Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

KEYNOTE SPEECH AT SYDNEY GOLD SYMPOSIUM 14-15 NOVEMBER 2011 By ALF FIELD

* Monday, November 14, 2011

THE MOSES PRINCIPLE

The Moses Principle is an irreverent theory based on the question of why Moses spent 40 years traversing the Sinai desert before leading the Israelites to the “promised land”.

God was powerful enough to send numerous plagues to devastate the Egyptian economy until Pharaoh allowed the Israelites to leave Egypt. Later God caused the Red Sea to part so that the Israelites crossed on a dry sea bed. When the pursuing Egyptian army and their chariots were in the sea bed, the waters crashed back and drowned them.

If God was powerful enough to do all of these things, why not allow the Israelites to go straight to the “promised land”? Why did Moses spend 40 years traversing the barren desert before leading the Israelites to the “promised land”? Here is the irreverent theory. Every Israelite over middle age when they left Egypt probably died during the ensuing 40 years. The younger people were born in the desert or spent their adult lives in the desert. After 40 years the life experience of the survivors consisted of living in the desert. When they finally got to the “promised land” it appeared to be “flowing with milk and honey” when compared to their prior desert existence.

A total generational change had taken place so that the survivors had no knowledge of anything other than the desert. There was nobody who could remember what Egypt was like. The Moses Principle recognizes the fact that over any 40 year period, a generational change takes place.

What has this got to do with gold? Recently we passed the 40th anniversary of 15 August 1971, the date when the last link between currencies and gold was ended by President Nixon. This launched an era of floating “I owe you nothing” currencies. Money was what any government deemed it to be, generally something that the government could create in unlimited quantities. That system, plus the fractional reserve banking system, launched an era of ever increasing debt and credit. It was an era where debt was desirable and money lost its purchasing power.

Everyone in this room has spent their adult lives living under this system. Most have had no exposure to monetary history or what money really is. The new “Moses” generation will have to re-learn the lessons of monetary history before the world can enter a new era of sound money and stable economic growth. The impact of this generational change will be discussed later.

The 15 August 1971 was an important date for me personally. I had grown up in South Africa and in early 1970 started a funds management company with a good friend of mine. The first 18 months was a struggle as we were buffeted by a vicious bear market. By August 1971 our clients were largely in cash awaiting the end of the bear market or an inspirational idea.

That inspirational idea came on 15 August 1971 when I heard that President Nixon had decreed that the USA would no longer exchange US dollars held by foreign governments for gold at $35 per ounce. Gold had limited downside but appeared to have good potential for substantial gain. Gold shares were deeply depressed after 37 years of a fixed $35 gold price, another “Moses Principle” period. We bought gold shares aggressively. This proved to be an astute move and our funds management business was launched on a successful path.

Having locked ourselves into a big position in gold shares, we needed to have some idea of how the gold price might perform and how high it might rise. We ran into the conundrum that has confounded fundamental analysts since 1971. How do you value something that has no utility value, no earnings or net asset value, does not spoil or corrode and is not used up?

Other commodities such as copper, soya beans and corn etc., are priced using a combination of demand, supply and stocks. If demand exceeds supply, stocks diminish, shortages develop, prices rise and new production comes on stream. Eventually supply exceeds demand, stocks build up, prices decline and marginal producers go out of business. The cycle then repeats itself. Other commodities are produced for consumption while gold is accumulated.

Consequently large stocks of gold exist in official hands as central bank reserves. There are also large stocks of gold in private ownership, in vaults around the world, in homes, buried in gardens, in coins and gold jewelry. New mine production of gold is tiny compared to available stocks. In 1971 official holdings of gold were about 37,000t. Cumulative world gold production throughout history up to 1971 was estimated to be about 90,000t, so investors/hoarders must have owned at least as much as the official holdings. In 1971 world gold production was a mere 1,450t, or less than 2% of the estimated amount of gold held in the world at that time.

The fundamental conclusion was that the owners of the large stocks of gold would determine the future of the gold price. If they became net sellers, the gold price would decline. If they became net buyers, the gold price would rise. There were reasons to believe that they would be net buyers. The world had been launched into an untried experiment where all countries were subject to Government fiat currencies and, in addition, there was a latent group of buyers in the wings. Americans had been prevented by law from holding gold since 1933. With the collapse of the gold exchange standard on 15 August 1971, there was no reason for this prohibition to continue. On 31 December 1974 (another Moses generation period from 1933) the largest and wealthiest nation on Earth allowed its citizens to buy and own gold.

The obvious conclusion was that it was necessary to resort to technical analysis to find a way to predict movements in the gold price. I experimented with a variety of technical systems and then got lucky. I discovered that the Elliott Wave Theory (EW) gave superb results in predicting the gold price. I couldn’t get the same great results using EW in other commodities or markets. EW is a complicated system with many difficult rules, but I will try and explain it in simple terms.

The technique is to concentrate on the corrections. In terms of EW, the sequence in a bull market is as follows. The market rises, has a 4% correction, rises, has a 4% correction and rises again. At this point the next correction jumps from 4% to a larger degree of magnitude, say 8%. The market then repeats the sequence. A rise, a 4% correction, a rise, 4% correction, a rise and another 8% correction. When the market is eventually due a third 8% correction, the magnitude of that correction jumps from 8% to 16%. This sequence is repeated until two 16% corrections have occurred when the size of the next big correction jumps to 32%.

The beauty of EW is that the corrections in gold are remarkably regular and consistent. Early in 2002 I picked up the 4%, 4%, 8% rhythm in the gold market which convinced me that a new bull market had started in gold. Another feature of EW is that once one is confident that these percentages have been established and one has some idea of the approximate size of the up moves, simple arithmetic allows one to calculate a forecast of the future price trend.

Using this method I calculated that the gold price should rise from the $300 ruling in 2002 to at least $750 without having anything worse than two 16% corrections on the way. That was valuable information at that time. Furthermore, from the $750 target a big 32% correction could be expected to about $500. Then the bull market would resume, rising to perhaps $2,500 before another 32% correction occurred. The final up-move would take the gold price to much higher levels, possibly $6,000. Once again, a valuable insight when gold was $300 in 2002...

Read On:

http://www.jsmineset.com/

George.

Gold traders most bullish since 2004 on debt crisis

* Saturday, November 12, 2011

LONDON: Gold traders and analysts are the most bullish in at least seven years as investors accumulate metal at the fastest pace since August to protect their wealth from a widening European debt crisis. Twenty-one of 22 surveyed by Bloomberg expect bullion to rise on the Comex in New York next week, the third consecutive increase and the highest proportion in data going back to April 2004.

Holdings in exchange-traded products backed by gold rose 27.5 tonne this week, within 1% of the record set almost three months ago, data compiled by Bloomberg show. Gold exceeded $1,800 an ounce for the first time in seven weeks on November 8 and hedge funds are holding their biggest bet on higher prices since mid-September , Commodity Futures Trading Commission data show. The metal is rebounding after tumbling as much as 20% in three weeks in September. Almost $9 trillion was wiped off the value of global equities since May and yields on Italian and Greek bonds rose to euro-era records this week. "Throughout history gold has protected people from the sort of turmoil that we're seeing," said Mark O'Byrne , the Dublin-based executive director of GoldCore, a brokerage that sells everything from quarter-ounce British Sovereigns to 400-ounce bars.

http://articles.economictimes.indiatimes.com/2011-11-12/news/30391300_1_gold-traders-gold-survey-history-gold

George.

lol.nice post. All stock posts welcome. I will check this one out too

It's a GOLD producer but what the hey! Caledonia Mining 2011 Third Quarter Results http://tmx.quotemedia.com/article.php?newsid=46015428&qm_symbol=CAL

Operational Highlights

Gold produced by the Blanket Mine in Zimbabwe in the Quarter increased by 18% to 9,743 ounces from the 8,226 ounces produced in the 2nd quarter 2011 (the "preceding quarter") and was 97% higher than the 4,935 ounces of gold produced in 3rd quarter 2010 (the "comparative quarter"). This is the sixth consecutive quarterly increase in gold production.

Average gold recovery increased to 93.1% from 92.9% in the preceding quarter and from 91.3% in the comparative quarter reflecting the benefits from investment in improvements to the milling and Carbon-in-Leach ("CIL") circuits.

Cash operating costs at the Blanket Mine in the Quarter were US$583 per ounce of gold produced compared to US$585 in the preceding quarter and US$651 in the comparative quarter.

CALVF Caledonia Mining Corp.(.11) 30-40 thousand ounce per year gold producer based in Zimbabwe.

Website: http://www.caledoniamining.com/index.php

TSX Ticker CAL: http://tmx.quotemedia.com/quote.php?qm_symbol=cal

IHUB: http://investorshub.advfn.com/boards/board.aspx?board_id=5294

I appreciate that very much. I have you marked now as well.

Lol. I keep a good eye on the silver stocks as well.

Your board is a great new addition to Ihub by the way. I have already followed you and boardmarked, looking forward to your future picks...

OK judging by the ibox I really like your board.

~$1790~$34.50~HDA~SOL~USA~AUN~ALL ON SALE TODAY!

~SILVER$35~~HDA.v~ 1,600 left at $1.40

~SOL.v~ BUYING SPREE ON THIS STOCK TODAY!!!

Do YOU Know who FEMA is?

FEMA Executive Orders

Some people have referred to it as the "secret government" of the United States. It is not an elected body, it does not involve itself in public disclosures, and it even has a quasi-secret budget in the billions of dollars. This government organization has more power than the President of the United States or the Congress, it has the power to suspend laws, move entire populations, arrest and detain citizens without a warrant and hold them without trial, it can seize property, food supplies, transportation systems, and can suspend the Constitution. Not only is it the most powerful entity in the United States, but it was not even created under Constitutional law by the Congress. It was a product of a Presidential Executive Order. No, it is not the U.S. military nor the Central Intelligence Agency, they are subject to Congress. The organization is called FEMA, which stands for the Federal Emergency Management Agency. Originally conceived in the Richard Nixon Administration, it was refined by President Jimmy Carter and given teeth in the Ronald Reagan and George Bush Administrations.

FEMA had one original concept when it was created, to assure the survivability of the United States government in the event of a nuclear attack on this nation. It was also provided with the task of being a federal coordinating body during times of domestic disasters, such as earthquakes, floods and hurricanes. Its awesome powers grow under the tutelage of people like Lt. Col. Oliver North and General Richard Secord, the architects on the Iran-Contra scandal and the looting of America's savings and loan institutions. FEMA has even been given control of the State Defense Forces, a rag-tag, often considered neo-Nazi, civilian army that will substitute for the National Guard, if the Guard is called to duty overseas.

THE MOST POWERFUL ORGANIZATION IN THE UNITED STATES.

Though it may be the most powerful organization in the United States, few people know it even exists. But it has crept into our private lives. Even mortgage papers contain FEMA's name in small print if the property in question is near a flood plain. FEMA was deeply involved in the Los Angeles riots and the 1989 Loma Prieta earthquake in the San Francisco Bay Area. Some of the black helicopter traffic reported throughout the United States, but mainly in the West, California, Washington, Arizona, New Mexico, Texas and Colorado, are flown by FEMA personnel. FEMA has been given responsibility for many new disasters including urban forest fires, home heating emergencies, refugee situations, urban riots, and emergency planning for nuclear and toxic incidents. In the West, it works in conjunction with the Sixth Army. FEMA was created in a series of Executive Orders. A Presidential Executive Order, whether Constitutional or not, becomes law simply by its publication in the Federal Registry. Congress is by-passed.

Executive Order Number 12148 created the Federal Emergency Management Agency that is to interface with the Department of Defense for civil defense planning and funding. An "emergency czar" was appointed. FEMA has only spent about 6 percent of its budget on national emergencies. The bulk of their funding has been used for the construction of secret underground facilities to assure continuity of government in case of a major emergency, foreign or domestic.

Executive Order Number 12656 appointed the National Security Council as the principal body that should consider emergency powers. This allows the government to increase domestic intelligence and surveillance of U.S. citizens and would restrict the freedom of movement within the United States and grant the government the right to isolate large groups of civilians. The National Guard could be federalized to seal all borders and take control of U.S. air space and all ports of entry. Here are just a few Executive Orders associated with FEMA that would suspend the Constitution and the Bill of Rights. These Executive Orders have been on record for nearly 30 years and could be enacted by the stroke of a Presidential pen:

EXECUTIVE ORDER 10990 allows the government to take over all modes of transportation and control of highways and seaports.

EXECUTIVE ORDER 10995 allows the government to seize and control the communication media.

EXECUTIVE ORDER 10997 allows the government to take over all electrical power, gas, petroleum, fuels and minerals.

EXECUTIVE ORDER 10998 allows the government to take over all food resources and farms.

EXECUTIVE ORDER 11000 allows the government to mobilize civilians into work brigades under government supervision.

EXECUTIVE ORDER 11001 allows the government to take over all health, education and welfare functions.

EXECUTIVE ORDER 11002 designates the Postmaster General to operate a national registration of all persons.

EXECUTIVE ORDER 11003 allows the government to take over all airports and aircraft, including commercial aircraft.

EXECUTIVE ORDER 11004 allows the Housing and Finance Authority to relocate communities, build new housing with public funds, designate areas to be abandoned, and establish new locations for populations.

EXECUTIVE ORDER 11005 allows the government to take over railroads, inland waterways and public storage facilities.

EXECUTIVE ORDER 11051 specifies the responsibility of the Office of Emergency Planning and gives authorization to put all Executive Orders into effect in times of increased international tensions and economic or financial crisis.

EXECUTIVE ORDER 11310 grants authority to the Department of Justice to enforce the plans set out in Executive Orders, to institute industrial support, to establish judicial and legislative liaison, to control all aliens, to operate penal and correctional institutions, and to advise and assist the President.

EXECUTIVE ORDER 11049 assigns emergency preparedness function to federal departments and agencies, consolidating 21 operative Executive Orders issued over a fifteen year period.

EXECUTIVE ORDER 11921 allows the Federal Emergency Preparedness Agency to develop plans to establish control over the mechanisms of production and distribution, of energy sources, wages, salaries, credit and the flow of money in U.S. financial institution in any undefined national emergency. It also provides that when a state of emergency is declared by the President, Congress cannot review the action for six months. The Federal Emergency Management Agency has broad powers in every aspect of the nation.

General Frank Salzedo, chief of FEMA's Civil Security Division stated in a 1983 conference that he saw FEMA's role as a "new frontier in the protection of individual and governmental leaders from assassination, and of civil and military installations from sabotage and/or attack, as well as prevention of dissident groups from gaining access to U.S. opinion, or a global audience in times of crisis." FEMA's powers were consolidated by President Carter to incorporate: The National Security Act of 1947, which allows for the strategic relocation of industries, services, government and other essential economic activities, and to rationalize the requirements for manpower, resources and production facilities; The 1950 Defense Production Act, which gives the President sweeping powers over all aspects of the economy; The Act of August 29, 1916, which authorizes the Secretary of the Army, in time of war, to take possession of any transportation system for transporting troops, material, or any other purpose related to the emergency; and The International Emergency Economic Powers Act, which enables the President to seize the property of a foreign country or national. These powers were transferred to FEMA in a sweeping consolidation in 1979.

HURRICANE ANDREW FOCUSED ATTENTION ON FEMA.

FEMA's deceptive role really did not come to light with much of the public until Hurricane Andrew smashed into the U.S. mainland. As Russell R. Dynes, director of the Disaster Research Center of the University of Delaware, wrote in The World and I, "...The eye of the political storm hovered over the Federal Emergency Management Agency. FEMA became a convenient target for criticism." Because FEMA was accused of dropping the ball in Florida, the media and Congress commenced to study this agency. What came out of the critical look was that FEMA was spending 12 times more for "black operations" than for disaster relief. It spent $1.3 billion building secret bunkers throughout the United States in anticipation of government disruption by foreign or domestic upheaval. Yet fewer than 20 members of Congress, only members with top security clearance, know of the $1.3 billion expenditure by FEMA for non-natural disaster situations. These few Congressional leaders state that FEMA has a "black curtain" around its operations. FEMA has worked on National Security programs since 1979, and its predecessor, the Federal Emergency Preparedness Agency, has secretly spent millions of dollars before being merged into FEMA by President Carter in 1979.

FEMA has developed 300 sophisticated mobile units that are capable of sustaining themselves for a month. The vehicles are located in five areas of the United States. They have tremendous communication systems and each contains a generator that would provide power to 120 homes, but have never been used for disaster relief. FEMA's enormous powers can be triggered easily. In any form of domestic or foreign problem, perceived and not always actual, emergency powers can be enacted. The President of the United States now has broader powers to declare martial law, which activates FEMA's extraordinary powers. Martial law can be declared during time of increased tension overseas, economic problems within the United States, such as a depression, civil unrest, such as demonstrations or scenes like the Los Angeles riots, and in a drug crisis.

These Presidential powers have increased with successive Crime Bills, particularly the 1991 and 1993 Crime Bills, which increase the power to suspend the rights guaranteed under the Constitution and to seize property of those suspected of being drug dealers, to individuals who participate in a public protest or demonstration. Under emergency plans already in existence, the power exists to suspend the Constitution and turn over the reigns of government to FEMA and appointing military commanders to run state and local governments. FEMA then would have the right to order the detention of anyone whom there is reasonable ground to believe...will engage in, or probably conspire with others to engage in acts of espionage or sabotage. The plan also authorized the establishment of concentration camps for detaining the accused, but no trial.

Three times since 1984, FEMA stood on the threshold of taking control of the nation. Once under President Reagan in 1984, and twice under President Bush in 1990 and 1992. But under those three scenarios, there was not a sufficient crisis to warrant risking martial law. Most experts on the subject of FEMA and Martial Law insisted that a crisis has to appear dangerous enough for the people of the United States before they would tolerate or accept complete government takeover. The typical crisis needed would be threat of imminent nuclear war, rioting in several U.S. cites simultaneously, a series of national disasters that affect widespread danger to the populous, massive terrorist attacks, a depression in which tens of millions are unemployed and without financial resources, or a major environmental disaster.

THREE TIMES FEMA STOOD BY READY FOR EMERGENCY

In April 1984, President Reagan signed Presidential Director Number 54 that allowed FEMA to engage in a secret national "readiness exercise" under the code name of REX 84. The exercise was to test FEMA's readiness to assume military authority in the event of a "State of Domestic National Emergency" concurrent with the launching of a direct United States military operation in Central America. The plan called for the deputation of U.S. military and National Guard units so that they could legally be used for domestic law enforcement. These units would be assigned to conduct sweeps and take into custody an estimated 400,000 undocumented Central American immigrants in the United States. The immigrants would be interned at 10 detention centers to be set up at military bases throughout the country.

REX 84 was so highly guarded that special metal security doors were placed on the fifth floor of the FEMA building in Washington, D.C. Even long-standing employees of the Civil Defense of the Federal Executive Department possessing the highest possible security clearances were not being allowed through the newly installed metal security doors. Only personnel wearing a special red Christian cross or crucifix lapel pin were allowed into the premises. Lt. Col. North was responsible for drawing up the emergency plan, which U.S. Attorney General William French Smith opposed vehemently. The plan called for the suspension of the Constitution, turning control of the government over to FEMA, appointment of military commanders to run state and local governments and the declaration of Martial Law. The Presidential Executive Orders to support such a plan were already in place. The plan also advocated the rounding up and transfer to "assembly centers or relocation camps" of a least 21 million American Negroes in the event of massive rioting or disorder, not unlike the rounding up of the Jews in Nazi Germany in the 1930s.

The second known time that FEMA stood by was in 1990 when Desert Storm was enacted. Prior to President Bush's invasion of Iraq, FEMA began to draft new legislation to increase its already formidable powers. One of the elements incorporated into the plan was to set up operations within any state or locality without the prior permission of local or state authorities. Such prior permission has always been required in the past. Much of the mechanism being set into place was in anticipation of the economic collapse of the Western World. The war with Iraq may have been conceived as a ploy to boost the bankrupt economy, but it only pushed the West into deeper recession. The third scenario for FEMA came with the Los Angeles riots after the Rodney King brutality verdict. Had the rioting spread to other cities, FEMA would have been empowered to step in. As it was, major rioting only occurred in the Los Angeles area, thus preventing a pretext for a FEMA response.

On July 5, 1987, the Miami Herald published reports on FEMA's new goals. The goal was to suspend the Constitution in the event of a national crisis, such as nuclear war, violent and widespread internal dissent, or national opposition to a U.S. military invasion abroad. Lt. Col. North was the architect. National Security Directive Number 52 issued in August 1982, pertains to the "Use of National Guard Troops to Quell Disturbances." The crux of the problem is that FEMA has the power to turn the United States into a police state in time of a real crisis or a manufactured crisis. Lt. Col. North virtually established the apparatus for dictatorship. Only the criticism of the Attorney General prevented the plans from being adopted. But intelligence reports indicate that FEMA has a folder with 22 Executive Orders for the President to sign in case of an emergency. It is believed those Executive Orders contain the framework of North's concepts, delayed by criticism but never truly abandoned. The crisis, as the government now sees it, is civil unrest. For generations, the government was concerned with nuclear war, but the violent and disruptive demonstrations that surrounded the Vietnam War era prompted President Nixon to change the direction of emergency powers from war time to times of domestic unrest.

Diana Reynolds, program director of the Edward R. Murrow Center, summed up the dangers of FEMA today and the public reaction to Martial Law in a drug crisis: "It was James Madison's worst nightmare that a righteous faction would someday be strong enough to sweep away the Constitutional restraints designed by the framers to prevent the tyranny of centralized power, excessive privilege, an arbitrary governmental authority over the individual. These restraints, the balancing and checking of powers among branches and layers of government, and the civil guarantees, would be the first casualties in a drug-induced national security state with Reagan's Civil Emergency Preparedness unleashed. Nevertheless, there would be those who would welcome NSC (National Security Council) into the drug fray, believing that increasing state police powers to emergency levels is the only way left to fight American's enemy within.

In the short run, a national security state would probably be a relief to those whose personal security and quality of life has been diminished by drugs or drug related crime. And, as the general public watches the progression of institutional chaos and social decay, they too may be willing to pay the ultimate price, one drug free America for 200 years of democracy."

The first targets in any FEMA emergency would be Hispanics and Blacks, the FEMA orders call for them to be rounded up and detained. Tax protesters, demonstrators against government military intervention outside U.S. borders, and people who maintain weapons in their homes are also targets. Operation Trojan Horse is a program designed to learn the identity of potential opponents to martial law. The program lures potential protesters into public forums, conducted by a "hero" of the people who advocates survival training. The list of names gathered at such meetings and rallies are computerized and then targeted in case of an emergency.

The most shining example of America to the world has been its peaceful transition of government from one administration to another. Despite crises of great magnitude, the United States has maintained its freedom and liberty. This nation now stands on the threshold of rule by non-elected people asserting non-Constitutional powers. Even Congress cannot review a Martial Law action until six months after it has been declared. For the first time in American history, the reigns of government would not be transferred from one elected element to another, but the Constitution, itself, can be suspended. The scenarios established to trigger FEMA into action are generally found in the society today, economic collapse, civil unrest, drug problems, terrorist attacks, and protests against American intervention in a foreign country. All these premises exist, it could only be a matter of time in which one of these triggers the entire emergency necessary to bring FEMA into action, and then it may be too late, because under the FEMA plan, there is no contingency by which Constitutional power is restored.

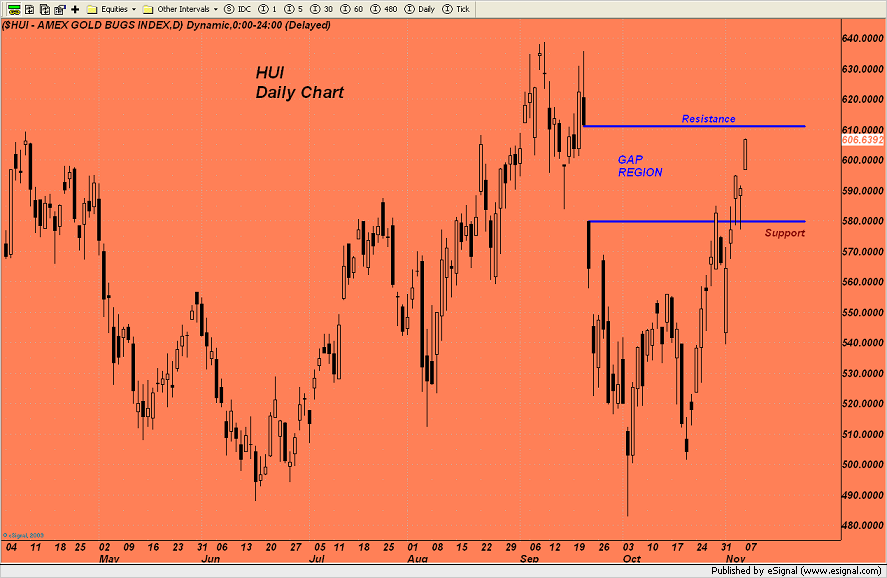

HUI continues its strong showing By Trader Dan

* Monday, November 7, 2011

Mining shares are getting a very strong bid in today's session taking the HUI up sharply through the 600 level, a psychological resistance level. As you can see on the chart, the index is moving ever closer to the top of the recent chart gap created last month when the shares were sold off during a downdraft in both the gold and silver bullion markets. I would expect the perma bears in the shares to try to make an effort to hold the index BELOW this resistance level. If they fail, I believe there will be enough momentum in the sector to mount a move back to the recent all time high.

Downside support is back at the bottom of the gap and is noted.

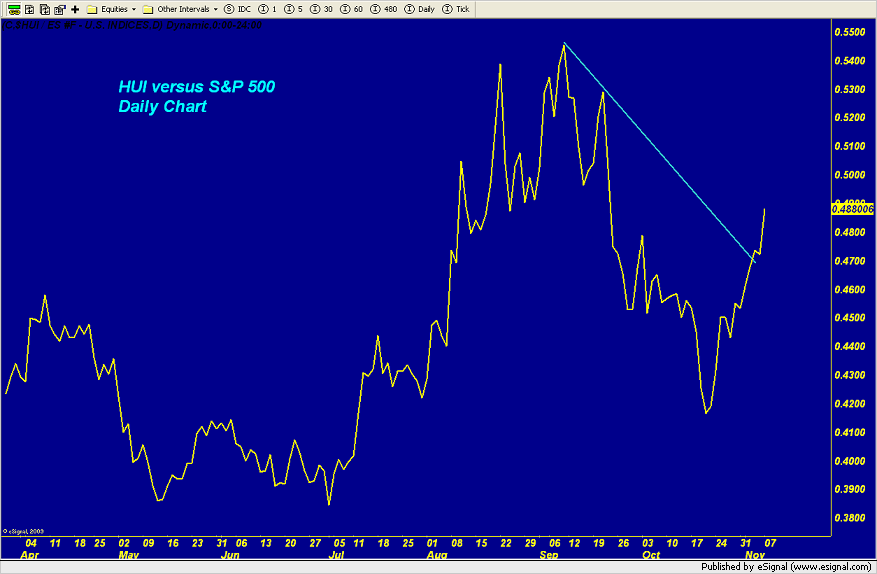

Note how the miners are continuing to outperform the broader equity markets today as they have done so over the last month.

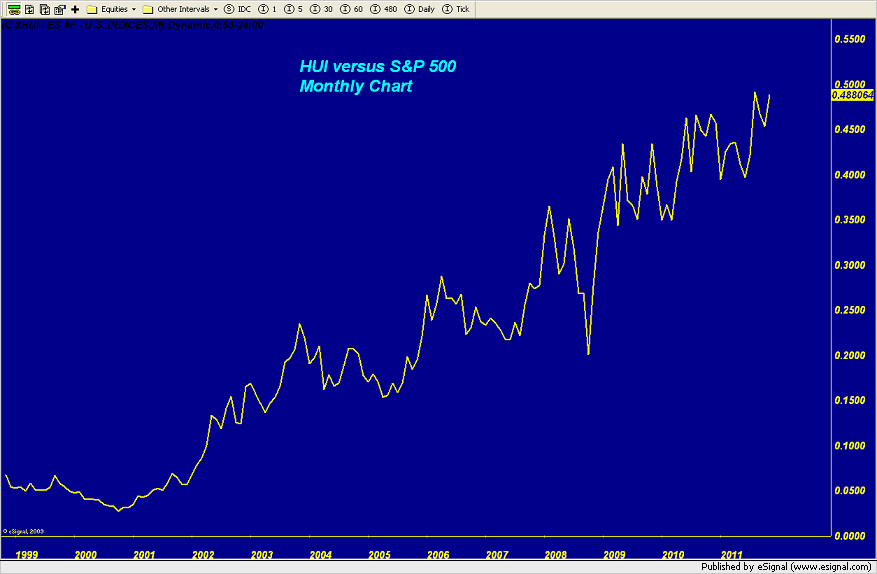

Also note the much longer term monthly ratio chart I have constructed showing the performance of this sector against the broader US equity market over the last decade+.

http://traderdannorcini.blogspot.com/2011/11/hui-continues-its-strong-showing.html

George.

Click on "In reply to", for Authors past commentaries.

CHEAP SILVER~G/S ratio below 50 to 1 w/ gold RUNNING!!!

~SILVER~HDA.v~Running!$1.34x$1.42~SUPER THIN L2...

$1.42-1,400

$1.45-5,400

$1.49-2,000

Huldra Silver DD:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=67494162

Huldra Silver board:

http://investorshub.advfn.com/boards/board.aspx?board_id=19452

~HDA.v~20,500 Hit the bid at $1.32CAD!

***** Latest Commodities Report shows Bank Participation in the Futures and Options Market *****

Updated November 1, 2011

The banks Increased their short positions in Gold and in Silver since last month.

http://www.cftc.gov/MarketReports/BankParticipationReports/index.htm

George.

Click on "In reply to", for Prior Reports.

I-box update today on silver stocks

U.S. DEBT = $15 Trillion

http://abcnews.go.com/blogs/politics/2011/11/u-s-approaches-15-trillion-debt-limit/

SILVER STOCKS UP ACROSS THE BOARD!

with the exception of SOHAF

~OAG.v~ POWER HOUR SENDS OAG UP 8%

~HDA.v/HUSIF~(1,700)1.32x1.38(4,500)

21,850 to 1.49... not too bad, no major blocks.

Right back into silver ![]() . $34.25!

. $34.25!

Nice move. I'd say bulk up on your favorite miners just like you did.

The Greek thing is a train wreck waiting to happen. There may be a sell off like in '08 but I doubt it will go that deep.

The timid liquidated back then too, but I don't think it will drop as steeply this time.

Where else you gonna put your assets?

Sooner or later people will remember what the true storehouses of value really are and quit selling precious metals when the wheels are coming off everything else.

I bought some more HDA.v though at under $1.35 today

I am liquidating a few profitable silver stocks in case the Greek vote causes a market crash. Aiming for 25% cash, just in case, ut I could easily miss out if it is simply passed. They are pressuring them now for a date on the vote.

Loving that! I want to see it over 36 bucks cause cause I heard that's where JPM really starts to hurt!

We'll see that 36 bucks and a lot more than that before all is said and done.

HUSIF Huldra Silver (1.3246) British Columbia based early stage silver producer with by product credits in lead and zinc.

Website: http://www.huldrasilver.com/

TSX Quote HDA http://tmx.quotemedia.com/quote.php?qm_symbol=HDA

Pinksheets: http://www.otcmarkets.com/stock/HUSIF/quote

IHUB: http://investorshub.advfn.com/boards/board.aspx?board_id=19452

Gold and silver show signs of a bottom

By Gil Morales and Chris Kacher

Commentary: Europe’s open spigot to support precious metals

PLAYA DEL REY, Calif. (MarketWatch) — When it comes to buying gold or silver, the best buy signals are found in what we refer to as “pocket pivots.”

These are statistically significant buy signals we have developed and used with great effect in our own handling of the precious metals in 2011 as we ourselves have thus far outperformed the S&P 500 Index over 50-fold as of this writing.

Pocket pivots essentially provide a tool that traders and investors can use to gain early entry into a narrow-based ETF such as the SPDR Gold Trust GLD +1.17% or iShares Silver Trust SLV +3.40% , or an individual stock, and they dovetail quite nicely with our general strategy and approach towards either gold or silver.

This approach has adhered to the principle of “buy it when it’s quiet,” and so pocket pivots fit the bill quite nicely as “quiet” buy signals within a stock or commodity ETF’s consolidation that generally occur when nobody is looking.

And right now, with sentiment somewhat bearish on the precious metals, not many investors have been looking. So while investors’ and traders’ eyes have turned elsewhere, the SPDR Gold Shares ETF, shown in a Chart 1 on a daily chart have developed some interesting and positive technical characteristics that could set them up for a bigger move in November.

The SPDR Gold Trust had a very nasty sell-off in late September, but found its low right above its prior breakout point at around the 151 price level soon thereafter. The recent retest of that low several days ago occurred on lighter volume, constituting a successful test of key lows for the gold shares. On October 25th, as we point out on the chart, the gold shares flashed a pocket pivot buy point. A pocket pivot buy point is described by an upside movement that carries above the 50-day or 10-day moving averages on upside volume that is heavier than any down-volume day in the pattern over the prior ten days.

In the chart you can see that the volume on October 25th as the gold shares came up and through its 10-day moving average, the magenta line on the chart, was indeed higher than any down-volume day in the pattern over the prior 10 days. According to our methodology, this is a pocket pivot buy point, and we will begin pyramiding a position in the gold shares from this point.

The iShares Silver Trust (SLV) representing of course, the white metal, shows similar action to the gold shares in that it also bottomed in late September after a nasty downside spill, retested that critical low several days ago on lighter selling volume, and then flashed a pocket pivot buy point of its own, as we see in Chart 2, below. This is very constructive technical action for silver, in our view, and portends a possible continued movement to the upside.

The action in both silver and gold is very constructive off of these recent lows, and with European officials looking to open up the “Euro-QE” spigot as they leverage the European Financial Stability Facility or EFSF, to the tune of 1.3 trillion euros. In our view, this is negative for currencies, particularly fiat currencies like the euro and dollar, and when combined with the strong technical bottoming action we are seeing in both metals, could eventually lead to a breakout to new highs for yellow and white metals. Silver and gold tend to follow one another around, but we might consider gold to be in the leading position currently given that it remains much closer to its all-time highs than silver does.

But we think that in a world that remains awash in fiat currencies as government officials can only continue to kick the can down the road, gold and silver show some strong potential for the month of November.

Gil Morales and Dr. Chris Kacher are both managing directors of MoKa Investors LLC, cofounders of www.selfishinvesting.com and co-authors of “Trade Like An O’Neil Disciple: How We Made 18,000% in the Stock Market” (Wiley, August, 2010).

http://www.marketwatch.com/story/gold-and-silver-show-signs-of-a-bottom-2011-11-01

~HDA.v~ LEVEL 2

1.32-2,300

1.33-4,500

1.34-500

1.35-500

1.36-500

1.38-6,000

1.39-7,000

1.43-3,000

Striking Euro Gold (and Silver)

* Tuesday, November 1, 2011

PRINCETON – The alternatives for Europe’s currency, the euro, seem increasingly limited to a desperate muddling through or a chaotic collapse. But there is a bolder and more productive approach that relies on past experience with multiple currencies.

The threat posed by Europe’s current policy impasse can hardly be overestimated. In the early 1930’s, monetary-policy incoherence paralyzed US policy, with the Federal Reserve Bank of New York locked in insurmountable conflict with the Chicago Fed over monetary easing (at that time through open-market securities purchases). Today’s chronic policy disputes between Germany and France are producing a level of uncertainty that is potentially even more destructive.

Every few months, European governments launch a new and ever more ingenious initiative to resolve the eurozone’s debt crisis. For a day (and sometimes only for a few hours), financial markets rally euphorically. But soon doubt sweeps back in. There is no sense of a realistic endgame. And there is no longer-term vision of how the fiscal integration needed for the effective operation of a monetary union could be achieved in a practical timeframe.

Europeans should look to the past, when previous crises produced innovative solutions. The extended crisis of the European Monetary System (EMS) between September 1992 and July 1993 looked as if it would derail European integration. What was initially seen as a problem in one country (Italy) toppled other currency regimes like dominos: Britain, Spain, and Portugal – and, by July 1993, even France was vulnerable. Then, as now, Europe’s future was at stake.

The solution adopted in frantic late-night negotiations in Brussels initially looked counterproductive. The massive widening of the EMS bands to 15% on either side of a central parity initially made a single currency appear more remote. But it also took away the one-way-bet character of speculative attacks on vulnerable currencies, and thus removed the fundamental driver of instability.

The modern equivalent of the band widening of 1993 would be to maintain the euro for all members of the eurozone, but also allow some of them (in principle, all of them) to issue – if necessary – national currencies. The countries that did would probably find that their new currencies immediately traded at a heavy discount. California recently adopted a similar approach, issuing IOUs when faced with the impossibility of access to funding.

The success of stabilization efforts could then be assessed according to the price of the new currency. If the objectives were met – fiscal stabilization and renewed growth – the discount would disappear. In the same way, after 1993, the French franc initially diverged from its old level, but, in a good policy setting, it then returned within the exchange-rate band.

This approach has an important advantage: it would not require the redenomination of bank assets or liabilities. As a result, it would not be subject to the multiple legal challenges that a more radical alternative would run into.

Of course, there would also be the possibility that no convergence would occur, and that the two parallel currencies would coexist for a much longer period. This is not a novel thought. One of the possibilities raised in the discussions on monetary union in the early 1990’s was that a common currency might not mean a single currency. That possibility is not just a theoretical construct in fringe debates two decades ago; it is a real historical alternative.

In fact, there is a rather surprising parallel for stable coexistence of two currencies over a long period of time. Before the victory of the gold standard in the 1870’s, Europe had operated with a bimetallic standard for centuries, using silver as well as gold. Each metal had its different coinage. This regime was so successful in part because the coins were used for different purposes. High-value gold coins were used as a reference for large-value transactions and international business. Low-value silver coins were used for small day-to-day transactions, including payment of modest wages and rents. Silver was what Shakespeare termed the “pale and common drudge ‘tween man and man.”

A depreciation of silver relative to gold in this system would bring down real wages and improve competitiveness. Early modern Italian textile workers would find their pay in silver reduced, while their products still commanded a gold price on the international market for luxuries. This is one of the reasons why theorists such as Milton Friedman considered a bimetallic standard inherently more stable than a monometallic (gold-based) regime.

Nowadays, the equivalent of the adjustment mechanism in the early modern world of bimetallism would be a fall in, say, Greek wage costs paid in the national currency, as long as it was traded at a discount. These would be the silver currencies.

Meanwhile, the euro would be the equivalent of the gold standard. It would be kept stable by the institutions that already exist today, the European Central Bank and those national central banks that have no new alternative. In this sense, the core countries would be the equivalent of eighteenth- and early nineteenth-century Britain, which had only a gold-standard regime.

Maintaining a choice of currencies in a national as well as an international setting seems odd and counterintuitive. But it can – and has – been done, and it can be remarkably successful at satisfying peak demand for stability.

http://www.project-syndicate.org/commentary/james60/English

George.

Huge ~HDA.v~ Volume today! 205k shares!

OREMEX SILVER Q4 2011 INVESTOR PRESENTATION:

http://www.oremex.com/Theme/Oremex/files/Oremex%20Silver%20Presentation%20Q4%202011.pdf

HDA.v making 39% gains for the week!

Still Work To Be Done In Silver?

* Saturday, October 29, 2011

Most likely.

Commercial traders' (smart money) long and short postions showed massive long buying and short liquidation towards the end of the D-wave decline in 2008. This was the perfect money flow setup. A similar setup is underway in 2011. Massive short liquidation, defined by statistical concentration, will likely mark its end in 2011-2012.

Silver London P.M Fixed and the Commercial Traders COT Futures and Options Stochastic Weighted Average of Long & Short As A % of Open Interest

Smart money wants (needs) to cover its shorts. Who will be the source of selling?

Silver's bounce from the October low has attracted retail buying (see red circle). Smart money will likely target thse new longs in effort to further reduce their short positions as they did in 2008.

Silver London P.M Fixed and the Commercial (C) & Nonreportables (NR) Traders COT Futures and Options Stochastic Weighted Average of Net Long As A % of Open Interest

Hi Eric is it possible for us to make the chart Silver or Gold COT ZScore weighted average of long and shorts as a % of OI?

It is ineteresting to see how that % evolves in the coming weeks before we will/could have a real advance out of these prices.

Gretings and thanks for the site.

Bert

http://edegrootinsights.blogspot.com/2011/10/still-work-to-be-done-in-silver.html

George.

HUI technical chart By Trader Dan

* Friday, October 28, 2011

The HUI put on a spectacular showing this week gaining more than 65 points and taking out several overhead resistance levels on its price chart in the process. The catalyst seemed to be the positive response by the broader equity markets to news coming out of Europe regarding their bank recapitalization plan and their funding of the Stability Mechanism. While I am personally repulsed by such actions the facts are that the hedge fund community could not wait for the ink to dry on the press release before they began pouring money back into the Risk Trades.

The resultant rally in stocks fed into the gold mining shares with the HUI actually outperforming gold this week.

We will have to wait to see whether there is a continuance of these risk trades next week but from a technical perspective the strong price action bodes wells for additional gains early next week. That would put the index up against a strong overhead chart resistance level coming in near 595 and extending towards 600. The shares have been stymied near this level in the past so the bulls have a big test of resolve coming.

The push past the last Fibonacci Retracement level of note near 580 should allow the index to first test the level just a few point above today's high. Should the bulls take this out, then the run towards major resistance will commence.

If the index sets back, dip buyers should surface down near the 560 level and again near 545.

My thinking is if we are moving back towards a period when RISK TRADES are back in vogue, the HUI should continue to lead the metals and outperform gold in particular. Note on the chart it is close to decisively ending the downtrend against the gold price. If the shares are going to eventually take a leading role then the horizontal resistance level noted on this ratio chart will need to be bested.

As a side note, that we are seeing some companies in this sector raising their dividends is a good sign and indicates that their management feels that earnings are strong enough to do so and should remain so for the foreseeable future. In other words, they are optimistic on future price prospects for the metal. That is also a sign that we should expect to begin seeing or hearing about planned aquistions by some of the majors or even larger mid-tiers as they look to increase their reserves. That should support the juniors which are of high-quality. This might be occurring already based on the ratio of the GDX to the GDXJ (major to juniors).

Note that since May of this year the majors have been outperforming the juniors as a whole. Beginning late last month (September) that began to change. Apparently some are already sniffing this change and are thinking acquisitions based on the profitability of the larger miners in the sector.

http://traderdannorcini.blogspot.com/2011/10/hui-technical-chart.html

George.

~HDA.v~ 61,000 shares on the Bid from $1.27 up!!!

More then ALL the shares on the Ask.

~HDA.v~$1.35~20,000@THEBID~Only 47k shares to $2.25

~HDA.v~ UP 25% from yesterday morning...

Super thin L2~ Only 55,000 to $2.25

I'M BACK... AGAIN. LOOK FOR UPDATES

~HDA.v~ L2 sooooo thin. Only 60,000 total shares on the ask all the way to $2.35!!!

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

627

|

|

Created

|

09/14/11

|

Type

|

Free

|

| Moderator SILVERISTHENEWGOLD | |||

| Assistants | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |