Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

A good reason to open a sales office.

https://www.otcmarkets.com/otcapi/company/dns/news/document/58856/content

ONLY CREDITABLE FACTS MATTER

A good reason to open a sales office.

https://www.einnews.com/amp/pr_news/590551344/tri-cascade-inc-announces-its-5g-tritom-gx500c-modem

ONLY CREDITABLE FACTS MATTER

Said 100% of the companies that have gone bankrupt, along with, IF we could sell anything THEN we would have revenue.

Please join me for the Chicago opening of Facts Matter Head Quarter, located at 405 W Superior, 7th Floor, Chicago, IL 60654

This will serve as a way for us to be in an area where we have strategically aligned with many clients. I hear POSRMX has an office near us, but we’ve seen no such evidence of that.

Watch for our next expansion of satellite offices to include international locations, as we have been able to network our vast set of resources to penetrate markets all over the world.

Don’t forget to visit our satellite office in Irvine, CA.

See you there. Or not.

POSRMX sucks!

What is a Head Quarter? Is that a quarter that has heads on both sides? Is it a quarter that was elected as the head of a group of quarters?

https://www.tricascadeinc.com/contact-us

A company that lists a phone booth as their Head Quarter, is a company that is trying to deceive people.

We know the Head Quarter isn’t an actual office, but rather a shoe box that is rented solely for the purpose of being able to show a mailing address that looks legitimate. Head Quarter has no employees and is never used.

And now the same scam with the Chicago consumer office.

Validates a lot about Maxine that he would do this.

No products, no revenue, but a Head Quarter in Irvine, and a Chicago sales office sound great to anyone who has no clue.

Oh, and I love that the TriCascade website shows photos of each building their fake offices are in, which is supposed to impress people.

Pathetic.

It warms my heart to know that I’ve taught what a huge POS POSRMX is to others! Too bad some have flunked the lesson. Duh!

Check out these beautiful “Quarterly Bollinger Bands” for SRMX!!!

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=Srmx+&x=57&y=18&time=10&startdate=1%2F4%2F1999&enddate=9%2F20%2F2022&freq=4&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=8&lf=131072&lf2=32&lf3=16&type=2&style=320&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=10

Disclaimer—This is not a recommendation to buy or sell a stock. As always, Do your own due diligence before making your own decisions.

Maxine left a few details out of the PR.

“has opened a Sales and Marketing office on West Superior Street in the heart of Chicagos Business District. Max C. Li, President and CEO of Tri Cascade, Inc. says We are very excited to announce the opening of our Chicago office.”

Sales and Marketing office? Wow, sounds so impressive.

Opening of our Chicago office? Wow, sounds so impressive.

Too bad it’s not as it sounds.

It’s a day or virtual office, that rents starting at $59.00 per month. It’s not an actual office. There are no POSRMX employees there. It’s not at all what Maxine made it sound like in his PR.

Nothing was “opened”, as nothing was built for POSRMX.

Facts matter, and the fact is ANYONE can “open and office” at the same address Maxine provided.

I might even open my Facts Matter Worldwide Headquarters there.

As usual, a bogus pump results in only fooling a few donkeys for only a few minutes, and pps reflects that.

And that’s 2 bogus pumps in the last 2 weeks which fell apart quickly.

Maxine and Savior Jerome, you suck, and so does your Chicago office!

.0004 on 9-20-22. Down 98% since 2-12-21. Pathetic!

That’s one hell of a story. A complete story.

When did that banking occur? I keep hearing that the past doesn’t matter, the past being from 2018 to 2022, but somehow pps from 19 months ago, which literally had nothing to do with POSRMX directly, is the only thing some think matters.

Very interesting.

POSRMX RUNNING OUT OF CASH IN 41 DAYS!!!!!

Unless they can get a huge infusion from somewhere, and no, a few thousand dollars from Halo won’t keep this ship from sinking.

Cash on hand 3-31-22

$82,017

Cash received from 4-1-22 through 6-30-22

$567,500

$82,017 + $567,500 = $649,517

Cash on hand 6-30-22

$369,805

Cash burned through from 4-1-22 through 6-30-22

$279,712

Average monthly burn rate of over $93,000

$369,805 divided by $93,000 = 3.98

With 4 months of cash on hand as of 6-30-21, POSRMX will run out of cash by 11-1-22, which is only 41 days from now.

THEY WILL NEED $200,000 BY 11-1-22, JUST TO MAKE IT TO THE END OF 2022.

MAXINE ALREADY CONCEDED REVENUE WOULD NOT HAPPEN ON 2022, SO WHERE WILL THEY GET $200,000 TO STAY AFLOAT IN Q4?????

Maxine and/or Savior Jerome, if you are reading this then you are more pathetic then I thought.

POSRMX sucks!

And yet, you won’t get one. Nobody will.

Rinse and repeat.

Max and/or Jerome if you are reading this board can you please update the Investors Page to include a link to the OTCMARKETS webpage.

Also very nice press releases, perhaps update those in the beautiful website too,

Thanks

GO SRMX$ (TCCI)

It only takes 1 successful popular product. I'd love a new TCCI T-Mobile consumer product for Christmas!

Go SRMX!

IDK, I have banked on SRMX, many investors did. Not too shabby.

I expect a repeat as soon as big revenue is confirmed.

Mr Max and Mr Jerome, bring on the BIG REVENUE!

Go SRMX!

According to the corks popping yesterday, your post is poppycock.

That’s so 2018, 2019, 2020, 2021 and 2022.

People have disagreed for 5 years, but my record is better then anyone else on the subject of POSRMX. Duh!

Brilliant, is all I got to say. Oh and you guys may want to buy those 5, 6, and 7s before I get another runner or I will suck them up!!

Revenue

From Wikipedia, the free encyclopedia

Jump to navigationJump to search

For other uses, see Revenue (disambiguation).

Part of a series on

Accounting

Early 19th-century German ledger

Historical costConstant purchasing powerManagementTax

Major types

Key concepts

Selected accounts

Accounting standards

Financial statements

Bookkeeping

Auditing

People and organizations

Development

Misconduct

vte

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. [1] Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees.[2] "Revenue" may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in "Last year, Company X had revenue of $42 million". Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses).[3]

In general usage, revenue is the total amount of income generated by the sale of goods or services related to the company's primary operations Sales revenue is income received from selling goods or services over a period of time. Tax revenue is income that a government receives from taxpayers. Fundraising revenue is income received by a charity from donors etc. to further its social purposes.

In more formal usage, revenue is a calculation or estimation of periodic income based on a particular standard accounting practice or the rules established by a government or government agency. Two common accounting methods, cash basis accounting and accrual basis accounting, do not use the same process for measuring revenue. Corporations that offer shares for sale to the public are usually required by law to report revenue based on generally accepted accounting principles or on International Financial Reporting Standards.

In a double-entry bookkeeping system, revenue accounts are general ledger accounts that are summarized periodically under the heading "Revenue" or "Revenues" on an income statement. Revenue account-names describe the type of revenue, such as "Repair service revenue", "Rent revenue earned" or "Sales".[4]

Contents

1 Non-profit organizations

1.1 Association dues revenue

2 Business revenue

2.1 Accounting terms

2.2 Accounting

2.3 Financial statement analysis

3 Government revenue

4 See also

5 References

6 External links

Non-profit organizations

For non-profit organizations, revenue may be referred to as gross receipts, support, contributions, etc.[5] This operating revenue can include donations from individuals and corporations, support from government agencies, income from activities related to the organization's mission, income from fundraising activities, and membership dues. Revenue (income and gains) from investments may be categorized as "operating" or "non-operating"—but for many non-profits must (simultaneously) be categorized by fund (along with other accounts).

Association dues revenue

For non-profits with substantial revenue from the dues of their voluntary members: non-dues revenue is revenue generated through means besides association membership fees. This revenue can be found through means of sponsorships, donations or outsourcing the association's digital media outlets.

Business revenue

Business revenue is money income from activities that are ordinary for a particular corporation, company, partnership, or sole-proprietorship. For some businesses, such as manufacturing or grocery, most revenue is from the sale of goods. Service businesses such as law firms and barber shops receive most of their revenue from rendering services. Lending businesses such as car rentals and banks receive most of their revenue from fees and interest generated by lending assets to other organizations or individuals.

Revenues from a business's primary activities are reported as sales, sales revenue or net sales.[2] This includes product returns and discounts for early payment of invoices. Most businesses also have revenue that is incidental to the business's primary activities, such as interest earned on deposits in a demand account. This is included in revenue but not included in net sales.[6] Sales revenue does not include sales tax collected by the business.

Other revenue (a.k.a. non-operating revenue) is revenue from peripheral (non-core) operations. For example, a company that manufactures and sells automobiles would record the revenue from the sale of an automobile as "regular" revenue. If that same company also rented a portion of one of its buildings, it would record that revenue as “other revenue” and disclose it separately on its income statement to show that it is from something other than its core operations. The combination of all the revenue-generating systems of a business is called its revenue model.[7]

Accounting terms

Net sales = gross sales – (customer discounts, returns, and allowances)

Gross profit = net sales – cost of goods sold

Operating profit = gross profit – total operating expenses

Net profit = operating profit – taxes – interest

Net profit = net sales – cost of goods sold – operating expense – taxes – interest

EBIT = net profit + taxes + interest

EBITDA = net profit + taxes + interest + depreciation + amortization

Accounting

While the current IFRS conceptual framework [8] no longer draws a distinction between revenue and gains, it continues to be drawn at the standard and reporting levels. For example, IFRS 9.5.7.1 states: "A gain or loss on a financial asset or financial liability that is measured at fair value shall be recognised in profit or loss ..." while the IASB defined IFRS XBRL taxonomy [9] includes OtherGainsLosses, GainsLossesOnNetMonetaryPosition and similar items.

Financial statement analysis

Main article: Financial statement analysis

Further information: Revenue management § Forecasting

Revenue is a crucial part of financial statement analysis. The company's performance is measured to the extent to which its asset inflows (revenues) compare with its asset outflows (expenses). Net income is the result of this equation, but revenue typically enjoys equal attention during a standard earnings call. If a company displays solid “top-line growth”, analysts could view the period's performance as positive even if earnings growth, or “bottom-line growth” is stagnant. Conversely, high net income growth would be tainted if a company failed to produce significant revenue growth. Consistent revenue growth, if accompanied by net income growth, contributes to the value of an enterprise and therefore the share price.

Revenue is used as an indication of earnings quality. There are several financial ratios attached to it:

The most important being gross margin and profit margin; also, companies use revenue to determine bad debt expense using the income statement method.

Price / Sales is sometimes used as a substitute for a Price to earnings ratio when earnings are negative and the P/E is meaningless. Though a company may have negative earnings, it almost always has positive revenue.

Gross Margin is a calculation of revenue less cost of goods sold, and is used to determine how well sales cover direct variable costs relating to the production of goods.

Net income/sales, or profit margin, is calculated by investors to determine how efficiently a company turns revenues into profits.

Government revenue

Main article: Government revenue

Government revenue includes all amounts of money (i.e., taxes and fees) received from sources outside the government entity. Large governments usually have an agency or department responsible for collecting government revenue from companies and individuals.[10]

Government revenue may also include reserve bank currency which is printed. This is recorded as an advance to the retail bank together with a corresponding currency in circulation expense entry, that is, the income derived from the Official Cash rate payable by the retail banks for instruments such as 90-day bills. There is a question as to whether using generic business-based accounting standards can give a fair and accurate picture of government accounts, in that with a monetary policy statement to the reserve bank directing a positive inflation rate, the expense provision for the return of currency to the reserve bank is largely symbolic, such that to totally cancel the currency in circulation provision, all currency would have to be returned to the reserve bank and canceled.

See also

List of companies by revenue

Legal tender#Demonetization

Proceeds of crime

References

Wolk, Harry I.; Dodd, James L.; Rozycki, John J. (2008). Wolk, Harry I. (ed.). Accounting Theory: Conceptual Issues in a Political and Economic Environment, Volume 2. Sage library in accounting and finance (7 ed.). Los Angeles: Sage. p. 383. ISBN 9781412953450. Retrieved 16 November 2020.

Joseph V. Carcello (2008). Financial & Managerial Accounting. McGraw-Hill Irwin. p. 199. ISBN 978-0-07-299650-0. This definition is based on IAS 18.

Williams, p.51[incomplete short citation]

Williams, p. 196.[incomplete short citation]

2006 Instructions for Form 990 and Form 990-EZ Archived 2009-08-25 at the Wayback Machine, U.S. Department of the Treasury, p. 22

Williams, p. 647[incomplete short citation]

"Revenue models". Dr. K.M.Popp. Archived from the original on 2014-06-19. Retrieved 2014-07-20.

"IASB".

"IASB".

HM Revenue & Customs (United Kingdom) Office of the Revenue Commissioners (Ireland) Internal Revenue Service bureau, Department of the Treasury (United States) Missouri Department of Revenue Louisiana Department of Revenue Archived 2017-06-05 at the Wayback Machine

External links

The dictionary definition of revenue at Wiktionary

vte

Accounting

Authority control Edit this at Wikidata

Categories: Revenue

Navigation menu

Not logged in

Talk

Contributions

Create account

Log in

ArticleTalk

ReadEditView history

Search

Search Wikipedia

Main page

Contents

Current events

Random article

About Wikipedia

Contact us

Donate

Contribute

Help

Learn to edit

Community portal

Recent changes

Upload file

Tools

What links here

Related changes

Special pages

Permanent link

Page information

Cite this page

Wikidata item

Print/export

Download as PDF

Printable version

Languages

Deutsch

Español

Français

???

Italiano

???????

Tagalog

Ti?ng Vi?t

??

40 more

Edit links

This page was last edited on 19 April 2022, at 10:29 (UTC).

Text is available under the Creative Commons Attribution-ShareAlike License 3.0; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

Story time Long story short 20 billion dollars took Jerome Riordan from SPRINT to T-MOBILE now he's with Tri Cascade. After 5 months WHAT DID WHAT DOES ANYONE THINK IS GOING TO HAPPEN. $$$$$$$REVENUES$$$$$$$

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business.

Wait for it...

Go SRMX!

I disagree, duh!

Go SRMX!

Nobody thought that. The PR was clear about the purpose.

Go SRMX!

Who thought they really were opening a sales office in Chicago? Not me!

Apparently not many others did either, based on the pump not working.

You do know they wasted many millions on product development for products that were never produced, right?

You think they care about wasting $60 per month?

Hahahahahahahahaha

Or, could be bullshit to make people think they are actually entertaining clients. Yup, that’s what it is. Duh!

Ha! It was really PR worthy wasn’t it??

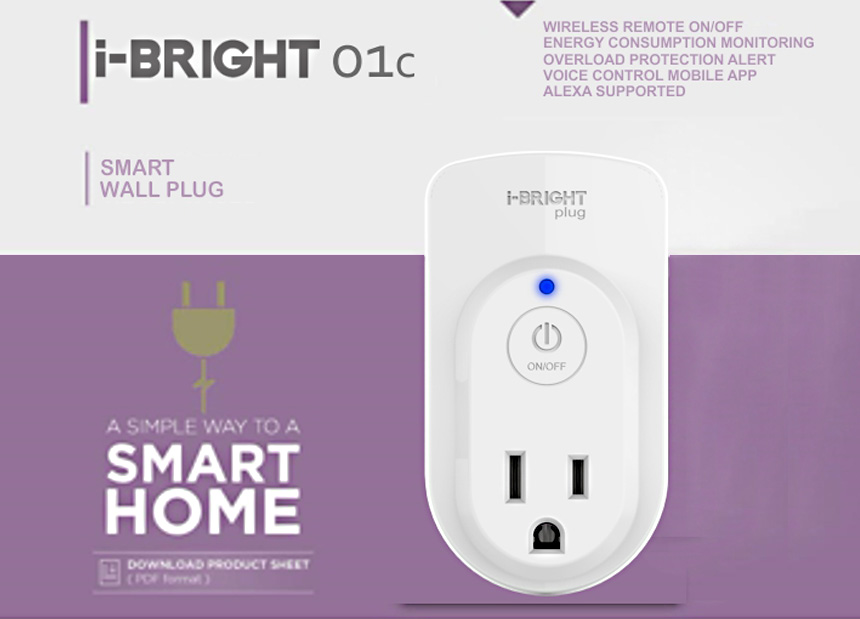

And to think some people thought it was like a show room for the entire suite of products.

Wow, Maxine really knows how to promote nothing.

Virtual office Smirtual office why waste investors money .For further information please visit www.tricascadeinc.com or send your request to

jerome.riordan@tricascadeinc.com.

Yep. Why does Tri-Cascade need a Chicago meeting location? Could it be exactly what is in the PR?

...ideally positioned to launch our upcoming new and innovative Smart connected products to consumers nationwide through our distribution arrangements with big box stores...

Looks like he may have gotten an even better deal than that (first month aside).

https://www.davincivirtual.com/loc/us/illinois/chicago-virtual-offices/facility-3008

.

Possibly and honestly, I have no idea, just patiently waiting.

Most likely but honestly that is all they really need at this point. Somewhere to utilize conference rooms or possibly a single office. Who really knows, I guess we will find out in the next few months.

Office buildinding might be a little to close to the candyman projects CABRINI GREEN

CANDYMAN CANDYMAN!!!!!

It also says day and virtual offices. Starting at $199 per month.

Maybe I’ll open a satellite office on the 7th floor so I can say I have a Chicago office too.

What next, a New York office???!

It’s a pump. Full stop.

Yes, I would assume they would not need much space. They are on the top floor (7th) and the website say they have suites, single offices, and shared space.

https://expansive.com/locations/illinois/chicago/superior/

Just as I thought; workspaces starting at only $199 per month.

That’s why it says 7th floor, with no suite number. They are using it as a day or virtual office. It won’t be staffed and isn’t a set space.

I knew this was a total pump.

https://expansive.com/locations/illinois/chicago/superior/

POSRMX has 2 offices, which is 2 more then the number of BC66 units sold in almost 3 years.

BAHAHAHAHAHAHAHAHAHA

Please research that building. Willing to bet it’s the same as the Irvine “office”, which is a 200 SQF box that Maxine uses the address for to make it look like they have an office there.

I guess trying to make people think POSRMX has an office in Chicago is the new business strategy.

Educated brains know Maxine has been recycling the same pumps, using different names, since 2018.

It took almost 5 years for Maxine to re-use the “will be sold in big box stores” pump, like he did for SkiQ. Anyone see SkiQ in a big box store? No, because 3 months after Maxine said that, it was announced that SkiQ wasn’t even produced and wouldn’t be selling anywhere.

Chicago Office (TCCI Consumer):

405 W Superior, 7th Floor,

Chicago, IL 60654

https://www.tricascadeinc.com/contact-us

Yup, that’s where Maxine said SkiQ would be selling in 2018. Oops!

Fiction and fantasy about POSRMX don’t matter. Facts do.

It’s almost Q4 of 2022. How much revenue is on the books? How many products are for sale? What is the pps?

These are the credible facts that matter.

The only credible facts about POSRMX are baaaaaaad!!!!!!

TCCI AND BIG BOX STORES COSTCO, WALMART, TARGETS? $$$SRMX$$$

DISCLAIMER: NONE OF MY POST SHOULD BE CONDIDERED ANY REASON TO BUY OR SELL. PLEASE DO YOUR DILIGENCE AND TRADE WISELYI

TCCI

ONLY CREDITABLE FACTS MATTER

That BS Chicago Office pump went over well I see with my educated eyes.

|

Followers

|

673

|

Posters

|

|

|

Posts (Today)

|

22

|

Posts (Total)

|

131172

|

|

Created

|

05/29/06

|

Type

|

Free

|

| Moderators CanItBThisEZ2Make SPARK'S FLY MrMike241 | |||

| Saddle Ranch Media Inc (SRMX) 657 FOLLOWERS AS OF 2/20/2021 iBox Updated 2/20/2021 |

Tri Cascade, Inc. - Operating Business Entity

5020 Campus Drive

Newport Beach, CA 92660

Phone: 949-296-7501

Fax: 949-296-7503

Max Chin Li

Chief Executive Officer

Phone: 949-296-7501

max.li@tricascadeinc.com

Alan Bailey

Chief Financial Officer

Phone: 310-722-6624

T-MOBILE NB-IOT - SERVICE PACK

TRITOM BC66 MINI PCe MODEM CARD

TRITOM BG96 MINI PCe CARD

CAT1-700 VO2 INDUSTRAIL IOT COMMUNICATION GATEWAY

CAT1-700-3 INDUSTRIAL IOT COMMUNIATION GATEWAY WITH CERTIFICATION

WIRELESS HOME GATEWAY (SKIQ)

DIGITAL WIRELESS NETWORK RECEPTACLE

IDENTIFICATION DETECTION SYSTEM FOR POWER CONSUMPTION OF ELECTRIC APPLIANCE

TRADEMARK LINKS

|

| ||

Website: http://www.tricascadeinc.com | ||

| $SRMX READY TO MAKE REVENUE IN 2020 $$$$$$$$$$$ |

| $SRMX IMPORTANT INFORMATION |

|

| ||

| | ||

| * |  | * |

The Tri Cascade management team has extensive years of innovation experience in Energy Efficiency Management, Home Wireless Networking, Home Automation and Device Control Systems, as well as B2B customer services.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |