Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Aurcana Silver live webinar on Fri, Jun 4 at 11:00 AM EDT

Join the Aurcana Silver Corporation (AUN.V; AUNFF) live webinar on Fri, Jun 4 at 11:00 AM EDT.

Register here: https://www.amvestcapital.com/webinar-directory/aurcana060421

Aurcana Silver on track to become major producer (TSX:AUN.V; OTCQX:AUNFF)

KOOTENAY SILVER INTERCEPTS 809 GPT SILVER OVER 2.63 METERS WITHIN 354 GPT SILVER OVER 9 METERS IN THE F VEIN AT COLUMBA PROJECT, MEXICO

May 25, 2021

Kootenay Silver Inc. (TSXV: KTN; OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce additional high-grade silver results from the Company’s 5,000 meter core drill program currently underway at its Columba silver project (the “Property”) located in Chihuahua State, Mexico.

James McDonald, President & CEO reports, “CDH-21-94 and 96 continue to hit consistent and high-grade results in the F Vein and are particularly important. They encountered excellent grades to 985 gpt and 425 gpt silver, respectively, within wide zones of high and moderate grades in a large area of the vein with no previous drilling.”

Augmenting the high-grade, in some areas, are thick zones of mineralization coming into the high-grade such as hole CDH-21-96 where over 30 meters of continuous mineralization averaged 86 gpt silver. A number of other areas within the F Vein show similar thick intervals coming into the high-grade such as holes CDH-20-41 (39.9 meters of 159 gpt silver), CDH-20-47 (15.65 meters of 166 gpt silver), CDH-20-51 (36 meters of 72 gpt silver), CDH-20-52 (42.43 meters of 61 gpt silver), CDH-20-53 (34 meters of 116 gpt silver) and CDH-21-89 (70.5 meters of 112 gpt silver). These thick zones of silver mineralization preceding the high grade have the potential to add significantly to the amount of silver within the F Vein.

Drill Highlights - Holes CDH-21-091 to 096:

CDH-21-091

* 271 gpt silver over 0.85 meters within 189 gpt silver over 1.55 meters in the F Vein

CDH-21-092

* 368 gpt silver over 0.94 meters within 217 gpt silver over 2.44 meters in the Hanging-wall structure

* 439 gpt silver over 1.14 meters within 321 gpt silver over 2.94 meters in in the F Vein

* 255 gpt silver over 2.9 meters within 130 gpt silver over 8.0 meters in the Footwall

* Hit 3 different Vein sets in the Hanging-Wall Vein, F Vein and a Footwall Vein.

* 425 gpt silver over 2.37 meters within 230 gpt silver over 9 meters and 86 gpt silver over 30 meters in the F Vein System.

CDH-21-094

* 985 gpt silver over 1.5 meters and 809 gpt silver over 2.63 meters within 354 gpt silver over 9 meters in the F Vein

* CDH-21-94 tested an area about 200 meters from the old shaft in a large undrilled segment.

* CDH-21-95 hit a fault and thus missed the F Vein.

CDH-21-096

* 425 gpt silver over 2.37 meters within 230 gpt silver over 9 meters and 86 gpt silver over 30 meters in the F Vein System.

* Hole CDH-21-096 is about 50 meters along strike and 30 meters deeper than CDH-21-94 and also tested a large area with no drilling.

* CDH-21-95 hit a fault and thus missed the F Vein.

Click the following links to view: Plan Map, Long Section https://tinyurl.com/35zfrz35 and Cross Sections https://tinyurl.com/2y2vesvd for holes CDH-21-091 to CDH-21-096.

Detailed Drill Results – Holes CDH-21-091 to CDH-21-096

Detailed results for all drill holes completed to date at the Columba high grade silver project can be viewed by clicking the following link: Columba Drill Results https://tinyurl.com/464p655k

Notes: All widths are drilled widths. At this time, it is estimated true widths will range from 55 to 94% of drilled widths depending on dip of the vein and inclination of the hole. All silver composites rounded to the nearest whole number.

Drilling continues at Columba within the JZ Vein area, located 700 meters east of the F Vein.Previous drilling in this region confirmed the discovery of a broad zone of high grade hydrothermal breccias that encompasses a low to medium grade quartz stockwork system at the J-Z Zone.Results in the JZ Area are highlighted by hole CDH-20-030 (415 gpt silver over 11.15 meters including 721 gpt silver over 4.07 meters) and hole CDH-20-060 (132 gpt silver over 64 meters including 361 gpt silver over 11 meters including 608 gpt silver over 5 meters, and 1,160 gpt silver over 1 meter all within 229 gpt silver over 22 meters).

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

Sampling and QA/QC at Columba

All technical information for the Columba exploration program is obtained and reported under a formal quality assurance and quality control ("QA/QC") program. Samples are taken from core cut in half with a diamond saw under the direction of qualified geologists and engineers. Samples are then labeled, placed in plastic bags, sealed and with interval and sample numbers recorded. Samples are delivered by the Company to ALS Minerals ("ALS") in Chihuahua. The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in Vancouver, B.C. Systematic assaying of standards, blanks and duplicates is performed for precision and accuracy. Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish. All drilling reported is HQ core and has been contracted to Globexplore Drilling from Hermosillo, Mexico.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

or visit: www.kootenaysilver.com

https://kootenaysilver.com/news/kootenay/2021/kootenay-intercepts-809-gpt-silver-over-263-meters-within-354-gpt-silver-over-9-meters-in-the-f-vein-at-columba-project-mexico

Dollar Debasement Makes Gold and Silver Shine – Craig Hemke

By Greg Hunter

May 15, 2021

Financial writer, market analyst and precious metals expert Craig Hemke predicted last year (about this time) that silver was headed way up. It was up more than 45% for 2020 and was one of the best performing assets of the year. Now, Hemke is predicting “another 45% rise for silver” and a nice ride up for gold, too. Hemke explains, “Look at all of the commodities here. Lumber is up five times. Iron ore is at new all-time highs. Soybeans are at new multi-decade highs. Corn, which goes into everything . . . and all these commodities are taking off, which is, in large part, a dollar debasement story. . . . The idea that ‘inflation is transitory’ is bogus. . . . We just got news that McDonald’s and Amazon are raising their minimum wage to attract workers. That’s just more dollars being pushed out. You have more dollars pushed out chasing a finite or decreasing amount of goods because of the supply chain problems around the world. This is a double edged sword and why inflation is not ‘transitory.’ This is why rates are going to stay higher, and that’s why these negative real rates are going to get even deeper. The markets are going to figure this out, and the prices of precious metals are going to surge in the back half of the year–again.”

Hemke says the Fed is stuck and is fearful of rising rates with massive U.S. debt. Hemke contends, “The Fed cannot allow the bond market to sell off because that would translate to higher interest rates. We are already at $30 trillion in a federal budget deficit . . . and they are averaging 1.5%. So, they are paying $450 billion in interest alone. If that goes to 3%, they are paying $900 billion. If that goes to 4.5%, they are paying $1.3 trillion. The whole budget deficit has already exploded, and there is no turning back. . . . You saw the CPI at 4.25 %. Who in their right mind is going to buy a Treasury note at 1.65%? They will guarantee themselves a loss of purchasing power of 2.5%. . . . The Fed is promising that the inflation rate is going to come down, and it will be ‘transitory.’ I say it’s not ‘transitory.’ We have $3 trillion in deficit spending this year already, and it’s only going to get worse. We are on the path of Modern Monetary Theory (MMT), and the Treasury issues the bonds and the Fed just buys the bonds. . . . This creates a very favorable environment for owning physical gold and physical silver even with the phony baloney pricing scheme of futures contracts.”

Above all, owning physical anything is protection from inflation that is already here. Hemke says, “We talk about owning physical precious metals for protection against all this madness. . . .They are constantly debasing the dollar, and I don’t want to save in dollars anymore. I’d rather save in an actual physical asset. . . . Even if it does nothing, this still beats an asset that is being inflated . . . . All these pieces are coming together again, and it’s pretty clear we’re going to have a heck of a summer and a heck of a rest of the year. I said silver is going to $36 or $38 per ounce this year, and from $26.50 is going to be 50 some odd percent. We are going to get there.”

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Craig Hemke (on Rumble), founder of the popular website TFMetalsReport.com. https://tinyurl.com/39zdk5fh

https://usawatchdog.com/dollar-debasement-makes-gold-and-silver-shine-craig-hemke/

KOOTENAY SILVER INTERCEPTS 2,176 GPT SILVER EQUIVALENT OVER 1.18 METERS WITHIN A WIDER INTERVAL OF 399 GPT SILVER EQUIVALENT OVER 10.5 METERS AT COPALITO SILVER-GOLD PROJECT, MEXICO

May 13, 2021

Kootenay Silver Inc. (TSXV: KTN; OTC: KOOYF) (the "Company" or "Kootenay") is pleased to announce results for the first four holes completed from the 2021 drill program at the Copalito silver-gold project (the "Property"), located in Sinaloa State, Mexico.

James McDonald, President and CEO, states "We continue to see good grade and width potential at Copalito with the 5 Señores vein returning grades up to 2,176 gpt silver equivalent. These results complement high grade drill holes previously intercepted in 5 Señores Vein, which returned 2,830 gpt silver and 0.145 gpt gold over 1 meter. There are 9 more holes to report from this vein the results of which will start to define the scope and continuity of high grade and where follow up drilling will be focused. Drilling has moved on to testing good results on the Cobriza, Aguilar and Pilar veins."

Highlights from Holes BDH-21-041 to BDH-21-044 include:

BDH-20-041 in the 5 Señores Vein

* 325.52 gpt silver equivalent ("silver Eq") over 1 meter consisting of 303 gpt silver, 0.09 gpt gold and 0.58% lead plus zinc within 86.28 gpt silver Eq over 5.75 meters consisting of 0.049 gpt gold, 75.3 gpt silver and 0.27% lead plus zinc;

* 101.33 silver Eq over 2 meters consisting of 1.10 gpt gold, 13 gpt silver and 0.30% lead plus zinc within 55.37 gpt silver Eq over 8.61 meters consisting of 0.456 gpt gold, 11.70 gpt silver and 0.38% lead plus zinc.

* This hole tested about 40° down dip of the high-grade intercept in hole BDH-20-040.

BDH-20-042 in the 5 Señores Vein

* 2,176.84 gpt silver Eq over 1.18 meters consisting of 1,965 gpt silver, 0.575 gpt gold, and 6.35% lead plus zinc within 213.68 gpt silver Eq over 21 meters consisting of 178.30 gpt silver, 0.187 gpt gold, and 0.81% lead plus zinc.

* BDH-21-042 filled an approximate 100-meter gap in drilling.

These results are showing potential for a mineralized "shoot" in the southern part of the 5 Señores vein. The zone remains open in several directions. Once assays from the remaining holes are received a clearer picture on the shape and size of these zones will begin to emerge and shape follow up drilling.

The 5 Señores vein is comprised of a mineralized structure with two parallel veins. These veins are comprised of both silicified breccia and classic banded quartz, quartz-calcite and calcite veining. The polymetallic veins are hosted in a volcanic andesite sequence with weak propylic alteration within faults and contact with a dioritic intrusive to the southwest. The veins are mainly quartz, with massive and crustiform textures and quartz-chalcedony bands. Dark gray bands indicate the presence of sulfides in these textures. Also local zones of carbonates mainly calcite can also carry very high grades of precious metals.

Mineralization is comprised of disseminated pyrite of 1% or less with varying amounts of sphalerite (< 1 to 5%), galena (< 1 to 3%) and probable acanthite.

Plan Map of Hole BDH-21-041 to BDH-21-044. Click here to view larger version.

Continued below:

https://kootenaysilver.com/news/kootenay/2021/kootenay-intercepts-2176-gpt-silver-equivalent-over-118-meters-within-a-wider-interval-of-399-gpt-silver-equivalent-over-105-meters-at-copalito-silver-gold-project-mexico

KOOTENAY SILVER HITS SEVERAL HIGH-GRADE INTERCEPTS IN THE HANGING WALL AND F VEIN AT COLUMBA PROJECT, MEXICO

May 6, 2021

Kootenay Silver Inc. (TSXV: KTN; OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce assay results from the first six core drill holes completed from its 2021 drill program at its Columba high-grade silver project (the “Property”) located in Chihuahua State, Mexico.

Kootenay President & CEO, James McDonald, stated “We continue to be extremely pleased as we see the first drill results of 2021 start to come in. The first six holes continue to show grade and continuity of the F Vein in large untested gaps with grades to 899 gpt silver and 559 gpt silver in the Hanging Wall and F Vein respectively”.

Drill Highlights:

CDH-21-90

* 503 gpt silver over 1.2 meters including 889 gpt silver over 0.55 meters in the Hanging Wall Vein

* Hole CDH-21-90 is a shallow test about 65 meters below surface and includes 2.4 meters of 245 gpt silver including 365 gpt silver over 0.6 meters in the F Vein.

CDH-21-89

* 439 gpt silver over 2.7 meters including 533 gpt silver over 0.57 meters and 511 gpt silver over 0.65 meters in the F Vein.

* The high grade sits within a wide interval of 162 gpt silver over 15.45 meters.

* 411 gpt silver over one meter within 4 meters of 233 gpt silver in a footwall vein to the F Vein

* Hole CDH-21-89 is important as it tests a large 100 by 150-meter gap in drilling where six peripheral drill holes encountered grades from 456 gpt over 1.5 meters (CDH-20-45) to 782 gpt over 1.05 meters (CDH-20-47) and 755 gpt silver over 1.75 meters (CDH-19-12) some 75 meters below. See the longitudinal section for reference.

CDH-21-87

* 559 gpt silver over 1.09 meters within 4 meters of 200 gpt silver in the F Vein

* CDH-21-87 was filling an untested area in the F Vein of about 100 by 75 meters where 5 peripheral holes hit grades ranging from 456 gpt over 1.5 meters (CDH-20-45) to 911 gpt silver over 1.4 meters (CDH-20-46). See the longitudinal section for reference.

Click the following links to view: Plan Map ( https://tinyurl.com/3y4n56ff ) and Long Section ( https://tinyurl.com/seb86f5e ) for holes CDH-21-085 to CDH-21-090

Detailed Drill Results – Holes CDH-21-085 to CDH-21-090

Detailed results for all drill holes completed to date at the Columba high grade silver project can be viewed by clicking the following link: Columba Drill Results ( https://tinyurl.com/cnb6bnu6 )

Drill Results Table

(Click on link below to view the Drill Results Table)

Notes: All widths are drilled widths. At this time, it is estimated true widths will range from 65 to 94% of drilled widths depending on dip of the vein and inclination of the hole. All silver composites rounded to the nearest whole number.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

Sampling and QA/QC at Columba

All technical information for the Columba exploration program is obtained and reported under a formal quality assurance and quality control ("QA/QC") program. Samples are taken from core cut in half with a diamond saw under the direction of qualified geologists and engineers. Samples are then labeled, placed in plastic bags, sealed and with interval and sample numbers recorded. Samples are delivered by the Company to ALS Minerals ("ALS") in Chihuahua. The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in Vancouver, B.C. Systematic assaying of standards, blanks and duplicates is performed for precision and accuracy. Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish. All drilling reported is HQ core and has been contracted to Globexplore Drilling from Hermosillo, Mexico.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

or visit: www.kootenaysilver.com

https://kootenaysilver.com/news/kootenay/2021/kootenay-hits-several-high-grade-intercepts-in-the-hanging-wall-and-f-vein-at-columba-project-mexico

Aurcana Silver Provides Construction Update And Production Outlook For Its Revenue Virginius Mine For The Remainder Of 2021

Vancouver, BC – May 4, 2021 – Aurcana SILVER Corporation ("Aurcana" or the "Company") (TSXV: AUN, OTCQX: AUNFF) is pleased to provide a construction update and a production outlook for the remainder of 2021 for its Revenue Virginius Mine, (RV) located near Ouray, Colorado.

Mine Development

* Underground mine development is proceeding on schedule with three raises being driven vertically from the 2000 main haulage level 800 feet to the 1200 level (See Figure 1 below).

* The #1 Alimak Raise is advancing vertically at an average rate exceeding 16 feet per day and is scheduled to be complete by late May, after which the hoist and shaft timber will be installed for permanent men and material access.

* The #2 Alimak Raise has progressed up to the 1500 Level and is temporarily being used for men and materials transport from the 2000 level to the 1800 and 1500 level pending completion of #1 Alimak Raise.

* The #3 Alimak Raise vertical development began in May and is scheduled to reach the 1800 level by the third week of May.

* On completion of #1 Alimak Raise, the #2 and # 3 Alimak raises will be dedicated ore and waste raises.

* Level (horizontal) development has commenced on the 1800 level to intersect the Virginius vein, which is scheduled to occur during the third week of May. Following this, development will continue by driving drifts both north and south on vein for over 1000 feet to prepare for stope development.

* Stope development on the 1800 level is estimated to begin in late June with first ore to the mill in early July.

* Ore development on 1800 level is on schedule to deliver initial ore to the processing plant in July. Two stopes (mining blocks) on the 1800 level will provide the initial ore supply while stopes on the 1500 level are developed.

* It is anticipated that four stopes will be available by year end 2021 (two stopes per level) to supply the processing plant.

However only two stopes are required to provide the 270 tons per day as specified in the 2018 feasibility study (the “2018 FS”) prepared in accordance with National Instrument NI 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A copy of the 2018 FS is posted on the Company’s website www.aurcana.com and is also available on the Company’s profile on SEDAR at www.sedar.com.

Processing Plant Preparation

* All processing plant upgrades including installing additional flotation capacity, replacing cyclones with sizing screens, installing a rod mill, installing crushers and conveyors along with a new instrument control system will be completed by mid-June. Processing plant commissioning with water is scheduled for the last week of June with first ore through the processing plant in the second week of July.

* Final work on the transition chute from the coarse ore bin to the new primary pan feeder is scheduled to be completed by July 10th, 2021 and will enable full processing plant operation.

* Throughput will be ramped up over the course of July to reach 111 ton per day (tpd) during August, and then to the full production level of 270 tpd during September.

* Concentrate shipments will be in 100 ton lots and are anticipated to begin in early August. Trafigura Trading LLC is the off-taker for 100% of the concentrates and will pay the value of 95% of the contained metals based on the mine site concentrate assays at the time of shipment, with final settlement based on smelter returns.

* Payable silver equivalent1 production for the period between August to December 2021 is anticipated to be 1,300,000-1,600,000 ounces at an estimated cash operating costs of between USD10.00 to USD12.00/oz silver after by-product credits2.

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Michael Gross, P. Geo, a “qualified person” within the meaning of NI 43-101

ABOUT AURCANA CORPORATION

Aurcana Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Virginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

Gary Lindsey, Corporate Communications

Phone: (720)-273-6224

Email: gary@strata-star.com

http://www.aurcana.com/news/2021/index.php?content_id=481

Aurcana Silver Corporation live webinar Monday, April 26, 4:05 PM EDT

Remains on track to deliver a ramp up to full production in the second half of 2021

Aurcana Silver Corporation (TSX-V: AUN, OTCQX: AUNFF) is the 100% owner of a fully permitted, prior producing Revenue-Virginius silver mine located in Colorado, US. The mine value is underpinned by the strong economics contained in an SRK-authored 2018 Definitive Feasibility Study. The known southerly extension of the Virginius vein holds the potential to more than double the existing resource base.

CLICK ON LINK TO REGISTER for the live webinar and alerts to the replay:

https://mailchi.mp/amvestcapital.com/join-us-aurcana-silver-live-webinar-fri-jan-8-1100-am-est-silver-leverage-near-term-production-q3-10136894?e=8622d71292

Silver Bull Announces Voting Results of Annual Meeting of Shareholders

VANCOUVER, BC – (April 20, 2021) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) announces the detailed voting results of the proposals considered at its annual meeting of shareholders held on April 19, 2021 (the “Meeting”). A total of 18,265,547 or 54.17% of the Company’s issued and outstanding shares were represented at the Meeting.

Most critically, the Meeting included a proposal for shareholders to approve and adopt amended and restated articles of incorporation of the Company to increase the number of authorized shares of Silver Bull common stock from 37.5 million to 150.0 million and to make certain non-substantive amendments, which required the approval from a majority of the outstanding shares of Silver Bull common stock. The voting results were as follows: (Click on link below to view results)

As a majority of the outstanding shares of Silver Bull common stock was received in favour of the proposal, it was approved.

President and CEO, Tim Barry stated: “We would like to thank those shareholders who took the time to vote on this matter, which is vital to the future growth and advancement of the Company. We see great potential for the Company’s Sierra Mojada project, and with the ability to seek equity financing at Silver Bull, we will be focused on continuing its advancement.

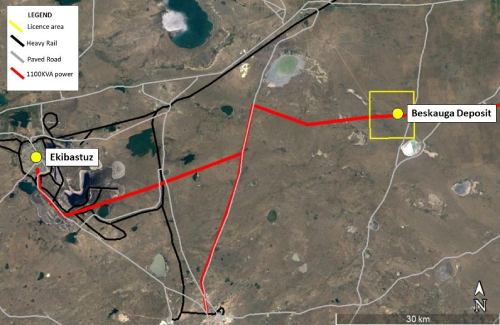

Additionally, we look forward to advancing the Beskauga project in Kazakhstan in our new subsidiary, Arras Minerals Corp., for which we recently completed a private placement financing, and are commencing a drill program in the coming months.”

In addition to the above-noted proposal, the following nominees, as listed in Silver Bull’s proxy statement, were re-elected as directors of the Company: (Click on link below to view results)

Silver Bull is also pleased to announce that the Company’s shareholders have ratified and approved the appointment of Smythe LLP, as the Company’s independent registered public accounting firm, for the fiscal year ending October 31, 2021 (18,080,515 or 98.98% voted “For”, 66,260 or 0.36% voted “Against” and 118,772 or 0.65% abstained from voting).

Finally, the Company’s shareholders voted to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (12,538,304 or 92.65% voted “For”, 740,928 or 5.47% voted “Against”, and 253,020 or 1.86% abstained from voting).

Full details of the proposals are fully described in the Company’s definitive proxy statement filed on February 23, 2021 available on SEDAR at www.sedar.com, and on EDGAR at www.sec.gov.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Lth. In addition, Silver Bull’s subsidiary, Arras Minerals Corp., holds an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-voting-results-of-annual-meeting-of-shareholders/

Silver Bull Reschedules Annual Meeting Of Shareholders

VANCOUVER, BC – (April 12, 2021) – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) (“Silver Bull” or the “Company”) today announced that it is postponing its 2021 annual meeting of shareholders (the “Meeting”) to April 19, 2021 to provide its shareholders with additional time to vote on the proposals submitted for shareholder approval at the Meeting. Shareholders are advised that because one of the proposals involves proposed amendments to the Company’s articles of incorporation, the holders of a majority of the outstanding shares of Silver Bull common stock must approve such proposal.

The record date for determining the shareholders eligible to vote at the Meeting will remain the close of business on February 18, 2021. Shareholders who have already submitted a proxy do not need to vote again for the postponed Meeting rescheduled for Monday, April 19, 2021 at 10:00 a.m. Pacific time at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia, as the proxies submitted will remain valid.

Of particular importance, the Company’s board of directors strongly recommends that all shareholders to vote “FOR” the proposal to increase the number of authorized shares. In the absence of an affirmative vote to increase the number of authorized shares of Silver Bull common stock, the Company will have virtually no shares available for issuance to raise funds to fund general corporate overhead or cover the costs associated with maintaining its mining interests, including in the Sierra Mojada project in Mexico.

Silver Bull shareholders as of close of business on February 18, 2021 who have not voted are encouraged to vote online at www.proxyvote.com or by telephone at 1-800-690-6903. The proxy voting deadline to vote by Internet or telephone is April 18, 2021 at 11:59 p.m. Eastern time. Silver Bull shareholders who require assistance with voting their shares or have questions may contact the Company by email at info@silverbullresources.com.

Shareholders who have already submitted proxies and want to change their proxy can update their vote at any time before the votes are cast at the Meeting. Your vote will be recorded at the Meeting in accordance with your most recently submitted proxy.

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Meeting. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on February 23, 2021.

Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Meeting. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2020 filed with the SEC on January 28, 2021, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the Meeting filed with the SEC on February 23, 2021.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd. In addition, Silver Bull’s subsidiary, Arras Minerals Corp. holds an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-postponement-of-annual-meeting-of-shareholders/

My personal plea to ALL fellow Silver Bull shareholders (TSX:SVB, OTCQB:SVBL):

Please vote "YES" on the provision to increase the number of shares from 37.5 million to 150 million!

All bets are off if shareholders choose not to increase the share capital of Silver Bull. No company can run itself without access to the capital markets - Silver Bull will be no different

Silver Bull Reminds Shareholders Of The Annual Meeting Of Shareholders On April 12, 2021

VANCOUVER, BC – (April 6, 2021) – Silver Bull Resources, Inc. (TSX:SVB, OTCQB:SVBL) (“Silver Bull” or the “Company”) reminds all shareholders to vote in advance of the annual meeting of shareholders (the “Meeting”) on Monday, April 12, 2021 at 10:00 a.m. PT.

The Company’s board of directors STRONGLY RECOMMENDS that all shareholders vote “FOR” all proposals, particularly the proposal to increase the number of authorized shares.

YOUR VOTE IS IMPORTANT – PLEASE VOTE TODAY

The proxy voting deadline is 11:59 p.m. ET on April 11, 2021.

We encourage you to vote well in advance of the deadline.

For any questions or assistance with voting, please contact management by email at info@silverbullresources.com.

President and CEO Tim Barry states,

We have recently announced the private placement into our British Columbia incorporated subsidiary “Arras Minerals Corp.” which holds the option agreement for the Beskauga Project, and the Stepnoe and Ekidos mineral licenses in Kazakhstan. This structure allows us to move forward and finance the Kazakhstan projects. We still need to be able to fund the costs of the Sierra Mojada Project. To do this we need to increase the Company’s authorized share capital. To ensure the Company can continue the development of the Sierra Mojada project, and ensure shareholders continue to have exposure to silver and zinc, it is vital that the Company has access to capital.

Without shareholder approval, the Company will have virtually no shares available for issuance to cover the costs of maintaining its interest in the Sierra Mojada project or cover the costs of its general corporate overhead. (basser's bolding for emphasis) Management would need to immediately investigate all available options, including, but not limited to, seeking to dispose of the Company’s assets or engage in a business combination. Any such transaction may not be on terms that are favorable to the Company. Continuing in business with virtually no shares available for issuance is not a sustainable path for the Company.

On behalf of Silver Bull’s management and board, we thank you for your support on this very important matter.”

Authorized Share Increase Proposal

By increasing the number of authorized shares of Silver Bull common stock now, the Company will be able to act in a timely manner when the need to raise equity capital arises or when the Company’s board of directors believes it is in the best interests of the Company and shareholders to take action, without the delay and expense that would be required at that time to obtain shareholder approval to increase the authorized shares. Business purposes for which the Company could seek to raise additional capital include furthering the development of the Sierra Mojada project in Mexico. Virtually all junior exploration companies like the Company remain as viable companies and conduct their mineral exploration activities by raising funds by issuing shares from time to time. In the absence of an affirmative vote to increase the number of authorized shares of Silver Bull common stock, the Company will have an insufficient number of authorized shares to raise funds to fund general corporate overhead or cover the costs associated with maintaining its interests in the Sierra Mojada project in Mexico.

Silver Bull Annual Meeting of Shareholders

The Meeting is scheduled for 10:00 a.m. PT on Monday, April 12, 2021, at the Company’s offices at 777 Dunsmuir Street, Suite 1610, Vancouver, British Columbia.

The board of directors of Silver Bull unanimously recommends that Silver Bull shareholders vote FOR all proposals.

Additional information concerning the proposals can be found in the definitive proxy statement dated February 23, 2021. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

How to Vote Your Shares

* By Internet: If you received a Notice of Internet Availability of Proxy Materials (the “Notice”), you can access the Company’s proxy materials and vote online at www.proxyvote.com. Further instructions to vote online are provided in the Notice.

* By Telephone: You may vote your shares by calling 1-800-690-6903. You will need to follow the instructions on your proxy card and the voice prompts.

Due to the essence of time, shareholders are encouraged to vote by Internet or telephone as set out above.

Important Information

This communication may be deemed to be solicitation material in connection with the proposals to be considered at the Meeting. In connection with the proposals, Silver Bull filed a definitive proxy statement on Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) on February 23, 2021. Shareholders are urged to read the definitive proxy statement and all other relevant documents filed with the SEC because they contain important information about the proposals. An electronic copy of the definitive proxy statement is available on the Company’s website at www.silverbullresources.com, on the Company’s EDGAR profile at www.sec.gov, and on its SEDAR profile at www.sedar.com.

Participants in the Solicitation

Silver Bull and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Silver Bull shareholders in respect of the proposals to be considered at the Meeting. Information about the directors and executive officers of Silver Bull can be found in its Annual Report on Form 10-K for the year ended October 31, 2020 filed with the SEC on January 28, 2021, filings on Form 3, 4 and 5 filed with the SEC, and the Company’s definitive proxy statement for the Meeting filed with the SEC on February 23, 2021.

About Silver Bull

Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. Silver Bull owns the Sierra Mojada Project which is located 150 kilometers north of the city of Torreon in Coahuila, Mexico, and is highly prospective for silver and zinc. Sierra Mojada is currently under a joint venture option with South32 International Investment Holdings Pty Ltd. In addition, Silver Bull’s subsidiary, Arras Minerals Corp. holds an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

On behalf of the Board of Directors

“Tim Barry”

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-reminds-shareholders-of-the-annual-meeting-of-shareholders-on-april-12-2021/

For anyone who might be interested, here is a link to the AGM.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MONDAY, APRIL 12, 2021

https://www.silverbullresources.com/site/assets/files/5778/letter_to_shareholders_and_proxy_statement.pdf

Silver Bull Announces Private Placement of C$2,517,500 in Newly Incorporated Subsidiary Arras Minerals Corp. And Transfer of Kazakh Exploration Projects

VANCOUVER, British Columbia, April 01, 2021 -- Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull” or the “Company”), a mineral exploration company with assets in Kazakhstan and Mexico, is pleased to announce the completion of a C$2,517,500 private placement (the “Private Placement”) into its newly incorporated British Columbia subsidiary, Arras Minerals Corp. (“Arras Minerals”).

Pursuant to the Private Placement, investors purchased 5.035 million shares of Arras Minerals at a price of C$0.50 each for gross proceeds of C$2,517,500, with management and directors (and their affiliates) taking approximately C$200,000 of the offering. No placement agent or finder’s fees were paid in connection with the Private Placement.

Silver Bull’s assets in Kazakhstan, including the Beskauga Option Agreement and the Ekidos and Stepnoe mineral licences, have been transferred to Arras Minerals. In return, Silver Bull has received 36 million shares of Arras Minerals and owns approximately 88% of the company, with the remaining 12% owned by the individuals who participated in the Private Placement.

The net proceeds from the Private Placement will be used to fund exploration activities, technical studies and permitting on the Company’s projects in Kazakhstan and for general and working capital purposes in managing the Kazakhstan projects.

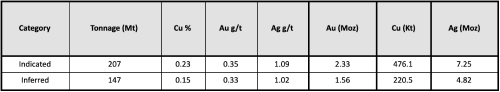

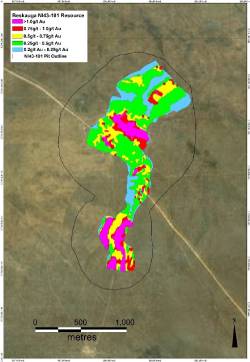

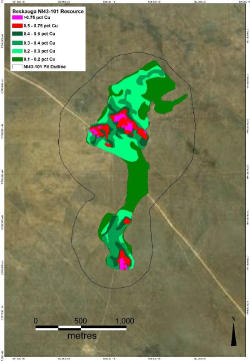

Beskauga Deposit, Kazakhstan: The Beskauga deposit is an open pittable gold-copper-silver deposit with a NI 43-101 compliant “Indicated Mineral Resource” of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million contained ounces of gold, 476.1 thousand contained tonnes of copper and 7.25 million contained ounces of silver and an “Inferred Mineral Resource” of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million contained ounces of gold, 220.5 thousand contained tonnes of copper and 4.82 million contained ounces of silver.

The constraining pit was optimised and calculated using a net smelter return (“NSR”) cut-off based on prices of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and with an average recovery of 81.7% for copper and 51.8% for both gold and silver. Mineralization remains open in all directions as well as at depth.

Table 1. Pit-constrained Mineral Resource estimate for the Beskauga copper-gold project:

(Click on link below to view Table 1.)

Notes:

* An NSR $/t cut-off of $5.70/t was used, and the NSR formula is: NSR $/t = (38.137+11.612 x Cu%) x Cu% + (19.18 + 12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x Ag g/t

* The NSR formula incorporates variable recovery formulae. Average copper recovery was 81.7% copper and 51.8% for both gold and silver.

* Metal prices considered were $2.80/lb copper, $1,500/oz gold and $17.25/oz silver.

* The Resource is stated within a pit shell that considers a 1.25 factor above the metal prices.

* Mineral Resources are estimated and reported in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves adopted 10 May 2014.

* The Mineral Resource is not believed to be materially affected by any known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant factors

* These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

* The quantity and grade of reported Inferred Resources in this mineral resource estimate (MRE) are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

For additional details, please refer to the Beskauga Copper-Gold Project NI 43-101 Technical Report prepared by CSA Global Mining Industry Consultants dated February 8, 2021, which is available on SEDAR at www.sedar.com.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-announces-private-placement-of-c-2-517-500-in-newly-incorporated-subsidiary-arras-minerals-corp-and-transfer-of/

KOOTENAY SILVER SIGNS OPTION AGREEMENT TO GRANT CENTERRA GOLD INC. INTEREST IN THE TWO TIMES FRED PROPERTY IN BRITISH COLUMBIA, CANADA

March 30, 2021

Kootenay Silver Inc. (TSXV:KTN; OTCQX:KOOYF) (the "Company" or "Kootenay") is pleased to announce the signing of an option agreement with a wholly owned subsidiary of Centerra Gold Inc. ("Centerra"), whereby Centerra is granted an option to earn a 70% interest in the Two Times Fred property located in the Nechako Plateau of Central British Columbia.

A total of C$6 million in exploration expenditures and C$500,000 in cash payments must be incurred and made over a four-year period for Centerra to earn a 70% interest. The first year requires a work expenditure of $1 million with a minimum commitment of $650,000. Current plans for this year's work include up to 1,000 meters of trenching and 20 drill holes. Upon the fulfillment of these conditions, the two companies will enter a standard joint venture agreement with Kootenay retaining a 30% interest, and funding of further work will be done on a pro rata basis amongst the joint venture partners.

James McDonald President and CEO of Kootenay Silver states "We are very pleased to have signed an agreement with major gold producer Centerra Gold Inc. We look forward to benefiting from Centerra's expertise and consider their participation via the option agreement a reflection of our belief that Two Times Fred has the potential to host a gold deposit of significant size."

Two Times Fred

The Two Times Fred property is host to a large classic low-sulphidation epithermal gold vein system. It is a grass roots discovery made by the Kootenay Silver team. Over the past several years Kootenay has advanced the project with limited drilling, mapping, sampling, and geophysical surveys. The project comprises numerous northeast trending veins over a 1.5 by 3.0 kilometer trend. Select rock chip sampling at surface has returned assays as high as 12.8 gpt gold and 194 gpt silver. Limited drilling (2,628 meters over 13 drill holes) shows the main identified veins occur as classic vein and vein breccia zones from a few meters to 40 meters wide. Best drill results to date include 7.6 meters of 1.69 gpt gold and 29 gpt silver.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652 1-888-601-5650

or visit: www.kootenaysilver.com

https://kootenaysilver.com/news/kootenay/2021/kootenay-silver-signs-option-agreement-to-grant-centerra-gold-inc-interest-in-the-two-times-fred-property-in-british-columbia-canada

Silver Bull Resources Wins Lawsuit in Mexico

Vancouver, British Columbia March 31, 2021 – Silver Bull Resources, Inc. (TSX: SVB, OTCQB: SVBL) ("Silver Bull" or the "Company") is pleased to announce it has won a definitive and conclusive decision in its favor in a lawsuit filed by a local mining co-operative called Minera Norteños. The decision was made by the unanimous vote of three Judges in the third Federal Circuit Court of Chihuahua.

Tim Barry, President, CEO and director of Silver Bull states, "This ruling is welcome, but not unanticipated. This is the fourth time that the courts have ruled in our favor on this issue. Unfortunately, we believe the plaintiff, Minera Norteños was manipulated and ill advised by legal and other advisers. Our legal team in Mexico is to be commended for patiently making progress in the face of numerous tactics to delay a judgement on the merits of the case.

Despite the fact that the Company has at all times proceeded in accordance with the law, the project remains under an illegal blockade manned by a small group of radical members from within Minera Norteños. We believe their actions do not represent the view of the vast majority of the Minera Norteños members and wider local community, and we are working with authorities to resolve the situation in a safe, fair, and timely manner. We remain committed to good faith dialogue with reasonable members from Minera Norteños, many of whom have worked for Silver Bull, to find a solution that facilitates the resumption of the drilling program halted by the blockade more than one year ago.

It is unfortunate shareholders have had to put up with this type of action over the recent years, however we are optimistic we will find a solution to the blockade and look forward to continuing our exploration program with our joint venture partner, South32. Sierra Mojada remains one of the largest undeveloped silver-zinc projects in Mexico. The silver-zinc mineralization sits largely at surface and is open pittable and has excellent infrastructure close by. These types of deposits are rare."

South32 Joint Venture Option: In June 2018 Silver Bull signed an agreement with a wholly owned subsidiary of South32 whereby Silver Bull has granted South32 an option to form a 70/30 joint venture with respect to the Sierra Mojada Project. To maintain the option in good standing, South32 must contribute minimum exploration funding of US$10 million ("Initial Funding") during a 4-year option period with minimum aggregate exploration funding of US$3 million, US$6 million and US$8 million to be made by the end of years 1, 2 and 3 of the option period respectively. South32 may exercise its option to subscribe for 70% of the shares of Minera Metalin S.A. De C.V. ("Metalin"), the wholly owned subsidiary of Silver Bull which holds the claims in respect of the Sierra Mojada Project, by contributing US$100 million to Metalin for Project funding, less the amount of the Initial Funding contributed by South32 during the option period.

Despite the blockade, the joint venture option with South32 remains in good standing but under a force majeure pause.

About Silver Bull: Silver Bull is a Vancouver-based mineral exploration company whose shares are listed on the TSX and trade on the OTCQB in the United States. In addition to the Sierra Mojada project, Silver Bull recently signed an Option Agreement to acquire the Beskauga Copper-Gold Project, located in North Eastern Kazakhstan. The Beskauga deposit is an open pittable gold-copper-silver deposit with a NI 43-101 compliant "Indicated Mineral Resource" of 207 million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33 million contained ounces of gold, 476.1 thousand contained tonnes of copper & 7.25 million contained ounces of silver and an "Inferred Mineral Resource" of 147 million tonnes grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56 million contained ounces of gold, 220.5 thousand contained tonnes of copper & 4.82 million contained ounces of silver.

For additional details, please refer to the Beskauga Copper-Gold Project NI 43-101 Technical Report prepared by CSA Global Mining Industry Consultants dated February 8, 2021, which is available on SEDAR at www.sedar.com and on the Company's website at www.silverbullresources.com.

The technical information of this news release has been reviewed and approved by Tim Barry, a Chartered Professional Geologist (CPAusIMM), and a qualified person for the purposes of National Instrument 43-101.

On behalf of the Board of Directors

"Tim Barry"

Tim Barry, CPAusIMM

Chief Executive Officer, President and Director

INVESTOR RELATIONS:

+1 604 687 5800

info@silverbullresources.com

https://www.silverbullresources.com/news/silver-bull-wins-lawsuit-in-mexico/

KOOTENAY SILVER COMMENCES DRILLING AT COPALITO HIGH-GRADE SILVER & GOLD PROJECT, MEXICO

March 25, 2021

Kootenay Silver Inc.(TSXV: KTN, OTCQX: KOOYF) (the “Company” or “Kootenay”) is pleased to announce that a 3,500-meter core drilling program (the “Program”) has commenced at the Copalito gold and silver project (the “Property”), located in Sinaloa State, Mexico.

The Program will follow up the results of 40 shallow drill-holes totaling 4,153 meters completed in 2020, confirming gold and silver mineralization in several areas of the Property.Drilling will be guided by detailed structural mapping totest veins such as 5 Senores located in the southern area where good continuity and grade potential has been shown for at least 600 meters of strike length.

Drill results from 5 Senores are highlighted by several high-grade intercepts that ranged to 2,830 gpt silver (BDH-20-04) and 16.95 gpt gold (BDH-20-40).Further highlights from drilling completed on other veins at Copalito include the Pilar Vein with gold values of up to 7.05 gpt and 13.55% lead plus zinc (BDH-20-33); the Chiva Vein with silver values of up to 936 gpt (BDH-20-09); and the Cobriza Vein with silver values of up to 307 gpt.

2020 drill highlights of significant high-grade mineralization intersected at Copalito, include:

BDH-20-001: 369 gpt silver equivalent (“AgEq.”); 250 gpt silver and 0.247 gpt gold over 5.0 meters; 272 gpt AgEq.; 360 gpt silver and 0.1 gpt gold over 1.0 meter within

BDH-20-002: 179 gpt AgEq.; 1.69 gpt gold over 4.3 meters and 274.8 gpt AgEq.; 3.02 gpt gold over 1.7 meters

BDH-20-004: 1,323 AgEq.; 1,297 gpt silver and 0.285 gpt gold over 3.2 meters

BDH-20-009: 1,047 gpt AgEq.; 936 gpt silver, 0.29 gpt gold and 3.31% lead+zinc (“Pb+Zn”) over 1.0 meter

BDH-20-015: 394 gpt AgEq.; 51 gpt silver, 2.28 gpt gold, 6.18 % Pb+Zn over 1.2 meters

BDH-20-033: 1,210 gpt AgEq.; 59 gpt silver, 7.05 gpt gold, 13.55 % Pb+Zn over 0.2 meters

BDH-20-037: 1,261 gpt silver AgEq. over 1.0 meter consisting of 846 gpt silver, 3.11 gpt gold and 6.15% lead plus zinc; 5 senores vein

BDH-20-040: 933 gpt AgEq. over 2.25 meters consisting of 6.65 gpt gold, 335 gpt silver 1,813 gpt AgEq. over 0.51 meters consisting of 16.95 gpt gold, 369 gpt silver and 3.74% Pb+Zn

including: 1,813 gpt AgEq. over 0.51 meters consisting of 16.95 gpt gold, 369 gpt silver and 3.74% lead plus zinc 5 Senores vein (one of the deepest holes drilled to date)

Complete drill results for Copalito can be found on our company website. AgEq. calculated above are based on $24/oz silver, $1900/oz gold, $1/lb zinc, $0.8/lb lead. Estimated true widths range from 65 to 90% of drilled widths depending on dip of the vein and inclination of the hole. All AgEq. and silver composites rounded to the nearest whole number. See news releases dated July 22 2020, October 27, 2020 and November 12, 2020 for further detail.

James McDonald, CEO and President Stated: "This program is aimed at establishing if we have continuity and size in zones already identified and to test those areas, we did not test in 2020. We are excited to get going again and are looking forward to the results of the drill program.”

The Company has contracted GlobeXplore, S.A. de C.V. of Hermosillo, Sonora, Mexico to conduct the HQ core drilling at Copalito.Results of the drill program will be announced as soon as the assays are received and interpreted by the Company.

About the Copalito Property

The Copalito Project is a classic low sulphidation epithermal vein system which has numerous small old workings and no evidence or reports of historic exploration drilling. The Property consists of seven concessions totaling approximately 3,700 hectares and is located 35 kilometers east of McEwen Mining’s “El Gallo Mine” complex in Sinaloa State, along the western fringes of the Sierra Madre Occidental in northwestern Mexico. The Copalito Project has good access, topography and infrastructure.

Copalito Geology

Mineralization is hosted within classic low sulfidation epithermal quartz and rare calcite veins. Multiple mineral events are evidenced by banded mineralized textures, multiple cross cutting veins/veinlets, laminated banding of chalcedonic and crystalline quartz, sulfide replacement and infillings of breccia matrix. Sulfide content is generally low but does range to 20% or more in hand samples. Sulfides and their oxide equivalents include fine grained pyrite, black and yellow sphalerite, galena, chalcopyrite and silver sulphosalts. Some zonation is becoming apparent with veins in the northeast being higher in gold and base metals and those in the south being high in silver and low in base metals.

Sampling and QA/QC at Copalito

All technical information for the Copalito exploration program is obtained and reported under a formal quality assurance and quality control (“QA/QC”) program. Samples are taken from core cut in half with a diamond saw under the direction of qualified geologists and engineers. Samples are then labeled, placed in plastic bags, sealed and with interval and sample numbers recorded. Samples are delivered by the Company to ALS Minerals (“ALS”) in Hermosillo, Sonora. The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in North Vancouver, B.C. Systematic assaying of standards, blanks and duplicates is performed for precision and accuracy. Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay scientific and technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of two of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

On Behalf of the Board of Directors of

KOOTENAY SILVER INC.

“James McDonald”

President & CEO

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://kootenaysilver.com/news/kootenay/2021/kootenay-commences-drilling-at-copalito-high-grade-silver-and-gold-project-mexico

This is an excellent Aurcana Silver presentation.

Aurcana Silver live webinar, Fri 3/19 @ 11:00 AM EDT

Join the Aurcana Silver (AUN.V; AUNFF) live webinar on Fri, Mar 19 @ 11:00 AM EDT

https://attendee.gotowebinar.com/register/8554021657044930063?source=sh

KOOTENAY SILVER TRENCHES 33.0 METERS OF 2.67 GPT GOLD INCLUDING 9.0 METERS OF 5.29 GPT GOLD AT MALE GOLD PROJECT, MEXICO

March 17, 2021

Kootenay Silver Inc.(TSXV: KTN, OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce the discovery of significant gold on its 100% owned Maria Elena gold project (“Male” or the “Property”), located approximately 100 kilometers south east of the city of Hermosillo in Sonora State, Mexico.

Trenching conducted at the Property has exposed several exciting gold results.This program included a total of 8 trenches completed over four areas of the Property.Of the eight trenches, positive results from five (trenches 0,2,4,5,6) were received with results for the remaining trenches (1, 3 and 7) not encountering any significant veining or values.Highlights from the results received to date are as follows:

Trench 6

* 33 meters averaging 2.67 gpt gold

Includes 9 meters of 5.29 gpt gold

Includes 1 meter of 23.7 gpt gold

Trench 4

* 24 meters averaging 1.81 gpt gold

Includes 8 meters of 3.98 gpt gold

Includes 1 meter of 17.25. gpt gold

Trench 2

* 9 meters averaging 2.01 gpt gold

Includes 1 meter of 15.45 gpt gold

Click this link to view maps of the trenching.https://www.kootenaysilver.com/assets/img/nr/2021-03-Male-Trench-Maps.pdf

Initial trenching was completed by an excavator with chip samples taken across one-meter lengths. Trench 0 returned narrow anomalous gold values to 0.38 gpt gold over one meter.

Gold mineralization is hosted by stock works of quartz and quartz carbonate veins formed by conjugate sets of veins striking northeast and northwest. These stock working veins form zones that range in apparent width, from a scale of one meter to over 30 meters. The zones form mineralized “structures” or trends that can be traced individually for hundreds of meters (generally 200 to 1000 meters).Further trenching is required to better determine true widths and continuity along strike.

The mineralized stock works are made of multiple veins that individually range from tens of centimeters to 1.7 meters in width.Numerous conjugate vein sets and associated stock work zones occur within a 1.5 by 1.5-kilometer area hosted within a diorite intrusion and are the source of the placer gold historically mined on the property.

Prior to trenching, earlier prospecting work by Kootenay indicated very anomalous gold in the quartz veins.Out of 426 select (prospector) grab samples and soils, 47% of the tests returned greater than 0.5 gpt gold, whereas 36% returned greater than 1 gpt gold and 16% retuned greater than 5 gpt gold. Individual gold values included highs of 260 gpt, 85 gpt, 81 gpt, 53 gpt and 51 gpt.

Historic activity at Male includes hundreds of dry placer pits that often tested into the gold bearing quartz veins in bedrock. The area is extensively covered by overburden and thus holds the possibility of hiding a potentially large gold deposit.

The gold is associated with irregular silver values exceeding 900 gpt however silver is generally low. Copper, lead and zinc is also anomalous with highs to 0.56%, 2.6% and 3.9%, respectively.Molybdenum and tungsten occur as well.

A 36-line kilometer ground magnetic survey has been conducted. Preliminary interpretation shows some association with magnetic trends striking northwest, north-south and northeast with the primary stock work trends. Interpretation of the mag data continues. Two IP lines which range about 2 kilometers each have also been run. These results are also being compiled.

Follow up steps involve interpretation of the geophysics to determine its usefulness in mapping the gold zones in covered zones, more trenching and then a decision on whether to drill or option the project.

The geophysical and trenching was conducted and paid for by a third-party with Kootenay submitting the trench samples for assay.

Sampling and QA/QC at Male

All technical information for the Columba exploration program is obtained and reported under a formal quality assurance and quality control ("QA/QC") program. Samples reported were all taken in one meter long intervals and are chip samples. Samples were delivered by the Company to ALS Minerals ("ALS") in Hermosillo. The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in Vancouver, B.C.Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay scientific and technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of two of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

On Behalf of the Board of Directors of

KOOTENAY SILVER INC.

“James McDonald”

President & CEO

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://kootenaysilver.com/news/kootenay/2021/kootenay-trenches-330-meters-of-267-gpt-gold-including-90-meters-of-529-gpt-gold-at-male-gold-project-mexico

$VIPRF showing promise at their Sonora, Mexico exploration site. $VIPRF reports drill core tests averaging 88 g/t Ag, 2.43 g/t Au. Confirms previous test at the same mine site of 10,681g/t Ag, 738 g/t Au.

Their latest PR: https://www.otcmarkets.com/stock/VIPRF/news/Silver-Viper-Drills-10-metres-core-length-grading-491-gt-silver-and-103-gt-gold-and-10-metres-grading-351-gt-silver-and-?id=293150

The company website: https://silverviperminerals.com/

KOOTENAY SILVER COMMENCES DRILLING AT COLUMBA HIGH-GRADE SILVER PROJECT, MEXICO

March 3, 2021

Kootenay Silver Inc. (TSXV:KTN; OTC:KOOYF) (the "Company" or "Kootenay") is pleased to announce that a 5,000-meter core drilling program (the "Program") has commenced at the Columba silver project, located in Chihuahua State, Mexico.

The Program will focus on step out and infill drilling on impressive results to date in the high-grade F-vein and its associated hanging wall vein, a new discovery blind to surface. Focus will then shift to expanding on numerous other high-grade results such as found in holes CDH 20-030 (415 gpt silver over 11.15 meters including 721 gpt silver over 4.07 meters) in the JZ area and CDH 20-082 (1,186 gpt silver over 4.6 meters) in the B Vein.

James McDonald, CEO and President Stated: "Ending on a high note last year with 1,186 gpt silver over 4.6 meters on the largely untested B Vein we are eager to continue testing the various high-grade areas established by our 2019 and 2020 programs."

Comprehensive drill results from the 2019 and 2020 programs can be viewed by clicking the following link: Columba Drill Results.

The Company has contracted GlobeXplore, S.A. de C.V. of Hermosillo, Sonora, Mexico to conduct the drilling at Columba. Results of the drill program will be announced as soon as the assays are received and interpreted by the Company.

About the Columba Property

Columba is a past producing high-grade silver mine, which operated on a small scale circa 1910 and again briefly circa 1958-60. The Property covers a large high-grade epithermal vein system which the Kootenay has mapped over strike lengths from 200 meters to up to 2 kilometers and sampled with grades returning up to 693 gpt silver on surface and exceeding 2,000 gpt in drilling. The Project area includes a network of underground workings comprised of 4 shafts and 6 levels of drifts reported to measure over 1,000 meters in length.

Sampling and QA/QC at Columba

All technical information for the Columba exploration program is obtained and reported under a formal quality assurance and quality control ("QA/QC") program. Samples are taken from core cut in half with a diamond saw under the direction of qualified geologists and engineers. Samples are then labeled, placed in plastic bags, sealed and with interval and sample numbers recorded. Samples are delivered by the Company to ALS Minerals ("ALS") in Chihuahua. The samples are dried, crushed and pulverized with the pulps being sent airfreight for analysis by ALS in Vancouver, B.C. Systematic assaying of standards, blanks and duplicates is performed for precision and accuracy. Analysis for silver, zinc, lead and copper and related trace elements was done by ICP four acid digestion, with gold analysis by 30-gram fire assay with an AA finish. All drilling reported is HQ core and has been contracted to Globexplore Drilling from Hermosillo, Mexico.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay scientific and technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of two of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

On Behalf of the Board of Directors of

KOOTENAY SILVER INC.

"James McDonald"

President & CEO

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://kootenaysilver.com/news/kootenay/2021/kootenay-commences-drilling-at-columba-high-grade-silver-project-mexico

$silverbugs thanks; 'Great Panther Silver, Ltd. (GPL)' Webcasts -

The Company will host a conference call and webcast on Thursday,

March 4, 2021, at 9:00 AM PT/12:00 PM ET. Shareholders, analysts,

investors and media are invited to join by logging in or calling in

five minutes prior to the start time.

Webcast: Webcast Registration

https://www.greatpanther.com/investors/webcasts/

Canada/USA TF:

1 800 319 4610

International Toll:

+1 604 638 5340

Scroll to the right to see the table data.

A replay of the webcast will be available approximately one hour

after the conference call.

Audio replay will be available until April 4, 2021, by calling

the numbers below using the replay access code 6298.

Canada/USA TF:

1 800 319 6413

International Toll:

+1 604 638 9010

Replay Access Code: 6298

Scroll to the right to see the table data.

Replay of previous Great Panther conference call and webcasts

are available below.

2020

Third Quarter 2020 Financial Results Webcast and Conference Call

Second Quarter 2020 Financial Results Webcast and Conference Call

First Quarter 2020 Financial Results Webcast and Conference Call

https://www.greatpanther.com/investors/webcasts/

$jsc52033 thanks; Great Panther Mining Ltd (GPL) BARCHART OPINION Overall Average: 88% BUY

$GPL is way undervalued and heading to multi dollars the financial

forecasts to be released soon!!

$BARCHART OPINION Overall Average: 88% BUY

Overall Average Signal calculated from all 13 indicators.

Signal Strength is a long-term measurement of the historical strength

of the Signal, while Signal Direction is a short-term (3-Day)

measurement of the movement of the Signal.

Barchart Opinion

https://www.barchart.com/stocks/quotes/GPL/opinion

Will Silver investors take delivery on the COMEX this week: w/David Smith

Aurcana Silver Provides Construction Update for Its Revenue Virginius Mine

Vancouver, BC – February 18, 2021 – Aurcana SILVER Corporation ("Aurcana" or the "Company") (TSXV: AUN; OTCQX: AUNFF) is pleased to provide a construction update for its Revenue Virginius Mine, (RV) located near Ouray, Colorado. Aurcana is fully funded for the RV Mine restart including a robust contingency. Excess funding will be applied to potential value added activities such as such as exploration of vein extensions, potential production volume increases, strategic regional consolidation, and Shafter value added activities.

The Company remains on track to deliver a ramp up to full production in the second half of 2021. Please note the following progress milestones:

Staffing:

* All management personnel have been hired and are currently in place at the RV Mine along with Kevin Drover, President and CEO of Aurcana Silver Corporation who relocated to Ouray at the end of 2020 to directly oversee the restart.

* The current complement of employees and contractors working at the site is approximately 130 people including 110 working directly for the RV Mine.

Surface Facilities Upgrades:

* The rail-yard building constructed to provide storage of ore car train sets and material storage is completed.

* Foundations for the reagent building and miners dry room are poured and awaiting structural steel erection.

Underground Development:

* Debottlenecking of underground infrastructure continues allowing for more efficient development work.

* Significant progress has been made on #1 and #2 vertical raises to access the initial production stopes, and the vertical development sequence has been optimized to allow horizontal drifting to begin earlier on the lower (closer to rail level) production levels. #3 raise will commence in April.

* The Hubb-Reed raise shown on the drawing below is the main secondary escapeway from the mine. The opening has been completed and awaiting installation of the elevator.

http://www.aurcana.com/_resources/news/nr-20210218-figure1-tn.jpg

Processing Facilities Upgrades:

* All major pieces of equipment have been ordered and are either on-site or in transit.

* The mill foundation has been poured for the upgraded main mechanical feeder.

* Current expectations remain for mill commissioning and first ore through the mill in the third quarter of CY2021.

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Michael Gross, P. Geo, a “qualified person” within the meaning of NI 43-101

ABOUT AURCANA CORPORATION

Aurcana Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Viriginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

Gary Lindsey, Corporate Communications

Phone: (720)-273-6224

Email: gary@strata-star.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

http://www.aurcana.com/news/2020/index.php?content_id=477

Silver Bull Files Maiden NI 43-101 Resource of 2.33 Million Ounces of Gold & 476 Thousand Tonnes of Copper in the “Indicated” Category, and 1.56 Million Ounces of Gold & 220 Thousand Tonnes of Copper in the “Inferred” Category on the Beskauga Copper-Gold Project in Northeastern Kazakhstan (OTCQB:SVBL; TSX:SVB)

February 16, 2021

An excerpt: