars ($5,000,000) for calendar year 2019 and is currently operating at a profit with positive operating cash flow. The Company believes the single location the acquisition would be accretive to earning for Sugarmade. Should all three acquisitions close, Sugarmade will increase its annual revenues by approximately Twenty Five Million Dollars ($25,000,000) million per year.

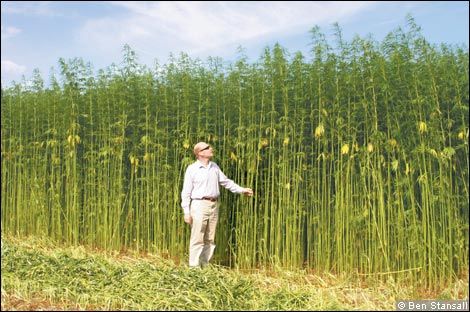

Hydro4Less is significant supplier to the growing hydroponic cultivation sector. Neither the Company nor Hydro4Less conduct any business involving the sale of any cannabis product or relating to any products containing cannabis.

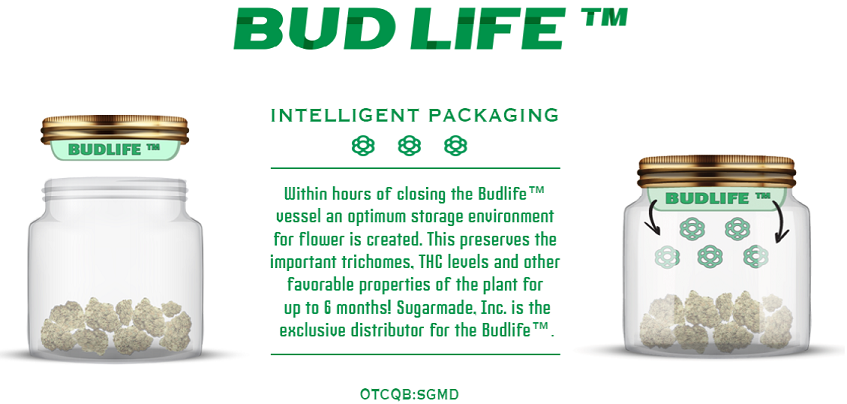

BUDLIFE CANNABIS STORAGE

World's First And Only Patented Storage For Preserving Cannabis Flowers. Maximizing the Power of Medical Cannabis.

SUMMARY - Sugarmade, Inc. (OTCQB:SGMD) plans a leadership role in the market for cannabis storage via introduction of patented storage containers that utilize modified intelligent atmosphere packaging to extend the life of cannabis, preserve terpenes and THC/CBC levels, prevent spoilage, and reduce dangerous pathogens.

| | Authorized Shares | 1,990,000,000 | 12/31/2018 |

| | Outstanding Shares | 646,888,318 | 12/31/2018 |

| | -Restricted | 454,296,711 | 12/31/2018 |

| | -Unrestricted | 192,591,607 | 12/31/2018 |

| | Held at DTC | 184,493,775 | 12/31/2018 |

| | Float | 190,091,607 | 12/27/2018 |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |